LAO Contacts

May 12, 2018

The 2018-19 Budget: The May Revision

Initial Comments on the May Revision

General Fund Condition

Governor Proposes Total Reserves of $17 Billion. Figure 1 shows the General Fund’s condition from 2016‑17 through 2018‑19 under the Governor’s budget assumptions and proposals. The Governor proposes the state end 2018‑19 with $17 billion in total reserves. This would consist of two amounts: $13.8 billion in the state’s constitutional rainy day fund (reserves available for future budget emergencies), as well as $3.2 billion in discretionary reserves (available for any purpose).

Figure 1

General Fund Condition Under Administration’s Estimates

(In Millions)

|

2016‑17 |

2017‑18 |

2018‑19 |

|

|

Prior‑year fund balance |

$5,012 |

$5,672 |

$8,451 |

|

Revenues and transfers |

119,982 |

129,825 |

133,513 |

|

Expenditures |

119,322 |

127,046 |

137,562 |

|

Ending fund balance |

$5,672 |

$8,451 |

$4,402 |

|

Encumbrances |

1,165 |

1,165 |

1,165 |

|

SFEU balance |

4,507 |

7,286 |

3,237 |

|

Reserves |

|||

|

SFEU balance |

$4,507 |

$7,286 |

$3,237 |

|

BSA balance |

6,713 |

9,410 |

13,767 |

|

Total Reserves |

$11,220 |

$16,696 |

$17,004 |

|

SFEU = Special Fund for Economic Uncertainties and BSA = Budget Stabilization Account. |

|||

Major Features of the May Revision

Figure 2 displays the major changes between the Governor’s January Budget and May Revision. As the table shows, the Governor’s revenue estimates have increased substantially since January. However, a large portion of these revenue increases are offset by formula-driven constitutional spending requirements and other increases resulting from caseload changes and federal requirements. After satisfying these higher spending requirements, we estimate that the Governor had $4.1 billion in discretionary resources to allocate in the May Revision. We describe the major features of the May Revision below.

Figure 2

Major General Fund Changes Between Governor’s

January Budget and May Revision (2016‑17 Through 2018‑19)

(In Millions)

|

Higher net revenues and transfers |

$7,588 |

|

Baseline spending changes |

|

|

Higher constitutional spending for schools and community colleges |

$1,343 |

|

Higher constitutional spending on debt payments |

211 |

|

Higher Medi‑Cal spending |

1,636 |

|

Higher (net) other spending |

263 |

|

Subtotal |

($3,453) |

|

Discretionary Proposals |

|

|

Higher SFEU Balance |

$950 |

|

Higher expenditures |

3,186 |

|

Subtotal |

($4,135) |

|

Total |

$7,588 |

|

SFEU = Special Fund for Economic Uncertainties. |

|

Baseline Changes

Total Revenues Higher by $7.6 Billion. Compared to January, the administration’s estimates of revenues and transfers have increased by $7.6 billion across the three fiscal years. These increases are primarily driven by higher revenue estimates from the personal income tax (PIT) and, to a lesser extent, the corporate tax. Over the three-year period, PIT revenues are higher than January estimates by $4.5 billion. In large part, this reflects the administration’s projected increase between 2017 and 2019 in the share of income earned by higher income households (who pay higher tax rates under California’s graduated tax structure). The administration also has raised its estimates of corporation tax revenue by $2.5 billion since January.

Constitutional Requirements Higher by $1.5 Billion. Under the administration’s estimates, constitutionally required General Fund spending is higher across the three fiscal years. These higher requirements are driven by two sets of constitutional formulas:

Schools and Community Colleges. School and community spending (under the provisions of Proposition 98) is $1.3 billion higher across the three fiscal years. Three main factors explain this increase. First, higher revenue requires the state to make larger payments to schools and community colleges in each year of the period. In addition, the Governor proposes to adjust (or “rebench”) the constitutional spending requirement upward to account for a cost shift the state approved as part of the 2015‑16 budget plan. Finally, the administration revises its estimates of local property tax revenue down across the period. The reduction in local property tax revenue requires the state to backfill generally dollar for dollar with additional General Fund spending.

Debt Payments. In addition, constitutionally required debt payments (under the provisions of Proposition 2 [2014]) are higher by $211 million. This is the result of the administration’s higher General Fund revenue estimates, particularly those from capital gains, in 2018‑19.

Medi-Cal Spending Higher by $1.6 Billion. Under the administration’s estimates and assumptions, Medi-Cal spending would increase by $1.6 billion, on net, across 2017‑18 and 2018‑19 (relative to January). The upward adjustment generally does not reflect any new policy proposals, such as expanded coverage or benefits. Rather, these changes largely reflect workload budget assumptions projecting lower available federal funding. In particular, the administration assumes:

Higher Costs of Deferred Claims. The most significant change relates to a $1.5 billion General Fund adjustment—$680 million in 2017‑18 and $820 million in 2018‑19—to pay for a projected increase in disputed claims with the federal government.

Lower Costs Related to Children’s Health Insurance Program. Increases in Medi-Cal spending would be even higher, but are offset by about $900 million in General Fund savings related to Congressional reauthorization of the Children’s Health Insurance Program. (We discussed this federal change, and its effect on the 2018‑19 budget picture, in this post: Recent Congressional Action on the Children’s Health Insurance Program.)

No Change in Proposition 55 Funding. Proposition 55 (2016) contained a formula that provides up to $2 billion per year to Medi-Cal if available revenues exceed constitutionally required spending and the “workload budget.” (We describe the calculation in more detail in this post: The 2018‑19 Budget: The Administration Proposition 55 Estimates.) As with January, the administration continues to identify a deficit in its Proposition 55 calculation, which means there is no additional funding for Medi-Cal under the measure.

Other Spending Higher by $263 Million. Relative to January, the Governor also estimates a variety of other smaller programmatic changes throughout the budget that arise as a result of updated estimates of caseload, prices, and other similar factors. For example, the administration estimates that In-Home Supportive Services (IHSS) costs are higher by about $300 million due to higher-than-anticipated cost per case and overtime costs. The administration also estimates Cal Grant costs will be higher (partially as a result of participation increases), CalWORKs costs will be lower (as a result of additional local realignment funds that offset state spending), and SSI/SSP costs will be lower (reflecting continued modest caseload declines).

Allocating $4.1 Billion in Discretionary Resources

After satisfying constitutional and federal requirements and providing funds for caseload and price growth, the Governor had $4.1 billion in available discretionary resources to allocate in the May Revision. We describe how these funds were allocated below.

Governor Increases Reserves by Roughly $1 Billion. The Governor’s May Revision sets aside an additional $1 billion in the state’s discretionary reserve, the Special Fund for Economic Uncertainties. This action brings that fund’s total balance to $3.2 billion. (The Governor also maintains his January budget proposal to bring the state’s rainy day fund to its constitutional maximum of $13.8 billion, a small increase under the Governor’s new revenue estimates.)

Governor Allocates $3.2 Billion in May Revision to New Spending. The Governor’s May Revision allocates about $3.2 billion in remaining discretionary resources to a variety of spending proposals. Of this amount, mostly all is allocated for one-time purposes, with roughly $400 million in ongoing commitments. Figure 3 shows, and we describe below, the major programmatic themes of these proposals.

Figure 3

Major Proposed Areas of Spending in the Governor’s May Revision

(In Millions)

|

One‑Time Cost |

2018‑19 Total Cost |

|

|

Infrastructure |

$1,860 |

$1,885 |

|

Mental health |

386 |

389 |

|

Homelessness |

276 |

309 |

|

Criminal justice |

23 |

232 |

|

Wildfire response |

82 |

93 |

|

Parks |

110 |

110 |

|

Expand earned income tax credit |

— |

60 |

|

Other |

95 |

108 |

|

Totals |

$2,833 |

$3,186 |

Infrastructure. The Governor allocates the largest share of discretionary spending to a few major infrastructure proposals. This includes about $1 billion for deferred maintenance projects throughout many program areas, $630 million for state office buildings, and nearly $200 million for flood control projects.

Mental Health. The Governor allocates funds to support mental health programs throughout the state, including $281 million to reduce the state’s mandate backlog mostly related to county mental health services for children, $50 million for counties to provide homeless individuals with mental illnesses, and $55 million to the University of California to support graduate medical education for psychiatric programs.

Homelessness. The Governor allocates funds for a variety of proposals related to homelessness. The largest of these is $250 million in one-time emergency homeless aid block grants to local governments for a variety of housing programs, including emergency housing vouchers and shelter construction. The Governor also proposes $64 million in ongoing spending to local governments for housing support and homelessness assistance programs through the CalWORKs program. In addition, the Governor proposes asking voters to approve No Place Like Home in the November election. In 2016, the Legislature created the No Place Like Home program to construct and rehabilitate permanent supportive housing for those with mental illness who are homeless. The program authorizes the issuance of bonds backed by PIT revenues raised under the Mental Health Services Act (Proposition 63 of 2004).

Criminal Justice. The Governor includes a variety of new proposals for corrections and criminal justice programs. The largest item in this area is $139 million in ongoing funding to pay for increased correctional officer and parole agent compensation resulting from a new labor agreement with the California Correctional Peace Officers’ Association. (The agreement has not yet been submitted to the Legislature for ratification. Our office will release more information on this agreement after we have reviewed it.) The administration also proposes spending $13 million from the General Fund to increase training for state correctional staff.

Significant Portion of Proposals Directed to Local Projects, Reimbursements, and Grants. Many of the spending proposals described above are directed to local governments, particularly through grant programs. In total, the Governor proposes allocating nearly $1 billion in General Fund spending to local governments in the May Revision. This includes roughly $300 million to repay local governments’ mandates, $150 million for urban flood control projects, and the emergency homeless aid block grants described above.

Total Discretionary Resources in 2018‑19 May Revision

Over $10 Billion in Total Discretionary Resources Available. In January, we estimated the Governor allocated $7 billion discretionary resources in his budget plan. Due to higher revenue estimates, a portion of the January discretionary resources allocated to reserves are now constitutionally required. As a result, the amount of discretionary resources available is reduced to $6.1 billion. With the $4.1 billion available in May, the Governor has allocated over $10 billion in discretionary resources to the 2018‑19 budget. These are funds that the Legislature now has available to commit in the budget process—either by approving the Governor’s proposals or directing these resources toward other priorities.

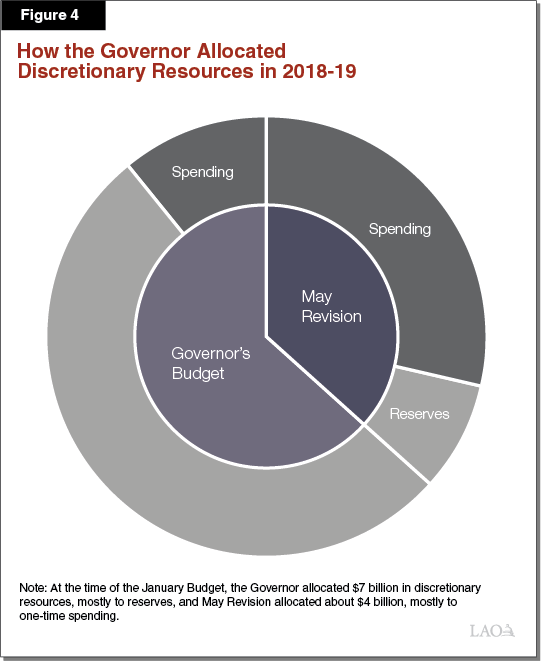

Governor’s Budget Emphasized Reserves, May Revision Emphasizes One-Time Spending. Figure 4 shows how the Governor allocated these total discretionary resources between reserves and spending proposals in the Governor’s Budget and May Revision. As the figure shows, the Governor dedicates more than half of the total available resources toward building reserves. While the Governor’s Budget emphasized building reserves most of the Governor’s proposals in the May Revision focus on spending. As we noted above, the vast majority of these spending proposals are one time.

LAO Comments

Potential Upside on Budget Condition. In the coming days, our office will release assessments of the various programmatic proposals in the 2018‑19 budget. However, our initial assessment of the Governor’s May Revision proposals suggests that there are reasons to believe the bottom line condition of the General Fund could be considerably better than the administration currently suggests. In particular, compared to the administration, our assessments imply:

PIT Revenues Likely to Be Higher. In total, our General Fund revenue and transfer estimates are higher than the administration’s by $2.6 billion over the three-year period. Largely, this stems from, our office’s higher estimates of PIT revenue in 2017‑18 and 2018‑19. This primarily reflects our office’s higher projections of capital gains in 2017 and 2018 and higher wages and salaries in 2019. (We compare our revenue estimates to the administration’s in greater detail in our recently published post: 2018 May Revision: LAO Revenue Projections.)

School and Community College Spending Likely to Be Lower. There are two reasons that required General Fund spending for schools and community colleges (under Proposition 98) could be lower than the administration assumes. First, the administration assumes that average daily attendance at K-12 institutions and community colleges will remain relatively flat, although there is strong evidence to suggest it will decline. Second, our office’s estimates of local property tax revenues are higher than the administration’s estimates. All else equal, this would mean General Fund spending would be lower than the administration estimates by several hundred million dollars.

Recommend Scrutiny of Medi-Cal Budget. We recommend the Legislature scrutinize the administration’s assumptions and estimates for Medi-Cal. The administration takes a new approach to projecting the costs of deferred claims, which substantially increases these costs. Based on our initial review, this amount likely represents a high-end estimate of the amount that is required. This is because the state may be able to recover a portion of this funding by submitting required supporting documentation for the claims. The amount and timing for recovering funds is unknown at this time. In the coming days, our office will review all of the major Medi-Cal adjustments.

Budget Prepared to Weather a Mild Recession. The Governor proposes a total reserve balance of $17 billion, which is slightly larger than the reserve balance proposed in January. The Governor also uses available discretionary resources for spending on largely one-time purposes. As we discussed in our recent report (Building Reserves to Prepare for a Recession), both reserves and one-time spending are important tools to prepare for a coming recession. If enacted, these proposals would mean the state is well-prepared to weather a mild recession. If the state experienced a mild recession after 2018‑19, it might not need to take many actions, such as spending cuts or revenue increases, to bring the budget into balance. However, this level of reserves would not be sufficient to fully cover the costs of a moderate or a severe recession. If the state faced one of these recessions in the coming years, the Legislature would still need to take many billions of dollars in actions over a multiyear period to bring the budget back into balance.