LAO Contact

February 24, 2020

The 2020-21 Budget

Taxation of E‑Cigarettes

Executive Summary

State Taxes Cigarettes and E‑Cigarettes. The state levies a $2.87 per pack tax on cigarettes. The state currently taxes other tobacco products—including e‑cigarettes—at 59 percent of the wholesale price.

Governor’s Budget Proposal

New Tax on E‑Cigarettes. The Governor has proposed a new state tax on e‑cigarettes at a rate of $1 for every 20 milligrams of nicotine in a product (in addition to the existing tax). The stated goal of this proposal is to reduce youth use of e‑cigarettes. The proposal does not include an inflation adjustment.

Revenue Would Go to New Special Fund. The Governor proposes that revenue from the proposed e‑cigarette tax be deposited into a new special fund. The fund would be available for three purposes: administration and enforcement of the new tax, tobacco youth prevention programs, and health care programs.

2020‑21 Spending Proposals. In 2020‑21, the Governor proposes spending $9.9 million from the new fund on tax administration and $7 million on an enforcement tax force.

LAO Comments

Effects on Vaping and Smoking. Our review of available evidence suggests that the proposed tax likely would reduce both youth and adult e‑cigarette use substantially. The tax also likely would increase adult cigarette smoking. The effects on youth cigarette smoking are unclear.

Tax Structure. If the Legislature wishes to enact a new tax on e‑cigarettes, the proposed nicotine‑based tax structure is reasonable. If the Legislature agrees with the Governor’s focus on reducing youth e‑cigarette use, we suggest it consider alternative nicotine‑based taxes that place higher rates on products that tend to encourage or enable youth use.

Governor’s Proposed Tax Rate. The administration estimates that its proposal would result in roughly the same state tax rate on nicotine intake, whether that intake comes from e‑cigarettes or conventional cigarettes. The administration, however, has not presented a compelling argument for this rate. In particular, it has not made a case that e‑cigarettes and cigarettes are equally harmful, nor that the current cigarette tax is set at the right rate. The administration’s comparison also does not account for federal taxes.

Initial Tax Rate. As the Legislature considers what tax rate to set on e‑cigarettes, it faces six key questions:

- How harmful are e‑cigarettes?

- To what extent do vapers’ choices account for these harms?

- How would the tax rate affect e‑cigarette use?

- How would the tax rate affect other outcomes, such as cigarette smoking?

- How would the tax rate affect compliance with the tax?

- How would the tax interact with other state and federal policies?

Future Tax Rates. We recommend that the Legislature index the tax rate to inflation to keep its economic value steady over time. We also recommend that the Legislature revisit the rate frequently in the coming years.

Revenues. We estimate that the new tax would raise tens of millions of dollars annually.

Revenue Allocation. We recommend that the Legislature take an approach to revenue allocation that prioritizes flexibility. Ideally, this would mean depositing the revenue into the General Fund. If, however, the Legislature prefers to deposit the revenue into a special fund, the Governor’s proposed approach is better than a restrictive, formulaic approach.

Tax Stamps. The Governor proposes $8 million in 2020‑21 and ongoing for a stamp contract. In the cigarette tax program, stamps help distinguish tax‑paid cigarettes from others. Stamps could have similar enforcement benefits for e‑cigarettes, but they would need to be more complex. The administration does not appear to have considered this complexity carefully enough to justify the requested appropriation.

Background

What Are E‑Cigarettes? Vaping products are electronic devices that heat liquid to create an aerosol inhaled, or “vaped,” by the user. This report uses the term “e‑cigarettes” to refer to devices that create aerosols containing nicotine—the substance that makes tobacco products addictive. E‑cigarettes come in a variety of forms, and the mix of available products has changed rapidly in recent years. Some e‑cigarettes create aerosols that are unflavored or tobacco‑flavored, while others taste like fruit, candy, menthol, or mint.

E‑Cigarette Health Concerns. Researchers and public officials have raised a variety of health concerns related to e‑cigarettes and to vaping more generally. We classify these concerns into three categories:

- 2019 E‑Cigarette or Vaping Use‑Associated Lung Injury (EVALI) Outbreak. In the summer of 2019, public health officials in many states reported a sharp increase in severe lung injuries associated with the use of vaping devices. This increase continued until September 2019, at which point the number of new EVALI cases began to decline. As of February 4, 2020, the Centers for Disease Control and Prevention (CDC) had received reports of 2,758 hospitalizations and 64 deaths resulting from these injuries. The CDC has identified a substance used in certain illicit cannabis products as a key factor contributing to EVALI, but investigations into the causes of these injuries are still ongoing.

- Nicotine Concentrations. Many e‑cigarettes enable users to inhale more nicotine than smokers typically obtain from cigarettes. In addition to nicotine’s addictive properties, researchers have raised other concerns about its effects, particularly with regard to youth brain development.

- Other Aerosol Contents. E‑cigarettes contain much smaller amounts of the known toxicants and carcinogens present in cigarettes. That said, emerging research suggests that they may contain other substances of potential concern. More generally, many of the long‑term health effects of e‑cigarette use appear to be unknown at this time.

E‑Cigarette Use

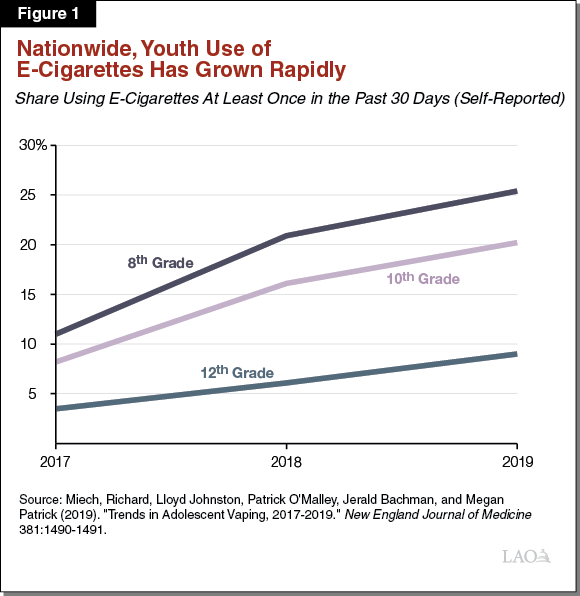

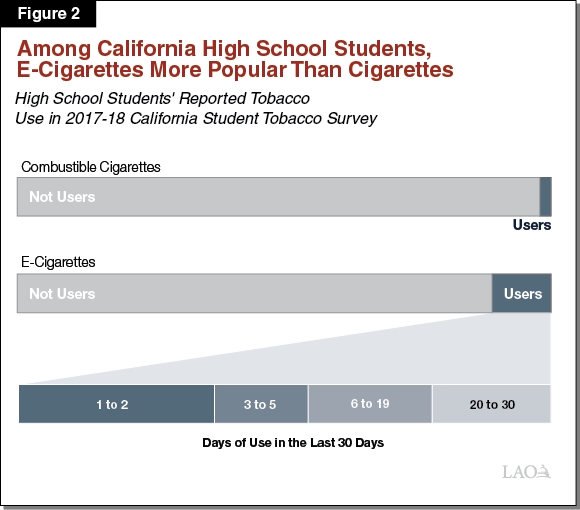

Youth Use of E‑Cigarettes Has Grown Rapidly. As shown in Figure 1, youth e‑cigarette use has grown rapidly in the U.S. over the last few years. Nationwide, the share of high school seniors who report using e‑cigarettes at least once in the past month rose from 11 percent in 2017 to 25 percent in 2019. Despite California’s relatively low and declining rates of cigarette smoking, the state also has experienced rapid growth in youth e‑cigarette use. As shown in Figure 2, e‑cigarettes were roughly five to six times as popular as conventional cigarettes among California high school students during the 2017‑18 school year.

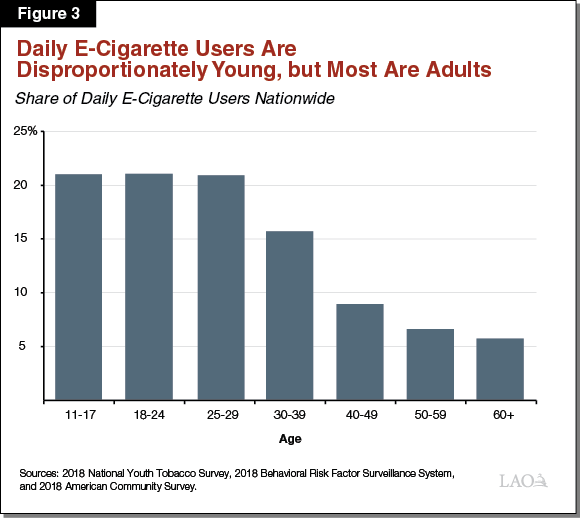

Daily E‑Cigarette Users Disproportionately Young, but Most Are Adults. As shown in Figure 3, daily e‑cigarette users are disproportionately young, but the majority are adults. One‑fifth of daily users are under 18 and another fifth are 18 to 24 years old. The remaining three‑fifths are 25 or older.

Current Cigarette and E‑Cigarette Policies

State Taxes Cigarettes. California levies a $2.87 per pack excise tax on cigarettes. Ballot measures have enacted $2.75 of this rate, while the Legislature has enacted the other $0.12. Two of the key tools used to enforce this tax include:

- Stamps. To pay the cigarette tax, cigarette distributors purchase tax stamps from the state‑approved vendor, then affix them to packs of cigarettes before they sell the cigarettes to wholesalers or retailers. These stamps help tax administrators, businesses, and consumers distinguish tax‑paid cigarettes from others.

- Federal Law on Purchases From Other States. Sometimes consumers try to avoid state cigarette taxes by purchasing cigarettes over the Internet from retailers in lower‑tax states. A 2009 federal law known as the Prevent All Cigarette Trafficking (PACT) Act gives states some effective tools for preventing this type of tax avoidance.

State Taxes E‑Cigarettes. California levies an excise tax on non‑cigarette tobacco products. This tax has applied to e‑cigarettes since April 1, 2017. The rate currently is 59 percent of the wholesale price.

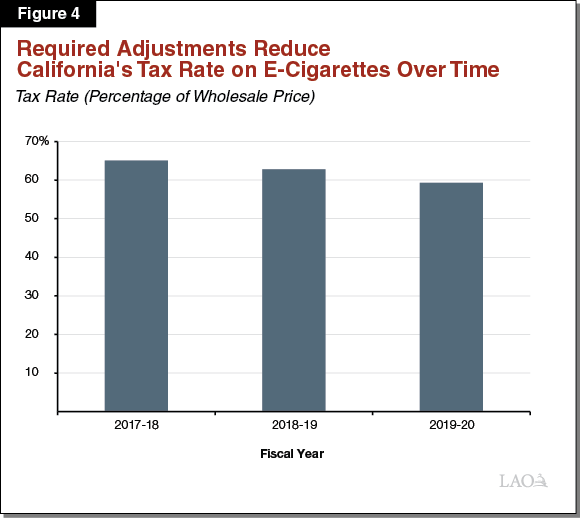

Required Adjustments Reduce Tax Rate Over Time. The California Department of Tax and Fee Administration (CDTFA) must adjust the tax rate on non‑cigarette tobacco products (including e‑cigarettes) annually based on a formula originally established by Proposition 99 of 1988 and modified by subsequent ballot measures. Under this formula, the tax rate on e‑cigarettes depends on the ratio of the state cigarette tax rate to the average wholesale price of cigarettes. (In particular, the rate is equal to this ratio multiplied by roughly 117 percent.) However, cigarette prices tend to grow over time, so the tax rate as a share of the overall price tends to decline over time. Correspondingly, the e‑cigarette tax rate tends to decline over time as well, as illustrated in Figure 4.

State Has Taken Other Actions. In addition to levying an excise tax, the state has undertaken a variety of efforts related to e‑cigarettes, with a particular focus on reducing youth use. Examples include:

- Chapters 7 and 8, Statutes of 2016 (SB X2 5, Leno and SB X2 7, Hernandez) raised the minimum age to purchase e‑cigarettes (and other tobacco products) from 18 to 21.

- Chapter 295, Statutes of 2019 (SB 39, Hill) imposed stricter age verification requirements for e‑cigarettes (and other tobacco products) sold online or by mail.

- In September 2019, the Governor issued an executive order directing CDTFA and the California Department of Public Health (CDPH) to develop recommendations and take actions related to e‑cigarettes, including a vaping awareness campaign.

- In November 2019, the Attorney General and local officials sued JUUL, a leading e‑cigarette manufacturer, for allegedly marketing its products to youth and failing to provide required health warnings.

The Legislature currently is considering further actions, including a bill that would ban flavored tobacco products (including flavored e‑cigarettes) and the tax proposal discussed in this report.

Federal Government Has Taken Actions. Although the federal government levies excise taxes on conventional cigarettes and most other tobacco products, it does not levy such a tax on e‑cigarettes. However, the federal government has taken some steps towards regulating e‑cigarettes. For example, in January 2020, the Food and Drug Administration (FDA) banned the sale of certain types of flavored e‑cigarettes. The FDA additionally announced that e‑cigarette manufacturers would need to submit applications for FDA approval by May 2020. At this time, the scope and timing of further FDA actions are unclear, but the agency appears to be taking a more active role in e‑cigarette regulation than it had in the past.

Many States Tax E‑Cigarettes. California is one of 18 states that currently levy statewide excise taxes on e‑cigarettes. As shown in Figure 5, these taxes come in four forms:

- Percentage of Wholesale Price. California is one of nine states that impose e‑cigarette taxes as a percentage of the wholesale price. The tax rates range from 10 percent to 95 percent.

- Percentage of Retail Price. New Jersey and New York tax retail sales of e‑cigarettes at 10 percent and 20 percent respectively.

- Volume‑Based. Nine states levy e‑cigarette taxes based on the volume of liquid, with rates ranging from 5 to 27 cents per milliliter.

- Cartridge‑Based. New Mexico taxes cartridge‑based e‑cigarette products at $0.50 per cartridge.

Figure 5

Statewide E‑Cigarette Taxes

|

State |

Year Implemented |

Current Rate |

|

Taxes on Wholesale Price |

||

|

California |

2017 |

59% |

|

Illinois |

2019 |

15% |

|

Maine |

2020 |

43% |

|

Minnesota |

2012 |

95% |

|

Nevada |

2020 |

30% |

|

Pennsylvania |

2016 |

40% |

|

Vermont |

2019 |

92% |

|

Tax on Retail Price |

||

|

New York |

2019 |

20% |

|

Taxes on Volume of E‑Liquid |

||

|

Delaware |

2018 |

$0.05/ml |

|

Kansas |

2017 |

$0.05/ml |

|

Louisiana |

2015 |

$0.05/ml |

|

North Carolina |

2015 |

$0.05/ml |

|

Ohio |

2019 |

$0.10/ml |

|

West Virginia |

2016 |

$0.08/ml |

|

Taxes That Vary By Type of Product |

||

|

Connecticut |

2019 |

10% of wholesale price or $0.40/ml |

|

New Jersey |

2018 |

10% of retail price or $0.10/ml |

|

New Mexico |

2019 |

13% of wholesale price or $0.50 per cartridge |

|

Washington |

2019 |

$0.09/ml or $0.27/ml |

Governor’s Proposal

New Tax on E‑Cigarettes. The Governor has proposed a new state tax on e‑cigarettes with the stated goal of reducing youth use of e‑cigarettes. (The new tax would be in addition to the existing tax described above.) The proposed tax would go into effect on January 1, 2021. The proposal also includes a one‑time tax on e‑cigarette inventories to deter businesses from stockpiling untaxed products in advance of the tax increase.

Tax Rate. The rate of the new tax would be roughly $1 for every 20 milligrams of nicotine in a product (in addition to the existing tax). The exact amount of tax on each item would be determined in two steps: (1) rounding up the total amount of nicotine to the next‑highest multiple of 20 milligrams, and (2) assessing a $1 tax per 20 milligrams, For example, the tax on an item containing 92 milligrams of nicotine—roughly the amount in a four‑pack of 3 percent nicotine JUUL pods—would be $5.

Governor’s Revenue Estimates. The 2020‑21 Governor’s Budget assumes that the proposed e‑cigarette tax would raise $34 million in 2020‑21 and $55 million in 2021‑22. That said, the administration has emphasized that the amount of revenue raised is highly uncertain at this time.

Revenue Would Go to New Special Fund. The Governor proposes that revenue from the proposed e‑cigarette tax be deposited into a new special fund. The Legislature would appropriate the monies in this fund during the annual budget process. The fund would be available for three purposes: administration and enforcement of the new tax, tobacco youth prevention programs, and health care programs.

2020‑21 Spending Proposals. The 2020‑21 Governor’s Budget includes two specific proposals for spending the revenue raised by the new tax.

- Tax Administration. The Governor has proposed spending $9.9 million from the new fund in 2020‑21, $10.2 million in 2021‑22, and $10.4 million in 2022‑23 for CDTFA to administer the tax.

- Vaping‑Related Enforcement. The Governor has proposed spending $7 million in 2020‑21 and ongoing for the California Highway Patrol (CHP) and the California Department of Justice (DOJ) to create a task force to enforce laws related to vaping devices generally (not limited to e‑cigarettes). We analyze this proposal along with other CHP proposals in The 2020‑21 Budget: Transportation.

LAO Comments

In this section, we provide information and perspectives for the Legislature to consider as it weighs not just the Governor’s proposal, but also the design of e‑cigarette taxes more broadly.

Effects on Vaping and Smoking

Tax Likely Would Reduce E‑Cigarette Use Substantially. Our review of available evidence suggests that the proposed tax likely would reduce both youth and adult e‑cigarette use substantially. That said, the size of these effects is uncertain. Key sources of uncertainty include recent changes in the e‑cigarette market, potential major state and federal policy changes besides the proposed tax, and the novelty of the proposed tax structure.

Likely Increase in Adult Smoking; Effects on Youth Smoking Unclear. In principle, the new tax could lead to higher or lower conventional cigarette smoking. On one hand, to the extent that the tax reduces the number of people who become addicted to nicotine, it could reduce cigarette smoking. On the other hand, to the extent that the tax reduces the number of smokers who switch from cigarettes to e‑cigarettes, it could increase cigarette smoking. In our view, the best available evidence suggests that the proposed tax likely would increase cigarette smoking among adults, at least over the first few years. The evidence regarding youth cigarette smoking is more ambiguous.

Tax Structure

Nicotine‑Based Tax Reasonable. The amount of nicotine contained in e‑cigarette liquid can vary widely, even for a given volume and price. For example, retailers often sell ten‑milliliter bottles of a given brand of liquid for the same price, regardless of whether that liquid’s nicotine concentration is high, low, or somewhere in between. Due to this variation, the Governor’s proposal to tax e‑cigarettes based on nicotine content would raise the cost of nicotine more directly and consistently than a price‑based, volume‑based, or cartridge‑based tax. This would make the proposed tax structure more effective at discouraging nicotine consumption than the alternative tax structures. This focus on nicotine—rather than some other measure of the chemical composition of e‑cigarette liquid—is reasonable for two reasons: (1) many e‑cigarette health concerns are nicotine‑related; and (2) information about e‑cigarettes’ nicotine content generally is readily available.

Alternative Nicotine‑Based Structures Worth Considering. If the Legislature agrees with the Governor’s focus on reducing youth e‑cigarette use, we suggest it consider alternative nicotine‑based tax structures that could target youth use more effectively. In particular, the state could levy a relatively high tax rate on products that tend to encourage or enable youth use, and a relatively low tax rate on other products. For example, the Legislature could levy a higher tax rate on types of e‑cigarettes that are smaller or easier to use, and a lower tax rate on other types.

Assessing Governor’s Proposed Tax Rate

Administration Aims to Tax Vaped and Smoked Nicotine at Same Rate. The administration has indicated that it intends to tax nicotine intake at the same rate, regardless of whether the nicotine is vaped or smoked. The administration estimates that the proposed e‑cigarette tax rate of $1 per 20 milligrams of nicotine, combined with the existing tax rate of 59 percent of the wholesale price, would bring the state’s overall tax rate on e‑cigarettes roughly in line with its tax rate on conventional cigarettes.

Are E‑Cigarettes and Cigarettes Equally Harmful? Given potential substitution between cigarettes and e‑cigarettes, we suggest considering the two tax rates in relation to each other. If the Legislature views cigarettes and e‑cigarettes as equally harmful, then taxing them at the same rate could make sense. The administration, however, has not presented an argument that they should be considered equally harmful.

Is the Cigarette Tax Currently Set at the Right Rate? Even if the Legislature shares the administration’s intent of taxing e‑cigarettes and cigarettes at the same rate, a key question remains: what should that rate be? As long as the Legislature is considering changes to the e‑cigarette tax rate, we see no reason to rule out changes to the cigarette tax rate as well. Whether the current rate appropriately balances the trade‑offs discussed above is unclear. (As noted in the “Background” section, ballot measures have enacted cigarette taxes totaling $2.75 per pack.)

Why Not Consider Federal Taxes? The federal government currently taxes cigarettes at $1.01 per pack but does not levy a tax on e‑cigarettes. If the Legislature would like to set the e‑cigarette tax rate based on a comparison to the cigarette tax rate, the comparison should include federal taxes, since they also affect consumers’ behavior.

Setting the Tax Rate

Consider Wide Range of Rates. The administration has not presented a compelling argument in favor of its proposed tax rate. More generally, the evidence we reviewed does not indicate any “sweet spot” that would make one specific tax rate preferable to others. Consequently, we suggest that the Legislature consider a wide range of possible rates. As it considers what tax rate to set, the Legislature faces six key questions:

- How Harmful Are E‑Cigarettes? The choice of an e‑cigarette tax rate depends crucially upon a full assessment of the harmful effects of e‑cigarettes, which requires close consultation with scientific experts. All else equal, the greater the harm, the higher the appropriate tax rate.

- To What Extent Do Vapers’ Choices Account for These Harms? The choice of a tax rate depends on the extent to which consumers’ choices—such as whether or not to vape, and how much—account for e‑cigarettes’ harmful effects. All else equal, the greater the extent to which vapers’ choices account for these harms, the lower the appropriate tax rate. The answer to this question likely differs between youth and adults, both of whom represent large shares of the overall population of frequent e‑cigarette users.

- How Would the Tax Rate Affect E‑Cigarette Use? In general, we would expect higher tax rates to reduce actual e‑cigarette consumption more effectively than lower tax rates.

- How Would the Tax Rate Affect Other Outcomes, Such as Cigarette Smoking? In general, we would expect higher e‑cigarette tax rates to increase adult smoking more than lower rates. (As noted above, the effects on youth smoking are unclear.) As noted above, however, the Legislature could consider changing not just the tax rate on e‑cigarettes, but also the tax rate on conventional cigarettes.

- How Would the Tax Rate Affect Compliance With the Tax? In general, we would expect higher tax rates to reduce tax compliance more than lower rates. For example, a higher tax rate would give consumers a stronger incentive to avoid the tax by purchasing e‑cigarettes from out‑of‑state over the Internet. The PACT Act does not apply to e‑cigarettes, so the state’s ability to deter this type of tax avoidance is somewhat limited.

- How Would the Tax Interact With Other State and Federal Policies? In general, the greater the extent of other state or federal policy actions to reduce youth e‑cigarette use, the lower the tax rate needed to achieve this policy goal. For example, if the state bans flavored e‑cigarettes, the tax rate need to achieve a given reduction in youth vaping likely would be lower than if the state does not enact a flavor ban.

Recommend Revisiting Rate Frequently. Currently available answers to these questions likely do not provide clear guidance on the tax rate. Accordingly, we recommend that the Legislature revisit the e‑cigarette tax rate at least once every two years to assess the need for changes.

Adjusting Rate for Inflation

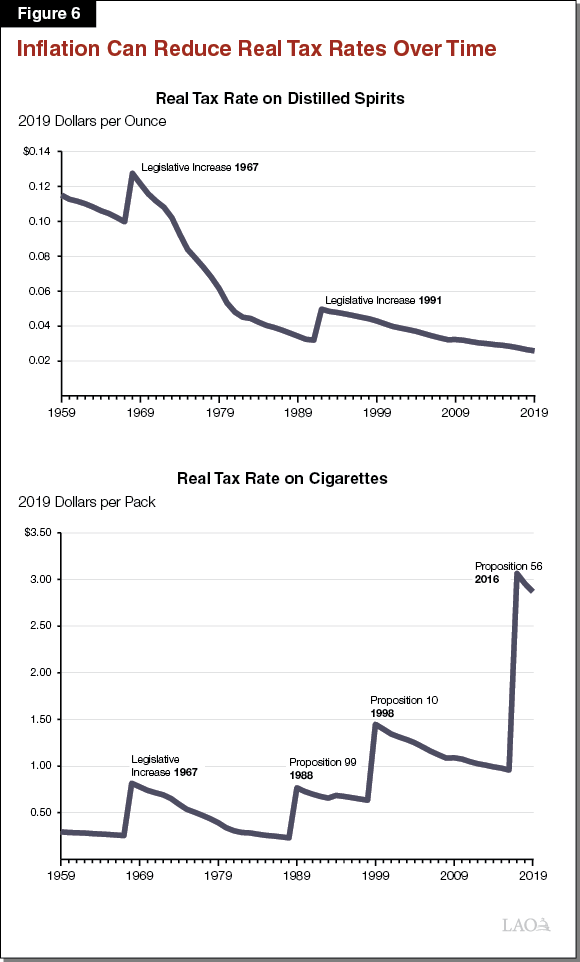

Inflation Can Reduce Real Tax Rates Over Time. Prices tend to rise over time. Due to this inflation, the real economic value of any fixed amount of money—such as one dollar per 20 milligrams of nicotine—diminishes over time. As shown in Figure 6, for example, tax rates set in fixed dollar terms—such as the state’s taxes on cigarettes and distilled spirits—do not remain fixed in economic terms. Instead, absent policy changes, they tend to decline over time. To address this issue, some of the state’s tax policies—such as fuel tax rates, cannabis cultivation tax rates, and income thresholds used to calculate income taxes‑include statutory language directing the administration to adjust these policies annually to account for inflation.

Governor’s Proposal Does Not Include Inflation Adjustments. The Governor’s e‑cigarette tax proposal does not include annual inflation adjustments. The administration argues that adjusting the new tax for inflation would not be consistent with its goal of aligning the state’s tax on e‑cigarettes with its tax on cigarettes, which is not subject to an inflation adjustment.

Recommend Inflation Adjustments. If the Legislature chooses to enact a nicotine‑based e‑cigarette tax, we recommend that it direct the administration to adjust the tax rate for inflation. If the Legislature wants to maintain a consistent relationship between tax rates on cigarettes and e‑cigarettes, we recommend that it adjust both tax rates for inflation, rather than neither. The Legislature could create a cigarette tax inflation adjustment without amending any ballot measures. For example, in addition to the existing cigarette tax, the Legislature could create a new cigarette tax that starts at zero dollars per pack and increases annually by the amount required for the combined rate to keep pace with inflation.

Revenues

Tax Likely Would Raise Tens of Millions of Dollars Annually. The amount of revenue raised by the proposed tax is highly uncertain at this time. Our current best estimate is that the tax initially would raise tens of millions of dollars annually. The estimates included in the 2020‑21 Governor’s Budget are reasonable, but actual revenue could be much higher or lower than those estimates. Key sources of uncertainty include:

- Data Limitations. We have not found any precise, credible estimates of the current size of the proposed tax base—the total amount of nicotine sold in e‑cigarettes in California.

- Changing Policy Landscape. Potential state and federal policy changes—such as a state flavor ban or further FDA restrictions on e‑cigarettes—could have large effects on e‑cigarette sales in California.

- Consumer Response to Tax. The extent to which consumers would respond to the tax by reducing e‑cigarette use or avoiding the tax through other means is uncertain.

Useful Data Could Be Available Soon. Until recently, the state did not require tobacco taxpayers to distinguish e‑cigarettes from other types of tobacco products (such as cigars or chewing tobacco) on their tax returns. As a result, the state did not collect any administrative data on e‑cigarette sales. The Governor’s recent executive order directed CDTFA to require taxpayers to list e‑cigarette sales separately from other tobacco sales starting in January 2020. This administrative change could yield data that could help us refine our revenue estimates in the coming months. Even in the best‑case scenario, however, many of the uncertainties described above will remain.

Revenue Allocation

Options Range from Very Flexible to Very Restrictive. If the Legislature chooses to enact a new tax on e‑cigarettes, it has a range of options for allocating the resulting revenue. At one end of the spectrum, the Legislature could take a very flexible approach, depositing the revenue into the General Fund and appropriating it through the annual budget process along with other General Fund revenue. (For example, this is the current method for allocating alcoholic beverage tax revenues.) At the other end, the Legislature could take a very restrictive approach, depositing the revenue into a special fund and directing the administration to appropriate it continuously to specific departments or programs based on a detailed formula. (For example, this is the current approach for allocating most tobacco tax revenues.)

The Governor’s proposal falls somewhere in between these two approaches. On one hand, the proposal would place some restrictions on the use of the new revenue by depositing it into a special fund set aside for designated purposes. On the other hand, the Legislature would appropriate the funds during the annual budget process, and a wide range of programs would be eligible to receive the funds.

Recommend Very Flexible Approach. We recommend that the Legislature take an approach to revenue allocation that prioritizes flexibility. Ideally, this would mean depositing the revenue into the General Fund. If, however, the Legislature prefers to deposit the revenue into a special fund, we view the Governor’s relatively flexible approach much more favorably than a restrictive, formulaic approach.

We discuss in detail a number of advantages of flexibility in our 2018 report, Taxation of Sugary Drinks. Flexibility allows budgeting to focus on key issues like the costs and benefits of different proposals. The resulting budget discussions revolve around questions like, “How cost‑effectively does this proposal advance our policy goals?” or “Would these resources be better spent in a different program?” In contrast, when the state uses formulas or special funds to commit excise tax revenues to specific purposes, budget discussions often revolve around questions like, “How much revenue will this tax raise this year?”

Connection Between Proposed Language and Enforcement Proposal Unclear. The Governor’s proposed trailer bill language designates the monies in the new fund for youth tobacco prevention programs, health care programs, and administration and enforcement of the new e‑cigarette tax. The proposed CHP‑led enforcement task force, however, would not focus on e‑cigarettes specifically. Instead, it would conduct enforcement activities related to the illicit vaping market broadly, including devices that deliver nicotine, tetrahydrocannabinol (THC), and other substances. Accordingly, if the Legislature decides to appropriate money from the new e‑cigarette fund to this proposal, we recommend that it modify the trailer bill language to authorize this use of the fund.

Consider How Funding Shortfalls Would Be Handled. The Governor’s official January proposals include $17 million of expenditures from the new fund. Including the additional administrative costs described below, we expect the administration’s overall 2020‑21 expenditure plan for e‑cigarette tax revenues to total roughly $24 million. As noted above, the revenues raised by the new tax are highly uncertain. Accordingly, if the Legislature chooses to deposit the new e‑cigarette tax revenue into a special fund, appropriating less than $24 million from this fund in 2020‑21 would be prudent. Alternatively, the Legislature may want to consider how it will fund the planned expenditures if revenues fall below $24 million. As discussed in The 2020‑21 Budget: Transportation, for example, the Legislature could consider a variety of options for funding the proposed enforcement task force, rather than relying exclusively on the new e‑cigarette fund.

General Fund Could Help Address Revenue Uncertainty. Although the revenue raised by the proposed tax is highly uncertain, the range of possible revenues would be small in the context of the General Fund. Consequently, depositing the revenues into the General Fund would allow the Legislature to provide some insurance against this revenue uncertainty by pooling the risk across many areas of the budget.

Tax Administration

Additional Cost to Add Tax to Information Technology (IT) System. The cost of implementing the proposed e‑cigarette tax includes some items that are not included in the Governor’s January budget proposals. Most notably, the January proposals do not include the cost of adding the tax to CDTFA’s new IT system. We anticipate a budget proposal to cover this one‑time cost—likely in the range of $6 million to $8 million—later this spring.

Stamps Could Aid Enforcement, But Cost and Feasibility Unclear. $8 million of the Governor’s $10 million tax administration proposal would be for a stamp contract. The intent of this proposal is to create a system of tax stamps analogous to the ones used in the state’s cigarette tax program. The feasibility and effectiveness of cigarette tax stamps is due, in part, to the high degree of consistency in the size, shape, and amount of tax due on a pack of cigarettes. Packs typically contain 20 cigarettes and thus require a $2.87 tax stamp. A second, less common type of pack contains 25 cigarettes and requires a $3.59 tax stamp. As a result, the vendor needs to produce just two denominations of stamps, and taxpayers can comply with the tax by affixing just one stamp to each pack.

In contrast to cigarettes, the size, shape, and amount of tax due on e‑cigarettes would vary widely under the Governor’s proposal. As a result, the proposed e‑cigarette tax either would require the vendor to produce stamps in a much wider variety of denominations than cigarette stamps, or would require taxpayers to affix multiple stamps per item. Furthermore, the vendor would need to offer stamps that could fit on all manner of e‑cigarette packages. In principle, careful implementation could overcome these challenges. The information provided to date, however, does not suggest that the administration has considered them carefully enough to justify the requested appropriation.

Conclusion

In this report, we have discussed many issues for the Legislature to consider as it decides whether to change the state’s approach to taxing e‑cigarettes. We find that a tax based on nicotine content has some advantages. We also suggest that the Legislature consider a wide range of possible tax rates. Once the Legislature has chosen a rate, we recommend indexing the rate to inflation and revisiting it frequently to assess whether further adjustments are warranted.

If the Legislature chooses to enact a new tax on e‑cigarettes, we recommend that it take an approach to revenue allocation that prioritizes flexibility. Ideally, this would mean depositing the revenue into the General Fund. If, however, the Legislature prefers to deposit the revenue into a special fund, we view the Governor’s proposed approach much more favorably than a restrictive, formulaic approach.

Selected References

Cantrell, Jennifer, Jidong Huang, Marisa S. Greenberg, Haijuan Xiao, Elizabeth C. Hair, and Donna Vallone (2019). “Impact of E‑Cigarette and Cigarette Prices on Youth and Young Adult E‑Cigarette and Cigarette Behaviour: Evidence From a National Longitudinal Cohort.” Tobacco Control.

Cotti, Chad, Erik Nesson, and Nathan Tefft (2018). “The Relationship Between Cigarettes and Electronic Cigarettes: Evidence From Household Panel Data.” Journal of Health Economics 61:205‑219.

Cotti, Chad, Charles Courtemanche, Johanna Catherine Maclean, Erik Nesson, Michael Pesko, and Nathan Tefft (2020). “The Effects of E‑Cigarette Taxes on E‑Cigarette Prices and Tobacco Product Sales: Evidence From Retail Panel Data.” National Bureau of Economic Research Working Paper 26724.

Deng, Xueting and Yuqing Zheng (2019). “Estimating the Effects of Electronic Cigarette Excise Taxes on the Demand for Tobacco Products.” Mimeo, University of Kentucky.

Pesko, Michael and Casey Warman (2019). “The Effect of Prices and Taxes on Youth Cigarette and E‑Cigarette Use: Economic Substitutes or Complements?” Mimeo, Georgia State University.

Pesko, Michael, Charles Courtemanche, and Johanna Catherine Maclean (2019). “The Effects of Traditional Cigarette and E‑Cigarette Taxes on Adult Tobacco Product Use.” National Bureau of Economic Research Working Paper 26017.

Saffer, Henry, Daniel Dench, Michael Grossman, and Dhaval Dave (2019). “E‑Cigarettes and Adult Smoking: Evidence from Minnesota.” National Bureau of Economic Research Working Paper 26589.

Zhao, Juliana (2019). “E‑Cigarettes and Cigarettes: Complements or Substitutes?” Mimeo, University of California, Berkeley.