LAO Contact

December 12, 2018

Child Care Attendance Records:

Comparing Paper and Electronic Processes

Summary

State Tasks Certain Entities With Collecting Monthly Child Care Attendance Records. The state relies on regional Alternative Payment (AP) agencies to administer certain child care programs. For these programs, the state specifically tasks AP agencies with verifying child attendance and calculating payments to providers in their regions. Although state law allows AP agencies to collect attendance records electronically, almost all AP agencies still process the vast bulk of attendance records in paper form. Earlier this year, the Legislature directed our office to gather more information on the pros and cons of using a paper versus electronic process to collect these records.

Net Benefit of Processing Attendance Records Electronically Is Likely to Vary Widely Among Entities. In the near term, shifting to an electronic process would be costlier for all AP agencies and providers given the upfront costs associated with acquiring needed software and hardware. Over the long term, an electronic process could be lower cost for some entities, particularly if the new process yielded staff–related savings. Most notably, an electronic system likely could be designed to save considerable staff time by automatically identifying attendance record errors and calculating provider payments. The entities obtaining the greatest long–term net benefit likely would be those serving more children, processing more records, calculating more payments, and currently employing more staff. Small providers might see little or no net fiscal benefit. Even small entities, however, might view an electronic process as more convenient than a paper process.

Recommend Legislature Continue to Allow AP Agencies to Decide Best Process for Their Regions. We believe the state’s current approach of allowing AP agencies to decide whether to collect monthly attendance records using a paper or electronic process is reasonable. Though we do not believe the state should require all agencies to use an electronic process, the Legislature could authorize a pilot program to amass greater knowledge and expertise regarding how to implement an electronic process. Under the pilot, a few AP agencies and a subset of interested providers could work together to develop or procure an electronic system. The pilot could be particularly helpful in getting a better sense of the cost of an electronic system and the implementation challenges, including available and desired technical support. The findings from the pilot could help other AP agencies decide if they want to implement an electronic process moving forward. Though creating a pilot is an option, the Legislature may first want to survey AP agencies and providers to explore whether other possible changes, such as phone upgrades, could be more beneficial than an electronic records system.

Introduction

The Supplemental Report of the 2018–19 Budget Act requires our office to assess the current processes Alternative Payment (AP) agencies use to collect monthly attendance records from child care providers. It directs us specifically to describe the pros and cons of using a paper versus electronic process. This report fulfills this requirement.

Background

Below, we provide background on (1) AP agencies and their core responsibilities and (2) monthly attendance record distribution and storage.

Alternative Payment Agencies

AP Agencies Administer Certain Subsidized Child Care Programs. The state relies on various regional agencies to administer child care programs on its behalf. The California Department of Education (CDE) currently contracts with 76 AP agencies to administer three child care programs—CalWORKs Stage 2, CalWORKs Stage 3, and the Alternative Payment program. Of the 76 AP agencies, 51 are nonprofit community–based organizations, 14 are county offices of education, 9 are county welfare departments, 1 is a school district, and 1 is a city government.

AP Agencies Have a Variety of Administrative Responsibilities. AP agencies’ core administrative responsibilities include determining a family’s eligibility for child care, making payments to child care providers, and creating and maintaining detailed records about each family and provider. State law and regulations, as well as CDE’s contracts with AP agencies, are highly prescriptive regarding how agencies conduct these and other administrative activities.

AP Agency Funding Is Based on a Percentage of Provider Payments. Each year, CDE first determines the amount AP agencies receive for their provider payments. The department then provides additional funding to cover each AP agency’s operational costs. This allotment is equal to 21.21 percent of provider payments. This funding, together with the provider payments, comprise the total AP agency contract amount, or “Maximum Reimbursable Amount” (MRA). For example, an AP agency that receives $1 million for provider payments also receives $212,100 for operational expenses, for a MRA of $1,212,100.

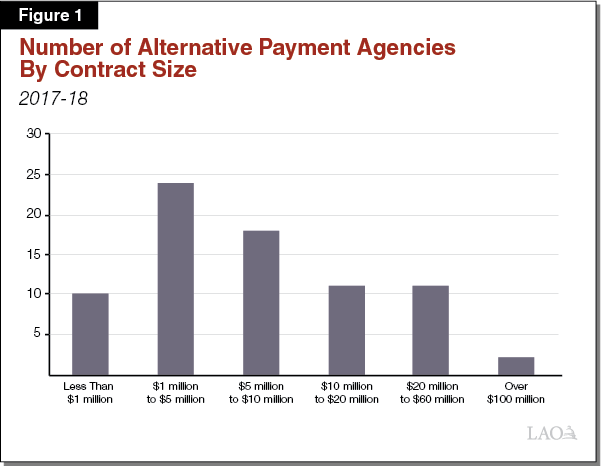

AP Agency Funding Ranges From Very Small to Large. AP agencies vary substantially in the size of their contract amounts. In 2017–18, total contract amounts (for CalWORKs Stage 2, CalWORKs Stage 3, and the Alternative Payment program combined) range from $122,000 to $145 million. Figure 1 shows the distribution of AP agencies by contract amount. Whereas ten AP agencies have total contract amounts less than $1 million, two have contract amounts in excess of $100 million.

Monthly Attendance Records

Monthly Attendance Records Are Intended to Verify the Children Who Received Care. State law requires AP agencies to collect monthly attendance records from child care providers. The monthly attendance record includes the date and time the child received care. It also contains signatures from both the child’s parent and the provider verifying the information is accurate. At a minimum, AP agencies use these records to verify which children received care and how much care they received that month. AP agencies do not pay a provider until that provider has submitted its monthly attendance records. (The nearby box discusses timing issues in more detail.)

The Timing of Record Collection and Provider Payments

Timing Varies Among AP Agencies. Alternative Payment (AP) agencies determine when attendance records are due and when provider payments are processed. Some AP agencies require providers to submit attendance records by the 5th of each month, with payments made to providers by the 20th of each month. Rather than making provider payments once a month using this type of set schedule, some AP agencies effectively process payments continually throughout the month, making payment five days after receiving a monthly attendance record.

Electronic Process Unlikely to Decrease Wait Time for Most Provider Payments. During our conversations with providers, some indicated they were interested in shifting to an electronic process because they believed such a process would lead to quicker payments from AP agencies. An electronic process alone, however, is unlikely to decrease the wait time for most provider payments. If an AP agency shifted to an electronic process but retained its payment schedule, providers working with that AP agency would see no change to the timing of their payments. The exception could be for those providers that currently get paid later than other providers because they submit their attendance records late or their records have errors. Were an electronic system to help in submitting records on time and with fewer errors, these providers likely could get paid sooner (that is, at the same time other providers are paid).

Monthly Attendance Records Are Sometimes Used to Calculate Provider Payments. In certain cases, AP agencies use monthly attendance records not only for verification of care but also to determine provider payments. Specifically, AP agencies use the records in this way for families that have variable, or changing, work schedules. For providers who care for children with parents who have consistent, unchanging work schedules, the contents of the attendance record are not used to calculate the providers’ payment. In these cases, the amount paid is based on the hours of care the family is eligible to receive, as determined annually by the AP agency.

Currently, All AP Agencies Collect Monthly Attendance Records in Paper Form. Though state law allows AP agencies to collect and store monthly attendance records electronically, no agency currently uses an electronic process with all of its providers. Instead, most AP agencies distribute record sheets in paper form, typically several days in advance of a monthly attendance cycle. Once the attendance records are signed at the end of the monthly attendance cycle, providers mail or hand deliver the attendance records back to the AP agencies. Once an AP agency receives an attendance record, it verifies care was provided and, in the case of variable schedules, calculates provider payments. AP agencies are required to store monthly attendance records for a minimum of five years. To date, storage primarily occurs in paper form.

Virtually No Electronic Collection and Storage. Collecting records in this manner would require providers and parents to fill out and sign electronic forms using a digital signature. To date, very few providers have acquired this capability.

Many Factors Likely Contribute to Lack of Electronic Processing. The following reasons could be contributing to the lack of electronic collection and storage.

- Different Agency Funding Priorities. The most likely source of funding for AP agencies to shift to an electronic process is the portion of funds they receive for administrative purposes. AP agencies might want to use these funds for other operational costs, such as staff salaries, before using them for an electronic attendance system.

- Perceived Lack of Interest From Providers. AP agencies may be hesitant to implement electronic attendance records if they believe providers are not interested in using an electronic process. In our conversations with providers and in their survey responses to us, some providers expressed interest in an electronic process, whereas others preferred the current paper process.

- Lack of Use to Date Means No Clear Best Practices. Since no AP agency currently has a comprehensive electronic attendance record collection or storage process, minimal information is available on how to develop such a system.

Assessment

Below, we offer our comparative assessment of the paper and electronic means of processing monthly attendance records.

Near Term, Electronic Process Likely to Be Higher Cost for Both AP Agencies and Providers. Figure 2 identifies the core set of costs associated with administering monthly attendance records. As the figure shows, both the paper and electronic processes entail costs relating to the distribution, collection, and storage of records as well as staff costs. In the near term, implementing an electronic process is very likely to be costlier because of the upfront costs associated with acquiring needed software and hardware. Most notably, AP agencies and providers would need to obtain (through either internal or external means) the capability to accept and transmit digital signatures. Both types of agencies also would need to train staff how to use the new electronic system.

Figure 2

The Costs of a Paper Process Compared With an Electronic Processa

|

Paper Process |

Electronic Process |

Assessment |

|

|

Distribution and Collection |

Paper, ink, postage, and gas |

Digital–signature capability and means to transmit records electronically |

Electronic process would be costlier in near term due to upfront development costs, but could reduce distribution and collection costs in the long run. |

|

Storage |

Physical space and cabinets |

Electronic storage capacity |

For some AP agencies, an electronic process would be costlier in near term if they needed to expand or purchase electronic storage capacity. Some AP agencies may already have sufficient electronic storage capacity given their other administrative responsibilities. |

|

Equipment |

Computers and printers |

Computers |

Electronic process would be costlier in near term if providers and AP agencies had to purchase additional equipment. Some AP agencies likely already have sufficient equipment given their other administrative responsibilities. |

|

Staff Review |

Staff time to review attendance forms, correct errors, and calculate provider payments |

Staff time to review attendance forms, correct errors, and calculate provider payments |

Electronic process would be substantially less costly in long run if it flagged errors automatically, reduced staff review time, and calculated provider payments. |

|

Staff Training |

Initial training for new staff in verifying eligibility, checking attendance records, and calculating provider payments |

Initial training for all staff to use new electronic system and training thereafter for new staff in verifying eligibility, checking attendance records, and calculating provider payments |

Electronic process likely would be costlier in near term as all staff would need to be trained on how to use the new system. Electronic process could reduce training costs in long term if key processing steps were automated. |

|

aAlternative Payment agencies and providers both incur many of the costs shown, but only AP agencies are required to store records and calculate provider payments. |

|||

Long Term, Electronic Process Could Be Lower Cost for AP Agencies. Though higher cost in the near term, an electronic process very likely could be less costly for AP agencies in the long run due to potential staff savings. In particular, AP agency staff costs could be reduced over the long term to the extent the new electronic system automatically identified errors in attendance records and calculated provider payments. Achieving such savings would require AP agencies to reduce their staffing levels (all else constant) moving forward. Such staff savings could be partly offset by any annual licensing fee charged for use of digital signature software.

Larger AP Agencies Likely to See Greatest Long–Term Benefit. Whether any specific AP agency found an electronic process to be cost–effective would depend on various factors, including their existing caseload and staffing levels as well as their existing technical capacity. Large AP agencies likely would be the most notable beneficiaries of an electronic process. These AP agencies currently process many attendance records and calculate many provider payments, such that an electronic process could reduce their associated staff time considerably. These large agencies likely could recoup any initial upfront spending to build the electronic process within just a few years. Their staff savings also likely could exceed any annual software licensing fee. Small AP agencies, by comparison, likely would take longer, perhaps much longer, before they would recoup their initial upfront spending. Both large and small AP agencies also may be able to point to other types of spending (for example, upgrading phone systems) that they believe would have higher payoff for them and their clients.

Long Term, Electronic Process Might Not Be Fiscally Advantageous for Providers. The net, long–term fiscal impact on providers is unlikely to be notable. While an electronic process might result in some reduction of initial errors in the attendance records that providers submit to their AP agencies, providers still would need to correct any errors ultimately identified by their AP agencies. Moreover, most providers do not have a staff person assigned solely to attendance record collections and corrections, such that most providers may achieve little, if any, staff savings over the long run. Even were providers to achieve some staff savings, those savings might be entirely offset by the cost of annual software licensing fees as well as the periodic cost entailed in replacing associated computer equipment (such as laptops) to maintain a digital signature system.

For Providers, Certain Practical Issues to Consider. On the one hand, providers might have the greatest initial hesitation to implement an electronic process due to concerns with their internal technical capabilities to navigate such a system. An electronic system could appear especially daunting given new associated software and hardware that providers are unaccustomed to using. Providers also might be concerned with the availability of external technical support to help them navigate a new system. On the other hand, some providers might view an electronic system as ultimately more convenient for themselves and their clients than the current paper system.

Recommendations

Recommend Continuing to Allow AP Agencies to Determine Best Process for Their Regions. We believe the state’s current approach of allowing AP agencies to decide whether to collect paper or electronic monthly attendance records is reasonable. Given AP agencies differ significantly in terms of contract size, and both AP agencies and providers differ significantly in terms of number of staff and technical capacity, a one–size–fits–all approach does not seem warranted. Whereas some AP agencies, especially large ones, might determine that an electronic process would create administrative efficiencies and be worthwhile to implement, other AP agencies might conclude the net benefits are small and would take a long time to achieve. Most providers also might conclude that an electronic process, though potentially more convenient than a paper process, does not produce savings, even over the long term.

State Could Create a Small Pilot Program. Though we do not believe the state should require all agencies to use an electronic process, the Legislature could authorize a pilot program to amass greater knowledge and expertise regarding how to implement an electronic process. Under the pilot, a few AP agencies and a subset of interested providers could work together to develop or procure an electronic system. AP agencies and providers could use the electronic system for a year and then determine if it is worthwhile to continue using the system. The pilot could be particularly helpful in getting a better sense of the cost of an electronic system and the implementation challenges, including available and desired technical support. The pilot also could serve to begin identifying best practices. Additionally, it could shed greater light on the most appropriate role for CDE. In all these ways, the findings from the pilot could help other AP agencies decide if they want to implement an electronic process.

Alternatively, the State Could First Survey AP Agencies and Providers to Determine If Higher One–Time Priorities Exist. Before even creating a pilot program, the state might want to explore whether other possible changes to child care administrative practices could be more advantageous for AP agencies and providers than an electronic records system. To this end, the Legislature could direct CDE to survey AP agencies and providers about their one–time priorities. The department either could conduct the survey with its existing staff or contract with a surveying entity for such work. The department likely could absorb the minor one–time cost of such a survey. Upon receiving the survey results, the Legislature could use them to inform its future budget and policy decisions.