LAO Contact

March 15, 2018

The 2018-19 Budget

California Hiring Tax Credits

- Introduction

- Existing New Employment Credit

- Governor’s Proposal

- LAO Comments

- Options to Improve Credit

Summary

The Existing Hiring Tax Credit. Certain California employers may claim a tax credit—called the New Employment Credit—if they hire qualified individuals and pay them at least 150 percent of the state minimum wage. However, few taxpayers have claimed the existing credit because many businesses do not qualify, the credit amount is small for lower‑wage employees, and claiming the credit is complex. In 2014 and 2015 combined, just 310 taxpayers claimed about $1 million in tax credits.

The Governor’s Proposal for a New Hiring Credit. The 2018‑19 proposed budget includes a new tax credit—the California Hiring Credit—that would be similar to the existing credit but with several changes that should make it more attractive to employers. In particular, the proposed credit would be available to most California businesses and the amount of the credit would be larger for lower‑wage employees.

LAO Assessment and Recommendations. While the administration’s proposed tax credit would improve upon the existing one, we believe an even more fundamental restructuring is necessary. We suggest increasing the amount of the tax credit at lower wages by either (1) calculating the credit amount on total wages (up to a specified ceiling), or (2) setting the credit at a flat per hour dollar amount. We also suggest allowing all California businesses to claim the credit if they hire qualified workers and eliminating a restriction against part‑time employment.

Introduction

The Governor’s 2018‑19 proposed budget includes a new California Hiring Credit that would provide an incentive for businesses to hire certain individuals who face barriers to employment. The administration modeled the proposed California Hiring Credit after the existing—but lightly used—New Employment Credit. The administration does not propose modifying the existing tax credit. It proposes instead to leave the existing credit in place and create a new tax credit for 2019 through 2024. (Businesses would be able to continue claiming the existing credit for new employees hired through 2020.)

In this report, we explain how the existing credit works and why so few taxpayers are claiming it. Then we describe and comment on the administration’s California Hiring Credit proposal, which would improve upon the existing credit in some respects. We conclude with some options for making more fundamental changes to the credit.

Existing New Employment Credit

Credit Details

State’s Economic Development Programs Overhauled in 2013. California comprehensively overhauled its economic development incentive programs in 2013 by replacing the “Enterprise Zone” programs with three new tax provisions:

- Manufacturer’s Sales Tax Exemption. A partial sales tax exemption for purchases of certain manufacturing equipment.

- New Employment Credit. A tax credit for businesses located in certain designated areas that hire certain individuals.

- California Competes. A program that awards tax credits to selected businesses that agree to meet multiyear hiring and investment targets.

Credit Intended to Address Barriers to Employment. The existing credit is intended to provide an incentive for businesses to hire individuals who, because of their personal history, may have difficulty entering the workforce or developing employment skills. A new full‑time employee must be from one of five groups in order to qualify for the credit: the long‑term unemployed, recent military veterans, felons, low‑income families with children, and other very low‑income individuals.

Focused on Certain Areas. The existing credit is available only to businesses located in certain designated areas within California, including: (1) any census tract that has a high unemployment rate and a high poverty rate, (2) portions of former enterprise zones, and (3) former military bases (specifically, Local Agency Military Base Recovery Areas). For businesses with multiple locations, the new hires must work in one of these areas. Current law also attempts to prevent businesses from replacing employees in another part of the state with new employees in one of the designated areas. Interested employers may check to see whether they are located in one of these designated areas using an online map.

Excludes Some Types of Businesses. Some types of businesses may not claim the existing credit. These include businesses that provide temporary help services, retail businesses, restaurants and bars, casinos, and certain entertainment businesses.

Starting Wages Must Be at Least 50 Percent Above Minimum Wage. New qualified employees must be hired on a full‑time basis (at least 35 hours per week). Additionally, to claim the existing credit, the employer must pay a new employee a starting wage of at least 150 percent of the state minimum wage—in 2018, for most businesses with more than 25 employees, that amount is $16.50 per hour.

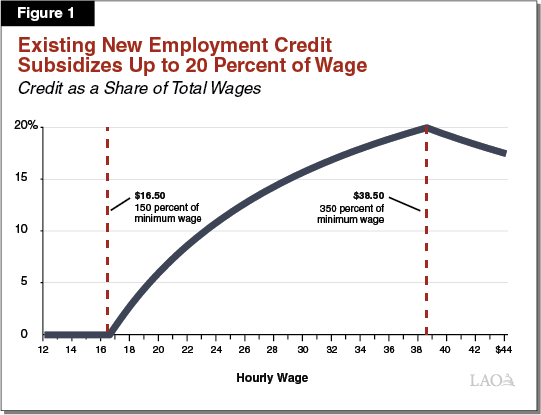

Credit Amount Is 35 Percent of a Portion of Wages. The amount of the existing credit is 35 percent of qualified wages. Qualified wages exclude the portion of wages below 150 percent of minimum wage. For example, a business that pays a new qualified employee $20.00 per hour in 2018 could receive a tax credit based on 35 percent of $3.50 per hour ($20.00 minus $16.50), or $1.23 per hour. If the qualified employee works 2,000 hours in a given year, the taxpayer could claim a credit of $2,450 on their qualified wages of $7,000. This works out to 6.1 percent of the $40,000 in total wages paid to the employee. The credit also is capped at 350 percent of the minimum wage—$38.50 in 2018. This means that, regardless of an employee’s hourly wage, a taxpayer may not claim a tax credit in excess of $7.70 per hour worked ($38.50 minus $16.50, multiplied by 0.35). For example, if a highly paid qualified employee works 2,000 hours in 2018, the employer would be able to claim a credit for no more than $15,400.

Credit Requires Reservation, Additional Filings. State law requires businesses claiming the existing credit to provide the state with certain information. First, the business must reserve a “tentative” tax credit online with the Franchise Tax Board (FTB) within a month after hiring each new qualified employee. This process requires the business to provide information about itself and the employee. Second, the credit must be claimed on an original tax return (as opposed to a revised return). Third, the business also must complete an “annual certification” online with FTB that includes updated information about any employee for which they previously reserved an existing credit, including a termination date if applicable. FTB may disallow any credit claimed if the taxpayer or the taxpayer’s business failed to satisfy any of these three filing requirements.

Credit Can Affect up to 11 Tax Years. The existing credit is available to the employer for up to five years after hiring the qualified employee. This means that the existing credit will affect up to six tax years. In addition, the taxpayer may carryforward the credit for up to five years if their net tax liability is less than the full value of the credit.

Experience to Date

Few Taxpayers Claiming Existing Credit. When the existing credit was first proposed, the administration estimated that taxpayers would claim $22 million in the 2014 tax year and $69 million in the 2015 tax year. These estimates were much too high. Final, valid claims were $340,822 in 2014 (2 percent of the initial estimate) and $693,323 in 2015 (1 percent of the initial estimate). Over these first two tax years the credit was available, at least 1,829 taxpayers claimed the credit but 83 percent of the claims were invalid. The 310 valid returns were generated from hiring by a total of 62 individual businesses. (The number of taxpayers claiming the credit exceeds the number of affiliated businesses because pass‑through businesses, such as partnerships and LLCs, generally have multiple investors and each investor may claim a proportional share of the credit.) These results suggest that the existing tax credit has been challenging or unappealing for businesses to use.

Key Reasons for Credit Underutilization. Several factors appear to be contributing to the low utilization of the existing tax credit:

- Starting Wage Threshold Too High. Many employers do not qualify for the existing credit because their starting wages are less than 150 percent of minimum wage. Labor market statistics collected by the Employment Development Department (EDD) show that many occupations have an average wage well below $16.50 per hour. For example, dry cleaning workers earn an average hourly wage of $13.07. Employers will often pay new hires a lower wage initially, because of their lack of experience, increasing pay as the employees become more skilled.

- Credit Amount Too Small. The existing credit amount may be too small to influence the hiring decisions of most employers hiring lower‑wage workers. As we noted above, the credit amount is based on just the portion of wages that are above 150 percent of minimum wage and below 350 percent of minimum wage. This can still be a significant amount—as we show in 1. The existing credit can subsidize up to 20 percent of an employee’s annual wage at $38.50 per hour. However, for lower‑wage workers, the existing credit is much smaller. For example, if a business paid their qualified employee $18 per hour—or $1.50 per hour above 150 percent of minimum wage—they would receive a tax credit for just 3 percent of the employee’s annual salary. We do not know the average wage for the groups targeted by the credit. Given that many may not have significant work experience, their wages likely do not qualify for the higher credit amounts.

- Complexity. There are complicated rules limiting which businesses and which employees qualify for the credit. Moreover, the existing credit has a complex structure. The amount of the credit depends on several factors that may fluctuate during the year.

- Uncertainty. Given the program’s complexity, many taxpayers might be unsure of whether they qualify and how much of a credit they would receive if they did. For example, a taxpayer may not know they are located outside a designated area until FTB disallows the credit. (While the online map may be used to indicate if a location “is likely to be eligible” for the existing credit, compliance is subject to manual verification.) A business with regular employee turnover, in another example, may not know until the end of the year whether their net change in employment will be large enough to claim the credit. This uncertainty may help to explain why so many employers reserved credits that they ultimately were unable to claim.

- Interactions With Other Tax Credits. The existing credit overlaps with geographical areas of the state that previously qualified for other tax credits under the former enterprise zone programs. Many businesses that had earned credits under those programs still have credits available. FTB reports that some businesses may be using their older enterprise zone credits, while carrying forward any more recent existing employment credits they also may have earned. Unfortunately, we lack specific information on the number of taxpayers who might be in such a situation.

Credit May Have Indirectly Increased Hiring of Targeted Groups. California businesses made 18,628 credit reservations in 2014 and 2015 (11,554 and 7,074 reservations, respectively). If these reservations were all valid, each would have been associated with the hiring of one qualified new employee. In 2014, however, only 901 claims for qualified employees were made. These claims were associated with $340,822 in credits. Consequently, only about 8 percent of the 11,554 reservations received that year ultimately resulted in a credit. Given the number of credit reservations made, however, the credit may have played a role in hiring individuals who employers expected to be eligible for the credit but ultimately were not eligible. To the extent this occurred, the credit’s availability may have influenced employers’ decisions to hire targeted individuals. (For context, there were about 800,000 unemployed people in California at the end of 2017 and about 3.5 million new hires statewide each year.)

Governor’s Proposal

An Expanded Employment Credit. The administration proposes a new tax credit—the California Hiring Credit—that would be similar to the existing credit but with several notable changes. The administration estimates that the proposed credit would reduce General Fund revenues by an average of $50 million per year. Below, we describe the proposed credit and, where appropriate, compare it to the existing credit.

Targets Same Individuals. The proposed credit targets the same five categories of individuals who may face barriers to employment:

- The long‑term unemployed (for at least the past six months).

- Recent military veterans (separated within the past year).

- Ex‑offenders (felony conviction).

- Recipients of California Work Opportunity and Responsibility to Kids or county general assistance (at time of hiring).

- Earned Income Tax Credit recipients (for the prior tax year).

Available to Significantly More Businesses. Whereas the existing credit is available only to businesses in certain designated areas of the state, the proposed credit would be available to businesses statewide. In addition, restaurants and retailers—which cannot claim the existing credit—would be able to claim the proposed credit. Temporary help services, casinos, bars, and certain entertainment businesses would still be ineligible.

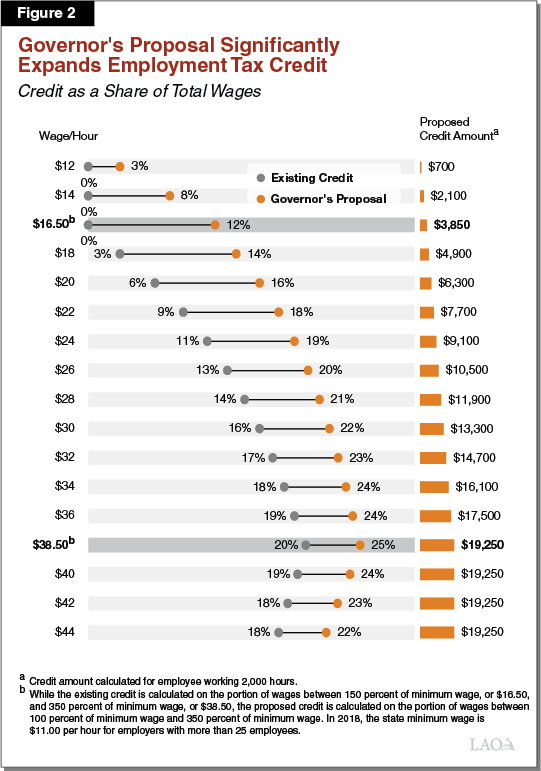

Lowers Floor on Qualified Wages. While the existing credit is based on the portion of wages between 150 percent and 350 percent of the minimum wage, the proposed credit would lower the floor of that range to 100 percent of the minimum wage. This would have two important effects. First, taxpayers would be able to claim a credit for employees that are paid below 150 percent of the minimum wage—significantly increasing the number of taxpayers able to claim the credit. Second, as we show in 2, the lower floor could make the amount of the proposed credit significantly larger than the existing credit—strengthening the incentive to hire individuals in the targeted groups. For example, as shown in the , the credit for a qualifying employee working 2,000 hours per year at $20 per hour would be worth 16 percent of total wages compared with 6 percent under the existing credit. (The assumes that the proposed credit percentage remains at 35 percent but, as explained below, the Legislature would be able set the credit percentage in the annual budget act.)

Other Differences. There are several other notable differences between the proposed credit and the existing credit:

- Credit Percentage Set in Budget Act. The proposed credit percentage would be 0 percent unless the Legislature sets it at a higher value in the annual budget act. This proposed change would allow the Legislature to annually reevaluate the credit percentage as part of the state budget process.

- Shortens Duration of Credit. The proposed credit would only be available for the first two years of employment, compared to the five years allowed by the existing credit. In addition, if a business terminates the qualified employee within the first year of their employment (reduced from the first three years under the existing credit), the state would recapture any previously claimed credit.

- Accounts for Differences Between State and Local Minimum Wage. The proposed credit would clarify that—when city, county, and state minimum wages differ—the applicable minimum wage is whichever is highest.

- No Annual Certification. Unlike with the existing credit, the proposal would not require the taxpayer to submit a certification of employment to FTB every year. (The proposed credit would continue to require taxpayers to reserve a tentative credit within 30 days after they have hired a qualified new employee. In addition, taxpayers must still claim the proposed credit on a timely original return.)

LAO Comments

A Stronger Incentive. The administration has proposed changes to the credit that should make it more attractive to employers. In particular, the proposed reduction in the wage floor from 150 percent to 100 percent of the minimum wage would reduce the starting wage requirement and increase the amount of the credit across the board.

More Businesses Would Qualify. Under the proposal, all businesses in the retail and food services industries—about 170,000 establishments, according to EDD—would become eligible for the proposed credit. This change alone opens up eligibility for the credit to more than 10 percent of the state’s roughly 1.4 million private business establishments.

Statewide Credit Preferable to Geographically Limited Credit. Unlike the existing credit, which is only available to businesses in certain areas of the state, the proposed credit would be available to businesses statewide. This change treats similar taxpayers—employers hiring new workers from among the targeted categories—similarly. This change also reduces the possibility of jobs shifting within the state without growing the overall economy.

Fiscal Estimate Uncertain. The administration estimates that the proposed credit would reduce General Fund revenues by $50 million per year, but this estimate is uncertain. Estimating the fiscal effect of a new tax provision is difficult. For example, the administration initially estimated the cost of the existing credit to be $91 million over the 2014 and 2015 tax years combined, but taxpayers ultimately claimed only about $1 million over that period. The changes proposed by the administration, however, likely will increase the proposed credit’s use. The cost of the proposed credit would also depend on the credit percentage set by the Legislature in the annual budget act.

Reducing Duration of Credit Is Reasonable. While the proposal limits the credit to two years of qualified wages, the proposed credit amount would be larger than the existing credit at any wage. We think this change is reasonable because it creates a larger upfront incentive—by providing a greater tax reduction—for a business to hire an individual from one of the targeted categories. Few employers would let go of a trained employee once their tax credit is no longer available.

Options to Improve Credit

The existing New Employment Credit is, for the most part, ineffective and unused. The administration’s proposed California Hiring Credit would improve upon the existing credit in some respects. Notably, the proposal increases the credit size and makes it available statewide. However, to be effective, we believe the credit needs a more fundamental restructuring.

Increase Credit Amount at Lower Wages

Workers targeted by the tax credit face one or more barriers to employment including limited skills, little work history, or long‑term unemployment. Consequently, many of these individuals will only qualify for jobs at or close to minimum wage. The credit as currently proposed, however, provides much less benefit to employers hiring people making below 150 percent of minimum wage (between 0 percent and 12 percent of wages) than it does to people making 350 percent of minimum wage (25 percent). As a result, the credit may not provide a sufficient incentive to the employers most likely to hire the targeted workers. We recommend adopting a different structure that would provide a significantly higher subsidy at lower wages. We suggest two options to consider:

- Apply Credit Percentage to Total Wages. In this option, the amount of the credit would be based on a constant percentage of total wages up to a ceiling of, for example, 150 percent of minimum wage (instead of the portion of wages above 100 percent of minimum wage). If the Legislature set the rate at 35 percent, then credit amounts would range from $7,700 (at minimum wage) up to $11,550 (at 150 percent of minimum wage) for employees working 2,000 hours per year in 2018.

- Flat Credit Amount. In this option, the employer would receive a flat amount of, for example, $4 per hour. The Legislature could adjust the amount in the annual budget act or set the amount to increase on a schedule over time. This would provide a much greater subsidy for lower‑wage employees.

Both the existing and proposed credits have complicated rules for calculating the amount. This complexity—and associated uncertainty—likely are among the reasons the existing credit is underutilized. An advantage of the options provided above is that they would be simpler to calculate and understand.

Eliminate Certain Limitations

Allow All Businesses to Claim Credit. The proposed credit would still exclude temporary help agencies, bars, and casinos from claiming the tax credit. Such exclusions likely will reduce the credit’s use. In addition, limiting the industries eligible for the credit reduces the potential job opportunities for targeted workers. For instance, temporary help agencies can provide useful work experience for individuals with limited work history.

Make Part‑Time Employment Eligible for a Credit. The proposed credit would only be available to employers that hire new full‑time qualified employees. This requirement assumes that a full‑time job is preferable to a part‑time job when that may not always be the case. In some cases, an employer may prefer to hire new employees on a part‑time evaluative basis before increasing the employee’s hours or promoting them to a full‑time position. In other cases, individuals looking to reenter the workforce after a long period of unemployment may prefer a part‑time job. Regardless of whether a qualified employee is hired on a full‑time or part‑time basis, the individual will gain experience that could help to reduce barriers to employment in the future. Consequently, we recommend eliminating this requirement from the new credit.