LAO Contact

November 18, 2020

The 2021-22 Budget

Medi-Cal Fiscal Outlook

Background. Medi‑Cal, the state’s Medicaid program, provides health care coverage to about 13 million of the state’s low‑income residents. Medi‑Cal costs generally are shared between the federal and state governments. In a typical year, the General Fund covers a little more than 20 percent of total Medi‑Cal costs, with federal funds and other state and local funds respectively covering the remaining 65 percent and 15 percent of total costs. In this web post, we describe the major factors that we expect to drive changes in General Fund spending in Medi‑Cal over the near term—in 2020‑21 and 2021‑22—and over the longer term through 2024‑25. We also describe a number of key assumptions that we made in our spending projections.

Main Fiscal Outlook Forecast Assumes Gradually Improving Public Health and Economic Conditions. The coronavirus disease 2019 (COVID‑19) has brought a severe disruption to the California economy and the health of its residents. Nevertheless, while there remains considerable risk and uncertainty going forward, there are signs of improvement on both the economic and public health fronts (in the form of potentially safe and effective vaccines). For our 2021‑22 Fiscal Outlook main forecast, we assume that economic conditions in the state gradually will improve over the next several years. We also anticipate public health to improve following the expected release of an effective COVID‑19 vaccine in early 2021 and vaccination of Californians over the proceeding months. Nevertheless, predicting economic and public health trends under the COVID‑19 pandemic is subject to extraordinary uncertainty. Should the improvement in these conditions prove slower, faster, or more volatile than assumed in our outlook, General Fund spending in Medi‑Cal could be substantially higher, lower, or more volatile than we project.

Fiscal Outlook Assumes Current Law and Policy, Including at the Federal Level. Our outlook assumes current laws and policies remain in place throughout the outlook window (through 2024‑25). This includes federal law and policy. Accordingly, we assume no changes to the Patient Protection and Affordable Care Act (ACA) that affect Medi‑Cal costs. Nor do we assume changes in federal Medicaid financing regulations, such as those that were proposed under the Medicaid Fiscal Accountability Regulation, which federal officials announced was no longer being pursued.

Near‑Term Outlook

Summary

Significantly Lower Estimated General Fund Costs in 2020‑21. We estimate that the state will spend about $22.7 billion from the General Fund on Medi‑Cal in 2020‑21, a $920 million (4 percent) reduction relative to what was assumed in the 2020‑21 Budget Act (hereafter referred to as the “budget act”). As we describe below, this downward adjustment largely reflects our revised projections showing lower caseload growth due to COVID‑19 than was assumed in the budget act. Our downward caseload adjustment applies to 2019‑20 as well, resulting in additional estimated savings of $320 million General Fund.

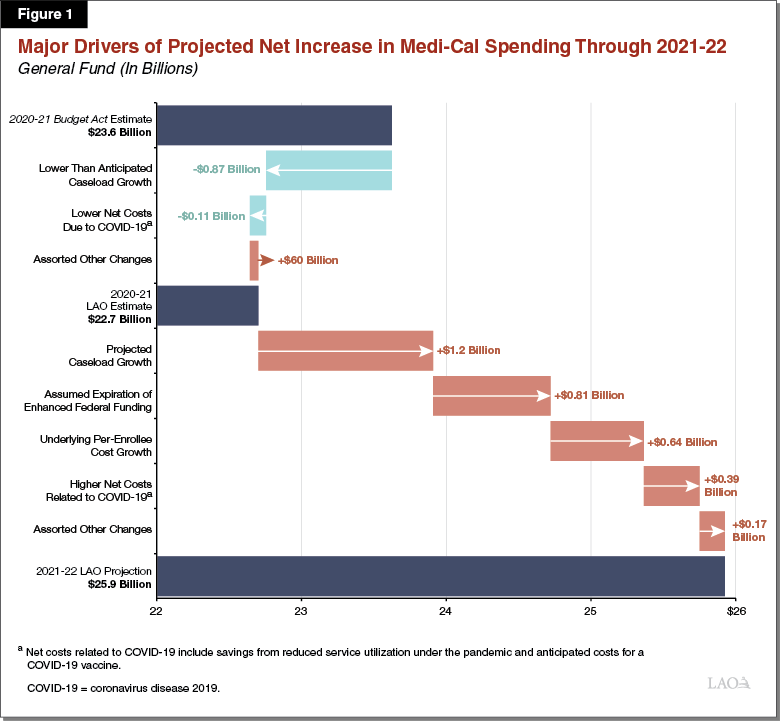

Sharp Projected Upturn in General Fund Costs in 2021‑22. From our revised 2020‑21 estimate, we project General Fund spending in Medi‑Cal will increase by about $3.2 billion (10 percent) in 2021‑22 to a total of $25.9 billion. This reflects the net effect of several different factors that are displayed in Figure 1. Through the remainder of this section, we describe the major factors that contribute to adjustments in both 2020‑21 and 2021‑22.

Underlying Net Growth in Program Costs

Summary. This section describes our projections of underlying program costs in Medi‑Cal, which are driven by caseload and per‑enrollee costs. In 2020‑21, we estimate savings of $980 million General Fund relative to the budget act’s assumptions of underlying Medi‑Cal program costs. The majority of these savings reflect our updated projections of Medi‑Cal caseload (we project that caseload in 2020‑21 will be significantly lower than that assumed in the budget act), while a relatively small portion of these savings are attributable to estimated declines in service utilization during the COVID‑19 pandemic. In 2021‑22, we project a significant upturn in underlying program costs of $2.2 billion in General Fund, driven by significant projected growth in the Medi‑Cal caseload, general medical inflation, anticipated new costs related to a COVID‑19 vaccine, and a projected return to normal levels of service utilization as the pandemic declines in severity.

Caseload

Summary. We project that average monthly Medi‑Cal caseload will be 13.8 million enrollees in 2020‑21, which is 9 percent higher than the revised estimate for 2019‑20 caseload. Between 2020‑21 and 2021‑22, we project the caseload to grow from 13.8 million enrollees to 14.9 million—an increase of 8 percent, or 1.1 million beneficiaries. As we describe below, these projections generate significant General Fund savings in 2020‑21 relative to the budget act, and at the same time result in significant year‑over‑year General Fund cost growth from 2020‑21 to 2021‑22.

Budget Act Assumed Sharply Rising Caseload Due to COVID‑19. The budget act assumed that the deteriorating economic conditions caused by the COVID‑19 crisis would cause a surge in the Medi‑Cal caseload. From a low of around 12.5 million beneficiaries in March 2020, the budget act projected Medi‑Cal caseload would swell to roughly 14.5 million enrollees by July 2020, increasing General Fund costs above what they otherwise would be by about $3 billion across 2019‑20 and 2020‑21. This breakneck projected growth in the Medi‑Cal caseload was assumed to be due to two primary factors:

- Unprecedented Employment Losses. The early months of the COVID‑19 pandemic brought unprecedented declines in employment in California. The budget act assumed that individuals and families experiencing job losses or otherwise having their incomes fall under COVID‑19 would join the Medi‑Cal program in huge numbers. Most of the caseload growth assumed in the budget act was attributed to this factor.

- Suspension of Eligibility Terminations. Federal COVID‑19‑related legislation effectively requires the state to suspend eligibility terminations in Medi‑Cal for the duration of the national COVID‑19 public health emergency. As a result, enrollees who, under standard Medi‑Cal eligibility rules, would be found to have become ineligible and therefore dis‑enrolled from the program (for example, because they no longer meet the program’s low‑income requirements), now may remain enrolled in Medi‑Cal through the emergency period. The budget act assumed Medi‑Cal caseload would increase significantly—on net—from what it otherwise would be if eligibility terminations were not suspended.

Caseload Growth to Date Is Significantly Below Initial Expectations… Preliminary data show that Medi‑Cal caseload growth to date has been significantly slower than what was assumed in the budget act. Rather than growing by around 2 million enrollees between March 2020 and July 2020 as assumed in the budget act, caseload has grown only by around 500,000 enrollees over this same period. Moreover, the budget act assumed that (1) caseload growth mostly would be concentrated in the families caseload category (which includes parents and children), (2) that growth within the ACA optional expansion (which primarily includes childless adults) would be relatively slow, and (3) that growth among seniors and persons with disabilities would be fairly robust. In contrast, the preliminary data show that caseload growth is fairly evenly split between just two caseload categories: families and the ACA optional expansion. While there has been some growth among seniors and persons with disabilities to date, this growth has been significantly less than was assumed in the budget act. As we describe below, enrollees in the ACA optional expansion and families caseload categories tend to have significantly lower General Fund costs than seniors and persons with disabilities. As a result, the greater concentration of caseload growth in the less costly caseload categories than was assumed in the budget act contributes to the General Fund savings we estimate for 2020‑21. Overall, caseload growth to date appears largely due to the suspension of eligibility terminations. Relatively few new enrollees appear to have joined the program even as unemployment reached record numbers.

…Saving an Estimated $1.2 Billion General Fund Across 2019‑20 and 2020‑21. We estimate that our revised caseload projections save $320 million General Fund in 2019‑20 and nearly $870 million General Fund in 2020‑21 relative to budget act assumptions. (These estimated savings arise despite our projections of significant year‑over‑year caseload growth in 2020‑21 under the pandemic. From 2019‑20 to 2020‑21, we project that average monthly caseload will grow by 9 percent from over 12.6 million enrollees to nearly 13.8 million enrollees. This significant projected caseload growth raises estimated General Fund costs in 2020‑21 by $1.4 billion above what they would be absent the COVID‑19 pandemic.)

Nevertheless, We Project Substantial Caseload Growth Until Midway Through 2021‑22. We project average monthly Medi‑Cal caseload to increase by another nearly 1.1 million enrollees between 2020‑21 and 2021‑22, reaching 14.9 million enrollees in 2021‑22. This year‑over‑year growth in the caseload is projected to result in higher General Fund costs of $1.2 billion in 2021‑22 compared to 2020‑21. We attribute this caseload growth to two factors:

- Suspension of Eligibility Terminations Expected to Have a Large Impact on Medi‑Cal Caseload Growth on Net. Our projections assume positive caseload growth for the duration of the national COVID‑19 public health emergency—the period in which eligibility terminations in Medi‑Cal are expected to remain suspended. Given our assumption that the national COVID‑19 public health emergency will end by December 2021, we expect the Medi‑Cal caseload to grow through the end of calendar year 2021 before entering a period of consistent decline that begins in early 2022.

- Economic Conditions Expected to Have a Delayed Impact on Medi‑Cal Caseload. We assume high unemployment and adverse economic conditions will persist through 2021‑22. Individuals who became unemployed or experienced a persistent decline in their household incomes in 2019‑20 may, for example, wait until they plan to begin utilizing health care services before enrolling in Medi‑Cal. The resulting delay in enrollment could last several months for some beneficiaries. As a result, we assume enrollment will accelerate slightly as individuals who have become eligible for Medi‑Cal as a result of the deteriorating economic conditions—but have not yet enrolled in Medi‑Cal—do so in the near future.

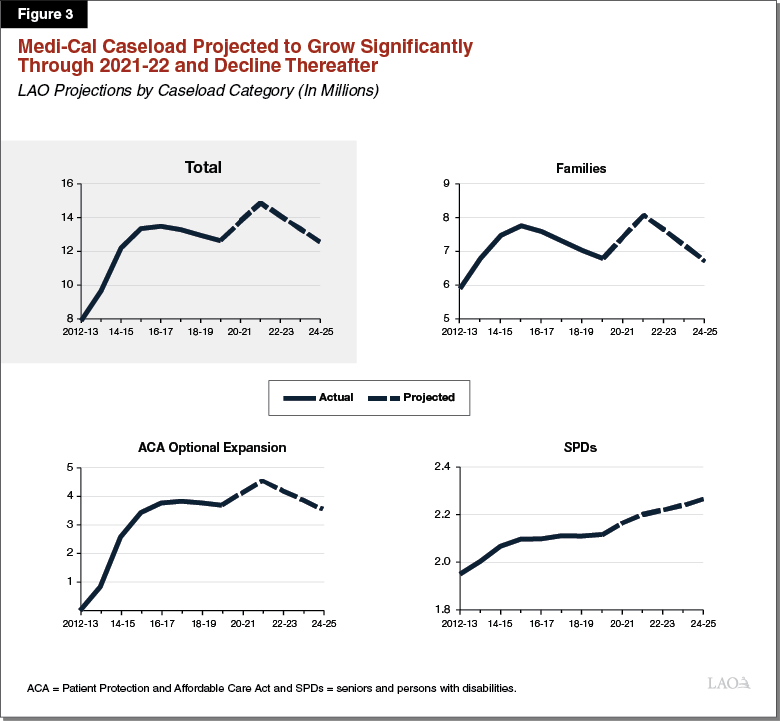

Caseload Projections Are Subject to Significant Uncertainty. Our caseload projections for the outlook period through 2024‑25 are displayed later in Figure 3 under the “Longer‑Term Outlook” section of this post. Importantly, our caseload projections are based on several highly uncertain assumptions. These include, but are not limited to, the severity and duration of the COVID‑19 public health emergency, the severity and duration of the economic crisis, which caseload categories experience significant growth, and the degree to which the suspension of eligibility terminations prevents enrollees from leaving the program who otherwise would do so. A number of factors, including a delay in the deployment of an effective COVID‑19 vaccine or worsening economic conditions, could substantially alter the basis for these assumptions. Should the future unfold significantly differently than we have assumed, caseload could be significantly higher or lower than projected, with potentially major General Fund consequences.

Underlying Per‑Enrollee Costs

Limited Underlying Per‑Enrollee Cost Growth Going Into 2021‑22. Underlying per‑enrollee costs—from a General Fund perspective—are driven by three major factors: (1) medical inflation, (2) service utilization, and (3) the federal government’s traditional share of cost. (The federal government’s share of cost is critical since the federal government typically will pay 50 percent, around 65 percent, or 90 percent of total costs depending on the caseload category that a beneficiary is enrolled in.) We project that underlying per‑enrollee costs—only counting the portion that falls on the General Fund—will grow by less than 1 percent between 2020‑21 and 2021‑22. This limited growth in underlying per‑enrollee costs is due to our projections that the influx of additional enrollees in the program under the pandemic will, on average, be less costly than current enrollees. This is for two reasons:

- We project most of the growth in enrollment to be concentrated in the families and ACA optional expansion caseload categories. From a total fund and General Fund perspective, these groups tend to be less expensive than enrollees in Medi‑Cal’s other major caseload category—seniors and persons with disabilities—since they tend to utilize fewer services.

- We project the fastest growth in the ACA optional expansion caseload category, for which the federal government pays 90 percent of cost. This generally results in the General Fund only bearing 10 percent of the cost of coverage for ACA optional expansion enrollees. In contrast, the General Fund generally covers 50 percent of costs for most other Medi‑Cal enrollees. We project that growth will be fastest for the ACA optional expansion for two main reasons. First, empirically, to date, under the pandemic from March 2020 to July 2020, the ACA optional expansion caseload category has grown at a rate that is 60 percent higher than the caseload as a whole. Second, we believe enrollment in this caseload category is likely to be more responsive than other caseload categories, such as seniors and persons with disabilities, to changes in economic conditions. Accordingly, we believe individuals in the ACA optional expansion caseload category would be more likely to enroll given recent unemployment losses.

Costs and Savings Related to COVID‑19 Affect Per‑Enrollee Costs. As described below, we expect costs and savings related to COVID‑19 to influence underlying per‑enrollee costs over the near term. These projected costs and savings are subject to considerable uncertainty as they closely depend on our assumptions around when a COVID‑19 vaccine becomes widely available and how quickly public health conditions under COVID‑19 continue to improve. These COVID‑19‑related impacts are as follows:

- Additional General Fund Savings in 2020‑21 From Foregone Routine Care Utilization. The COVID‑19 pandemic has caused a major disruption in routine medical care utilization, which we expect to result in General Fund savings in Medi‑Cal. The budget act assumed that COVID‑19 would reduce Medi‑Cal service utilization in the final months of 2019‑20, but not at all in 2020‑21. We assume that some reductions in Medi‑Cal service utilization persist through much of 2020‑21, with utilization gradually returning to normal, pre‑pandemic levels by the start of 2021‑22. These projected declines in service utilization result in additional estimated General Fund savings of roughly $110 million in 2020‑21 relative to budget act assumptions.

- General Fund Costs in 2021‑22 to Vaccinate Medi‑Cal Members Against COVID‑19. We assume that a COVID‑19 vaccine will become available to Medi‑Cal beneficiaries in early 2021 and that millions of Medi‑Cal beneficiaries will receive vaccinations through 2021‑22 and beyond. General Fund is assumed to be needed both to pay for the vaccine itself and to pay health care professionals for administering the vaccine. We project COVID‑19 vaccination costs to be minimal in 2020‑21 and, instead, to peak in 2021‑22 at around $140 million General Fund. (Beyond 2021‑22, we assume General Fund costs in the tens of millions of dollars annually to continue to vaccinate Medi‑Cal enrollees from COVID‑19.) Significant uncertainty surrounds the availability, cost, and take‑up rates for one or more COVID‑19 vaccines. Accordingly, General Fund costs to vaccinate the Medi‑Cal population ultimately could differ significantly from our projections.

Assume Enhanced Federal Funding Expires in December 2021

Enhanced Federal Funding for Medi‑Cal Results in Substantial General Fund Savings. To relieve state budgetary pressure caused by the impacts of COVID‑19 on state tax revenues and Medicaid expenditures, Congress enacted legislation that provides for a temporary 6.2 percentage point increase in the federal government’s share of cost for state Medicaid programs. Under this legislation, beginning January 1, 2020 and ending the first quarter in which the national COVID‑19 public health emergency is no longer in effect, the federal share of cost for Medi‑Cal services generally increases from 50 percent to 56.2 percent. Because Medicaid is an entitlement program, the amount of additional federal funding due to the enhancement is not a fixed amount but instead varies based on overall Medi‑Cal program costs. By offsetting General Fund costs in Medi‑Cal, we estimate that the enhanced federal share of cost results in General Fund savings of $2.4 billion in 2020‑21 and $1.6 billion in 2021‑22. (These amounts do not include General Fund savings from the enhanced federal share of cost that are projected to accrue in the In‑Home Supportive Services and Department of Developmental Services programs.)

Assumed Expiration of Enhanced Federal Funding in December 2021 Raises General Fund Costs Beginning in 2021‑22. Coinciding with our assumed expiration of the national COVID‑19 public health emergency, we assume that enhanced federal funding under the pandemic will expire in December 2021. This has the effect of increasing General Fund costs by $800 million between 2020‑21 and 2021‑22.

Major Fiscal Implications if Enhanced Federal Funding Expires Sooner or Later Than We Assume. Our assumed expiration date for enhanced federal funding is highly uncertain. When the expiration occurs ultimately will depend on public health conditions around the country, as well as other national considerations. For example, should the national COVID‑19 public health emergency persist six months longer than we have assumed, we estimate the state would benefit from more than $1 billion in additional General Fund savings in Medi‑Cal in 2021‑22 than is assumed in our outlook. However, were the emergency to expire six months sooner than we assume, the state would face over $1 billion in higher General Fund costs in Medi‑Cal in 2021‑22.

Assumes Suspensions Do Not Take Effect

Similar to action taken in 2019‑20, the budget act makes several ongoing Medi‑Cal spending items subject to potential suspension in 2021‑22. In these cases, statute directs the Department of Finance (DOF) to calculate whether General Fund revenues will exceed General Fund expenditures—without suspensions—in 2021‑22 and 2022‑23. If DOF determines revenues will exceed expenditures, then the expenditures will continue and not be suspended. Otherwise, the expenditures are automatically and indefinitely suspended. The Medi‑Cal items subject to suspension are (1) most Proposition 56‑funded provider payment increases, (2) the extension of coverage for postpartum mental health, (3) the restoration of previously eliminated optional benefits, and (4) the expansion of screening and intervention to drugs other than alcohol. If the Proposition 56‑funded provider payments were suspended, most Proposition 56 funding in Medi‑Cal would be used to offset General Fund spending on cost growth in Medi‑Cal. The potential suspension of the other three items would result in direct General fund savings. The outlook assumes that the suspensions do not take effect. However, if the suspensions were activated, we project that General Fund spending in Medi‑Cal would be lower than it would otherwise be by around $900 million annually in 2021‑22 and beyond.

Longer‑Term Outlook

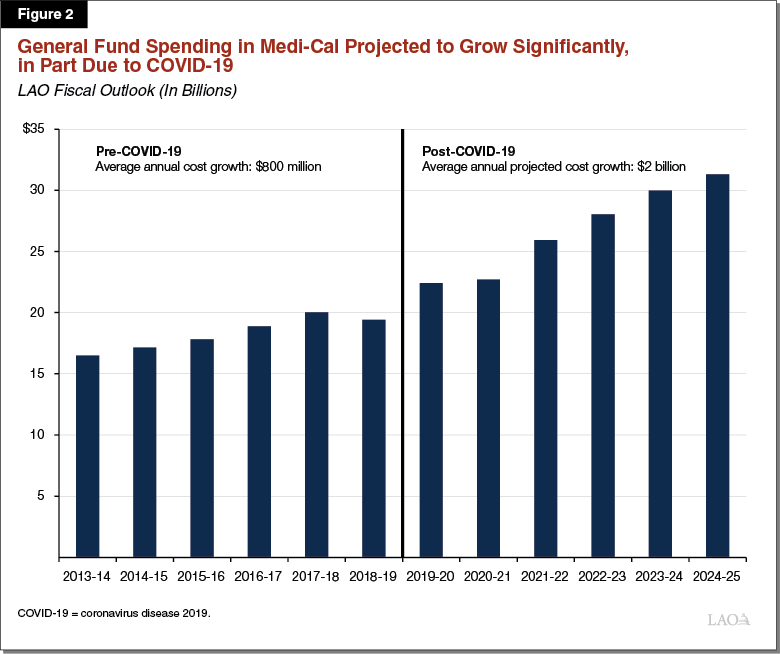

Annual General Fund Costs Grow by $8.6 Billion Between 2020‑21 and 2024‑25. As shown in Figure 2, we project that General Fund spending in Medi‑Cal will grow at an annualized rate of over 8 percent from around $22.7 billion in 2020‑21 to $31.3 billion at the end of our outlook window in 2024‑25. Previously, we described the major drivers of General Fund cost growth from 2020‑21 to 2021‑22. This section describes the major factors that account for the $5.4 billion in projected growth in annual General Fund costs between 2021‑22 and 2024‑25.

Significant Underlying Net Cost Growth

Projected Caseload Declines Bring Savings. We project that caseload will peak midway through 2021‑22 and decline thereafter, reflecting the resumption of eligibility terminations and improving economic conditions. This results in significant year‑over‑year General Fund savings from 2022‑23 to 2024‑25. Overall, we project caseload will decline by 5 percent annually from a high of 14.8 million in 2021‑22 to 12.6 million in 2024‑25. These projected caseload declines are estimated to generate more than $600 million in annual General Fund savings each fiscal year from 2021‑22 to 2024‑25. Our caseload projections for the outlook window, broken down by major caseload population category, are displayed in Figure 3.

Project Significant Per‑Enrollee Cost Growth. Consistent with our expectation that new enrollees in Medi‑Cal during challenging economic times will have, on average, lower per‑enrollee costs than beneficiaries with longstanding ties to the program, we expect those who leave the program during periods of economic expansion to have lower average per‑enrollee costs. This movement of less costly beneficiaries out of the program has the effect of significantly increasing average per‑enrollee cost growth in Medi‑Cal starting in 2022. While we would expect average per‑enrollee cost growth of 3 percent to 4 percent annually in periods where the caseload is stable, we project average per‑enrollee cost growth of more than 5 percent annually through the period of projected caseload declines, from 2021‑22 through 2024‑25. In General Fund terms, this adds around $1.4 billion annually to Medi‑Cal costs.

Net Increase in Underlying Costs. Over the longer term, robust projected average per‑enrollee cost growth (annually around $1.4 billion General Fund) is expected to more than offset the savings from projected declines in caseload (annually around $600 million General Fund). As such, we project annual underlying net cost growth of around $800 million over the longer term from 2021‑22 to 2024‑25.

Assume Enhanced Federal Funding Has Fully Expired

As previously noted, we assume that the enhanced federal funding under the national COVID‑19 public health emergency will expire at the end of December 2021, or halfway through 2021‑22. Accordingly, by 2022‑23, we expect the federal share of cost in Medi‑Cal to return to normal, raising General Fund costs in Medi‑Cal by $1.6 billion between 2021‑22 and 2022‑23. However, should the emergency persist into 2022‑23 or even beyond, significant General Fund savings in Medi‑Cal could materialize to the extent that the enhanced federal funding continues as well.

Assume Statutorily Scheduled Expiration of Managed Care Organization (MCO) Tax

For a number of years, the state has imposed a tax on MCOs’ Medi‑Cal and commercial lines of business. The state’s previous MCO tax expired at the end of 2018‑19 and, in 2019‑20, the Legislature reauthorized the MCO tax in similar but not identical form to the prior tax. The reauthorized MCO tax offsets as much as roughly $1.7 billion in General Fund spending annually for the years it is in effect—January 2020 through December 2022. We assume that the MCO tax is not reauthorized following its expiration halfway through 2022‑23. This assumption has the effect of raising General Fund costs in Medi‑Cal by roughly $1.7 billion annually in 2023‑24 and 2024‑25. If the Legislature instead elects to reauthorize the MCO tax in a similar form—and the federal government provides its necessary approval—the state could receive $1.7 billion or more in annual General Fund savings in the final two years of our outlook and beyond.