LAO Contact

Other Publications

June 8, 2017

Overview of the 2017 Transportation

Funding Package

Summary

In April 2017, the Legislature enacted Chapter 5 (SB 1, Beall), also known as the Road Repair and Accountability Act. The administration estimates this legislation will increase state revenues for California’s transportation system by an average of $5.2 billion annually over the next decade. In this report, we (1) provide a brief background on the state’s transportation system, (2) describe the major features of the transportation funding package contained in the legislation, and (3) discuss issues for the Legislature to consider moving forward. (Though California’s transportation system also is supported by federal and local funds, this report focuses only on state funding given the purview of SB 1.)

California’s Transportation System

The state’s transportation system helps to move people and goods around and through the state. State funding primarily supports three segments:

- State Highways. The state’s highway system includes about 50,000 lane‑miles of pavement, 13,000 bridges, and 205,000 culverts (pipes that allow naturally occurring water to flow beneath a roadway). The California Department of Transportation (Caltrans) is responsible for maintaining and rehabilitating the highway system.

- Local Streets and Roads. The state has over 300,000 paved lane‑miles of local streets and roads, including nearly 12,000 bridges. California’s 58 counties and 482 cities own and maintain these streets and roads. They also operate and maintain other aspects of their local street and road systems, such as traffic signals and storm drains.

- Transit Operations. There are 200 transit agencies in California that primarily operate bus, light rail, and subway systems. These transit systems are generally owned and operated by local governments, such as local transit authorities.

As we discuss below, SB 1 increases state funding for these transportation segments from various state transportation taxes and fees, including gasoline excise taxes, diesel excise and sales taxes, and vehicle taxes and fees.

Major Features of the 2017 Transportation Funding Package

This section consists of three parts. First, we describe the funding package’s revenues. Second, we describe its spending provisions. Lastly, we discuss accountability and other measures contained in the legislation.

Increases State Transportation Revenues

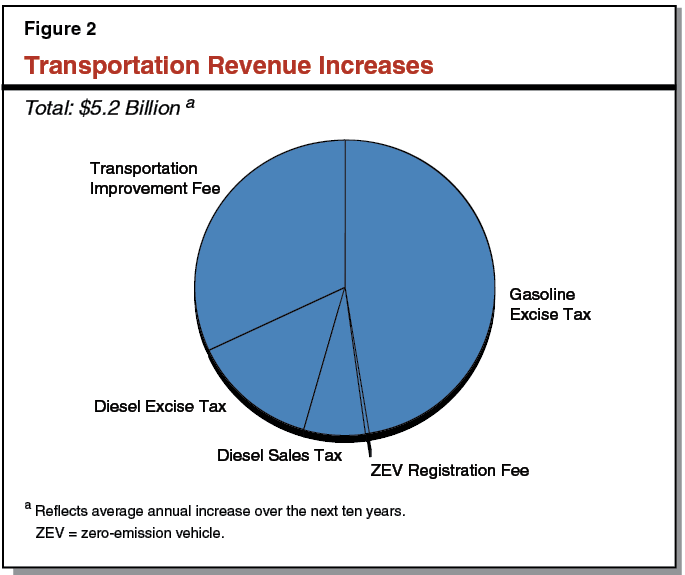

Figure 1 shows the tax and fee rate increases established by SB 1. The legislation increases both gasoline and diesel taxes, while also creating new vehicle taxes and fees to fund transportation. Figure 2 shows the share of revenues from each tax and fee increase. (Because the tax and fee rate increases are phased in over the next several years, the associated revenue increases cited here and throughout the remainder of this report reflect the administration’s estimated annual average increase over the next decade.) As shown, the gasoline excise tax increases and the new Transportation Improvement Fee are the two largest revenue sources. Altogether, the administration projects ongoing revenues to increase by $5.2 billion annually. Currently, state funding for transportation from these and other revenue sources (such as truck weight fees and cap and trade auction revenues) total about $7.5 billion annually. Below, we provide more detail on each revenue increase.

Figure 1

Tax and Fee Rate Increases

|

Current Rates |

New Ratesa |

Effective Date |

|

|

Fuel taxesb |

|||

|

Gasoline |

|||

|

Base excise |

18 cents |

30 cents |

November 1, 2017 |

|

Swap excisec |

9.8 cents |

17.3 cents |

July 1, 2019 |

|

Diesel |

|||

|

Excisec |

16 cents |

36 cents |

November 1, 2017 |

|

Swap sales |

1.75 percent |

5.75 percent |

November 1, 2017 |

|

Vehicle taxes and feesd |

|||

|

Transportation Improvement Fee |

— |

$25 to $175 |

January 1, 2018 |

|

ZEV registration fee |

— |

$100 |

July 1, 2020 |

|

aAdjusted for inflation starting July 1, 2020 for the gasoline and diesel excise taxes, January 1, 2020 for the Transportation Improvement Fee, and January 1, 2021 for the ZEV registration fee. The diesel sales taxes are not adjusted for inflation. bExcise taxes are per gallon. cCurrent rate set annually by the state Board of Equalization. The funding package converts the variable rate to a fixed rate. dPer vehicle per year. ZEV = zero‑emission vehicle. |

|||

State Fuel Taxes

Gasoline Taxes ($2.5 Billion). The state currently has two excise taxes on each gallon of gasoline: a base tax and a variable “swap” tax. (We note that there is also a federal excise tax of 18.4 cents per gallon.)

- Base Excise Tax ($2.2 Billion). This tax is set in state law at 18 cents per gallon. Starting November 1, 2017, the transportation funding package adds a 12 cent per gallon base excise tax—bringing total base excise taxes to 30 cents per gallon. It also adjusts the rates for inflation starting in 2020. These changes are expected to raise $2.2 billion annually.

- Swap Excise Tax ($300 Million). Currently, this tax is set annually by the Board of Equalization (BOE), which considers both gasoline price and quantity sold in an effort to mimic a sales tax on gasoline (which the swap tax replaced in 2010). The current swap rate is 9.8 cents per gallon but will increase to 11.7 cents on July 1, 2017. Starting July 1, 2019, the funding package eliminates the swap tax and replaces it with a fixed excise tax of 17.3 cents per gallon—the rate in effect when the swap was created in 2010. It also adjusts the rate for inflation starting in 2020. These changes are expected to raise $300 million annually. (This estimate reflects the administration’s assumption that the swap tax increases to 16.9 cents just prior to the funding package fixing the rate at 17.3 cents.)

Diesel Taxes ($1.1 Billion). The state currently collects revenue from excise and sales taxes on diesel fuel. (We note that there is also a federal excise tax of 24.4 cents per gallon.)

- Excise Tax ($700 Million). Currently, this tax has a variable rate set annually by BOE. The board adjusts the rate to ensure the combined revenues from this tax and a diesel sales tax enacted in the 2010 tax swap (discussed below) are neutral compared to diesel excise tax revenues prior to the swap. The current rate is 16 cents per gallon. Starting November 1, 2017, SB 1 increases this tax by 20 cents per gallon to 36 cents per gallon and makes the rate fixed. It also adjusts the rate for inflation starting in 2020. These changes are expected to raise $700 million annually. (This estimate reflects an assumption by the administration that the rate would have decreased to 14 cents starting July 1, 2018.)

- Swap Sales Tax ($350 Million). The state also has a sales tax specific to diesel (enacted as part of the gasoline tax swap) set at 1.75 percent. The funding package increases this rate to 5.75 percent. This is expected to increase associated revenues by $350 million annually. (In addition, state and local sales taxes on tangible goods that together average 8.5 percent statewide also apply to diesel, with revenue from a rate of 4.75 percent funding transportation. Senate Bill 1 makes no changes to this tax.)

Vehicle Taxes and Fees

Transportation Improvement Fee ($1.7 Billion). The funding package creates a new vehicle charge—called a Transportation Improvement Fee—specifically to fund transportation. Vehicle owners are to pay the fee annually at the same time they pay their vehicle registration fee. Figure 3 shows the rate schedule for the new fee. The fee is expected to generate $1.7 billion annually.

Figure 3

Transportation Improvement Fee Schedule

|

Value of Vehiclea |

Annual Fee |

|

$0 to $4,999 |

$25 |

|

$5,000 to $24,999 |

50 |

|

$25,000 to $34,999 |

100 |

|

$35,000 to $59,999 |

150 |

|

$60,000 and higher |

175 |

|

aBased on depreciated value of vehicle. Values not adjusted for inflation in the future. |

|

Zero‑Emission Vehicle Registration Fee ($19 Million). Senate Bill 1 creates a new $100 registration fee for zero‑emission vehicles only. Called a Road Improvement Fee, it is expected to generate $19 million annually. (The reason for this fee is because drivers of zero‑emission vehicles do not pay fuel taxes like other drivers.)

Increases State Transportation Spending

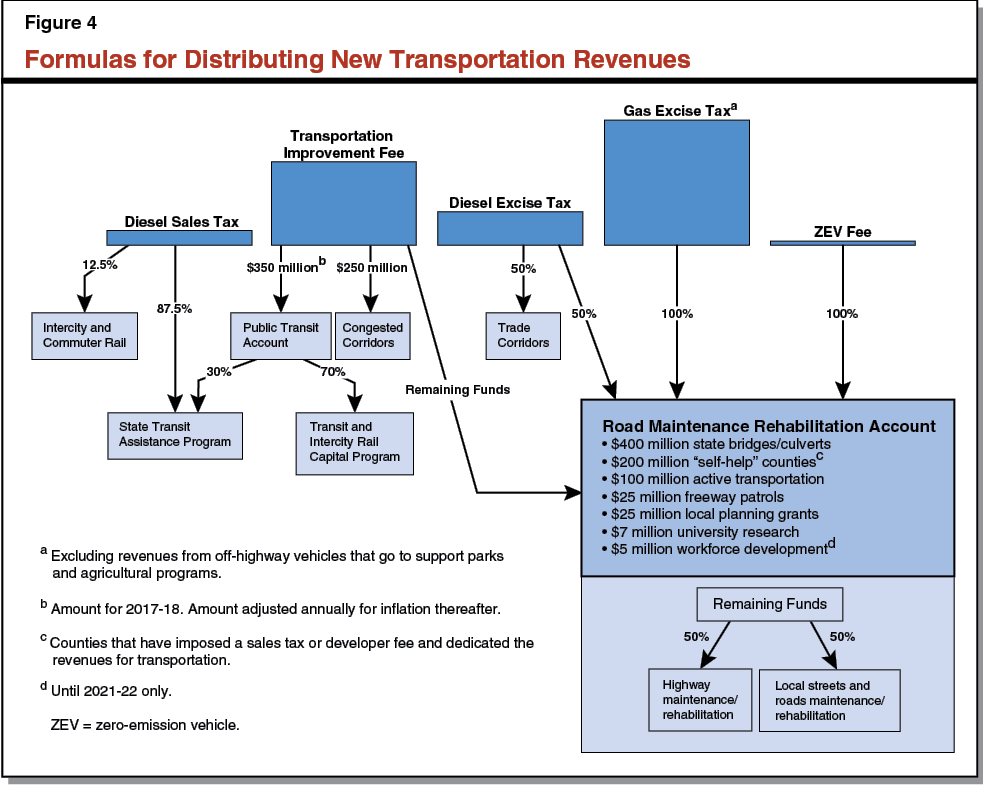

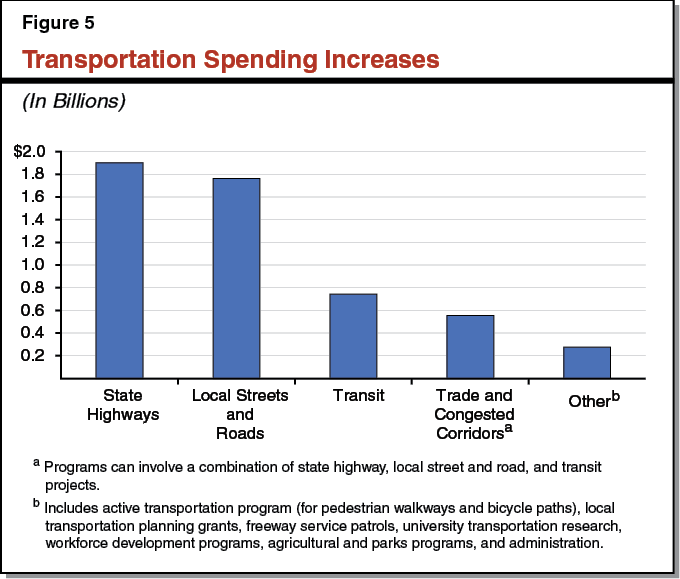

As shown in Figure 4, SB 1 creates a series of formulas to distribute the revenues from the new taxes and fees to different transportation programs and purposes. In most cases, the formulas split the revenues based on percentages, but in some cases the legislation sets aside fixed dollar amounts for certain programs. (Revenues from the inflation adjustments imposed by SB1 on existing taxes are distributed according to existing statutory formulas.) Figure 5 shows how much ends up being spent by each type of program. As shown, the largest spending increases are for state highways and local streets and roads. Below, we describe the specific transportation programs that receive the new revenues. (Additionally, as we discuss in the box below, a proposed constitutional amendment would add to existing restrictions on the use of transportation revenues.)

Proposed Constitutional Amendment Related to Funding Package

Currently, the State Constitution places restrictions on the use and borrowing of certain state transportation revenues. A companion measure to the transportation funding package, Chapter 30 of 2017 (ACA 5, Frazier), proposes to amend the State Constitution to place similar restrictions on transportation revenues not covered by existing constitutional provisions. Additionally, the measure adds to existing exemptions on certain transportation spending from counting toward a constitutional spending limit. The measure will go before the voters in June 2018. Below, we summarize its provisions.

Spending Restrictions. ACA 5 requires that revenues from the Transportation Improvement Fee established in the transportation funding package only be spent on specified transportation purposes. These purposes are researching, planning, constructing, improving, maintaining, and operating public streets and highways and transit systems. ACA 5 also prohibits the state from using Transportation Improvement Fee revenues to pay for debt service on state transportation general obligation bonds authorized on or before November 8, 2016. Additionally, ACA 5 requires that revenues from the diesel sales swap tax be restricted to transportation planning and mass transportation purposes. (Currently, such revenues could be used for any general purpose.)

Borrowing Restrictions. ACA 5 restricts the Legislature from borrowing Transportation Improvement Fee and diesel sales swap tax revenues, except in limited circumstances when the General Fund is exhausted.

Spending Limit Exemptions. The State Constitution currently includes spending limits—technically, appropriations limits—on the state and most local governments, known as “Gann limits.” The Constitution exempts certain appropriations from these limits, including appropriations from a portion of gas excise tax revenues and appropriations for capital outlay (including transportation capital outlay). ACA 5 adds to these exemptions by excluding all appropriations from revenues raised by the transportation funding package.

State Highway Programs

The funding package includes $1.9 billion annually specifically for state highways. This includes funding for:

- Maintenance and Rehabilitation ($1.8 Billion). Caltrans’ Highway Maintenance Program performs minor maintenance (such as roadside landscaping) and major maintenance (such as laying a thin overlay of pavement) on highways that are in good or fair condition, while its State Highway Operations and Protection Program (SHOPP) delivers capital projects to rehabilitate or reconstruct highways when they reach the end of their useful life. The administration estimates that the funding package will increase ongoing revenues for highway maintenance and rehabilitation by $1.8 billion annually, including $400 million specifically for bridges and culverts. The funding package does not designate revenues between the two programs, leaving it up to the annual budget act. (Additionally, the legislation makes a $225 million loan repayment from the General Fund to the SHOPP.)

- Capacity Expansion ($33 Million). The State Transportation Improvement Program (STIP) is the state’s program for improving transportation systems, generally by increasing their capacity. The administration estimates the funding package will increase revenues for state STIP projects by $33 million annually. (As discussed further below, STIP also funds local road improvements.)

Local Streets and Roads Programs

The funding package includes about $1.8 billion annually specifically for local streets and roads. This includes funding for:

- Maintenance and Rehabilitation ($1.7 Billion). The funding package increases revenues for local road maintenance and rehabilitation by $1.5 billion annually, and it distributes this funding to local jurisdictions according to existing statutory formulas based on factors such as population and number of registered vehicles. The package also sets aside an additional $200 million annually for road maintenance and rehabilitation for counties that have enacted developer fees or voter‑approved taxes dedicated specifically to transportation. The California Transportation Commission (CTC) is to determine how to allocate the funds. (Additionally, the legislation makes a $225 million loan repayment from the General Fund to the local streets and roads program.)

- Capacity Expansion ($100 Million). The administration estimates the local share of the funding package’s revenues for STIP will total about $100 million annually. (These funds primarily support streets and roads but in some cases could be used for transit projects as well.)

Transit Programs

The funding package includes about $750 million annually for three transit programs:

- State Transit Assistance Program ($430 Million). This program distributes funding to transit operators based on a formula. The funds can be used for either operational support or to fund capital projects based on local priorities. The administration estimates the funding package will increase state revenues for this program by about $430 million annually.

- Transit and Intercity Rail Capital Program ($270 Million). This is a competitive grant program that awards funding to transit and rail capital projects, including intercity, commuter, and urban rail projects, as well as projects for bus and ferry transit systems. The program requires projects to meet certain criteria, such as reducing greenhouse gas emissions. The administration estimates the funding package will increase state revenues for this program by about $270 million annually. (Additionally, the legislation makes a $256 million loan repayment from the General Fund to this program, with up to $20 million of this repayment amount available for local and regional agencies to plan for climate changes.)

- Commuter Rail and Intercity Rail ($44 Million). Senate Bill 1 creates a new stream of revenues for commuter and intercity rail operations and capital improvements. The legislation splits funding equally between commuter rail and intercity rail. The California Transportation Agency is to develop guidelines to allocate funding among eligible rail agencies. The administration expects the funding package to provide $44 million annually for both commuter and intercity rail combined.

Trade and Congested Corridor Programs

The funding package includes a total of about $560 million annually for two new programs to improve trade corridors and congested corridors. These programs, which can support state highways, local streets and roads, or transit, include:

- Trade Corridor Enhancements Program ($310 Million). Under this program, Caltrans and local agencies can apply for funds for corridor‑based freight projects. (Proposition 1B of 2006 created a similar program.) The administration estimates this program will receive about $310 million annually.

- Solutions for Congested Corridors Program ($250 Million). This is another new program created by SB 1. Under the program, Caltrans and local agencies can apply to the CTC to fund projects that address transportation, environmental, and community access improvements within highly congested travel corridors. The legislation sets aside $250 million annually for the program.

Other Programs

The funding package includes about $270 million annually for various other programs, including:

- Active Transportation Program ($100 Million). This program funds bicycling and pedestrian improvement projects. Funds in the program are allocated through competitive grants with half of the funds distributed to projects selected by the state, 40 percent distributed to projects selected by large urban regions, and 10 percent for projects selected by rural and small urban regions. The funding package increases funding for this program by $100 million annually.

- Freeway Service Patrols ($25 Million). Caltrans, the California Highway Patrol, and local agencies jointly operate freeway service patrols that remove disabled vehicles from state freeways in order to mitigate traffic congestion. Senate Bill 1 increases funding for this program by $25 million annually.

- Local and Regional Planning ($25 Million). The funding package provides $25 million annually for a new program of local planning grants. These grants are to encourage local and regional planning that further state goals.

- University Transportation Research ($7 Million). Four University of California campuses currently have transportation research centers. The funding package provides $5 million altogether annually for these centers. Additionally, the legislation appropriates $2 million annually to the California State University to conduct similar research activity.

- Workforce Development ($5 Million). The funding package appropriates $5 million annually from 2017‑18 through 2021‑22 to the California Workforce Development Board to assist local agencies in promoting pre‑apprenticeship training programs. These training programs are to focus on delivering certain projects funded by SB 1.

- Parks and Agricultural Programs ($108 Million). The funding package sets aside the increased base gasoline excise tax revenues from off‑highway vehicles and boats for the California Department of Parks and Recreation for general purposes. The administration expects these revenues to total $82 million annually. In addition, the legislation sets aside the increased base gasoline excise tax revenues from agricultural vehicles—estimated at $26 million annually—for the California Department of Food and Agriculture.

Includes Accountability and Other Provisions

The transportation funding package includes several other provisions beyond raising and spending new revenues. Most of these provisions concern oversight of the new funding as well as certain aspects of Caltrans’ operations. Below, we summarize each provision.

Sets Preliminary Performance Outcomes for Caltrans. Senate Bill 1 states legislative intent for Caltrans to achieve five outcomes by the end of 2027. Caltrans is to report annually to the CTC on its progress in meeting the outcomes. The commission is to evaluate Caltrans’s progress toward the outcomes and include any findings in its annual report to the Legislature. The five outcomes are:

- At least 98 percent of state highway pavement in good or fair condition.

- At least 90 percent level of service for maintenance of potholes, spalls, and cracks.

- At least 90 percent of culverts in good or fair condition.

- At least 90 percent of transportation management system units in good condition.

- At least an additional 500 bridges fixed.

Expects Caltrans to Operate More Efficiently. Senate Bill 1 requires Caltrans to implement unspecified efficiency measures with the goal of generating at least $100 million annually in savings to redirect toward maintaining and rehabilitating state highways. Caltrans is to report on these savings to the CTC.

Creates New Independent Office of Audits and Investigations for Caltrans. This new office is responsible for ensuring Caltrans and its contractors (including local agencies) spend funding efficiently, economically, and in compliance with state and federal requirements. The office is to report its findings annually to the Governor and the Legislature. The Governor is to appoint an Inspector General to oversee the office, subject to Senate confirmation, for a six‑year term.

Modifies Approval Process for Caltrans’ Biannual Proposal of Rehabilitation Projects. Currently, the CTC reviews and approves Caltrans’ proposed plan for rehabilitation projects every other year. The funding package alters the current approval process in a few ways, such as by requiring (1) CTC to allocate funds for capital outlay support for each project phase and (2) Caltrans to receive the commission’s approval for changes to a programmed project or increases in capital or support costs (above a certain threshold).

Establishes Requirements for Local Governments to Receive Funding. To be eligible to receive SB 1 funding for streets and roads maintenance and rehabilitation, the legislation requires cities and counties to spend at least as much on transportation from their unrestricted funds as they spent from 2009‑10 through 2011‑12, on average. The State Controller’s Office is authorized to perform audits to ensure compliance. Additionally, cities and counties must submit to the CTC a list of proposed projects approved by the city council or county board of supervisors.

Other Provisions. Other major provisions in the legislation (1) create an Advance Mitigation Program at Caltrans to protect natural resources and accelerate project delivery, (2) require Caltrans to create a plan to increase contracts awarded to certain groups (such as small businesses), (3) require Caltrans to incorporate the “complete streets” design concept into its highway design manual, (4) require the Department of Motor Vehicles to confirm certain trucks are in compliance with state air pollution standards as a condition of registration starting in 2020, and (5) prohibit state and local regulations requiring a truck to meet stricter air pollution standards for up to 18 years after it is first certified for use.

Issues for Legislative Consideration

While SB 1 included specific funding allocations to individual programs, it left some implementation details up to future legislative and administration actions. On May 11, 2017, the Governor released his May Revision budget proposal for 2017‑18, which addresses some implementation issues. We discuss these issues below. Additionally, we discuss at the end overarching issues for the Legislature to consider regarding oversight and accountability.

Allocating State Highway Funding. As previously indicated, one area where the legislation does not explicitly allocate funding is between state highway maintenance and rehabilitation programs. In his May Revision, the Governor allocates slightly more funding from the new revenues to highway maintenance as compared to rehabilitation. As maintenance projects can help prevent more costly rehabilitation projects in the future, the Legislature could consider allocating more funding to maintenance to achieve long‑term savings.

Establishing Program Guidelines. Most of the programs funded through SB 1 already are in existence. The legislation, however, creates a few new programs, such as one for commuter and intercity rail and another for trade corridors. CTC and the California State Transportation Agency are tasked with developing guidelines for the new programs. Nonetheless, the Legislature could consider specifying in statute certain program requirements. In his May Revision, for example, the Governor proposes trailer bill language for the trade corridor program that establishes various program requirements, such as for 60 percent of funds to support projects nominated by local and regional agencies and 40 percent for projects nominated by Caltrans.

Increasing Efficiency at Caltrans. As described earlier, SB 1 includes several measures to increase efficiency at Caltrans, such as by creating a new Inspector General to find ways to improve the department’s operations and by setting an expectation for Caltrans to achieve efficiency savings. As part of his May Revision, the Governor proposed an initial staffing plan for the Inspector General’s office but certain key questions remain unanswered, such as how the Inspector General would select audits and investigations to perform. Additionally, the administration did not present a plan for Caltrans to operate more efficiently and achieve the expected $100 million in savings (though its spending plan documents reflect the savings). One way our office in the past has recommended having Caltrans operate more efficiently is by reducing its capital outlay support staff relative to the volume of capital projects the department delivers. The Governor’s May Revision takes a step in this direction by reducing capital outlay support staff, but it also leaves open the possibility for staffing augmentations in 2017‑18 after the enactment of the budget.

Ensuring Oversight and Accountability. Though SB 1 establishes various long‑term performance outcome measures for highway conditions, the legislation does not include specific mechanisms for holding the administration accountable for achieving these outcomes nor does it set interim benchmarks against which to measure the administration’s progress in the near term. To improve its oversight of the new funding, we encourage the Legislature to begin now considering how to hold the administration accountable in the near term. For instance, the Legislature could establish in state law interim outcome measures against which to measure the administration’s progress in achieving the longer‑term outcomes contained in SB 1. It also could consider consequences should the administration not achieve these interim outcome measures. For instance, the Legislature could consider reprioritizing funding across programs (such as from rehabilitation to maintenance) or enacting organizational or governance changes to state transportation agencies to improve their effectiveness (such as by further strengthening the authority of CTC to oversee Caltrans’ rehabilitation projects by authorizing the commission to approve or reject individual projects, rather than an entire program of projects).