On March 28, 2017, the federal Bureau of Economic Analysis released updated data on personal income. In this post, we describe the new data and the implications for school funding.

LAO Contact

March 30, 2017

The 2017-18 Budget

Update on Per Capita Personal Income

The federal government recently released updated data on personal income. This data affects some key California state budget calculations, including its school funding calculations. Below, we provide background on how California per capita personal income can affect school funding and examine the specific effects based upon the newly released data.

Background

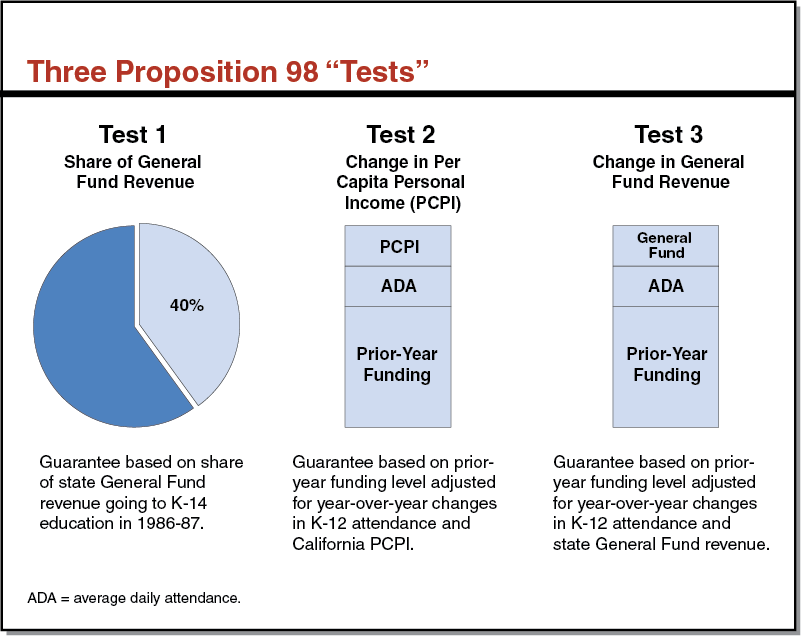

Proposition 98 Establishes Minimum Guarantee and Rules for Calculating It. Proposition 98, approved by voters in 1988, established an annual minimum funding guarantee for K-14 education. The minimum guarantee is determined by one of three “tests” set forth in the State Constitution. The figure below provides some basic information about each test. Various inputs and rules determine which test applies in a given year. In most years, Test 2 and Test 3 are compared and the test yielding the lower funding level sets the minimum guarantee. (Test 1 generally becomes important only when state revenue is growing or dropping substantially.)

Constitution Also Has Rules for Creating and Paying “Maintenance Factor.” When Test 3 is operative, the state creates a maintenance factor obligation that is equal to the difference between the higher Test 2 level and the lower Test 3 level. When Test 2 is operative, the state pays all or a portion of any outstanding maintenance factor obligation. The size of these payments increases as the difference between the Test 2 and Test 3 levels increases. In concept, the maintenance factor is intended to allow the state to provide less K-14 funding when state revenues are sluggish and more K-14 funding when state revenues are stronger. (A maintenance factor also is created when the minimum guarantee is suspended, which may occur with a two-thirds vote of each house of the Legislature.)

Per Capita Personal Income Is One Factor Affecting Proposition 98. In 15 of the past 28 years, Test 2 has been the operative test used to calculate the minimum guarantee. Under Test 2, the minimum guarantee equals the amount of state and local funding schools received the previous year, adjusted for changes in student attendance and California per capita personal income. To determine per capita personal income, the state relies upon income data from the federal Bureau of Economic Analysis and state population estimates from the Department of Finance. Regarding the income data, the state compares growth in per capita personal income from the fourth quarter (last three months) of two years ago with last year’s fourth quarter. For 2017-18, the state, for example, compares the fourth quarter of calendar year 2015 to the fourth quarter of calendar year 2016. Unlike all other Proposition 98 inputs, the state finalizes the calculation of per capita personal income in May before adopting the budget. The income portion of the calculation is finalized according to the March data from the federal government and the population portion is finalized according to Department of Finance May Revision estimates.

Recent Data

New Data Show Per Capita Personal Income Growing Faster Than Previous Estimates. On March 28, 2017, the Bureau of Economic Analysis released updated data on personal income in California and other states. Based on the new income data (and assuming no change in the population data), we estimate that per capita personal income growth in 2017-18 will be 3.9 percent. This estimate compares with the 3.3 percent growth assumed in the January budget.

New Data Has No Effect on the 2017-18 Minimum Guarantee…The Governor’s January budget estimated that per capita personal income would grow faster than per capita General Fund revenue in 2017-18. The latest federal data show per capita personal income growing even more quickly. In these situations, Test 3 is operative and the minimum guarantee is determined by growth in per capita General Fund. As a result, the change in per capita personal income has no effect on the minimum guarantee for 2017-18. The state, however, will create a larger maintenance factor obligation relative to January estimates. Holding other factors constant, the new maintenance factor created would be $605 million instead of the $219 million assumed in the January budget. Combined with the state’s existing $1.4 billion maintenance factor obligation, total outstanding maintenance factor at the end of 2017-18 would grow to $2 billion.

…But Schools Could Benefit if State Revenue Exceeds January Estimates. Although the updated estimate of per capita personal income does not affect the minimum guarantee in 2017-18, it would result in schools receiving a greater share of any additional General Fund revenue recognized in May. In our February Proposition 98 Education Analysis, we noted that the Governor’s 2017-18 revenue estimates could be too low and examined what would happen to the minimum guarantee if revenues came in higher. Our February estimates had the guarantee taking roughly half of the first $400 million in additional state revenue in 2017-18, none of the next $1 billion, and 50 cents for each additional dollar above the $1.4 billion mark. Adjusting for the new personal income data, we now estimate the guarantee would take roughly half of the first $1.2 billion in additional revenue, none of the next $900 million in revenue, and 50 cents for each additional dollar above the $2.1 billion mark. The changes have to do with the amounts of revenue needed for Test 2 to become operative and maintenance factor payments to be triggered. (The formulas work such that the guarantee takes about half of every additional dollar of state revenue until it reaches the Test 2 level and no additional revenue until maintenance factor payments are triggered, at which level the guarantee begins once more to take about half of every additional dollar of state revenue.)