LAO Contact

February 3, 2021

The 2021-22 Budget

Analysis of the Governor's

CalWORKs Proposals

In this post, we provide important background on the California Work Opportunity and Responsibility to Kids (CalWORKs) program, updates on how caseload has been affected by the coronavirus disease 2019 (COVID‑19) pandemic, and analyze the Governor’s proposed CalWORKs budget. In short, caseload has declined precipitously in the most recent data, reaching a new all‑time low in November 2020 (the most recent month for which there are data). This runs contrary to both the Governor’s budget (which assumes a fairly rapid rate of caseload growth from 2020 through 2022) and the historic relationship between caseload and economic data (which suggests caseload should increase following increased unemployment). In line with other efforts the administration is proposing to support low‑income individuals during the COVID‑19 pandemic, we suggest the Legislature work with the administration to understand the factors leading to the lower than expected caseload and explore options for ensuring CalWORKs assistance reaches eligible families.

Background

The CalWORKs program provides cash grants and job services to low‑income families. The program is administered locally by counties and overseen by the state Department of Social Services (DSS). For more information about CalWORKs, please see our report The 2020‑21 Budget: Department of Social Services. Below, we provide background on recent changes to the CalWORKs program.

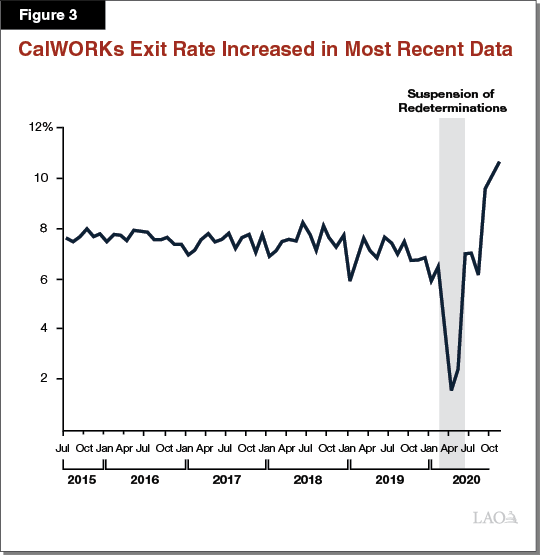

Governor Temporarily Suspended Lifetime Limits, Redeterminations During the Ongoing Pandemic. Executive Order N‑29‑20 included two provisions affecting CalWORKs caseload during the COVID‑19 pandemic. First, the order automatically recertified all recipients whose redeterminations were due between March and May of 2020. (CalWORKs recipients generally must submit redetermination paperwork once every six months to remain on aid. The redetermination paperwork is intended to determine whether participants continue to meet the eligibility requirements to participate in the program.) This had the effect of reducing the exit rate from about 6 percent to 8 percent of all cases to about 2.5 percent for those three months. Second, the order (along with extensions from subsequent executive orders) prevented any month of CalWORKs participation during the COVID‑19 emergency from counting against an adult’s 48‑month lifetime limit.

Under State Law, Local Revenue Growth Automatically Triggers CalWORKs Grant Increases. Following a major realignment of state and local responsibilities in 1991, some funds generated by a new sales tax and a portion of the vehicle license fee accrue to a special fund with a series of subaccounts which pay for a variety of health and human services programs and responsibilities. Under state law, sufficient revenue growth in the Child Poverty and Family Supplemental Support Subaccount triggers an increase in CalWORKs cash grant amounts. In the past, this account funded two separate grant increases of 5 percent in 2013‑ 14 and 2014‑15 and another of 1.43 percent in 2016‑17, as well as funding the repeal of the maximum family grant policy starting in 2016‑17.

2020‑21 Budget Act Made Several Changes to CalWORKs Program. Among the most notable changes made to CalWORKs in the most recent budget are:

- Extended lifetime limits for adult recipients from 48 months to 60 months starting in May 2022.

- Offered adults increased flexibility in work participation requirements for their entire time on aid starting in May 2022 (currently, adults are allowed this increased flexibility for a total of only 24 months).

- Provided $2.4 billion for county CalWORKs services (referred to as the single allocation), an amount not directly connected to the budget’s caseload projections.

- Temporarily eliminated $20 million for counties to implement the CalWORKs Outcomes and Accountability Review.

- Eliminated a planned $30 million ramp‑up of the Home Visiting Program, under which some CalWORKs families with a child under two years old receive regular visits from a nurse, parent educator, or early childhood specialist who works with the family to improve maternal health, parenting skills, and child cognitive development.

Caseload Trending Much Lower Than Budget Act Expectations

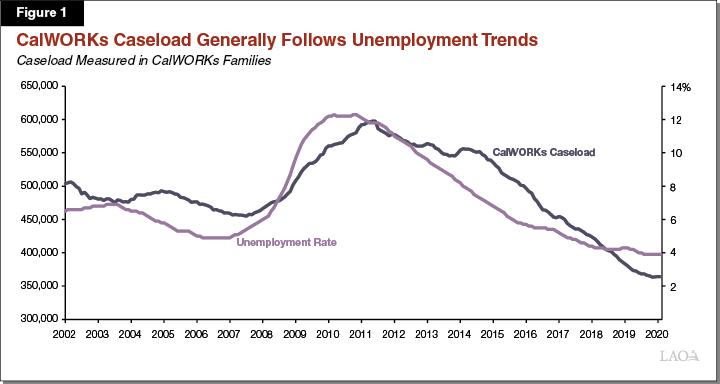

Recent Recession Was Projected to Increase Caseloads. As Figure 1 shows, CalWORKs caseload generally follows trends in California’s unemployment rate. When the unemployment rate is high—for example, during the Great Recession of 2008‑09 (when unemployment peaked at about 12 percent)—caseload grows (eventually reaching an all‑time high of about 587,000 cases in 2010‑11). When the unemployment rate is low—for example, during the pre‑COVID‑19 economic expansion—caseload declines (reaching what was then an all‑time low of about 366,000 cases in 2019‑20). Because the recession due to the COVID‑19 pandemic has caused the unemployment rate to reach historic highs (peaking at 15.6 percent in May 2020), caseload also was projected to increase at an unprecedented rate (expected to go from its then historic low all the way up to its historic high of 587,000 in 2020‑21 according to budget act projections).

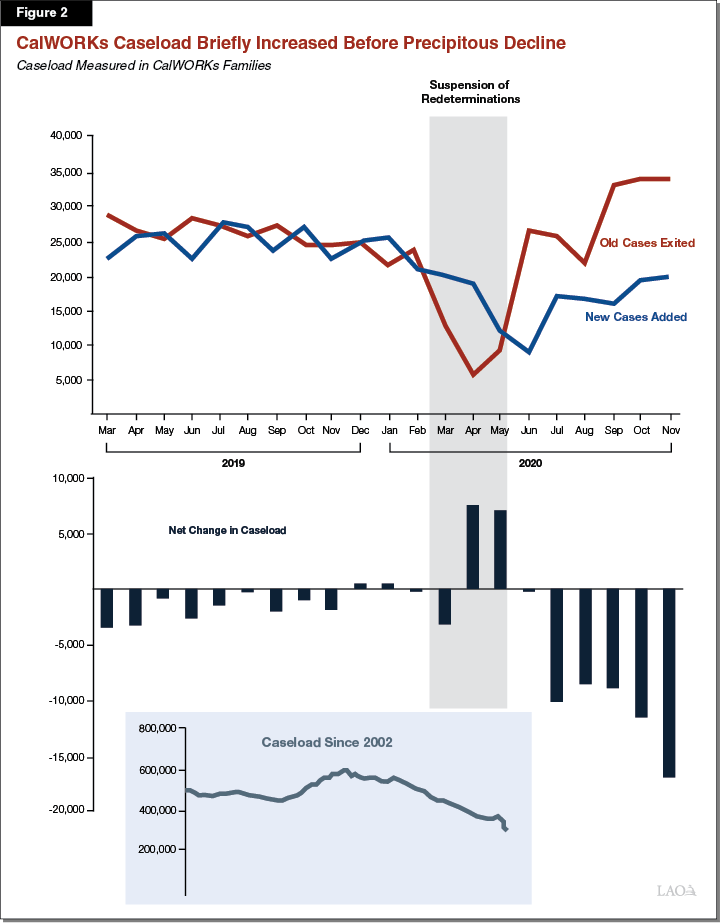

Caseload Increased Modestly Following a Temporary Suspension of Redeterminations, Then Fell Precipitously. CalWORKs caseload increased by about 11,000 cases (3 percent) during the first three months of the COVID‑19 recession (March through May 2020) before decreasing in subsequent months. As Figure 2 shows, this period of caseload growth was primarily driven not by an increase in cases added, but by a decrease in cases exiting following the temporary suspension of redeterminations. (Generally, when cases added are greater than cases exited, net caseload grows, and vice versa.) In November, CalWORKs caseload reached a new all‑time low following the fastest five month period of caseload declines since at least 2002 (see insert in Figure 2).

Caseload Decline Reflects Relatively Few Applications Coupled With Higher Than Usual Denial and Exit Rates. After a brief increase in spring 2020, CalWORKs applications fell in the summer and fall to their lowest level since at least 2002. Moreover, since spring, a larger share of applications (about 60 percent) has been denied compared to recent years (about 48 percent). Finally, Figure 3 shows that the exit rate has accelerated in October and November to about 10 percent of the caseload, above the recent average of about 6 percent to 8 percent. (This figure also shows the significant decline in exits in the spring of 2020—largely reflecting the temporary suspension of redeterminations.) Each of these factors helps explain the rapid caseload decrease observed in recent months.

Low Applications Likely Due to Combination of Economic and Public Health Factors. In our recent CalWORKs Fiscal Outlook post, we discuss three potential reasons for low levels of CalWORKs applications in recent data: (1) job losses have not yet affected workers with children as severely as past recessions, (2) the extraordinary level of federal and state relief offered to individuals (in particular, enhanced unemployment insurance) temporarily has reduced CalWORKs demand, and (3) public health concerns temporarily have reduced CalWORKs demand (for example, applicants are reluctant or unable to come to county offices to have their questions answered while completing applications). We continue to believe each of these factors plays some role in the low number of CalWORKs applications.

Reasons for Higher Denial, Exit Rates Are Unclear. The available data do not offer a clear picture as to why CalWORKs applications are being denied at historically high rates, nor why CalWORKs exits have increased. However, public health concerns may play some role in either or both of these trends. For example, a growing number of applications are now completed online rather than in county offices, where staff could be available to answer applicant questions. Without staff assistance, applicants may be more likely to incorrectly or incompletely fill out their applications, resulting in a denial of benefits.

Budget Overview

The Governor’s budget proposes a CalWORKs funding level of about $7.2 billion (all fund sources) in 2021‑22, a $729 million (11 percent) increase over the revised 2020‑21 level. This increase is the net effect of the caseload assumptions and policy proposals described below.

Budget Includes Large Revisions to CalWORKs Caseload, Cost Estimates in 2019‑20 and 2020‑21. Relative to the 2020‑21 Budget Act, the Governor’s budget projects caseload‑related savings on CalWORKs cash assistance in 2019‑20 of about $280 million General Fund. (The administration also reports that about $330 million from the 2019‑20 single allocation is currently unspent, although counties still have two quarters in which they can make claims towards this appropriation. These savings eventually will revert to the General Fund.) The budget further projects 2020‑21 caseload will average about 405,000, or 30 percent below budget act projections, for associated costs savings on cash assistance of about $470 million General Fund.

Projected Caseload Increase, Policy Changes Drive Cost Increases in 2021‑22. As shown in Figure 4, the bulk of the 2021‑22 funding increase is due to a projected 19 percent increase in caseload (from the revised 405,000 cases in 2020‑21 to about 482,000 cases). Other cost drivers include the extension of lifetime limits to 60 months for adults scheduled for May 2022 (estimated to cost about $22 million in 2021‑22, with higher costs anticipated for future years) and the various policy proposals described below.

Figure 4

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2020‑21 |

2021‑22 |

Change From 2020‑21 |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs Cases |

405,317 |

482,436 |

77,119 |

19% |

|

Cash Grants |

$3,589 |

$4,387 |

$798 |

22% |

|

Single Allocation |

||||

|

Employment services |

$1,223 |

$1,238 |

$15 |

1% |

|

Cal‑Learn case management |

32 |

21 |

‑12 |

‑36 |

|

Eligibility determination and administration |

648 |

666 |

18 |

3 |

|

Subtotals |

($1,904) |

($1,924) |

($21) |

1% |

|

Stage 1 Child Carea |

$486 |

$424 |

‑$62 |

‑13% |

|

Home Visiting Initiative |

$90 |

$73 |

‑$18 |

‑19% |

|

Other County Allocations |

$422 |

$406 |

‑$16 |

‑4% |

|

Otherb |

$4 |

$9 |

$6 |

154% |

|

Totals |

$6,495 |

$7,224 |

$729 |

11% |

|

aIn 2020‑21 and prior years, this was included in the single allocation. Starting in 2020‑21, it is a separate allocation. We present it as a separate line item in both years for ease of comparison. bPrimarily includes various state‑level contracts. |

||||

General Fund Accounts for Small, but Growing, Share of CalWORKs Costs. Figure 5 shows how CalWORKs costs are shared between federal, state, and local revenue sources. While General Fund grows notably year over year (79 percent), it still accounts for a fairly small share of overall program costs (29 percent). The General Fund still accounts for a fairly small share of overall program costs (29 percent). The General Fund typically pays for year‑to‑year increases in CalWORKs costs because federal funding does not increase proportionally with caseload or policy changes. (The reduction in year‑over‑year Temporary Assistance for Needy Families funding reflects a projected exhaustion of one‑time carryover funds in 2020‑21.)

Figure 5

CalWORKs Funding Sources

(Dollars in Millions)

|

2020‑21 |

2021‑22 |

Change From 2020‑21 |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$2,811 |

$2,566 |

‑$245 |

‑9% |

|

State General Fund |

1,169 |

2,096 |

928 |

79 |

|

Realignment and other county fundsa |

2,515 |

2,561 |

46 |

2 |

|

Totals |

$6,495 |

$7,224 |

$729 |

11% |

|

aPrimarily various realignment funds, but also includes county share of grant payments, about $60 million. TANF = Temporary Assistance for Needy Families. |

||||

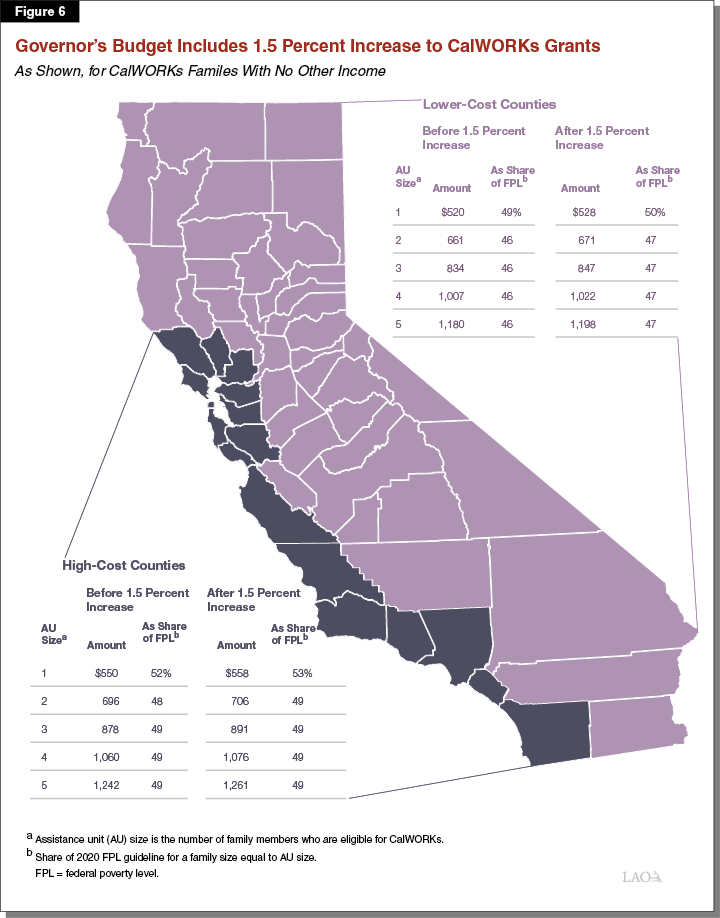

Budget Includes 1.5 Percent Grant Increase Triggered by Local Revenue Growth. The administration estimates a budget year cost of $52 million (annual cost of about $71 million) to fund a 1.5 percent increase to cash grants starting in October 2021. This increase was triggered, and will be funded, by revenue growth in the Child Poverty and Family Supplemental Subaccount. Figure 6 shows this increase would raise grants for all Assistance Unit (AU) sizes in high‑cost counties to at or above 49 percent of the federal poverty level (FPL) (assuming household size equals AU size), whereas grants for most AU sizes in lower‑cost counties would be at about 47 percent of the FPL. (As part of the 2018‑19 Budget Act, the Legislature set a goal to increase CalWORKs grants to 50 percent of the FPL for a family that is one person larger than the AU size, a considerably higher target than would be reached in 2021‑22 under the Governor’s budget.) Ultimately, the amount of this grant increase will depend on revenue and caseload assumptions. To the extent caseload comes in below the administration’s forecast, realignment revenue could support a larger grant increase.

Budget Aligns Single Allocation to Projected Caseload Levels. The final 2020‑21 budget package provided counties more funding for CalWORKs‑related services than would be typical based on the assumed caseload. This funding to counties is referred to as the single allocation. As Figure 7 shows, the Governor’s budget would align the single allocation to the level suggested by the overall caseload forecast, consistent with prior practice. The net effect of this adjustment and the administration’s projected caseload increase is a relatively modest decrease in the single allocation.

Figure 7

CalWORKs Single Allocation in Governor’s Budget

All Funds (Dollars in Millions)

|

2020‑21 |

2021‑22 |

Change From 2020‑21 |

||

|

Amount |

Percent |

|||

|

Employment Services |

||||

|

Caseload‑driven costs |

$1,043 |

$1,238 |

$194 |

19% |

|

Maintenance of 2020 Budget Act funding levels |

180 |

— |

‑180 |

— |

|

Subtotals |

($1,223) |

($1,238) |

($15) |

(1%) |

|

Administration and Eligibility |

||||

|

Caseload‑driven costs |

$614 |

$666 |

$52 |

8% |

|

Maintenance of 2020 Budget Act funding levels |

34 |

— |

‑34 |

— |

|

Subtotals |

($648) |

($666) |

($18) |

(3%) |

|

Stage 1 Child Carea |

||||

|

Caseload‑driven costs |

$415 |

$424 |

$9 |

2% |

|

Maintenance of 2020 Budget Act funding levels |

71 |

— |

‑71 |

— |

|

Subtotals |

($486) |

($424) |

(‑$62) |

(‑13%) |

|

Cal‑Learn Case Management |

||||

|

Caseload‑driven costs |

$17 |

$21 |

$3 |

18% |

|

Maintenance of 2020 Budget Act funding levels |

15 |

— |

‑15 |

— |

|

Subtotals |

($32) |

($21) |

(‑$12) |

(‑36%) |

|

Totals |

$2,390 |

$2,348 |

‑$41 |

‑2% |

|

aIn 2020‑21 and prior years, this was included in the single allocation. Starting in 2020‑21, it is a separate allocation. We present the item here in both years for ease of comparison. |

||||

Budget Extends Temporary Suspension of State Lifetime Limits. The budget includes $46.1 million to continue the suspension of any month counting towards adults’ 48‑month lifetime limits during the COVID‑19 pandemic. (This exemption, already put into place by executive order, is estimated to cost $18.2 million in 2020‑21.)

Assessment

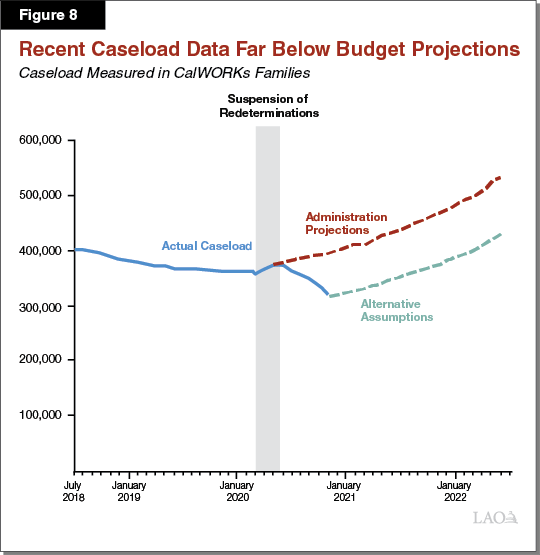

Budget Very Likely Overestimates Caseload Growth. The administration informs us that when its caseload estimate was constructed the most recent data available were from June 2020. These data predate the rapid caseload decrease observed in the summer and fall and the most recent federal extension of unemployment insurance benefits. As Figure 8 shows, the administration’s forecast essentially extrapolates from the initial caseload increase observed during the spring, an increase which now appears driven entirely by the suspension of redeterminations. Even assuming caseload resumed growing in December and continued growing throughout the budget window (see “Alternative Assumptions” in the figure below), we estimate CalWORKs costs would come in about $450 million below Governor’s budget projections in 2020‑21 and $900 million below in 2021‑22. Thus, we anticipate large downward revisions to the administration’s caseload projections in May.

Pausing State Lifetime Limits During Pandemic Is Reasonable. The Legislature and administration currently are considering various options (such as the proposed Golden State Stimulus) for providing extraordinary assistance to low‑income Californians during the current pandemic. As CalWORKs already provides important assistance to some of California’s lowest‑income families, taking steps (such as temporarily suspending the state’s 48‑month lifetime limit on aid to adults) to ensure the program continues to reach as many of these families as possible is prudent.

Consider Additional Strategies for Preventing Caseload Declines and Increasing CalWORKs Enrollment. In addition to the Governor’s proposal to suspend temporarily the state’s lifetime limits on aid, the Legislature may wish to consider other options for ensuring CalWORKs continues to reach low‑income Californians during the current pandemic. In particular, we are concerned by the precipitous caseload declines in a time of significant economic strain. We understand that DSS currently is working to better understand and validate the recent trends in CalWORKs caseload applications, denials, and exits. This analysis could inform additional steps that could ensure CalWORKs reaches eligible families. For example, if the increased exit rate is due to participants struggling to comply with the administrative requirements for redeterminations, the Legislature may wish to consider suspending the redetermination requirement through the duration of the public health emergency (federal law has already extended a similar moratorium on Medi‑Cal redeterminations through the spring). Another potential response may be to provide outreach to families who became disenrolled in the program since spring and offer them assistance in re‑enrolling in the program, or to provide additional statewide outreach (similar to efforts provided to programs such as the California Earned Income Tax Credit). To determine what steps would be most effective, we recommend the Legislature request DSS to report at budget hearings on their findings.