LAO Contact

June 21, 2019

Allocating Utility Wildfire Costs:

Options and Issues for Consideration

- Executive Summary

- Recent Wildfire Damages

- Allocating Costs From Utility‑Started Wildfires

- Potential Changes Related to Utility Wildfire Costs

- Criteria for Assessing Potential Changes

- Option 1—Change Prudent Manager Standard for IOU Cost Recovery

- Option 2—Change Strict Liability to a Fault‑Based Standard

- Option 3—Establish Liquidity‑Only Fund to Pay Wildfire Claims Before CPUC Cost‑Recovery Decision

- Option 4—Establish Wildfire Fund to Pay Wildfire Claims

- Summary of LAO Comparison of Potential Changes

- Other Considerations

Executive Summary

Catastrophic Wildfires Caused by Utilities Increase Costs for Utility Ratepayers. Recent catastrophic wildfires caused by utilities in California have caused tens of billions of dollars in property damage. Under current legal standards, these damages will directly lead to increased costs for utilities, which could be passed on to ratepayers. Moreover, the recognition of increased potential costs associated with wildfire risks has affected the credit markets, contributing to one investor owned utility (Pacific Gas and Electric) declaring bankruptcy, as well as credit downgrades for other utilities. These credit effects will make it more difficult and expensive for utilities to secure financing for capital investments, which will also increase costs for ratepayers, as well as potentially affect other policy goals. The goal of this report is to be a resource for policymakers and the public seeking to better understand the complicated issues surrounding utilities and the costs associated with wildfire risks.

Recent Government Reports Identify Potential Changes to Allocating Costs. Specifically, we describe and assess four options that were identified by both the Governor’s Strike Force and the Commission on Catastrophic Wildfire Cost and Recovery:

- Changing the prudent manager standard used by the California Public Utilities Commission (CPUC) to determine whether the utilities will be allowed to pass costs on to ratepayers in the form of higher electricity rates.

- Changing the strict liability legal standard—which makes utilities pay for property damages from fires started by their equipment, regardless of whether they were negligent—to a negligence standard.

- Establishing a liquidity‑only fund to pay wildfire claims before CPUC determines whether the utility can pass costs to ratepayers.

- Establishing a broader wildfire fund—funded by shareholders, ratepayers, property owners, and/or state taxpayers—to pay wildfire claims.

Summary of LAO Assessment. The effects of each option depend heavily on key implementation details. However, for each option, we qualitatively assess how the change could qualitatively affect three key policy criteria.

- Fair Distribution of Financial Costs and Risks Among Different Groups. Most of the changes would shift how future costs associated with utility‑caused wildfires are paid among different groups. For example, changing the prudent manager standard would shift future risks from utility shareholders to ratepayers. Other changes—specifically, changing strict liability and establishing a wildfire fund—would likely result in a broader shift in risk between shareholders, ratepayers, insurers, and property owners.

- Incentives for Different Groups to Reduce Overall Wildfire Risk. Changes that increase potential wildfire‑related costs for insurers and property owners could encourage them to take additional actions to reduce future risk, such as through increased implementation of home hardening and defensible space. On the other hand, changes that reduce financial risk for utilities (shareholders or ratepayers) could reduce utilities’ financial incentives to take actions to reduce wildfire. However, the ultimate impact on wildfire risk reduction activities would depend, in large part, on other state actions intended to promote greater risk mitigation activities, including oversight of utility mitigation activities and property insurance market reforms.

- Ability to Raise Capital for Utility Expenses and Reduce Ratepayer Financing Costs. By reducing the perceived riskiness of utilities, all of the changes have the potential to improve utilities’ ability to raise capital for paying wildfire claims, as well as potentially for other expenses such as to implement wildfire safety and carbon emission reduction activities. The changes could also reduce ratepayer costs related to raising this capital by lowering bond interest rates and shareholder returns on equity. The magnitude of these effects are unclear and depend, in part, on how the changes affect investors’ perception of utility financial risk.

Recent Wildfire Damages

Wildfire Damages Have Been Growing

- Catastrophic wildfires have a wide variety of adverse effects, including property damage, loss of life and personal injuries, and adverse environmental effects, such as air pollution.

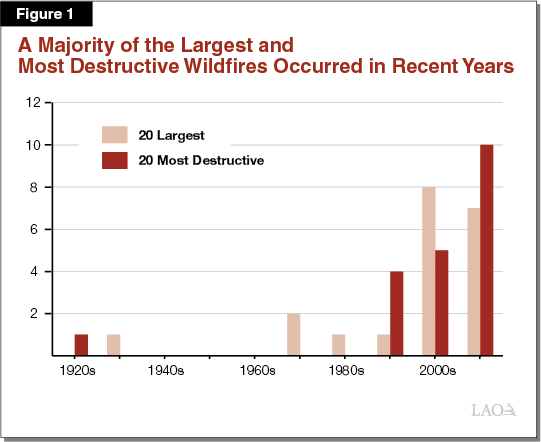

- As shown in Figure 1, the last couple decades have seen a substantial increase in the frequency of catastrophic wildfires. The 2017 and 2018 fire seasons were especially costly—with annual property damages estimated to be about $20 billion. The extent to which this pattern of catastrophic wildfire damages will continue in future years is currently unclear.

- It is worth noting that the major problem is uncontrolled, catastrophic fires in areas near human populations. Fires in many parts of California are a natural part of ecological processes and many can have significant forest health benefits.

Many Factors Contribute to Growing Wildfire Damages

Many different factors are contributing to growing wildfire damages. However, the degree to which each of these factors has impacted wildfire damages is unclear.

- Development in the Wildland Urban Interface (WUI). Increasing development in the WUI in the last several decades has increased the overall risk of wildfire damages by increasing (1) the likelihood of fires starting in these areas as a result of the additional human activity and infrastructure and (2) the amount of potential damage when fires occur. There are currently over 3 million California households in the WUI.

- Forest Management. Forest management practices—such as decades of fire suppression—have contributed to a significant build‑up of vegetation in the forest that serves as “fuel” for more intense wildfires.

- Climate Change and Drought. Climate change is contributing to longer fire seasons, and a severe drought earlier this decade has led to an increase in dead trees and fuel.

- Utility Infrastructure Management. As we discuss below, some of the most damaging fires in the last couple of years have been ignited by utility equipment. The degree to which utility mismanagement of its infrastructure has contributed to these fires is unclear.

Utilities Start a Small Portion of Fires, but They Are Often the Largest and Most Damaging

- Only about 10 percent of fires are started by utility equipment, and many of those fires result in little or no property damage.

- However, some of the most damaging fires are started by utility equipment. For example, utility powerlines caused at least 8 of the 20 most destructive fires (40 percent) in California’s history. Seven of these utility‑caused fires occurred since 2007, and six have occurred since 2015.

- Wildfires caused by powerlines can be particularly damaging, in part, because some of the factors that cause utility ignitions—such as high winds damaging electrical lines—also contribute to a rapid spread of fire that is difficult to control. For example, according to the California Department of Forestry and Fire Protection (CalFire) investigations, Pacific Gas and Electric (PG&E) equipment started the 2018 Camp Fire in Paradise, which destroyed nearly 19,000 structures and killed 86 people. PG&E estimates that it could be liable for up to $15 billion in damages from the fire.

Allocating Costs From Utility‑Started Wildfires

Inverse Condemnation Makes Utilities Liable for Property Damages

California’s current legal structure of inverse condemnation makes utilities liable for all property damage associated with fires started by their equipment. In this report, we focus primarily on the process for paying for these damages through inverse condemnation. This covers a substantial share of the overall damages associated with wildfires. (We note that there are other processes through which a utility might be held liable, including government recovery of fire suppression costs and tort cases brought against the utilities.)

- Property Owners and Insurers Pay Initial Costs . . . For insured property owners, the insurance company pays to replace damaged properties (minus any deductible or other cost‑sharing provisions). In the long run, most of these costs are reflected in future rate increases and borne by a broad set of insured property owners. Uninsured and underinsured property owners pay for damages that are not covered by insurance (or simply lose property).

- . . . Then May Seek to Recover Damages From Entity That Caused the Fire. Insurers and property owners can file claims in court to recover damages from the entity that caused the fire. Recovery often occurs through a process known as subrogation in which the insurer pays the property owner for the covered damages and then the insurer seeks to recover financial damages from the entity that caused the fire.

- Legal Standard for Recovering Damages Depends on What Entity Caused the Fire. The two standards are negligence standard and strict liability standard.

- Negligence Standard Generally Applied to Private Entities. For most sources of fire, ability to recover damages from the entity that started the fire is based on a negligence standard. If the court finds that the entity that started fire was negligent, it is liable for the damages.

- Strict Liability Standard Applied to Governments and Investor‑Owned Utilities (IOUs). If a fire was started by a government entity or private utility, ability to recover property damages is based on a strict liability standard—meaning the utilities must pay for the damages if they caused the fire, regardless of whether or not they acted negligently. This standard is based on a legal doctrine known as inverse condemnation, which results from the courts’ application of the takings clause in the State Constitution. Courts have applied inverse condemnation and strict liability to IOUs because—similar to public entities—they are given extraordinary powers, including eminent domain, and have the ability to spread costs across ratepayers.

Utility Wildfire Costs Borne by Ratepayers or Shareholders

Utilities generally buy commercial insurance to cover costs related to unexpected events such as wildfires. For example, the largest IOUs have policies that cover roughly $1 billion in damages. The costs of the premiums utilities pay for this insurance are passed on to ratepayers. However, if wildfire costs exceed the amount of the insurance—which can be the case for some catastrophic wildfires—the utility must pay for the difference. Some insurers have indicated that they do not plan to offer wildfire insurance for utilities in the coming years. Any uninsured utility wildfire costs can be borne by utility ratepayers and/or shareholders.

Publicly Owned Utilities (POUs) Costs Borne Entirely by Ratepayers

- There are about 40 POUs in California that provide about one‑quarter of total electricity in the state. The two biggest POUs are Los Angeles Department of Water and Power ($3.6 billion in annual revenue) and Sacramento Municipal Utilities District ($1.4 billion in annual revenue). The remaining POUs collect a few hundred million dollars in annual revenue or less.

- For POUs, the costs of wildfire damages will generally be passed on to ratepayers in the form of higher electricity rates. There are no POU shareholders.

- Ignitions from POU equipment have caused much less damage than ignitions from IOU equipment. This is, in part, because their service territories are generally smaller.

IOU Costs Borne by Ratepayers and/or Shareholders Depending on “Prudent Manager” Determination

- The state has three major electric IOUs—PG&E, Southern California Edison, and San Diego Gas and Electric (SDG&E)—along with three small IOUs that provide about three‑quarters of the state’s electricity and collect a total of roughly $30 billion in annual revenue.

- For IOUs, costs could be borne by utility ratepayers and/or shareholders. Wildfire claims under inverse condemnation are initially paid by the company, which then must seek authority from the California Public Utilities Commission (CPUC) to recover those costs from ratepayers through higher electricity rates.

- The CPUC must determine whether the utility was a prudent manager of its system before it authorizes cost recovery from ratepayers. If CPUC does not find that the utility was a prudent manager, utility shareholders bear the direct costs through lower company profits.

- In 2017, the CPUC rejected a request from SDG&E to recover $379 million from ratepayers for fires that occurred in 2007 because it found that the utility did not meet the prudent manager standard. So far, this is the only example of an IOU requesting cost recovery for wildfire claims that exceeded the utility’s insurance coverage.

- Chapter 626 of 2018 (SB 901, Dodd) specified certain factors that the CPUC may consider when evaluating whether IOUs acted prudently when their equipment causes wildfires (post‑2018)—such as the extent to which costs were caused by circumstances beyond the utility’s control, whether extreme climate conditions contributed to the damages, and the utility’s history of compliance with CPUC regulations.

Legal Structure Leads to Higher Electricity Rates and Potential Difficulty Raising Capital

Wildfires have a wide variety of adverse effects on many different groups, including households and businesses directly affected by the fires, nearby communities affected by the air pollution caused by the fires, ratepayers that might have to ultimately bear a significant share of the costs associated with these fires, and taxpayers that pay for fire suppression and recovery activities. In this section, we focus on the ways in which the current system for allocating risks and paying for wildfire damages caused by utility equipment can lead to a significant increase in costs for utility ratepayers.

Direct Ratepayer Costs to Pay for Past or Future Wildfire Damages

- In general, IOU ratepayers are liable for the costs of past fires started by utility equipment if the utility acted prudently. In addition, SB 901 directed CPUC to develop a “stress test” to determine the maximum amount utility shareholders could pay for 2017 wildfire damages without harming ratepayers or impacting the utility’s ability to provide adequate and safe service, even if the utility was found to act imprudently. If this methodology is applied, ratepayers would bear some direct costs related to 2017 fires.

- Ratepayers also will be liable for the costs of any future fires started by utility equipment where the utility acted prudently.

- Damages from catastrophic fires caused by IOU equipment in the last couple of years likely totals tens of billions of dollars.

Higher Indirect Ratepayer Costs Related to Utility Financing When Utilities Are Seen as Risky Investments

- Risky Companies Pay Higher Financing Costs to Raise Capital. Companies that are viewed as risky investments must pay higher rates of return in order to raise capital from investors (by issuing bonds or stock), often to build or repair infrastructure. Several factors are causing investors increasingly to view utilities as a risky investment, contributing to one IOU (PG&E) filing for bankruptcy and other major IOUs having their credit ratings downgraded substantially.

- Several Factors Have Led to Perceived Riskiness. These factors include:

- Costs for Past Fires. IOUs face potentially billions of dollars in costs related to past fires. Moreover, it is uncertain whether CPUC will determine that the IOUs were prudent managers or how it will apply the SB 901 stress test to 2017 fires, allowing them to raise rates to cover those costs.

- Potential Costs for Future Fires. Given the continued state of California forests and proximity of dense or unhealthy forests to populated areas, there remains significant risk of future fires to be started by utility equipment, and there is uncertainty regarding whether CPUC will allow cost‑recovery for those fires.

- Uncertainty Over Future Willingness to Raise Rates. Even if CPUC allows IOUs to raise electricity rates to cover the costs of past or future fires, doing so could make CPUC reluctant to approve future rate increases to fund other utility expenditures or shareholder returns for fear that rates would become unaffordable for many customers.

- Utility Financing Costs Are Generally Passed on to Ratepayers. Utilities are a relatively capital‑intensive industry and, thus, rely heavily on raising up‑front capital to pay for infrastructure investments and maintenance. The major IOUs recently filed applications to the CPUC to approve an increase in their authorized return on equity from about 10 percent to about 16 percent. If approved, PG&E estimates this change could increase monthly residential ratepayer bills in its territory by roughly 7 percent.

High Electricity Rates Adversely Affect Households, Businesses, and Governments

- California retail electricity rates are already relatively high compared to other states, even before incorporating recent wildfire damages, future risks, and additional spending related to additional utility wildfire mitigation activities. These higher rates can have a variety of adverse economic effects.

- Households. In 2018, average California retail rates were 47 percent higher than the national average for residential customers. Higher residential electricity rates mean households have less money to spend on other goods and services.

- Businesses. In 2018, average California retail rates were 54 percent higher than the national average for commercial customers and 93 percent higher for industrial customers. Higher commercial and industrial rates will likely lead to lower employee wages, lower profits, and/or increased product prices. In some cases, higher electricity prices might shift some business activity to other states or countries.

- Governments. Higher electricity rates for state and local governments mean they have less money to spend on other public services.

Difficulty Raising Capital Potentially Affects Other State Policy Goals

- If the utility is viewed as a risky investment, it might have difficulty raising funds to make infrastructure investments intended to improve safety, ensure reliability, and/or reduce greenhouse gas (GHG) emissions. For example, it might be more difficult to raise funds for additional wildfire mitigation activities to improve safety and new electric vehicle infrastructure to promote GHG reductions.

- Even if the utility is able to raise the funds, the higher financing costs will result in higher electricity rates. The net effect of these higher rates on GHG emissions is not entirely clear. In some cases, higher electricity rates could encourage a reduction in electricity consumption, which tends to reduce GHGs. However, higher electricity rates could make it more expensive to switch to lower GHG technologies. For example, it could discourage businesses or households from switching from gasoline or diesel powered vehicles to electric vehicles.

Potential Changes Related to Utility Wildfire Costs

Given the risks and costs to utility ratepayers identified above, many have called for the state to make further changes to how the state allocates and finances utility wildfire costs. Two recent government reports identified key options for potential changes.

Governor’s Strike Force Identified Four Key Changes for Legislative Consideration

- In April 2019, Governor Newsom’s Strike Force issued Wildfires and Climate Change: California’s Energy Future, which discusses various options for allocating the costs and future risks of utility wildfires. According to the report, these options are not mutually exclusive and more than one change likely will be needed. The key options include:

- Changing the prudent manager standard used by CPUC to determine whether the utilities will be allowed to pass costs on to ratepayers in the form of higher electricity rates.

- Changing the strict liability legal standard—which makes utilities pay for property damages from fires started by their equipment, regardless of whether they were negligent—to a negligence standard.

- Establishing a liquidity‑only fund to pay wildfire claims before CPUC determines whether the utility can pass costs to ratepayers.

- Establishing a broader wildfire fund—funded by shareholders, ratepayers, property owners, and/or state taxpayers—to pay wildfire claims.

- The report does not propose a specific set of changes and does not provide implementation details for some of the proposed options.

SB 901 Commission Report Provides Additional Detail and Recommendations

- Senate Bill 901 created the Commission on Catastrophic Wildfire Cost and Recovery (the Commission) to (1) examine issues related to utility‑caused wildfires and (2) recommend statutory changes to ensure equitable distribution of costs among affected parties.

- In June 2019, the full Commission and smaller Commission work groups issued reports that (1) recommend a series of changes to the current legal and regulatory system, (2) discuss in detail how different changes might be implemented, and (3) identify a wide variety of issues for legislative consideration. The reports also discuss the four key options in the Governor’s Strike Force report.

Criteria for Assessing Potential Changes

In order to assist the Legislature in weighing the relative trade‑offs of potential changes to the current system (such as those identified by the Governor’s Strike Force and the SB 901 Commission), we identify below some key factors that the Legislature might want to consider when evaluating different options.

Fair Distribution of Financial Risks Among Different Groups

- Direct costs for utility‑caused wildfire property damages—both past and future—could be in the tens of billions of dollars and will ultimately be borne by some combination of utility ratepayers, utility shareholders (as well as bondholders), insurers, property owners, and/or governments (taxpayers). Policy changes have the potential to shift the allocation of wildfire costs and future risks to benefit some groups of households and businesses and have adverse effects on others.

- The Legislature will want to consider whether the current system of allocating costs and future risks to these different groups is fair. For example, the current legal and regulatory system makes ratepayers liable for the cost of fires where utility equipment started the fire, but the utility was a prudent manager. The Legislature will want to consider whether some other system is more fair.

- Fairness is ultimately a policy decision for the Legislature. A couple of issues that the Legislature might want to consider when evaluating fairness of the current system for allocating costs include: (1) some entities that contribute to the fire risk—such as property owners in high‑risk areas—do not bear the full financial risk related to their actions because ratepayers ultimately pay for a large share of the financial costs of wildfires started by utility equipment and (2) the legal standard that is applied for property owners and insurers trying to recover costs for wildfire damages depends on whether the fire was started by utilities or some other private entity.

Incentives for Different Groups to Reduce Size of Future Fire Risk

- As previously discussed, the primary factor driving the problems identified above is the growing magnitude of costs and future risks from wildfires started by utility equipment. One way to encourage risk reduction is to distribute risks to entities that have the ability to take actions that reduce risk.

- A variety of different groups could take actions to help reduce wildfire risk, including property owners, utilities, and governments. The current system of paying for wildfire costs started by utilities allocates a significant amount of risk to utilities—including both ratepayers and shareholders. As a result, they have a significant incentive to invest in activities to reduce risk of fires caused by their equipment though such things as vegetation management and equipment improvements. (The reasons why this incentive did not encourage enough utility risk mitigation to prevent recent fires are unclear but could be due, in part, to utilities underestimating the magnitude of their overall wildfire risk.)

- The current allocation of costs limits some of the financial risk borne by property owners who live in high‑risk fire areas—and insurers who cover those properties—because they can recover costs from utilities that started the fire, regardless of whether the utility was negligent. As a result, these owners have somewhat less of a financial incentive to invest in fire prevention activities to protect their home, such as defensible space. Similarly, the current allocation of costs could be a contributing factor to growing demand for development in high‑risk fire areas because of the lower financial risk faced by property owners living in those areas.

Effects on Ratepayer Financing Costs and Utilities’ Ability to Raise Capital

- The effects of the current legal structure on utilities’ ability to raise capital and how that might affect ratepayers is one of the key challenges and considerations. As a result, the Legislature will want to consider how any change might affect utilities’ ability to raise capital and the costs to ratepayers associated with financing utility expenses, including infrastructure investments and/or paying wildfire claims. These costs are determined by the degree to which potential investors view the utilities as financially risky.

- In the long run, the risk associated with investing in a utility could be lowered by reducing the potential magnitude of wildfire damages through such things as effective implementation of utility wildfire mitigation plans, enhanced forest management and fire prevention activities, and additional home hardening activities. These actions could also reduce future direct costs mentioned above.

- In the near to medium term, investor risk could be reduced by actions that (1) shift costs or liability for future fires from utility ratepayers and shareholders to other groups, (2) shift costs or future liability from shareholders to ratepayers, and/or (3) reduce uncertainty related to the standard that will be used to determine whether or not IOUs will be able to recover wildfire costs from ratepayers.

Option 1—Change Prudent Manager Standard for IOU Cost Recovery

There are two aspects of the prudent manager standard that some view as problematic. First, the CPUC has significant discretion on how to apply the prudent manager standard and determine whether utilities can recover wildfire costs from ratepayers for damages that exceed IOU insurance coverage. This discretion creates uncertainty about the degree to which utilities will be able to recover costs from past or future fires from ratepayers. This adds risk for investors (bondholders and shareholders) and, therefore, increases IOU financing costs (bond interest rates and shareholder returns). These costs generally are passed on to ratepayers. Second, some view the CPUC prudent manager standard as difficult for IOUs to meet because they must prove, by a preponderance of the evidence, that they acted prudently in how they managed their operations in order for the CPUC to approve cost recovery.

Overview of Option

- Both the Strike Force and the SB 901 Commission recommend a change to the prudent manager standard, and both reports suggest that changes in cost recovery standards alone are not sufficient and should be combined with one or more of the other changes discussed below. The SB 901 Commission provides more specific options and recommendations for changing the prudent manager standard, which are generally intended to either clarify the standard and/or make it more likely that utilities are found to have acted prudently.

- Shift Burden of Proof and Refine SB 901 Factors. If the Legislature does not create a wildfire fund, the Commission recommends the state (1) shift the burden of proof so that IOUs are presumed to have acted prudently unless ratepayer advocates demonstrate otherwise (this would be more consistent with the approach of the Federal Energy Regulatory Commission) and/or (2) require CPUC to give greater weight to certain factors—such as factors that are out of the utilities’ control—when evaluating the portion of costs that should be borne by shareholders. (We discuss below modified recommendations to the prudent manager standard if the Legislature also adopts the wildfire fund.)

- Do Not Rely on Compliance With Wildfire Mitigation Plans. Some have proposed making substantial compliance with CPUC‑approved wildfire mitigation plans sufficient to demonstrate prudency. However, the SB 901 Commission recommends waiting until California gains more experience and expertise on what constitutes effective utility wildfire mitigation activities before it considers relying entirely on the plans for prudency determination.

LAO Assessment

Shifts Risk From IOU Shareholders to Ratepayers

- Any change to the standard making it more likely that an IOU would be found to be a prudent manager would shift wildfire risks from shareholders to ratepayers. This has a direct effect of increasing risks to ratepayers for fires.

- It is worth noting that, by itself, a change in the prudent manager standard would not result in a significant shift of risks between utilities and other parties, such as insurers and property owners. Utility ratepayers and shareholders would remain liable for damages from fires started by utility equipment.

Changes Utility Incentives to Reduce Overall Magnitude of Wildfire Risk, but Net Effect Is Unclear

- Changing the prudent manager standard would have different potential effects on utility actions to mitigate wildfire risk.

- For example, if risk of future fires is shifted from shareholders to ratepayers, shareholders (represented by utility management) would have less incentive to take certain actions to reduce fire risk. This is because certain actions might no longer be necessary to meet the CPUC prudent manager standard. However, ratepayers (represented by ratepayer advocacy groups and CPUC) would have greater incentive to advocate for more ratepayer funding for aggressive wildfire mitigation activities at the CPUC. The net effects on overall utility actions to reduce wildfire risk is unclear, but would depend in large part on CPUC regulatory activities, such as what activities are included in utility wildfire mitigation plans (WMPs), how much funding is authorized for those activities, and how aggressively the CPUC monitors and enforces those plans.

- Since this change would not affect the allocation of future wildfire risk to groups outside of the utility (such as insurers or property owners), it does not provide additional financial incentive for these parties to reduce wildfire risk.

Likely Improves Ability to Raise Capital and Reduces Financing Costs

- A change making it more likely that a utility is determined to be a prudent manager and/or providing more clarity about what is needed to meet the standard could lower financing costs. However, the degree to which the changes identified by the Commission provide greater certainty to investors would depend on the specific changes. Consequently, it is unclear how much they would reduce financing costs.

- It is important to note that lowering the perceived riskiness of utilities would reduce financing costs for all utility expenses, including both wildfire claims, as well as for other utility expenses intended to promote safety, reliability, and environmental benefits.

Option 2—Change Strict Liability to a Fault‑Based Standard

Overview of Option

- This option would change the liability standard for utilities from strict liability to fault‑based liability. A fault‑based standard would make utilities liable for wildfire damages only if caused by utility negligence.

- This change would align the liability standard for utilities with private entities that cause wildfires.

- The SB 901 Commission recommended this change be adopted as a way to more equitably allocate catastrophic wildfire costs for utilities.

LAO Assessment

Shifts Risk From Utility Ratepayers and Shareholders to Insurers and Property Owners.

- In general, this option would shift some risk from utilities—both shareholders and ratepayers—to insurers and property owners.

- In cases where the utility is not negligent and otherwise would have been determined to have acted prudently, ratepayers would no longer be liable for property damages from wildfires started by utility equipment. These costs instead would be borne by insurers and property owners, often those located in high‑risk fire areas.

- In cases where the utility is not negligent and otherwise would not have met the CPUC’s prudent manager standard, shareholders would no longer be liable. The costs and risks for these fires would be borne by insurers and property owners.

- Utility shareholders would still be liable for fires that they started due to negligence.

Increases Incentives for Property Owners to Reduce Wildfire Risk, but Might Lower Utility Incentives to Reduce Risk

- If property owners in high‑risk areas bear more of the financial risk of wildfire damage, they would have greater incentive to take actions to reduce fire risk. However, the degree to which property owners would take these actions to reduce risk depends, in part, on actions by property insurers and local governments.

- For example, the greater financial risk might encourage insurers to make their coverage or premiums contingent on risk reduction activities undertaken by the homeowner, such as defensible space or other “home hardening” activities. In addition, with greater financial risk associated with wildfires, property insurers might be less willing to offer coverage to properties in high risk areas or increase premiums in those areas. This might make it less likely that local governments approve new developments in high‑risk areas and/or more likely that they adopt and enforce regulations requiring property owners to implement risk reduction activities.

- Since this option would shift some risk away from utilities—ratepayers and shareholders—it could reduce some of the incentive for utilities to undertake activities to reduce risk. However, as discussed above, actual utility risk reduction activities would depend, in part, on the degree to which CPUC is effectively overseeing utility wildfire mitigation activities, including those in WMPs.

Likely Improves Ability to Raise Capital and Reduces Financing Costs in the Long Run, but Near‑Term Effects More Uncertain

- In the long run, shifting some of the risks of future fire damages from utilities to property owners (and insurers) likely reduces risk for utility investors and, as a result, reduces ratepayer financing costs. Some investor risk would still remain because investors would still be liable if a utility is determined to be negligent. A recent report by Moody’s stated that this change would have a strongly positive impact on utilities’ credit ratings.

- However, in the near term, the degree to which a statutory change to strict liability will reduce investor uncertainty is unclear. This is because there is legal uncertainty about whether the Legislature can make a statutory change to the strict liability standard under inverse condemnation, or whether such a change requires voter approval of a Constitutional amendment. As a result, a statutory change is likely to be challenged in court. This could lead to a period of time in which there is continuing market uncertainty until these legal questions are resolved. One option to reduce this uncertainty might be to seek voter approval of a Constitutional change at an upcoming election.

Other Legislative Considerations

- Addressing Challenges for Property Insurance Market. As discussed above, these changes would increase risk for insurers that cover properties in high‑risk areas. This could lead to higher insurance rates and less insurance availability in these areas. If it chooses to adopt this option, the Legislature also might want to consider making changes to ensure options to increase insurance availability in these areas.

- Facilitating Actions to Reduce Risk by Property Owners. Since some of the risk would be shifted to property owners in high‑risk areas, the Legislature might want to consider ways to facilitate actions to reduce risk for those property owners. This could include greater outreach or increased funding for programs to offset a portion of the costs for activities property owners can implement to reduce risk, such as home hardening and defensible space. The Legislature could also consider opportunities that help encourage insurers to offer discounts to property owners that undertake risk reduction activities. For example, the Commission recommends that the Legislature require insurers to offer an insurance policy for a home when both the home and the community where the home is located meet a pre‑determined standard for adequate wildfire risk reduction.

- Timely Resolution of Wildfire Claims. Even though resolving wildfire claims made by insurers and uninsured property owners can take several years under a strict liability standard, the time line for resolution can be shorter than under a fault‑based standard. This is because a court does not have to evaluate whether or not the utility was negligent before utilities are required to pay claims to insurers or uninsured property owners (or a settlement is reached). The claims are paid once it is determined that a utility caused the fire, which is a matter that can often be resolved quicker. A fault‑based standard, which would require courts to evaluate negligence, could slow this process down, thereby delaying when property owners and insurers are paid for these losses.

Option 3—Establish Liquidity‑Only Fund to Pay Wildfire Claims Before CPUC Cost‑Recovery Decision

After a utility is found to cause a fire, the utility can be viewed as a more risky investment, which can increase the costs of raising money to pay wildfire claims and other utility expenses. The costs of raising money (by issuing debt and equity) are generally passed on to ratepayers. In more extreme cases, such as the current PG&E bankruptcy, a wildfire could limit the amount the utility would pay wildfire claims and other expenses.

Overview of Option

- Under this option, the state would create a liquidity‑only fund that would be available to pay for wildfire damage claims during the period after it is determined that an IOU caused the fire but before the CPUC makes a decision about cost‑recovery under the prudent manager standard. The primary intention would be to ensure there is funding available to pay wildfire claims during this period and reduce the financing costs of raising capital to pay for catastrophic wildfire damages by establishing a dedicated fund source from ratepayers.

- Some key elements of this option include the following:

- Initial Contributions to Establish the Fund. The liquidity‑only fund could be funded initially (capitalized) by utility ratepayers and potentially shareholders. Ratepayer funding could come, at least in part, by securitizing a dedicated rate component. A dedicated rate component is essentially a guaranteed charge included on ratepayers’ bills. For example, in the electricity crisis in the early 2000s, the state authorized a dedicated rate component to pay debt service on bonds issued to cover costs of purchasing electricity. Since the dedicated rate component is a relatively low‑risk revenue stream, it would provide greater certainty to investors and, thus, reduces ratepayer financing costs related to raising capital.

- Size of the Fund. Neither the Governor’s Strike Force nor the SB 901 Commission propose a specific amount of money for the fund. However, our understanding is that the liquidity‑fund would be smaller than the wildfire fund discussed below.

- Future Contributions to Replenish the Fund. If the CPUC subsequently determines that the IOU acted as a prudent manager, and therefore can recover the costs from ratepayers, then the CPUC would authorize additional rate increases to collect the money needed to reimburse the fund. If the CPUC subsequently determines that the IOU did not meet the cost recovery standard and, therefore, cannot recover costs in rates, then utility shareholders would be required to reimburse the fund.

- Determining Amount of Claims Paid. Typically, insurers and uninsured property owners negotiate a settlement with utilities for an amount that is substantially less than the full amount of the original claim. Neither the Strike Force nor the SB 901 Commission make specific recommendations about how the amount of claims paid from the liquidity fund would be determined.

- SB 901 Commission Views Liquidity‑Only Fund as Secondary Option. The SB 901 Commission recommends adopting a liquidity‑only fund—and revising the prudent manager standard—if the Legislature does not change strict liability or establish a larger wildfire fund.

LAO Assessment

Liquidity‑Only Fund Would Not Change the Underlying Distribution of Risks . . .

- This option simply establishes a mechanism to provide cheaper “bridge funding” needed to pay wildfire claims to property owners and insurers after a fire occurs but before CPUC makes a cost recovery determination.

. . . Or the Underlying Incentives for Risk Reduction

- Since the fund does not change the underlying distribution of risks among different groups, it does not change the fundamental incentive for different groups to reduce the overall magnitude of the risk.

Improves Ability to Raise Capital and Likely Reduces Ratepayer Financing Costs, Primarily for Wildfire Claims

- The primary benefit of this option would be to help ensure there is funding available to pay wildfire claims and reduce IOU financing costs related to paying wildfire claims.

- In the near term, making a separate source of funding available to pay wildfire claims before CPUC makes a cost recovery determination might free up some utility funds for other expenses. This could have some minor positive effect on the perception of the overall financial condition of the utility and, thus, reduce financing costs for other utility expenditures, including expenditures related to infrastructure, safety, reliability, and environmental benefits. However, without more substantial changes that reduce long‑term shareholder risk such as those discussed elsewhere in this report, the utility could still have high financing costs for its other expenditures in the period before CPUC makes its cost‑recovery determination.

Other Legislative Considerations

- Some Key Details Would Still Need to Be Determined. For example, it is unclear how large the fund would be and how much of the initial funding would come from ratepayers versus shareholders. As a result, it is difficult to conduct a detailed analysis of the effects of this potential option.

- Could Liquidity Fund Be Created After Fire Event? The Legislature might want to consider whether there are other options that could reduce financing costs related to wildfire claims. For example, as suggested in the SB 901 Commission report, the Legislature could consider whether it would be feasible to authorize a dedicated rate component and securitizing the revenue stream after a determination that the utility caused the fire, but before the IOU needs to pay the claims.

Option 4—Establish Wildfire Fund to Pay Wildfire Claims

Overview of Option

- A wildfire fund would be used to pay certain claims from catastrophic wildfires caused by utility equipment. The fund would have some similar characteristics and goals as the liquidity‑only fund, but with two primary differences. First, contributions to the wildfire fund would likely come from more non‑IOU sources and, as a result, would spread the costs to a wider population. Second, initial contributions to the fund from utility shareholders would likely be larger and, in exchange, the state would make changes that more substantially reduce shareholder liability for future fires.

- Some key elements of this option include the following:

- Initial Contributions to Establish the Fund. Initial up‑front contributions to the fund could come from (1) IOU shareholders, possibly through one‑time cash contributions; (2) IOU ratepayers, possibly through securitization of a dedicated rate component; and (3) POUs, through a one‑time or ongoing contribution. The SB 901 Commission recommends voluntary utility participation from utilities, but the Legislature could consider mandating certain utilities participate. The fund could be structured in a way that other parties would contribute, such as the state (through direct cash contributions or providing tax exempt status to the fund), and/or a surcharge on property insurance policies.

- Size of the Fund. Consultants for the Governor’s Strike Force testifying at a recent legislative hearing and the SB 901 Commission report suggest that a $40 billion fund might be adequate to pay claims over the next decade, but both recognize the need for further analysis to evaluate the appropriate size of such a fund. The SB 901 Commission suggests that a wildfire fund should be smaller if there is a change to strict liability.

- Future Contributions to Replenish the Fund. Future contributions to the fund could come from shareholder payments or penalties when utilities fail to prudently manage wildfire risks. An SB 901 Commission workgroup recommends a cap on future shareholder contributions. This cap could be implemented in a couple of different ways, but the level of the cap would depend on the size of the initial shareholder contribution—the greater the initial contribution, the lower the cap on future liability. It is possible that future contributions might come from other sources too. The SB 901 Commission recommends giving authority to the administrator of the fund to levy assessments on different parties if it turns out the amount in the fund is insufficient to pay wildfire claims.

- Determining Amount of Claims Paid. Both the Strike Force and the SB 901 Commission suggest that the Fund be designed to pay wildfire claims at a settlement amount that is less than the full amount of the claim. The process for determining this settlement amount through a wildfire fund is complex and, according to the SB 901 Commission workgroup report, requires further evaluation.

- Change in Prudent Manager Standard and Cost‑Recovery Tied to Initial Shareholder Contributions. Both the Strike Force and the SB 901 Commission suggest that establishing a wildfire fund also be accompanied by a change in the CPUC’s prudent manager standard for cost‑recovery. The specific change is not identified, but both reports suggest that the amount of the initial contributions from shareholders should depend on the degree to which the change in the regulatory standard for cost recovery provides clarity for investors or limits future liability. Greater certainty around cost recovery and limitations to future utility liability would be accompanied by a higher initial contribution to the fund.

LAO Assessment

Likely Shifts Costs and Future Risks Between Different Groups, but Net Effects Would Depend on Key Details

- The shift in costs and risks between different parties depends on details of the fund, including which groups pay into the fund—both initially and in future years—how much each group pays, what changes are made to the prudent manager standard, the size of the fund, and what changes are made that affect the amount of wildfire damage claims.

- Initial Contributions to the Fund. The net effect on different groups depends, in part, on the amount each group would initially contribute to the fund. For example, if other parties—such as insurers, the state, and/or property owners—contributed to the fund, it could reduce costs for utility ratepayers and shareholders compared to what they otherwise might have to pay for wildfire claims.

- Changes to Prudent Manager Standard Reduce Shareholder Risk. As discussed above, a change to the prudent manager standard (or whatever standard is used to determine whether utilities must reimburse the fund) is likely to reduce shareholder risk. For shareholders, these lower future risks might outweigh the amount of their initial contribution to the fund, although estimating the net effect could be difficult.

- Reduction to Future Ratepayer Risk Depends on Size of Fund. In concept, the wildfire fund acts as an insurance policy for ratepayers. The initial contributions to the fund are used to pay future wildfire claims that would otherwise be paid by ratepayers. This reduces the risk to ratepayers of future fires. The degree to which the fund reduces future risk depends, in part, on the size of the fund. A larger fund would be more likely to cover future wildfire claims where the utility acted prudently and, thus, reduce ratepayer risk. On the other hand, if a smaller fund is established and wildfire claims exceed the size of the fund, ratepayers would still bear risk for future fires where the utility acted prudently.

- Limits on Wildfire Claims Could Shift Risk From Ratepayers and Shareholders to Insurers or Property Owners. A cap on settlement values for claims from insurers or uninsured property owners could shift some risk from utility ratepayers or shareholders to insurers. (In the long run, many of the insurer costs would likely be borne by property owners in the form of increased premiums or lack of access to coverage in high‑risk areas.) However, if the fund pays insurers a pre‑determined percentage of subrogation claims, the insurers would have more certainty around the amount of money they would be able to recover for damages related to utility wildfire claims. This could help insurers manage some of their risk.

Could Reduce Incentives to Reduce Future Wildfire Risk, but Depends on Details and Other Actions

- A wildfire fund could reduce incentives for various parties to reduce future wildfire risk. This is because different groups—such as utilities—might have lower financial risks for future wildfires because the fund would pay those claims.

- The net effect on incentives depends on some of the key details and how they affect future fire liability among different groups. For example, incentives for utilities to reduce future risk of fires would depend, in part, on the degree to which shareholders would still have to reimburse the fund for the costs of future fires where the utility acted imprudently. This future liability could be affected by changes to the prudent manager standard or caps on the amount that utilities would be required to pay.

- The degree to which different groups take action to reduce risk of future fires also could be affected by implementation of other state or local policies. For example, utility risk mitigation would depend on (1) CPUC enforcement of wildfire mitigation plans, (2) limiting the number of new homes that are built in high‑risk areas would depend on land use decisions by local governments, and (3) actions to reduce risks for homes and communities (such as creating defensible space) could be affected by new requirements that insurers consider such changes when making coverage decisions.

Improves Ability to Raise Capital and Likely Reduces Ratepayer Financing Costs, but Effects Depend on Details of Fund

- The wildfire fund might reduce future fire‑related financial risks for utility investors by providing even greater certainty around the prudent manager standard and/or establishing a cap on the amount of claims paid by shareholders. If so, this would have additional indirect benefits for ratepayers by reducing financing costs for other utility investments because the utility is viewed as a less risky.

- The magnitude of the effect of the fund on investor risk and financing costs is uncertain because (1) key details have not been defined, such as the amount of initial shareholder contributions and changes to the prudent manager standard; and (2) it is unclear how specific changes would affect the perception of risk among potential investors.

Other Legislative Considerations

- Effects on Insurance Market. This option would potentially include some significant change for property insurers, including a potential cap on subrogation claims. The consequences of these changes on the insurance market—both rates and availability—are unclear, but they are an important consideration if making these changes. (The SB 901 Commission report includes more detailed comments and recommendations related to the insurance market and wildfire issues.)

- Contributions From PG&E. This option presumably relies on initial contributions from IOU shareholders. However, the process for and ability of PG&E shareholders to contribute to the fund is particularly uncertain while the utility is in bankruptcy court.

Summary of LAO Comparison of Potential Changes

Figure 2

Assessment of Changes to Allocation of Utility Wildfire Costs Discussed in Recent Reportsa

|

Options |

Criteria for Evaluating Options |

||

|

Distribution of Financial Risks for Wildfires |

Incentive to Reduce Future Wildfire Risk |

Effects on Ability to Raise Capital and Financing Costs |

|

|

Option 1—Change Prudent Manager Standard for IOU Cost Recovery |

Shifts risks from IOU shareholders to ratepayers. |

Changes utility incentives to reduce overall risk. Net effect on overall risk is unclear because, in part, effect depends on CPUC regulatory actions and oversight. |

Likely improves ability of utilities to raise capital and reduces ratepayer financing costs for utility expenses, including infrastructure and wildfire claims. |

|

Option 2—Change Strict Liability Standard Under Inverse Condemnation to a Fault‑Based Standard |

Shifts risk from utility ratepayers and investors to insurers and property owners. |

Increases incentives for property owners to reduce wildfire risk and might reduce utility incentive to reduce risk. Net effect on risk ultimately depends on many different factors, including CPUC regulatory actions and oversight. |

In the short run, effects uncertain due to legal uncertainty about change to inverse condemnation liability standard. In the long run, if legal issues resolved, would improve ability to raise capital and reduce ratepayer financing costs related to wildfire claims and general utility infrastructure. |

|

Option 3—Establish Liquidity‑Only Fund to Pay Wildfire Claims Before CPUC Makes Cost‑Recovery Decision |

No change. |

No change. |

Improves ability to raise capital and likely reduces ratepayer financing costs primarily to pay for wildfire claims, but not for other utility infrastructure expenditures. |

|

Option 4—Establish Wildfire Fund to Pay Wildfire Claims |

Shifts costs and future risks among ratepayers, IOU investors, insurers, and property owners. Net effect on each group depends on details of the fund, such as initial contributions, process for settling claims, and future reimbursements to the fund. |

Could reduce incentives for different groups to reduce overall risk, but net effect depends on how fund shifts risks of future fires among different groups and other state and local actions intended to reduce risk. |

Improves ability to raise capital and likely reduces ratepayer financing costs for utility expenses, including infrastructure and wildfire claims, but magnitude of effect depends on details of the fund. |

|

aReports issued by Governor Newsom’s Strike Force (April 2019) and Commission on Catastrophic Wildfire Cost and Recovery (June 2019). IOU = investor owned utility and CPUC = California Public Utilities Commission. |

|||

Other Considerations

Allocating costs and future risks related to catastrophic wildfires is a complex issue with a wide variety of important considerations. Below, we discuss some other important questions for the Legislature when considering how to allocate utility wildfire costs.

Is CPUC Ensuring Utilities Take Appropriate Actions to Reduce Risk?

- Regardless of the legal structure for wildfire liability, the CPUC has an important role in ensuring utilities are taking appropriate actions to reduce risk, such as through implementation and enforcement of IOU WMPs. Some key regulatory questions about how these plans are implemented include: what is appropriate level of risk reduction activities that should be funded by ratepayers, what are most cost‑effective utility risk reduction actions, and how should these plans be monitored and enforced?

- The Legislature could consider whether a new structure for overseeing utility wildfire mitigation activities would help reduce risk. For example, the SB 901 Commission recommends establishing a new Electric Utility Wildfire Board that, among other things, would have authority to evaluate best practices for utility wildfire mitigation activities, as well as to set and enforce wildfire safety standards for all utilities (including IOUs and POUs).

Should Utility Rates More Closely Reflect Costs of Providing Service to High‑Risk Areas?

- Currently, utility customers in high‑risk fire areas pay similar electricity rates as customers in low‑risk areas. The Legislature could consider directing CPUC to change utility rate structures in a way that better align electricity rates in high‑risk fire areas with the costs and risks of providing electricity to those customers. This would better align electricity rates with the full costs and risks of providing that service.

Are There Opportunities to Reduce Other Ratepayer Financing Costs?

- The Governor’s liquidity‑only option focuses on reducing financing costs for a certain set of utility costs—costs related to paying wildfire claims before CPUC determines cost recovery—through securitizing a dedicated rate component on electricity rates.

- The Legislature might want to consider whether there are similar opportunities to utilize a dedicated rate component to reduce ratepayer costs for other expenses. For example, the Governor’s report also identifies the possibility of using a similar process to lower costs of borrowing money needed to pay for implementation of WMPs.

What Can Be Done to Better Understand Magnitude of Future Risk and Undertake Actions That Reduce Risk Most Cost‑Effectively?

- The overall magnitude of future wildfire risk caused by wildfires is unclear. This makes it difficult to evaluate what level of risk mitigation expenditures is justified and the magnitude of the risks that might be shifted under potential changes to future wildfire liability.

- There is limited publicly available information on the costs and benefits of different risk mitigation activities. For example, it is unclear what vegetation management activities and infrastructure hardening activities achieve risk reduction most cost‑effectively, or how those actions compare to creating defensible space around more homes and communities. As a result, it is difficult to determine the mix of activities that are likely to achieve the greatest level of risk reduction.

- More transparent analysis of these issues could help inform future legislative and regulatory changes intended to reduce wildfire risk cost‑effectively. For example, the SB 901 Commission recommends creating a Wildfire Vulnerability and Risk Reduction Coordinator at the Office of Planning and Research. This coordinator would be responsible for conducting research and providing recommendations to state and local governments on the optimal level of risk mitigation spending by various parties.