LAO Contacts

February 14, 2019

The 2019-20 Budget

Proposition 56 Revenues:

Reductions in Fixed Allocations

Background

State Excise Taxes on Cigarettes and Other Tobacco Products. The state currently levies a $2.87 per pack excise tax on cigarettes and a 63 percent excise tax on the wholesale price of other tobacco products. In November 2016, voters approved Proposition 56, which raised the cigarette tax from $0.87 per pack to the current level of $2.87 per pack and raised the tax on other tobacco products by a corresponding amount.

Allocation of Proposition 56 Revenues. The state deposits Proposition 56 revenues into a special fund. As described in our 2017 report, The 2017-18 Budget: An Overview of the Governor’s Proposition 56 Proposals, the measure directs the state to allocate the revenue in four steps:

Step One: Revenue Backfills. The Proposition 56 taxes reduce tax-paid tobacco purchases (hereafter, “consumption”), resulting in lower revenue for other tobacco tax funds. In the first revenue allocation step, some Proposition 56 revenues replace—or “backfill”—these revenue losses.

Step Two: Tax Administration. The California Department of Tax and Fee Administration (CDTFA) receives up to 5 percent of remaining funds to pay for the costs of administering the tax.

Step Three: Fixed Allocations. Various state entities receive fixed dollar amounts for physician training, preventing and treating dental disease, enforcement of tobacco-related laws, and audits.

Step Four: Percentage Allocations. Various programs receive specified percentages of the remaining funds. The largest percentage allocation—82 percent—goes to the Medi-Cal program, which provides health care services to low-income Californians.

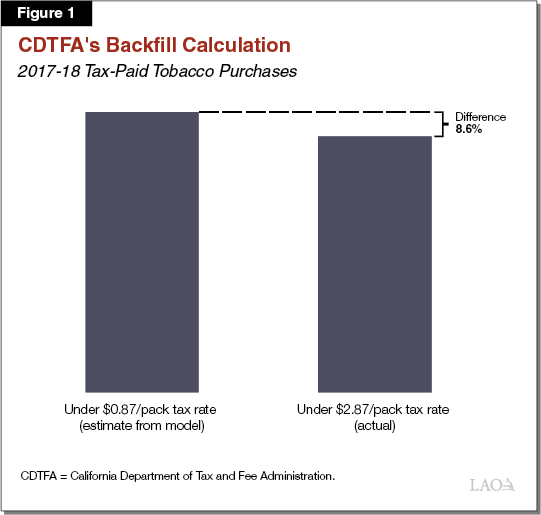

CDTFA’s Backfill Calculation. To carry out the first step described above (revenue backfills), CDTFA uses a model to estimate what tobacco consumption would have been without the Proposition 56 taxes. (The model is based on statistical relationships between tobacco consumption and other factors, including tax rates.) For 2017‑18, for example, CDTFA compared two numbers: (1) actual tobacco consumption in 2017‑18, and (2) the level of purchases that would have occurred under a tax rate of $0.87 per pack, as predicted by the model. As illustrated in Figure 1 below, the difference between these two numbers is the estimated effect of the Proposition 56 tax increases in 2017‑18. Note that the estimate is a comparison between two numbers in the same year—not a change from one year to the next.

Percentage Allocations Decline as Revenue Declines. We expect Proposition 56 tax revenue to decline over time. In the revenue allocation formula described above, this gradual decline in revenue results in corresponding gradual declines in the percentage allocations—such as the allocation for Medi-Cal.

Reductions in Fixed Allocations. A provision of Proposition 56 directs the administration to perform an annual calculation related to reductions in tobacco revenues. This provision directs the administration to use the results of this calculation to reduce the fixed allocations for physician training, dental disease, and tobacco enforcement. The provision leaves key details of the calculation open to interpretation.

Governor’s Approach

Proposition 56 Revenues. The Governor’s January budget proposal projects that overall Proposition 56 revenues will total $1.41 billion in 2019‑20—2.2 percent lower than 2018‑19.

Reduce 2019‑20 Fixed Allocations Based on Backfill Calculation. For 2019‑20, the Governor proposes 8.6 percent year-over-year reductions in the fixed allocations for physician training, dental disease, and tobacco enforcement. This number comes from CDTFA’s 2017‑18 backfill calculation, which estimated that tobacco consumption in 2017‑18 was 8.6 percent lower than it would have been under a tax rate of $0.87 per pack. The resulting dollar amounts appear in Figure 2 below.

Figure 2

Reductions in Proposition 56 Fixed Allocations

(In Millions)

|

Program |

2018‑19 Allocation |

2019‑20 Allocation |

|

University of California—Graduate Medical Education |

$40.0 |

$36.5 |

|

Department of Public Health—State Dental Program |

30.0 |

27.4 |

|

Department of Justice—Enforcement |

36.0 |

32.9 |

|

Department of Public Health—Enforcement |

6.0 |

5.5 |

|

California Department of Tax and Fee Administration—Enforcement |

6.0 |

5.5 |

No Multiyear Proposal. The administration has not yet decided how adjustments to the fixed allocations will be determined in 2020‑21 and beyond.

LAO Comments

Assessment of 2019‑20 Proposal

2019‑20 Proposal Is Reasonable. The Governor’s overall Proposition 56 revenue projections are reasonable. The measure directs the administration to reduce the fixed allocations of Proposition 56 revenue, but it does not provide precise instructions for calculating these reductions. In our view, the administration’s 2019‑20 reductions reflect a reasonable interpretation of the statute.

Reductions in Percentage Allocations Much Smaller Than Reductions in Fixed Allocations. Year-over-year declines in the percentage allocations generally track year-over-year declines in overall Proposition 56 revenue, which tend to be much smaller than 8.6 percent. For example, the Governor’s Budget projects that the percentage allocation to Medi-Cal will decline by 1.7 percent in 2019‑20.

Future Decisions Could Have Substantial Fiscal Effects

Future Allocations Unknown . . . At this time, we do not know how the administration will determine reductions to the fixed allocations in 2020‑21 and beyond. However, some future choices would be more logically consistent with the administration’s current approach than others.

. . . But Some Potential Approaches Would Raise Concerns. CDTFA’s backfill estimate is not a year-over-year change; it is a comparison between two numbers that describe the same year. If the administration overlooks this distinction, it might interpret the backfill estimates as year-over-year changes when it reduces the fixed allocations in 2020‑21 and beyond. Hereafter, we refer to this problematic approach as the “year-over-year method.”

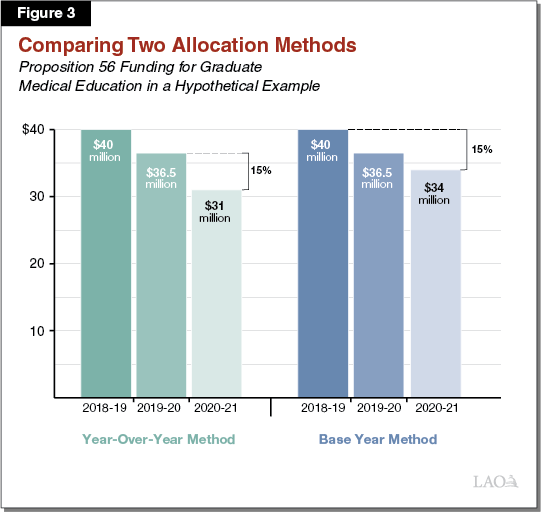

Year-Over-Year Method: an Example. The left-hand side of Figure 3 below illustrates the allocation for graduate medical education under the year-over-year method. Suppose—hypothetically—that CDTFA’s 2018‑19 backfill calculation produces an estimate of 15 percent. Under the year-over-year method, the administration would calculate the 2020‑21 allocation by starting with the prior year’s allocation—in this case, the $36.5 million allocated in 2019‑20—and then reducing it by 15 percent. The resulting 2020‑21 allocation would be $31 million.

A Better Approach: the “Base Year Method.” Instead of treating the backfill estimate as a year-over-year change, the administration instead could apply it to the same fixed dollar amount each year. In particular, this amount could be the original funding amount authorized by Proposition 56 and allocated in 2018‑19. In effect, this approach would maintain 2018‑19 as a base year going forward, so we refer to it as the base year method.

Base Year Method: an Example. The right-hand side of Figure 3 illustrates the allocation for graduate medical education under the base year method. Suppose—hypothetically—that CDTFA’s 2018‑19 backfill calculation produces an estimate of 15 percent. Under the base year method, the administration would calculate the 2020‑21 allocation by starting with the original funding amount authorized by Proposition 56—in this case, $40 million—and then reducing it by 15 percent. The resulting 2020‑21 allocation would be $34 million.

Fiscal Effects Likely Would Grow Over Time. As illustrated by the examples, the choice between the year-over-year method and the base year method could have substantial fiscal effects as soon as 2020‑21. These effects likely would grow over time. Unlike the base year method, the year-over-year method likely would lead to large cumulative reductions over time—much larger than the overall decline in tobacco tax revenue.

Other Issues to Consider

Alternative Interpretation: Proportional Year-Over-Year Reductions? The administration’s approach to reducing the fixed allocations is based on one interpretation of an ambiguous provision of Proposition 56. Alternatively, perhaps this provision aims to reduce the fixed allocations every year in direct proportion to year-over-year declines in tobacco consumption—and, in turn, declines in overall Proposition 56 revenue. For example, given the 2.2 percent projected revenue decline in 2019‑20, the fixed allocations could be reduced by 2.2 percent. Although this alternative interpretation has some appealing features, it arguably does not follow the statutory language as closely as the administration’s interpretation.

Legislative Options Limited. Most allocations of Proposition 56 revenue are subject to continuous appropriations. As such, these funding decisions can bypass the annual budget process, limiting the Legislature’s involvement. Furthermore, Proposition 56 does not allow the Legislature to amend the provision that reduces the fixed allocations. Nevertheless, the Legislature can conduct oversight to ensure that the administration implements Proposition 56 appropriately.