LAO Contact

May 11, 2019

The 2019-20 May Revision

Opportunity Zones

Summary. The Governor proposes to allow state tax benefits for investments in alternative energy or affordable housing in communities designated as Opportunity Zones under a new federal program. Given the mixed evidence regarding the benefits of similar policies and the existence of better mechanisms to fund affordable housing, we recommend rejecting the Governor’s proposal to create a state Opportunity Zone tax benefit.

Note. At the time of publication of this post, the administration had not yet made available trailer bill language with specific details of the proposal.

Background

Certain Economically Distressed Areas Identified as Opportunity Zones. A December 2017 federal law (known as the Tax Cuts and Jobs Act) established new tax benefits to encourage investment in certain economically distressed areas—called Opportunity Zones. States had discretion to identify Opportunity Zones based on federal guidance. Generally, these are areas with relatively low median income and high levels of unemployment. In California, the state Department of Finance—with public input—identified 879 census tracts as Opportunity Zones.

Tax Benefits for Investments in Opportunity Zones. When an individual or business sells an asset for more than they paid for it, their profit—known as a capital gain—is considered taxable income by the federal and state governments. Under the new Opportunity Zone program, taxpayers can defer federal income taxes on capital gains if those gains are invested in a business or real estate located in an Opportunity Zone. If investors hold on to the investment for multiple years, their tax liability on their deferred capital gains can be reduced. In addition, investors that maintain their investment for at least ten years will not be taxed on any capital gains earned on their Opportunity Zone investment.

Various Government Programs Help Californians Afford Housing. Federal, state, and local governments fund a variety of programs aimed at helping Californians, particularly low-income Californians, afford housing. Some of these programs support building of new affordably priced housing by providing direct financial assistance—typically tax credits, grants, or low-cost loans—to housing developers for the construction of new housing. In addition to constructing new housing, governments also have taken steps to make existing housing more affordable. In some cases, the federal government makes payments to landlords—known as housing vouchers—on behalf of low-income tenants for a portion of a rental unit’s monthly cost. In other cases, local governments have policies that require property owners charge below-market prices and rents.

Governor’s Proposal

Create State Opportunity Zone Tax Benefits. The Governor proposes to allow state tax benefits for investments in alternative energy or affordable housing in Opportunity Zones. State tax benefits for Opportunity Zone investments would mirror the federal tax benefits.

LAO Analysis

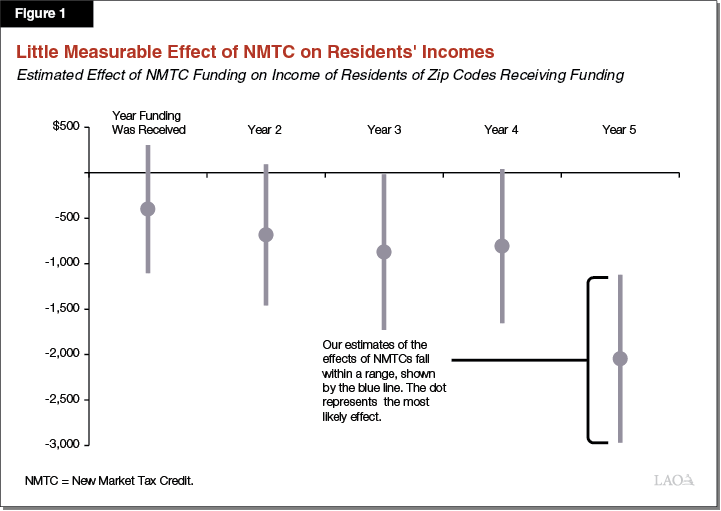

Unclear That Opportunity Zones Will Bring Economic Benefits to Residents. California and the federal government previously have carried out several programs similar to Opportunity Zones—such as Enterprise Zones, Empowerment Zones, and New Market Tax Credits—that have used tax benefits and other means to attempt to bring investment to economically distressed areas. Many studies have been conducted on these types of programs, but there is no consensus among researchers about whether these programs improve the economic situations of residents in targeted communities. Multiple credible studies have found that these programs do not have a measurable impact on economic outcomes, while others have found positive impacts. Our analysis (discussed below) of New Market Tax Credits—a federal program similar to Opportunity Zones—suggests this program did not measurably increase the incomes of residents living in California communities targeted for investment. One potential explanation for these findings is that many investments that received benefits from these programs would have occurred anyway and, therefore, did not represent new investments.

Similar Program Appears to Have Offered Californians Little or No Benefit in Past Years. Opportunity Zones share many similarities with another federal tax incentive: New Market Tax Credits. New Market Tax Credits, established in 2000, provide tax credits to taxpayers who invest in businesses or real estate in certain economically distressed areas. Investments under this program have been made for a wide variety of purposes, including renewable energy and affordable housing. Given the similarity between these programs, we analyzed the results of New Market Tax Credits in California to gain insight about the possible outcomes of Opportunity Zones in California. Specifically, we examined whether New Market Tax Credits had a measurable effect on the incomes of residents of zip codes that received New Market Tax Credit investments between 2003 and 2014. To do so, we first matched each zip code that received investment with another zip code in California that (1) was eligible but did not receive New Market Tax Credit investments and (2) had residents with similar incomes. We then compared the income growth of residents of zip codes that received investment to the income growth of residents in comparable zip codes that did not receive investment (using a statistical method known as difference in differences). Our results, summarized in Figure 1, suggest that New Market Tax Credits likely had little to no effect on the incomes of residents living in communities targeted for investment.

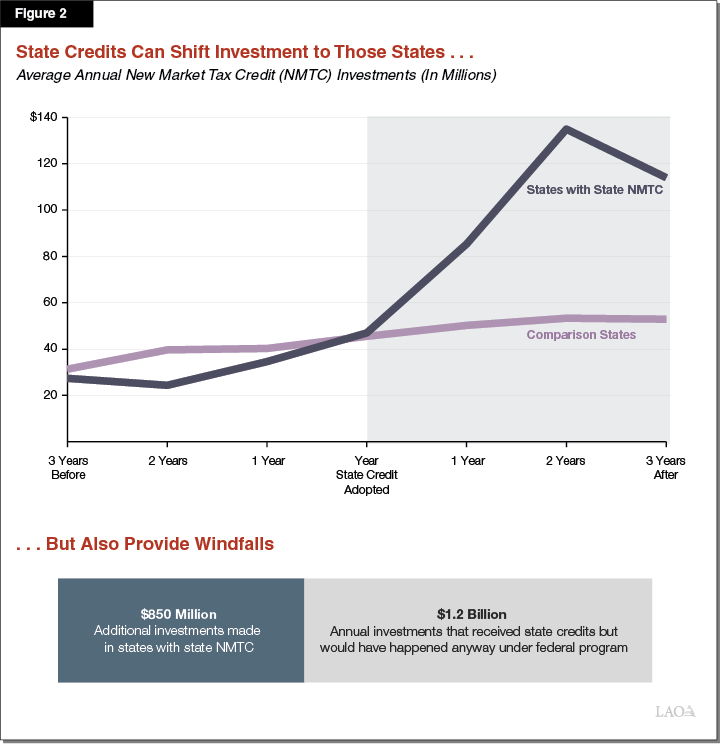

State Opportunity Zone Benefit Could Shift Investment to California, but Would Give Windfalls to Investors. Because Opportunity Zone investments can be made anywhere in the country, California’s Opportunity Zones are competing with zones in other states for investment. Arguably, creating a state Opportunity Zone benefit could help draw investment to California from other states by making California Opportunity Zone investment more financially attractive to investors. At the same time, federal tax law typically influences people’s choices more than state tax law because federal tax rates are higher. This means that at least some of the investment receiving California tax benefits would happen anyway in response to the federal tax benefit. Should this occur it would result in fiscal costs for the state but no new economic activity.

Past Experience Offers Insights on Magnitude of Possible Windfalls. Past experience with New Market Tax Credits also can shed some light on how much of the proposed state Opportunity Zone benefit would be windfalls for investors. A handful of other states have adopted state tax credits that mirror the federal New Market Tax Credit to encourage investors to shift their New Market Tax Credit investment to those states. To gauge the effect of these state credits, we looked at how New Market Tax Credit investments changed in states after they adopted state credits and compared these investment changes to similar states without state credits (using a statistical method known as synthetic control). Our results, summarized in Figure 2, suggest that state credits shifted investment to those states but that the majority (around 60 percent) of state credits were investments that would have happened anyway under the federal program.

Limitations of Using Opportunity Zones to Fund Affordable Housing. There are several potential drawbacks of using Opportunity Zones to fund affordable housing. First, marrying Opportunity Zone benefits with affordable housing financing could complicate an already complex process which often involves multiple funding steams and complicated legal arrangements. This added complexity could create increased administrative burdens for builders, lenders, and government agencies tasked with funding affordable housing. Added complexity also could open the possibility of unintended consequences or misuse of funds. Second, existing state affordable housing programs seek to spread affordable housing across all communities in an effort to increase access to high amenity neighborhoods and avoid further concentration of low-income households in high-poverty areas. Affordable housing funded with Opportunity Zone benefits, however, would necessarily be concentrated in existing low-income neighborhoods, running counter to state goals. Finally, the state does not have a clear governance structure to track Opportunity Zone affordable housing investments and provide oversight and compliance monitoring. Given these limitations, it is not clear why the state should allocate new affordable housing dollars through an Opportunity Zone program as opposed to using established programs such as the state low-income housing tax credit.

Budgetary Cost of State Opportunity Zones Highly Uncertain. Very little information is available to inform an estimate of the state income tax revenue losses that would result from a state Opportunity Zone benefit. The potential costs are highly uncertain. The administration assumes annual revenue losses of $100 million.

LAO Recommendation

Reject Governor’s Proposal. Given the mixed evidence regarding the benefits of such policies and the existence of better mechanisms to fund affordable housing, we recommend rejecting the Governor’s proposal to create a state Opportunity Zone tax benefit.

Consider Including These Features If Opportunity Zone Benefit Is Created. Should the Legislature adopt the Governor’s proposal to create a state Opportunity Zone benefit, it may wish to include the following elements:

Limit Revenue Losses. Establish an annual limit for income tax revenue losses and create a competitive process to allocate Opportunity Zone benefits to potential investors to allow state input and oversight on which projects receive tax-advantaged investment. If designed very carefully, such a process potentially could make the program more efficient and transparent.

Designate Administrative Agency to Track and Monitor Investments. A state agency (or agencies) should be tasked with tracking and monitoring compliance of Opportunity Zone investments. Investors (or entities carrying out Opportunity Zone investments) should be required to report to the state the location and amount of the investment, as well as an explanation for how the investment satisfies the criteria to be considered affordable housing or alternative energy.