The 2020-21 Budget:

California's Fiscal Outlook

See a list of this year's fiscal outlook material, including the core California's Fiscal Outlook report, on our fiscal outlook budget page.

LAO Contacts

November 20, 2019

The 2020-21 Budget

California’s Fiscal Outlook

Medi-Cal Fiscal Outlook

Medi-Cal, the state’s Medicaid program, provides health care coverage to about 13 million of the state’s low-income residents. Medi-Cal costs are generally shared between the federal and state governments. In this web post, we describe the major factors that we project will drive changes in General Fund spending in Medi-Cal over the near term—in 2019‑20 and 2020‑21—and over the longer term through 2023‑24. We also describe a number of key assumptions that we made in our spending projections.

Near-Term Outlook

Summary

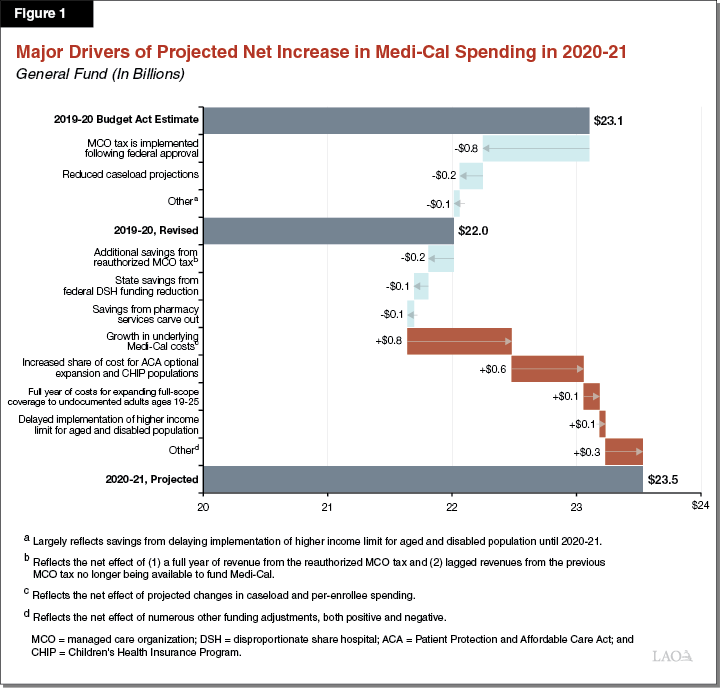

We estimate that the state will spend about $22 billion from the General Fund on Medi-Cal in 2019‑20, a roughly $1.1 billion reduction relative to what was assumed in the 2019‑20 Budget Act. As we describe further below, this largely reflects our assumption—although subject to significant uncertainty—that the federal government approves the state’s recently submitted proposal to renew the managed care organization (MCO) tax, as well as our updated projections of lower caseload. From this revised 2019‑20 amount, we project that General Fund spending in Med-Cal will then increase by about $1.5 billion (7 percent) in 2020‑21, to a total of $23.5 billion. This reflects the net effect of several different factors that are displayed in Figure 1. In the following sections, we describe the major factors that contribute to adjustments in both 2019‑20 and 2020‑21 in greater detail.

Underlying Net Growth in Program Costs

Medi-Cal Caseload Projected to Decline in 2019‑20 and 2020‑21 . . . Our baseline projection for the near term assumes continued economic expansion through 2020‑21. As such, we expect that increased wages—in part driven by the continued incremental increases in the minimum wage—will lead to fewer people qualifying for and remaining enrolled in Medi-Cal. We project that the Medi-Cal caseload will be 1.7 percent lower in 2019‑20 than was assumed in the 2019‑20 Budget Act, reducing General Fund costs by about $200 million. We project a further 1.2 percent decline in the caseload between 2019‑20 and 2020‑21, lowering General Fund costs by an additional roughly $70 million in 2020‑21.

. . . While Spending Per Person Projected to Continue to Rise. Per-enrollee costs in Medi-Cal are driven by growth in service utilization, changes in the kinds and cost of services that enrollees utilize, and the prices paid by the Medi-Cal program. Based on recent trends of approximately 4 percent annual growth, we project these costs to grow by about $900 million between 2019‑20 and 2020‑21.

On Net, Underlying Costs Expected to Increase. Projected growth in per-enrollee costs are more significant than the projected caseload decline, such that savings from a declining caseload are more than offset by higher per-person costs. Between 2019‑20 and 2020‑21, we project underlying costs to grow by over $800 million.

Assumes Federal Approval and Implementation of the MCO Tax

Although the Legislature Reauthorized the MCO Tax, Its General Fund Benefit Is Not Currently Reflected in the State’s Budget. Legislation related to the 2019‑20 Budget Act reauthorized the state’s MCO tax for a period of three and a half years, from 2019‑20 to halfway through 2022‑23. The reauthorized MCO tax will generate a net General Fund benefit in Medi-Cal of up to $2 billion annually. To be implemented, however, the MCO tax must obtain federal approval, which as of this publication remains pending. Because (1) federal approval is uncertain and (2) the MCO tax was reauthorized after the budget was approved by the Legislature, the 2019‑20 Budget Act did not allocate revenue from the reauthorized MCO tax to Medi-Cal. As such, the General Fund benefit from the reauthorized MCO tax is not currently reflected in the state's budget for 2019‑20.

Assumes Reauthorized MCO Tax Is Approved by the Federal Government and Implemented. Our outlook assumes that the MCO tax is approved by the federal government and implemented in 2019‑20. However, given our assumptions that federal approval will occur later in the fiscal year and that there will be an associated delay in the availability of MCO tax revenues, we assume that only a half-year of revenue from the MCO tax will be allocated to Medi-Cal in 2019‑20.

Recent Federal Proposal—if Ultimately Enacted—Jeopardizes Long-Run Permissibility of the MCO Tax. We note that just as our outlook was being finalized in November 2019, the federal government released draft regulations which, if adopted, would appear to effectively prohibit the state from implementing the reauthorized MCO tax in its current form. In our view, based on the proposed regulations’ grandfathering provisions, as long as the state receives federal approval of the MCO tax before the draft regulations are finalized, then the MCO tax should be able to remain in effect for its full three and a half year duration. However, if the MCO tax is not approved prior to the finalization of the draft regulations, it likely would not be able to be implemented for any of its duration. We would expect finalization of the draft regulations to occur at some point in 2020. Accordingly, the new federal draft regulations add additional uncertainty regarding whether the revenues from the reauthorized MCO will become available to benefit the General Fund. At a minimum, the draft regulations suggest that continued federal approval of another reauthorized MCO tax following the expiration of the current one in December 2022 is highly unlikely.

Federal Denial of the Reauthorized MCO Tax Would Increase Medi-Cal Expenditures by Up to $2 Billion Annually. Were the federal government to either deny approval of the MCO tax or delay a decision on approving the MCO tax past 2019‑20, General Fund expenditures in Medi-Cal would be around $860 million higher in 2019‑20 than we have estimated. Federal denial of the MCO tax would increase General Fund expenditures in 2020‑21 (and in the subsequent years) by as much as $2 billion relative to our projections in Medi-Cal.

Implementation of Other Major Recent Policy Changes

Expansion of Full-Scope Coverage for Undocumented Adults Age 19 Through 25. Legislation related to the 2019‑20 Budget Act expands full-scope Medi-Cal coverage to otherwise income-eligible undocumented adults ages 19 through 25. Due to systems changes that must be completed before the expansion is implemented, a half year of funding of $72 million General Fund was provided in 2019‑20. In 2020‑21 and beyond, we project the expansion to cost around $200 million General Fund. (This amount excludes additional associated spending in the In-Home Supportive Services program that we project to be in the low millions of dollars throughout the outlook window.)

Delayed Implementation of Aged and Disabled Income Limit Increase. Legislation related to the 2019‑20 Budget Act increased the income threshold for seniors and persons with disabilities to receive Medi-Cal services without paying a share of cost to 138 percent of the federal poverty level (FPL)—from the current 122 percent of FPL. The budget includes $31.5 million from the General Fund to cover the costs of this policy change, reflecting a half year of costs starting from a January 2020 implementation date. However, the administration has indicated that implementation of this policy change will likely be delayed until October 2020, after the end of the 2019‑20 fiscal year. As a result, our outlook assumes savings of $31.5 million in 2019‑20 and costs of around $50 million for nine months of implementation in 2020‑21.

Assumes Savings Associated With the Pharmacy Services Carve Out. In January 2019, Governor Newsom released an executive order directing the Department of Health Care Services to completely remove the Medi-Cal pharmacy services benefit from its contracts with managed care plans and instead administer the pharmacy benefit directly through Medi-Cal’s fee-for-service delivery system. (Removing a Medi-Cal benefit from managed care for managed care enrollees is referred to as “carving out” a service.) The carve out is expected to be implemented on January 1, 2021. We project associated savings of around $50 million General Fund in 2020‑21, to grow to over $200 million annually in subsequent years.

Anticipated Changes in Federal Funding

Increased State Share of Cost for Optional Expansion and Children’s Health Insurance Program (CHIP) The Patient Protection and Affordable Care Act (ACA) established enhanced federal shares of cost for Medi-Cal’s optional expansion and CHIP populations. (CHIP is a joint federal- and state-funded program—operated through Medi-Cal in California—that provides health coverage to children in low-income families, but with incomes too high to qualify for Medicaid.) Under federal law, the federal shares of cost for both populations were scheduled to gradually decline over time, with corresponding increases in the state’s share of cost. Between 2019‑20 and 2020‑21, we project increased General Fund costs in Medi-Cal of around $580 million due to the upcoming fiscal year’s scheduled declines in the federal share of cost for these populations.

Federal Disproportionate Share Hospital (DSH) Funding Reduction. Under federal and state law, the state makes payments to certain hospitals that treat a large number of low-income patients (including the uninsured and Medi-Cal enrollees) to help cover the cost of uncompensated care. These payments are funded with federal funds (which we refer to as federal DSH funding) that are matched with state and local funds. As part of the ACA, federal DSH funding was scheduled to be reduced, in light of coverage expansions that reduced the number of uninsured. As of the writing of this analysis, the amount of federal DSH funding available for California hospitals is scheduled to be reduced by 28 percent beginning November 22, 2019, with this reduction doubling in the following year. Because reduced federal DSH funding leads to reduced need for state and local matching funds, the 2019‑20 Budget Act reflects $76 million in General Fund savings in 2019‑20. We estimate that these saving will grow to about $120 million in 2020‑21. We note that scheduled reductions to federal DSH funding have been repeatedly delayed by Congress in the past and there are very recent indications that Congress may again enact another short delay of the reductions, until the end of 2019. Additional delays after the end of 2019 are also possible. Should Congress further delay or limit reductions in California’s federal DSH funding, these savings would be lower than assumed in our outlook or might not materialize at all.

Assumes No Additional Spending in Medi-Cal Due to Proposition 55 Funding Formula

In 2016, voters passed Proposition 55, which extended tax rate increases on high-income Californians. Proposition 55 includes a budget formula—first taking effect in 2018‑19—that in some years could direct a portion of the revenues from the extended tax increases to increase funding in Medi-Cal. The Director of Finance is given significant discretion in making calculations under this formula. Under the approach used by the Director of Finance, no additional funding was allocated to Medi-Cal in 2018‑19 or 2019‑20, and we believe allocations of funding to Medi-Cal are unlikely in the future. Accordingly, our outlook assumes no additional Medi-Cal spending due to the Proposition 55 funding formula in 2020‑21 or in later years. We anticipate maintaining this assumption until such a time as the Director of Finance adopts a different approach to the budget formula that makes allocations to Medi-Cal more likely.

Assumes No Changes Related to California Advancing and Innovating Medi-Cal (CalAIM) Proposal

In October 2019, the administration announced a series of proposed Medi-Cal reforms referred to collectively as CalAIM. The CalAIM proposal primarily relates to how the state finances and oversees the delivery of health care services provided through contracted managed care plans and behavioral health (mental health and substance use disorder) services provided through counties. The majority of the components of the CalAIM proposal are likely to require legislative approval in order to be implemented. Some components of the CalAIM proposal, if approved by the Legislature, could require significant state funding. In the coming months, the administration intends to discuss the various components of the CalAIM proposal with stakeholders and the Legislature. In light of our practice of projecting Medi-Cal spending under current law, we have not assumed any costs or savings related to the CalAIM proposals in 2020‑21 or in any of the years in our longer-term outlook described below. However, future decisions about implementing CalAIM reforms could significantly affect the Medi-Cal budget and result in spending totals that differ from our projections.

Medi-Cal Budget Projections Subject to Significant Uncertainty

Adjustments in estimated Medi-Cal spending following budget enactment are common and, in some cases in recent years, very significant. Many of these adjustments occur because Medi-Cal is budgeted on a cash basis, which means that relatively minor shifts in the timing of payments around the end of a fiscal year can shift expenditures from one fiscal year to another. In light of this and other features of the Medi-Cal budget, we anticipate actual Medi-Cal spending could differ from our projections—either upwards or downwards—in any given year by hundreds of millions of dollars or more.

Longer-Term Outlook

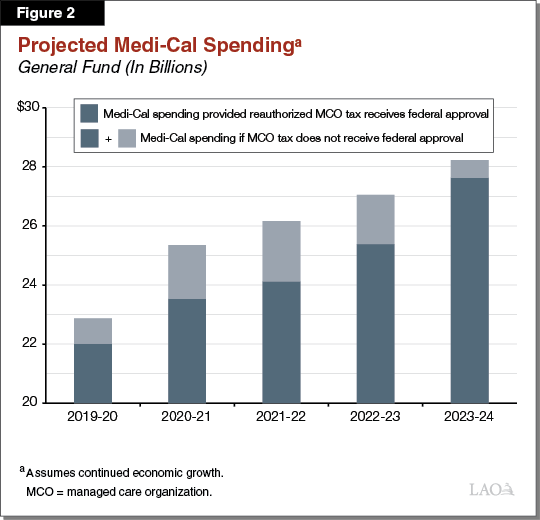

As shown in Figure 2, we project that General Fund spending will grow from around $22 billion in 2019‑20 to $27.6 billion at the end of our outlook window in 2023‑24. As previously noted, this projection depends highly on our assumption that the federal government will approve the reauthorized MCO tax. Figure 2 also shows our Medi-Cal spending projections if the federal government were to reject the state’s MCO tax. In this latter scenario, General Fund spending in Medi-Cal would grow from around $22.9 billion in 2019‑20 to $28.2 billion in 2023‑24. As described below, continued growth in Medi-Cal costs is mostly driven by underlying net cost growth—which combines our projected changes in caseload and per capita costs. Importantly, these projections assume continued economic growth in the state. Were California to instead experience an economic downturn, caseload and costs would likely be significantly higher than our projections show.

Underlying Net Cost Growth Largely Reflects Continued Projected Growth in Per-Enrollee Costs. We project net underlying cost growth to generally be between 4 percent and 5 percent annually over the outlook window, or about $1 billion in General Fund spending growth on an annual basis. We project somewhat higher underlying cost growth in the later years of the outlook (beyond 2020‑21) compared to the earlier years. This largely reflects smaller projected year-over-year declines in the Medi-Cal caseload in the later years.

Assumes Expiration of Reauthorized MCO Tax Halfway Through 2022‑23. The reauthorized MCO tax is scheduled to expire halfway through the 2022‑23 fiscal year. Accordingly, our outlook assumes no revenues from an operative MCO tax after December 2022. However, because revenues from MCO taxes have historically been allocated to Medi-Cal in years after the taxes have expired—due to lags related to Medi-Cal being budgeted on a cash basis—we assume some revenues from the reauthorized MCO tax will continue to be available to Medi-Cal through 2023‑24.

Recent Draft Federal Regulations Introduce Fiscal Uncertainty Over Longer Term. As noted earlier in this post, the federal government very recently released draft regulations that, if finalized, would likely limit the state’s ability to continue its recently reauthorized MCO tax after it expires in 2022-23. Based on our preliminary read of the draft regulations, they could also potentially have broader implications for other Medi-Cal financing mechanisms whereby fee revenue or local government funding is used to draw down additional federal funding. For example, our preliminary read suggests that the regulations could potentially affect the state’s ability to continue as currently structured certain fees on providers—such as private hospitals and skilled nursing facilities—that collectively offset well over $1 billion annually in what otherwise would be General Fund costs in Medi-Cal. These impacts are uncertain; however, to the extent that the draft regulations are finalized and are interpreted to negatively affect the state’s ability to continue these financing mechanisms, state General Fund costs for Medi-Cal could significantly increase in the longer run above what our outlook assumes. In the coming months, we will update the Legislature as we have more information about the potential impact of the draft federal regulations.

Does Not Assume Suspension of Pre-Selected Medi-Cal Augmentations. The Governor’s May 2019 multiyear budget projections showed a General Fund operating deficit arising before the end of 2022‑23. As a preventive measure, the spending plan adopted provisional suspension language that applies to 20 pre-selected augmentations included in the 2019‑20 Budget Act. Under this language, if the Department of Finance determines that the General Fund is in a sound condition in 2021‑22 and 2022‑23, then the augmentations’ ongoing expenses will continue. Otherwise, the expenditures are automatically suspended on December 31, 2021. The outlook does not assume that the suspensions take place. However, if the suspensions are activated, we project that General Fund spending in Medi-Cal would be lower than it would otherwise be by about $440 million in 2021‑22 and $850 million in 2022‑23 and beyond. These savings primarily result from the elimination of the Proposition 56 (2016) provider payment increases (which results in a General Fund benefit of a like amount), as well as ending (1) the optional benefits restoration; (2) the post-partum coverage expansion; and (3) the screening, brief intervention, referral, and treatment benefit expansion.

Federal Share of Cost Reaches Stable Levels for ACA Optional Expansion and CHIP Populations. As previously noted, scheduled declines in the federal share of cost are a major driver of General Fund cost growth in Medi-Cal between 2019‑20 and 2020‑21 (as well as in previous years). Between 2020‑21 and 2021‑22, however, further declines in the federal share of cost are only a very minor driver of General Fund cost growth in Medi-Cal. By the end of 2021‑22, there are no further scheduled declines in the federal share of cost, and therefore no corresponding increases in General Fund costs. The scheduled stabilization of the federal share of cost for Medi-Cal will reduce year-over-year General Fund cost growth by hundreds of millions of dollars compared to previous years.

Assumes Proposition 56 Provider Payment Increases Continue Through the Outlook Window. The outlook assumes that essentially all Proposition 56 funding will support provider payment increases throughout the outlook period, provided the suspensions previously discussed do not take place on January 1, 2022. Consistent with legislative intent, we assume that Proposition 56 funding for the Value-Based Payment Program and provider trauma screening trainings expires at the end of 2021‑22.