May 16, 2017

The 2017-18 Budget

The Governor's May Revision In-Home Supportive Services Cost-Sharing Proposal

Background: Termination of the Coordinated Care Initiative (CCI)

Creation of the CCI. The CCI was a joint state-federal demonstration project that was implemented beginning in 2012-13, and designed to improve the coordination of health care and long-term services and supports and reduce the cost of providing care for seniors and persons with disabilities. As part of the CCI, counties’ historical share of In-Home Supportive Services (IHSS) costs—35 percent of nonfederal costs—was replaced with a maintenance of effort (MOE). Effective July 1, 2012, IHSS county costs were set at 2011‑12 expenditure levels, with an annual growth factor of 3.5 percent plus any additional costs associated with locally negotiated IHSS wage increases. The state General Fund assumed the remaining nonfederal IHSS costs.

Governor’s January Budget Terminated the CCI. Under statute, all components of CCI, including the IHSS MOE, remained operational as long as the CCI generated net General Fund savings and was cost-effective as determined by the Department of Finance. In January, the administration determined that the CCI was not cost-effective, automatically ending the program in 2017-18. This resulted in the termination of the IHSS MOE and reinstatement of the historical state-county IHSS cost-sharing ratios. Consequently, roughly $600 million of state costs shift back to counties in 2017-18. At the time of the Governor’s budget, the administration recognized that this cost increase would be problematic for counties. In the months leading up to the May Revision, the administration worked with counties to develop a mitigation strategy that would reduce the fiscal impact of returning to the historical cost-sharing ratios for counties. (We analyzed the details of the Governor’s January CCI and IHSS proposals here.)

May Revision Proposes a New State-County Cost-Sharing Agreement. The May Revision includes a proposal to reduce the fiscal impact to counties due to the elimination of the IHSS MOE under the CCI. In particular, the May Revision proposes a new, complex cost-sharing structure for county and state IHSS costs that would significantly reduce county costs compared to the January budget. This write-up outlines the proposal, raises key issues for Legislative consideration, and provides our recommendation for how to move forward.

Proposal Basics

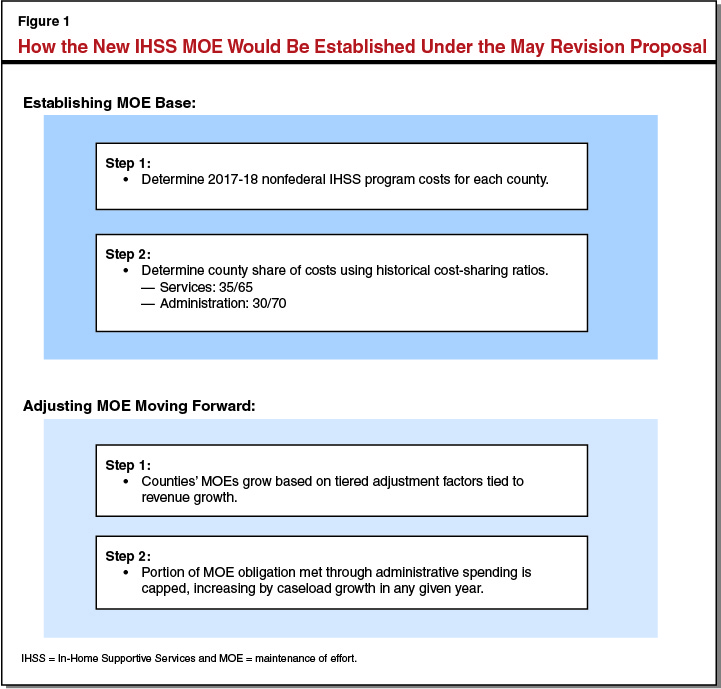

May Revision Proposes Establishing a New County IHSS MOE. Rather than return to the original 1991 realignment cost-sharing ratios for IHSS as initiated by the Governor in January (described here), the administration proposes establishing a new MOE for counties’ share of IHSS cost. The new MOE would include both services and administration using 2017-18 costs. The new MOE would significantly increase costs to counties in 2017-18 relative to 2016-17. Figure 1 walks through how the new MOE would be calculated. While the MOE shifts significant costs to counties, the proposal provides state General Fund support and additional realignment revenue to partially offset this increase. Figure 2 shows the main features of the IHSS cost-sharing proposal.

MOE Would Increase Starting in 2018-19. As shown in Figure 2, under the proposal, the MOE would increase by 5 percent in 2018-19. Starting in 2019-20, the MOE would grow based on tiered adjustment factors. These adjustment factors would vary based on the growth in realignment revenues, which generally reflect overall economic conditions. In years that realignment revenues decline—like during recessions—there would be no increase to the MOE and counties’ costs would be the same year to year. If realignment revenues increase by less than 2 percent, the MOE would increase by 3.5 percent. When realignment revenue growth exceeds 2 percent—which the Department of Finance expects will be the case through at least 2020-21—the MOE would grow by 7 percent.

Figure 2

Main Features of the Proposal

|

2017-18 |

2018-19 |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

|

|

General Fund support to partially offset increased county IHSS costs |

$400 million |

$330 million |

$200 million |

$150 million |

$150 million |

$150 million |

|

Realignment revenue growth to partially offset increased county IHSS costsa |

All sales tax and VLF growth |

All sales tax and VLF growth |

All sales tax and VLF growth |

All sales tax growth and half of VLF growth |

All sales tax growth and half of VLF growth |

All sales tax growth |

|

Adjustment factor to maintenance of effortb |

0% |

5% |

0, 3.5, or 7% |

0, 3.5, or 7% |

0, 3.5, or 7% |

0, 3.5, or 7% |

|

DOF estimate of county IHSS costs not covered by state General Fund or realignment revenues |

$141 million |

$129 million |

$230 million |

$251 million |

No projection |

No projection |

|

aA small portion of VLF growth would still be provided to the Child Poverty and Family Supplemental Support Subaccount in 1991 realignment. bStarting in 2019-20, the adjustment factor will depend on the rate of growth in realignment revenues. If realignment revenues are negative, the adjustment factor will be zero. If the realignment revenues are less than 2 percent, the adjustment factor will be 3.5 percent. If the realignment revenues exceed 2 percent, the adjustment factor will be 7 percent. DOF forecasts the adjustment factor will be 7 percent in 2019-20 and 2020-21. |

||||||

|

IHSS = In-Home Supportive Services; VLF = vehicle license fee; and DOF = Department of Finance. |

||||||

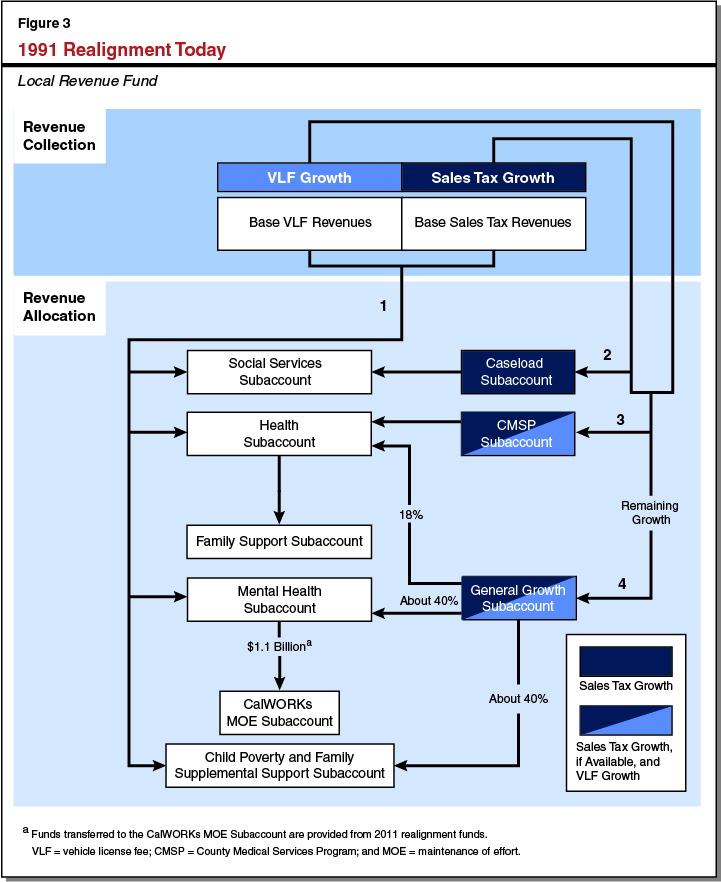

Despite Additional Revenue, Counties Would Face Some Costs. As seen in Figure 2, the administration proposes to provide General Fund support to assist counties in meeting their share of IHSS costs. The General Fund support to counties would decline over the next five years, but the state would provide $150 million on an ongoing basis. In addition, the administration proposes to temporarily redirect some 1991 realignment revenues to partially cover IHSS county costs. As seen in Figure 3 and described in detail in the nearby box, under the existing 1991 realignment fiscal structure, IHSS only receives sales tax growth, while vehicle license fee (VLF) growth is provided to other realignment programs. (Other realignment programs also receive sales tax growth when available.) To increase realignment funding for IHSS, the proposal would redirect VLF growth from other realignment programs to IHSS for five years. For the first three years, almost all VLF revenue growth would be redirected to IHSS. In the last two years, half of VLF revenue growth would be redirected to IHSS. While these additional sources of revenue would significantly reduce the cost increase to counties due to the new MOE (from $592 million to $141 million in 2017-18), the proposal does not cover all of counties’ IHSS costs. The last row of Figure 2 shows the Department of Finance estimates for the costs counties would face over the next few years. Counties would need to find other revenue sources—likely their county general funds—to cover these amounts.

How 1991 Realignment Funds Flow Today and Effects of the May Revision Proposal

How Funds Flow Today. Figure 3 shows how funds flow under 1991 realignment today:

Step One: Fund the Base. Sales tax and vehicle license fee (VLF) revenues dedicated to 1991 realignment fund the “base.” Generally, the base reflects the funding the realigned programs received in the prior year.

Step Two: Sales Tax Growth to the Caseload and Social Services Subaccounts. Growth in sales tax revenue funds prior-year increases in county costs for the Social Services Subaccount programs (through the Caseload Subaccount).

Step Three: Growth to County Medical Services Program (CMSP). A portion of the remaining sales tax growth (if any) and the growth in the VLF goes to the CMSP, which then is allocated to the Health Subaccount. (The proportion of sales tax and VLF growth allocated to CMSP is based on formulas set in statute.)

Step Four: General Growth. The remaining growth from the sales tax (if any) and VLF is allocated to the General Growth Subaccount. Of the funds allocated to the General Growth Subaccount, 18 percent goes to the Health Subaccount, roughly 40 percent goes to the Mental Health Subaccount, and the remainder goes to the Child Poverty and Family Supplemental Support Subaccount (hereafter the Child Poverty Subaccount).

In some years, the growth in sales tax revenue is not sufficient to fully fund changes in county costs for social services programs through the Caseload and Social Services Subaccounts (Step Two). As a result, in those years, counties do not receive sufficient funding through 1991 realignment to cover the growth in costs for those programs. Those unmet county costs are carried forward to the next year and any sales tax growth first goes to pay off that balance before paying any new growth. When the cost growth in the Caseload and Social Services Subaccounts equal or exceed the amount of sales tax growth, the Health, Mental Health, and Child Poverty Subaccounts receive growth only from VLF.

How the May Revision Proposal Changes Realignment. The May Revision proposal would affect Steps Two, Three, and Four (described above) for five years. In particular, rather than only allocating sales tax growth to the Caseload Subaccount, In-Home Supportive Services (IHSS) also would receive almost all of VLF growth for three years. (A small portion of VLF growth would continue to flow to the Child Poverty Subaccount.) As a result, for three years, Health and Mental Health would receive no growth funds (Steps Three and Four). After three years, half of VLF growth would be allocated to IHSS. At that time, the Mental Health and Health Subaccounts would receive some growth funds. After two years of allocating half of VLF growth to IHSS, the 1991 realignment fiscal structure would revert to its current form.

Other 1991 Realignment Programs Would Not Receive Any Growth Funding Until 2020-21. Due to the increased costs in IHSS and redirection of VLF growth, no realignment revenue growth would be available for some other 1991 realignment programs until 2020-21 (the Child Poverty and Family Supplemental Support Subaccount would continue to receive some VLF growth). Under the proposal, the revenue growth these programs would have received in the Governor’s January budget—VLF revenue—would be redirected temporarily to cover IHSS costs (Steps Three and Four in Figure 3). Starting in 2020-21, VLF growth funding for these programs—Health and Mental Health—would be partially restored. Growth funding from the VLF would be fully restored in 2022-23 and onwards. Sales tax growth, however, likely will not be provided to these programs for many years. Absent these changes, counties would have received roughly $50 million in VLF growth for Health and Mental Health in 2017-18 (and these revenues would have grown in the out years). Due to the decreased realignment funding to these programs, counties may have to provide local general fund to support costs in these programs or make program reductions.

Other Elements of the Proposal

Adjustments to Cap on State Participation in IHSS Wages and Benefits. State participation in total IHSS county wage and benefit costs is capped at $12.10. The May Revision proposes to increase the state contribution cap to $1.10 above the state minimum wage in any given year. The proposal also maintains the state and county cost-sharing ratios for the nonfederal wage and benefit costs below (35 percent county and 65 percent state) and above (100 percent county) the state contribution cap. In the case of locally negotiated wage increases, counties’ MOE base is adjusted upward to reflect their share of cost, whereas counties’ MOE base is not adjusted for costs associated with state minimum wage increases.

In addition, the May Revision institutes a three-year alternative cost-sharing structure for wage increases in counties currently above the $12.10 cap. For those counties, the state would share a portion of costs associated with wage increases over the next three years that, in sum, do not exceed 10 percent of their current wage and benefit level. For example, if a county is currently at $13 the state would participate in wage increases up to an additional $1.30 over the next three years. After three years, the state would have no share of cost in any locally negotiated wage or benefit increases above the state contribution cap for all counties.

Portion of MOE Obligation Met by Administrative Costs Is Capped. While the MOE determines the total county share of IHSS costs in any given year, the May Revision limits the portion of the MOE obligation that can be met by county administrative costs. Specifically, to the extent that counties spend more than is determined necessary to cover increasing administrative costs due to caseload growth, the exceeding administrative costs will not be counted towards their MOE obligations, meaning counties will pay the full nonfederal share of the cost. In contrast, there is no cap to the county share of IHSS services costs that can be counted towards the MOE obligation, meaning any county IHSS service cost in excess of the MOE cap will be paid by the state.

Counties Would Not Receive Caseload Growth Costs Incurred in 2016-17. Under the existing 1991 realignment fiscal structure, counties receive funding for increased costs due to caseload growth in arrears. That is, year-over-year increases in realignment revenue pay for prior-year increases in county costs for realignment programs. As a result, counties effectively receive “reimbursement” for the costs they incur. The May Revision shifts revenues that traditionally would have paid for costs incurred in 2016-17 to cover IHSS costs that will be incurred in 2017-18. As a result, counties would be paid on a “cash basis” for IHSS costs in 2017-18, however, costs incurred in 2016-17 would not be fully reimbursed. As a result, counties would have to cover costs incurred in 2016-17 that traditionally realignment revenues had paid. Moreover, due to this shift, year-to-year changes in IHSS costs would be calculated differently than all other 1991 realignment programs.

Additional Provisions. The MOE proposal contains several other additional components, many of which lack detail. We outline these components below.

Loans to Counties. The Department of Finance indicates it is willing to provide low-interest loans to counties facing financial hardship due to the shift in IHSS costs. The terms and extent of these loans have yet to be determined.

Realignment Revenue Growth. As described above, the adjustment factor applied to counties’ MOEs would grow based on the growth in realignment revenues. The proposal does not specify whether this determination would be made based on the growth in sales tax, VLF, or a combination.

Sales Tax Forgiveness. Recently, the Department of Finance and others have identified issues in the Board of Equalization’s distribution of sales tax revenue. The proposal indicates counties would not need to repay any over-allocation provided to 1991 realignment through 2015-16. How any changes in the sales tax allocation would affect the growth in sales tax revenues for 1991 realignment, however, is not clear.

State Participation in Wages for Some Counties. As described above, under the proposal, the state would share in up to 10 percent of additional wage growth for counties already at or above the $12.10 wage cap for three years. The proposal does not specify whether counties that are currently below the wage cap but exceed it during the three-year period would be eligible for this assistance as well.

Future Discussions. The Department of Finance indicates a willingness to continue to discuss the cost-sharing structure for the IHSS program. The conditions under which such discussions would take place are not clear, however. Moreover, Department of Finance does not indicate whether there are specific circumstances under which this proposal would be revisited.

LAO Comments and Recommendations

Proposal Achieves Some County Priorities. The Governor’s January proposal was widely understood to be problematic for counties. The May Revision substantially reduces 2017-18 IHSS cost to counties. The May Revision proposal also achieves two other county priorities for IHSS cost sharing: (1) the MOE and tiered adjustment factors make increases to counties’ IHSS costs relatively predictable and (2) the adjustment factors are tied to the growth in realignment funding. In addition, the administration’s proposal to adjust the wage cap based on changes to statewide minimum wage recognizes the impact of this state policy decision on counties’ IHSS costs.

Proposal Extremely Complex, Many Details Unsettled. The newly proposed cost-sharing structure for county and state IHSS costs adds additional complexity to the already labyrinthine 1991 realignment fiscal structure. Moreover, some key elements of the proposal have yet to be finalized. Some of these elements could affect overall costs for counties and the state in future years. Offering this solution in the May Revision gives the Legislature virtually no time to review an extraordinarily complex—as well as incomplete—proposal that could have significant long-term impacts to both state and county finances.

Adjustment Factor Likely to Be 7 Percent in Most Years. We anticipate that the MOE adjustment factor would be 7 percent in most years as realignment revenues likely will grow by more than 2 percent most of the time. During recessions, however, growth in realignment revenues likely would dip below 2 percent. There also may be other infrequent scenarios (for instance, years of weak growth combined with weak taxable sales) in which realignment revenue growth would dip below 2 percent. As a result, the adjustment factor would be 0 or 3.5 percent infrequently. (As discussed earlier, how frequently realignment revenue growth would be below 2 percent also would depend on whether the growth is measured based on sales taxes, VLF, or both.)

Counties Likely Would Not Share in Cost-Saving Policy Changes. While the MOE and tiered adjustment factors would give counties certainty as to the maximum growth in IHSS costs, counties would have limited opportunities to lower their costs. For instance, during recessions, the state may take steps to reduce program costs. In those years, nonfederal IHSS costs may not increase at all. Due to the MOE, however, counties would not see a reduction in their costs—all savings would accrue to the state.

Policy Basis for Continued MOE Unclear. When considering the appropriate levels of state and county cost shares for programs, fiscal responsibility for a program should be matched with the level of control over that program. Matching fiscal responsibility with the level of control gives both the state and counties an incentive to manage costs to the extent possible. As we described in our analysis of the Governor’s January budget proposal, the state has made several changes to IHSS over the past few years that have significantly increased the cost of the program. As a result, the historical IHSS cost-sharing ratios may no longer be appropriate. The proposal from the administration, however, does not appear to have considered what cost-sharing relationship would reflect the levels of control over the program today. Instead, the administration states that it expects the annual cost growth of the IHSS program to be 7 percent. By making the assumed adjustment to the MOE 7 percent in most years—equal to the overall expected growth of the program—the proposal would likely effectively maintain the current overall state-county cost relationship at close to 35 percent county and 65 percent state in the long term. This means that the county costs under this new MOE may be very similar to the costs under the traditional sharing ratios—making the policy basis for an MOE unclear.

LAO Recommendation: Adopt a Simpler, Shorter-Term Solution. As we have discussed, the Governor’s May Revision includes a complex, multiyear plan with many details that have not yet been provided. It is difficult to determine all of the potential benefits and drawbacks of the proposal in the short time frame of the May Revision. Referencing the volatility of 1991 realignment revenues, the administration has already signaled the intent to continue to have ongoing conversations with counties about this plan in future years. We do not see the need for the Legislature to authorize a complex, multiyear policy at this time. We recommend that the Legislature instead approve a simpler, short-term solution that provides some General Fund relief for the counties in the next few years, while allowing time for the Legislature to fully consider a simpler solution for the long term. Below we provide some options of what this short-term solution could be:

Option 1: Provide Some Level of General Fund Relief to Counties for Two Years. For the next two years, the Legislature could decide to have the counties return to their historical IHSS sharing ratios while providing them with some level of General Fund relief. The level of General Fund relief could be the same as that proposed by the Governor, or some higher or lower amount. This approach would not require any changes to 1991 realignment in the short term.

Option 2: Adopt the Governor’s Proposal for Two Years. Alternatively, the Legislature could adopt the Governor’s proposal on a short-term basis while a longer-term solution is more fully considered. This would provide counties with the same level of fiscal relief as proposed by the Governor, while guaranteeing that the issue will be reconsidered for the long term. A drawback to this approach is that, similar to the Governor’s proposal, it will require changes to the complex 1991 realignment structure.