LAO Contact

December 8, 2020

The 2021-22 Budget

CalWORKs Fiscal Outlook

In this post, we describe our most recent forecast for California Work Opportunity and Responsibility to Kids (CalWORKs) program costs and discuss recent caseload trends. With this post we intend to provide information but do not include any explicit recommendations to the Legislature.

Background

CalWORKs Provides Cash Assistance and Employment Services to Low‑Income Families. To qualify for CalWORKs, families must have one or more children and generally earn no more than about 80 percent of the federal poverty level. Once qualified, adults generally are limited to a total of 48 months of cash assistance (as we discuss later, effective May 2022, the 48‑month limit will be extended to 60 months). After adults have timed out, their children remain eligible for cash assistance until their 18th birthdays. Cash grants generally are adjusted for family size and income, such that larger families and families with less income receive larger grants than smaller families and families with more income. (When adults time out of the program, the family’s cash grant is reduced.)

Program Costs Largely Are Driven by Underlying Caseload. CalWORKs has no cap on program enrollment, meaning all eligible families who apply for the program receive cash assistance. Consequently, program costs typically increase in proportion to increased caseload.

CalWORKs Caseload Largely Follows Economic and Demographic Trends. Our office forecasts CalWORKs caseload using three primary factors: (1) current economic conditions, (2) economic conditions over the last two years, and (3) the number of Californians ages 0‑18. CalWORKs caseload tends to increase during economic downturns and decrease during economic expansions. Although these increases/decreases are usually apparent to some degree immediately following a change in economic growth, larger CalWORKs caseload trends tend to lag economic trends, such that caseload typically increases for about two years following an increase in unemployment. In addition to these economic fluctuations, CalWORKs caseload also exhibits a long‑term downward trend corresponding to the long‑standing decline in California birth rates.

Historically, CalWORKs Caseload Lags Unemployment Trends by a Year or More. One element of our caseload forecast is particularly relevant to understanding current caseload trends: the time lag between when unemployment peaks and when CalWORKs caseload peaks. For example, as a result of the Great Recession, CalWORKs caseload reached its all‑time high in the summer of 2011, whereas both initial jobless claims and the unemployment rate peaked in the winter of 2009‑10. This pattern, by which CalWORKs caseload follows jobless trends on a long lag, has occurred throughout the program’s history, including after the Great Recession and after the recession of the early 2000’s. One important reason for this lag is that recently unemployed CalWORKs applicants generally are required to apply for unemployment insurance (UI) before they can qualify for cash assistance. The typical weekly benefit for a Californian on UI is about equal to the maximum income allowed for a CalWORKs family of three. Consequently, households may choose not to apply for (and/or may not be eligible for) CalWORKs at least until their UI benefits expire.

Prior to Coronavirus Disease 2019 (COVID‑19), CalWORKs Caseload Was Experiencing Historic Decline. CalWORKs caseload reached its lowest level ever in February 2020 (about 360,000 cases), following a historically long period of economic expansion combined with the long‑standing decline in California birth rates.

In Response to COVID‑19, Governor Temporarily Suspended CalWORKs Redeterminations, Increasing Caseload. CalWORKs recipients generally must submit “redetermination” paperwork once every six months to remain on aid. The redetermination paperwork is intended to determine whether participants continue to meet the eligibility requirements to participate in the program. Typically, between 6 percent and 9 percent of the caseload exits CalWORKs each month. Some cases exit because the head of household forgets to submit their redetermination or makes an error on the paperwork, and many of these families successfully re‑file the next month. Executive Order N‑28‑20 suspended CalWORKs redeterminations for the months of March, April, and May. This policy change cut the exit rate by more than half in each of these months, temporarily increasing the caseload.

COVID‑19 and Subsequent Recession Was Projected to Increase Caseload. The economic contraction experienced in the spring of 2020—as a result of the COVID‑19 pandemic—was unprecedented in both its speed and scale. In its May Revision of the 2020‑21 budget, the administration projected that historically high unemployment would result in a historically high CalWORKs caseload averaging about 724,000 cases in 2020‑21 (or about 25 percent greater than the previous all‑time high caseload in 2010‑11). Following further deliberations and some preliminary spring caseload data, the final 2020‑21 budget assumed a somewhat more modest caseload increase to about 587,000 cases (approximately equal to the previous all‑time high). (Our office projected a more modest increase in caseload, to about 420,000.)

Preliminary Data Show Caseload Has Come in Below Projections. Although few data are yet available from 2020‑21, caseload from 2019‑20 appears to have come in far below projections. Whereas the budget act assumed 2019‑20 caseload would average about 412,000 per month, initial data suggest that number was closer to 367,000 (lower even than our office’s more modest projection of 375,000, and lower also than the 2018‑19 caseload of 387,000). In June and July—the most recent months for which we have data—caseload has actually trended downwards further, contrary to projections that it would increase continuously long past the end of 2020‑21.

Budget Act Included Policy Change Which Will Increase Future Costs. In addition to the projected caseload‑driven cost increases, the 2020‑21 Budget Act reverses a policy change made during the previous recession. When CalWORKs was first established, adults in the program could participate in the program for a total of 60 months (the maximum allowed for recipients of federal Temporary Assistance for Needy Families, or TANF, funding). Starting in 2011, California reduced this to a 48‑month time limit in an effort to reduce program costs. 2020‑21 budget‑related legislation extends this time limit back to 60 months starting in May 2022. The administration estimates this policy will cost about $70 million ongoing, although the initial costs in 2022‑23 are estimated to be about twice that large (this is because the policy change retroactively extends eligibility for an estimated 80,000 cases that have already timed out under the 48‑month limit with associated limited‑term costs).

Base Forecast

We Project Large Revisions to CalWORKs Cost Estimates in 2019‑20 and 2020‑21. Even though the budget assumed a caseload notably below initial May Revision estimates, preliminary caseload data (and our own updated projections) indicate further downward revisions are likely in prior and current years. Relative to the budget act, we project caseload‑related savings in 2019‑20 at $350 million. Projecting forward from the latest data, we project 2020‑21 caseload will average about 393,000, or 33 percent below budget act projections, for associated costs savings of about $1.6 billion. After accounting for an error related to double‑counting some federal funding (that was discovered by the administration after the enactment of the 2020‑21 budget), we project savings of about $880 million General Fund in 2020‑21 relative to budget act assumptions.

We Project CalWORKs Costs to Increase by About $300 Million in 2021‑22. Because caseload typically follows economic trends on a lag, we project an increase of about 10 percent in 2021‑22 (for an average caseload of about 430,000) relative to our updated estimate of 2020‑21 caseload. Alongside costs related to the extension of lifetime limits (our estimates for that policy change are roughly equal to the administration’s), this produces a $287 million General Fund year‑over‑year increase in 2021‑22 relative to our updated estimate of 2020‑21 costs.

We Project Further Increases in Out‑Years. We project caseload to peak in 2022‑23, consistent with historic evidence suggesting caseload peaks roughly two years after peak unemployment. We further project caseload to remain above pre‑pandemic levels through at least 2024‑25. Combined with the extension of lifetime limits, these increases result in additional cost pressures in the out‑years.

Recent Caseload Trends

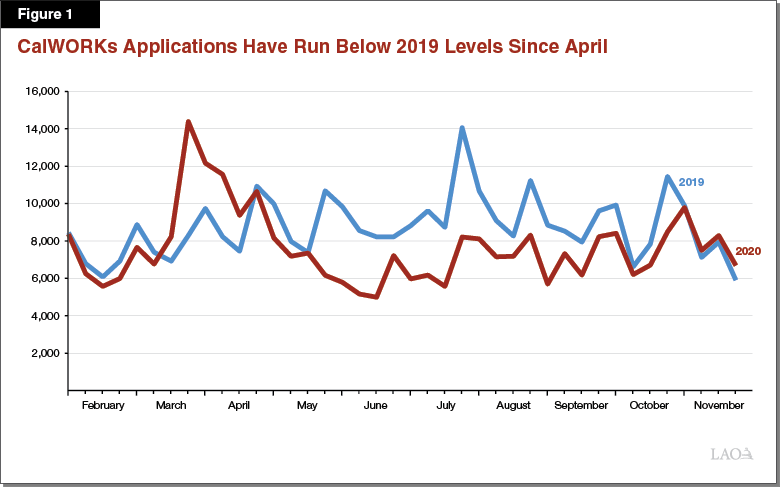

Contrary to Expectations, Recent Data Suggest Caseload Is Declining. As noted above, both the administration and our office projected caseload increases immediately following increased unemployment starting in March 2020. Recent data, however, tells a different story. Although caseload increased between March and May, this increase appears almost entirely due to the temporary suspension of redeterminations. Since redeterminations were reinstated, caseload declined in both June and July (the most recent months for which data are available). As shown in Figure 1, applications for the program dropped below 2019 levels in April and remained low through October, suggesting further caseload declines may be revealed when more recent data are made available.

Current Economic Conditions Are Distinct From Historic Precedent. The economic fallout from COVID‑19 differs from other recent recessions in three important ways, potentially explaining why caseload has not followed expectations based on historic trends:

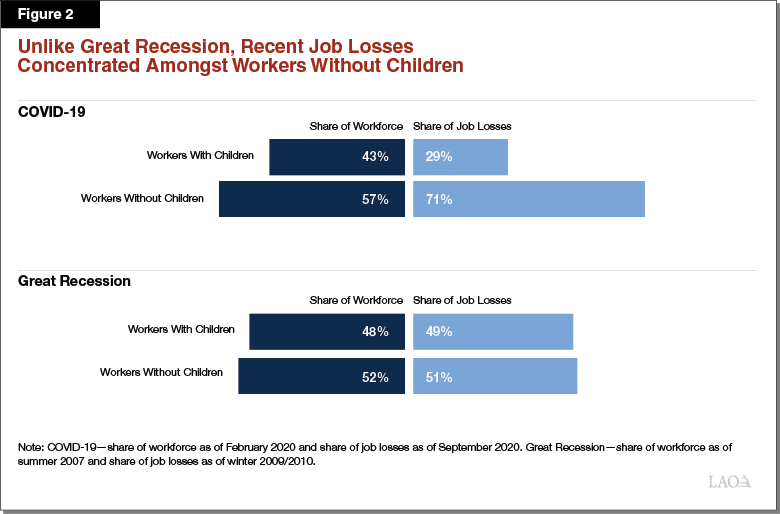

- Recent Recession Has Disproportionately Affected Workers Without Children. As Figure 2 shows, workers with and without children each accounted for about half of all job losses during the Great Recession, whereas workers without children accounted for 71 percent of pandemic‑related job losses. Since workers without children are ineligible for CalWORKs, this may explain why caseload has not increased in proportion to the increase in unemployment.

- Initial Jobless Claims Appear to Have Overstated the Extent of Job Loss. Between February and July, more than 6 million claims for UI were filed, while only about 2 million jobs were recorded as lost. (This difference in part reflects that self‑employed individuals were newly eligible for UI under federal coronavirus relief legislation, but are not recorded in total employment figures, and also possibly that some individuals applied who were not eligible.) Typically, there is not such a large disparity between these two measures. Given this disparity, we reduced our reliance on UI claims in forecasting CalWORKs caseload. Had we not done so, our forecast would reach improbably large levels in the out‑years.

- Recent Economic Trends Have Shifted Back and Forth in Unprecedented Ways. Many traditional economic measures, such as gross domestic product growth, exhibited an unprecedented “sea‑saw” effect over the summer—first falling rapidly, and then recovering almost as quickly as they fell. This is unlike other recent recessions, after which economic growth resumed only gradually following a months‑long period of economic stagnation.

Recent Economic Stimulus May Have Temporarily Decreased CalWORKs Demand. Federal coronavirus relief measures were both larger and quicker in their effects than stimulus in other recent recessions. Personal income for Californians actually increased by about 6 percent between the first and second quarters of 2020 even as unemployment increased more than 10 percentage points, in part reflecting federal relief measures that put cash in people’s pockets. In addition, the state placed a moratorium on evictions, potentially providing additional relief to cash‑strapped families. These relief efforts may have reduced demand for cash assistance programs like CalWORKs, at least in the short term.

Public Health Measures May Affect CalWORKs Applications. Another important difference between current economic conditions and other recent recessions is the public health crisis itself. As a result of the ongoing pandemic, most county human services offices have been affected by public health closures since March. We have talked to several of these offices throughout the state, and we understand that they have made extraordinary efforts to ensure CalWORKs remains accessible even during public health lockdowns. Such steps include expanding online and telephone application and approval processes, maintaining physical drop boxes for paper applications, and allowing for in‑person applications by appointment. Nevertheless, it remains possible that public health closures have affected the ability, and desire, of some potential CalWORKs applicants to enroll in the program.

Future Trends Unclear

Caseload Might Increase After Stimulus Ends, Public Health Restored. We anticipate several future events which will affect enrollment in CalWORKs, although their exact timing or impact on caseloads is unclear:

- Federal Stimulus Will Eventually Be Exhausted. Currently authorized federal relief funding will be expended by 2020, and it is not clear whether additional relief measures will be authorized or for how long. At some point, all relief funding will be expended. To the extent this funding has reduced demand for CalWORKs assistance, its expiration may lead to increased caseloads.

- Improvements in Public Health. At some point, some combination of vaccines and therapeutics will allow for normal economic activities to resume, including normal operations at county human services departments. To the extent that public concerns or related policy measures have suppressed CalWORKs applications, the restoration of public health may lead to increased caseloads. On the other hand, public health concerns have also resulted in the loss of income for many families, and thus the restoration of normal economic activity could dampen caseload increases.