We reviewed the proposed memorandum of understanding (MOU) between the state and Bargaining Unit 16. This bargaining unit is represented by the Union of American Physicians and Dentists (UAPD) and consists of state employed physicians, dentists, and podiatrists. This analysis fulfills our requirement under Section 19829.5 of the Government Code.

LAO Contact

March 14, 2017

MOU Fiscal Analysis

Bargaining Unit 16 (Physicians)

On March 3, 2017, the administration submitted a proposed agreement between the state and Bargaining Unit 16. This bargaining unit is represented by the Union of American Physicians and Dentists (UAPD) and consists of about 1,600 state employed physicians, dentists, and podiatrists. This analysis fulfills our requirement under Section 19829.5 of the Government Code. More information about this and other bargaining units and proposed agreements is available at our website. The administration has posted this agreement and summaries of the agreement and the administration’s fiscal estimates on its website.

If approved by the Legislature and affected employees, this agreement would direct Unit 16 state employee compensation policies and costs through 2019-20. The timing of this agreement, along with the agreements with 14 other bargaining units pending legislative approval (see our analyses of these other agreements here and here), gives the Legislature the opportunity to consider the administration’s employee compensation proposals for a majority of the state workforce.

The proposed Unit 16 agreement includes changes to the state’s retiree health benefits that largely are similar to the plans the Governor proposed in six agreements the Legislature has ratified since 2015 and the 14 agreements pending ratification. If this and the 14 other pending agreements are ratified by the Legislature and affected employees, the state will have adopted a plan to address its large unfunded retiree health liabilities over the next few decades—through prefunding and reducing benefits for future employees—for much of the state workforce. These actions would lower state retiree health costs significantly over the long term. In order to reach these agreements, however, the Governor agreed to propose various pay and benefit increases for affected employees in the near term. These proposed pay and benefit increases—along with the state contributions to match employee payments to a retiree health funding account—would be a significant new budgetary commitment for the state with both near- and long-term effects on state obligations.

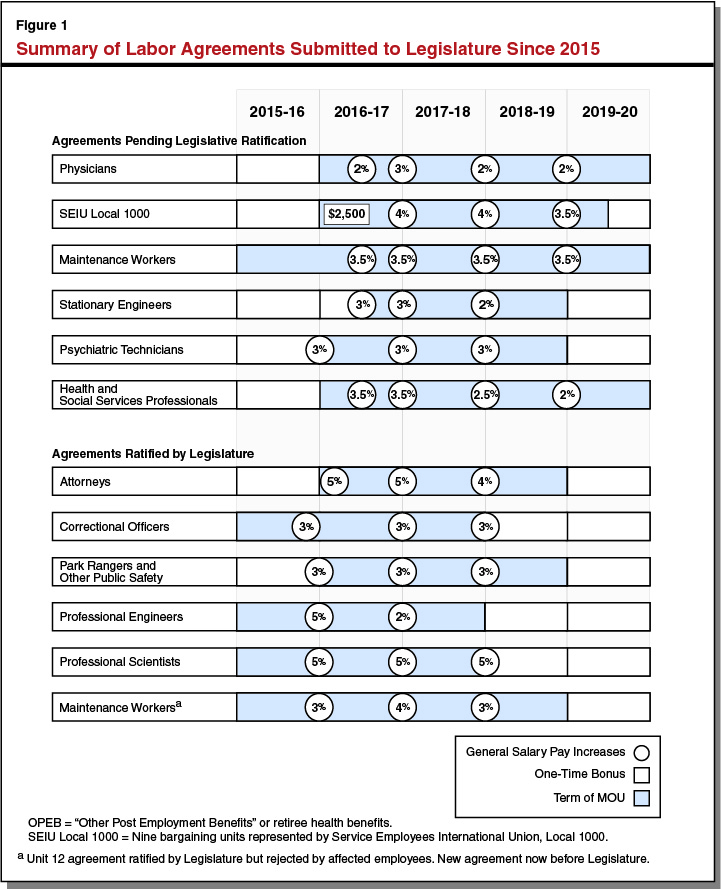

Duration. Since we started analyzing proposed labor agreements about a decade ago, most of the agreements the Legislature has ratified have had terms of about two years. (In general, these agreements were consistent with our 2007 recommendation to the Legislature not to approve any proposed labor agreements with a term of more than two years.) The past two Unit 16 agreements that were ratified by the Legislature had terms of three years. The proposed agreement would have a term of four years—from July 1, 2016 through July 1, 2020. Figure 1 illustrates the terms of the agreements submitted to the Legislature since 2015.

Pay

General Salary Increases (GSIs) for All. The agreement increases pay by a specified percentage for all Unit 16 members on four separate occasions—2 percent effective the pay period following ratification of the agreement; 3 percent on July 1, 2017; 2 percent on July 1, 2018; and 2 percent on July 1, 2019. This is a cumulative increase of 9.3 percent over the course of the agreement. These salary increases generally also increase state costs for overtime and salary-driven benefits, including state contributions to employees’ pension, Medicare, and Social Security benefits. (In addition, the agreement establishes the state’s contributions to prefund retiree health benefits as a percentage of pay, creating an additional cost that fluctuates with pay levels.)

Special Salary Adjustments (SSAs) for Some. In addition to the GSIs described above, the agreement would provide about one-quarter of Unit 16 members special salary adjustments of specified percentages at specified dates. Over the course of the agreement, these SSAs increase most affected employees’ pay by between 11.5 percent and 13.7 percent after accounting for the GSIs. (Employees in the podiatrist [Correctional Facility] classification salary range would receive a larger pay increase to align with salary ranges of other podiatrist classifications. The administration indicates that this affects about one employee. In total, this employee would receive a 28.8 percent pay increase over the course of the agreement, after accounting for the GSIs and SSAs.) Like GSIs, these SSAs generally increase state costs for overtime and salary-driven benefits.

Monthly Pay Differentials for Some. The agreement provides about 250 employees who work at specified facilities pay differentials that increase their monthly pay by between 7 percent and 15 percent. These pay differentials increase state costs for Medicare; however, they do not affect state costs for pension or Social Security benefits. These employees’ pay in 2019-20 would be between 17 percent and 26 percent higher than current levels.

Leave Cash Outs. Under the current MOU, Unit 16 members may not cash out vacation or annual leave until they separate from state service. To the extent authorized by department directors, the agreement would allow Unit 16 members to cash out up to 80 hours of unused vacation or annual leave each year.

Travel and Business Reimbursements. State employees are reimbursed for specified costs incurred while traveling and doing business for the state. The agreement adjusts the amount of money Unit 16 members may be reimbursed for these activities. The proposed reimbursement rates seem consistent with the administration’s reimbursement policies.

Health Benefits

End Dependent Vesting Period. The current Unit 16 MOU requires a new employee to work with the state for two years before receiving the state’s full contribution towards health coverage for the employee’s enrolled dependents. Specifically, the share of the state’s contribution to dependent health coverage increases over time so that the state pays (1) 50 percent of this benefit in the first year, (2) 75 percent of this benefit in the second year, and (3) the full benefit after the employee has worked two years with the state. The proposed agreement eliminates this vesting period so that the state pays the full contribution towards health coverage of new hires’ enrolled dependents. The administration assumes that departments will not receive augmentations to their budget to pay for these increased costs.

Retiree Health Benefits and Prefunding

Current Benefits and Funding. Until recently, like most governments in the U.S., the state did not fund health and dental benefits for its retirees during their working careers in state government. This has resulted in large unfunded state liabilities for the benefits. The state now pays for retiree health and dental benefits on an expensive “pay-as-you-go” basis. This means that later generations pay for benefits of past public employees. Although the state has not made contributions to prefund Unit 16 retiree health or dental benefits, Unit 16 employees have contributed 0.5 percent of their base pay to prefund these benefits since July 2013.

After most current employees retire, the maximum state contribution to their health benefits covers 100 percent of an average of CalPERS premium costs plus 90 percent of average CalPERS premium costs for enrolled family members. This maximum contribution is sometimes referred to as the “100/90 formula.” In 2017, the 100/90 formula entitles retirees to a maximum state contribution towards their health care of $707 per month for single coverage. Most state employees receive 50 percent of the maximum contribution from the state if they retire with 10 years of service, with this amount growing each year until it reaches 100 percent of the maximum contribution if they retire after 20 or more years. The state contribution for the typical retiree who is enrolled in Medicare is sufficient to pay the monthly CalPERS Medicare health plan premium and Medicare Part B premium costs—$134 per month for the typical Medicare enrollee.

Proposed Retiree Benefit Changes. The proposed agreement changes future retiree health benefits for employees first hired on April 1, 2017 and thereafter. Unlike the benefit received by current retirees, retired future employees will receive a significantly smaller amount of money from the state to pay for healthcare. Specifically, (1) the maximum benefit available to retirees not eligible for Medicare will be up to 80 percent of the weighted average premium cost of CalPERS health plans available to active employees and (2) the maximum benefit available to employees eligible for Medicare will be up to 80 percent of the weighted average premium cost for CalPERS Medicare plans and retirees will be responsible for paying the full Medicare Part B premium. Using current premiums for comparison, whereas a typical current retiree enrolled in Medicare has no premium costs, a single retired future employee enrolled in Medicare would be responsible for paying about $1,800 per year to pay Medicare Part B premiums and CalPERS Medicare plan premiums.

Proposed Funding Changes. The agreement institutes a new arrangement to address unfunded retiree health benefits for Unit 16 members. While the administration’s plan seems to be to keep making pay-as-you-go benefit payments for many years, the new arrangement would require state and employee contributions towards the “normal costs” each year for the future retiree health benefits earned by today’s workers. The agreement establishes a “goal” that employees and the state each regularly contribute half of the normal costs by July 1, 2018. Specifically, the agreement requires the state and employees to contribute 1 percent of pay effective July 1, 2017 and 1.4 percent of pay effective July 1, 2018. The agreement deposits these payments into a dedicated account in an invested trust fund managed by CalPERS. This account would generate earnings and gradually reduce unfunded liabilities over the next three decades or so.

Fiscal Effects

New Budgetary Commitment. As Figure 2 shows, the administration estimates that this agreement would increase annual state costs by $90 million by 2019-20. Most of these costs would be paid from the state’s General Fund. The administration assumes that departments will pay for about one-quarter of these costs from existing departmental resources without the need of additional appropriations. We think the actual annual costs of this agreement will be a few million dollars higher than the administration estimates by 2019-20. In particular, the administration’s estimates do not take into consideration the effect (1) of CalPERS lowering the discount rate used to determine state contributions to the pension system, increasing state contributions significantly over the next several years or (2) the proposed increases to employee base pay will have on overtime payments.

Figure 2

Administration’s Fiscal Estimates of Proposed Unit 16 Labor Agreement

(In Millions)

|

2016-17 |

2017-18 |

2018-19 |

2019-20 |

||||||||

|

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

||||

|

Pay Increases |

$4.8 |

$5.2 |

$35.0 |

$38.8 |

$45.6 |

$50.2 |

$56.5 |

$61.9 |

|||

|

Retiree health |

— |

— |

3.1 |

3.3 |

4.4 |

4.8 |

4.5 |

4.8 |

|||

|

Leave cash outa |

16.3 |

17.6 |

16.8 |

18.1 |

17.1 |

18.5 |

17.5 |

18.8 |

|||

|

Discontinue dependent vesting of healtha |

0.8 |

0.9 |

3.4 |

3.7 |

3.6 |

3.9 |

3.9 |

4.2 |

|||

|

Travel and business reimbursementsa, b |

— |

— |

— |

— |

— |

— |

— |

— |

|||

|

Totals |

$21.9 |

$23.7 |

$58.3 |

$63.9 |

$70.7 |

$77.4 |

$82.4 |

$89.7 |

|||

|

aAdministration assumes some or all of these costs will be paid with existing departmental resources. bCosts of less than $50,000. |

|||||||||||

Likely Indirect Costs to Prevent Future Compaction. When rank-and-file pay increases faster than managerial pay, “salary compaction” can result. Salary compaction can be a problem when the differential between management and rank-and-file is too small to create an incentive for employees to accept the additional responsibilities of being a manager. Consequently, the administration often provides compensation increases to managerial employees that are similar to those received by rank-and-file employees. While the administration has significant authority to establish compensation levels for employees excluded from the collective bargaining process, these compensation levels are subject to legislative review. To prevent any compaction issues, the administration likely will propose pay increases for excluded employees that are comparable to the pay increases received by rank-and-file employees under the agreement, increasing annual state costs by more than ten million dollars by 2019-20.

Agreement Could Be in Effect During Next Economic Downturn. The state has a revenue structure that depends on many volatile and unpredictable economic conditions, including fluctuations in the stock market. The U.S. economy currently is in one of the longest periods of economic expansion in the country’s history. It is difficult to predict with any level of certainty the timing, duration, or severity of the next economic downturn. However, it is reasonable to suggest that the next downturn could occur within the next few years. This agreement provides pay increases and other provisions that increase state costs through 2019-20. Employees will expect to receive the pay increases provided by the agreement, regardless of the condition of state revenues during the terms of the agreement. While the Legislature has the authority to set employee compensation to any level in any budget year, this agreement will make any action in response to fiscal constraints to reduce Unit 16 employee compensation below what is provided by the agreement very difficult.

Retiree Health

Insisting on Employee Other Postemployment Benefits Contributions May Increase State Costs. In a 2015 report, we noted that the Governor’s approach of requiring employee—rather than just employer—contributions to fund retiree health benefits would create pressure for the state to provide offsetting pay increases. It is now clear that this pressure affected the recent round of state employee negotiations. Employee pay increases proposed for this and 14 other bargaining units pending legislative approval likely are larger than they would be if the administration had not insisted on employee contributions to retiree health benefits. We also noted in 2015 that higher pay increases of this type drive up state pension costs. As such, it will probably end up costing the state more—including pay and pension costs—to share retiree health costs with employees than it would have costed to prefund retiree health benefits with just an employer contribution. In addition, the contribution rates established in this agreement to prefund retiree health benefits likely will need be changed in future labor negotiations, perhaps driving future changes in pay or other elements of compensation.

Employee Contributions to Pension Benefits

New CalPERS Discount Rate Will Increase Pension Contributions . . . CalPERS pensions are funded from three sources: investment gains, employer contributions, and employee contributions. CalPERS reports that about two-thirds of benefit payments are paid from past investment gains. CalPERS expects investment returns over the next decade to be lower than past returns. At its December 2016 meeting, the CalPERS board voted to change a key assumption used in calculating how much money employers and employees must contribute to the pension system each year. Specifically, the board voted to lower the discount rate from 7.5 percent to 7.0 percent over the next three years. This lower discount rate means that CalPERS calculations of plan assets and liabilities will assume investments will have lower returns. By assuming less money comes into the system through investment gains, the state will be required to contribute more money to pay for higher normal costs and a larger unfunded liability.

Current Law Establishes Standard that Employees Pay One-Half of Normal Costs. The California Public Employees’ Pension Reform Act (PEPRA) of 2013 created a standard that all state employees pay one-half of normal costs for their pension benefits. Contribution levels for state employees are established in labor agreements and statute. Today, the contributions paid by most state employees meet this standard.

Agreement Specifies Conditions Required Before Employee Contributions Increase. The proposed agreement specifies that employees’ contributions to pension normal costs will increase if and when, relative to 2016-17 contributions (1) the total normal costs increase by 1 percent and (2) one-half of the total normal costs exceeds the employee contribution towards CalPERS pension benefits. About two-thirds of Unit 16 employees earn “Safety” tier pension benefits (contributing 11 percent of pay in 2016-17—about one-half of total normal costs) and about one-fifth receive “Miscellaneous” tier pension benefits (contributing 10 percent of pay in 2016-17—about 2 percent of pay more than one-half of total normal costs).

Employee Contributions to Pensions May Increase During Term of Agreement. CalPERS estimates that the lower discount rate will increase the normal costs for both Safety and Miscellaneous plans by more than 2 percent of pay by 2019-20. Based on these estimates and the provisions established under this agreement, it seems likely that Unit 16 members earning Safety pensions will pay more towards their pensions by the end of the contract period. To the extent that increased pension costs resulting from the lower discount rate are shared with employees, the state’s increased annual costs resulting from this assumption change would be somewhat lower than otherwise would be the case in the absence of this provision—perhaps by millions of dollars.