LAO Contact

September 25, 2017

Update on School District Retiree Health Benefits

Introduction

Rising Cost of Retiree Health Benefits Placing Added Pressure on District Budgets. Most school districts in California provide their retired employees with health benefits at least until they reach age 65. These benefits are becoming an increasingly important issue for districts given their rising cost. Adjusted for inflation, districts today are spending about twice as much on retiree health benefits as they did in the early 2000s. This added cost pressure comes at a time when districts are facing other pressures—most notably, rising pension costs and expectations to enhance services for low-income students and English learners.

Legislature Could Benefit From Better Understanding of These Issues. Knowing more about school districts’ retiree health benefits could help the Legislature in various ways. It could help the Legislature understand why certain districts spend more on these benefits than other districts. It also could help the Legislature better understand how proposals affecting the cost of health care could interact with district budgets. Additionally, it could help the Legislature better assess school districts’ overall fiscal health.

This Web Post Provides an Update. The first section of this web post provides background—describing how retiree health benefits vary across districts, explaining how districts pay for these benefits, and reviewing associated disclosure requirements. The second section examines the liabilities districts have accumulated for retiree health benefits, analyzes annual spending on these benefits, and discusses the steps districts have taken to reduce costs.

Background

Virtually All School Districts Provide Health Benefits for Their Active Employees. School districts in California provide various benefits for their teachers and other employees. Among the most significant are health benefits. These benefits pay for costs that employees incur when they visit a doctor, dentist, or optometrist or otherwise receive medical treatment. The value of these benefits varies across the state. For example, some districts pay most of the cost of providing these benefits, with employees paying a relatively small share. Other districts require larger contributions from their employees. In addition, some districts cover the cost of providing health benefits to family members of their employees, whereas other districts do not provide such coverage. Depending upon their local priorities, districts sometimes change their health benefits. Under state law, health benefits are a mandatory subject of collective bargaining and districts negotiate most changes with their employees.

Most Districts Also Provide Health Benefits for Retirees. About two-thirds of districts provide health benefits that continue after their employees retire. The share of districts providing these benefits varies according to size (see Figure 1). Nearly all large districts (those with more than 10,000 students) provide benefits for retirees, compared with about one-third of small districts (those with fewer than 1,000 students). In 2015-16, about 90 percent of all school employees worked for districts that provided retiree health benefits.

Figure 1

Larger Districts Are More Likely to Provide Retiree Health Benefits

|

District Size (Students) |

Number of Districts |

Total Attendancea |

Share of Districts |

|

Small (below 1,000) |

399 |

121,934 |

36% |

|

Mid-size (1,000-10,000) |

399 |

1,610,614 |

80 |

|

Large (above 10,000) |

148 |

3,706,733 |

93 |

|

Statewide Totals |

946 |

5,439,281 |

64% |

|

aExcludes students attending independently managed charter schools. |

|||

Retirees Qualify for Health Benefits Through a Combination of Age and Years of Service. The districts that provide retiree health benefits do not provide them for all former employees. Instead, employees must qualify by (1) retiring after they reach a minimum age and (2) working for their district for a minimum number of years. Most districts require employees to be at least age 55 and have a minimum of 10 or 15 years of service prior to retirement. The specific requirements vary among districts. For example, some districts allow employees to retire with health benefits if they have 5 years of service, whereas others require as many as 30 years.

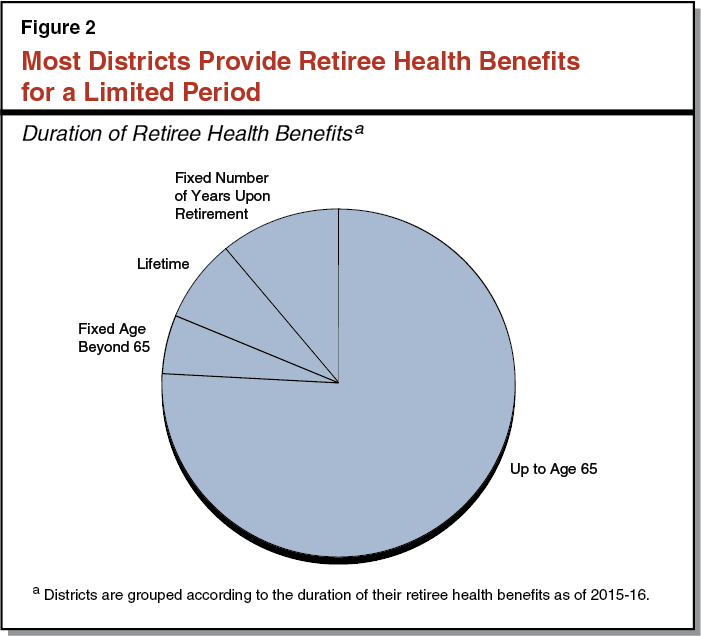

District Health Benefits Usually End Once Retirees Reach Age 65. Figure 2 shows the duration of retiree health benefits for the districts that provide them. In 78 percent of these districts, district-sponsored retiree health benefits begin upon retirement and end at age 65. Districts tend to structure their benefits this way so that their retirees are covered until they become eligible for Medicare. (Medicare is a federal program that provides health benefits for qualifying individuals age 65 and older.) Given that the average school employee retires at age 61, these districts are providing health benefits for an average of four years. In 15 percent of districts, retirees receive health benefits until a fixed age beyond 65 or for a fixed number of years after retirement. In most of these districts, benefits extend between age 67 and 70 or last between three and seven years upon retirement. In the remaining 7 percent of districts, retirees receive health benefits for life. The benefits that districts provide after age 65 tend to take the form of Medicare supplements that cover costs that otherwise would be paid by retirees. In many cases, districts limit these supplements to a fixed monthly allotment.

Retirees Can Purchase District Health Benefits at Their Own Expense. Certain state and federal laws allow retirees to purchase district health benefits at their own expense. Retirees can use these laws to obtain health benefits if they (1) retire from a district that does not otherwise provide retiree health benefits or (2) retire without meeting the minimum age and service requirements for district-funded benefits. Teachers and other certificated employees (such as administrators and librarians) can purchase benefits for as long as they remain retired. Other school personnel can purchase benefits for up to three years. To be eligible, employees generally must enroll in these benefits as soon as they retire. Even though employees are responsible for the full cost of their benefits, these options are often less expensive than the benefits employees could purchase elsewhere.

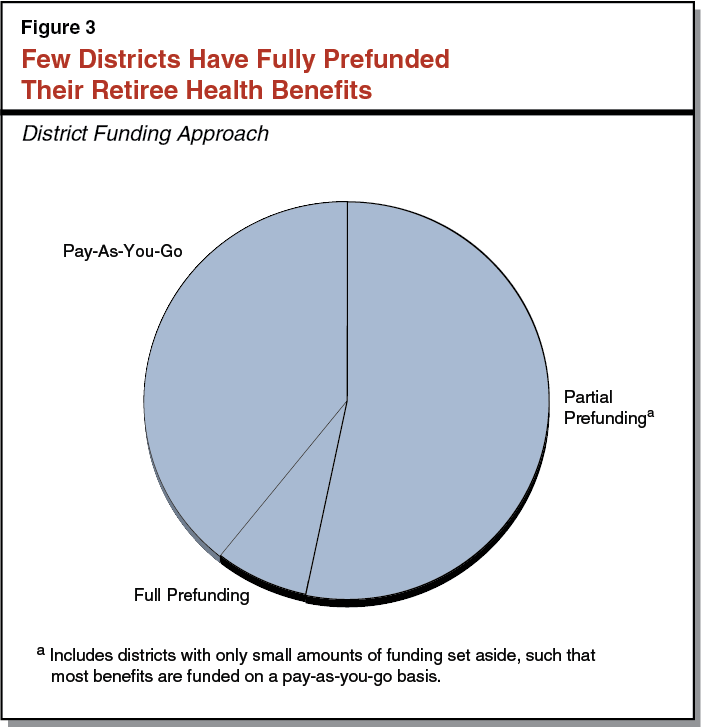

Some Districts Prefund Their Benefits, Some Pay Costs as They Come Due, and Others Have a Mixed Approach. Under a prefunding approach, a district sets aside funding over the course of its employees’ working careers. The district invests this funding, then draws upon it to pay for health benefits those employees receive during retirement. If the district has enough funding set aside to cover all of the future costs of those benefits, the district is “fully prefunded.” By contrast, districts using a pay-as-you-go approach cover the costs of retiree health benefits as they come due. Under this approach, a district does not begin to pay for benefits until employees retire. A third approach is partial prefunding. Districts using this approach have set aside some funding, but not enough to cover all of their costs. This approach includes districts that have only recently begun to prefund benefits as well as districts that set aside small amounts of funding on an occasional basis. For example, some districts set aside funds only when they have an unexpected budget surplus. In practice, many of these districts still pay most costs on a pay-as-you-go basis.

Full Prefunding of Retiree Health Benefits Is Uncommon. Prefunding is fiscally advantageous for school districts because it allows investment returns to cover a significant portion of the cost of providing benefits. Moreover, prefunding adheres to the basic principle of public finance that the cost of retiree benefits should be paid for as employees earn them, rather than deferred until retirement. Only 7 percent of districts providing retiree health benefits, however, have implemented full prefunding (see Figure 3). Most of these prefunded districts are small (with fewer than 1,000 students). Slightly more than half of the remaining districts have partially prefunded their benefits, and about 40 percent rely entirely on the pay-as-you-go approach. These latter two approaches allow districts to defer some or all of the cost of retiree health benefits for many years, though such approaches are more expensive over time.

Accounting Standards Require Disclosure of Retiree Health Benefit Liabilities… Government accounting standards require districts to disclose information about retiree health benefits in their annual audit reports. The most significant disclosure is an estimate of a district’s “total liability” for retiree health benefits. In broad strokes, this is a measure of the total future cost of providing retiree health benefits. More specifically, it is the amount of money that, if set aside and invested today, would be sufficient to cover the future cost of retiree health benefits already earned by current and former employees. To calculate their total liability, districts rely upon statisticians (called actuaries) who estimate trends in health costs, life expectancy, investment returns, and other factors affecting future spending on retiree health benefits. (Changes in these assumptions can cause the estimate of the total liability to change from year to year, even if districts do not change their retiree health benefits.) Given that the total liability represents costs that districts will pay over the course of several decades, it is significantly larger than annual spending on retiree health benefits.

…And Prefunding. Accounting standards also require districts to disclose the funding they have set aside to pay for future retiree health benefits. For this disclosure, districts only report the funding that they have set aside in irrevocable trust accounts. Funds that have been earmarked for future retiree health benefits but not permanently set aside are excluded. The difference between the total liability and the funding set aside in irrevocable trusts is the “unfunded liability.”

Update on Liabilities and Expenditures

Unfunded Liability for Retiree Health Benefits Is $24 Billion Statewide. To determine the extent of retiree health liabilities across the state, we examined district audit reports. For 2015-16, these reports identify total liabilities of $25.5 billion statewide. The reports also show that districts have $750 million invested in irrevocable trust accounts to pay for retiree health benefits. Subtracting this funding from the total liability produces an unfunded liability of $24.8 billion statewide. Using these figures, the average district is 3 percent prefunded. We also found that districts have another $750 million in reserves that they have earmarked for future retiree health benefits but not permanently set aside. Using a broader definition of funding that includes this amount, the unfunded liability is $24 billion and the average district is 6 percent prefunded.

A Few Large Districts Account for a Disproportionate Share of the Unfunded Liability. Although most districts in the state have an unfunded liability, a few large urban districts account for a disproportionate share of the total (see Figure 4). One district—Los Angeles Unified—accounts for 9 percent of statewide student attendance but 56 percent of the statewide unfunded liability. Another ten districts (see Figure 4) account for about 8 percent of student attendance yet 15 percent of the unfunded liability. Differences also are evident in per-pupil comparisons. Whereas the specific districts shown in Figure 4 have unfunded liabilities ranging from $3,800 to $27,000 per pupil, the average for all other districts in the state is about $1,500 per pupil. (To put these numbers in context, the average district received about $9,000 per pupil in general purpose funding in 2015-16.)

Figure 4

A Few Districts Account for a Disproportionate Share of Unfunded Liabilities

Liabilities and Funding (Dollars in Millions)

|

Total Attendancea |

Total Liabilityb |

Funding Set Asidec |

Unfunded Liability |

Unfunded |

|

|

Los Angeles Unified |

501,444 |

$13,649 |

$145 |

$13,503 |

$26,929 |

|

Sacramento City Unified |

38,655 |

619 |

48 |

571 |

14,772 |

|

Fresno Unified |

66,228 |

965 |

31 |

934 |

14,103 |

|

West Contra Costa Unified |

27,137 |

353 |

21 |

332 |

12,239 |

|

San Francisco Unified |

50,800 |

624 |

20 |

604 |

11,899 |

|

Oxnard Union High |

15,205 |

202 |

51 |

151 |

9,916 |

|

Alhambra Unified |

16,820 |

183 |

28 |

155 |

9,201 |

|

Clovis Unified |

39,878 |

260 |

20 |

239 |

6,000 |

|

Long Beach Unified |

74,004 |

327 |

9 |

318 |

4,303 |

|

Fontana Unified |

37,164 |

168 |

13 |

155 |

4,166 |

|

Santa Ana Unified |

49,804 |

203 |

15 |

188 |

3,782 |

|

All other districts |

4,522,142 |

7,979 |

1,099 |

6,880 |

1,521 |

|

Totals |

5,439,281 |

$25,532 |

$1,500 |

$24,032 |

$4,418 |

|

aExcludes students attending independently managed charter schools. bAs disclosed in districts’ 2015-16 audit reports. cConsists of funds set aside in permanent trust account as well as earmarked reserves. |

|||||

Large Unfunded Liabilities Result From More Generous Benefits and Limited Prefunding. Districts with disproportionately large unfunded liabilities tend to (1) require relatively little cost-sharing from their retirees, (2) cover the cost of health benefits for family members of their retirees, and (3) provide benefits that last beyond age 65. In addition, many of these districts have only recently begun to set aside funding to pay for these benefits. Most of the districts shown in Figure 4, for example, did not have any funding set aside until a few years ago. Most other districts, by contrast, provide relatively less generous benefits. Specifically, these districts tend to (1) require a higher level of cost-sharing from their retirees, (2) cover few or no benefits for family members of retirees, and (3) end benefits once retirees reach age 65. A few of these districts also have prefunded a significant portion of their benefits. These decisions tend to result in much smaller unfunded liabilities.

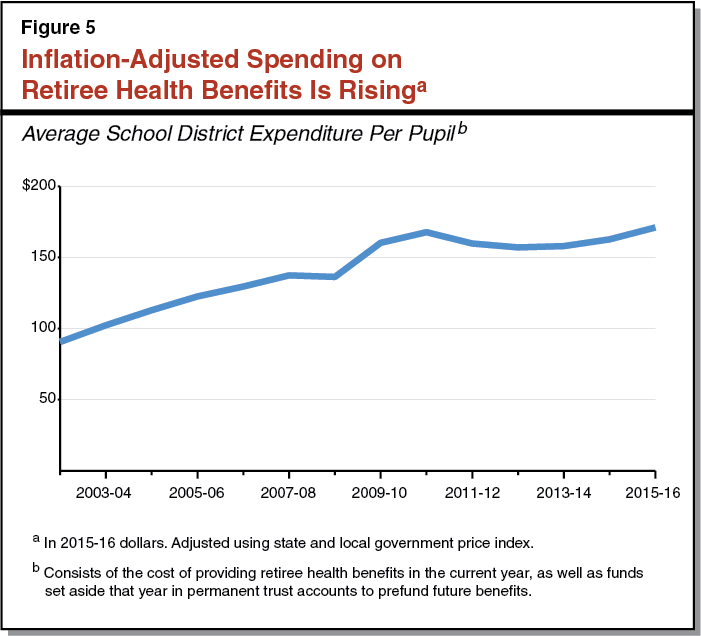

Annual Spending on Retiree Health Benefits Has Been Rising. In addition to examining unfunded liabilities, we reviewed annual spending on retiree health benefits. Annual spending is important because of its immediate effect on district budgets. As districts spend more on retiree health benefits, they have less funding available for their other priorities. Figure 5 displays annual spending on retiree health benefits over time. In 2002-03, the first year for which reliable data are available, inflation-adjusted spending averaged $91 per student. By 2015-16, spending had risen to $171 dollars per student—nearly doubling over the past 13 years. The average inflation-adjusted increase was about 5 percent per year over this period. (Spending in the figure primarily reflects the costs of providing retiree health benefits as they come due but also includes any new amount districts set aside that year in irrevocable trust accounts to pay for future benefits.) Available data show that spending increases on retiree health benefits are not unique to school districts, with costs for other California employers growing at a similar rate over the period.

Some Districts Have Taken Steps to Reduce Future Costs and Increase Prefunding. A few districts have made fundamental changes to reduce the future cost of their retiree health benefits. For example, in 2005, the Fresno Unified School District ended lifetime benefits for newly hired employees. New district employees now receive benefits only until they qualify for Medicare. A somewhat more common strategy involves increasing the age or years of service required to receive retiree health benefits. For example, in 2007, the Clovis Unified School District began requiring newly hired employees to have at least 30 years of service with the district. Previously, the district had required 15 years of service. Since these changes applied to new employees, however, they did not immediately reduce district costs. For near-term savings, many districts have capped their contribution toward health benefits and required employees and retirees to pay for any costs exceeding those caps. Other districts have changed how they purchase health benefits. Most districts, for example, now belong to multidistrict associations that can negotiate lower prices on behalf of their members. Finally, a growing number of districts are prefunding at least a portion of their liabilities. Available data show that the number of districts with funding set aside in irrevocable trust accounts has increased by more than 30 percent over the past five years.

Full Prefunding Would Be Costly Now. Though full prefunding results in substantial long-term savings, it increases districts’ annual costs in the near term. Specifically, districts would need to set aside enough funding to (1) prefund the benefits that their employees earn moving forward, and (2) gradually pay down their existing unfunded liabilities. For the average district, this annual amount is roughly twice as much as its current annual spending on retiree health benefits. That is, the average district would need to increase its annual spending from $171 per student to roughly $340 per student. (These figures generally assume full funding is reached over a period of 30 years.)

Prefunding Results in Significant Future Savings. Moving forward, districts that prefund would see investment returns cover an increasing share of their benefit costs. Over time, this would reduce the share of costs that these districts would need to cover out of their current operating budgets. By contrast, districts that remained on a pay-as-you-go approach would need to continue covering all costs as they come due. Eventually—perhaps within roughly two decades—the districts implementing full prefunding would be spending less on an annual basis than pay-as-you-go districts. Within three decades, the fully prefunded districts would be spending significantly less than districts using a pay-as-you-go approach. Although districts face cost pressures that make the transition to full prefunding difficult, even partial prefunding would lead to lower costs over time.