LAO Contacts

April 3, 2019

A Review of LifeLine Budget

Estimates and Enrollment Process

- Introduction

- Background on LifeLine Program

- Budget and Caseload Forecasting

- Enrollment and Renewal Process

Summary

The California Public Utilities Commission’s (CPUC’s) LifeLine program provides free or discounted phone service to about 1.7 million households and has an annual budget of more than $350 million. The Supplemental Report of the 2018‑19 Budget Act requires our office to (1) review the caseload and budget estimates for this program and make recommendations about how CPUC could improve the accuracy of its estimates and (2) assess and make recommendations about ways to improve enrollment and re‑enrollment in the program.

Caseload Forecasts Appear to Be Improving, but Significant Uncertainty Remains. Caseload is a primary driver of costs in the LifeLine program. In recent years, the CPUC has substantially overestimated caseload. These overestimates are primarily attributable to major structural changes to the LifeLine program. Most notably, CPUC overestimated the enrollment effects of a 2014 decision to expand the program to include discounts for wireless service. In our view, recent changes to CPUC’s forecasting methodology reflect a significant improvement. However, significant uncertainty about future caseload and costs remain, particularly related to state and federal policy changes that could affect enrollment. As a result, we recommend the Legislature continue to monitor the accuracy of CPUC’s forecasts as part of the regular budget process.

Different Potential Explanations for Low Enrollment and Renewal Rates. Currently, about 40 percent of eligible households are enrolled in the program. There are several reasons why an eligible household might not enroll or renew in the program, including that the household might (1) be unaware of the program or need to renew, (2) prefer a non‑LifeLine telephone plan or carrier, or (3) have difficulty completing the enrollment and/or renewal process. CPUC is currently planning to implement some changes intended to improve enrollment and renewal. However, CPUC has not conducted a large‑scale study of the primary reasons why eligible households do not participate in the program.

We recommend the Legislature direct CPUC to conduct a formal evaluation of the major reasons why eligible households do not enroll in the program in order to inform future decisions about potential changes that could improve enrollment. The Legislature might want to wait for the results of such an evaluation before directing CPUC to make major changes to the program, though the Legislature could consider adopting other changes that appear to be relatively low cost and that are likely to have some enrollment benefits. To help assess the merits of different options, the Legislature might want to consider directing CPUC to report on the feasibility, costs, and risks associated with implementing potential changes. For other options that are likely more costly or complicated, the Legislature could wait until the results of the study are complete to determine whether they are likely to address significant barriers to enrollment, or direct CPUC to implement them on a pilot basis.

Introduction

The California LifeLine program (LifeLine), which is administered by CPUC, provides free or discounted telephone service to low‑income households. As part of the 2018‑19 budget package, the Legislature adopted supplemental report language directing our office to review the LifeLine program’s budget estimates—specifically the caseload estimate—and make recommendations on how CPUC could improve the accuracy of these estimates. In order to help address concerns about the number of individuals enrolling and staying enrolled in LifeLine, the supplemental report language also requires our office to assess and make recommendations about ways to improve enrollment and re‑enrollment (also known as renewal) in the program.

This report responds to the supplemental report language. Specifically, we provide (1) background information on the LifeLine program, (2) our assessment and recommendations related to CPUC’s LifeLine budget and caseload estimate, and (3) our assessment of and recommendations related to potential factors contributing to current enrollment and renewal rates.

Background on LifeLine Program

State Law Requires Discounted Telephone Service to Low‑Income Households. The Moore Universal Service Telephone Act of 1987 established the goal of offering basic telephone service at affordable rates to the greatest number of California residents. To help achieve this goal, state law directs CPUC to develop the LifeLine program to provide basic telephone service at a discounted cost to low‑income households. In order to administer this program, CPUC is required to establish (1) the minimum level of service a telephone plan would need to provide, (2) the rates and charges program participants would have to pay for discounted service, and (3) eligibility criteria to qualify to receive that service. State law also requires that rates for LifeLine enrollees be no more than 50 percent of basic telephone service rates.

To qualify for California’s LifeLine program, a household must have income below 150 percent of the federal poverty level (FPL) (for example, currently about $38,000 annually for a family of four to qualify) or be enrolled in certain public assistance programs for low‑income households, such as Medi‑Cal or CalFresh. Roughly 90 percent of enrollees demonstrate eligibility for the LifeLine program by qualifying for certain programs (program‑based eligibility). Each eligible household can receive one subsidized telephone line—either wireline or wireless.

For each household enrolled in the program, CPUC generally provides telephone companies (carriers) a monthly state subsidy equal to 55 percent of the most expensive basic landline service from the four largest carriers. The subsidy is meant to offset the lower rate charged to the consumer. Currently, the maximum state subsidy is about $15 a month. The Federal Communications Commission (FCC) administers the federal LifeLine program that provides an additional monthly discount of about $9 to qualifying plans. Currently, the federal and state programs are closely aligned so most enrollees are eligible for both the federal and state subsidy.

Most Enrollees Are Now in Wireless Plans. Historically, LifeLine has included only traditional wireline (landline) service. Chapter 381 of 2010 (AB 2213, Fuentes) gave CPUC the authority to allow LifeLine customers to choose between wireline and wireless service. In January 2014, CPUC expanded the program to allow wireless carriers to offer LifeLine service. Wireless carrier participation is voluntary, and participating wireless plans are eligible for the same monthly subsidy amount as for traditional landline plans. Currently, about a dozen wireless carriers participate in the program in California although none of the largest wireless carriers (such as Verizon and AT&T) participate. Participating carriers have flexibility to determine the plans and prices they offer, subject to the minimum requirements set by CPUC, such as including a minimum of 1,000 monthly voice minutes to be eligible for the entire $15 monthly state subsidy. Most LifeLine wireless plans are free and include unlimited minutes and unlimited text. Many of them also include some data. Carriers will also often provide new customers a free or discounted phone when customers sign up. The state provides a one‑time $39 connection subsidy to a carrier for each new enrollee or if an enrollee switches to a new carrier. The CPUC also contracts with a third‑party administrator (TPA) to conduct many administrative tasks needed to operate the program, such as determining household eligibility and conducting the annual renewal process.

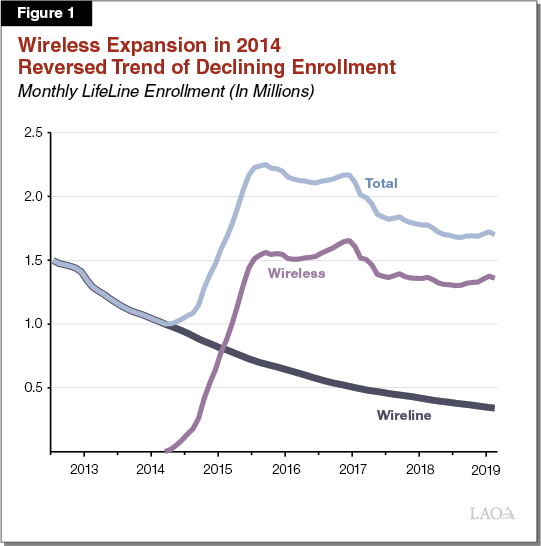

As shown in Figure 1, program enrollment had been steadily declining prior to adding wireless service in 2014. Program enrollment increased significantly after adding wireless in 2014, but then leveled off in 2016 and has been declining in recent years. Currently, there are about 1.7 million total enrollees in the LifeLine program, including about 1.4 million wireless enrollees.

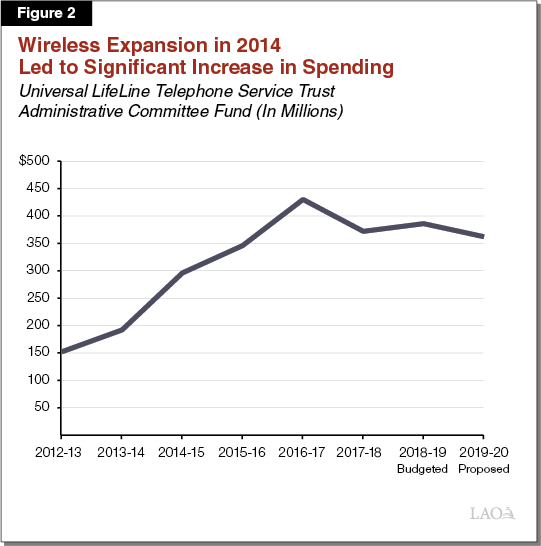

Annual Budget Over $350 Million. As shown in Figure 2, trends in program costs largely follow trends in enrollment. The expansion to include wireless service in 2014 resulted in a significant increase in costs. For example, 2015‑16 spending for LifeLine was $345 million (from the Universal LifeLine Telephone Service Trust Administrative Committee Fund)—more than twice 2012‑13 spending. The 2018‑19 budget allocated $390 million for the LifeLine program, and the Governor’s 2019‑20 budget proposes $362 million for the program. The large majority of spending is for monthly subsidies to carriers for plan discounts. For example, about three‑quarters of the 2018‑19 budget is expected to go towards monthly subsidies to carriers. Other significant program costs include the one‑time service connection subsidies to carriers (13 percent) and payments to the TPA (4 percent).

Revenues to fund LifeLine are collected from a surcharge on intrastate telephone bills. (LifeLine customers are exempt from paying this surcharge and other taxes and fees applied to their phone bill.) The surcharge is currently set at 4.75 percent of intrastate revenue, though CPUC can adjust the level of the surcharge based on its projections of the amount of revenue needed to cover the costs of the program.

Budget and Caseload Forecasting

In this section, we provide our assessment of CPUC’s budget estimates, focusing specifically on caseload estimates. As discussed above, caseload is the major factor driving overall costs for the LifeLine program. Seventy‑four percent of overall costs are for monthly subsidies to carriers for the phone services. The total amount of monthly subsidies are driven by two factors: (1) the amount of the subsidy and (2) caseload. In recent years, the amount of the subsidy has been relatively steady. However, as noted earlier, overall caseload has changed significantly from year to year. Other significant program costs—such as one‑time connection subsidies and TPA costs—are also driven, in part, by the number of households enrolling in the program.

Background

CPUC Develops Caseload and Spending Estimates as Part of Annual Budget Process. As part of the annual state budget process, in January, CPUC releases estimates of LifeLine program caseload and spending for the next fiscal year. CPUC then provides updated estimates in the spring as part of the Governor’s May Revision. As we discuss below, CPUC has made changes in recent years in how it develops these estimates.

Estimates Appear to Be Improving, but Uncertainty Remains

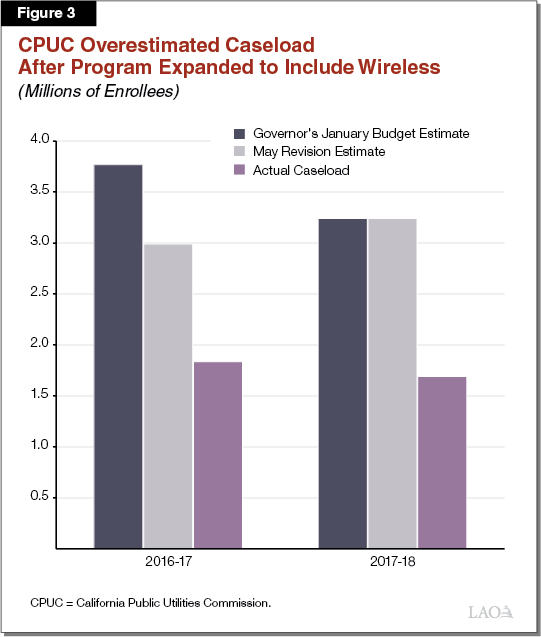

Recent Enrollment Projections Have Been Overstated. CPUC has substantially overestimated program caseload in recent budgets. Specifically, Figure 3 shows CPUC caseload estimates at different stages of the budget process compared to actual caseload for each of the prior two fiscal years. The Governor’s January budget proposal for 2016‑17 estimated that caseload would be nearly 3.8 million by the end 2016‑17 (including 3.5 million wireless enrollees). About five months later, the Governor’s May Revision for 2016‑17 estimated that caseload would be nearly 3 million. As shown in the figure, actual program enrollment at the end of 2016‑17 was only 1.8 million (1.4 million wireless)—significantly less than estimated.

Major Program Changes Have Made Accurately Forecasting Caseload Difficult . . . We attribute these recent overestimates of program caseload primarily to major changes to the LifeLine program that have made it difficult to accurately forecast future caseload. Most notably, the expansion to include wireless service in January 2014 substantially expanded the type of service available to eligible populations. Such a substantial structural change to the program made projecting caseload inherently difficult given the uncertainty about the number of new households that would now enroll in the program specifically because of the change. In the first few years of including wireless service, CPUC estimated caseload by trying to forecast the percentage of eligible households that would enroll in the program. For example, the Governor’s January budget proposal for 2016‑17 assumed that 90 percent of the estimated 4.2 million eligible households would enroll by the end of 2016‑17. The estimated number of eligible households was based on Department of Finance (DOF) estimates of the number of households with incomes less than 200 percent of the FPL—the eligibility threshold for the CalFresh program. The assumed percentage of the eligible households that would enroll (also known as the “take‑up rate”) was based on CPUC’s analysis of take‑up rates in other programs for low‑income households (such as Medi‑Cal). Actual enrollment data show a take‑up rate close to 45 percent.

Other substantial programmatic changes have also added to the difficulty forecasting caseload. For example, after a rapid increase in enrollment, CPUC eliminated the one‑time connection subsidy in July 2015, and enrollment subsequently declined. This might have occurred because carriers received less funding for new enrollees and, in turn, carriers reduced their marketing and outreach. We note, however, that enrollment has continued to decline even after the subsidy was reinstated in December 2015.

. . . But Caseload Estimates Appear to Be Improving. CPUC recently changed its methodology for forecasting LifeLine caseload as part of the Governor’s 2018‑19 May Revision. The new methodology relies on historical trends in new enrollments and annual renewals to project future caseload, rather than basing estimates on assumptions about future take‑up rates. In our view, this recent methodological change reflects a significant improvement. Such a methodology was infeasible in the initial years after the program expanded to include wireless because there was limited historical data on wireless enrollments and it was unclear when enrollment might stabilize after the expansion to include wireless. However, once a few years of historical data on program enrollment were available—and enrollment stabilized somewhat over the last couple of years—relying on historical trends became a more feasible approach.

Recent enrollment data suggests that caseload forecasts are improving under the new methodology. The 2018‑19 May Revision estimated that monthly caseload would be about 1.6 million and, so far, average monthly program enrollment in the first few months of 2018‑19 was about 1.7 million. We caution, however, that the available monthly enrollment data upon which to evaluate the new methodology is still limited and, thus, not sufficient to conclude that the new methodology should be adopted as a long‑term approach.

Significant Caseload and Cost Uncertainty Remains. Although CPUC’s caseload estimates appear to be improving, several factors continue to make it difficult to project future enrollment, particularly several recently adopted and proposed programmatic changes at the federal and state levels. For example, the FCC has adopted changes that phase‑out subsidies for plans that do not include broadband. There continues to be uncertainty about how these changes will affect LifeLine enrollment in California both because many of these changes have not been fully implemented yet and some have been challenged in court. If fully implemented, some of the federal changes could reduce the availability of federal subsidies for certain plans and/or reduce the number of carriers participating in the program. Fewer carriers could also lead to fewer plans being available. Fewer available plans—or more expensive plans—might make the program less attractive to certain households and, in turn, reduce the number of enrollees.

In addition to the above federal changes, future CPUC changes to the state’s LifeLine program could have a significant effect on enrollment. For example, as discussed below, CPUC is considering a variety of changes to streamline the enrollment and renewal process with the intent of increasing overall program enrollment. In light of this ongoing uncertainty, similar to previous years, the Governor’s proposed budget for 2019‑20 includes provisional language authorizing DOF to increase budget allocations to LifeLine midyear if there are unexpected changes in program costs. We discuss this authority in more detail in the box below.

Budget Bill Language Provides Flexibility Given Caseload Uncertainty

Similar to previous years, the Governor’s proposed 2019‑20 budget includes language authorizing the Department of Finance to increase funding allocations to the LifeLine program beyond the amount provided in the budget to cover additional program costs based on information submitted by the California Public Utilities Commission (CPUC) on the amount of claims submitted by carriers. Any changes made pursuant to this authorization would be subject to a 30‑day review period by the Joint Legislative Budget Committee. In our view, it is reasonable to provide additional flexibility to make midyear budget adjustments to cover unexpected changes in costs given the uncertainty around caseload, carrier participation, and federal actions. However, in other cases where the Legislature provides this type of budget flexibility, it often includes some limitations on the administration’s authority to maintain legislative oversight. Two common examples are: (1) a cap on the additional amount that can be allocated and (2) requiring the administration to demonstrate that certain conditions are met in order to allocate the additional funds. The Legislature might want to consider including one or both of these types of limitations in the proposed budget bill language to maintain additional fiscal oversight. For example, the Legislature could require the administration to demonstrate that the additional spending is the result of unforeseen changes in caseload, rather than decisions made by CPUC to modify or expand the program.

Large Fund Balance Has Accrued. As a result of overestimating caseload and costs in recent years, the amount of surcharge revenue collected has exceeded program costs, and CPUC has accrued a large balance in the Universal LifeLine Telephone Service Trust Administrative Committee Fund. The Governor’s budget for 2019‑20 projects a $482 million fund balance at the end of 2018‑19, growing to $580 million by the end of 2019‑20. CPUC has not adjusted the surcharge rate that funds the program since November 2016.

LAO Recommendation

Continue to Monitor Caseload Estimates. We recommend that the Legislature continue to monitor the accuracy of CPUC’s caseload forecasts as part of the regular budget process. Although we think CPUC’s methods for estimating caseload have improved, the evidence that the new methods will accurately forecast caseload are still somewhat preliminary. In addition, future changes to the program at the state and federal level could have significant, yet uncertain, effects on caseload and costs. Our office will continue to review future estimates as part of our regular budget analysis and provide our comments and recommendations to the Legislature. Accurate budget forecasts are important because they are used to determine the appropriate surcharge used to fund the program. Underestimating expenditures creates a risk that surcharges do not generate enough revenue to fund the program. On the other hand, overestimates result in higher than necessary surcharges on consumers.

Enrollment and Renewal Process

Background

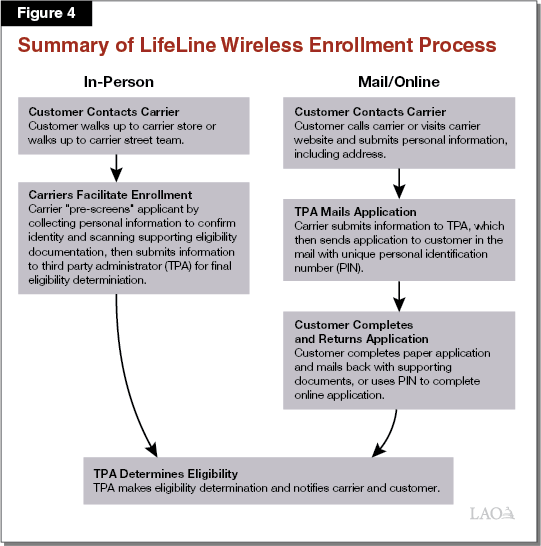

Carriers and TPA Play Key Roles in Program Enrollment. Both the carriers and the TPA play significant roles in customer enrollment and the annual renewal process. For initial enrollment, the typical wireline customer calls his or her carrier to express interest in participating in the program. The carrier then mails an application to the customer, who completes it and returns it in the mail. Wireless is typically a different process. Figure 4 summarizes the process by which an eligible household can enroll in the wireless portion of the program. In general, the customer begins enrollment by contacting a carrier, which then utilizes the TPA to complete the enrollment process. Nearly 80 percent of wireless customers initiate the enrollment process in‑person through carrier “street teams” made up of representatives from the carrier. The street teams usually set up temporary booths in public places—such as social service agencies and shopping centers—and offer free or discounted wireless service to potential LifeLine customers. In all enrollment pathways, the customer must provide personal information that can be used to verify identity, including address, date of birth, and social security number. The customer must also provide information on income eligibility, such as a copy of an identification card for a qualifying public assistance program or prior year tax returns.

Annual Renewal Relies Heavily on Mailing Documents to Consumers. About 100 days before the annual renewal date (also known as the anniversary date), the TPA mails enrollees a renewal packet that includes a personal identification number (PIN). The customer can complete and return the renewal form through the mail, use the PIN to renew online, or use the PIN to renew through an automated phone system. Unlike the initial enrollment, the customer self‑certifies that he or she is still eligible for the program. The customer does not have to resubmit documentation to demonstrate meeting income requirements. Most customer renewals are submitted through traditional mail.

In December 2015, CPUC began giving carriers the option to send text message renewal reminders to customers (with customer consent). These text messages notify the enrollee that they will receive a renewal packet in the mail. They also include a PIN and links to the website where the enrollee can renew.

Program Take‑Up Rate Is About 40 Percent. According to estimates from DOF, there are currently about 3.9 million households with income less than 200 percent of the FPL. CPUC uses this as its estimate for the overall number of eligible households because it is similar to the income level of some of the other qualifying public assistance programs, such as CalFresh. This estimate is subject to significant uncertainty because the methods for determining what constitutes a household and how to define income varies between programs. However, it provides a rough estimate of the number of households eligible for LifeLine. With about 1.7 million current LifeLine enrollees, this means that about 40 percent of eligible households are enrolled in the program. Furthermore, only about 25 percent of enrollees successfully complete the annual renewal process. In most cases, this is because the enrollee does not submit a renewal form. For example, only about one‑third of wireless customers complete and return renewal forms.

The overall program take‑up rate is substantially lower than some other low‑income public assistance programs. For example, the CalFresh take‑up rate is about 70 percent. However, the national average LifeLine take‑up rate is about 25 percent, and California has the highest estimated take‑up rate of any state in the country. This is likely in large part because California offers the largest monthly subsidy of any state.

Different Potential Explanations for Enrollment and Renewal Rates

Based on our conversations with CPUC and various stakeholders, there are several potential reasons why an eligible household would not enroll or renew its enrollment in the LifeLine program. Such reasons could include that the household (1) is unaware of the program or the need to renew enrollment, (2) prefers a non‑LifeLine telephone plan or carrier, or (3) has difficulty completing the enrollment and/or renewal process. We discuss each of these potential reasons in more detail below, as well as some steps CPUC plans to take to address some these issues.

Eligible Households Might Be Unaware of Program or Need to Renew. In some cases, eligible households might be unaware the program exists or that they need to complete an annual renewal to remain in the program. Currently, CPUC does not have a formal statewide marketing and outreach plan to ensure eligible customers are aware of the program. Instead, individual carriers do almost all of the marketing and outreach for their own plans. Relying on carriers to conduct outreach has certain advantages for the state. As private companies, carriers have a profit incentive to increase the number of households they serve and are likely to have some level of expertise in marketing their product effectively. In addition, the carriers bear all of the costs associated with outreach and marketing, rather than the state. However, the current approach might have some limitations as a tool to ensure strong and consistent overall consumer awareness. Examples of these limitations include:

- Lack of Coordination With Other Government Agencies or Nonprofits Limits Outreach. Currently, CPUC has only limited coordination with other government agencies or nonprofit organizations that work with income‑eligible households—such as county social service agencies, certain health care providers, and community‑based organizations (CBOs). These agencies and organizations frequently can be a source of information for eligible households on different programs and services available to them and are well‑positioned to provide marketing and outreach materials to potential LifeLine customers.

- Lack of Program “Branding” Could Affect Renewal Rates. Each carrier uses different names and branding for the LifeLine plans they offer. Many of the plans offered do not include the term “LifeLine” in the name. As a result, some households that enroll through street teams might not know that they are enrolling in a government‑subsidized program. In turn, when the customer receives annual renewal information from the LifeLine program (rather than the phone carrier), he or she might not understand that the materials are needed to renew their phone service. This could be one factor contributing to a low renewal rate.

- Inconsistent Marketing Across Geography and Populations. Carriers have an incentive to conduct outreach and marketing in areas where they are likely to get the most customers (such as urban areas), but carrier marketing activities might be more limited in rural areas of the state. Also, some program materials currently are available in only English and Spanish. This could reduce program awareness among certain ethnic groups that primarily speak other languages, such as Asian languages.

Consumers Might Prefer a Different Plan or Carrier. Even if eligible households are aware of the program, they might choose not to enroll in LifeLine because they prefer a different plan or carrier. For example, each eligible household can receive only one discounted phone line. For wireless service, there are no family plans offered through the program. As a result, some families might choose to get their wireless service through a different carrier that offers a family plan. In addition, as discussed above, the largest wireless carriers—such as Verizon and AT&T—do not currently participate in the program. Some eligible households might choose to purchase wireless plans from the larger carriers because they prefer their services, even if they are more expensive than a LifeLine plan.

Challenges in Completing Enrollment and Renewal Process. In some cases, the enrollment and renewal process might be slow, confusing, and/or burdensome for households. As a result, some eligible households might not enroll in the program or renew service. Some potential problems with the current enrollment and renewal process include:

- Online Enrollment Process Overly Complicated. Households interested in enrolling in the program online must first contact a carrier to request that a LifeLine paper application be mailed to them, which includes a unique PIN that is needed to enroll online. It can take at least a few days for this application to arrive, which makes the overall online enrollment process more complicated and lengthy for enrollees. As a result, some enrollees might sign up for a non‑LifeLine plan instead of waiting to complete the application process so that they can quickly have phone service.

- Lack of Real‑Time Eligibility Verification Creates Problems. All methods of enrollment require the TPA to verify documents demonstrating eligibility either through enrollment in a qualifying public assistance program or by income level. In some cases, obtaining and submitting such documents might be difficult. For example, making copies of the documents could be difficult for some households if they do not have easy access to a copier or scanner. In addition, it may take the TPA a few days to verify eligibility. This creates a delay in the process. We also note that the current eligibility verification process could result in some individuals enrolling in the program even if they are not eligible. For example, a household can qualify by submitting an identification card for a qualifying public assistance program. However, while such a document shows that the household was at one time enrolled in the program, it does not always indicate whether the person is currently enrolled in the program.

- Renewal Process Relies Heavily on Mailing Documents to Enrollees. Nearly 60 percent of customers who do not renew are back on the program within a year. One possible explanation for this is that the current renewal process is confusing or burdensome and, thus, at least part of the reason for low renewal rates. The renewal process relies heavily on mailing renewal documents to enrollees. As a result, customers might not be receiving the information because they moved. About 6 percent of initial renewal notices are returned as nondeliverable. In addition, mailing paper documents could increase the possibility that the customer loses the renewal packet, or does not notice it. As discussed above, CPUC started giving carriers the option to send text message renewal reminders. Last year, renewal rates for carriers that participated was about 5 percent higher than for those carriers that did not participate.

- Correctible Denials Could Be Confusing. If a potential customer initially submits an incomplete application or renewal form, the TPA mails the customer a “correctible denial” packet. This packet includes a new application or renewal that the customer can complete again. Currently, both the initial documents and the correctable denial packet come in pink envelopes. This could be confusing for some customers if they think the correctible denial is a duplicate. In addition, the customer has to complete the entire application again, even if there was just one piece of incomplete information. As a result, the customer might get frustrated and stop completing the application.

Lack of Evaluation to Determine Reasons for Enrollment and Renewal Rates. Since the expansion of LifeLine to include wireless, there has not been a large‑scale formal evaluation of the reasons why eligible households do not participate in the program. Currently, CPUC relies on call center data, certain program metrics (such as undeliverable mail rate), and feedback from stakeholders to identify potential problems with enrollment and renewal. CPUC is currently working with the TPA to undertake some limited research activities, such as customer surveys to better understand potential problems with the renewal process. However, CPUC reports that the survey includes a relatively small sample of customers and the questions are only addressing certain aspects of the renewal process.

CPUC Planning Actions to Improve Enrollment and Renewal. CPUC is currently planning to implement certain actions aimed at improving enrollment and renewal rates. For example, CPUC plans to implement mandatory text message renewal reminders for all wireless customers in the coming months. It also plans to implement a statewide option to renew over the phone with a representative from the TPA. This option was recently made available only to households located in areas that were damaged by recent wildfires.

CPUC is also considering pilot programs proposed by different stakeholders intended to increase enrollment and renewal rates. The pilot programs that CPUC is considering include:

- Changes to Encourage Participation From Carriers With Greater Brand Name Recognition. Boost Mobile is proposing a pilot whereby the state would provide a LifeLine subsidy for plans that are already available to the general public. Effectively, this would make the program more similar to a voucher program because the subsidy could be used for any available plan—rather than only LifeLine plans that have been approved by CPUC. This could make it easier for some of the larger carriers to participate because they do not have to develop separate LifeLine plans that require CPUC approval.

- Online Enrollment Option Through Carrier Website. Some stakeholders are proposing to create an online enrollment option whereby a customer can enroll through a carrier’s website without having to request a PIN. This could potentially streamline the enrollment process.

- Outreach and Coordination With CBOs and Other Entities. For example, one proposed pilot would involve working with a CBO in San Francisco to enhance outreach to eligible households. Another proposal would create a process whereby health care providers that serve Medi‑Cal populations could streamline the eligibility determination process by verifying that a household has Medi‑Cal insurance coverage.

LAO Recommendations

In our view, conducting a more thorough evaluation of the major reasons why eligible households do not enroll in the program would be valuable. As such, we recommend below directing CPUC to conduct such an evaluation. The findings from this evaluation could inform future decisions about what types of changes are likely to result in the most substantial improvements to enrollment. The Legislature might want to wait for the results of such an evaluation before directing CPUC to make major changes to the program.

Below, we also offer some potential changes that the Legislature could consider, even before such an evaluation is complete. To help assess the merits of these options, the Legislature might want to consider directing CPUC to report on the feasibility, costs, and risks associated with implementing these and other potential changes. For those that appear relatively low cost and that are likely to have some enrollment benefits, the Legislature could consider directing CPUC to implement the changes. For other options that are likely more costly or complicated, the Legislature might want to wait until the results of the study are complete to determine whether they are likely to result in significant enrollment benefits. In some cases, the Legislature might also want to consider directing CPUC to pilot some potential changes so the Legislature can evaluate the effectiveness of the changes while limiting the overall costs and risks. As discussed above, there is a large fund balance in the Universal LifeLine Telephone Service Trust Administrative Committee Fund. This fund balance could be used to pay for some of these one‑time evaluation and pilot activities.

Direct CPUC to Conduct Study Evaluating Key Factors Affecting Enrollment and Renewal Rates. We recommend the Legislature direct CPUC to conduct a study to identify the primary reasons for eligible households not enrolling in the program, such as lack of program awareness, preferences for non‑LifeLine plans, and challenges completing the enrollment or renewal process. This study would likely include a survey of eligible households—including those that are not enrolled in the program—to better understand the primary reasons that many households do not enroll or renew. This information could help the state target any future actions that are most likely to be effective at increasing enrollment. As an example, the state Employment Development Department (EDD) funded a similar study in 2015 that evaluated reasons for households not participating in the state’s paid family leave program to inform future outreach efforts and programmatic changes. This study cost $325,000. Although the scope and methods of the LifeLine study might be somewhat different, the EDD study provides one example of a study that can provide valuable insight into the reasons why eligible households might not enroll in a state program.

Consider Directing CPUC to Develop Statewide Marketing and Outreach Plan. We recommend the Legislature consider directing CPUC to develop a statewide marketing and outreach plan to help improve overall program awareness among eligible households. Such a plan could be costly to develop and implement, so we recommend the Legislature wait until the results of the above study are available before directing CPUC to develop the plan. Any such plan should incorporate information obtained from the study about specific locations or populations with lower program awareness to determine where outreach activities can be targeted to have the most substantial effect. A marketing and outreach plan could also incorporate results from any of the pilots that CPUC is currently considering. Such a plan should also be developed in consultation with the existing LifeLine Advisory Committee that advises CPUC on implementation of the program, state and local agencies administering public assistance programs, and CBOs that frequently interact with eligible populations. The Legislature might want to direct CPUC to consider the following options when developing a plan: (1) greater coordination with other state and local agencies and CBOs, (2) ensuring outreach and program information provided by CPUC and carriers is consistent to avoid consumer confusion, and (3) ensuring materials are available in an adequate number of languages.

Direct CPUC to Report on Options to Make LifeLine More Attractive to Eligible Households. One method to increase enrollment might be to improve the type or quality of plans being offered to potential enrollees. However, in general, we recommend the Legislature wait for the results of the above study to evaluate the degree to which the type of service being offered is a factor affecting enrollment before making major, program‑wide changes to the structure of the program. In the meantime, we recommend the Legislature direct CPUC to report at future budget or policy committee oversight hearings on various options to make LifeLine service more attractive to eligible households. These options might include such things as making more than one phone line available to each household and/or making changes to attract some of the larger carriers to the program. If implemented program‑wide, these types of policy changes could represent a significant change to the structure of the program and could be costly. For example, such changes could represent a significant departure from the federal LifeLine program and, thus, the state would need to consider whether any changes might increase the risk of carriers losing federal subsidies which would reduce the incentive for carriers to offer LifeLine service. Therefore, for any such changes, the Legislature might benefit from having a better understanding of the costs and risks of such options so it can weigh them against the potential benefits they would provide to eligible households. It also might want to consider piloting any changes to limit risk and evaluate effectiveness before expanding the changes program‑wide. The proposed Boost Mobile pilot that CPUC is considering is one example of such an approach.

Direct CPUC to Report on Potential Changes to Enrollment and Renewal Process. We recommend the Legislature direct CPUC to report at future budget or policy committee hearings on the costs and feasibility of different options to improve the enrollment or renewal process. As discussed earlier, CPUC is already planning to implement some changes to the enrollment and renewal process. For example, CPUC plans to implement mandatory text messaging reminders for renewals for customers of all wireless carriers and add a statewide option for renewing over the phone with a TPA representative. In our view, these types of changes are reasonable to implement before the results of the above study are complete because they are likely relatively low cost and help make the enrollment and renewal process easier for consumers. There may be additional low cost changes that the Legislature could direct CPUC to implement. For example, the CPUC could change the color or format of correctible denial envelopes to ensure consumers do not confuse them with the initial applications. With additional information about the costs of such changes, the Legislature could then direct CPUC to implement changes that it determines are relatively simple and low cost, even before the results of the study are complete.

For potential changes that are likely to be more complex or costly, the Legislature could direct CPUC to pilot certain changes and/or wait for the results of the study to determine whether they would address a major barrier to enrollment. These types of changes might include:

- Enter into agreements with other state and/or local agencies—such as county social services agencies—to share program eligibility information with TPA, which could then allow a streamlined eligibility verification process and better real‑time information on household eligibility.

- Allow direct enrollment with the TPA through an updated LifeLine website without having to contact a provider first.

- Remove requirement for a PIN to renew.

- Use correctible denial forms that only ask for missing information rather than requiring enrollee to fill out the entire application again.