LAO Contact

Related Publications

December 12, 2017

Cap-and-Trade Extension:

Issues for Legislative Oversight

- Introduction

- Background

- Key Implementation Decisions Could Affect Program Outcomes

- Implementing the Market Advisory Committee

- Implications for Auction Revenue

- Conclusion

- Appendix: Key Cap‑and‑Trade Terms

Executive Summary

Cap‑and‑Trade Program Recently Extended From 2020 to 2030. In adopting Chapter 135 of 2017 (AB 398, E. Garcia), the Legislature extended the state’s cap‑and‑trade program from 2020 to 2030. Cap‑and‑trade is a key policy to help ensure the state achieves its goal of reducing greenhouse gas (GHG) emissions to 40 percent below 1990 levels by 2030. The program establishes a “cap” on emissions by issuing a limited number of permits to emit, also known as allowances. Allowing businesses to buy and sell (“trade”) allowances results in a market price, which creates a financial incentive for businesses and household to undertake emission reduction activities that are less costly than the allowance price.

Key Implementation Decisions Could Have Significant Effects on Program Outcomes. Although AB 398 provides direction to the California Air Resources Board (CARB) regarding certain design features of the cap‑and‑trade program, the bill gives CARB significant discretion regarding how to implement many of these features. These implementation decisions are often complex and can have significant effects on key program outcomes, such as GHG reductions and program costs. To help the Legislature ensure CARB is implementing AB 398 in a way that is consistent with legislative goals and priorities, we identify the following key issues for future oversight:

- Setting Post‑2020 Caps and Banking Rules to Ensure State Meets Its GHG Targets. The Legislature will want to evaluate CARB’s assessment of the potential for a large number of banked allowances issued in the early years of the program to be carried forward and used in the later years of the program, and how this could affect the likelihood of the state meeting its 2030 GHG target. If it is determined that a large number of banked allowances creates a significant risk of not meeting the 2030 target, the Legislature will want to evaluate different options to address the issue, such as reducing the number of allowances offered at future auctions.

- Setting Hard Price Ceiling at Level That Balances Emissions and Costs. The Legislature will want to evaluate how the level of CARB’s proposed price ceiling balances trade‑offs, such as interests in containing costs versus certainty that targeted emissions levels will be achieved.

- Setting Price Containment Points to Limit Price Spikes. The Legislature will want to evaluate whether the number of allowances in each containment point and the level of each price containment point are consistent with legislative interest in slowing price increases, while also limiting emissions.

- Implementing New Offset Limits Consistent With Legislative Intent. The Legislature will want to ensure CARB identifies projects with direct environmental benefits and limits the use of projects without direct environmental benefits in ways that are consistent with legislative intent.

- Determining Industry Assistance Factors (IAFs) Through 2020. The Legislature will want to evaluate whether CARB direction to maintain 100 percent IAFs through 2020 balances leakage risk and incentives for GHG‑reductions in a way that is consistent with legislative priorities.

Clarifying the Role of Market Advisory Committee Could Enhance Information in Future Reports. Assembly Bill 398 includes a variety of new reporting requirements meant to enhance oversight and accountability. This includes establishing an Independent Emissions Market Advisory Committee and requiring the committee to report annually on the environmental and economic performance of cap‑and‑trade and other relevant climate policies. In our view, the committee has the potential to provide valuable information that enhances legislative oversight and improves future policy decisions. However, there are areas where the Legislature might want to consider clarifying or refining the direction given to the committee. For example, the Legislature could clarify (1) which climate policies are within the committee’s jurisdiction, (2) whether the committee should advise on future program design issues and/or evaluate past program performance, and (3) specific outcomes it would like the committee to evaluate. More specific direction could increase the likelihood that committee reports will include the type of information that the Legislature finds most valuable.

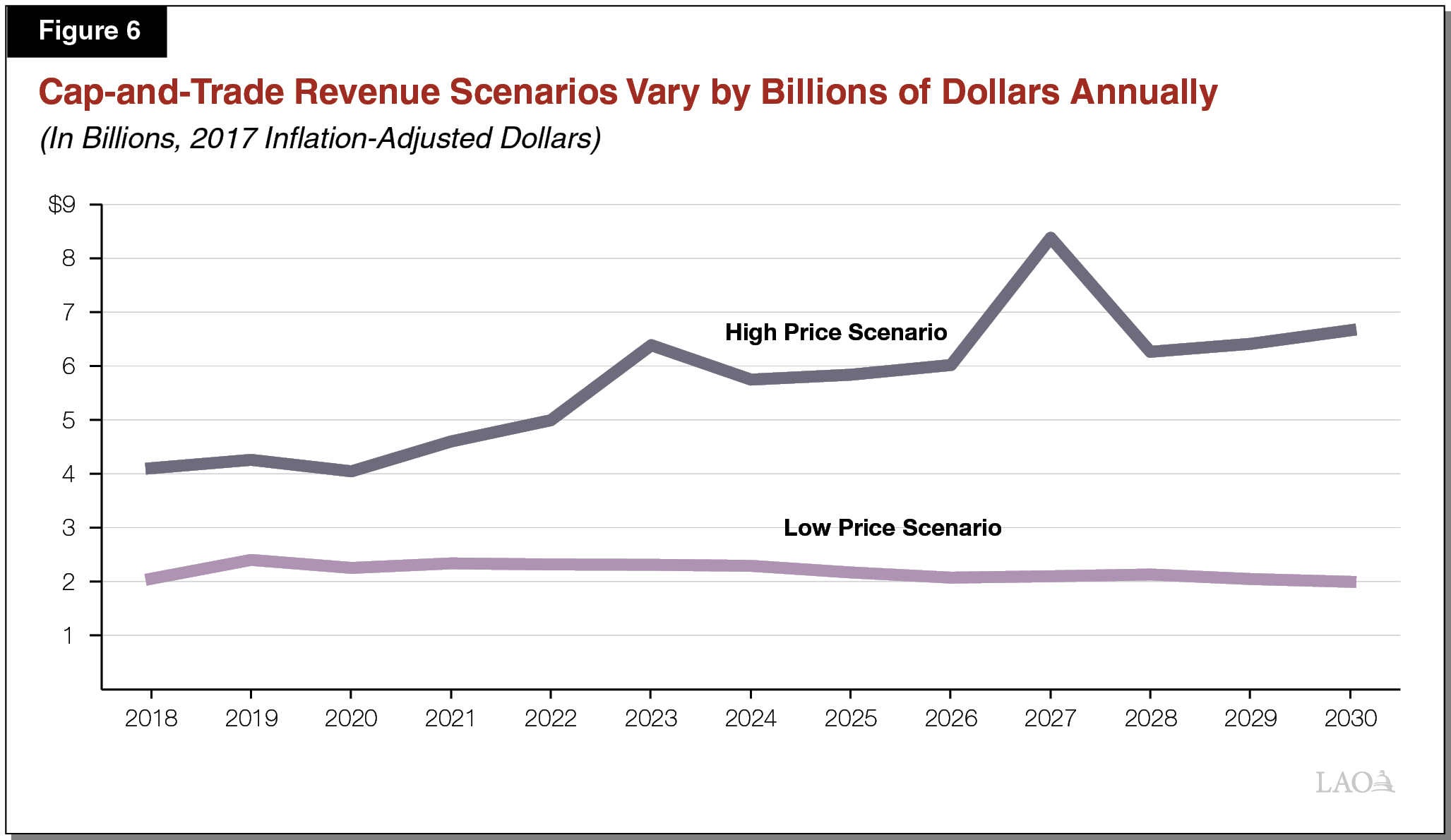

Cap‑and‑Trade Revenue Could Vary By Billions of Dollars Annually. Assembly Bill 398 also extended the period in which the state will receive revenue from cap‑and‑trade auctions. The amount that will be generated in future years is highly uncertain, largely because a wide variety of factors could affect prices, including (1) future “business‑as‑usual” emissions, which depend on economic conditions and technological changes; (2) the stringency and effectiveness of other GHG reduction policies; and (3) cap‑and‑trade program design decisions, such as the ones discussed in this report. We examine state revenue under two different assumptions about future allowance prices—a “low price” scenario and a “high price” scenario. Under these two scenarios, revenues would range from $2 billion to $4 billion in 2018 and from $2 billion to about $7 billion in 2030. Although these two scenarios provide a plausible range of future revenues, there are alternative scenarios where revenue could be higher or lower.

Introduction

The cap‑and‑trade program is one of the state’s key policies intended to reduce statewide greenhouse gas (GHG) emissions. Recently, the Legislature extended the state’s cap‑and‑trade program from 2020 to 2030 with the passage of Chapter 135 of 2017 (AB 398, E. Garcia). In this report, we (1) provide background information on cap‑and‑trade and the recent extension of the program to 2030, (2) identify key administrative implementation decisions that could affect program outcomes and the need for legislative oversight, (3) identify potential opportunities to increase the effectiveness of a new advisory committee created by AB 398, and (4) describe potential state cap‑and‑trade revenue scenarios through 2030.

Background

AB 32 Authorized Cap‑and‑Trade Through 2020

State Law Establishes 2020 and 2030 GHG Limits. The Global Warming Solutions Act of 2006 (Chapter 488 [AB 32, Núñez/Pavley]) established the goal of limiting GHG emissions statewide to 1990 levels by 2020. Subsequently, Chapter 249 of 2016 (SB 32, Pavley) established an additional GHG target of reducing emissions by at least 40 percent below 1990 levels by 2030. The California Air Resources Board (CARB) is required to develop a Scoping Plan, which identifies the mix of policies that will be used to achieve the emission targets, and update the plan periodically. Prior Scoping Plans included a wide variety of programs, including a low carbon fuel standard (LCFS) intended to reduce the carbon intensity of transportation fuels, energy efficiency programs, and the 33 percent renewable portfolio standard (RPS) for retail electricity sales. One policy that is used to help ensure the state meets its emissions goals is cap‑and‑trade. Assembly Bill 32 authorizes CARB to implement a market‑based mechanism, such as cap‑and‑trade, through 2020. However, prior to the passage of AB 398, CARB did not have the authority to implement cap‑and‑trade beyond 2020.

Cap‑and‑Trade Designed to Limit Emissions at Lowest Cost. The cap‑and‑trade regulation places a “cap” on aggregate GHG emissions from large GHG emitters, such as large industrial facilities, electricity generators and importers, and transportation fuel suppliers. Capped sources of emissions are responsible for roughly 80 percent of the state’s GHGs. To implement the program, CARB issues a limited number of allowances, and each allowance is essentially a permit to emit one ton of carbon dioxide equivalent. (Please see the Appendix for a more detailed definition of an allowance and other key cap‑and‑trade terms used in this report.) The annual caps—or number of allowances issued each year—decline over time, from 395 million allowances in 2015 to 334 million allowances in 2020. Entities can also “trade” (buy and sell on the open market) the allowances in order to obtain enough to cover their total emissions. Businesses that are covered by the regulation can comply in three ways: (1) reduce emissions, (2) obtain allowances to cover emissions, and/or (3) obtain “offsets” to cover emissions. Offsets are alternative compliance instruments—similar to allowances—that are generated by undertaking certified GHG emission reduction projects from sources that are not subject to the state’s cap‑and‑trade program (uncapped sources), such as forestry projects that reduce GHGs.

From a GHG emissions perspective, the primary advantage of a cap‑and‑trade regulation is that total GHG emissions from the capped sector do not exceed the number of allowances issued. Some entities must reduce their emissions if the total number of allowances (and offsets) available is less than the number of emissions that would otherwise occur. From an economic perspective, the primary advantage of a cap‑and‑trade program is that the market sets a price for GHG emissions, which creates a financial incentive for businesses and households to implement the least costly emission reduction activities. In theory, the market price will adjust to reflect the cost of reducing the last ton needed to ensure emissions remain under the cap. This is the price that provides an incentive to businesses and households that is high enough to encourage enough emission reductions to stay under the cap, but no higher than what is needed. (For more details on how cap‑and‑trade works, see our February 2017 report The 2017‑18 Budget: Cap‑and‑Trade.)

Some Allowances Auctioned, Some Given Away for Free. About half of allowances are allocated for free to certain industries, and most of the remaining allowances are auctioned by the state. Of the allowances given away for free, most are given to utilities and natural gas suppliers. CARB also allocates free allowances to certain energy‑intensive trade‑exposed industries based on how much of their goods (not GHG emissions) they produce in California. This strategy, known as “industry assistance,” is intended to minimize the extent to which emissions are shifted out of state because companies move their production of goods out of California in response to higher costs associated with the cap‑and‑trade regulation. This type of emissions shifting is referred to as “leakage.”

The allowances offered at auctions are sold for a minimum price—set at about $14 in 2017—which increases annually at 5 percent plus inflation. A small percentage of allowances are also placed in a special account—called the Allowance Price Containment Reserve (APCR)—and made available at higher predetermined prices. These predetermined prices are sometimes called a “soft” price ceiling. The APCR is intended to help moderate potential spikes in allowance prices by increasing the supply of allowances available if prices increase to a certain amount.

State Revenue Used to Facilitate GHG Reductions. The state has collected a total of about $6.5 billion in cap‑and‑trade auction revenue from 2012 through 2017. Money generated from the sale of allowances is deposited in the Greenhouse Gas Reduction Fund (GGRF). To date, the revenues have generally been used to fund projects intended to reduce GHGs.

AB 398 Extends Cap‑and‑Trade Through 2030

Assembly Bill 398 extends CARB’s authority to operate cap‑and‑trade from 2020 to 2030 and provides additional direction regarding certain design features of the post‑2020 program. It also includes new reporting and oversight requirements. We summarize these changes below. (As discussed in the box below, AB 398 and related legislation make other significant changes to climate change and air quality polices.)

Other Major Climate and Air Quality Changes Recently Adopted

In addition to extending the cap‑and‑trade program, the Legislature also recently adopted various other related changes.

Limitations on Adopting Additional Greenhouse Gas (GHG) Regulations. Chapter 135 of 2017 (AB 398, E. Garcia) requires the California Air Resources Board (CARB) to update the Scoping Plan by January 1, 2018 and to designate cap‑and‑trade as the GHG reduction regulation for refineries and oil and gas production facilities. This restricts CARB from implementing a new GHG regulation focused on refineries, which was a measure included in the proposed Scoping Plan update issued in early 2017. Assembly Bill 398 also restricts local air quality management districts from implementing their own regulations intended to reduce carbon dioxide—the most common GHG—from stationary sources that are also subject to the state cap‑and‑trade program.

State Fire Prevention Fee Suspension. Assembly Bill 398 suspends the state fire prevention fee from July 1, 2017 until January 1, 2031. The fee was imposed on landowners in State Responsibility Areas (SRAs), and the money was used to fund state fire prevention activities in these areas. The bill also expresses the Legislature’s intent to use cap‑and‑trade revenue to backfill the lost fee revenue and continue fire prevention activities. Subsequently, the 2017‑18 budget provided $80 million from the Greenhouse Gas Reduction Fund to backfill lost SRA fee revenue.

Extension and Expansion of Sales and Use Tax (SUT) Exemption for Certain Equipment. Assembly Bill 398 extends the sunset date from 2022 to 2030 for a partial SUT exemption for certain types manufacturing and research and development equipment. It also expands the exemption to include equipment for other types of activities, such as certain electric power generation and agriculture, through 2030. The bill, as amended by legislation adopted as part of the 2017‑18 budget, also transfers cap‑and‑trade revenue to the General Fund to backfill revenue losses associated with these changes.

Changes Intended to Reduce Local Air Pollution. Chapter 136 of 2017 (AB 617, C. Garcia) makes a variety of changes that are intended to reduce criteria and toxic air pollutants that have adverse effects on local communities. The key changes include (1) directing CARB to establish a uniform statewide annual reporting system; (2) requiring local air districts to adopt an expedited schedule for requiring certain facilities to install updated pollution control technologies; (3) increasing the maximum allowable penalties for violations of air quality rules; (4) requiring CARB to develop, and air districts to implement, additional air monitoring in heavily polluted communities; and (5) requiring CARB to develop a strategy to reduce air pollution in these communities.

Constitutional Amendment Establishing Temporary Two‑Thirds Vote Requirement for Cap‑and‑Trade Spending. Chapter 105 of 2017 (ACA 1, Mayes) places a proposed Constitutional Amendment on the June 2018 ballot. If the amendment passes, a two‑thirds vote of the Legislature would be needed to allocate cap‑and‑trade revenue collected after January 1, 2024. After one such vote, any future revenue could again be allocated with a simple majority vote. Also, beginning in 2024, the manufacturing SUT exemption would be suspended until the Legislature allocated cap‑and‑trade funds with a two‑thirds vote.

Provides Direction for Certain Post‑2020 Cap‑and‑Trade Design Features. Assembly Bill 32 gave CARB almost complete discretion over how to design the cap‑and‑trade program. In contrast, AB 398 provides more specific legislative direction about certain design features of the post‑2020 program, such as the price ceiling and offsets.

CARB adopted amendments to the cap‑and‑trade regulation a few weeks after the Legislature passed AB 398. However, restrictions imposed by the state regulatory process prevented CARB from adjusting the regulation to incorporate most of the AB 398 changes. As a result, CARB will have to undertake a new rulemaking process to amend the regulation to comply with AB 398. Figure 1 summarizes the major areas of direction in AB 398 and how they compare to the current cap‑and‑trade regulation, as amended this past summer by CARB.

Figure 1

Major Differences Between Current CARB Cap‑and‑Trade Regulation and AB 398a

|

Design Feature |

Current Regulation |

AB 398 Extension (2021 Through 2030) |

|

Setting Post‑2020 Emissions Caps |

Establishes the number of allowances issued each year through 2030. |

When setting post‑2020 caps, directs CARB to evaluate and address concerns related to a large number of banked allowances. |

|

Banking |

No expiration date for allowances; limits on the number of allowances an entity can hold at a time. |

Directs CARB to adopt banking rules that “discourage speculation, avoid financial windfalls, and consider impact on complying entities and market volatility.” |

|

Price Ceiling |

“Soft” price ceiling of about $60 per allowance in 2017, increasing gradually in future years. |

Directs CARB to establish “hard” price ceiling and consider various factors when setting the level of ceiling. |

|

Price Containment Points |

None. |

Directs CARB to establish two price containment points (also known as speed bumps) between the price floor and the price ceiling. |

|

Offset Limits |

Maximum of 8 percent of a covered entity’s emissions. |

Maximum of 4 percent in 2021‑2025 and 6 percent in 2026‑2030, with no more than half from projects that do not provide direct environmental benefits in California. |

|

Industry Assistance |

Different IAFs for high‑ (100 percent), medium‑ (75 percent) and low‑ (50 percent) risk industries from 2018 through 2020; not specified from 2021 through 2030. |

100 percent IAFs from 2021 through 2030. |

|

aChapter 135 of 2017 (AB 398, E. Garcia). CARB = California Air Resources Board and IAF = industry assistance factor. |

||

Adds New Reporting and Oversight Requirements. Assembly Bill 398 adds several new reporting and oversight requirements, as summarized in Figure 2. In most cases, existing entities—such as CARB and our office—are required to report on certain topics. Assembly Bill 398 also creates a new Independent Emissions Market Advisory Committee (Market Advisory Committee), located within the California Environmental Protection Agency. The committee is composed of at least five experts on emissions trading market design—including three appointed by the Governor, one by the Senate Committee on Rules, and one by the Speaker of the Assembly. It will also include a representative from our office.

Figure 2

Key AB 398a Reporting Requirements

|

Subject of Report |

Responsible Entity |

Date and Frequency |

|

Environmental and economic performance of cap‑and‑trade regulation and other relevant climate policies. |

Market Advisory Committee. |

At least annually until 2031. |

|

Economic impacts and benefits of state greenhouse gas (GHG) limits. |

Legislative Analyst’s Office. |

Annually until 2031. |

|

Need for increased workforce development activities and funding to help transition to economic and labor‑market changes related to state GHG targets. |

California Workforce Development Board, in consultation with California Air Resources Board (CARB). |

By beginning of 2019. |

|

Progress toward meeting GHG limits, leakage risk posed by cap‑and‑trade regulation, and recommended changes needed to reduce leakage, including potential for border carbon adjustment. |

CARB. |

By end of 2025. |

|

Potential for allowance prices to reach price ceiling for multiple auctions. |

CARB, in consultation with Market Advisory Committee. |

If prices at two consecutive auctions exceed the lower speed bump. |

|

aChapter 135 of 2017 (AB 398, E. Garcia). |

||

Key Implementation Decisions Could Affect Program Outcomes

A variety of factors will affect future cap‑and‑trade outcomes, including the key outcomes of GHG emission reductions and the costs of reducing emissions. Reducing GHG emissions is the primary goal of the program, and the costs of GHG reductions will ultimately be borne by California households and businesses. Many of the major factors that could affect these outcomes—such as future technological changes, broader economic conditions, and the presence of other GHG regulations—will largely occur for reasons that are unrelated to the design of the state’s cap‑and‑trade program. However, some key cap‑and‑trade implementation decisions—such as the overall supply of allowances and how they are distributed—could have significant effects on program outcomes. For these decisions, the Legislature will want to ensure CARB is implementing the program in a way that is consistent with legislative goals and priorities.

At the time this report was prepared, CARB staff had already begun public workshops to discuss some of the changes to the post‑2020 cap‑and‑trade regulation required by AB 398, as well as other potential changes identified by the board. Based on an initial timeline presented at a public workshop in October 2017, CARB expects to begin the formal process to amend the regulation in 2018 and finalize the amendments in the middle of 2019.

In this section, we discuss some of the key regulatory decisions CARB will have to consider when implementing AB 398. These decisions relate to (1) setting post‑2020 caps and banking rules, (2) implementing a hard price ceiling, (3) establishing two price speed bumps, (4) implementing new offset limits, and (5) providing industry assistance through 2020. We also identify some key issues related to these decisions to guide legislative oversight and identify areas where the Legislature might want to consider clarifying state law if it determines CARB’s actions are inconsistent with legislative goals and priorities. CARB also has considerable discretion over many other critical design features of the program not specifically addressed in AB 398—such as minimum auction price, allowance allocations to electric utilities, and linking the program with other jurisdictions. These particular design features are outside the scope of this report.

Setting Post‑2020 Caps and Banking Rules to Ensure State Meets Its GHG Targets

Current Program Allows Banking. Under the current program, there is no expiration date for allowances. An allowance issued today can be purchased today and used to cover emissions in a future year—a design feature commonly known as banking. Since the annual cap on emissions becomes more stringent in later years, banking gives firms an incentive to obtain extra allowances in early years as a way to protect against the risk of higher prices in later years when allowances are more scarce. As a result, banking can change when emissions (and emission reductions) occur. Relative to a program without it, banking has the effect of increasing allowance prices (and incentives for reductions) in early years, while reducing prices (and incentives for reductions) in later years. This is because it shifts some of the supply of allowances from earlier years to later years.

Banking Has Significant Advantages, but Also Has Trade‑offs. Some of the key advantages of banking include (1) less price volatility and (2) incentivizing some emission reduction activities in early years that are less costly than an equivalent number of reductions in later years. One potential downside to banking, however, is that there is a greater risk that the state does not meet its specific GHG target set in 2030. With banking, cumulative emissions are capped over the life of the program and covered entities have some flexibility to adjust their level of emissions between different years. Since entities can use banked allowances from earlier years to comply in later years, it is possible that annual emissions from these entities exceed the 2030 annual target. Although there are legitimate debates about whether state climate policies should focus primarily on cumulative or annual emissions targets, the Legislature has established an annual 2030 GHG target, and banking creates a risk of not meeting that goal.

Over 200 Million Banked Allowances Could Be Used for Post‑2020 Compliance. Emissions from covered entities have been below the annual caps for the first few years of the program, and CARB projects emissions will remain below the annual caps through 2020. This is likely primarily the result of factors unrelated to cap‑and‑trade, such as economic conditions and the effects of other GHG reduction policies. As a result, there could be a substantial number of allowances banked into the post‑2020 program. Earlier this year, we estimated that by 2020 there could be a substantial number of banked California allowances—ranging from 100 million to 300 million allowances, with it most likely being roughly in the middle of that range. This estimate did not account for other factors that could increase or decrease the oversupply, including the effect of linking California’s cap‑and‑trade program with other jurisdictions, recently adopted regulatory changes affecting previously unsold allowances, and updated 2016 emissions data.

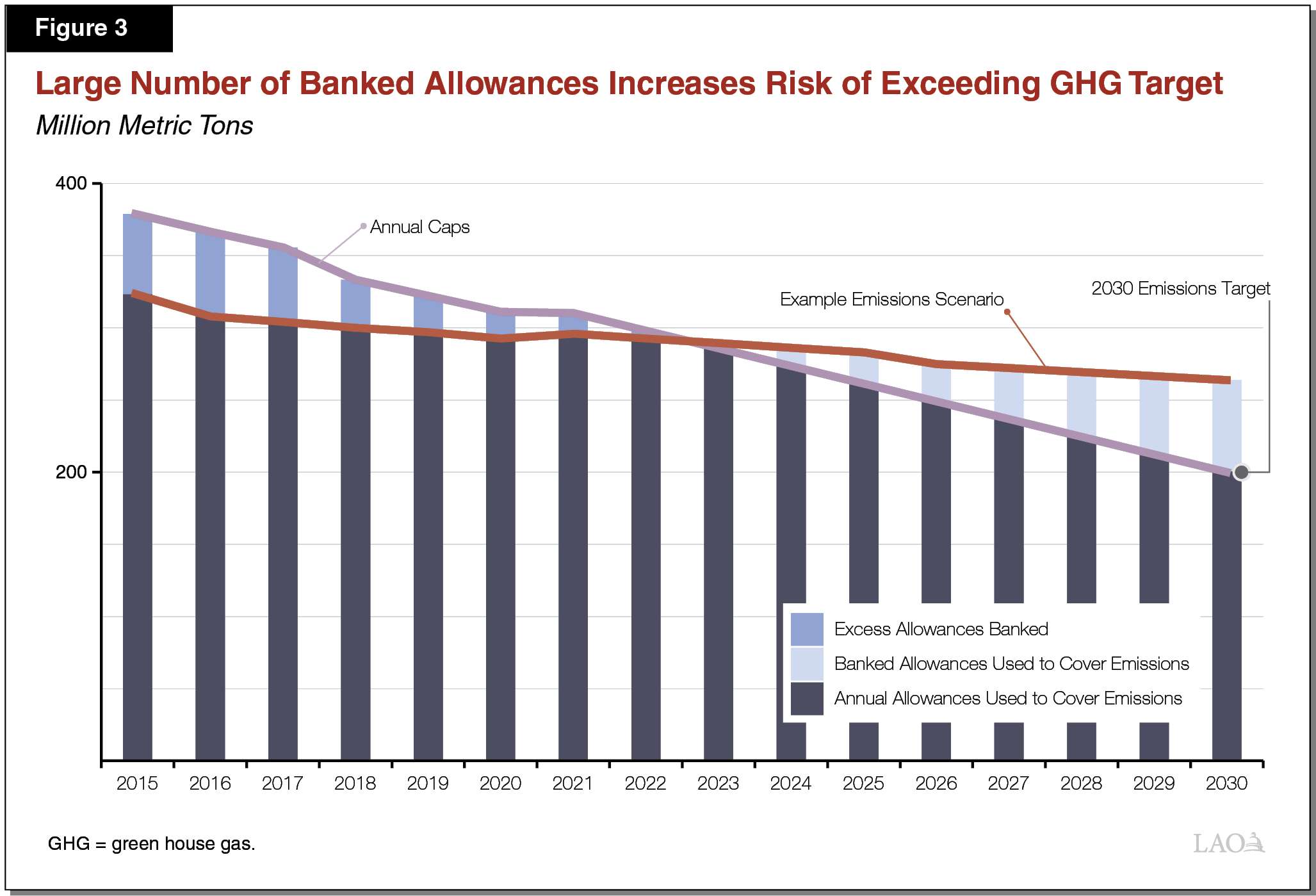

Effect of Oversupply on 2030 Target Could Be Substantial. Figure 3 illustrates a potential scenario where over 200 million banked allowances are carried forward into the post‑2020 program without any adjustments to the current caps. This example assumes California emissions from covered entities (minus offsets) decline steadily through 2030 as a result of incentives provided by allowance prices, as well as other factors. It also assumes no allowances are sold from the price containment points or price ceiling (discussed in more detail below). Notably, under this scenario, the cap would effectively limit cumulative emissions, and covered entities would be complying with the regulation. However, due to the large number of banked allowances, 2030 annual emissions from covered entities would be over 30 percent higher than the levels likely needed to meet the state’s target.

We found this general result—2030 emissions significantly higher than the annual target—under a couple different scenarios we analyzed. There are alternative scenarios where the difference is either larger or smaller than the one illustrated in Figure 3. Some factors that could change this outcome are (1) if emissions trends are substantially different than the steady decline in emissions reflected in Figure 3 and (2) if linking with other jurisdictions has significant effects on emissions from California entities.

AB 398 Directs CARB to Address Overallocation and Consider Changes to Banking Rules. Assembly Bill 398 directs CARB to evaluate and address concerns related to overallocation when determining post‑2020 caps. (Although overallocation is not defined in the legislation, we interpret it to mean the number of allowances that are banked into the post‑2020 period.) It also directs CARB to establish banking rules that “discourage speculation, avoid financial windfalls, and consider the impact on complying entities and volatility in the market.”

Key Issues for Legislative Oversight. Setting the post‑2020 caps are a critical design feature of the cap‑and‑trade program because the caps are the key mechanisms used to limit emissions. As discussed above, there are important questions about whether the caps and banking rules are likely to ensure the state meets its annual 2030 GHG target, especially given the large number of banked allowances that are likely to be carried forward from the pre‑2020 program.

As a result, the Legislature will want to monitor CARB’s assessment of overallocation and how it could affect the likelihood of meeting the state’s GHG goals. For example, the Legislature could direct CARB to explain how it will evaluate overallocation and outline what criteria it will use to determine whether the program is likely to ensure the state meets its 2030 GHG goals. The Legislature could also direct CARB to explain what type of adjustments it would likely make in the future if it determines that the program is likely not going to ensure the state meets its 2030 GHG targets. Clearly outlining this process in advance could give the Legislature greater confidence that the program will limit GHGs in a way that is consistent with its goals. It could also provide greater long‑term certainty to the market, which helps ensure allowance prices provide the incentives for GHG reduction strategies that are needed to meet the state’s goals.

Options to Address Potential Overallocation Concern Exist. If the Legislature decides that having a large supply of banked allowances in the future is an issue that needs to be addressed, it has several options. In general, these approaches would be aimed at reducing the number of allowances available in later years of the program (including 2030). One such option would be to directly reduce the supply of allowances issued in post‑2020 years to account for some or all of the allowances available to be banked from the pre‑2020 period. Specifically, the state could offer fewer allowances in regular auctions than what is currently scheduled. This could reduce cumulative emissions (assuming prices do not reach the ceiling), as well as reduce the risk that emissions from covered entities substantially exceed the state’s 2030 goal. Alternatively, the Legislature could direct CARB to establish an expiration date for allowances sold in the future. This would reduce the number of allowances issued in the next several years that could be banked and used to comply in later years.

The above options would have trade‑offs. For example, establishing an expiration date for allowances could increase price volatility by reducing the ability to bank allowances. In addition, both of these options could increase long‑term allowance prices by reducing the overall supply of allowances available in the later years. However, in our view, decisions about the number of allowances that could be available to be used in the later years of the program should be driven primarily by an evaluation of what is likely needed to ensure the state meet its 2030 GHG goals. Other design features that are designed specifically to limit price increases, such as the price ceiling and price containment points, are likely to be effective tools for addressing concerns about high allowance prices. In fact, if the state reduced the number of allowances available at future auctions, it could move those allowances to the price containment points (discussed below) to help mitigate potential price increases.

Setting Hard Price Ceiling at Level That Balances Emissions and Costs

Current Program Has Soft Price Ceiling. To implement the soft price ceiling, CARB sets aside a limited number of allowances in the APCR and offers them for sale to covered entities at predetermined price tiers—ranging from about $51 to $63 per allowance in 2017. This design feature is intended to moderate potential price spikes by increasing the supply of allowances if prices reach a certain level. It is sometimes called a soft price ceiling because market prices could still exceed the ceiling after all of the APCR allowances are purchased. Since the overall number of allowances available is still limited, there is still a fixed limit on overall emissions in the capped sector.

AB 398 Directs CARB to Establish a Hard Price Ceiling. Assembly Bill 398 directs CARB to establish a “hard” price ceiling. In contrast to a soft ceiling, a hard ceiling makes an unlimited number of additional compliance instruments available for sale at a predetermined maximum price. (Assembly Bill 398 does not specify a name for these compliance instruments, but in this report we refer to them as allowances because, like allowances, they could be used as a permit for covered entities to emit GHGs.) This approach is intended to ensure that market prices do not exceed the amount established by the ceiling. It accomplishes this goal by ensuring covered entities always have the option of purchasing compliance instruments from CARB at the ceiling price. Assembly Bill 398 specifies that some of the allowances left in the APCR at the end of 2020 will be sold at the price ceiling in the post‑2020 program. After those allowances are sold, CARB must offer “additional metric tons” for sale to covered entities at the ceiling price if needed for compliance. Assembly Bill 398 also identifies the following factors that ARB must consider when setting the level of the ceiling:

- Need to avoid adverse impacts on households, businesses, and the state’s economy.

- Social cost of emitting a ton of GHGs.

- 2020 APCR tier prices.

- Minimum auction price.

- Potential for leakage.

- Cost per metric ton of GHG reductions to achieve the state’s emissions targets.

The primary trade‑off associated with creating a hard price ceiling is that the program would no longer cap overall emissions if prices reach the ceiling. This is because entities could purchase an unlimited number of additional compliance instruments at that predetermined price. Assembly Bill 398 seeks to address this issue by specifying that the revenue from selling the additional compliance instruments sold at the ceiling must be expended by CARB to achieve an equivalent number of emissions reductions.

Issue for Legislative Oversight. Assembly Bill 398 provides CARB with significant discretion in setting the level of the price ceiling. The decision requires a balancing of the state’s interests in containing costs for businesses and households with the certainty that targeted emission levels will be achieved. A relatively low ceiling price would do more to limit the costs of the program on businesses and households. On the other hand, it would increase the likelihood that prices reach the ceiling, thereby increasing the likelihood that emissions exceed the cap (by selling additional allowances). In contrast, a higher ceiling price does less to limit program costs but provides greater certainty that emissions will not exceed the cap.

Other factors are also worth considering when setting the price ceiling, such as how different price levels might affect the likelihood of linkages with other jurisdictions and the extent to which higher prices encourage businesses to develop different types of technologies that can be used to reduce GHGs in other jurisdictions. For example, in a recent workshop, CARB indicated that it might consider what price level might be needed to encourage the development of carbon capture and sequestration technology.

In our view, setting the level of the price ceiling is a policy decision that will depend on how one weighs many different factors. The Legislature will want to monitor whether CARB is weighing these various factors in ways that are consistent with legislative priorities. If the level of the price ceiling proposed by CARB is inconsistent with legislative priorities, the Legislature could set the price ceiling in statute or provide additional direction about how to weigh the different factors.

Setting Price Containment Points to Limit Price Spikes

CARB to Establish Price Containment Points. Assembly Bill 398 directs CARB to create two new price containment points—sometimes called speed bumps—at levels below the price ceiling. Assembly Bill 398 specifies that one‑third of the allowances available in the APCR at the end of 2017 be deposited in each speed bump (roughly 40 million each). In concept, the speed bumps are intended to moderate potential price spikes. This is accomplished in a manner that is similar to the current APCR, where a limited number of allowances are offered at predetermined prices. However, in contrast to the APCR, the speed bumps will be set at intermediate price levels somewhere between the price floor and the ceiling.

Issues for Legislative Oversight. CARB has discretion to set the price level of the speed bumps. Similar to setting the level of the price ceiling, this decision involves a potential trade‑off between having lower prices or lower emissions. Making more allowances available at a certain price helps limit price increases, but also permits more emissions. When determining the level of the speed bumps, CARB must determine the price at which it is willing to release more allowances in order to moderate price increases. The Legislature will want to evaluate CARB’s regulatory proposal when it is available to ensure that the price levels at which it sets the speed bumps are consistent with legislative intent. If the Legislature determines that the speed bumps are set too high or too low, it could set the levels in statute or provide more specific direction to CARB about factors to consider when setting them.

In addition, in an initial workshop, CARB staff requested stakeholder feedback on whether it should place additional allowances that would otherwise go to the post‑2020 price ceiling into the speed bumps. More allowances in the speed bumps could increase the degree to which they slow price increases but also make the program less stringent once prices reach certain intermediate levels. Since placing additional allowances in the speed bumps goes beyond the direction in AB 398, the Legislature will want to evaluate CARB’s assessment of why this change might be needed to prevent rapid price spikes and determine whether any such change would reflect the Legislature’s desired balancing of the potential effects on overall emissions and costs. If not consistent with its priorities, the Legislature could provide additional direction to CARB that explicitly limits the number of allowances allocated to each speed bump.

Implementing New Offset Limit Consistent With Legislative Intent

Current Program Has 8 Percent Limit on Offsets. Currently, a covered entity can use offsets to cover up to 8 percent of its emissions. To date, covered entities have used offsets to cover about 5 percent of their compliance obligations. As the Legislature considered extending cap‑and‑trade, there was some concern that continuing to allow up to 8 percent offsets for compliance would result in a large share of GHG reductions coming from offset projects, relative to reductions directly from covered entities. This was a concern largely because offset projects, many of which are in other states, might be less likely to provide other environmental benefits to Californians—such as reductions in local air pollutants.

AB 398 Establishes Stricter Offset Limits and Prioritizes Projects With Direct Environmental Benefits in California. In response to these concerns, AB 398 directs CARB to reduce the offset limit to 4 percent from 2021 through 2025 and to 6 percent from 2026 through 2030. The bill also requires that no more than half of these offsets can come from projects that do not provide direct environmental benefits in California (non‑direct offsets). The bill defines direct environmental benefits as the reduction or avoidance of any air pollutant in the state or pollutant that could adversely affect state waters. These restrictions on offsets will likely decrease the overall number of offsets used for compliance. To make up the difference, covered entities would need to either buy more allowances or reduce more emissions directly. As a result, there could be higher allowance prices. Assembly Bill 398 also establishes the Compliance Offsets Protocol Task Force, made up of different stakeholder representatives appointed by CARB, to provide guidance on ways to increase offset projects with direct environmental benefits in the state.

Issues for Legislative Oversight. CARB has a variety of implementation decisions that could affect the types of offset projects undertaken and the overall level of offsets used for compliance. For example, it must determine which projects meet the requirements for direct environmental benefits. It is currently unclear whether certain types of projects would qualify, such as forestry projects in neighboring states that could affect water in California. Rules that tend to limit the number projects determined to have direct environmental benefits would decrease the overall number of offsets available and used. The Legislature will want to monitor how CARB identifies projects that provide direct environmental benefits to ensure those decisions are consistent with legislative intent and consider approving legislation if additional clarification is necessary.

In addition, there is some uncertainty about how the limit on non‑direct offsets is applied. For example, if a company uses offsets to cover 2 percent of its compliance obligation in 2021, can all 2 percent be from non‑direct offsets (half of the 4 percent limit) or only 1 percent (half of the offsets used for compliance)? The second interpretation would likely limit the number of offsets used for compliance more than the first. It would also be more complex for covered entities to plan for the use of offsets because the number of non‑direct offsets to purchase would depend, in part, on the number of direct offsets it is able to purchase, which could be subject to considerable uncertainty. In an initial workshop, CARB staff indicated that it would apply the first interpretation. The Legislature will want to ensure this provision is being implemented in a way that is consistent with legislative intent and consider clarifying legislation if CARB adopts an inconsistent approach.

Determining Industry Assistance Factors Through 2020

Current Regulation Reduces Industry Assistance Factors (IAFs) in 2018. In 2017, about 15 percent of allowances were given for free to certain businesses for industry assistance. Only those covered entities operating in industries CARB has assessed as being at risk for leakage receive free allowances for industry assistance. The number of allowances given to each company is calculated based on four factors:

- Output. The amount of product (not GHG emissions) the company produces in California. The more a business produces in California, the more allowances it receives.

- Emissions Intensity Benchmark. A benchmark level of GHG emissions per unit of output. This benchmark is developed by CARB and reflects about 90 percent of each affected industry’s average emissions intensity.

- Industry Assistance Factor. A percentage assigned by CARB to each industry based on that industry’s risk of leakage. Industries with higher leakage risk can be assigned higher IAFs than those in industries with lower leakage risk. A higher IAF means a business within that industry receives more free allowances than if it were in a lower risk industry. CARB currently divides industries into one of three categories of leakage risk: high, medium, or low.

- Cap Adjustment Factor. A percentage that declines each year for all affected industries, consistent with the decline in the annual caps.

Through 2017, CARB applied a 100 percent IAF to businesses in all three categories of leakage risk. Setting the IAFs at 100 percent for all three categories was largely intended to serve as transition assistance to give affected companies time to adjust to the effects of the cap‑and‑trade program. Under the current regulation, IAFs are scheduled to decrease for medium (75 percent) and low (50 percent) risk industries from 2018 through 2020. This change was originally intended to more closely align the number of free allowances with the level of leakage risk.

AB 398 Requires 100 Percent IAFs for Post‑2020 Program. Assembly Bill 398 directs CARB to apply 100 percent IAFs for all three categories of leakage risk beginning in 2021 (but to continue to apply the declining cap adjustment factor). However, the legislation does not provide direction for what IAF to apply in 2018 through 2020. Soon after AB 398 was enacted, the board directed staff to propose future amendments to the regulation that would maintain all IAFs at 100 percent from 2018 through 2020.

Issues for Legislative Oversight. Maintaining the higher IAFs would align with the post‑2020 direction provided by the Legislature and could reduce leakage risk for medium‑ and low‑risk industries. On the other hand, it also increases the risk that the state is providing more allowances to medium‑ and low‑risk industries than are needed to prevent leakage. This could encourage more production and consumption of some GHG‑intensive goods, which means more in‑state emissions from these industries. Higher emissions from these industries could mean more emission reductions are needed from other sources—which could lead to higher overall costs to the extent that these other sources have higher costs for reducing emissions.

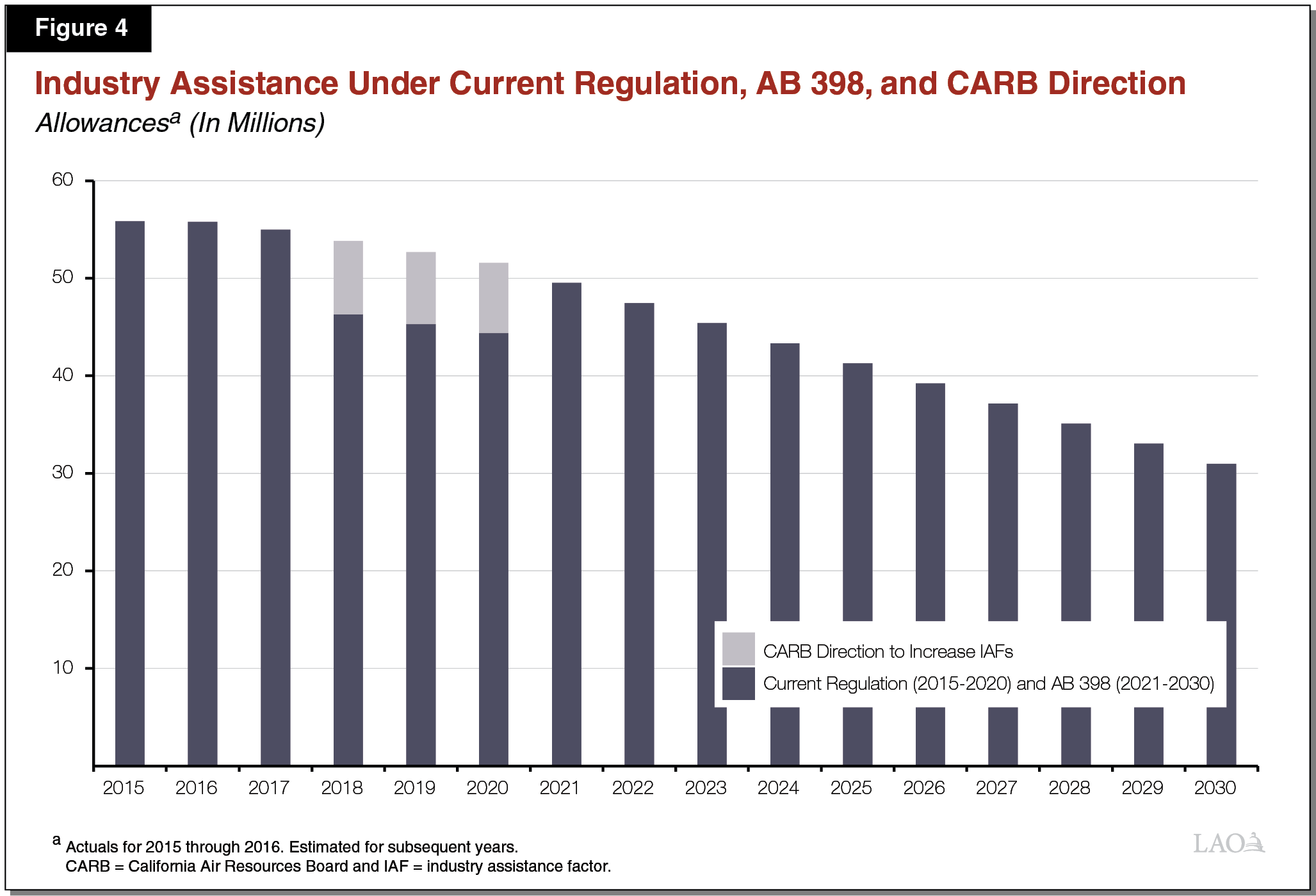

Figure 4 provides an estimate of industry assistance under the current regulation and AB 398 direction, as well as how the board’s direction could increase the number of free allowances for industry assistance by about 8 million in each of the next few years. At fall 2017 allowance prices, the value of the additional allowances that would be allocated is over $100 million in each of the three years. These estimates assume output remains constant through the life of the program and is unaffected by a change in IAFs. Since higher IAFs would tend to lead to higher in‑state output and the number of allowances given as industry assistance, the figure might underestimate the difference in allowances.

Although AB 398 does not provide specific direction regarding industry assistance from 2018 through 2020, the Legislature may want to consider whether the board’s direction is consistent with legislative priorities. If not, the Legislature could specify in statute the IAFs for this period.

Summary of Key Issues for Legislative Oversight. Figure 5 summarizes the key issues discussed above for legislative oversight of AB 398 discussed in this report.

Figure 5

Key Issues for Legislative Oversight

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GHG = greenhouse gas; CARB = California Air Resources Board; and IAF = industry assistance factor. |

Implementing the Market Advisory Committee

Given the potentially significant environmental and economic effects of state GHG policies, including cap‑and‑trade, AB 398 includes a variety of reporting requirements meant to enhance oversight and accountability. Key among these is the establishment of the Market Advisory Committee. In our view, the committee has the potential to provide valuable information to support legislative oversight and future policy and regulatory decisions. Below, we identify potential areas where the Legislature might want to consider clarifying or refining direction for the Market Advisory Committee to increase the likelihood that it will provide useful information for these future decisions.

Scope of Policies Under Committee Jurisdiction. Assembly Bill 398 directs the committee to annually report on the environmental and economic performance of cap‑and‑trade and other relevant climate policies. Given the wide range of state policies focused on climate change—such as cap‑and‑trade, energy efficiency, RPS, and LCFS—the scope of this requirement appears rather broad. The Legislature could provide more specific direction about which policies it would like the committee to focus on. This could help ensure the committee’s workload is manageable and make it easier to appoint members that have in‑depth expertise in the policies within the committee’s jurisdiction.

Role of Committee. It is not clear whether the Legislature established the committee to (1) advise on future program design issues (such as how to manage an oversupply of allowances) and/or (2) evaluate past program performance. Advisory activities are generally aimed at providing information to guide future program decisions. In contrast, program evaluations tend to focus more on measuring past program outcomes. Although the name of the committee suggests it will serve an advisory function, the statutory requirements suggest that it is responsible for program evaluation. In a workshop on October 2017, CARB indicated that the advisory committee will be responsible only for program evaluation. The Legislature will want to consider whether this approach is consistent with its intent. If not, it should clarify whether it would like the committee to advise on program design issues, evaluate program outcomes, or both.

CARB has indicated that to ensure that the committee’s evaluation is independent, committee members will not be involved in advising on program design issues. It is reasonable to have some concern about this conflict. However, this type of conflict frequently occurs when agencies are asked to evaluate their own programs. In this case, unlike agencies that evaluate their own programs, the committee would not be the one responsible for designing the program (just advising). As a result, in our view, this is a relatively minor concern. Nonetheless, if this is a significant concern for the Legislature, one option would be to establish two separate committees—one for program evaluation and one to advise on program design. This would help maintain independence for each committee. In addition, the members of each committee could be selected based on the type of expertise that is most relevant for the activities within the committee’s jurisdiction.

Alternatively, under a scenario where there continues to be only one committee, the Legislature could direct the committee to primarily serve in an advisory role for program design while also requiring it to (1) identify high‑priority areas for additional research funding and/or (2) help evaluate proposed research projects, particularly to ensure sound methodologies. Since the committee members would not be conducting the research, this could reduce concerns about conflicts. We find that this approach would also more clearly focus the committee’s role as advisory, while using its expertise in guiding effective evaluation practices.

Different Roles Could Require Different Levels of Resources. In our view, there is value in having independent experts both advising on program design issues and evaluating program outcomes. When determining which activities the committee should conduct, the potential value of these activities will have to be balanced against the level of resources that might be needed. For example, a committee with a narrower scope of advising just on cap‑and‑trade program design might require fewer resources—likely less than a million dollars annually—because committee members would largely rely on their existing expertise in these areas and other information that is already available.

Alternatively, program evaluation activities could require substantially more resources for new data collection, modeling, and analysis. The structure of the committee could also limit the amount of analysis that could be conducted in a timely manner. For example, a similar committee established by the California Energy Commission to help evaluate petroleum markets (called the Petroleum Market Advisory Committee) recently found a significant unexplained difference in California gasoline prices compared to the rest of the country. However, it could not reach clear conclusions about the cause of elevated gasoline prices and the best remedies for a variety of reasons, including:

- Limited staff with the necessary expertise were available to carry out the analysis needed by the committee. Less than one full‑time equivalent staff person from the California Energy Commission was available to support committee activities.

- Difficulty conducting regular in‑person meetings because the committee members had full‑time jobs in disparate locations and did not receive reimbursement for travel or other expenses. Committee members had full‑time jobs in Irvine, Berkeley, San Francisco, Stanford, and Davis. In addition, under California’s Bagley‑Keene open meeting rules, members are limited in how much they can discuss issues within the jurisdiction of the committee with each other outside of public meetings.

If the Emissions Market Advisory Committee faced similar challenges, they could adversely affect its ability to conduct timely and effective program evaluations. As discussed above, the Legislature might want to direct the committee to have a more limited role in helping identify areas for future research funding and/or evaluate research proposals to ensure they are methodologically sound, rather than conducting its own research. This approach would also be less costly to support than if the committee were directly responsible for program evaluation. However, there could still be additional costs to fund the program evaluations performed by other entities that the committee identifies as high priorities.

Consider Identifying More Specific Outcomes to Evaluate. Assembly Bill 398 does not specify which outcomes or program characteristics the committee should focus on. The Legislature could provide more specific direction about what it would like the committee to evaluate. For example, if the committee should be focused on evaluating program performance, the Legislature could direct it to evaluate such things as GHG emission reductions, costs of reductions, and how those costs are distributed across the different sectors of the state economy. If the committee primarily acts in a cap‑and‑trade advisory role, the Legislature could direct it to make recommendations on program design features that would help ensure the program limits price volatility, prevents market manipulation, encourages the most cost‑effective reductions, and is structured in a way that likely helps the state meet its GHG targets. Providing more specific direction could help ensure the committee is focusing on the outcomes that are of greatest interest to the Legislature.

Implications for Auction Revenue

The extension of the cap‑and‑trade regulation through 2030 also extended the period in which the state will receive revenue from cap‑and‑trade auctions. While it is clear that there will be additional revenues to the state beyond 2020, the amount that will be generated annually is highly uncertain. Accordingly, we identify two potential cap‑and‑trade revenue scenarios below.

Various Factors Contribute to Substantial Uncertainty. Over the last few years, annual revenue has ranged from less than $1 billion to nearly $2 billion. The amount of state revenue generated from future cap‑and‑trade auctions depends on two basic factors: the number of allowances sold and the price of those allowances. Both of these factors, especially prices, are affected by (1) future “business‑as‑usual” (BAU) emissions, (2) the effect of other GHG reduction policies, and (3) cap‑and‑trade program design decisions. First, BAU emissions reflect what future emissions would be if no new GHG reduction policies (including extending cap‑and‑trade) were implemented. These future emissions would largely depend on general economic conditions and technological changes, both of which are subject to significant uncertainty. Higher BAU emissions means cap‑and‑trade would need to encourage greater emission reductions, resulting in higher allowance prices. Second, the effect of other GHG reduction policies—such as RPS requirements and LCFS standards—on emissions could affect revenue. For example, a more stringent RPS or LCSF means cap‑and‑trade would need to encourage fewer emission reductions and result in lower allowance prices. Third, as discussed above, various regulatory decisions—such as setting post‑2020 caps, banking rules, the level of industry assistance, and setting the levels of the price ceiling and speed bumps—could also have significant effects on the number of allowances sold and prices.

Range of Future Revenue Could Vary by Billions of Dollars Annually. Figure 6 illustrates two revenue scenarios through 2030 under different assumptions about future allowance prices. The low price scenario assumes all allowances sell at the minimum price established by CARB from 2018 through 2030. The high price scenario assumes prices are roughly $20 in 2018 and increase to reach a price ceiling of about $85 in 2030 (in 2017 inflation‑adjusted dollars). This scenario also assumes the price speed bumps are evenly distributed between the price floor and ceiling, and that they have the effect of keeping prices flat for about one year (in 2023 and 2027). Although the speed bumps slow price increases, the result is a net increase in revenue in this scenario because the state sells the additional allowances available in the speed bumps. Under these two scenarios, revenues would range from $2 billion to $4 billion in 2018 and from $2 billion to almost $7 billion in 2030. In our view, these two scenarios provide a plausible range of future revenues. However, there are alternative scenarios where revenue could be higher or lower, especially in certain years.

Conclusion

In July 2017, the Legislature passed AB 398, extending the state’s cap‑and‑trade program through 2030. The program is one of the state’s key strategies intended to ensure GHG emissions are 40 percent below 1990 levels by 2030. Cap‑and‑trade is a complex program that requires many different design decisions that could affect both emissions and costs to businesses and households. In this report, we identify key CARB implementation decisions and major trade‑offs associated with those decisions. We also identify potential opportunities to improve Legislative oversight and future policy decisions to ensure that the administration is implementing the program in a way that is consistent with legislative intent and priorities.

Appendix: Key Cap‑and‑Trade Terms

Allowance. A permit issued by the California Air Resources Board (CARB) to emit one ton of carbon dioxide equivalents. Allowances are either given away to certain industries, auctioned, or sold at a price ceiling or price containment point.

Allowance Price Containment Reserve (APCR). A limited number of allowances that are set aside by CARB and used to implement the soft price ceiling. Specifically, CARB offers these allowances for sale to covered entities if allowance prices reach a predetermined level.

Banking. The act of purchasing an allowance in one year, but using it for compliance in a future year.

Business‑as‑Usual (BAU) Emissions. The level of emissions that would occur absent any effects from cap‑and‑trade or other greenhouse gas (GHG) reduction policies. The level of BAU emissions is affected by such things as general economic activity and technological changes.

Compliance Instruments. Allowances or offset credits that covered entities can use to comply with the regulation. Each instrument covers one ton of carbon dioxide equivalent.

Emissions Cap. The number of allowances issued, as determined by CARB. Cap can be considered on either annual or cumulative basis.

Greenhouse Gas Reduction Fund (GGRF). The state fund where moneys generated from state auction or sale of allowances are deposited.

Industry Assistance Factor. A factor, established by state law or regulation, that is used to determine the number of allowances given to certain industries for free to help prevent emissions leakage.

Leakage. When emissions are shifted out of state because companies move their production of goods out of California in response to higher costs associated with in‑state regulations.

Offsets. Emissions credits that are generated by undertaking certified GHG emission reduction projects from sources that are not subject to the state’s cap‑and‑trade program. Covered entities can use a limited number of offsets instead of allowances.

Price Ceiling. A predetermined allowance price level that is intended to moderate or prevent price spikes above that price level. There are two types of price ceilings:

- Soft Price Ceiling. A predetermined allowance price level intended to moderate, but not necessarily prevent, price spikes. If prices reach the soft ceiling, CARB would sell a limited number of allowances from the APCR.

- Hard Price Ceiling. A maximum allowance price that is designed to ensure that allowance prices do not exceed that level. If prices reach the hard ceiling, CARB would be able to sell an unlimited number of allowances at that price.

Price Containment Points (“Speed Bumps”). Similar to the APCR, speed bumps are intended to limit price spikes by making a limited number of allowances available at predetermined prices. However, for the speed bumps, allowances are made available at intermediate prices between the floor and the ceiling.

Price Floor. A predetermined allowance price level that is intended to moderate or prevent price drops below that level. To implement a price floor, CARB establishes a minimum price at which allowances can be auctioned.