LAO Contact

February 10, 2020

The 2020-21 Budget

Structuring the Budget

- Introduction

- Key Concepts in Multiyear Budgeting

- Key Elements of Budget Structure

- 2020‑21 Budget Structure

- Conclusion

Executive Summary

Assessing Fiscal Resilience Is an Annual Activity. California has made significant progress in recent years to make its budget more resilient. Yet the process of achieving resilience can never be considered finished. Rather, the state must revisit its budget condition each year, update its goals, and respond to its current and unique challenges and conditions.

This Report Responds to Unique Challenges Posed in This Year’s Budget. This report lays out a framework for evaluating the budget’s structure in the context of the conditions facing the state today. In particular, this year, after enjoying a long period of economic growth, some data suggest that economic growth could slow. Moreover, the state faces a new and plausible risk to the state’s budget’s bottom line from federal draft regulations regarding the types of fees and taxes the state can levy on healthcare providers and payers. These regulations, if enacted, could result in billions of dollars in higher state costs.

Two Key Tools in Budget Structure This Year. This report considers two key tools of the budget’s structure important in this context: reserves and operating surpluses. Reserves are monies set aside—like a household’s savings account—that can be used to address future budget problems. Operating surpluses are the annual difference between revenues and spending. Creating a gap between anticipated revenues and planned spending creates a cushion that allows the state to absorb unexpected shortfalls in revenues or increases in costs. As the budget’s multiyear condition faces risks from both economic and noneconomic sources this year, we emphasize the importance of both of these tools in this report.

Evaluating the Governor’s Proposed 2020‑21 Budget Structure. Using this framework, we evaluate the Governor’s proposed 2020‑21 budget structure. The Governor proposes a multiyear budget structure with small operating surpluses, which eliminates a key tool of fiscal resilience despite heightened risk. The Governor proposes the state end 2020‑21 with $20.5 billion in reserves. Deviating from the practice of recent budgets, however, the Governor does not devote any significant share of the state’s estimated $6 billion surplus to building additional reserves. This reserve level is sufficient to cover revenue losses of $47 billion, but more reserves would be needed to prepare for a larger scenario (for example, the one that we estimated in our November Fiscal Outlook) or to protect school districts from constitutional declines in funding in a recession. We think that building more reserves or preserving a larger operating surplus would be prudent.

Multiyear Planning Supports the State’s Ability to Uphold Its Commitments. At times, concepts like multiyear budgeting and the state’s operating surplus are complex and seem abstract. Yet we do not emphasize the importance of them for their own sake. Rather, the goal of this report is to help decision makers evaluate whether or not the state can afford to keep its current obligations and to determine the extent to which the state can commit to new services. The Legislature has indicated that maintaining service levels in a recession is a key priority. Multiyear budget planning is integral to the state’s ability to achieve this goal.

Introduction

Our office long has emphasized the importance of multiyear budget planning. Multiyear budget planning tells the Legislature whether the state can afford its current and proposed commitments based on what is known today about the economy and state costs. In a variety of contexts, we also have stressed the importance of reserves. Building reserves allows the state to maintain its spending commitments during recessions and other temporary budget problems. While reserves are the main tool to foster fiscal strength, they are not the only tool. Operating surpluses—the amount by which revenues are expected to exceed costs in the multiyear budget plan—also help insulate the state from revenue declines or unexpected cost increases.

In two of this year’s budget reports—The 2020‑21 Budget: California’s Fiscal Outlook and The 2020‑21 Budget: Overview of the Governor’s Budget—we made explicit recommendations to the Legislature about maintaining an operating surplus in this year’s multiyear budget plan. We made this recommendation for three reasons. First, multiyear budget planning has become a more important part of negotiations between the Legislature and Governor. Second, certain economic data indicate the prolonged economic expansion could be weakening and we anticipate revenue growth will be slower in the coming years. Third, other noneconomic sources of risk—outside the Legislature’s control—are increasingly plausible. Consequently, we urge the Legislature to be mindful of the budget’s capacity to take on new commitments.

This report has two purposes. First, we lay out the basic concepts and analytical framework that we use to evaluate the budget’s structure over a multiyear period. Second, we apply this framework to the Governor’s proposed 2020‑21 budget structure to determine whether the state is likely to be able to maintain its commitments into the future.

Key Concepts in Multiyear Budgeting

The California Constitution requires the Legislature to pass a balanced budget. This means the state cannot appropriate more in General Fund expenditures than are anticipated in resources. While this requirement is relatively simple in concept, it can pose a significant challenge when resources are insufficient to cover existing commitments. The remainder of this section explains the basic concepts needed to understand how the state balances the budget for the upcoming year (the budget year) and over a multiyear period (for the subsequent few years). We then explain sources of legislative flexibility over the short and long term and explain why sources of inflexibility are important to long‑term planning. Figure 1 summarizes the key terms introduced in this section.

Figure 1

Key Terms in This Report

|

Surplus |

When projected resources available exceed estimated baseline spending in the budget window.a |

|

Budget Problem |

When estimated baseline spending exceeds projected resources available in the budget window.a |

|

Revenue Loss |

A decline in revenues compared to expectations. |

|

Operating Surplus |

When projected revenues exceed estimated baseline spending over a multiyear period. |

|

Operating Deficit |

When estimated baseline spending exceeds projected revenues over a multiyear period. |

|

Baseline Spending |

Spending required under current law. |

|

For example: |

|

|

|

|

|

|

|

|

|

|

|

|

Discretionary Spending |

Spending not required under current law. |

|

For example: |

|

|

|

|

|

|

|

|

|

|

aIn this case, “resources available” includes revenues and discretionary reserves held in the Special Fund for Economic Uncertainties. |

|

The Budget Year

Budget Process First Aligns Anticipated Revenues With Estimated Baseline Expenditures. The first step in the budget process is to anticipate how much revenue will be available for the upcoming year. This process is complex, but generally means using assumptions about how the economy is likely to perform over the coming 12 to 18 months and then using those estimates to project revenue collections. The second step compares those anticipated revenues to the level of spending required under current law. Spending under current law, which we term “baseline spending,” has several components. These include fulfilling constitutional obligations, like minimum required spending on schools and community colleges; paying debt service to bond holders; and supporting the programs authorized under current law. The last component includes, for example, updating estimates of caseload, providing statutory price increases, and funding the costs of recently enacted legislation.

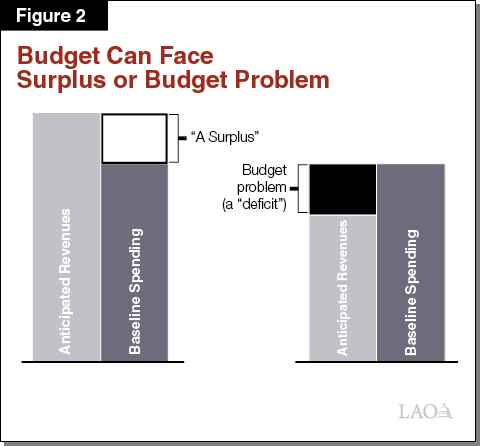

State Will Either Face a Surplus or Deficit for Upcoming Fiscal Year. Figure 2 shows a simplified example of the comparison between anticipated revenues and baseline spending. As the figure shows, for the upcoming year, the state will either have:

- A surplus if anticipated revenues would exceed baseline spending. This means the Legislature will have additional discretionary resources available to allocate to any public purpose (for example, reducing revenues or increasing spending).

- A budget problem if anticipated revenues would be insufficient to cover baseline spending.

Reserves Are the Main Tool to Address a Budget Problem. Because the Legislature must ultimately pass a balanced budget, when the state faces a budget problem, the Legislature must solve the problem using a combination of tools. The main tool for solving a budget problem is building a savings account—called a reserve. If reserves are insufficient to cover the budget problem, however, the Legislature must reduce spending, increase revenues, and/or take other actions to bring the budgeted expenditure level equal to or below anticipated revenues.

A Deficit (or Surplus) Also Can Emerge After the Budget Is Passed. While the state must pass a balanced budget for the upcoming fiscal year, nothing precludes a deficit (or surplus) from emerging after the budget has been passed. Specifically, after the budget is passed in June, actual revenue performance could be weaker than anticipated. We refer to a decline in revenue—relative to expectations—as a “revenue loss.” This can cause a budget problem in which case the Legislature must realign revenues and spending. Similarly, the state could pass a budget that anticipates a lower level of revenues than actually occur. In this case, a surplus arises and is available for the Legislature to expend in the following budget.

The Multiyear

State Considers Multiyear Fiscal Condition in Planning Documents. When the state is deliberating over the structure of the budget for the upcoming year, statutes require the Department of Finance (DOF) to submit to the Legislature an estimate of the budget’s multiyear condition for the three fiscal years following the budget year. (DOF must produce these estimates with the January Governor’s budget, May Revision, and the June budget act. By convention, our office also produces similar estimates—using our own projections—in November and May.)

Over a Multiyear Period, the State Can Face a Surplus or Deficit. Even though the Legislature must enact a balanced budget for the upcoming fiscal year, the budget does not have to be balanced over a multiyear period. As a result, over a multiyear period, the state can face a deficit or surplus. Again, this calculation compares anticipated revenues to baseline expenditures. Over a multiyear period, the state could experience an:

- Operating surplus when anticipated revenue growth would exceed baseline spending growth on an ongoing basis.

- Operating deficit when anticipated revenue growth would be less than baseline spending growth on an ongoing basis.

Uncertainty Grows With Each Year of the Forecast Period. Estimates of the budget’s condition—particularly revenues—are always subject to uncertainty. This uncertainty grows with each fiscal year of the outlook because past data become increasingly less reliable for predicting future trends. For example, our revenue estimates this year are more reliable for 2020‑21 than 2023‑24. As a result, the calculation of a surplus or deficit for the upcoming budget year is more reliable than the estimates for the out‑years.

Legislative Flexibility

The state constitution entrusts the Legislature with the power of appropriation. This means the Legislature has a great deal of constitutional authority and control over many aspects of the budget. Nonetheless, some external forces—including the voters, the federal government, and the courts—have placed limits on legislative control to reduce baseline spending. We discuss the sources of constraints on the Legislature’s budgetary authority in this section.

Legislature’s Short‑Term Flexibility to Reduce Spending Is Relatively Constrained. In many programmatic areas, in the short term (meaning over a year or two), the Legislature has relatively little flexibility to make substantial reductions to state spending. For example, there are various voter‑approved constitutional requirements—like Proposition 98 (1988) and Proposition 2 (2014)—that dictate minimum amounts the state must spend on different purposes. (Although in both cases the Legislature can suspend certain rules with a two‑thirds or majority vote and with action by the Governor.) The Legislature’s authority to significantly change jointly administered programs with the federal government—like Medi‑Cal or In‑Home Supportive Services—also is constrained due to federal law. Finally, in some areas—most notably corrections—various lawsuits have required the state to spend money to comply with court orders. In all of these cases, the Legislature has nearly unlimited authority to spend more than current law requires, but instead is constrained by the balanced budget requirement. Moreover, in some cases, once the Legislature takes action to spend more on a certain program—for example, by appropriating bond funds—it can create a long‑term and relatively inflexible budget commitment.

Over the Long Term, Legislature Has Much More Flexibility. Over the longer term, the Legislature has more control to reduce spending. For example, the Legislature could choose not to appropriate bond funds, resulting in lower debt service costs. The state also can make different choices about benefits for future employees, affecting pension costs for decades into the future. Finally, the state can make changes to sentencing laws, eventually resulting in changes to spending on corrections. These are just three examples among many.

More Long‑Term Flexibility Makes Multiyear Budgeting More Important. The Legislature’s ability to constrain cost growth over the long term, but not the short term, heightens the importance of multiyear budget planning. Anticipating future budget problems gives the Legislature more time to address them, in ways consistent with legislative priorities. To the extent that decisions today create long‑term and relatively inflexible obligations also heightens the importance of examining the multiyear effects of budget year choices. For example, past decisions to provide retroactive pension benefits created a very inflexible long‑term spending requirement for the state.

Key Elements of Budget Structure

This section of the report focuses on two key elements of the budget’s structure: (1) operating surpluses and (2) reserves. This section describes how each of these are measured, discusses how they help the budget withstand—or reduce—a budget problem, and gives guidance on setting a target level for each.

Operating Surpluses

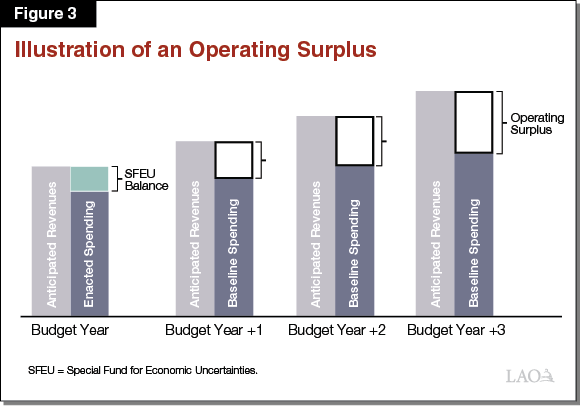

The first key element in the budget’s structure is the budget’s operating surplus. Figure 3 illustrates how operating surpluses accrue. As the figure shows, over this hypothetical four‑year period, anticipated revenues are higher than baseline expenditures. In fact, because this hypothetical shows revenues growing faster than expenditures, the operating surplus is increasing. (If, by contrast, anticipated revenues were lower than expenditures, the state would face an operating deficit.)

How Do We Measure the Operating Surplus or Deficit? Both our office and DOF produce multiyear estimates of the budget’s condition on a semiannual basis. These estimates use similar conventions. For example, both of our offices begin with a forecast of how we expect the economy could perform over the next few years. Using these economic assumptions, we construct estimates of anticipated revenues. (For instance, after making an assumption about wage and employment growth by industry in California, we estimate how much the state would collect in personal income tax [PIT] revenue from wages and salaries.) Then, we construct forecasts of baseline spending growth using constitutional formulas, models of caseload and prices, and assumptions about the effects of current law. Comparing forecasted revenue growth to expenditure growth, by year, yields the estimate of the operating surplus or deficit.

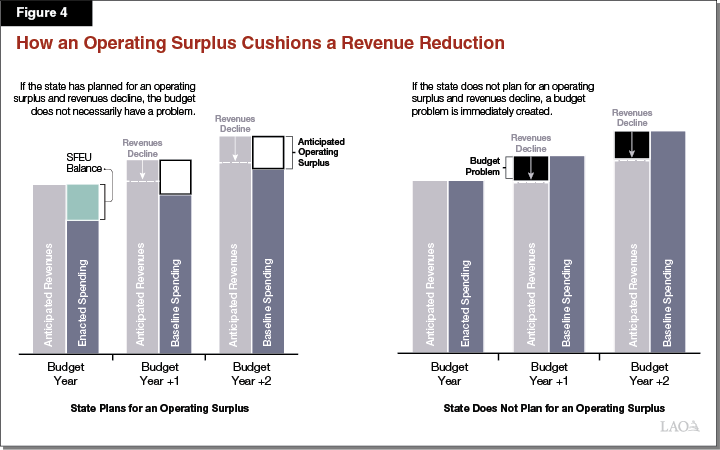

Maintaining an Operating Surplus Reduces Potential Budget Problems. Planning for an operating surplus creates a “cushion” to absorb potential revenue losses. In particular, over the course of the multiyear period, revenues will be higher or lower than anticipated. If revenues are lower than expected and the state has an operating surplus, the reduction to revenue might not result in a budget problem. Conversely, if the state has no operating surplus, any decline in revenues results in a corresponding budget problem. Figure 4 illustrates how this works.

While revenues most often are revised downward when the state is experiencing a recession, downward revisions can occur during economic expansions as well. For example, the 2016‑17 budget anticipated General Fund revenues (excluding transfers) would total $124.2 billion for that year. That estimate was ultimately too high by about $1 billion, with actual revenues in 2016‑17 now estimated to be $123.4 billion. (For simplicity, this example uses budget year estimates, but the same logic also applies to out‑year revenue estimates, which are subject to even more uncertainty.)

Determinants of Operating Surplus

Underlying Growth of Current Revenue Structure. The first determinant of the operating surplus is the rate at which revenues are expected to grow. The PIT is the largest revenue source in the state General Fund and grows relatively quickly when the economy is expanding. During a recession, however, PIT collections can decline precipitously. In recent years, with growth in wages and financial assets outpacing growth in other sectors and increases in marginal PIT rates, California’s revenue system has benefited from relatively fast revenue growth.

Underlying Growth of Baseline Spending. The second determinant of the operating surplus is the growth rate of baseline spending. (As noted in Figure 1 above, baseline spending is the cost to maintain state services authorized under current law.) Some programs within the budget can grow relatively quickly (for example, some health programs), but others grow more slowly (for example, corrections as inmate population growth has slowed or declined). Programmatic growth also can depend on a variety of factors, like demographic trends and economic conditions.

Budget Choices. Each legislative decision about the budget has an effect on the budget’s multiyear condition and—as a result—on the operating surplus. Generally, these fall into two categories:

- One‑Time Spending and Revenue Decisions. Spending and revenue decisions that are one time (that is, only authorized for one year) or temporary (authorized for a set period of years) expire. To continue, they must be reauthorized by the Legislature. A choice to allocate resources on a one‑time basis spends down the surplus for the budget year, but leaves the operating surplus intact.

- Ongoing Spending and Revenue Decisions. Commitments that are made on an ongoing basis are indefinite. Once made, ongoing expenditures will continue unless the Legislature takes action to end them. As such, an ongoing choice in one budget year becomes part of “baseline” spending and revenue in future budgets. In general, a choice to allocate resources on an ongoing basis will reduce the operating surplus by a like amount. Similarly, a choice to increase revenues on an ongoing basis would increase the state’s operating surplus.

Perhaps counterintuitively, there are one‑time and ongoing spending decisions that can result in higher operating surpluses. Examples of these choices are included in the box below.

Examples of How Budgetary Choices Can Result in Higher Operating Surpluses

Paying Down Debt Can Increase the Operating Surplus. The 2019‑20 budget focused on paying down state debts—in particular, making supplemental pension payments—as a key tool to improving the budget’s multiyear balance. These supplemental payments reduce the state’s unfunded liabilities, thereby reducing future annual payments to the pension system and reducing costs over a few decades. Taken alone, this action increases the state’s operating surpluses because it reduces costs over the long term.

Other Actions Also Can Increase Operating Surpluses. There are other ways the state can achieve long‑term savings and thereby increase the operating surpluses. For example, in the past the state has achieved state savings by shifting costs to other entities, including other governments and individuals. Other policy changes aim to lower state costs by reducing the average cost per unit of services—that is, by improving efficiency. Finally, the state can try to reduce costs over the long term by providing services that aim to reduce poverty, improve health outcomes, or avoid natural disasters, among others.

Setting an Operating Surplus Target

We suggest the Legislature consider an operating surplus target at the beginning of each legislative budget process. This target helps set the structure for the state’s budget and can form an overarching guide for decision‑making as the Legislature evaluates individual budget proposals. This target must be revisited each year because its level should depend on a variety of moving factors. These factors are:

- Expected Revenue Growth and Level of Uncertainty. While our revenue estimates are always subject to uncertainty, uncertainty is greater in some circumstances. For example, when economic signals suggest revenue growth could be weaker than the current consensus view—as was the case in November—we advise targeting a larger operating surplus.

- Expected Baseline Spending Growth and Level of Uncertainty. In general, uncertainty about baseline spending is caused by factors outside of the Legislature’s control. For example, if the Legislature has reason to believe choices by the federal government or courts are likely to result in higher expenditures than currently assumed, we advise setting the operating surplus at a higher level.

- Balancing Current Needs Against Future Needs of the State. Maintaining an operating surplus poses a trade‑off. Forgoing spending today to maintain an operating surplus limits the Legislature’s ability to address current priorities. In some cases the Legislature will prefer to address some programmatic needs today. As such, choosing a target operating surplus often means balancing the state’s current needs with its expected future needs.

Limitations of Multiyear Planning. Multiyear budget estimates in general—and operating surplus targets in particular—are only a reliable tool to the degree they are executed with fidelity. Making unrealistic or unsupported assumptions about revenues or spending growth—either too high or too low—renders both exercises less meaningful or even counterproductive. This is one of the key reasons our office scrutinizes the estimates and assumptions implicit in the administration’s multiyear estimates. It is also the reason we produce our own semiannual, independent multiyear estimates.

Reserves

The second key element of the budget’s structure is the state’s savings account—reserves. Reserves are key to the state’s ability to address a budget problem. As discussed earlier, budget problems arise when revenues are expected to be insufficient to cover baseline spending in a particular fiscal year.

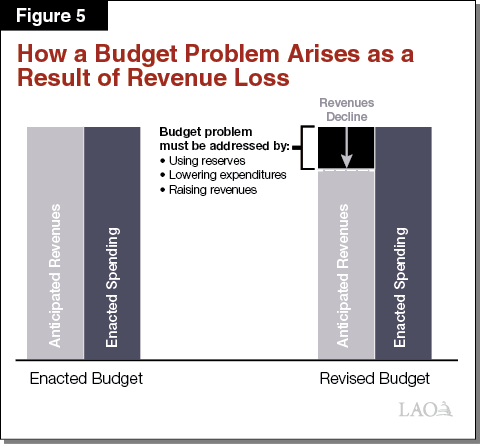

Budget Problem Likely Will Emerge as a Result of a Revenue Loss. Recessions are the most common reason that large budget problems occur. In a recession, revenues decline due to reduced economic activity. Despite this economic slowdown, absent policy changes, much of the state’s spending base continues to grow. This revenue loss often creates a budget problem in the tens of billions of dollars over multiple years. Figure 5 illustrates this concept. However, recessions are temporary. When they end, revenues begin to grow again. With good fiscal decision‑making, the related budget problems will eventually dissipate.

Budget Problems Also Can Arise as a Result of Ongoing Imbalance. Budget problems, however, are not always the result of temporary circumstances. Budget problems also can emerge when the underlying structure of the budget is misaligned. For example, if the state consistently commits more to spending than it is expected to receive in revenues, a budget problem will occur.

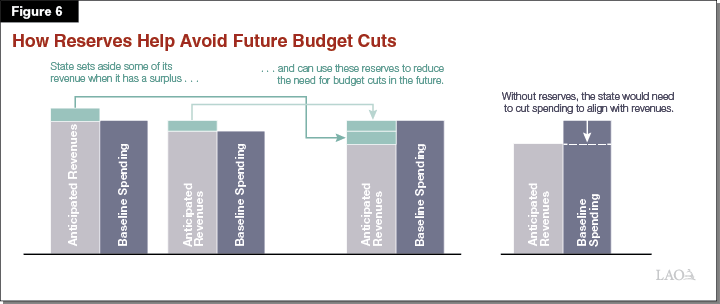

Reserves Are the Main Tool for Addressing Temporary Budget Problems. By functioning like a savings account, reserves help the Legislature address a budget problem. Figure 6 shows this point. When revenues are growing and are anticipated to exceed baseline spending, the state can set monies aside in a reserve. When revenues fall below baseline expenditures, reserves can be withdrawn to reduce the need for budget cuts. Because reserves are limited, they should only be used for budget problems that are expected to end—for instance, when the economy recovers. Using reserves to cover a budget problem that resulted from an ongoing structural issue would deplete the state’s savings account without addressing the underlying problem.

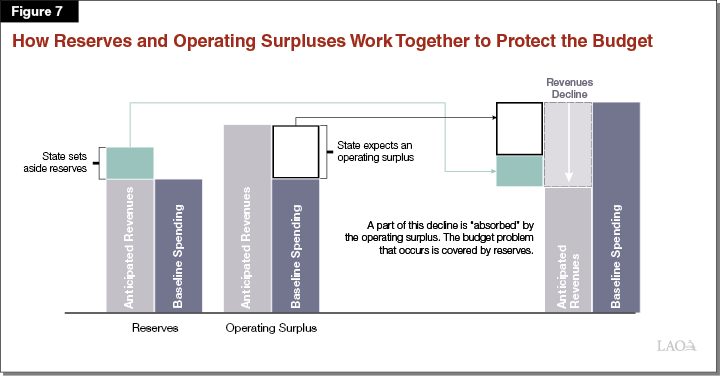

Reserves Work in Tandem With Operating Surpluses to Protect the Budget’s Condition. Reserves and operating surpluses work in tandem to improve the budget’s condition. First, an operating surplus cushions the revenue loss, resulting in a smaller budget problem. Then, reserves can be used to address a budget problem that remains. Figure 7 has an illustration of how this works. While these tools are both important, they are not equivalent. Unlike an operating surplus, reserves are not subject to measurement error. In fact, once reserves are deposited into an account they are certain. This is one of the reasons that we say reserves are the main tool for creating a more resilient budget.

California’s General Fund Reserves. The state has three major General Fund reserves: (1) the Budget Stabilization Account (BSA), (2) the Special Fund for Economic Uncertainties (SFEU), and (3) the Safety Net Reserve. The BSA is the state’s general purpose constitutional reserve and it is governed by the rules of Proposition 2. The Legislature is limited in when it can access these constitutional BSA deposits. The state’s other primary general purpose reserve account is the SFEU. Unlike the BSA, the Legislature has wide discretion to use the funds in the SFEU for any public purpose. The box below describes how the SFEU works in more detail. Finally, the Safety Net Reserve was created in 2018‑19 to fund the future costs for two means‑tested programs in the event of a recession.

Understanding the Special Fund for Economic Uncertainties (SFEU)

What Is the SFEU? The SFEU is the state’s general purpose reserve. More technically, however, the SFEU is the ending balance of the General Fund. That is, the SFEU is equal to the carry‑in balance from the prior year, plus revenues and transfers, and minus expenditures and encumbrances. As a result, the SFEU automatically adjusts to changes in each of these inputs—for example, the SFEU balance increases when anticipated revenues rise or when estimated expenditures fall.

In What Cases Can the SFEU Balance Be Negative? The constitutional balanced budget requirement means that the Legislature cannot enact an SFEU balance that is lower than zero. However, once enacted, the SFEU will adjust upward or downward as actual revenues or expenditures differ from expectations. For example, if revenues in the current year fall below expectations, the SFEU balance will automatically decline—sometimes falling below zero. The most recent example of this is the 2011‑12 budget package, which anticipated an SFEU balance of $543 million. However, when revenues fell short of expectations, the revised balance was later scored at ‑$2.2 billion.

How Does the SFEU Differ From a Surplus? In a proposed or enacted budget, the SFEU is part of the surplus, but not the entire surplus. When the state has a surplus expected for the upcoming fiscal year, both our office and the Department of Finance include the balance of the SFEU in that estimate. That is because the entire SFEU balance is discretionary and the Legislature could choose to set the fund balance at any other level greater than zero. However, our calculations of the surplus also include any other discretionary spending proposals—that is, spending not required under current law.

Setting a Reserve Target

Considerations for Setting a Reserve Target. We always recommend the Legislature begin its budget deliberations by setting a target level for reserves. There is no one single, ideal target. Rather, the target should change from year to year depending on certain factors. Those are:

- Size of the Revenue Loss. We suggest the Legislature first consider the size of the revenue loss for which it wants to prepare. Revenue losses can be larger or smaller depending on a few different factors. For example, for a revenue loss resulting from a recession, the key factors are the timing, severity, and length of that recession. To be prepared for a larger, more severe recession, the state needs more reserves.

- Size of Underlying Operating Surplus. The next criterion for determining a target level of reserves is the size of the underlying operating surplus. If the state has planned for a larger operating surplus, all else equal, the budget problem associated with a given revenue loss will be smaller than it could be otherwise and less reserves will be required. In fact, every dollar of operating surplus offsets revenue losses dollar‑for‑dollar over multiple years. This means a dollar of operating surplus yields more than a dollar of benefit. In contrast, a lower operating surplus means more reserves are required to cover a budget problem.

- Willingness to Take Actions During a Recession. We noted earlier that the Legislature has three possible responses to address a budget problem if reserves are insufficient to cover the shortfall. Namely, the Legislature can increase revenues, reduce spending, or shift costs. If the Legislature is more willing to take these actions, less reserves are needed. On the other hand, if the Legislature would prefer to cover most or all of a future budget problem with reserves, then more reserves would be needed.

- Ability to Take Actions During a Recession. While the Legislature has a great deal of control over the state budget, there are some areas of the budget in which the Legislature has less flexibility to reduce costs. The areas where the Legislature has more flexibility might not align with those where the Legislature would prefer to make budgetary reductions. For example, while the Legislature has significant discretion to lower General Fund spending on the universities, many policymakers might prefer not to do so. Conversely, it might be appealing to reduce debt payments or pension contributions during a recession, but the Legislature has very little flexibility to do so.

Past Publications Noted Budget Problems Likely to Range From $20 Billion to $40 Billion. Our past budget publications have estimated ranges of reserves that would be needed for the state to weather various types of recessions with minimal reductions to ongoing programs. Based on the experience of recent recessions, we estimate the state would need about $20 billion in reserves to cover a budget problem associated with a mild recession (a revenue loss of about $40 billion) or $40 billion to cover a moderate recession (a revenue loss of about $80 billion). (The box below describes how the concepts of “budget problem” and “revenue loss” differ.)

How a Budget Problem Differs From a Revenue Loss

A budget problem represents the amount by which expenditures exceed revenues in a given year. A budget problem is not the same as a revenue loss. There a two key reasons for this:

- Operating Surplus Lowers Potential Budget Problem. First, as this report has discussed extensively, if the state has an operating surplus, that will “cushion” an initial revenue loss to some extent. This means that revenues can decline relative to expectations by some amount before they actually fall below baseline spending.

- Constitutional Spending Requirements Fall When Revenues Fall. Second, some state expenditures adjust automatically to changing revenue conditions, also offsetting revenue losses. For example, the state’s required debt payments under Proposition 2 (2014) likely will fall by at least $1 billion or $2 billion over a multiyear period, leading to a smaller budget problem. (The state’s other annual debt payments—for example, for bond debt service—would not be affected.) In addition, required General Fund spending on schools and community colleges—under the provisions of Proposition 98 (1988)—also usually declines when revenues do. If the Legislature does not wish to reduce school and community college spending in a recession, the budget problem would be larger than what we have described here, and more reserves would be required.

Reserve Target Will Change Depending on Operating Surplus. Those estimates of budget problems assume the state has no operating surplus. Yet, if the state does have an operating surplus, it directly would offset reserves needed. For example, if a recession is expected to last three years, a $1 billion operating surplus would offset revenue losses by $3 billion, lowering reserves needed by a like amount.

2020‑21 Budget Structure

This section applies the analytical framework from this report to the budget structure for 2020‑21. In particular, we evaluate the proposed structure of the Governor’s budget and offer alternatives and recommendations to improve its resilience.

Prior Budgets Affect Starting Place for 2020‑21. The starting place for each annual budget is the result of the cumulative effects of decisions made in the past. The 2020‑21 budget is influenced, in particular, by a number of significant choices from 2019‑20. First, last year’s spending plan allocated a large dollar amount of discretionary spending toward new ongoing purposes. Specifically, the budget included $4 billion in new discretionary spending, which is expected to grow to $6 billion over time. On the other hand, the budget dedicated a large amount of funding to accelerating payments toward state debts. While those payments are likely to eventually save the state billions of dollars over the long term, in 2020‑21 those payments are saving the General Fund less than $100 million.

The Governor’s Proposed Budget Structure

This section describes and evaluates the Governor’s proposed budget structure for 2020‑21. First, we outline the assumptions that underline the Governor’s multiyear budget estimates and evaluate their reasonableness. Second, we describe the key choices the Governor makes that affect the budget’s multiyear condition. Those assumptions and choices result in the key elements of the budget’s structure: the operating surplus and reserves. Third, we describe those key elements and provide our assessment of them.

Key Assumptions

While the Governor’s budget includes hundreds of assumptions, we describe three key ones here. Each of these assumptions are vital to the underlying condition of the budget and dictate—to a large degree—the multiyear condition of the budget. They are:

- Economy Continues to Grow, Albeit at a Slower Pace. The Governor’s budget assumes the economy will continue to grow but at a more modest pace than recent years. Job growth is expected to continue but will slow as the pool of workers looking for jobs continues to shrink. Wage growth is expected to increase as employers compete for workers. Housing construction is expected to pick up after plateauing during the last few years.

- Modest Revenue Growth. The Governor’s budget assumes General Fund revenues grow about 2 percent per year, increasing from $150 billion in 2019‑20 to $164 billion in 2023‑24. In contrast, revenues grew 6 percent in 2018‑19 and are expected to grow 5 percent in 2019‑20.

- Managed Care Organization (MCO) Tax Approved. After enacting the 2019‑20 budget in June, the Legislature reauthorized the MCO tax in September. The MCO tax generates General Fund benefit by taxing enrollment in MCOs and using that revenue to offset General Fund costs in Medi‑Cal. The MCO tax requires federal authorization. The Governor’s budget assumed the federal government would eventually approve it in 2021‑22. After the release of the Governor’s budget, however, the federal government indicated it will not approve the tax. (A spokesperson for the administration has indicated they continue to expect to come to an agreement with the federal government on this issue.) The Governor’s budget assumed no benefit from the MCO tax in 2020‑21, but an annual benefit of $1 billion to $2 billion over the multiyear period.

Assumptions Are Reasonable, but Uncertain. We find the administration’s assumptions to be generally reasonable on net. On one hand, our own office’s most recent estimates of multiyear revenue growth are somewhat higher than the administration’s estimates—averaging 3.4 percent over the period. This represents a net difference of $5.6 billion across 2021‑22 to 2023‑24. (While our revenue estimates were put together a couple of months before the administration’s were, there have not been any major reversals in economic trends that would likely cause us to substantially change these estimates.) On the other hand, given that MCO tax approval is uncertain, the administration takes an optimistic approach in assuming it ultimately is approved.

Key Choices

The primary choices the Governor makes in the budget that affect its multiyear structure are in allocating the surplus. We estimate the Governor had a $6 billion surplus to allocate in the 2020‑21 budget process. (The box below discusses our calculation of the surplus and how it relates to the state’s net position in financial statements.) The Governor chooses to allocate that surplus to a variety of purposes, including:

- $2.7 Billion to One‑Time or Temporary Spending. The Governor dedicates $2.7 billion of this surplus to one‑time or temporary spending—which we define to mean spending that will occur under law for fewer than four years. Unless reauthorized, this spending will not continue in future years thereafter.

- $1.6 Billion of Surplus to Ongoing Spending (Growing to $1.9 Billion Over Time). The Governor’s spending proposals also include $1.6 billion in ongoing spending, representing roughly one‑quarter of resources available. Because some of these ongoing proposals are phased in over a multiyear period, we estimate the cost at full implementation of these proposals is $1.9 billion annually.

- $235 Million to Accelerate Planned CalPERS Payment. The 2019‑20 budget authorized three future supplemental payments to state employee pensions: $265 million in 2020‑21, $200 million in 2021‑22, and $35 million in 2022‑23. The Governor’s budget accelerates the planned out‑year payments to the current year, resulting in $235 million in additional payments this year.

How Our Calculation of the Surplus Interacts With State Financial Statements

State Produces Annual Financial Statements. Each year, the State Controller’s Office works with departments to produce the Comprehensive Annual Financial Report (CAFR). The CAFR displays the state’s finances in compliance with generally accepted accounting principles (GAAP) for state and local governments in the United States. The Governmental Accounting Standards Board—a nonprofit entity—has a key role in establishing GAAP for state and local governments. The State Auditor’s Office audits the CAFR, and the report is released each spring.

How the Budget Can Have a “Surplus” and Hundreds of Billions of Dollars of Liabilities. The CAFR includes a statement of the state’s assets and liabilities, which are not reflected in the state budget. For example, the CAFR reflects the state’s hundreds of billions of dollars in liabilities, but those do not appear in the budget. That is because financial statements like the CAFR serve a different purpose than the state budget. Debts like unfunded liabilities have budgetary implications to the extent that addressing them requires more (or less) expenditures in a given year. Financial statements are important for budgetary conversations because they signal the extent to which these future payments will grow. However, the calculation of the state’s budgetary position—for example, the surplus or deficit—in any given year is not otherwise affected by changes in unfunded liabilities and other debts.

Governor’s Budget Chooses to Suspend Program Expenditures in 2023‑24. The 2019‑20 budget package made a number of ongoing program augmentations subject to suspension on December 31, 2021 if the budget is not projected to collect sufficient revenues to fund them. The augmentations subject to suspensions were in a variety of state programs, including In‑Home Supportive Services, developmental services, and Medi‑Cal. The Governor proposes delaying the planned suspensions by 18 months—to July 1, 2023. However, because the Governor also proposes new spending of roughly the same cost of these suspended programs, he is effectively choosing to suspend the program expenditures in order to fund its new priorities. Absent the new proposed spending that totals roughly $2 billion in 2023‑24, the suspensions would not need to be operative.

Constitutionally Required Debt Payments Focus on Teachers’ Pensions. The Governor also makes choices in allocating constitutional requirements that affect the budget’s structure. (These requirements are considered part of baseline spending and so are not included in the allocation of the $6 billion surplus.) In particular, under the Governor’s revenue estimates, the state is required to make $2 billion in additional debt payments under Proposition 2. (The box below describes Proposition 2 in more detail, including the various ways it improves budget resilience.) The Governor allocates these payments to a few different purposes, placing an emphasis on the state’s unfunded liabilities for teachers’ pensions. While this payment would help to pay down debt, it is unlikely to result in state savings over the next few years. As a result, it has little effect on the multiyear budget condition.

How Proposition 2 Improves Budget Resilience

Reserve Deposits Mitigate Revenue Losses. Proposition 2 (2014) aims to insulate the budget from revenue declines in several ways. In particular, it sets aside monies—including from capital gains, one of the most volatile components of state revenues—and dedicates them to budget reserves and debt payments. It therefore first mitigates revenue losses first by taking revenues “off the table” in good economic times, which can lead to lower ongoing spending—increasing the state’s operating surplus. Second, it requires the state to build budget reserves.

Some Debt Payments Further Increase Operating Surplus. To the extent that Proposition 2 debt payments are used to pay down debts that result in state savings, the measure also further increases the state’s operating surplus. For example, in the 2019‑20 budget, $1.1 billion in Proposition 2 debt payment requirements were used to make a supplemental payment to the California State Teachers’ Retirement System (CalSTRS). This payment is likely to reduce state contributions to CalSTRS over the next few decades, saving the state money. However savings are unlikely to begin accruing for at least a few years.

Key Elements

In this section we describe—and then provide our evaluation of—the two key elements of the Governor’s multiyear budget structure: the planned operating surplus and reserve level. In particular the Governor proposes:

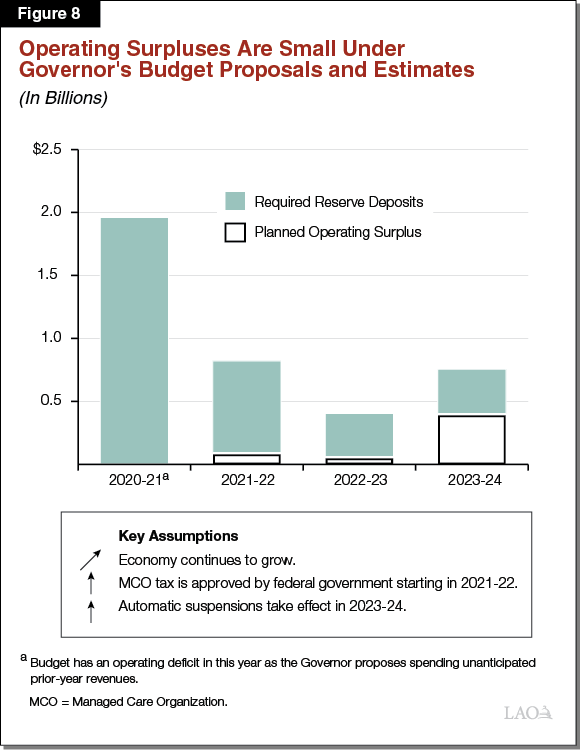

- Multiyear Budget Structure With Small Operating Surpluses. Figure 8 shows the operating surpluses under the administration’s estimates in the Governor’s proposed budget. (Importantly, this figure shows the administration’s own assessment of its proposals, not our independent estimates.) As the figure shows, the administration’s estimates suggest the proposed budget is in structural balance with operating surpluses near zero in most years of the period.

- Total Reserve Balance of $20.5 Billion. Under the Governor’s proposed budget, the state would end 2020‑21 with $20.5 billion in total reserves. This represents an increase of $1.7 billion from the 2019‑20 enacted reserve level of $18.8 billion. This increase is nearly entirely attributable to the state’s constitutional reserve requirement. (Reserve deposits would also continue throughout the period, as required under the state constitution and also shown in Figure 8.)

Recommend Legislature Consider Priority of Governor’s Proposals Relative to Proposed Suspensions. The administration’s own multiyear estimates suggest the state cannot afford both to make the new augmentations proposed by the Governor and avoid suspending existing program expenditures in 2023‑24. While we acknowledge there is a great deal of uncertainty in these estimates, the Governor’s budget effectively chooses to make new program augmentations at the expense of existing expenditures subject to suspension. If the Legislature agrees with the assumptions underlining the Governor’s budget, we recommend it consider whether the new spending proposed by the Governor is a higher priority than the augmentations subject to suspension. Forgoing some of these augmentations also would increase the state’s operating surplus over the multiyear period.

Operating Surplus More Important This Year Than Prior Years. Reserves are the best tool the state has to address budget problems that emerge during temporary shocks to the state budget—such as a recession. However, they are a poorly suited and inappropriate tool for addressing ongoing structural budget problems. For example, if the state in unable to gain federal approval for the MCO tax, using reserves to cover the budget problem that likely would emerge would be inadvisable. Similarly, if the economy cools and revenue growth weakens—as some economic signals suggest—we likely would advise the Legislature against using reserves to cover any ensuing budget problems. As such, maintaining an operating surplus is the key tool to prevent risks like these from developing into deficits—making it more important to the budget condition than it has been in previous years. By proposing a budget that does not include much of an operating surplus, the Governor eliminates this cushion at the very moment the risk of doing so is heightened. Correspondingly, we have recently sharpened our focus on this issue.

Proposed Reserves Are Sufficient to Cover Revenue Loss of $47 Billion. After accounting for the proposed operating surplus and constitutional funding requirements, the Governor’s level of reserves could address a revenue loss of $47 billion. (This assumes schools and community colleges are funded at their constitutional minimum level.) This is less than the revenue loss we estimated the budget could withstand—$57 billion—in our most recent Fiscal Outlook. There are two reasons the Governor’s budget is less prepared for a recession than our Fiscal Outlook anticipated:

- Lower Operating Surpluses. First, the Governor proposes lower operating surpluses than our Fiscal Outlook anticipated. In particular, our Fiscal Outlook estimated the budget would have operating surpluses of roughly $3 billion each year. The Governor’s estimated operating surpluses, however, are near zero in two years of the period. There are two reasons for this difference: (1) the Governor assumes lower revenue growth than we do and (2) the Governor proposes nearly $2 billion of new ongoing spending. (Our outlook does not assume any new spending above what is required to fund existing services.)

- Governor Builds Less in Reserves. The second reason for the difference in preparedness is the planned reserve level. In our Fiscal Outlook scenario, we assumed the state entered the recession with $23 billion in reserves. The Governor proposes a reserve level of $20.5 billion.

To Prepare for a Larger Revenue Loss, Either More Reserves or Higher Operating Surpluses Are Needed. By proposing a budget with very small operating surpluses, the Governor eliminates a key tool of recession preparedness. In a still‑growing but now mature economic expansion, supplementing the state’s fiscal resilience by preserving a larger operating surplus would be prudent. Alternatively, if the Legislature chooses to follow the Governor’s approach on the operating surplus, we advise building more reserves, for example, by repurposing some of the Governor’s one‑time spending proposals.

Conclusion

California has made significant progress in recent years to improve its budget structure, making the state more fiscally resilient. Yet the process of achieving resilience can never be considered finished. In fact, the goals for state reserves and operating surpluses will constantly shift, updating each year depending on new information about the challenges and conditions facing the state. As a result, the state’s fiscal condition and budget structure must be revisited each year.

At times, concepts like multiyear budgeting and the state’s operating surplus are complex and seem abstract. Yet we do not emphasize the importance of them for their own sake. Rather, the goal of this exercise is to evaluate whether or not the state can afford to keep its current commitments and to help decision makers determine the extent to which the state can support new services. While we conduct this exercise based on what we know today—and our knowledge of the world and the future is limited—it is nonetheless integral to these decisions.