The 2018-19 Budget:

California's Fiscal Outlook

See a list of this year's fiscal outlook material, including the core California's Fiscal Outlook report, on our fiscal outlook budget page.

LAO Contact

November 15, 2017

The 2018-19 Budget

California's Fiscal Outlook

Fiscal Outlook: Medi-Cal

Medi-Cal, the state’s Medicaid program, provides health care coverage to over 13 million of the state’s low-income residents. Medi-Cal costs are generally shared between the federal and state governments. In this post, we describe the major factors that we project will impact changes in General Fund Medi-Cal spending over the outlook period, which extends from 2017‑18 through 2021‑22. We also provide an in-depth discussion of a number of key assumptions that we made in our spending projections. With one major exception—reauthorization of the Children’s Health Insurance Program (CHIP)—we base our projections on current federal and state law. As such, this outlook assumes no changes to federal Medicaid law or to the Patient Protection and Affordable Care Act (ACA) other than those related to CHIP reauthorization.

Lower General Fund Spending in Medi-Cal in 2017‑18 Relative to 2017‑18 Budget Act. In 2017‑18, we estimate General Fund Medi-Cal spending to be $18.9 billion. This estimate is around $625 million lower than what was assumed in the 2017‑18 Budget Act. This downward adjustment is largely the result of two major factors. First, we project higher-than-anticipated estimated Proposition 56 (2016)—tobacco tax—revenues for Medi-Cal in 2017‑18 (that serve to offset General Fund costs). Second, we assume that federal funding for CHIP will be reauthorized by Congress at a higher federal cost share than assumed by the 2017‑18 Budget Act.

Medi-Cal Expenditures Projected to Be Substantially Higher in 2018‑19. We project that Medi-Cal General Fund spending will be $21.1 billion in 2018‑19, a nearly 12 percent increase over our revised estimate of 2017‑18 spending. The two most significant drivers of higher Medi-Cal spending in 2018‑19 compared to 2017‑18 are (1) growth in the underlying cost of the Medi-Cal program—such as modestly higher caseload and more significant increases in per-enrollee costs—and (2) a substantial reduction in the amount of Proposition 56 funding that would be available to offset General Fund spending in Medi-Cal (based on an assumption discussed below).

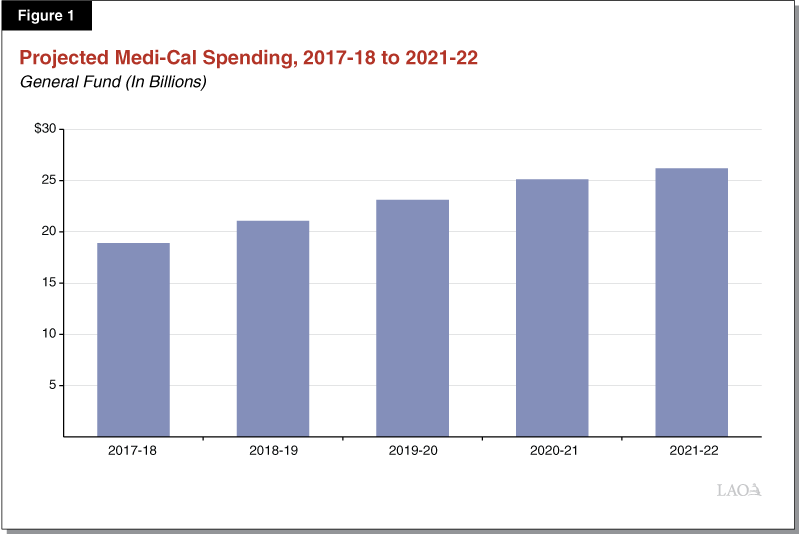

Significant Growth in General Fund Medi-Cal Spending Through 2021‑22. We project significant average annual growth in General Fund Medi-Cal spending of around 9 percent throughout the outlook period of 2017‑18 to 2021‑22. Figure 1 summarizes projected General Fund spending in Medi-Cal over this period. While projected increases in per-enrollee costs continue to be an important factor, a substantial portion of projected growth in General Fund Medi-Cal spending beyond 2018‑19 results from anticipated reductions in the amount of federal funding for Medi-Cal which the General Fund would have to backfill.

Underlying Growth in Medi-Cal

The underlying sources of year-over-year growth in Medi-Cal spending are changes in caseload and per-enrollee costs. We discuss our estimates for both of these factors below.

Project Relatively Modest Caseload Growth . . . While Medi-Cal enrollment has risen significantly in recent years (primarily because of coverage expansions related to the ACA), recent enrollment counts suggest that growth in the Medi-Cal caseload may be slowing. We therefore assume that overall Medi-Cal enrollment will increase by less than 1 percent in 2018‑19, translating into roughly 50,000 additional enrollees. Changes in caseload in later years are highly uncertain. For our economic growth outlook scenario, we assume that overall Medi-Cal enrollment will have modest growth of about 1 percent annually through 2021‑22.

. . . And Moderate Growth in Per-Enrollee Costs. Per-enrollee costs in Medi-Cal are driven by growth in service utilization and the health care prices paid by the program in managed care and fee-for-service (FFS). Based on recent trends, we project that per-enrollee costs will grow by about 4 percent in 2018‑19 and about 3 percent annually thereafter through 2021‑22. These projections are subject to considerable uncertainty, particularly if future changes in managed care capitated rates or FFS costs differ substantially from recent historical trends.

Taken Together, Underlying Factors Account for Significant Portion of Higher Medi-Cal Spending. Taking growth in caseload and per-enrollee costs together, we estimate underlying General Fund expenditure growth in Medi-Cal of about $950 million in 2018‑19, with underlying expenditures growing by an additional roughly $1 billion each year through 2021‑22.

Net Savings From Increasing Minimum Wage

Under current law, the state’s minimum wage is scheduled to increase to $11 per hour in January 2018, with additional planned increases of $1 annually until the minimum wage reaches $15 per hour in January 2022. We estimate that the higher minimum wage will result in net savings in Medi-Cal, primarily as the minimum wage increases result in some enrollees having higher incomes that make them ineligible for the program. (Many of these individuals, however, would likely become eligible for federal subsidies to purchase commercial health insurance through the state’s Health Benefit Exchange, Covered California.) We estimate that net savings in Medi-Cal from the increasing minimum wage could reach the hundreds of millions of dollars annually by 2021‑22.

Proposition 56

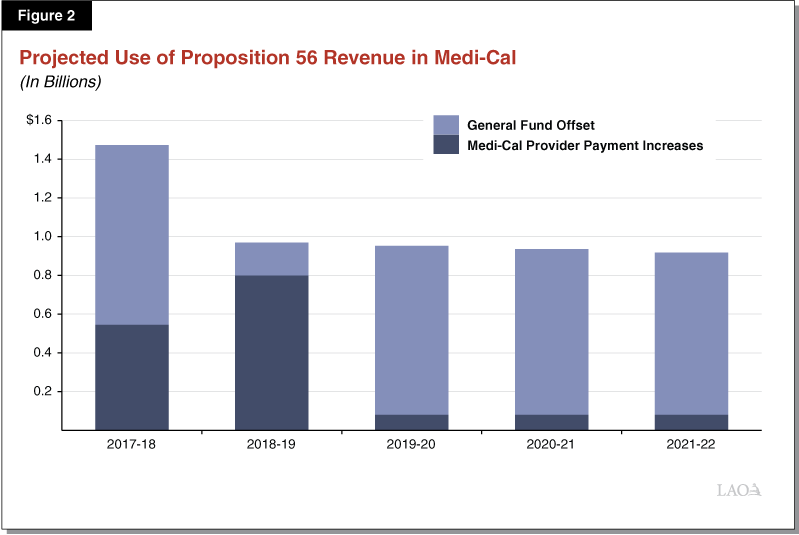

Proposition 56 raised state taxes on tobacco products and dedicated a significant portion of its revenues to Medi-Cal. Pursuant to an agreement reached in the 2017‑18 budget package, varying portions of Proposition 56 revenues will be used over time to fund Medi-Cal provider payment increases, with any remaining Proposition 56 funds supporting year-over-year underlying growth in the program (the latter of which results in a General Fund offset). We anticipate that the amounts of Proposition 56 funding dedicated to provider payment increases versus underlying program growth in Medi-Cal will vary significantly by fiscal year. Figure 2 summarizes Proposition 56 Medi-Cal spending throughout the outlook period, based on our assumptions about the allocation of Proposition 56 revenues between provider rate increases and funding underlying program growth as discussed below.

$1.5 Billion in Proposition 56 Funding for Medi-Cal in 2017‑18, With Over $900 Million to Offset General Fund Costs. In 2017‑18, we estimate that almost $1.5 billion in Proposition 56 revenue will be dedicated to Medi-Cal. Proposition 56 funding for Medi-Cal in 2017‑18 reflects Proposition 56 revenues collected in both 2016‑17 and 2017‑18. (Since Proposition 56’s taxes began to be collected in April 2016, only one fiscal quarter of Proposition 56 revenue was collected in 2016‑17.) Our $1.5 billion estimate is about $200 million higher than was assumed in the 2017‑18 Budget Act. This upward revision, which we do not expect to carry forward into subsequent fiscal years, is the result of higher than previously anticipated Proposition 56 revenue collected to date. According to the 2017‑18 budget agreement, in 2017‑18, almost $550 million in Proposition 56 revenue will be used to fund increases in Medi-Cal provider payments, with the balance (now estimated to be over $900 million) supporting anticipated spending increases in year-over-year underlying growth in Medi-Cal and producing an equivalent General Fund offset.

Almost $1 Billion in Proposition 56 Funding for Medi-Cal in 2018‑19, With Somewhat Less Than $200 Million Assumed to Offset General Fund Costs. We project that the amount of Proposition 56 revenue dedicated to Medi-Cal will drop to somewhat less than $1 billion in 2018‑19. In 2018‑19 and beyond, the amount of Proposition 56 funding available to Medi-Cal will only comprise a single year of collected revenues. According to the 2017‑18 budget agreement, in 2018‑19 up to $800 million in Proposition 56 revenue can be allocated to fund provider payment increases. While the budget agreement gave the administration discretion in the amount of Proposition 56 funding that could be used for provider payment increases in 2018‑19, our outlook assumes the full $800 million will be used for this purpose, leaving somewhat less than $200 million to fund year-over-year underlying growth in the Medi-Cal program. Lower total Proposition 56 funding for Medi-Cal and higher Proposition 56 funding for provider payment increases combine to reduce the Proposition 56 General Fund offset by $750 million between 2017‑18 and 2018‑19, increasing General Fund spending in Medi-Cal in 2018‑19 by an equivalent amount.

Gradually Declining Proposition 56 Funding for Medi-Cal in 2019‑20 and Beyond, Most of Which Is Assumed to Offset General Fund Costs. From 2019‑20 to 2021‑22, we project annual Proposition 56 funding for Medi-Cal to be between $900 million and $1 billion, with annual declines of around 2 percent as fewer tobacco products are purchased in the state over time. According to our understanding of the 2017‑18 budget agreement, Proposition 56 funding for the bulk of provider payment increases will expire at the end of 2018‑19. Accordingly, our outlook assumes that only about $80 million in Proposition 56 funding will fund provider payment increases on an ongoing annual basis. Beginning in 2019‑20, the assumed expiration of funding for the bulk provider payment increases will leave balances of between $800 million and $900 million to fund year-over-year ongoing growth in Medi-Cal. This will have the effect of reducing annual General Fund Medi-Cal spending by $800 million to $900 million through 2021‑22 below what it would otherwise be if all the current Proposition 56-funded provider payment increases were continued.

Proposition 55

Proposition 55 (2016), which extended tax rate increases on high-income earners, gave the Director of Finance significant discretion to determine the amount of revenues from the measure to dedicate to Medi-Cal. Our outlook assumes no additional spending on Medi-Cal associated with the measure. If the administration makes different decisions regarding these revenues, Medi-Cal spending could be higher by up to $2 billion annually beginning in 2018-19.

Expiration of Managed Care Organization (MCO) Tax

Current MCO Tax. The current MCO tax is assessed on a large number of managed care plans in the state. Revenues from the MCO tax, which leverage federal funding for Medi-Cal, provide a substantial General Fund offset—an estimated $1.8 billion in 2017-18. The authorization of the MCO tax was also tied to a 7 percent service-hour restoration in In-Home Supportive Services (IHSS) at a General Fund cost of roughly $300 million in 2017-18. (For more information on the IHSS implications of the MCO tax, please see our IHSS supplemental online post.) The current MCO tax is authorized through July 1, 2019.

State Budget Implications. It is highly uncertain whether the federal government would provide its required approval of the current MCO tax structure if it were proposed to be continued beyond July 1, 2019. Therefore, we assume the General Fund offset from the current MCO tax will expire in 2019-20, increasing General Fund spending by $1.3 billion in 2019-20 and $1.8 billion in each of 2020-21 and 2021-22. (We assume lower General Fund spending in 2019-20, relative to 2020-21 and 2021-22, due to payment lags similar to those experienced with the previous MCO tax.) We would note that some of the increased General Fund spending due to the expiration of the MCO tax would be offset by assumed savings triggered by the elimination of the 7 percent service-hour restoration in IHSS.

ACA Optional Expansion

In 2014, California expanded Medi-Cal eligibility to childless adults with incomes up to 138 percent of the federal poverty level, a population known as the ACA optional expansion population. Until 2016, the federal government paid 100 percent of the costs for this population. Under current law, the federal share is scheduled to gradually decline between 2017 to 2020, with the state eventually paying 10 percent of the cost of health care services for the ACA optional expansion population. Between 2017-18 and 2018-19, the state share of cost for this population will increase from 5.5 percent to 6.5 percent. As a result, we project that General Fund spending on the ACA optional expansion population will increase by over $200 million between 2017-18 and 2018-19. By 2020-21, the state share of cost will reach 10 percent for the full fiscal year. At this point, we project higher annual General Fund costs of around $1 billion for the ACA optional expansion population relative to current state costs for this population.

CHIP Reauthorization

Current Program Status. CHIP is a joint federal-state program—operated in California through Medi-Cal—that primarily provides health insurance coverage to children in low-income families with incomes too high to qualify to Medicaid. Federal authorization of CHIP funding expired on September 30, 2017. California is currently funding its CHIP program at the ACA-enhanced CHIP federal medical assistance percentage (FMAP)—or federal cost share—of 88 percent with a combination of unspent funds from the state’s previous CHIP allotment and funds redistributed from other states’ allotments to California. (Historically, prior to the ACA, the CHIP FMAP that applied in California was 65 percent.) The administration projects that the state will exhaust its CHIP funding by the end of 2017.

Federal Proposal. The proposed federal reauthorization of CHIP funding contains several major components: (1) states would continue to receive annual allotments to cover the federal share of CHIP expenditures until September 30, 2022; (2) states would continue to receive the increased FMAP for CHIP authorized by the ACA—in California, an 88 percent FMAP—until September 30, 2019; (3) starting October 1, 2019, states would receive half of the ACA’s FMAP increase for CHIP—in California, this would result in a 76.5 percent FMAP—until September 30, 2020; (4) starting October 1, 2020 and thereafter, states would return to their traditional CHIP FMAPs—in California, a 65 percent FMAP; and, (5) states that provide CHIP-eligible children with health coverage through their Medicaid programs would be required to maintain their March 23, 2010 Medicaid and CHIP eligibility levels for children (the ACA maintenance-of-effort requirement [MOE]) through September 30, 2022.

Outlook Assumes CHIP Reauthorization at Enhanced FMAP. The 2017-18 Budget Act assumed federal funding for CHIP would be reauthorized, but not at California’s ACA-enhanced CHIP FMAP of 88 percent. Instead, it assumed the state would receive its traditional CHIP FMAP of 65 percent, resulting in additional spending of $396 million General Fund in 2017-18 (relative to what it would have spent at the ACA-enhanced CHIP FMAP of 88 percent). Our outlook assumes that the federal proposal described above is enacted. Reauthorization of federal CHIP funding at the increased FMAP of 88 percent would reduce estimated General Fund Medi-Cal costs by $396 million in 2017-18 relative to what was assumed in the 2017-18 Budget Act. General Fund savings of a similar amount would also be reflected in the 2018-19 budget. Starting in 2019-20, however, a reduction of California’s CHIP FMAP from 88 percent to 76.5 percent would increase General Fund costs by $100 million to $200 million relative to prior years that had the ACA-enhanced FMAP. A return to California’s traditional CHIP FMAP of 65 percent in 2020-21 would further increase General Fund spending, for a total of almost $400 million in additional General Fund spending relative to prior years that had the ACA-enhanced FMAP. By 2021-22, estimated General Fund Medi-Cal costs for CHIP would be between $400 million and $500 million higher than in 2017-18.

Possible Federal Failure to Reauthorize CHIP. Without federal reauthorization of CHIP funding, the state would likely exhaust its remaining unspent federal funds for CHIP by the end of 2017. Under the ACA MOE requirement, which under current federal law continues until September 30, 2019, California would likely have to maintain its CHIP eligibility levels and receive its traditional Medicaid FMAP of 50 percent to cover these children. Relative to the CHIP FMAP of 65 percent assumed in the 2017-18 Budget Act, General Fund spending would increase $280 million in 2017-18 and almost $600 million in 2018-19, under the scenario where Congress has failed to reauthorize CHIP. Starting October 1, 2019, the state would no longer be required to cover these children and, therefore, would no longer receive a 50 percent FMAP for each beneficiary. If the state continued to cover CHIP-eligible children in Medi-Cal without federal funding, the state’s General Fund exposure would increase by about $2 billion in 2019-20. The state would, however, have the authority to eliminate CHIP and transition its beneficiaries to subsidized coverage through the state’s health benefit exchange, Covered California. This transition would eliminate any additional General Fund exposure in 2019-20.