LAO Contact

January 12, 2018

The 2018-19 Budget

Overview of the Governor's Budget

Executive Summary

Governor Prioritizes Reserves. The Governor’s 2018‑19 proposed budget places a high priority on building reserves. To that end, the Governor proposes a total reserve balance of nearly $16 billion, including an optional $3.5 billion deposit into the state’s rainy day fund. We believe the Governor’s continued focus on building more reserves is prudent in light of economic and federal budget uncertainty. In considering the Governor’s proposal, we advise the Legislature to first set its own optimal level of reserves in preparation for a future recession.

Governor Allocates Funding Increases for Schools and Community Colleges. Under the administration’s estimates, there are sizeable resources available to allocate within the constitutionally required funding guarantee for schools and community colleges. The Governor makes a few major decisions in allocating these funding amounts. These include: (1) fully funding the implementation of the K‑12 Local Control Funding Formula, (2) increasing community college apportionments and implementing a new allocation formula, and (3) creating a new high school career technical education program.

Governor Makes Various Infrastructure Proposals. After setting aside reserves and fulfilling constitutionally required spending, the Governor uses some discretionary funds for a variety of new infrastructure projects. While these proposals have merit, the Legislature may wish to consider whether it has a different set of priorities for infrastructure spending. Moreover, while many of the infrastructure proposals in the Governor’s budget include relatively small spending amounts for 2018‑19, some carry growing and significant costs in later years.

More Resources May Be Available in May. The Legislature may have more resources available to allocate in May for two reasons. First, the administration’s revenue estimates may be higher. Second, the Congress may authorize a higher federal cost share for the Children’s Health Insurance Program, resulting in General Fund savings.

On January 10, 2018 the Governor presented his initial 2018‑19 budget plan to the Legislature. In this report, we provide a brief summary of the Governor’s proposed budget. (In the coming weeks, we will analyze the plan more thoroughly and release several additional budget analysis publications.)

The Big Picture

This section presents a broad overview of the Governor’s proposed budget. Figure 1 shows the Governor’s key budget proposals. These focus on three areas of the budget:

- Building more reserves.

- Allocating sizeable funding increases available within the constitutionally required guarantee for schools and community colleges.

- Supporting a variety of new infrastructure proposals.

Figure 1

Key Features of the Governor’s Budget Plan

|

Reserves |

|

Proposes extra deposit of $3.5 billion into rainy day reserve (in addition to $1.5 billion in required deposits). |

|

Proposes discretionary reserve balance of $2.3 billion. |

|

Schools and Community Colleges |

|

Fully funds the Local Control Funding Formula ($2.9 billion). |

|

Provides $396 million in additional apportionment funding for community colleges and changes the allocation formula. |

|

Proposes a new high school career technical education program ($212 million). |

|

Creates an online community college ($100 million one time, $20 million ongoing). |

|

Provides $1.8 billion in one‑time per pupil discretionary grants. |

|

Infrastructure and Equipment |

|

Provides $375 million for the design and construction of trial courts. |

|

Proposes $134 million to purchase new voting systems in counties. |

|

Provides $136 million for infrastructure projects and equipment at correctional facilities. |

|

Proposes various other infrastructure projects and equipment purchases. |

|

Other |

|

Extends and changes business tax credits (future annual losses of over $200 million). |

|

Provides $210 million for trial court operations. |

|

Provides $92 million each for CSU and UC, a 3 percent General Fund base increase for both segments. |

|

Provides $131 million for counties to address Incompetent to Stand Trial wait list. |

Below, we discuss the administration’s estimate of the overall condition of the General Fund under these proposals. Then, we discuss how new federal tax changes may affect state revenues.

The General Fund Condition

Governor Proposes $15.7 Billion in Total Reserves

Figure 2 shows the General Fund’s condition from 2016‑17 through 2018‑19 under the Governor’s budget assumptions and proposals. The administration proposes to end 2018‑19 with $15.7 billion in total reserves. This would consist of two amounts: $13.5 billion in the state’s constitutional rainy day fund (reserves available for future budget emergencies), as well as $2.3 billion in discretionary reserves (available for any purpose). The budget would increase the rainy day fund by over $5 billion in 2018‑19, including an optional $3.5 billion deposit.

Figure 2

General Fund Condition Under Administration’s Estimates

(In Millions)

|

2016‑17 Revised |

2017‑18 Revised |

2018‑19 Proposed |

|

|

Prior‑year fund balance |

$5,029 |

$4,610 |

$5,351 |

|

Revenues and transfers |

118,669 |

127,252 |

129,791 |

|

Expenditures |

119,087 |

126,511 |

131,690 |

|

Ending fund balance |

$4,610 |

$5,351 |

$3,452 |

|

Encumbrances |

1,165 |

1,165 |

1,165 |

|

SFEU balance |

3,445 |

4,186 |

2,287 |

|

Reserves |

|||

|

SFEU balance |

$3,445 |

$4,186 |

$2,287 |

|

BSA balance |

6,713 |

8,411 |

13,461 |

|

Total Reserves |

$10,158 |

$12,597 |

$15,748 |

|

SFEU = Special Fund for Economic Uncertainties (discretionary reserve) and BSA = Budget Stabilization Account (rainy day fund). |

|||

Higher Revenue Estimates. Relative to the June 2017 budget package, the administration estimates that General Fund revenues will be $1.2 billion higher across 2016‑17 and 2017‑18 combined. In 2018‑19, the administration projects revenues will grow by $5.8 billion (4.5 percent). Most of this increase is attributable to the personal income tax, which grows by an estimated $4.2 billion (4.7 percent). The administration also estimates a 2017‑18 ending balance in the state’s discretionary reserve fund of $4.2 billion.

Higher 2017‑18 Spending. Relative to the June 2017 budget plan, General Fund expenditures in 2017‑18 are higher by $1.4 billion. This increase is partially due to new spending of $760 million for response and remediation related to the California wildfires in late 2017. (The state may receive reimbursements from the federal government for much of these costs in the future.) In addition, the administration estimates that 2017‑18 spending for the Medi‑Cal program will be $544 million higher relative to the June 2017 estimates. This increase is due to the net effect of multiple factors.

Lower 2016‑17 Spending. Relative to the June 2017 budget plan, the administration’s January estimates of General Fund expenditures in 2016‑17 are lower by $2.3 billion. This downward revision includes lower spending of: about $700 million for health and human services programs, nearly $500 million in General Fund spending for schools and community colleges (due to offsets from increased local property tax revenue), and $360 million for several natural resource programs.

2018‑19 Budget Plan

In this section, we describe key features of the Governor’s 2018‑19 General Fund proposed budget. We first describe increases that result from constitutionally required spending and recent legislative changes. We then describe how the Governor allocates discretionary resources available after fulfilling these commitments.

Provides $4.5 Billion in Constitutionally Required General Fund Increases. The state has two key constitutional spending formulas, which each year require the state to spend minimum amounts. The first—required by Proposition 98 (1988)—is a formula for determining the minimum amount of state funding for schools and community colleges. The second—required by Proposition 2 (2014)—is a formula that requires state spending on debt payments and reserve deposits into a rainy day fund. These formulas generally require more spending and rainy day fund deposits as General Fund tax revenues increase. Reflecting in part the administration’s revised revenue estimates, the Governor’s budget proposal provides $1.5 billion for constitutionally required increases in General Fund spending on schools and community colleges between 2016‑17 and 2018‑19. In addition, the budget provides $1.5 billion each ($3 billion total) for constitutionally required debt payments and rainy day fund deposits.

Budget Implements Various Legislative Initiatives and Agreements. The proposed budget next funds caseload growth, primarily in health and human services programs, and implements a variety of legislative initiatives and agreements from recent years. For example, in 2018‑19, the budget allocates $170 million in Proposition 56 (2016) revenues for year‑over‑year growth in the Medi‑Cal program and $680 million to fund payment increases for Medi‑Cal providers. The amount for payment increases is largely consistent with a two‑year agreement reached in the 2017‑18 budget package. However, it is less than the fully authorized amount of $800 million because, according to the administration, a portion of the spending will shift to 2019‑20. The budget also provides $69 million to complete a multiyear agreement to increase slots and reimbursement rates for child care and preschool providers. In addition, the budget allocates $29 million to provide eight hours of paid sick leave per year for In‑Home Supportive Services providers, consistent with 2016 legislation that also increased the state’s minimum wage.

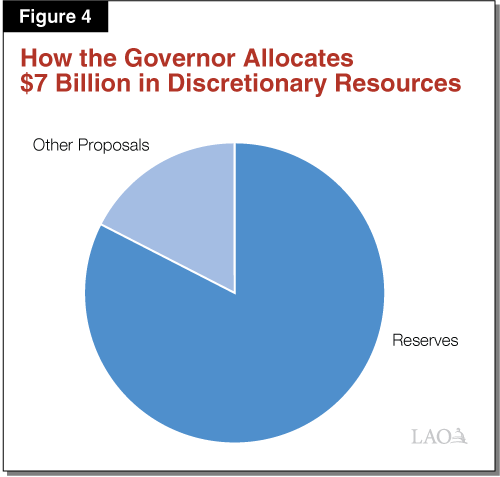

Governor Prioritizes Growing Reserves. After satisfying constitutional requirements and providing funds for caseload growth and new legislation, the Governor identifies $7 billion in available discretionary resources. As Figures 3 and 4 show, the Governor proposes using the vast majority of these resources to grow the state’s combined discretionary and mandatory budget reserves to nearly $16 billion—about 12 percent of estimated General Fund tax revenues in 2018‑19. In particular, the Governor proposes an optional deposit into the state’s constitutional rainy day fund of $3.5 billion in 2018‑19 (in addition to the $1.5 billion mandatory deposit). This increase in rainy day fund reserves would bring that account’s total balance to $13.5 billion, which the administration estimates is equal to the rainy day fund’s current constitutional maximum of 10 percent of General Fund tax revenues. As shown in the figures, after setting aside these reserves, the Governor uses the remaining discretionary funds for mostly one‑time and some ongoing new budget commitments.

Figure 3

Governor’s Key Choices in Allocating Discretionary General Fund Resourcesa

(In Billions)

|

Amount |

|

|

Reserves |

|

|

Extra rainy day fund deposit |

$3.5 |

|

Discretionary reserve balance |

2.3 |

|

Subtotal |

($5.8) |

|

Other Proposals |

|

|

Infrastructure and equipment |

$0.4 |

|

Funding for trial court operations |

0.2 |

|

Base increases for CSU and UC |

0.2 |

|

Funding increases for child care and preschool |

0.1 |

|

Funds for counties to address IST wait list |

0.1 |

|

Other |

0.2 |

|

Subtotal |

($1.2) |

|

Total |

$7.0 |

|

aTable excludes spending on K‑14 education, reserves, and debt required by the State Constitution and funding for caseload and recent legislation. Also excludes some discretionary funding below $50 million. IST = Incompetent to Stand Trial. |

|

No Added Funding to Medi‑Cal From Proposition 55. In 2016, voters passed Proposition 55, which extended tax rate increases on high‑income Californians. Proposition 55 includes a budget formula that goes into effect in 2018‑19. This formula aims to provide up to $2 billion of additional annual funding for the Medi‑Cal program in certain cases when General Fund revenues exceed constitutionally required spending for schools and the “workload budget” costs of government programs that were in place as of January 1, 2016. The Director of Finance is given significant discretion in making calculations under this budget formula. While the administration acknowledges that it had billions of surplus General Fund dollars to allocate to discretionary reserve deposits and some new spending in the overall budget, its Proposition 55 formula calculation identifies a $1.9 billion deficit in funding workload budget costs. As a result, the Governor’s plan provides no additional funds for Medi‑Cal in 2018‑19 under Proposition 55.

$12 Billion of Gann Limit Capacity Estimated. Under the administration’s 2018‑19 General Fund and special fund estimates, the state would be left with $12 billion of “room” (essentially, extra spending capacity) under its constitutional spending limit, known as the “Gann limit.” After the administration withdrew its proposal last year to change the state’s administration of the Gann limit, we understand that Department of Finance staff reviewed its Gann limit calculations. This year’s estimate of $12 billion of Gann limit room includes an approximately $8 billion upward revision since last year in the state’s estimated costs to meet federal health and human services mandates, which are excluded from the limit.

Revenues and Federal Tax Law

Revenues Likely to Be Higher Than Estimated. Prior to passage of the federal tax bill, our office’s November 2017 Fiscal Outlook estimated that General Fund revenues would be billions of dollars higher than prior administration estimates in 2017‑18 and 2018‑19 combined. Our November estimates for the four largest General Fund taxes are a combined $3.4 billion higher than the administration’s new January 2018 revenue estimates. Currently, our assessment is that state revenues in 2017‑18 and 2018‑19 combined will most likely be higher than the administration’s new estimates. That being said, the recent federal tax legislation introduces significant new uncertainties to typically uncertain state revenue projections, as discussed below.

Federal Action Not Yet Reflected in Governor’s Proposal. The President and the Congress agreed to major changes to federal individual, corporate, and estate taxes in December 2017. By that time, many key elements of the administration’s budget plan already had been completed. As such, the administration’s January 2018 budget plan generally does not reflect changes to the economy and taxpayer financial decisions that will result from the new tax law. The May Revision is expected to reflect some changes resulting from the federal plan.

Federal Law Already Affecting Revenues. In December 2017, the state experienced a multibillion‑dollar revenue influx. This revenue surge likely resulted from (1) economic growth and high stock prices and (2) decisions of individuals and businesses to maximize their near‑term benefits under the new federal tax law. Similar factors probably contributed to record high daily levels of personal income tax withholding in early January 2018.

In general, when the federal government passes new tax laws, individuals and businesses have incentives to accelerate some income and expenses (and delay other types of income and expenses) in order to maximize their benefits under the tax code. These “shifts” in taxpayer income and expenses likely have boosted state tax receipts by billions of dollars during the last few weeks. In the coming months, these shifts may boost state revenues in some months and depress revenues in other months. (For example, the upcoming mid‑January round of quarterly income tax payments may be smaller than usual because many high‑income people sent their payments in December.) A fuller understanding of what is happening will take months or years to develop.

Effects on U.S. Economy. In addition to the taxpayer shifts described above, a significant change to federal taxes affects the national economy. These effects are complicated, difficult to determine with precision, and potentially variable from one part of the country to another. Economic effects also often differ in the short run and the long run.

In the short run, many economic analysts expect the plan to boost national economic growth through the end of this decade. One key reason is that the federal plan reduces various taxes on businesses. Moreover, in the near term, a large portion of the nation’s taxpayers is expected to benefit from a decline in their federal taxes. These tax reductions are expected to stimulate the national economy, temporarily boosting growth. For example, Moody’s Analytics anticipates that the tax law will boost real gross domestic product growth by four‑tenths of a percentage point in 2018, with a smaller boost in 2019.

In the longer run, this short‑term economic stimulus is expected to diminish. With unemployment rates now low, wage and price pressures caused by the stimulus could create new economic concerns. Higher federal deficits and resulting higher interest rates may depress economic growth below what it would have been. Because many of the federal plan’s features were temporary, there is also uncertainty about which features will be extended in future years. Moody’s Analytics projects that the net economic boost from the tax plan will be small over the long term—increasing U.S. economic growth by 0.05 percentage points per year.

Effects on California. The tax plan’s short‑ and longer‑run effects on the U.S. economy—discussed above—will affect the California economy too, including near‑term reductions in federal taxes for a large portion of individual Californians and businesses. Concerns have been expressed about parts of the federal plan that could have a disproportionately negative effect on California and other states that have higher taxes and home prices. For example, about 15 percent of California individual income tax filers—largely those making $100,000 or more per year—reportedly claimed $10,000 or more in state and local tax (SALT) deductions under the prior tax law. These deductions will now be capped, and some of these filers will pay more in individual income taxes under the plan. In addition, changes to the SALT and mortgage interest deductions have led some to conclude that growth in California house prices will slow under the new tax law. Offsetting these concerns are the plan’s significant reductions in corporate and other business taxes, the benefits of which are likely to help high‑income earners with significant stock holdings and other investments.

Upcoming Tax Agency Report. California state income taxes generally do not automatically conform to changes in federal tax law. Yet, the recent changes to federal tax law will result in various changes in state taxpayer liabilities or behavior—some of them indirect or unintended. The Franchise Tax Board (FTB) is already required to provide a consolidated report by April 20 on how the new federal law will affect state tax revenues. It will be impossible for FTB to identify all potential issues related to the plan with precision in such a short time frame, but this information should be useful for finalizing the budget after the May Revision and considering possible changes to state tax law this year or in the future.

LAO Comments

May Revision Could Reflect More Resources Available. There are two key reasons the May Revision could reflect more resources available relative to what the administration now projects:

- Higher Revenues. As discussed earlier, the administration’s revenue estimates may be higher in May. In most years, increases in General Fund revenues lead to increases in the Proposition 98 and Proposition 2 requirements. However, under current conditions, even if revenue were to increase several billion dollars from the Governor’s January budget level, General Fund spending on the minimum guarantee would be unlikely to increase significantly. Similarly, higher 2017‑18 revenues would not lead to higher rainy day reserves by the end of 2018‑19 because the fund is at its constitutional maximum under the proposal. Higher 2018‑19 revenues could lead to higher debt payment requirements, however.

- Children’s Health Insurance Program (CHIP). Second, the budget assumes, beginning in January 2018 and onward, the federal government will reauthorize CHIP at its historical 65 percent federal cost share, rather than the higher 88 percent share it has appropriated in recent years. In December (after the administration was finalizing its proposal), Congress approved the higher share on a temporary basis. In May, this will lead to an estimated $150 million in additional General Fund savings. Moreover, if Congress reauthorizes the program at the higher level for a longer period, it would result in additional General Fund savings of about $750 million for the remainder of 2017‑18 and all of 2018‑19.

Recommend Legislature Consider Its Optimal Level of Reserves. As the Legislature crafts the 2018‑19 budget, we urge it to first consider its optimal level of reserves. In this budget, the Governor proposes depositing enough reserves into the state’s rainy day fund that it reaches its constitutional maximum. We believe the Governor’s continued focus on building more reserves is prudent in light of economic and federal budget uncertainty. The Legislature may want to consider whether the proposed level of reserves is its optimal level or if it wishes to have more or less total reserves (including those outside of the rainy day fund) at this point in time. While the Governor is correct that filling the rainy day fund now would help the state budget weather the next recession, filling that reserve now involves various trade‑offs for the state. For example, Proposition 2 requires the state to spend moneys in the rainy day reserve in excess of 10 percent on infrastructure. As a result, filling the rainy day fund now may constrain the Legislature’s ability to build more reserves or make other budget commitments in the coming years.

Recommend Scrutiny of Proposition 55 Calculation. The calculation in the Proposition 55 measure adds an additional layer of complexity to the state budget. Any future change to General Fund revenues or spending has the potential—depending on the methodology used by the Director of Finance—to (1) trigger or (2) increase or decrease the likelihood of a required supplemental appropriation to Medi‑Cal under the measure. As the new formula methodology in this budget may set a precedent for the future, we recommend the Legislature scrutinize the administration’s calculations.

Key Budget Proposals

Proposition 98

Below, we highlight the major components of the Governor’s Proposition 98 package and provide some high‑level comments about the package.

Overview of Governor’s Plan

Across Three Years, $6.3 Billion in Proposition 98 Spending Proposals. The Governor’s budget contains a total of $6.3 billion in new Proposition 98 spending proposals for K‑12 education, the California Community Colleges, and preschool. Of the augmentations, $3.9 billion is ongoing and $2.4 billion is for one‑time activities. Figure 5 summarizes the major components of the Governor’s Proposition 98 spending plan.

Figure 5

Major Components of Governor’s Proposition 98 Spending Plan

|

Ongoing Augmentations |

|

|

|

|

|

|

One‑Time Initiatives |

|

|

|

Higher Spending Driven Primarily by Higher State Revenues. Of the $6.3 billion increase in spending, $3.1 billion reflects estimated growth in the 2018‑19 Proposition 98 minimum guarantee from the revised 2017‑18 level. This growth is attributable to a 4.1 percent increase in per capita General Fund revenue. The administration also revises its estimate of General Fund revenue upward in the current year, resulting in a $687 million increase in the 2017‑18 guarantee. Another $2.2 billion in spending results from the expiration of various one‑time initiatives, with the associated funding repurposed for new commitments in 2018‑19. The other sources of funding in the Governor’s budget consist of $214 million from unspent prior‑year funds, $100 million from a settle‑up payment related to meeting the 2009‑10 guarantee (scored as a Proposition 2 debt payment), and $37 million freed up from various net technical adjustments (primarily lower‑than‑expected costs for community college apportionments).

Per Student Funding Increases Notably for Schools and Colleges. Figure 6 shows the distribution of Proposition 98 funding by segment and source across the period. Under the Governor’s budget, K‑12 funding per student increases from the 2017‑18 level of $11,165 to $11,628 in 2018‑19, an increase of $463 (4.1 percent). Community college funding per full‑time equivalent student increases from the 2017‑18 level of $7,624 to $8,099 in 2018‑19, an increase of $475 (6.2 percent).

Figure 6

Proposition 98 Funding by Segment and Source

(Dollars in Millions Except Per-Student Amounts)

|

2016‑17 Revised |

2017‑18 Revised |

2018‑19 Proposed |

Change From 2017‑18 |

||

|

Amount |

Percent |

||||

|

Funding by Segment |

|||||

|

K‑12 Education |

$62,048 |

$65,340 |

$67,695 |

$2,355 |

3.6% |

|

California Community Colleges |

8,283 |

8,654 |

9,207 |

553 |

6.4 |

|

Preschool |

975 |

1,122 |

1,338a |

216 |

19.2 |

|

Other agencies |

85 |

95 |

85 |

‑10 |

‑10.7 |

|

Totals |

$71,390 |

$75,211 |

$78,324 |

$3,114 |

4.1% |

|

Funding by Source |

|||||

|

General Fund |

$49,993 |

$52,741 |

$54,564 |

$1,823 |

3.5% |

|

Local property tax |

21,397 |

22,470 |

23,761 |

1,291 |

5.7 |

|

Totals |

$71,390 |

$75,211 |

$78,324 |

$3,114 |

4.1% |

|

Enrollment |

|||||

|

K‑12 average daily attendance |

5,960,037 |

5,961,253 |

5,944,090 |

‑17,163 |

‑0.3% |

|

Community college FTE students |

1,134,809 |

1,135,081 |

1,136,813 |

1,733 |

0.2 |

|

Funding Per Student |

|||||

|

K‑12 Educationb |

$10,588 |

$11,165 |

$11,628 |

$463 |

4.1% |

|

California Community Colleges |

7,299 |

7,624 |

8,099 |

475 |

6.2 |

|

a Includes $125 million for one‑time grants to fund the expansion of early education programs, including preschool. Excluding this amount, the increase from 2017‑18 is $91 million (8.1 percent). b Per‑pupil amount combines funding for K‑12 education, preschool, and other agencies. FTE = full‑time equivalent. |

|||||

Largest Ongoing K‑12 Augmentation Is for Full Implementation of LCFF. The Governor estimates that the $2.9 billion increase for the Local Control Funding Formula (LCFF) is sufficient to close the remaining gap to the formula targets and provide a 2.51 percent cost‑of‑living adjustment (COLA). Reaching full implementation in 2018‑19 would be two years ahead of schedule.

Largest Ongoing Community College Augmentation Is for Apportionments. The Governor proposes to provide more funding for community college apportionments and change the associated allocation formula. Specifically, the Governor’s budget increases apportionments to cover a 2.51 percent COLA ($161 million) and fund 1 percent enrollment growth ($60 million). The Governor also proposes a new allocation formula and provides $175 million to ensure no college receives less under the new formula than it would receive under current law. Under the proposed new formula, about one‑half of apportionment funding would be allocated based on enrollment, about one‑quarter based on the number of low‑income students served (as measured by eligibility for fee waivers and federal Pell grants), and another one‑quarter based on performance measures (such as three‑year degree/certificate completion rates). By comparison, apportionment funding currently is allocated based primarily on enrollment, with none based on performance.

Governor Has Three Other Notable Ongoing K‑14 Priorities. The Governor proposes a new $212 million high school career technical education (CTE) program funded through the existing Strong Workforce program administered by the community colleges. Of this amount, $200 million would be provided to existing Strong Workforce consortia consisting of colleges, school districts, and industry partners. The consortia, in turn, would decide how to allocate the new funds to school districts. The remaining $12 million would fund local industry experts who would provide technical assistance to school districts with CTE programs. The Governor also proposes $120 million to create a fully online community college, with most of the associated funding dedicated to startup costs. The college would create and coordinate online courses and programs targeted towards working adults with a high school diploma but lacking a college degree or certificate. Additionally, the Governor proposes a $70 million package of initiatives to provide county and regional support to low‑performing districts. Of this amount, the majority ($55 million) would fund county offices of education (COEs) to support districts flagged for improvement under the state’s new accountability system.

Several One‑Time Initiatives. The Governor’s budget also includes $1.8 billion for K‑12 discretionary grants. Similar to previous years, funds would be allocated on a per‑student basis and the grants would offset any existing mandate claims. This year, however, the state would first deduct any outstanding obligations districts have under a recent agreement with the federal government over Medi‑Cal billing practices. Regarding community colleges, the Governor’s budget includes $275 million in one‑time funding for deferred maintenance.

LAO Comments

Split Between Ongoing and One‑Time Initiatives Is Reasonable. The Governor’s budget allocates all of the funding increases associated with 2017‑18 and prior years to one‑time initiatives. Regarding 2018‑19 funding, the Governor’s budget allocates $1.3 billion to one‑time initiatives and $3.9 billion to ongoing programs. We think this split is reasonable, and we recommend the Legislature adopt a final budget plan that continues to rely upon a mix of one‑time and ongoing spending. The state has taken such an approach the past several years. Setting aside some funds for one‑time purposes helps the state avoid overcommitting to programs it might be unable to sustain during tighter fiscal times. If the minimum guarantee were to drop in 2019‑20, for example, the expiration of one‑time initiatives would provide a buffer, mitigating reductions to ongoing programs such as LCFF and community college apportionments.

Governor Has Reasonable Set of Priorities, but Legislature Could Modify. Many of the Governor’s proposals relate to issues of longstanding interest and concern to the Legislature. Over the past several years, for example, the Legislature has prioritized implementing LCFF, expanding CTE, increasing community college apportionments, and addressing maintenance backlogs. The Governor’s budget provides one reasonable starting point for making further progress in these areas. On the other hand, the Legislature has expressed other priorities too, such as increasing per‑student funding for special education services. Over the coming months, the Legislature could adopt the Governor’s priorities or establish a somewhat different set of its own priorities.

Several Proposals Are Complex and Raise Many Issues. The new community college funding formula represents the most significant change to community college funding in many years. We think the Legislature should carefully consider this proposal, especially the incentives created by the formula to serve certain student subgroups. The proposed online college is another significant proposal, raising several key issues. The governance structure of the new college, its program offerings, and its relationship to existing online community college programs will be particularly important to consider. The package of proposals to support and improve low‑performing school districts also involves many key decisions, including the role of COEs in the state’s new K‑12 accountability system. In all these cases, we recommend the Legislature begin analyzing these proposals early so that it has time to understand the problems the Governor seeks to address and determine the most effective way to address the root issues. In some cases, the Legislature may find it has several options for achieving the identified goals of a particular proposal.

Proposed K‑12 Discretionary Grants Continue an Inefficient Approach to Retiring the Mandate Backlog. We are concerned that the Governor’s per‑student funding approach likely will never eliminate the mandate backlog. The backlog currently totals an estimated $870 million, with most remaining claims concentrated in a few districts. With two‑thirds of districts having no claims, much of the $1.8 billion included in the Governor’s budget would have no effect on the backlog. We estimate that the state would need to provide around $200 billion to eliminate the backlog using the Governor’s approach. As in previous years, we recommend the Legislature consider ways to eliminate the backlog more efficiently. One approach would be to provide an amount somewhat in excess of the remaining backlog, distribute funds on a per‑student basis, but require districts receiving funds to write off all remaining claims. This approach would make substantially more progress toward eliminating the backlog without rewarding districts that submitted unusually costly mandate claims.

Infrastructure and Equipment

The Governor’s budget includes a variety of proposed spending on infrastructure and equipment. First, the Governor implements recent legislative initiatives on infrastructure consistent with current law under Chapter 5 of 2017 (SB 1, Beall), Chapter 852 of 2017 (SB 5, de León), and Chapter 365 of 2017 (SB 3, Beall). In 2017, the Legislature passed SB 1 to increase state funding for California’s transportation system. In 2018‑19, the budget allocates $4.6 billion in transportation spending, consistent with the measure’s statutory formula for allocating revenues. If approved by voters in 2018, SB 5 and SB 3 would each authorize $4 billion in general obligation bonds for natural resources‑related projects and housing, respectively. Assuming both measures are approved by voters, the budget allocates $1 billion for the first year of implementation of SB 5 and $285 million for SB 3. Second, the Governor makes a variety of new proposals for spending related to infrastructure projects and equipment for 2018‑19. The remainder of this section describes these proposals.

Governor’s Proposals

$375 Million for Trial Court Construction. The budget proposes $375 million for design and construction of trial courts. First, the budget authorizes $343 million in lease revenue bonds, to be repaid from the General Fund, for the construction of five courthouse projects. The budget also proposes spending $32 million from the Immediate and Critical Needs Account to complete the design of three additional courthouse projects. The future costs to complete these three projects, plus two others already in process, would be almost $1 billion, to be financed by lease revenue bonds supported by the General Fund.

$134 Million for Voting Systems. The budget proposes $134 million in one‑time General Fund spending to purchase new equipment for county voting systems. This equipment includes hardware, software, and initial licensing to replace existing systems and technology. Under the proposal, counties would provide a dollar‑for‑dollar match to receive the state funding. The $134 million estimate assumes that there is a widespread shift by jurisdictions to the new “vote center” elections model, as authorized by Chapter 832 of 2016 (SB 450, Allen).

$136 Million for State Correctional Facilities. The budget proposes $136 million in one‑time General Fund spending for infrastructure and equipment at the California Department of Corrections and Rehabilitation (CDCR). This includes $61 million to replace roofs at three facilities, $33 million to replace public safety radio communication systems, $20 million for mold remediation, $18 million to replace and purchase additional vehicles for inmate health care services, and $4 million to replace dental equipment.

Other Infrastructure Projects and Equipment Proposals. The budget also proposes a variety of smaller proposals related to infrastructure projects and equipment procurement. This includes the following amounts in 2018‑19:

- $98 Million for Helicopters. The budget proposes $98 million in one‑time General Fund spending to purchase and replace four helicopters for the Department of Forestry and Fire Protection.

- $30 Million for State Office Buildings. The budget proposes $30 million in General Fund resources for planning activities for the construction of proposed new state office buildings. This includes two renovation projects and the construction of one new office building. The future costs of completing these projects would be about $1.3 billion, to be financed by lease revenue bonds supported by the General Fund.

- $15 Million for Earthquake Early Warning System. The budget proposes spending $15 million in General Fund to purchase and install sensors for the California Earthquake Early Warning system.

- $14 Million for California Conservation Corps. The budget proposes $14 million in General Fund resources for acquisition and preliminary plans for the construction of four new residential centers and rehabilitation of two existing centers at the California Conservation Corps. The future costs to complete these projects would be $248 million, financed by direct General Fund appropriations and lease revenue bonds supported by the General Fund.

- $12 Million for Emergency Communications. The budget proposes spending $11.5 million from the State Emergency Telephone Number Account (SETNA) to replace the state’s 911 system. The proposal would also revise the SETNA fee structure for users to a per‑subscription flat‑rate on all voice and data plans. Future costs associated with this proposal are much higher, with average annual costs around $40 million.

LAO Comments

Decisions About Infrastructure Funding Priorities. The Governor’s budget would fund a variety of infrastructure projects in 2018‑19, such as the replacement of roofs at specified CDCR facilities. While these particular projects may have merit, the full magnitude of departments’ infrastructure and equipment needs is unclear. For example, in the case of CDCR, it is uncertain whether the proposed projects are of the highest priority both in terms of roof replacement and overall maintenance needs. The Legislature may wish to consider whether it has a different set of infrastructure priorities in 2018‑19.

Some Proposals Have Significant Out‑Year Costs. While many of the infrastructure proposals in the Governor’s budget include relatively small spending amounts for 2018‑19, some would have growing and significant costs in later years. In particular, committing the state to new debt service obligations would commit General Fund resources for decades in the future. The Legislature may want to consider these out‑year commitments as it evaluates the Governor’s infrastructure proposals for 2018‑19.

Trade‑Offs Related to Funding and Financing Approaches. The Legislature may want to consider alternative financing approaches to the Governor’s infrastructure proposals. For example, the Governor proposes using lease revenue bonds to fund the design and construction of state office buildings. The Legislature may want to consider whether more should be done through pay‑as‑you‑go financing or leasing. Additionally, it may want to consider the proposed funding approaches. For example, the Governor’s courthouse proposal is a significant departure from past practices to fund court construction with court fine and fee revenue rather than from the General Fund.

Legislature’s Election Administration Priorities. Most counties’ voting equipment is quite old, and historically, the state has assisted counties in replacing their election systems. The Governor’s proposal to assist counties has merit. In considering the proposal, the Legislature may wish to consider the extent to which this grant program can advance its overall priorities for election administration in the state. For example, the Legislature could design a grant program that incentivizes counties to switch to the SB 450 vote center model. Our office also has suggested that the state could encourage counties to improve the timeliness of vote counting, cybersecurity, voter registration processes, and other outcomes.

Other Key Budget Proposals

Over $200 Million in Business Tax Credits. The Governor proposes extending the California Competes tax credit program—which provides tax subsidies to select businesses that agree to expand employment or investment in the state—for five more years. The program would be able to provide $180 million of credits to businesses each year. Provisions of current law reserved some of these credits for small businesses, but these provisions would be removed. A future proposal is anticipated for a new program to provide $20 million in annual assistance to small businesses. In addition, the Governor proposes to replace the state’s little‑used New Employment Hiring Credit with a new business tax credit—budgeted at $50 million per year—to encourage hiring of parolees, CalWORKs recipients, and veterans.

$210 Million for Trial Court Operations. The Governor proposes an augmentation of $150 million in General Fund resources to support operations at the trial courts. This includes $75 million in discretionary funding, $48 million to equalize funding across trial courts, and $19 million to expand self‑help services. The budget also proposes some smaller increases for various programs, such as language access services and a pilot program for the online adjudication of certain traffic violations. The budget also includes an additional $34 million in General Fund resources to backfill shortfalls in criminal fine and fee revenue and $26 million for trial court employee retirement and health benefit costs.

$92 Million Each for CSU and UC. The Governor proposes augmenting General Fund spending for CSU and UC by $92 million each, which represents an increase of about 3 percent at each university system. This increase is somewhat lower than the 4 percent to 5 percent base increases the state has provided in recent years. Coupled with the proposal, the Governor indicates he does not want either CSU or UC to increase tuition charges for resident students in 2018‑19. Both the CSU Trustees and UC Regents are in the midst of considering such increases. In addition, the Governor’s budget does not establish new enrollment targets for CSU or UC or designate any new funding for enrollment growth.

$131 Million for Counties to Address Incompetent to Stand Trial (IST) Waitlist. When a defendant in a criminal proceeding has a mental health condition that renders him or her unable to understand the nature of the proceedings, a trial court can refer that person to the Department of State Hospitals for treatment. These referrals have grown in recent years, resulting in roughly 850 offenders waiting to receive IST treatment. The budget proposes $131 million ($128 million General Fund) to work with counties to address the waitlist. Most of these funds would be spent on diversion programs over the next three years to prevent individuals from being referred to IST treatment.

$40 Million for the 2020 Census. During the few years preceding each decennial U.S. Census, California typically funds outreach efforts to encourage resident participation in the nationwide population count. The 2017‑18 state budget plan included $7 million for grants to local governments that participate in a program to review and update Census address lists, as well as $3 million in start‑up funding for the state’s main outreach effort: the California Complete Count initiative. In his 2018‑19 budget plan, the Governor proposes that $40 million be provided from the General Fund to California Complete Count. The money would be available to spend over three fiscal years, ending in 2020‑21.