LAO Contacts

May 5, 2017

CalSTRS Funding: An Update

- Introduction

- Unfunded Liabilities Increase $21 Billion

- Who Pays for Increased Unfunded Liabilities?

- LAO Comments

Summary

Recent Legislation Aims to Fully Fund CalSTRS by Mid‑2040s. Prior to recent state action, the California State Teachers’ Retirement System (CalSTRS) faced large unfunded liabilities with no plan in place to address them. Recent legislation increased state, district, and teacher contributions to CalSTRS with a goal of fully funding the system by the mid‑2040s. This legislation was a major state accomplishment.

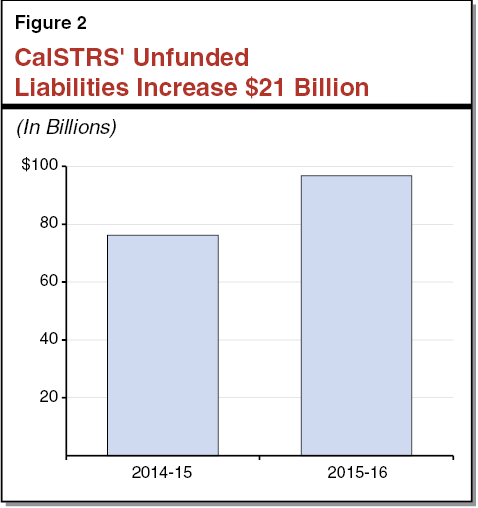

Recent Developments Increase Unfunded Liabilities. The CalSTRS board recently approved changes in a number of the assumptions actuaries use to estimate unfunded liabilities. Combined with a worse‑than‑expected investment return in 2015‑16 and other factors, these changes increase the estimate of CalSTRS’ unfunded liabilities from $76 billion as of 2014‑15 to $97 billion as of 2015‑16.

State Assigned Responsibility for Bulk of Increased Unfunded Liabilities. State law, as implemented by CalSTRS, uses complex calculations to assign responsibility for CalSTRS’ unfunded liabilities. Under this policy, the state is assigned $15 billion of the $21 billion increase, with school and community college districts generally assigned responsibility for the remainder. The state is now responsible for $29 billion of the total unfunded liability, and is expected to be assigned another several billion dollars of unfunded liabilities next year. CalSTRS projects that increases in the state’s contribution rate will not fully phase in for 15 years due to a cap in state law that limits state rate increases. These recent developments do not affect district contribution rates, which will continue to increase through 2020‑21 pursuant to a schedule in state law.

State Contributions Key to Meeting Funding Goal. CalSTRS projects that the pension fund is still on track for full funding by the mid‑2040s target date. To the extent that CalSTRS’ funding situation continues to erode—either through worse‑than‑assumed investment performance or further changes in actuarial assumptions—the state will largely bear the responsibility for covering the resulting costs (assuming the current funding approach remains in place). Whether CalSTRS is fully funded by the mid‑2040s target date will depend largely on whether the state pays enough to CalSTRS. Yet, increases in the state’s contribution rate are capped, which—under some scenarios—could prevent the funding plan from achieving its goal. If the Legislature wants to increase the likelihood that the funding plan is successful within the target time frame, it may need to ramp up state contributions even faster. It could do so by raising the cap on annual state contribution increases, dedicating a portion of required Proposition 2 debt payments, or using some combination of the two.

Introduction

A central tenet of public finance holds that expenses should be paid for during the year in which they are incurred. Applied to pension programs, this principle means that benefits should be funded during employees’ working careers. Underfunding benefits during employees’ working years imposes costs on future generations of taxpayers, a practice which should be avoided.

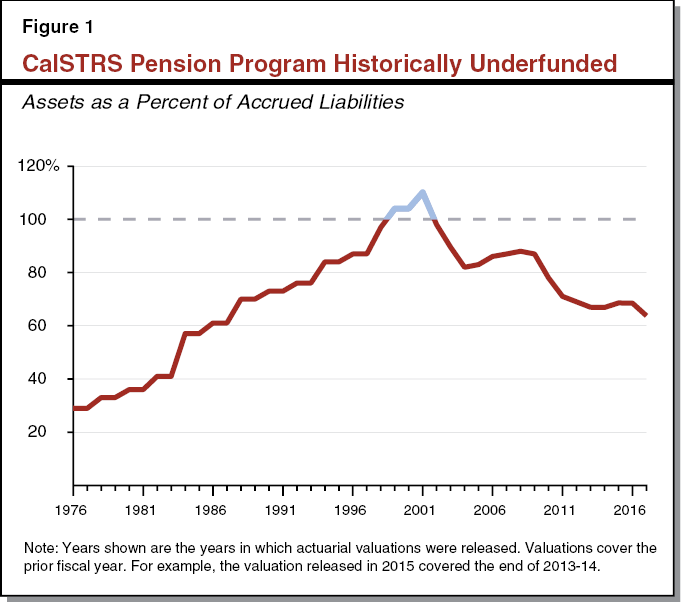

CalSTRS Historically Underfunded. An unfunded liability exists when the amount of assets a pension program has is insufficient to cover projected liabilities for pension benefits earned to date. Figure 1 displays CalSTRS’ historical “funded ratio”—a ratio of assets to liabilities. CalSTRS has been inadequately funded for almost all of its 100‑plus year history.

Recent Legislation Aims to Fully Fund CalSTRS by Mid‑2040s. Prior to recent state action, CalSTRS faced large unfunded liabilities with no plan in place to address them. CalSTRS was expected to exhaust its assets in the mid‑2040s, an alarming prospect for a pension system. Chapter 47 of 2014 (AB 1469, Bonta) increases contributions to CalSTRS made by the state, school and community college districts (referred to as districts in this report), and teachers. The plan aims to fully fund CalSTRS by the mid‑2040s. While fully funding CalSTRS will mean that taxpayers and teachers will contribute billions more in the next few decades, the plan will lower longer‑term costs and put CalSTRS on a sustainable path. As such, the funding legislation was a major state accomplishment.

Periodic “Experience Study” Results in New Assumptions Used in CalSTRS’ Actuarial Valuation. Every four years or so, CalSTRS’ actuaries produce a study that assesses the appropriateness of the system’s assumptions. The study looks at historical experience as well as expectations about the future. The CalSTRS board reviewed the actuaries’ most recent experience study at their February 2017 meeting and voted to change a number of assumptions that are used to estimate CalSTRS’ liabilities. These assumptions also affect how responsibility for CalSTRS’ unfunded liabilities is divided between the state and districts. This report describes how these new assumptions and other factors have increased CalSTRS’ unfunded liabilities and details how these developments will impact the state, districts, and teachers.

Assumptions Are Long Term in Nature. It is important for observers of pension programs to understand that actuarial valuations assess a system’s funding status over the very long term. While the way in which investments and other factors play out (what actuaries call “experience”) matters in the near term, the purpose of an actuarial valuation is to determine whether contributions from governments and public employees will be sufficient to cover the cost of providing pension benefits to those employees over the next several decades. We therefore urge users of this report to not only keep in mind recent experience and near‑term expectations about actuarial assumptions but also consider how these variables have performed several decades in the past and how they may perform very far into the future. For example, while annual inflation rates have been near zero in recent years and are expected to stay below 2 percent in the near term, actuaries also consider in their studies periods of “hyperinflation” during the 1970s and 1980s when inflation was at times greater than 10 percent.

Unfunded Liabilities Increase $21 Billion

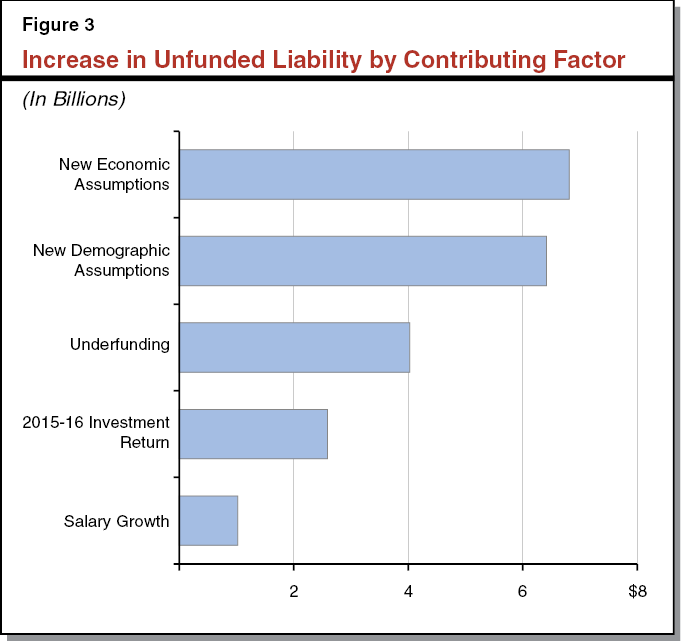

At its April 2017 board meeting, CalSTRS’ actuaries presented the actuarial valuation covering the fiscal year ending June 30, 2016. Compared with the actuarial valuation for the year prior, the total unfunded liability increased $21 billion, as shown in Figure 2. Five main factors contributed to the increase: new economic assumptions, new demographic assumptions, underfunding, investment returns in 2015‑16 falling short of assumptions, and salaries growing faster than assumed. Figure 3 shows how much each of these five factors contributed to the increase in unfunded liability. We describe these factors below.

Investment Return and Other Economic Assumptions

Investment Return Is Most Important Assumption. Actuarial valuations are premised on various assumptions about economic and demographic factors. The most important assumption concerns future investment returns. This is in part because the investment return assumption is used to “discount” the estimate of future benefit payments (liabilities)—in other words, to produce an estimate of the present value of future liabilities. (This is why the investment return assumption is sometimes called the “discount rate.”) Lowering the discount rate increases the present value estimate of the liabilities (and vice versa). Because actuaries project liabilities decades in the future, small changes in the discount rate result in large changes in the present value estimate of liabilities. In other words, the estimate of future liabilities—and therefore the estimate of unfunded liabilities—is highly sensitive to changes in the investment return assumption.

The investment return assumption has two components. First, the assumption incorporates the system’s assumption concerning future annual inflation (3 percent). In addition, CalSTRS assumes that it will receive an additional investment return based on the level of risk in its portfolio. This premium above inflation is assumed to be 4.5 percent. In total, the investment return assumption was 7.5 percent for the 2014‑15 actuarial valuation.

New Assumptions Increase Unfunded Liabilities by $7 Billion. At the February 2017 meeting, the board voted to reduce the inflation assumption to 2.75 percent. This decision flows through to assumptions that depend on inflation, including the wage growth and investment return assumptions. Specifically, the new inflation assumption reduces the annual wage growth assumption from 3.75 percent to 3.5 percent. The inflation decision also reduces the investment return assumption from 7.5 percent to 7.25 percent. These changes take effect for the 2015‑16 valuation, which was released in April 2017. In total, these new assumptions account for nearly $7 billion of the $21 billion increase in CalSTRS’ unfunded liabilities. (The board also voted to further reduce the investment return assumption to 7 percent for the 2017‑18 valuation, which will be released in spring 2018. While that assumption does not affect the estimate of the unfunded liability in the most recent valuation, it affects rate projections that we describe near the end of this report.)

New Mortality and Other Demographic Assumptions

Assumptions Concerning Life Expectancy Also Important. Another key actuarial assumption concerns life expectancy. To the extent that teachers live longer than was expected during their careers, contributions made by them and their employers—combined with investment returns on those contributions—will be insufficient to pay for their pension benefits for the portion of their lives that extend beyond their assumed life expectancy. If this happens, an unfunded liability results. It is therefore important for CalSTRS to reflect recent trends and future expectations about mortality in their assumptions so that pension benefits are funded by teachers and their employers during teachers’ working years rather than unfunded liability payments made by future generations of taxpayers.

Prior “Static” Assumptions Did Not Capture Future Improvements in Life Expectancy. Historically, CalSTRS—like most pension systems—has used static assumptions about life expectancy. This means that the assumptions did not change over time to reflect anticipated future improvements in life expectancy. Rather, CalSTRS would update the assumptions periodically to incorporate these improvements.

New Approach Increases Unfunded Liabilities by Over $6 Billion. CalSTRS’ new mortality assumptions use a “generational” approach. Essentially, this means that future improvements in life expectancy are incorporated up front in current assumptions. This could be thought of as accelerating life expectancy improvements that CalSTRS would have otherwise assumed in the future into today’s assumptions. The new approach aims to ensure that contributions from teachers and employers made during teachers’ working lives are sufficient to cover the costs of their pension benefits, and thus should help avoid unfunded liabilities in the future. In addition, the new approach will reduce the need to change mortality assumptions in the future. Because the generational approach accelerates future life expectancy improvements into current assumptions, however, it increases the current estimate of the unfunded liability. Specifically, the new mortality assumptions, along with other, relatively minor changes in demographic assumptions, account for over $6 billion of the $21 billion increase in CalSTRS’ unfunded liabilities.

Other Factors

Current Contributions Insufficient to Keep Unfunded Liability From Growing (Underfunding). The funding legislation phased in higher contributions over three years in the case of the state and teachers and seven years for districts. Higher contributions from the state and teachers are already phased in, while higher district contributions will be phased in by 2020‑21. While over the next few decades these contributions are projected to be sufficient to fully fund CalSTRS, during the phase in period contributions are insufficient to keep CalSTRS’ unfunded liability from growing. An analogy could be credit card debt. Each month, an individual with credit card debt incurs an interest charge. The cardholder’s monthly payment typically must exceed the interest charge in order for the principal—or in the case of CalSTRS, the unfunded liability—to decrease. This underfunding accounts for $4 billion of the $21 billion increase in CalSTRS’ unfunded liabilities.

2015‑16 Investment Return Fell Short of Assumption. The value of the system’s investment portfolio decreased by about 1.5 percent during 2015‑16. As of the end of 2015‑16, the portfolio was valued at $7.3 billion below assumptions. CalSTRS uses a “smoothing” policy to reduce volatility in reported unfunded liabilities and contribution rates, such that only one‑third of the variance is reflected this year. This means that only $2.4 billion of the difference is factored into the $21 billion increase in the unfunded liability, with the remainder of the difference deferred to future actuarial valuations.

Salary Growth Outpaced Assumptions. Assumptions about salary growth also affect estimates of liabilities. Similar to the investment return assumption, the salary growth assumption has two components—one tied to inflation that captures cost‑of‑living adjustments and another tied to pay raises that teachers receive as they progress in their careers. (As discussed above, the reduction in the inflation assumption also reduced the overall salary growth assumption from 3.75 percent to 3.5 percent.)

Salaries are one input in determining a teacher’s monthly pension benefit in retirement, along with age and number of years of service. Teacher and district contributions made during a teacher’s career are premised on an assumed amount of salary growth. When salaries grow faster than assumed there are two main effects. First, because contributions are measured as a percentage of payroll, CalSTRS receives more contributions. On the other hand, projected pension benefits will be higher than previously assumed. In part, because earlier contributions were premised on a lower estimate of projected benefit payments, an unfunded liability results for those prior years of service.

CalSTRS’ most recent valuation shows that salaries grew faster than CalSTRS’ new assumption. As shown earlier in Figure 3, the greater‑than‑assumed salary growth accounted for $1 billion of the $21 billion increase in CalSTRS’ unfunded liabilities.

Who Pays for Increased Unfunded Liabilities?

Funding Plan Assigns Responsibility for CalSTRS’ Unfunded Liabilities. The 2014 funding legislation, as implemented by CalSTRS, assigns responsibility for CalSTRS’ unfunded liabilities to the state and districts. (The legislation also increased teacher contributions, which help pay down the district share.) Specifically, the plan makes the state responsible for unfunded liabilities associated with the benefit and contribution structure that was in place as of 1990 (currently less than one‑third of the total). Districts pay for unfunded liabilities associated with changes made after 1990, but only through 2013‑14 (currently over two‑thirds of the total). (Responsibility for a small amount of CalSTRS’ unfunded liabilities—those associated with benefit changes made after 1990 and for years after 2013‑14—is not assigned under the funding plan.) We describe these concepts below in more detail, and discuss how CalSTRS’ new actuarial assumptions and the latest actuarial valuation affects the state, districts, and teachers.

State Share of Unfunded Liability Increases $15 Billion

Assembly Bill 1469 Assigns State Responsibility for 1990 Benefit Structure. As implemented by CalSTRS, the 2014 funding legislation makes the state responsible for unfunded liabilities associated with the benefits and contributions that were in place in 1990. This means that the state’s share of CalSTRS’ unfunded liabilities and its contribution rate are based on an estimate of what CalSTRS’ funding situation would be today had the state made different decisions about teacher pensions in the past. Generally, the calculation estimates what CalSTRS’ unfunded liabilities would be if (1) the state had not granted teachers more generous pensions in the late 1990s and (2) state and teacher contributions to CalSTRS’ main pension fund had not been decreased when CalSTRS was fully funded around 2000.

Theoretical Assets Assumed for Calculating State’s Share of Unfunded Liabilities. Had less generous benefits been paid to members and had more contributions been made to the investment fund, CalSTRS would have had more assets. In order to estimate what CalSTRS’ unfunded liabilities would have been in this theoretical situation, the calculation assumes that CalSTRS’ investment portfolio is larger than it actually is today. This is important because when CalSTRS records investment gains in the real world, the calculation gives the state the benefit of additional, theoretical gains off the fictional portion of the investment portfolio. For example, if CalSTRS’ real world portfolio grows by $10 billion, the calculation gives the state the benefit of a roughly $11 billion gain. Of course, the opposite is true as well. When CalSTRS records an investment loss—as they did in 2015‑16—the loss to the theoretical investment portfolio is larger than the real world loss, making the state share of the unfunded liability grow more than the increase in the real world unfunded liability.

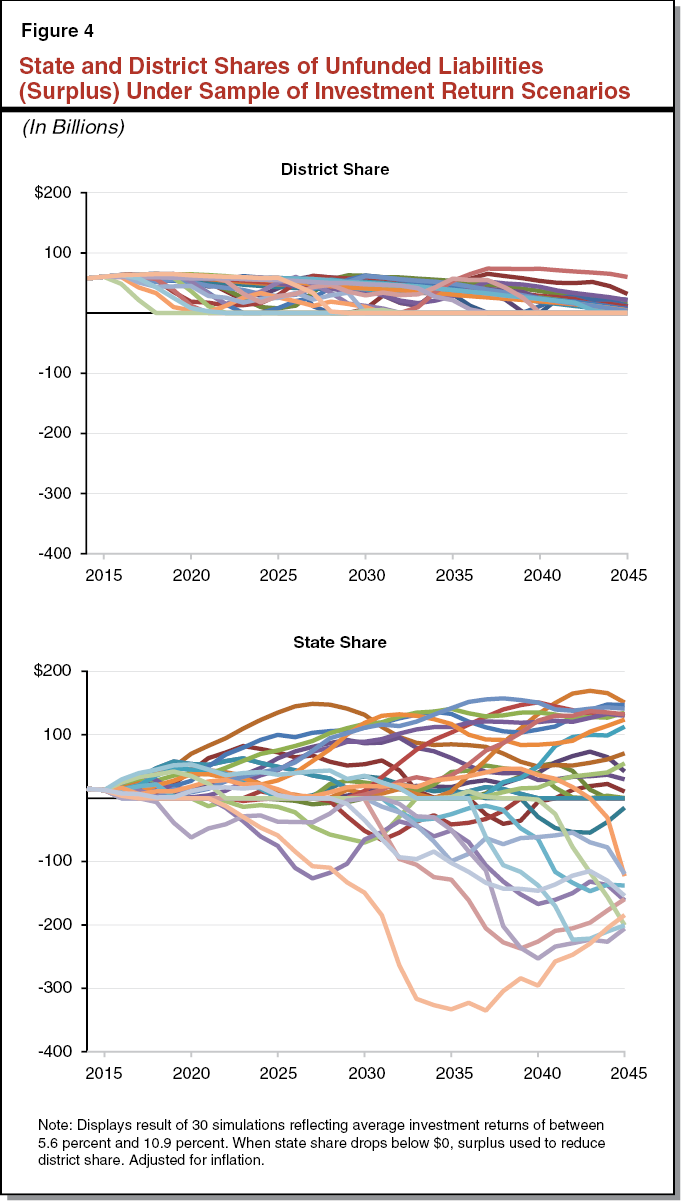

Theoretical Assets Makes State Share Relatively Volatile. Because theoretical assets that determine the state’s share of the unfunded liability fluctuate more than real world assets, the state share is relatively sensitive to changes in assets. Figure 4 shows a sample of possible investment return scenarios and resulting state and district shares of CalSTRS’ unfunded liabilities. The state’s share of future unfunded liabilities is far more volatile and uncertain than the district’s share. (We note that this figure is out of date for a variety of reasons—including new actuarial assumptions and a June 2016 amendment to the actuarial policy—but we offer it because it illustrates the volatility of the state share discussed above.)

State Share Also Sensitive to Changes in Liabilities. Figure 5 shows the breakdown of total CalSTRS assets and liabilities, as well as those credited to the state and to districts for purposes of calculating their respective shares. As described above, the state benefits from a theoretical asset portfolio ($189 billion) that is greater than the real world portfolio ($170 billion). Also, note that the state is responsible for the bulk of CalSTRS’ liabilities ($218 billion out of the $267 billion total). (Note that we are discussing total liabilities, not just the unfunded liability—the portion of liabilities not covered by assets.) This is because, had the post‑1990 benefit enhancements and contribution decreases not occurred, CalSTRS would still have had the bulk of the liabilities that it has today. This is important for determining the state’s share of the unfunded liability because when CalSTRS changes assumptions that increase the estimates of liabilities—like the investment return, mortality, and other assumptions described earlier—most of the resulting increase is assigned to the state.

Figure 5

Detail on Calculation of Responsibility for CalSTRS’ Unfunded Liabilities

2015‑16 (In Billions)

|

Total |

State |

Districts |

Unassigned |

|

|

Liabilities |

$266.7 |

$218.0 |

$41.8 |

$6.8 |

|

Assets |

170.0 |

188.7 |

‑25.1 |

6.4 |

|

Unfunded Liability |

$96.7 |

$29.3 |

$66.9 |

$0.5 |

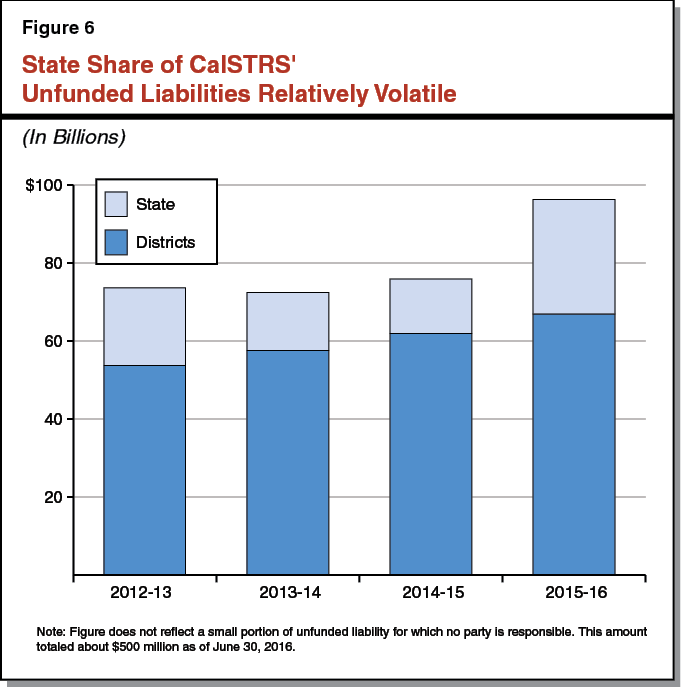

State Assigned Responsibility for $15 Billion of $21 Billion Unfunded Liability Increase. As described above, the state share of CalSTRS’ unfunded liabilities is sensitive to changes in both assets and liabilities. CalSTRS’ new assumptions about future investment returns, life expectancy, and other factors have increased liabilities. Moreover, the weak investment return in 2015‑16 decreased assets. The bulk of unfunded liabilities resulting from all of these changes are assigned to the state. Specifically, the state’s share of the unfunded liability as of the most recent valuation more than doubled from $13.9 billion as of 2014‑15 to $29.9 billion as of 2015‑16. This increase is reflected in Figure 6. Note that the figure also illustrates the relative volatility in the state’s share of CalSTRS’ unfunded liabilities. In the first two years following the funding plan, the state’s share dropped from $20 billion to $14 billion, before more than doubling as of the most recent estimate. In comparison, the district share of the unfunded liability has increased steadily over the period.

District Share of Unfunded Liability Increases $5 Billion

Districts Responsible for Cost of Benefit Enhancements and Contribution Decreases. The funding legislation, as implemented by CalSTRS, makes districts responsible for unfunded liabilities associated with the benefit and contribution changes that occurred after 1990, but only for service through 2013‑14. For example, Chapter 74 of 2000 (AB 1509, Machado) diverted one‑quarter (or 2 percentage points) of teachers’ contributions from the main pension program to a supplemental retirement benefit program. Had this change not been made, CalSTRS estimates that the investment portfolio would have roughly $10 billion more in assets. Districts are responsible for unfunded liabilities that resulted from these and other changes that were made after 1990.

Changes in Actuarial Assumptions Also Affect District Share. Districts are responsible for a small share of CalSTRS’ liabilities, as shown earlier in Figure 5. Changes in actuarial assumptions that increase liabilities will also increase the districts’ share of liabilities, albeit by a lesser amount than the state’s share. For example, like the state’s share of CalSTRS’ liabilities, the districts’ share is also discounted by the investment return assumption to arrive at a present value. The action to lower the investment return assumption therefore increases liabilities assigned to districts as well. As of the latest actuarial valuation, the district share of CalSTRS’ unfunded liability increased from $62 billion to $67 billion.

Contributions From PEPRA Teachers Expected to Increase in July 2018

Explanation of “Normal Cost.” The term normal cost refers to the amount actuaries estimate is necessary—combined with assumed future investment earnings—to pay the cost of pension benefits that employees earn in a given year. The normal cost is expressed as a percentage of payroll. Normal cost payments are different from unfunded liability payments. Normal cost payments fund the projected cost of pension benefits earned the year in which the normal cost contribution is made. In contrast, an unfunded liability is an amount owed for pension benefits earned in the past that were not fully funded.

New Assumptions Increase Estimate of Normal Cost. Changes in the various actuarial assumptions can have a significant impact on the estimate of normal cost. For example, assuming that teachers will live longer means that they are assumed to be paid pension benefits for a longer period. This in turn means that more must be paid during their working careers to fund their projected benefits in retirement. Likewise, to the extent that future investment returns are assumed to pay for less of a teacher’s future pension benefits, teachers and districts must pay more in normal cost during teachers’ working careers.

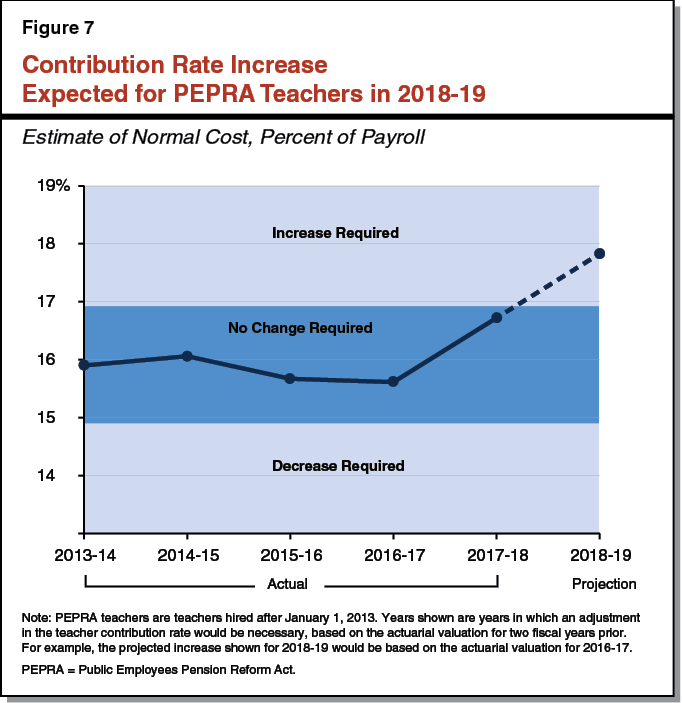

Teachers Hired After January 1, 2013 Pay Half of Normal Cost. Major pension legislation known as the Public Employees’ Pension Reform Act (PEPRA)—Chapter 296 of 2012 (AB 340, Furutani)—changed many aspects of public employee retirement programs. Among these changes was a requirement that public employees hired on or after January 1, 2013 pay half of the normal cost of their pension benefit. (We refer to teachers hired after this date as “PEPRA teachers.”) If the normal cost rate increases or decreases by more than 1 percentage point from the initial level set in the spring 2013 valuation (15.9 percent of payroll), the member must pay half of the increase, rounded to the nearest 0.25 percentage point.

Contributions From PEPRA Teachers Projected to Increase on July 1, 2018. Figure 7 shows estimates of normal cost since the first actuarial valuation following the passage of PEPRA. The darker band shows the range in which changes in teacher contributions are not necessary, while the two lighter bands show ranges in which changes would be necessary. As shown in the figure, CalSTRS’ actuaries are projecting that an increase in the PEPRA teacher contribution rate will be necessary in 2018‑19. This is largely due to the planned further reduction in the investment return assumption from 7.25 percent to 7 percent. The projected rate of 17.8 percent is nearly 2 percentage points higher than the initial post‑PEPRA rate of 15.9 percent. If this projection holds, the PEPRA teacher contribution rate will be 1 percentage point higher starting in 2018‑19. We discuss rate projections for the state, districts, and teachers in the section below.

New Rate Projections

District Rates Continue to Increase Pursuant to Statutory Schedule. Figure 8 shows near‑term projections of state, district, and teacher contribution rates and amounts. (The projections reflect the planned decrease in the investment return assumption to 7 percent in the spring 2018 actuarial valuation.) Under current law, district contributions are set in statute through 2020‑21. Pursuant to that statutory schedule, district contributions increase from 12.6 percent in the current fiscal year to 19.1 percent in 2020‑21. To begin to pay down the large increase in the state’s share of CalSTRS’ unfunded liabilities described earlier, the state’s rate increases by 0.5 percentage points per year over the period. This is the maximum increase in the state contribution rate allowable under current law. Lastly, the rate for PEPRA teachers is projected to increase by 1 percentage point in 2018‑19, as described earlier.

Figure 8

Near‑Term Projection of CalSTRS Contribution Rates and Amounts

(Dollars in Billions)

|

2016‑17 |

2017‑18 |

2018‑19 |

2019‑20 |

2020‑21 |

|

|

Contribution Rates |

|||||

|

Districts |

12.58% |

14.43% |

16.28% |

18.13% |

19.10% |

|

Statea |

8.58 |

9.09 |

9.60 |

10.11 |

10.62 |

|

Teachers hired before January 1, 2013 |

10.25 |

10.25 |

10.25 |

10.25 |

10.25 |

|

Teachers hired after January 1, 2013 |

9.21 |

9.21 |

10.21 |

10.21 |

10.21 |

|

Contribution Amounts |

|||||

|

Districts |

$4.0 |

$4.7 |

$5.5 |

$6.4 |

$7.0 |

|

Statea |

2.5 |

2.8 |

3.0 |

3.3 |

3.6 |

|

Teachers |

3.2 |

3.3 |

3.5 |

3.6 |

3.7 |

|

Totals |

$9.7 |

$10.9 |

$12.1 |

$13.3 |

$14.3 |

|

aIncludes roughly 2.5 percentage points related to a program that protects retired teachers’ pension benefits from the effects of inflation. State rate is based on statewide payroll as measured on a two‑year lag. |

|||||

State Rate Projected to Increase Until 2030. Figure 9 shows long‑term projections of state, district, and teacher contribution rates. As shown in the figure, most of the long‑term contribution increases are shouldered by the state. This is because the state’s share of CalSTRS’ unfunded liabilities more than doubled in the most recent valuation, and are assumed to increase further in next year’s valuation when the investment return is further reduced to 7 percent. Due to the 0.5 percentage point maximum allowable increase per year in the state’s contribution rate under current law, state rates are projected to increase for the next 15 years. District rates are expected to decline modestly beginning in 2020‑21. The districts’ rates do not increase as the state’s do because the current funding approach assigns the overwhelming majority of increased unfunded liabilities to the state. Increased contributions from the state and teachers keep the system on track to full funding, assuming future experience matches assumptions.

LAO Comments

New Assumptions Are a Good Thing for Many Reasons. While recent changes have increased CalSTRS’ unfunded liabilities notably, there are many positive aspects resulting from the new actuarial assumptions. CalSTRS’ new mortality assumptions better reflect future expected improvements in life expectancy. The new assumptions will increase future state contributions to address the increases in CalSTRS’ unfunded liabilities. The decision will also increase the estimate of normal cost, which is expected to increase contributions from PEPRA teachers. These decisions will increase contributions to CalSTRS, reduce the likelihood that unfunded liabilities materialize in the future, and keep the funding plan on track for full funding. As such, we view these developments positively.

Concerns About Current Funding Plan Implementation. In February 2016, we released a series of online posts titled, A Review of the CalSTRS Funding Plan. In our review, we examined a number of details about the plan that, in our view, differed from our earlier understanding of legislative intent. For example, we found that the plan “potentially exposes the state to larger unfunded liabilities than we thought possible when the Legislature passed the law.” That scenario seems to be coming to fruition with CalSTRS’ recent changes in actuarial assumptions. The state’s share of the unfunded liability is now about 50 percent greater than it was in 2014. Perhaps more important is the staggering complexity of CalSTRS’ policy that implements the funding law and the strange calculations that underpin that policy. We continue to have concerns about this complexity. That said, compared to the prior situation in which responsibility for funding CalSTRS was not defined in law and CalSTRS was projected to exhaust its assets in less than 30 years, the plan represents a major improvement.

State Contributions Key to Funding CalSTRS by Mid‑2040s. Earlier in this report, we described how the state’s share of CalSTRS’ unfunded liabilities is sensitive to changes in assets and liabilities. This is important because to the extent that CalSTRS’ funding situation continues to erode—either through worse‑than‑assumed investment performance or further changes in actuarial assumptions—the state will largely bear the responsibility for covering the resulting costs (assuming the current funding approach remains in place). Yet, increases in the state’s contribution rate are capped under state law at 0.5 percent per year. Under some scenarios, the funding plan may fall short of its key goal of fully funding CalSTRS by the mid‑2040s because this cap could keep state rates below what is necessary to fund CalSTRS. In short, whether the funding plan meets its stated goal will depend largely on whether the state pays enough to CalSTRS.

Consider Increasing State’s Contributions Faster. If the Legislature wants to increase the likelihood that the funding plan succeeds in achieving this goal, it probably needs to ramp up state contributions faster. While this would mean state costs for CalSTRS are even higher in the near term, it would lower state costs in future decades and increase the likelihood that CalSTRS is fully funded by the mid‑2040s target date.

Options for Increasing State Contributions Faster. The Legislature has three options for increasing state contributions to CalSTRS. First, the Legislature could increase the 0.5 percentage point cap on state rate increases. Each 0.25 percentage point increase in the cap would cost around $75 million per year in the near term. Second, Proposition 2 (2014) requires the state to pay down a certain amount of debt each year based largely on the amount of capital gains related revenue the state receives. The Legislature could dedicate a portion of Proposition 2 debt payments to CalSTRS on a one‑time, periodic, or ongoing basis. Third, the Legislature could take a hybrid approach in which it increases the statutory cap on state rate increases and dedicates a portion of Proposition 2 debt payments to CalSTRS.