LAO Contact

January 18, 2018

The 2018-19 Budget

Overview of the Governor’s Proposition 98 Budget Package

The Governor presented his budget package to the Legislature on January 10, 2018. In this post, we provide an overview and assessment of the largest component of that package—the Proposition 98 budget. The first section describes and assesses the Governor’s major Proposition 98 spending proposals. The second section analyzes the administration’s estimates of the Proposition 98 minimum guarantee. (For additional detail about the Proposition 98 budget, please see our January 2018 EdBudget tables.)

Major Spending Proposals

Below, we first provide an overview of the Governor’s Proposition 98 spending package and then highlight the major proposals for K-12 education, the California Community Colleges (CCC), and preschool. We conclude by offering high-level comments about the package.

Overview

Across Three Years, $6.3 Billion in Proposition 98 Spending Proposals. The Governor’s budget contains a total of $6.3 billion in new Proposition 98 spending proposals (see Figure 1). Of the new spending, almost $5 billion (78 percent) of it is for K-12 education, $1.2 billion (19) percent is for CCC, and $193 million (3 percent) is for the California State Preschool Program. As the figure shows, the spending package consists of a mix of ongoing and one-time proposals. Across the three segments, $3.9 billion is for ongoing programs and $2.4 billion is for one-time activities.

Figure 1

Governor’s Budget Contains $6.3 Billion in Proposition 98 Spending Proposals

(In Millions)

|

K‑12 Education |

|

|

Ongoing |

|

|

Fund full implementation of LCFF |

$2,883 |

|

Provide 2.51 percent COLA for select categorical programsa |

106 |

|

Provide county and regional support for low‑performing districts |

76 |

|

Make other ongoing augmentations |

29 |

|

Subtotal |

($3,095) |

|

One Time |

|

|

Provide per‑student discretionary grants |

$1,757 |

|

Establish special education teacher residency program |

50 |

|

Provide grants for addressing special education teacher shortage |

50 |

|

Support Southern California Regional Occupational Center |

3 |

|

Subtotal |

($1,860) |

|

Total |

$4,954 |

|

California Community Colleges |

|

|

Ongoing |

|

|

Increase apportionment funding and implement new allocation formula |

$396 |

|

Fund high school CTE initiative through Strong Workforce program |

212 |

|

Fund AB 19 fee waiver program and consolidated financial aid program |

79 |

|

Provide ongoing support for new online college |

20 |

|

Make other ongoing augmentations |

51 |

|

Subtotal |

($759) |

|

One Time |

|

|

Fund deferred maintenance and instructional materials |

$275 |

|

Provide one‑time support for new online college |

100 |

|

Fund other one‑time activities |

53 |

|

Subtotal |

($428) |

|

Total |

$1,186 |

|

Preschool |

|

|

Ongoing |

|

|

Increase Standard Reimbursement Rate by 2.8 percent |

$32 |

|

Provide 2.51 percent COLA |

28 |

|

Add 2,959 full‑day slots starting April 1, 2019 |

8 |

|

Subtotal |

($68) |

|

One Time |

|

|

Fund early education expansion |

$125 |

|

Total |

$193 |

|

Grand Total of All Spending Proposals |

$6,333 |

|

aApplies to special education, preschool, child nutrition, mandates block grant, services for foster youth, adults in correctional facilities, and American Indian education. LCFF = Local Control Funding Formula; COLA = cost‑of‑living adjustment; and CTE = career technical education. |

|

Per Student Funding Increases Notably. Figure 2 shows the distribution of Proposition 98 funding by segment across the period. Under the Governor’s budget, overall K-12 funding per student (including preschool and other agencies) increases from the revised 2017‑18 level of $11,165 to $11,628 in 2018‑19, an increase of $463 (4.1 percent). Community college funding per full-time equivalent (FTE) student increases from $7,624 to $8,099, an increase of $475 (6.2 percent). Regarding State Preschool, ongoing funding per slot is up 5.4 percent over the 2017‑18 level, with the part-day rate rising to $5,222 and the full-day rate rising to $12,047.

Figure 2

Proposition 98 Funding by Segment

(Dollars in Millions Except Per‑Student Amounts)

|

2016‑17 Revised |

2017‑18 Revised |

2018‑19 Proposed |

Change From 2017‑18 |

||

|

Amount |

Percent |

||||

|

Segment |

|||||

|

K‑12 education |

$62,048 |

$65,340 |

$67,695 |

$2,355 |

3.6% |

|

California Community Colleges |

8,283 |

8,654 |

9,207 |

553 |

6.4 |

|

Preschool |

975 |

1,122 |

1,338a |

216 |

19.2 |

|

Other agencies |

85 |

95 |

85 |

‑10 |

‑10.7 |

|

Totals |

$71,390 |

$75,211 |

$78,324 |

$3,114 |

4.1% |

|

Enrollment |

|||||

|

K‑12 average daily attendance |

5,960,037 |

5,961,253 |

5,944,090 |

‑17,163 |

‑0.3% |

|

Community college FTE students |

1,134,809 |

1,135,081 |

1,136,813 |

1,733 |

0.2 |

|

Funding Per Student |

|||||

|

K‑12 educationb |

$10,588 |

$11,165 |

$11,628 |

$463 |

4.1% |

|

California Community Colleges |

7,299 |

7,624 |

8,099 |

475 |

6.2 |

|

aIncludes $125 million for one‑time grants to fund the expansion of early education programs, including preschool. Excluding this amount, the increase from 2017‑18 is $91 million (8.1 percent). bPer‑pupil amount combines funding for K‑12 education, preschool, and other agencies. FTE = full‑time equivalent. |

|||||

K-12 Education

Funds Full Implementation of the Local Control Funding Formula (LCFF). The Governor proposes a $2.9 billion increase for LCFF to close the remaining gap to the formula targets and provide a 2.51 percent cost‑of‑living adjustment (COLA). Reaching full implementation in 2018‑19 would be two years ahead of schedule. The budget also includes $106 million to provide a 2.51 percent COLA for several categorical programs that remain outside LCFF (most notably special education).

Funds New System of Support for Low-Performing School Districts. The Governor proposes a $76 million package of initiatives to support low-performing districts. Of this amount, the majority ($55 million) would fund county offices of education (COEs) to support districts flagged for improvement under the state’s new accountability system. The package also includes $10 million for special education agencies to support districts flagged for improvement due to special education performance issues, $7 million for the California Collaborative on Educational Excellence to provide statewide assistance to COEs and special education agencies tasked with helping districts, and $4 million for selected COEs to serve as regional support leads.

Allocates $1.8 Billion for One-Time Discretionary Grants. The Governor’s budget includes $1.8 billion for K‑12 discretionary grants. Similar to previous years, funds would be allocated to school districts, COEs, and charter schools on a per-student basis. We estimate that the $1.8 billion allocation would equate to about $300 per student. From each school district’s discretionary grant amount, the Governor proposes to deduct any outstanding obligation from a recent agreement with the federal government over Medi-Cal billing practices. Each district’s deduction would be based on its individual obligation. The administration estimates that the associated statewide obligation is about $220 million. The remainder of each district’s discretionary grant amount would be attributed to any outstanding mandate claims. About one-third of districts have such claims.

Funds Two One-Time Initiatives Focused on Special Education Staffing Challenges. The budget funds two initiatives ($50 million each) to improve the recruitment and retention of special education teachers. The first initiative would fund teacher residency programs that pair new special education teachers with experienced mentor teachers. The second initiative would provide grants for locally developed efforts to address special education staffing challenges. The Commission on Teacher Credentialing would administer both initiatives as competitive grants.

California Community Colleges

Increases Community College Apportionments and Proposes New Allocation Formula. The Governor’s budget increases apportionments to cover a 2.51 percent COLA ($161 million) and fund 1 percent enrollment growth ($60 million). The Governor also proposes a new allocation formula and provides $175 million to ensure no college receives less under the new formula than it would receive under current law. Under the proposed formula, about half of apportionment funding is allocated based on enrollment, about one‑quarter is based on the number of low‑income students served (as measured by eligibility for fee waivers and federal Pell grants), and another one‑quarter is based on performance measures (such as three‑year degree/certificate completion rates). By comparison, apportionment funding currently is allocated based primarily on enrollment, with none based on performance.

Funds New High School Career Technical Education (CTE) Program Through CCC Budget. The Governor proposes a new $212 million high school career technical education program funded through the existing Strong Workforce program administered by the community colleges. Of this amount, $200 million is for existing Strong Workforce consortia consisting of colleges, school districts, and industry partners. The consortia, in turn, would decide how to allocate the new funds to school districts. The remaining $12 million would fund local industry experts who would provide technical assistance to school districts with career technical education programs.

Establishes New Online Community College. The budget includes $120 million—$100 million one time and $20 million ongoing—for the creation of a new online community college. The college would create online programs aligned with industry needs, establish competency-based educational options, and identify opportunities for students to earn badges and industry certifications as they complete their programs. The administration intends to target these new programs toward working adults who have a high school diploma but not a college degree or certificate.

Funds AB 19 Fee Waivers. The budget provides $46 million to fund the fee waiver program established by Chapter 735 of 2017 (AB 19, Santiago). AB 19 authorizes fee waivers for all resident first-time, full-time students during their first year of community college. Though the cost of the expanded program is calculated by assuming all these students obtain fee waivers, the legislation allows colleges to use their program allotments for other purposes, such as providing more student support services.

Consolidates Two Financial Aid Programs. The budget also proposes to replace the Full-Time Student Success Grant and the Community College Completion Grant with a new aid program. The new program still would provide certain financially needy students attending CCC with a grant to help with living costs, but the grant rules would be somewhat different. Specifically, rather than a student receiving $500 per grant if taking 12-to-14 units per term and $2,000 per grant if taking 15 or more units, the new program would provide increasingly higher grant amounts for each unit taken from 12 to 15 units. To implement this new program, the Governor provides $33 million more than combined funding for the two programs in the current year—bringing total funding for the new program in 2018-19 to $124 million.

Provides $275 Million in One-Time Funding for Deferred Maintenance. The budget provides $275 million for districts to use for scheduled and deferred maintenance as well as replacement of instructional equipment and library materials. Districts would receive these funds based on their FTE enrollment. This proposal builds upon the $551 million the state has provided to the community colleges for these purposes over the last 4 years.

Preschool

Funds Additional Slots and Rate Increase Consistent With Multiyear Budget Agreement. The Governor’s Proposition 98 budget includes $8 million for an additional 2,959 full-day State Preschool slots at school districts and COEs starting April 1, 2019. The Proposition 98 budget also provides $32 million (and an additional $16 million non-Proposition 98 General Fund) for a 2.8 percent rate increase. These increases represent the final augmentations associated with a multiyear child care and preschool budget agreement made by the Legislature and the Governor in 2016-17. In addition, the budget allocates $28 million in Proposition 98 funding (and $22 million non-Proposition 98 General Fund) to provide a statutory 2.51 percent COLA for certain preschool and child care programs.

Provides One-Time Funding for Early Education Expansion. The Governor’s budget provides $125 million in Proposition 98 funding (as well as $42 million in federal funds from the Temporary Assistance for Needy Families program) for a competitive grant to increase the availability of inclusive early education care for children from birth through age 5. The one-time grant, open to school districts as well as other providers, could be used for a variety of purposes, including facility renovations, training, and equipment. At the time of this writing, additional details regarding the structure of the grants had not been released

Comments

Split Between Ongoing and One-Time Initiatives Is Reasonable. We recommend the Legislature adopt a final budget plan that continues to rely upon a mix of ongoing and one-time spending. The state has taken such an approach the past several years. Setting aside some funds for one-time purposes helps the state avoid overcommitting to programs it might be unable to sustain during tighter fiscal times. If school funding were to drop in 2019-20, the expiration of one-time initiatives would provide a buffer mitigating reductions to ongoing programs such as LCFF and community college apportionments.

Governor Has Reasonable Set of Priorities, but Legislature Could Modify. Many of the Governor’s proposals relate to issues of longstanding interest and concern to the Legislature. Over the past several years, for example, the Legislature has prioritized implementing LCFF, expanding CTE, addressing special education teacher shortages, increasing community college apportionments, and addressing maintenance backlogs. The Governor’s budget provides one reasonable starting point for making further progress in these areas. On the other hand, the Legislature has expressed other priorities too, such as increasing per-student funding for special education services. Over the coming months, the Legislature could adopt the Governor’s priorities or establish a somewhat different set of its own priorities.

Several Proposals Are Complex and Raise Many Issues. The new community college funding formula represents the most significant change to community college funding in many years. We think the Legislature should consider this proposal carefully, especially the incentives created by the formula to serve certain student subgroups. The proposed online college is another significant proposal, raising several key issues. The governance structure of the new college, its program offerings, and its relationship to existing online community college programs will be particularly important to consider. The package of proposals to support and improve low-performing school districts also involves many key decisions, including the role of COEs in the state’s new K‑12 accountability system. Though details are limited at this time, the proposals to address special education staffing issues and expand early education also appear to involve many important policy considerations. In all these cases, we recommend the Legislature begin analyzing these proposals early so that it has time to understand the problems the Governor seeks to address and determine the most effective way to address the root issues. In some cases, the Legislature may find it has several options for achieving the identified goals of a proposal.

K-12 Discretionary Grants Continue an Inefficient Approach to Retiring the Mandate Backlog. We are concerned that the Governor’s per-student funding approach likely will never eliminate the mandate backlog. With two-thirds of districts having no claims, 84 percent of the $1.8 billion included in the Governor’s budget would have no effect on the backlog. We estimate that the state would need to provide around $200 billion to eliminate the backlog using the Governor’s approach. Moreover, this funding amount is not driven by the average district’s claiming practices, but those of an increasingly small number of outlying districts. As an alternative to the Governor’s approach, we recommend the Legislature identify an amount equal to or in excess of the remaining backlog and distribute funds on a per-student basis, but require districts receiving funds to write off all remaining claims. This approach would make substantially more progress toward eliminating the backlog without rewarding districts that have unusually costly claims.

Minimum Guarantee

Below, we provide background on the Proposition 98 minimum guarantee. We then explain the major drivers underlying the administration’s estimates of the minimum guarantee and discuss a few other adjustments that free-up Proposition 98 funding. We conclude by offering high-level comments about the calculation of the guarantee.

Background on Calculating Minimum Guarantee

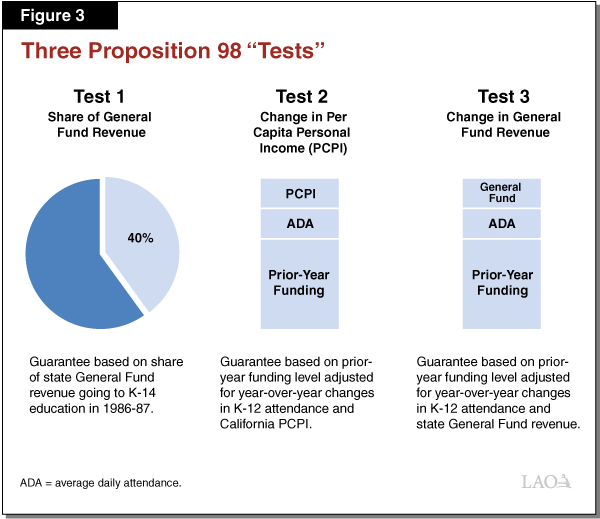

Minimum Guarantee Calculation Depends on Various Inputs and Formulas. The Constitution sets forth three main tests for calculating the minimum guarantee. These tests depend upon several inputs, including K-12 average daily attendance, per capita personal income, and per capita General Fund revenue (see Figure 3). Depending on these inputs, one of these tests will be “operative” and determine the minimum guarantee for that year. In most years, Test 2 or Test 3 is operative and the guarantee builds upon the level of funding provided the previous year. The state meets the guarantee through a combination of General Fund and local property tax revenue, with increases in property tax revenue usually reducing General Fund costs dollar for dollar. Although the state can provide more funding than required, in practice it usually funds at the guarantee. With a two-thirds vote of each house of the Legislature, the state can suspend the guarantee and provide less funding than the formulas require that year.

“Maintenance Factor” Payments Required in Certain Years. In addition to the three main tests, the Constitution requires the state to track an obligation known as maintenance factor. The state creates a maintenance factor obligation when Test 3 is operative or when it suspends the guarantee. The obligation equals the difference between the actual level of funding provided and the Test 1 or Test 2 level (generally whichever is higher). Moving forward, the state tracks and adjusts the maintenance factor obligation each year for changes in K-12 attendance and per capita personal income. In subsequent years, when General Fund revenue is growing relatively quickly, the Constitution requires the state to make maintenance factor payments until it has paid off the obligation. The magnitude of these payments is determined by formula, with stronger revenue growth generally requiring larger payments.

Estimates of the Guarantee Can Change After the Adoption of the Budget. The state does not finalize the minimum guarantee until the fiscal year is over. When the state updates the relevant inputs, the guarantee can change from the level initially assumed in the budget act. If the revised guarantee exceeds the initial estimate, the state makes a one-time payment to “settle up” the difference for that year and uses the higher base for calculating the guarantee the following year. If the revised guarantee is below the initial estimate, the state can allow funding to remain at the higher level or make mid-year adjustments to reduce funding to the lower guarantee. Typically, the state makes downward mid-year adjustments, as the decision affects the ongoing level of the minimum guarantee moving forward.

Governor’s Estimates of the Guarantee

2016-17 Guarantee Down Slightly but Proposition 98 Funding Level Unchanged. Compared with estimates made in June 2017, the 2016-17 minimum guarantee has dropped $63 million due to slightly lower estimates of K-12 attendance and General Fund revenue. Despite this decrease, the Governor proposes to maintain Proposition 98 funding at $71.4 billion—the same level the state approved in the June budget plan. This proposed funding level is $542 million more than required to meet the revised estimate of the minimum guarantee. The Governor’s budget also recognizes various minor adjustments—primarily lower LCFF costs—that reduce funding by $43 million. To offset these reductions and maintain funding at $71.4 billion, the Governor proposes to count $43 million of the funds associated with the K-12 discretionary grants toward 2016-17.

2017-18 Guarantee Up $687 Million From Budget Act Estimates. The administration’s revised estimate of the 2017-18 guarantee is $75.2 billion, an increase of $687 million compared with the June budget plan. This increase is mainly the result of an increase in General Fund tax revenue. This faster revenue growth requires the state to make an additional maintenance factor payment of $636 million (on top of the $536 million payment already included in the June budget plan). After making the $1.2 billion total maintenance factor payment, the state’s outstanding maintenance factor obligation at the end of 2017-18 would be $228 million. The rest of the increase in the guarantee is attributable to a small increase in attendance. Whereas the June budget plan assumed 2017-18 attendance would decline by 2,900 students (a 0.05 percent decline), the Governor’s budget estimates that attendance will grow by 1,200 students (a 0.02 percent increase).

2018-19 Guarantee Up $3.1 Billion Over Revised 2017‑18 Level. The administration estimates that the 2018‑19 guarantee is $78.3 billion, an increase of 4.1 percent over the revised 2017-18 level (see Figure 4). Test 3 is operative, with the increase in the guarantee attributable to growth in state General Fund revenue. The administration also estimates that K-12 attendance will decline by 0.3 percent. Although the minimum guarantee usually is adjusted for changes in attendance, the Constitution contains a two-year hold harmless provision that deems any decline in attendance to be zero unless attendance also declined during the two preceding years. Data from the California Department of Education show that attendance declined each year from 2014-15 through 2016-17. The administration’s estimate of a small attendance increase in 2017-18, however, restarts the hold harmless provision and prevents any downward adjustment to the 2018-19 guarantee. The administration also estimates that the state creates a new $83 million maintenance factor obligation in 2018-19. This additional maintenance factor brings the state’s total outstanding obligation to $320 million by the end of 2018-19.

Figure 4

Proposition 98 Key Inputs and Outcomes Under Governor’s Budget

(Dollars in Millions)

|

2016‑17 |

2017‑18 |

2018‑19 |

|

|

Minimum Guarantee |

|||

|

General Fund |

$49,993a |

$52,741 |

$54,564 |

|

Local property tax |

21,397 |

22,470 |

23,761 |

|

Totals |

$71,390 |

$75,211 |

$78,324 |

|

Change From Prior Year |

|||

|

General Fund |

$568 |

$2,747 |

$1,823 |

|

Percent change |

1.1% |

5.5% |

3.5% |

|

Local property tax |

$1,718 |

$1,074 |

$1,291 |

|

Percent change |

8.7% |

5.0% |

5.7% |

|

Total funding |

$2,287 |

$3,821 |

$3,114 |

|

Percent change |

3.3% |

5.4% |

4.1% |

|

Operative Test |

3 |

2 |

3 |

|

Maintenance Factor |

|||

|

Amount created (+) or paid (‑) |

$1,279 |

‑$1,172 |

$83 |

|

Total outstandingb |

1,350 |

228 |

320 |

|

Growth Rates |

|||

|

K‑12 average daily attendance |

‑0.2% |

0.02% |

‑0.3%c |

|

Per capita personal income (Test 2) |

5.4 |

3.7 |

4.3 |

|

Per capita General Fund (Test 3)d |

2.7 |

6.0 |

4.1 |

|

aIncludes General Fund provided on top of the minimum guarantee. bOutstanding maintenance factor is adjusted annually for changes in K‑12 attendance and per capita personal income. cUnder the two‑year hold harmless provision in the State Constitution, the 2018‑19 guarantee is calculated as though attendance is flat in 2018‑19. dAs set forth in the State Constitution, reflects change in per capita General Fund plus 0.5 percent. |

|||

Higher Local Property Tax Revenue Over the Period Reduces General Fund Cost Pressure. For 2016-17, the administration revises its property tax estimate upward by $495 million to reflect updated data reported by county auditor-controllers. For 2017-18, the administration revises its property tax estimate upward by $578 million. The bulk of this increase reflects the prior-year increase carrying forward. The administration also assumes assessed property values will grow slightly faster than 2017-18 Budget Act estimates (rising 6 percent rather than the earlier estimate of 5.3 percent). For both 2016-17 and 2017-18, the upward revisions result in a dollar-for-dollar reduction in General Fund spending. For 2018-19, the administration estimates property tax revenue will increase $1.3 billion from the revised 2017-18 level (refer back to Figure 4). This increase mainly reflects a 5.6 percent increase in assessed property values. The higher property tax revenue in 2018-19 covers about 40 percent of the estimated increase in the minimum guarantee that year.

Additional Proposition 98-Related Funding

Budget Includes $2.5 Billion in Additional One-Time Funding. Separate from the increases in the 2017-18 and 2018-19 minimum guarantees, the Governor’s budget contains $2.5 billion in Proposition 98 funding attributable to other adjustments. The largest of these adjustments is the expiration of $2.2 billion in one-time initiatives funded in 2017-18, with the associated funding repurposed for new commitments in 2018-19. In addition, the budget identifies and repurposes $214 million in unspent funds associated with previous years (primarily 2015-16 and 2016-17). The Governor also proposes to make a $100 million settle-up payment related to meeting the 2009-10 guarantee (scored as a Proposition 2 debt payment). This payment would reduce the state’s outstanding settle-up obligation to $340 million. Finally, the budget recognizes various technical adjustments (primarily lower-than-expected costs for community college apportionments) that free up a net total of $37 million. The $2.5 billion associated with all these adjustments, combined with the $687 million increase in the 2017-18 guarantee and $3.1 billion increase in the 2018-19 guarantee, accounts for the $6.3 billion total spending included in the Governor’s Proposition 98 package.

Comments

2017-18 Attendance Assumptions Have Significant Implications. The administration’s assumption of attendance growth in 2017-18 is a significant development because it restarts the hold harmless provision and prevents a $230 million decline in the 2018-19 guarantee that otherwise would occur. Under our November outlook, we projected that attendance would decline even faster than the administration assumes in 2018-19, with the potential associated reduction in the guarantee equating to more than $400 million. We recommend the Legislature carefully scrutinize preliminary 2017-18 attendance data—likely available in March—to determine whether growth is likely to materialize in 2017-18. If growth does not materialize, the 2018-19 guarantee could be several hundred million dollars below the level the administration currently assumes. The assumption about growth in 2017-18 also has significant implications for estimates of the 2019-20 guarantee, given that the hold harmless provision applies for two years and both our office and the administration assume attendance declines in 2019-20.

Administration’s Property Tax Estimates Appear Reasonable. The administration’s property tax estimates for 2016‑17 generally reflect the latest available data and are likely close to the final amounts for the year. For 2017‑18 and 2018‑19, the administration’s estimated growth in assessed property values seems consistent with the continued strength of the state’s real estate market. Over the three-year period, the administration’s estimates are $248 million above our November 2017 estimates, though this difference amounts to less than 0.4 percent of all property tax revenue collected during the period.

Further Upward Revisions to General Fund Revenue Unlikely to Increase Minimum Guarantee Significantly. In most years, increases in General Fund revenue lead to increases in the Proposition 98 minimum guarantee. These increases often reflect higher required Proposition 98 maintenance factor payments. The Governor’s budget, however, already assumes the state pays off most of its maintenance factor obligation by the end of 2017-18. The Governor’s budget also assumes the guarantee is already growing at the same rate as per capita personal income in 2017-18 and only slightly below this rate in 2018-19. Under these conditions, increases in General Fund revenue tend to have only modest effects on the minimum guarantee. Given these factors, we estimate the 2017-18 and 2018-19 guarantees likely would not increase significantly even were revenue to increase several billion dollars from the Governor’s January budget level.