LAO Contact

February 17, 2017

The 2017-18 Budget

Transportation Funding Package

- Introduction

- Background

- Governor's Proposal

- Road Map for Developing a Transportation Package

- Conclusion

Executive Summary

California’s Transportation Systems Face Several Challenges. California has a large and complex network of transportation systems that currently face several challenges. These challenges include (1) aging highways, (2) aging local roads and transit systems, (3) increased traffic congestion, (4) increased demand for transportation alternatives, and (5) increased goods movement. There is widespread concern that current funding levels for transportation programs are insufficient to fully address these challenges.

Governor’s Proposed Transportation Funding Package. The Governor’s 2017‑18 budget includes a transportation funding package that is estimated to generate an annual average increase in transportation funding of $4.2 billion over the next ten years. This funding would come from a mix of revenue sources including a new $65 vehicle registration tax, increases to gasoline and diesel excise taxes, cap‑and‑trade auction revenues, and the early repayment of certain transportation loans. The revenues generated under the proposal would be distributed through a complex series of formulas in a manner that partially addresses a mix of transportation challenges. For example, the Governor’s proposal would fully fund core highway rehabilitation needs in the State Highway Operation and Protection Program (SHOPP), but provide relatively little to address the state’s significant highway maintenance needs.

LAO Road Map for Developing a Transportation Package. In order to assist the Legislature in its deliberations on a transportation package, we provide in this report a road map to addressing five key issues that merit legislative consideration. Specifically, the Legislature will want to:

- Determine Specific Challenges to Address. The Legislature will want to consider its priorities and how they compare to the Governor’s proposal. In doing this we recommend that the Legislature first determine the level of shared funding for cities and counties and then make the Highway Maintenance Program its highest priority for the state’s share of new funds, followed by SHOPP. After which, the Legislature will want to consider whether to address additional transportation challenges, such as supporting local transit.

- Determine Overall Funding Level. The magnitude of funding needed will vary based on which transportation needs are prioritized and how robustly the Legislature wishes to fund those needs. In order to assist the Legislature, we provide three different scenarios to illustrate what level of funding would likely be needed to meet different sets of priorities. For example, we estimate that an annual average of $4.8 billion would be needed over the next decade to fully fund highway maintenance and certain core SHOPP needs, as well as providing a share of revenues for local streets and roads. Conversely, an annual average of $8.8 billion would be needed to meet these needs, as well as more robust funding for other programs proposed by the Governor.

- Determine Revenue Sources. After determining its transportation priorities and the level of funding needed to meet them, the next step would be for the Legislature to determine how to generate the necessary revenue. In determining which specific taxes or fees to increase, we recommend that the Legislature consider: (1) charging users of transportation systems, (2) a mix of sources, (3) stability of sources, and (4) distinguishing between temporary and permanent sources.

- Simplify Funding Distribution Model. In developing a funding package, we recommend that the Legislature adopt an approach that is more simplified than that proposed by the Governor in order to allow for future growth across all priorities. Moreover, putting together a funding package is an excellent opportunity for the Legislature to review the existing distribution formulas and consider improvements to reduce complexity and ensure that transportation funding is being distributed to the state’s highest priorities.

- Determine Administration of New Programs and Establish Accountability Measures. The Legislature will want to determine how new programs will be administered. We recommend that the Legislature consider having the California Transportation Commission (CTC) administer any new programs and consider awarding funds through competitive grants. The Legislature will also want to consider adopting well‑defined and robust accountability measures in the allocation of funds for both new programs and existing programs. For example, we recommend the Legislature require CTC to perform project‑level oversight of SHOPP by thoroughly reviewing the proposed cost, scope, and schedule of all SHOPP projects and allocating all funding for SHOPP projects.

Introduction

California has a large and complex network of transportation systems that currently face several challenges, such as aging infrastructure and increased demand. There is widespread concern that current funding levels for transportation programs are insufficient to fully address these challenges. In the fall of 2015, as part of a special legislative session to identify additional funding for transportation programs, the Governor proposed a transportation package to provide an ongoing increase in transportation funding and some measures intended to increase accountability and efficiency regarding the use of transportation funding. The special session ended without the Legislature and the Governor reaching an agreement on a transportation funding package.

The Governor’s proposed budget for 2017‑18 includes a package of proposals to increase funding for transportation programs, as well as to increase accountability. The proposed package is similar to the package previously proposed by the Governor. In this report, we (1) provide background information on the state’s major transportation programs and funding sources, (2) describe the Governor’s proposed 2017‑18 transportation package including how the increased funding would be allocated, and (3) provide a road map to assist the Legislature in making certain key decisions it will face in developing a transportation package.

Back to the TopBackground

The state has several major transportation programs that are funded from various state revenue sources to support state and local transportation systems. In this section, we provide background information on the state’s major transportation programs and how these programs are currently funded. We also identify some of the major transportation challenges currently facing the state.

Major State Transportation Infrastructure Programs

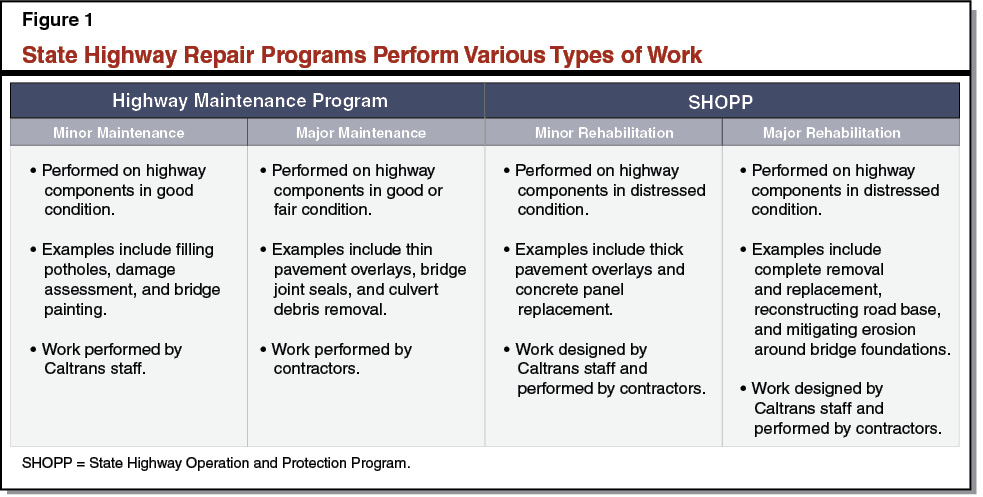

Highway Maintenance Program. The California Department of Transportation (Caltrans) is responsible for maintaining and rehabilitating the state’s highway system, which includes about 50,000 lane‑miles of pavement, 13,100 bridges, and 205,000 culverts (pipes that allow naturally occurring water to flow beneath a roadway). The department does so through the Highway Maintenance Program, as well as the State Highway Operation and Protection Program (SHOPP) which we discuss below. Figure 1 summarizes the spectrum of highway maintenance and rehabilitation work that is performed by these two programs. As shown in the figure, the Highway Maintenance Program focuses on highways that are in good or fair condition. Specifically, the program is responsible for:

- Minor Routine Maintenance. Most minor routine maintenance consists of operational activities such as maintaining roadside landscaping, graffiti removal, and trash pick‑up. A small portion of this routine maintenance includes minor repairs to pavement, bridges, and culverts. Such repairs include filling potholes and bridge painting. Minor routine maintenance work is performed directly by Caltrans staff.

- Major Maintenance Projects. Major maintenance projects are more significant repairs to help preserve highway pavement, bridges, and culverts. These projects are performed by construction contractors and overseen by Caltrans staff. A typical project would be the application of a thin overlay of new pavement to a stretch of state highway.

In 2016‑17, Caltrans plans to spend a total of $1.5 billion in state funds for the Highway Maintenance Program—$1.1 billion for minor routine maintenance and about $400 million for major maintenance projects. For major maintenance projects, Caltrans plans to spend $234 million for pavement, $131 million for bridges, and $23 million for culverts in 2016‑17.

SHOPP. SHOPP is a program of capital projects to rehabilitate or reconstruct highways when they reach the end of their useful life. Unlike the Highway Maintenance Program, SHOPP projects focus on highways that are in distressed condition and can involve tearing up and replacing an entire roadway or building a new bridge to replace an old one. SHOPP projects often require significant work by Caltrans staff to design and manage each project. The construction of SHOPP projects is done by a construction contractor. In 2016‑17, Caltrans estimates that it will spend $2.3 billion on SHOPP projects. Of the total amount, Caltrans plans to spend about $1.2 billion: on pavement ($800 million), bridges ($350 million), and culverts ($50 million). The remainder of SHOPP funding is available for other purposes such as responding to emergencies, making safety improvements, and improving roadside facilities.

Shared Revenues for Local Roads. The 58 counties and 482 cities in California own and maintain over 300,000 paved lane‑miles of local streets and roads. They also own nearly 12,000 bridges and numerous other aspects of their local road systems, such as storm drains and traffic signals. Funding for local streets and roads comes from local, federal, and state sources. Of the total funding for local roads, roughly one‑third comes from the state from “shared revenues”—a portion of the state’s excise taxes on gasoline and diesel that are distributed to cities and counties. The state has historically shared a portion of its transportation revenues with cities and counties in recognition that some of the state revenue collected is associated with driving on local roads and that state and local systems function together to allow people and goods to move around communities and across the state. Over the last couple of decades, the proportion of state revenue shared with locals is roughly one‑third of the state’s transportation revenues. In 2016‑17, shared revenues for local streets and roads is estimated to be $1.3 billion.

State Transportation Improvement Program (STIP). STIP is the state’s program for improving transportation systems, generally by increasing their capacity. STIP focuses on highway improvements, but can also fund local road improvements and certain transit projects. Funding in STIP is allocated with 75 percent to counties for projects they select and 25 percent to Caltrans for interregional projects. In 2016‑17, revenues for STIP are estimated at about $175 million.

Transit. There are 200 transit agencies in California. While these transit systems are generally owned and operated by local governments, the state provides some funding to support them. The state has three primary ongoing transit programs:

- State Transit Assistance (STA). The STA program distributes funding to transit operators based on a formula. STA funds can be used for either operational support or to fund capital projects based on local priorities. In 2016‑17, funding for STA is estimated at $260 million.

- Transit and Intercity Rail Capital Program. The Transit and Intercity Rail Capital Program is a competitive grant program that awards funding to transit and rail capital projects that meet certain criteria, such as reducing greenhouse gas (GHG) emissions. This program receives a portion of cap‑and‑trade auction revenues each year. Specifically, 10 percent of annual cap‑and‑trade auction revenue is continuously appropriated to the program. For 2016‑17, the estimated funding level for the Transit and Intercity Rail Capital Program is about $235 million, which includes an estimated $100 million from the continuous appropriation and $135 million provided on a one‑time basis.

- Low Carbon Transit Operations. The state also provides funding through the STA program formula for transit operations that help to reduce GHG emissions. The program is funded from 5 percent of cap‑and‑trade auction revenues that are continuously appropriated. In 2016‑17, funding for this program is estimated at $50 million from the continuous appropriation.

Active Transportation Program (ATP). The ATP, which is administered by the California Transportation Commission (CTC), funds bicycling and pedestrian improvement projects. Program goals include increasing the proportion of walking and bicycling trips and reducing GHG emissions. Funds in the program are allocated through competitive grants with half of the funds distributed to projects selected by the state, 40 percent distributed to projects selected by large urban regions, and 10 percent for projects selected by rural and small urban regions. In 2016‑17, funding for ATP is estimated at about $130 million.

Current State Transportation Funding Sources and Uses

Funding for transportation in California comes from numerous state, local, and federal sources. State funding for transportation comes from various state transportation taxes and fees that are dedicated to transportation purposes, including gasoline excise taxes, diesel excise and sales taxes, and vehicle weight fees. In addition, the state allocates a portion of its cap‑and‑trade auction revenues to transportation programs and provides General Fund support by paying a portion of the cost of transportation bond debt service. For 2016‑17, total state funding for transportation infrastructure is estimated to be $7.2 billion. Figure 2 provides a breakdown of this total by the different fund sources, which we describe in more detail below.

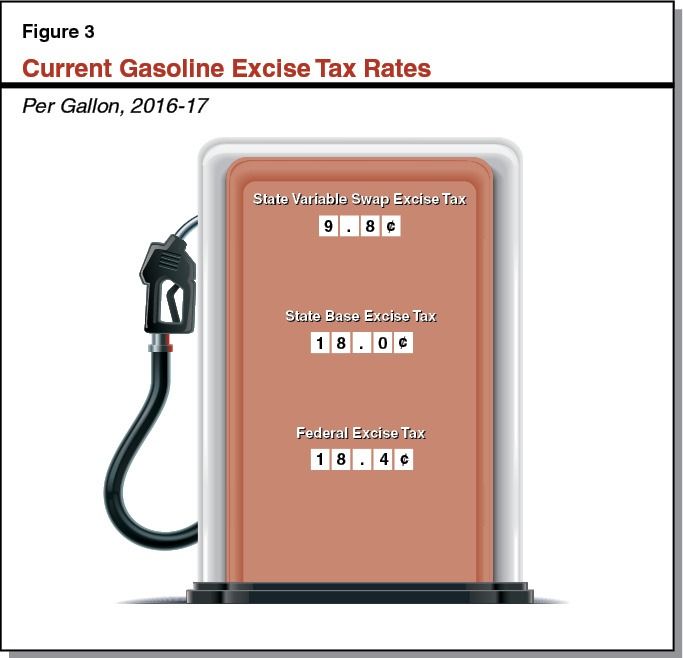

State Gasoline Excise Taxes. The majority of state transportation funding comes from excise taxes on gasoline. Figure 3 shows the current rates for the state’s two gasoline excise taxes—the base tax and the variable “swap” tax. (As shown in the figure, there is also a federal excise tax of 18.4 cents per gallon.)

- Base Rate. The state base gasoline excise tax is set at a rate 18 cents per gallon. In 2016‑17, this tax is estimated to generate about $2.6 billion. Two‑thirds of the revenue from the base excise tax is allocated to the State Highway Account (SHA) to support the Highway Maintenance Program, SHOPP, and Caltrans administration. One‑third of the funding is shared with cities and counties to support their local streets and roads.

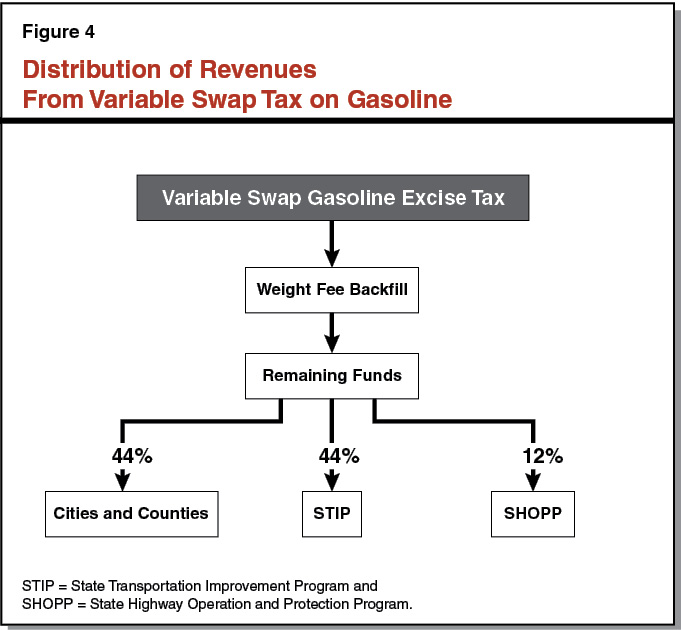

- Variable Swap Rate. The variable swap gasoline excise tax rate was established as part of the “fuel tax swap”—a package of legislation that changed the way the state taxes fuels. This tax is set annually by the Board of Equalization (BOE). BOE sets the rate by considering both gasoline price and quantity sold in an effort to mimic a sales tax, which had previously been collected on gasoline for transportation purposes. BOE has set this rate at 9.8 cents per gallon in 2016‑17, which is estimated to generate about $1.4 billion. Figure 4 shows the distribution of revenues from the swap excise tax on gasoline. First, an amount is taken “off the top” to fully backfill weight fees that are used to help pay debt service on transportation bonds, as discussed below. For 2016‑17, the amount necessary to backfill weight fees is roughly $1 billion. The remaining funds, which amount to about $400 million in 2016‑17, are allocated: 44 percent to cities and counties for local streets and roads, 44 percent to STIP, and 12 percent to SHOPP.

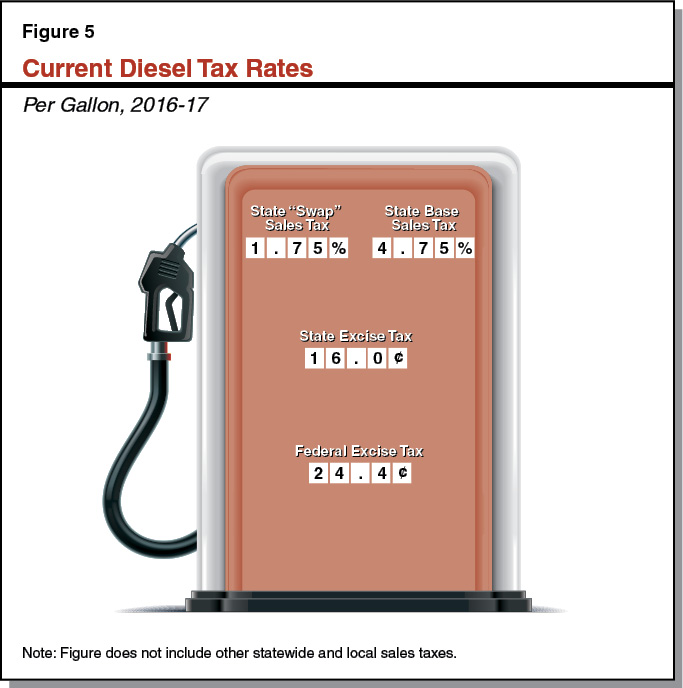

State Diesel Taxes. The state also collects revenue from taxes on diesel fuel. Figure 5 shows the current diesel tax rates for the state’s three taxes on diesel fuel—an excise tax and two sales taxes. (As shown in the figure, there is also a federal excise tax of 24.4 cents per gallon.)

- Diesel Excise Tax. The diesel excise tax is a variable tax, with a rate set annually by BOE. BOE has set this rate at 16 cents per gallon in 2016‑17, which is estimated to generate about $500 million. Revenue generated from 6 cents of this tax is allocated to cities and counties for local streets and roads. The remainder of the revenue is deposited into SHA to fund the Highway Maintenance Program, SHOPP, and Caltrans administration.

- Base Sales Tax. The state collects a base sales tax on diesel at a rate of 4.75 percent for transportation programs. In 2016‑17, this tax is estimated to generate about $300 million. Half of this revenue is allocated to the STA program to support local transit. The other half is used to fund state‑supported intercity rail and other state mass transportation programs.

- Swap Sales Tax. The state also collects a second sales tax on diesel at a rate of 1.75 percent for transportation programs. This diesel sales tax, which is referred to as the swap sales tax, was established in the fuel tax swap discussed above. All of the revenue from this tax is allocated to the STA program. In 2016‑17, this tax is estimated to generate about $110 million.

Vehicle Weight Fees. Vehicle weight fees are registration fees charged to vehicles that carry heavy loads on the state’s roadways, such as commercial trucks. Weight fees generate about $1 billion annually. Since 2011, vehicle weight fees have been used to offset a portion of the debt service costs on transportation bonds, rather than fully paying these costs from the General Fund. In 2016‑17, estimated debt service costs are about $1.5 billion. These costs will be paid from the roughly $1 billion in weight fee revenues collected in the current year, $100 million in weight fee revenues collected in prior years, and $60 million from certain miscellaneous revenues, such as revenue from rental properties owned by Caltrans. The remainder of the costs will be paid from the General Fund.

Cap‑and‑Trade Auction Revenues. The state’s cap‑and‑trade regulation places a “cap” on aggregate GHG emissions from large emitters, such as large industrial facilities, electricity generators and importers, and transportation fuel suppliers. Under the cap‑and‑trade program, the Air Resources Board issues allowances permitting GHG emissions up to the amount of the cap. Some of these allowances are given away for free, while the remainder of allowances are sold at quarterly auctions. The revenue generated from these cap‑and‑trade auctions is available to fund various programs that reduce GHG emissions, including certain transportation programs. Specifically, 25 percent of the total auction revenue collected each year is continuously appropriated to the state’s high‑speed rail project, 10 percent to the Transit and Intercity Rail Capital Program, and 5 percent to the Low Carbon Transit Operations Program.

Current Transportation Challenges

As we discuss below, the state’s transportation system faces several key challenges. These challenges include: (1) aging highways, (2) aging local roads and transit systems, (3) increased traffic congestion, (4) increased demand for transportation alternatives, and (5) increased goods movement.

Aging Highway Infrastructure. The state’s highway infrastructure is aging and requires regular maintenance to keep highways in a state of good repair. The highways also need rehabilitation or reconstruction when they reach the end of their useful life. As we discussed in our report, The 2016‑17 Budget: Transportation Proposals, the state has significantly less funding available to adequately maintain and rehabilitate the core aspects of the state highway system—pavement, bridges, and culverts. Figure 6 compares the current funding levels for major highway maintenance projects to the ongoing maintenance needs (specifically, to meet certain maintenance schedules provided to us by Caltrans). As shown in the figure, the total annual amount of funding needed to meet ongoing major maintenance needs is about $1.6 billion, or about $1.2 billion more than the current funding level for major maintenance projects.

Figure 6

Current Funding Level Falls Short of Meeting

Ongoing Major Maintenance Needs

(In Millions)

|

Current |

Ongoing |

Annual |

|

|

Pavement |

$234 |

$750 |

‑$516 |

|

Bridges |

131 |

200 |

‑69 |

|

Culverts |

23 |

600 |

‑577 |

|

Totals |

$388 |

$1,550 |

‑$1,162 |

In addition to the ongoing needs, there is a backlog of deferred major maintenance projects. In our 2016 report, we found that there were about 6,000 lane‑miles of pavement, 900 bridges, and 41,000 culverts requiring a major maintenance project. We estimate that it would cost about $3 billion on a one‑time basis to eliminate this backlog.

Figure 7 compares the current funding levels for SHOPP projects to the ongoing rehabilitation needs for pavement, bridges, and culverts. As shown in the figure, the total amount of funding needed to meet ongoing SHOPP needs is roughly $2 billion, or about $800 million more than the current funding level. These estimates are based on a variety of data provided by Caltrans including historical project costs, and infrastructure life cycles, such as how often minor rehabilitation or major reconstruction are generally needed.

Figure 7

Current Funding Level Falls Short of Meeting

Ongoing SHOPP Needs

(In Millions)

|

Current |

Ongoing |

Annual |

|

|

Pavement |

$800 |

$900 |

‑$100 |

|

Bridges |

350 |

350 |

— |

|

Culverts |

50 |

750 |

‑700 |

|

Totals |

$1,200 |

$2,000 |

‑$800 |

|

SHOPP = State Highway Operation and Protection Program. |

|||

In addition to the ongoing needs, there is a backlog of deferred SHOPP projects that has accumulated over the years. This is partly due to insufficient funding levels in prior years, as well as highways needing rehabilitation sooner due to a lack of proper maintenance. We estimate that roughly $9 billion is needed one a one‑time basis to eliminate this backlog. We note that there are additional SHOPP needs that were not part of our analysis, such as roadside rest areas.

Aging Local Transportation Systems. Many local transportation systems, such as local roads and transit systems, also face significant funding shortfalls for maintenance and rehabilitation in the billions of dollars. While it is generally known that local systems face the same challenges as the state, it is more difficult to precisely quantify the level of funding necessary to address these challenges given the diversity in needs and differing levels of information available across cities, counties, and transit operators in the state.

Increased Traffic Congestion. As the state’s population grows, increased travel demand contributes to traffic congestion on highways and roads. According to Caltrans, traffic congestion on the state highways increased from an average of about 250,000 hours each commute day in 2011 to about 475,000 hours each commute day in 2016. (This is based on the amount of time vehicles are in traffic with travel speeds below 35 miles per hour.) In other words, Californians collectively spent roughly 125 million hours in highway traffic congestion in 2016. Significant traffic congestion is problematic for several reasons. First, the individuals in traffic are giving up time that could otherwise be spent on personal, recreational, or professional pursuits. Congestion also poses challenges to businesses that must plan around the uncertainty of when employees will arrive for work and how long it will take to accomplish transportation‑related business tasks, such as making deliveries. In addition, vehicles that are sitting in traffic congestion also use more fuel and emit more pollution due to the longer travel times.

Increased Demand for Transportation Alternatives. In response to significant and ongoing traffic congestion, as well as environmental impacts of highways and roads, transportation agencies have increasingly sought to provide alternatives to driving. Alternatives include more comprehensive transit services, intercity and commuter rail, and safer options for bicycling or walking as a means of travel over short distances. Many travelers prefer these alternatives as they can avoid the stresses of being in traffic, as well as obtain other benefits. For example, individuals who travel on a train or bus are able to simultaneously complete other tasks (such as working or reading), while those who walk or bike are able to get exercise. As traffic congestion on highways and roads increases, the demand for these alternatives grows.

Increased Goods Movement. In addition to increased travel demand by drivers or passengers, the state faces increased movement of goods through ports and along freight corridors. There are 12 deep‑water seaports in California, as well as a couple of cargo border crossing areas with Mexico. These ports are a primary way of bringing imported goods into the country and also exporting U.S. products to other countries. For example, the Federal Highway Administration reports that the ports of Los Angeles and Long Beach combined form one of the largest container port complexes in the world and that these two ports handle 35 percent of all waterborne cargo in the U.S. According to reports from the ports of Los Angeles and Long Beach, the number of cargo containers handled through these two ports increased from 5.7 million containers in 1996 to 15.5 million containers in 2016. Goods are moved to and from ports and border crossings primarily by trucks operating on the state’s highways and by freight railroads. Accordingly, the demand and congestion on these trade corridors has also increased as the volume of goods moving in and out of ports has increased.

Back to the TopGovernor’s Proposal

The Governor’s 2017‑18 budget includes a transportation funding package. The proposed package is similar to the package proposed by the Governor in the fall of 2015 as part of a special legislative session on transportation funding. Specifically, the Governor’s package includes proposals to (1) increase funding for transportation programs, (2) create new formulas for distributing transportation funds, (3) allocate the increased funding to partially address certain transportation challenges, and (4) establish some accountability measures.

Increases Transportation Funding

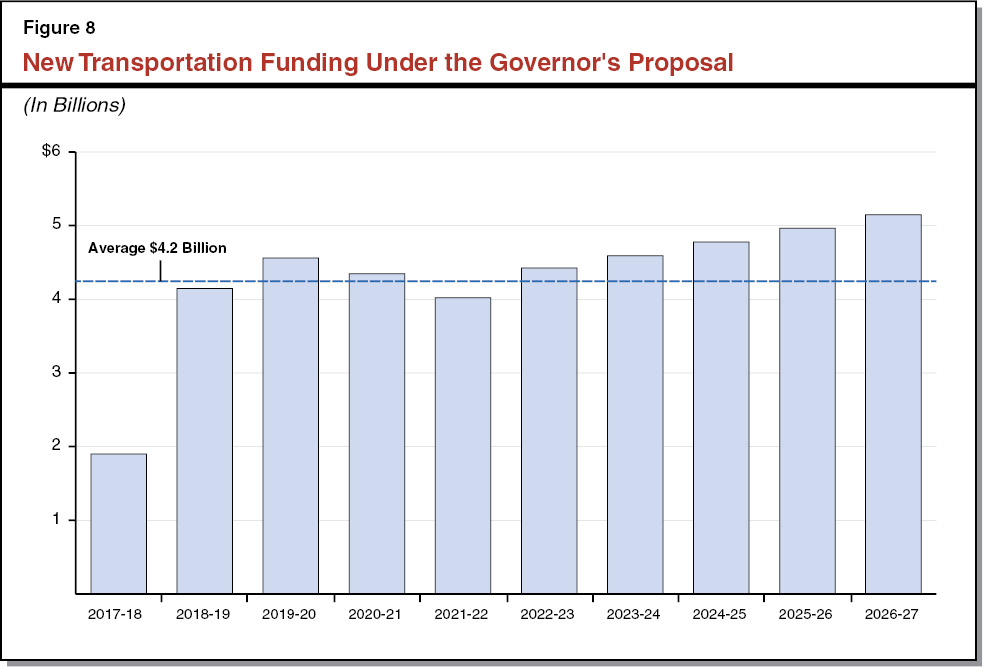

$4.2 Billion Annual Average Increase. The Governor’s transportation funding package proposes to provide an ongoing increase in funding for transportation programs beginning in 2017‑18. Funding from the package would phase in during 2017‑18 and 2018‑19, resulting in an increase of $1.8 billion in the budget year. The administration estimates that the funding package would generate an annual average increase in transportation funding of $4.2 billion over the next ten years. Figure 8 shows the annual funding increase estimated over this time period.

Mix of Revenue Sources. Under the Governor’s proposal, the increased transportation funding would come from a mix of revenue sources. Figure 9 summarizes the proposed revenue sources and the annual average amount that each source is estimated to generate over the next ten years. The specific revenue sources include:

- New Vehicle Registration Tax. As shown in the figure, about half of the funding would come from a new $65 registration tax (called a “road improvement charge”) that all vehicle owners would pay annually when registering their vehicles.

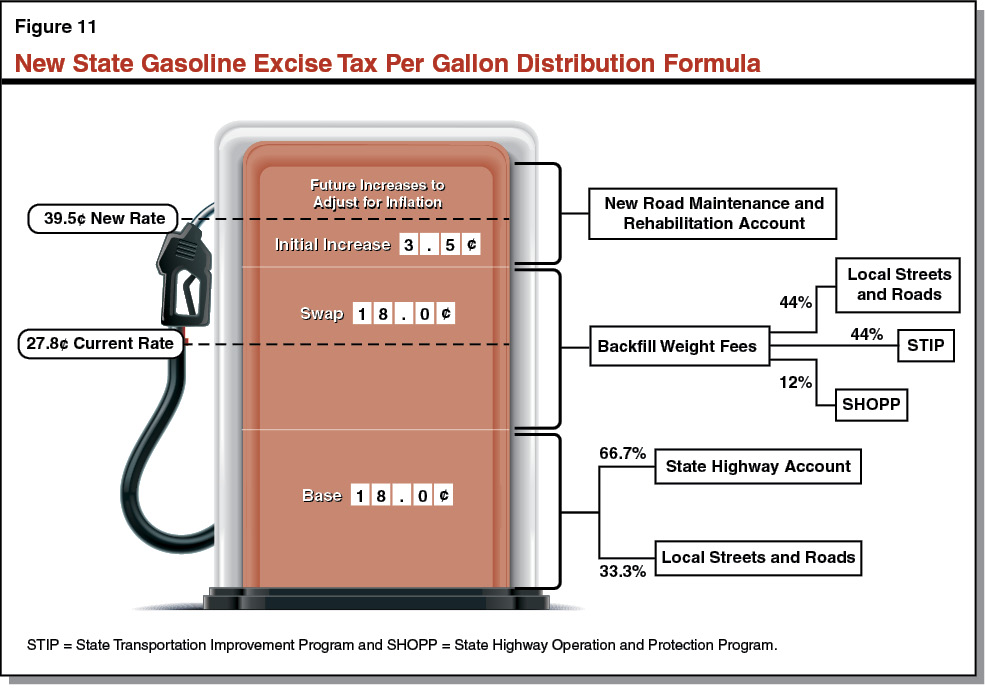

- Gasoline Excise Tax Increase. The Governor proposes to increase the state’s total gasoline excise tax rate by 11.7 cents per gallon compared to the current rates—from a total excise tax rate of 27.8 cents per gallon to 39.5 cents per gallon, beginning in 2018‑19. The proposed 39.5 cents per gallon is based on (1) maintaining the existing 18 cents base excise tax; (2) making the swap tax a fixed rate (rather than a variable rate) that would be set at 18 cents per gallon, which is 8.2 cents higher than the current rate; and (3) imposing an additional excise tax rate of 3.5 cents per gallon. In addition, under the proposal, the total 39.5 cents per gallon gasoline excise tax rate would be indexed to adjust for future inflation.

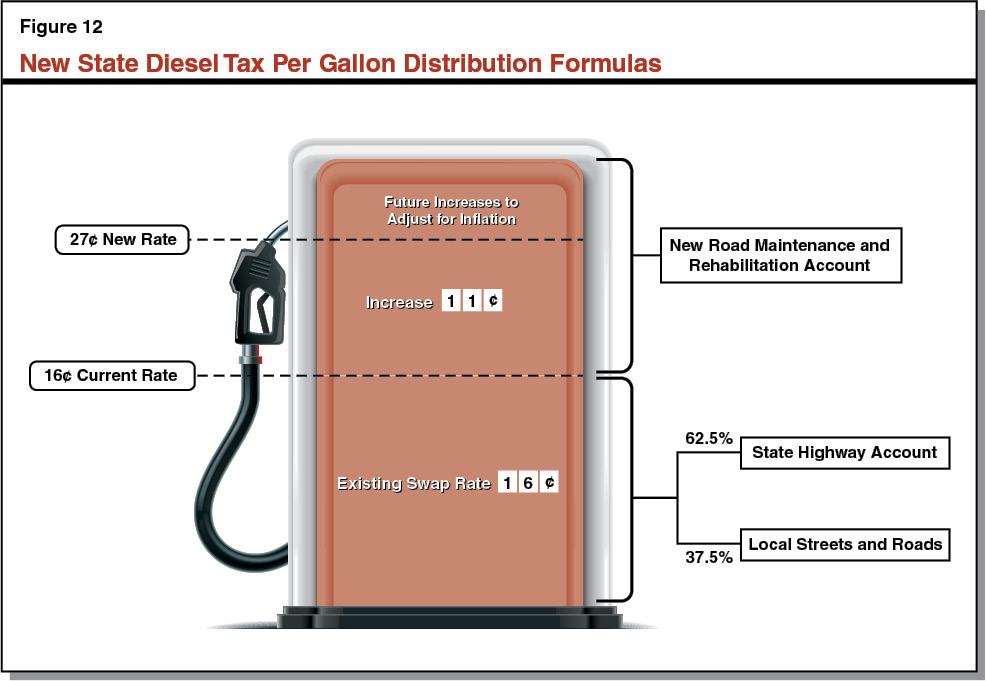

- Diesel Excise Tax Increase. The Governor proposes to increase the state’s excise tax on diesel from the current level of 16 cents per gallon to 27 cents per gallon beginning in 2018‑19. Under the Governor’s proposal, the excise tax on diesel fuel would no longer be a variable rate that is set annually by BOE, but instead the proposed 27 cent per gallon rate would be adjusted for inflation each year.

- Cap‑and‑Trade Auction Revenues. The Governor’s funding package proposes to allocate an additional $500 million annually in cap‑and‑trade auction revenues to transportation programs. Under the proposed budget for 2017‑18, the Governor’s total cap‑and‑trade expenditure plan (including the $500 million for transportation programs) is contingent on the Legislature extending the state’s cap‑and‑trade program beyond 2020 with a two‑thirds urgency vote. (For more information on the Governor’s cap‑and‑trade expenditure plan, please see our recent report The 2017‑18 Budget: Cap‑and‑Trade.)

- Loan Repayments. The proposal also provides for the early repayment of about $700 million in transportation loans. Specifically, one‑third of the loan amount would be repaid each year from 2017‑18 to 2019‑20.

Figure 9

Governor’s Proposed Revenue Sources

(In Billions)

|

Revenue Source |

Annual Average Amount |

|

New registration tax (road improvement charge) |

$2.1 |

|

Gasoline excise tax increase |

1.1 |

|

Cap‑and‑trade auction revenues |

0.5 |

|

Diesel excise tax increase |

0.4 |

|

Loan repayments |

0.1 |

|

Total |

$4.2 |

In addition to the revenues described above, the proposal assumes that Caltrans will achieve savings of $100 million annually through efficiencies, although the proposal does not identify how those savings will be achieved.

Creates New Distribution Formulas

Most of the revenue generated under the Governor’s funding package—including all of the revenue from the proposed vehicle registration tax—would be deposited into a new state transportation account that the Governor is proposing to establish, the Road Maintenance and Rehabilitation Account (RMRA). While some of the new fuel tax revenues would be deposited into this new account, a portion of such revenues would be distributed under the state’s existing formulas. Below, we describe in detail how the different revenue sources in the Governor’s package would be distributed.

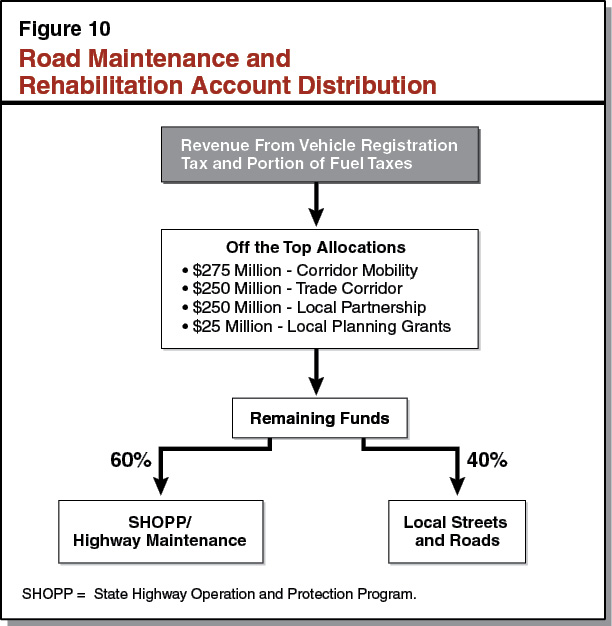

All Vehicle Registration Tax Revenues Distributed Under New RMRA Process. Under the Governor’s proposal, all of the revenue from the $65 vehicle registration tax would be deposited into the new RMRA and distributed to specific transportation programs under a new formulaic process proposed by the Governor. Figure 10 summarizes the proposed RMRA distribution process. As shown in the figure, a total of $800 million from RMRA would first be taken off the top and allocated to specific transportation programs, with each program receiving a specified amount. For example, $250 million would be allocated to support a trade corridor program. The remaining funds in the account would be split, with 60 percent allocated to the state for SHOPP and the Highway Maintenance Program and 40 percent to cities and counties for local streets and roads.

Fuel Tax Revenues Distributed Under Multiple Formulas. Figure 11 summarizes how state gasoline tax revenues would be distributed under the Governor’s proposal. As shown in the figure, revenue from the different tax rates would be distributed under different formulas. Specifically, revenue from:

- The first 18 cents per gallon (base excise tax rate) would continue to be distributed under the existing formula with two‑thirds to the state for the Highway Maintenance Program, SHOPP, and Caltrans administration, and one‑third to cities and counties for local streets and roads.

- The next 18 cents per gallon (set swap tax rate) would be allocated according to the existing swap formula with weight fees first being backfilled and remaining funds allocated: 44 percent to local roads, 44 percent to STIP, and 12 percent to SHOPP.

- Gasoline excise tax rates above 36 cents per gallon would the deposited into RMRA. Specifically, the initial increase of 3.5 cents per gallon in 2018‑19, as well as all funding from future increases resulting from inflationary adjustments.

Figure 12 summarizes how state diesel tax revenues would be distributed under the Governor’s proposal. As the figure shows, the proposal maintains the existing distribution of revenues generated from the first 16 cents per gallon of the excise tax rate. All revenue generated from diesel excise tax rates above 16 cents per gallon would be deposited into RMRA, meaning that deposits into RMRA would include revenue from the 11 cent per gallon increased rate taking effect in 2018‑19 as well as all funding from future inflationary adjustments.

Cap‑and‑Trade Revenues Allocated to Specific Programs. As mentioned above, the Governor’s proposal provides $500 million annually from cap‑and‑trade auction revenues as part of the transportation funding package. These funds would be allocated from the existing GHG Reduction Fund, with $400 million to the Transit and Intercity Rail Capital Program and $100 million to ATP.

Loan Repayments Allocated to Specific Programs, but Not Efficiency Savings. Of the $706 million in early loan repayments, the Governor proposes to allocate (1) $323 million to trade corridors, (2) $256 million to the Transit and Intercity Rail Capital Program, and (3) $127 million to SHOPP. The Governor’s proposal assumes that Caltrans will generate $100 million in savings from various efficiencies. However, the proposal does not identify how the $100 million savings would be spent.

Allocates Funds to Partially Address a Mix of Challenges

As indicated above, the Governor’s funding package would allocate additional transportation revenues to various programs. Figure 13 shows the estimated level of new funding that would be provided to each transportation program. As we discuss below, the proposed allocations would partially address a mix of the challenges currently facing the state’s transportation system.

Figure 13

Average Annual Funding Increase By Program

(In Millions)

|

Program |

Amount |

|

SHOPP |

$1,560 |

|

Shared revenues—local roads |

1,140 |

|

Transit |

430 |

|

Trade corridors |

280 |

|

Corridor mobility |

275 |

|

Local partnership grants |

225 |

|

Highway Maintenance |

120 |

|

Active Transportation |

100 |

|

STIP |

30 |

|

Local planning grants |

25 |

|

Total |

$4,185 |

|

SHOPP = State Highway Operation and Protection Program and STIP = State Transportation Improvement Program. |

|

Fully Addresses Core Highway Rehabilitation Needs, but Not Highway Maintenance Needs. As shown in the figure, the Governor’s plan would allocate about $1.6 billion to SHOPP. This level of funding is roughly the amount needed to fully fund SHOPP pavement, bridge, and culvert needs on an ongoing basis as well as to address the current backlog of SHOPP projects over a ten year period. However, the $120 million proposed for the Highway Maintenance Program would do relatively little to address the state’s significant highway maintenance needs. Under the Governor’s proposal, we estimate that about $1.1 billion in annual maintenance projects would remain unfunded. In addition, the proposal provides no funding to address the approximately $3 billion backlog of deferred maintenance projects.

Shares Some Revenues With Cities and Counties. The Governor proposes to share a portion of the new funds with cities and counties to help meet their local street and road needs. Of the $4.2 billion in new annual total transportation revenues, the Governor estimates that $1.1 billion, or 27 percent, would be shared with cities and counties. This level is somewhat less than the current one‑third proportion of revenues shared with cities and counties from existing transportation revenues.

Increases Transit and Intercity Rail Capital Program. The Governor’s proposal provides a $400 million increase, or 70 percent, above the current‑level of funding for the Transit and Intercity Rail Capital Program. Assuming the new funds are allocated to similar types of projects as the previous mix of grants provided by the program, the $400 million increase would partially fund about 15 transit and intercity rail capital improvement projects.

Creates Modestly Sized New Corridor Mobility and Trade Corridor Programs. The proposal also provides funding to two new programs that are modeled after programs in the 2006 Proposition 1B bond act. Specifically, the Governor’s proposal includes $275 million annually to improve traffic congestion on commute corridors. This new program is similar to the state’s previous Proposition 1B corridor mobility program, which funded large corridor improvement projects costing an average of about $120 million each. This means that if the new proposed corridor mobility program funds the same types of projects, the proposed funding level would fully fund, on average, two to three corridor mobility projects each year.

The proposal also creates an ongoing trade corridor program modeled after the one‑time Proposition 1B bond trade corridor program. Under the Governor’s funding package, the new trade corridor program would receive about $250 million annually. Projects in the Proposition 1B bond trade corridor program had an average cost of about $40 million. This means that if the new proposed trade corridor program funds the same types of projects as the previous bond program, the proposed funding level would fully fund, on average, about six trade corridor improvement projects each year.

Allocates Funds to Mix of Other Programs. Under the funding package, $250 million each year would be allocated for local partnership grants, beginning in 2018‑19. This is a program that has received occasional funding in the past from various state sources, including Proposition 1B, but currently receives no state funding. The program provides grants to local transportation agencies that have approved local sources of transportation funding as a way of incentivizing local governments to generate new local funding sources for transportation.

The funding package also allocates $100 million annually to the state’s ATP. This reflects an increase of 77 percent compared to the program’s current‑year level of funding. The proposal would also provide $25 million each year for local planning grants to assist local agencies in paying the cost of meeting certain state transportation planning requirements.

Assumes Slight Increase in STIP Funding. Under the Governor’s proposal, the swap excise tax that provides funding to STIP would be increased. In the short term, this would generate additional funding for STIP as well as the other programs that receive funding from this source. However, under current law this tax varies from year to year, and would likely increase over the next decade in the absence of the Governor’s proposal. This means that much of the increase proposed by the Governor would likely occur even without the changes proposed in the funding package. In addition, in some years the level of funding for STIP generated under the Governor’s proposal could be less than would otherwise be the case under current law. For these reasons, the Governor estimates an average annual STIP funding increase of about $30 million over the first decade following the implementation of the funding package. While the Governor does not estimate significant increases to STIP funding under his package, the proposal intends to stabilize funding for STIP by reducing the year‑to‑year volatility in funding.

Establishes Accountability Measures

The Governor’s proposal includes certain accountability measures, such as the establishment of performance metrics for Caltrans to meet with regard to the condition of the state highway system. However, at the time this report was prepared, the administration had not provided much detailed information about the proposed accountability measures.

Back to the TopRoad Map for Developing a Transportation Package

As discussed earlier in this report, much of the state’s transportation infrastructure is aging and needs maintenance, rehabilitation, and improvements to meet current and future needs. Thus, we think the Governor’s attention to transportation funding makes sense and that his proposed funding package is a step in the right direction in increasing funding to address certain transportation needs. However, in reviewing the proposed package, the Legislature will want to consider its own priorities and how they compare to the specific aspects of the Governor’s package.

In order to assist the Legislature in its deliberations on a transportation package, below we provide a road map to addressing five key questions that merit legislative consideration:

- What specific transportation needs or challenges does it want to address?

- What level of funding is necessary to meet these priorities?

- What funding sources best align with its priorities and desired funding levels?

- How to distribute funds to meet its priorities?

- How to ensure that additional funds are spent effectively and in a way that meets legislative priorities?

Determine Specific Transportation Challenges to Address

As indicated above, the state’s transportation system faces several challenges. While the Governor’s proposal would begin to partially meet these challenges, the Legislature will want to consider its priorities and how they compare to the Governor’s proposal. Based on our assessment of the various challenges and needs, we recommend that the Legislature first determine the level of shared funding for cities and counties and then make the Highway Maintenance Program its highest priority for the state’s share of new funds, followed by SHOPP. After which, the Legislature will want to consider whether to address additional transportation priorities, such as those identified in the Governor’s proposal.

Determine Funding Share for Local Roads

In developing a transportation funding package, one of the first decisions that the Legislature will want to consider is how much of the new funding to share with local governments. The state historically has shared a portion of its transportation revenues with cities and counties for their local streets and roads. Accordingly, the Legislature will most likely want to maintain the practice of sharing any increase in revenues that result from a funding package. There are different ways that the Legislature could determine the share it provides for local streets and roads. For example, the Legislature could choose to maintain the existing proportional allocation of revenue between the state and local governments with roughly one‑third of total revenues going to cities and counties and two‑thirds to the state. The Legislature could also choose an allocation amount based on various other factors, such as the number of heavy trucks on state and local streets and roads.

Make Highway Maintenance Program Highest Priority

We recommend making the Highway Maintenance Program the highest priority for the state’s share of any new funding. This is because maintenance projects are significantly more cost‑effective than allowing highways to deteriorate such that a SHOPP rehabilitation project is needed. For example, Caltrans estimates that for every dollar spent on a major maintenance project for pavement, bridges, and culverts, between $4 to $12 of costs can be deferred by postponing the need for rehabilitation. In addition, major maintenance projects can improve safety and ride quality (such as pavement smoothness) of highways.

Make SHOPP Next Priority

After meeting the needs of the Highway Maintenance Program, we recommend that the Legislature make additional funding for SHOPP pavement, bridge, and culvert projects its next priority for the state’s share of new revenues. As indicated above, we previously estimated that there is an annual ongoing shortfall of around $800 million and a one‑time $9 billion need to address the current backlog of pavement, bridge, and culvert projects.

Consider Meeting Other Challenges

The Legislature will also want to consider the extent to which it wants to address other transportation challenges, such as supporting local transit and improving trade corridors.

Local Transit Systems. While transit systems are generally the responsibility of local governments, the state historically has had some role in funding capital improvements and providing operational support for local transit systems. Local transit can benefit travelers and the state by providing alternatives to driving, which can ease the demand on state highways and provide travel options for people who cannot drive. The Legislature will want to consider how large of a role the state should have in funding local transit, as well as the extent to which the state will support and encourage alternatives to driving. In doing so, the Legislature will want to determine its transit priorities. For example, the Legislature could focus new transit funds on capital projects, such as the rehabilitation of aging transit systems or the construction of new systems. Alternatively, the Legislature could provide funding for operational support of existing systems, or for a mix of capital projects and operational support.

Commute and Trade Corridors. The Governor’s proposal acknowledges the growing challenges on congested commute and trade corridors. The Legislature will also want to consider these challenges and the priority of addressing them relative to other transportation needs. In doing so, the Legislature will want to consider the Governor’s general approach of creating new ongoing funding programs to address commute and trade corridor congestion. In determining whether to fund such new programs and at what level, the Legislature could consider how many major corridor mobility and trade corridor improvement projects it would like to fund each year. As discussed earlier, under the Governor’s proposal the state would likely fund a relatively modest number of new projects with about two to three corridor mobility projects and about six trade corridor projects each year.

Other Challenges. The Legislature will also want to consider the extent to which it is a priority to increase funding for other priorities, such as ATP and local planning grants as proposed by the Governor. In determining priorities and funding levels for ATP, the Legislature will want to consider (1) the extent to which bicycling and pedestrian infrastructure will be provided by cities and counties through shared revenues for local streets and roads and (2) the additional priorities that would be addressed by also increasing funding through ATP.

Determine Overall Funding Level

The Legislature will want to determine the level of funding to include in a transportation package based on its identified priorities. The magnitude of funding needed will vary based on which transportation needs are prioritized and how robustly the Legislature wishes to fund those needs. In order to assist the Legislature, we illustrate below what level of funding would likely be needed to meet different sets of priorities.

In each of the three scenarios discussed below, we assume that the Legislature will at a minimum want to meet its core highway needs in the Highway Maintenance Program and SHOPP, as we have recommended. We also assume that the Legislature will share one‑third of all new revenues with cities and counties for their local streets and roads, maintaining the current proportional share of revenues. To the extent that the Legislature chooses to provide a greater share of revenue to cities and counties, the level of funding needed under each scenario would increase. Figure 14 summarizes the Governor’s proposal and the three scenarios, which are described in more detail below.

Figure 14

Potential Scenarios for Additional Transportation Funding

(In Millions)

|

Program |

Governor |

Scenario 1 |

Scenario 2 |

Scenario 3 |

|

Shared revenues—local roads |

$1,140 |

$1,600 |

$2,200 |

$2,900 |

|

SHOPP |

1,560 |

1,700 |

1,700 |

1,700 |

|

Highway Maintenance |

120 |

1,500 |

1,500 |

1,500 |

|

Transit |

430 |

— |

430 |

860 |

|

Trade corridors |

280 |

— |

280 |

560 |

|

Corridor mobility |

275 |

— |

275 |

550 |

|

Local partnership grants |

225 |

— |

225 |

450 |

|

Active Transportation |

100 |

— |

100 |

200 |

|

STIP |

30 |

— |

30 |

60 |

|

Local planning grants |

25 |

— |

25 |

50 |

|

Totals |

$4,185 |

$4,800 |

$6,765 |

$8,830 |

|

SHOPP = State Highway Operation and Protection Program and STIP = State Transportation Improvement Program. |

||||

Scenario 1—Fully Fund Highway Maintenance Program and SHOPP. This scenario shows how much it will cost the state to fully fund the Highway Maintenance Program and fully fund pavement, bridge, and culvert projects in SHOPP, and share one‑third of total revenues with cities and counties for local streets and roads. The level of funding needed under this scenario averages $4.8 billion annually over the first decade. This includes an annual average of $1.7 billion for SHOPP, $1.6 billion to cities and counties, and $1.5 billion for the Highway Maintenance Program. This scenario also assumes that the Legislature funds both the ongoing and backlog of the Highway Maintenance Program and SHOPP needs.

In comparison to the Governor’s proposal, the level of funding identified in the above scenario is greater than the $4.2 billion total annual level proposed by the Governor for the next decade for all transportation programs. However, the amount needed after the backlogs of work are addressed in the first ten years, would be about $3 billion annually.

Scenario 2—Fully Fund SHOPP and Maintenance and Fund Other Priorities at Governor’s Proposed Levels. In this scenario we show how much it would cost to fully fund the priorities described in scenario 1 and also fund all other programs included in the Governor’s funding package at the levels proposed by the Governor. The level of funding needed under this scenario averages $6.8 billion annually over the next decade. As shown in the figure, this amount includes an annual average of $2.2 billion in shared revenues for local streets and roads, $1.7 billion for SHOPP, $1.5 billion for the Highway Maintenance Program.

Scenario 3—Fully Fund SHOPP and Maintenance and Provide More Robust Funding for Other Priorities. In this scenario we show how much it would cost to fully fund the priorities described in scenario 1, and provide more robust funding for other programs proposed by the Governor. Specifically, it includes twice the amount proposed by the Governor for these programs. The level of funding needed under this scenario averages $8.8 billion annually over the first decade. Under this scenario, an annual average of $2.9 billion would be provided for local streets and roads.

Determine Revenue Sources

After determining its transportation priorities and the level of funding needed to meet them, the next step would be for the Legislature to determine how to generate the necessary revenue. This includes determining which specific taxes or fees to increase. Below, we address several key considerations for the Legislature in choosing revenue sources.

Focus on Charging Users of Transportation Systems

As described above, state transportation programs are generally funded from various taxes and fees on fuels and vehicles, which function somewhat as user fees—meaning the individuals who directly benefit from the good or service pay the associated costs. For example, with fuel taxes, generally the more someone drives on the state’s highways and roads the more they will pay in fuel taxes. As the Legislature considers various sources of revenue for a transportation funding package, we think a good approach is to focus on increasing existing taxes and fees on fuels and vehicles to maintain the state’s general approach to having users of the transportation system pay for the associated costs. Figure 15 shows the major existing fuel and vehicle taxes and fees, the current allowable uses of each source, and the potential revenue that could be generated from an increase in the rates of each tax and fee. Major factors to consider with each revenue option are discussed below.

Figure 15

Options to Increase Existing State Transportation Taxes and Fees

|

Revenue Source |

Allowable Uses |

Potential Revenue |

|

Gasoline excise tax |

State highway and local road construction, maintenance, mitigation, and associated administrative costs. Transit fixed guideways. |

$150 million per 1 cent increase. |

|

Diesel excise tax |

State highway and local road construction, maintenance, mitigation, and associated administrative costs. Transit fixed guideways. |

$30 million per 1 cent increase. |

|

Diesel sales tax |

General use. |

$85 million per 1 percent increase.a |

|

Vehicle registration fee |

State highway and local road construction, maintenance, mitigation, and associated administrative costs. Transit fixed guideways. State administration and enforcement of traffic laws. |

$34 million per $1 increase. |

|

Vehicle weight fees |

State highway and local road construction, maintenance, mitigation, and associated administrative costs. Transit fixed guideways. State administration and enforcement of traffic laws. |

$10 million per 1 percent increase of all rates. |

|

Vehicle license fee |

General use. |

$3.5 billion to $4 billion per 1 percent increase. |

|

aAssumes an average diesel price of $3 per gallon. |

||

Gasoline and Diesel Excise Taxes. The amount of excise taxes on gasoline or diesel fuel paid by drivers is generally proportional to how much they drive and how much fuel they consume. Because most vehicles operate on gasoline or diesel fuel, increasing these taxes would share the costs of transportation systems broadly across drivers. However, drivers of fuel efficient vehicles pay less than other drivers. In addition, drivers of vehicles that do not operate on gasoline or diesel fuel, such as electric vehicles, do not pay gasoline or diesel excise taxes. Fuel excise taxes also generally do not take into account that certain vehicles, because of their weight, can cause more wear and tear on highways and roads than other vehicles. It is also important to note that fuel excise taxes are restricted primarily to highway and road purposes, with only limited transit purposes being allowable.

Diesel Sales Tax. The sales tax on diesel is paid only by drivers of vehicles that operate using diesel fuel. Since much of the diesel fuel in the state is used by heavy trucks, raising this tax would generally have the effect of charging more to the drivers with vehicles that do the most damage to roadways. However, similar to excise taxes, not all heavy vehicles operate on diesel fuel. A sales tax is also more volatile than an excise tax as the revenue it generates will fluctuate based primarily on the price of the fuel. An increase in the diesel sales tax could be used for any purpose, which would give flexibility to the Legislature in spending revenue from this source in a way that meets its priorities.

Vehicle Registration Fee. The state currently charges vehicle registration fees that fund state administration and enforcement of traffic laws. In addition to these fees, the Legislature could charge a vehicle registration tax, such as that proposed by the Governor, that charges a flat rate to all vehicle owners and allocates the revenue to transportation infrastructure programs. The Legislature can think about this option as an access charge that all drivers would pay for having access to the state’s transportation systems, regardless of level of use. Such a tax would be charged broadly to all vehicle owners, including electric vehicle owners that are excluded under the fuel tax options. However, the amount paid would not differentiate between drivers who put a lot of wear and tear on roadways from those who rarely drive. Similar to fuel excise taxes and weight fees, vehicle registration taxes can only be used to fund primarily highway and road purposes.

Vehicle Weight Fees. Vehicle weight fees are taxes charged on heavy vehicles or those carrying a heavy load, such as commercial trucks. Increasing these fees would directly link the vehicles doing the most damage to increased costs of maintaining and rehabilitating roadways. Similar to fuel excise taxes, weight fee revenue is restricted primarily to highway and road purposes.

Vehicle License Fee (VLF). The state currently levies a VLF at 0.65 percent on the value of a vehicle. The tax is charged broadly to all vehicle owners, including electric vehicles. The amount charged is based on the vehicle’s value rather than the driver’s use or wear and tear on roadways. VLF revenue can be used for general purposes and could therefore be available to fund any mix of transportation priorities.

New Taxes or Fees. In addition, the Legislature could consider charging other new taxes or fees in order to increase funding for transportation programs. For example, Caltrans is currently conducting a pilot program to evaluate whether the state could implement a road usage charge—a charge based on the number of miles driven. Such a charge would most directly link individual driver’s usage of highways and roads with the amount charged. However, given the complexity of such a system, it would not be available for immediate implementation.

Consider a Mix of Sources

In developing a funding package, the Legislature will want to consider approving a mix of various revenue sources. This would allow the Legislature to ensure that everyone who benefits from state and local transportation systems pays an appropriate share for their maintenance and improvement. The Legislature will also want to consider a mix of sources that are primarily available for highways and roads along with sources that could also be used more broadly to support other priorities that it may have now or in the future, such as transit or active transportation. For example, the Legislature could adopt a modest vehicle registration tax as an access fee that all vehicle owners would pay. This could be paired with an increase in vehicle weight fees, to account for the greater damage done to roadways by heavy vehicles. Since both of those sources would provide funding restricted primarily for highways and roads, the Legislature could also consider one of the taxes that can be used for general purposes in order to have the flexibility to fund transit or other priorities.

Consider Stability of Revenue Sources

Another factor that the Legislature will want to consider in selecting revenue sources, is the stability of that source year to year and over the long term. In order to ensure that any funding package provides stable revenues, we recommend that the Legislature (1) take steps to stabilize existing fuel taxes, and (2) consider non‑fuel tax sources for long‑term funding stability.

Stabilize Fuel Tax Revenues. As discussed above, two of the state’s fuel taxes—the swap gasoline tax and the diesel excise tax—have rates that vary from year to year. These rates, in particular the gasoline rate, are impacted by the price of gasoline. Because the state has seen relatively low gasoline prices recently, BOE has reduced the rate charged for the swap excise tax so that the rate is about half the amount it was when the tax was first implemented. This volatility in the revenue sources makes it difficult for state and local transportation agencies to plan for multiyear projects. We think the Governor’s proposal to eliminate the current variable nature of these taxes and instead index them to inflation has significant merit. While the Governor’s proposal would not generate significant levels of funding, it would provide needed stability to the revenue source and better allow state and local transportation agencies to plan for the receipt of these funds.

Consider Non‑Fuel Tax Sources for Long‑Term Funding Stability. In the near term, fuel taxes continue to be a good option for funding transportation programs. However, over the longer term, there is uncertainty about the role of fuel taxes in funding transportation programs. This is because of advancements in vehicle technology that allow vehicles to operate while using significantly less fuel as well as the adoption of electric vehicle technology. To mitigate against this uncertainty and provide long‑term stability for transportation funding, we recommend the Legislature consider including funding sources in its package that are not based on fuel consumption, similar to the Governor’s approach. Weight fees and vehicle registration fees are such options that are not based on fuel consumption.

Distinguish Between Temporary and Permanent Sources

In addition to funding shortfalls to meet ongoing needs, some transportation programs have significant one‑time backlogs of necessary work. For example, as we discussed earlier in this report, the Highway Maintenance Program currently has a backlog of $3 billion in deferred projects and SHOPP has a backlog of projects totaling roughly $9 billion. These backlogs would be best addressed with one‑time or temporary funding sources, since ongoing funding needs will be less once backlogs of work are addressed. Temporary or one‑time sources of funding could include temporary taxes, general obligation bonds, or redirections from existing revenues.

Simplify Funding Distribution Model

Currently, state transportation funding is allocated to specific programs based on complex distribution methods specific in statute. As discussed earlier, the Governor’s transportation package would create new distribution formulas for the increased revenues—further making the state’s transportation funding system even more unnecessarily complex. Moreover, the complex distribution of transportation funds proposed by the Governor will result in uneven funding growth across the various programs over time. This is because programs funded from existing revenue sources will essentially be capped, while the growth in revenues will all be allocated through the new RMRA process based on the Governor’s priorities. In addition, within the Governor’s proposed RMRA distribution formula, the proposal provides fixed amounts off the top for certain priorities, which would not grow over time under the Governor’s proposal.

In developing a funding package, we recommend that the Legislature adopt an approach that is more simplified than that proposed by the Governor and allow for future growth across all priorities. One way of doing this would be to allow future growth in fuel taxes to be distributed through the existing formulas. Another approach would be to use proportional shares to establish funding levels for all programs, rather than creating off the top allocations. It will be important to ensure that new revenues are actually allocated to legislative priorities and that the planned funding levels are maintained over time. Moreover, putting together a funding package is an excellent opportunity for the Legislature to review the existing distribution formulas and consider improvements to reduce complexity and ensure that transportation funding is being distributed to the state’s highest priorities.

Determine Administration of New Programs and Establish Accountability Measures

The Legislature will also want to determine how new programs will be administered and establish accountability measures to ensure the efficient and effective use of all transportation funds.

Administration of New Programs

Determine Administering Entity. The Legislature will want to consider which agencies or departments should have responsibility for administering any new transportation programs that may be established. For example, the Governor’s package would establish corridor mobility and trade corridors programs. At the time of this analysis, the administration had not provided detailed information on the specific entity that would administer these programs, as well as how the funding would be allocated to specific projects. In the past, CTC has administered statewide transportation programs, such as the corridor mobility and trade corridor programs funded from Proposition 1B. This approach allowed for more independent oversight on the use of funds, given CTC’s role as an independent commission. To the extent that the Legislature establishes new transportation programs, we recommend it consider having CTC administer them. This would allow CTC to evaluate proposals and select projects across the state that meet’s the highest priorities for those programs.

Consider Competitive Programs. For any new transportation programs established, the Legislature will want to ensure that funding for the programs is allocated to the highest priority projects. One way to help ensure this is to require that funds are awarded through competitive grants. Such a competitive process would allow projects to be evaluated against certain criteria, with the highest priority projects meeting the criteria receiving state funding.

Robust Accountability

In order to ensure that any additional funds for transportation are spent effectively and in a way that meets legislative priorities, the Legislature will want to consider adopting well‑defined and robust accountability measures in the allocation of funds for both new programs and existing programs. For example, as we found in our May 2014 report, The 2014‑15 Budget: Capital Outlay Support Program Review, SHOPP currently has limited project‑level external oversight. Specifically, as discussed in that report, we recommend that the Legislature require CTC to perform project‑level oversight of SHOPP by thoroughly reviewing the proposed cost, scope, and schedule of all SHOPP projects when they are initially proposed. In addition, we recommend that CTC allocate all funding for SHOPP projects (rather than only allocating a portion of the funding as is currently the case), in order to ensure that Caltrans is providing regular updates to CTC on the status of each project and allowing for oversight to occur while projects are still under development.

In addition, the Legislature will want to consider adopting performance metrics for the various programs. Specifically, we recommend adopting such metrics for both the Highway Maintenance Program and SHOPP that provide a comprehensive assessment of the condition of the highway system. For example, the Legislature could establish goals that a certain amount of pavement be kept in good condition. In order to track progress, toward meeting its identified goals, the Legislature could require Caltrans to report on the status of these metrics on a regular basis. Similar accountability systems could be taken for the other state transportation programs, particularly SHOPP.

Back to the TopConclusion

The state faces significant transportation challenges, such as aging highways and roads and increased traffic congestion, that require additional funding to be addressed. The Governor’s proposed transportation package is a step in the right direction in beginning to address these challenges. However, in reviewing the proposed package the Legislature will want to consider its own priorities and how they compare to the specific aspects of the Governor’s package. In order to assist the Legislature in its deliberations on a transportation package, we provide in this report a road map to guide the Legislature in determining key aspects of a funding package, such as establishing its funding priorities, determining a specific funding level need, how the additional revenue will be generated, and how to ensure that the funding is allocated in a manner consistent with legislative priorities.