February 16, 2021

The 2021-22 Budget

Analysis of the Medi-Cal Budget

Overview. This post describes the major adjustments to the Medi‑Cal budget in 2020‑21 and 2021‑22, with a focus on the technical adjustments such as the administration’s caseload estimates. While this post summarizes the major discretionary proposals that contribute to increased spending in 2021‑22, we will further analyze the major discretionary Medi‑Cal proposals in separate publications and communications to the Legislature.

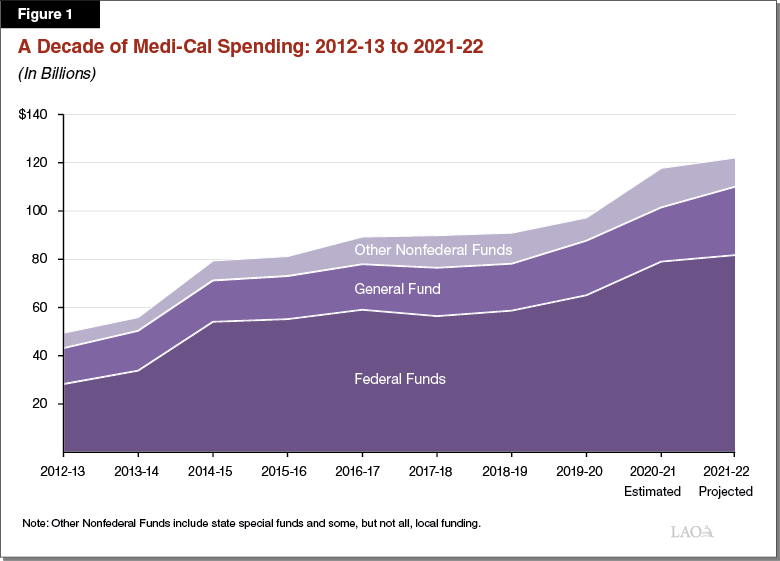

Medi‑Cal Is the State’s Largest Health Care Program, Covering Over 13 Million Low‑Income Californians. Medi‑Cal is the state’s Medicaid program and provides health care coverage to over 13 million Californians with low incomes. As a joint state‑federal program, costs are shared between the federal and state as well as local governments. Figure 1 summarizes Medi‑Cal spending trends over the last decade.

Overview of the Governor’s Budget

Current Year

Estimated General Fund Revised Downward by Roughly $1.2 Billion to $22.5 Billion in 2020‑21. The Governor’s budget estimates Medi‑Cal spending to be $22.5 billion General Fund ($118 billion total funds) in 2020‑21. This reflects an approximately $1.2 billion (5 percent) downward adjustment relative to what was assumed in the 2020‑21 Budget Act. Compared to previous years, a 5 percent adjustment is large but not unprecedented. As we expand upon below, lower than anticipated caseload growth accounts for roughly $950 million of the downward adjustment in estimated General Fund spending in 2020‑21. Furthermore, the Governor’s budget recognizes additional savings in 2020‑21 of around $230 million General Fund related to the decline in routine health care utilization due to the coronavirus disease 2019 (COVID‑19) pandemic. These two adjustments explain virtually all of the net change in estimated General Fund spending in 2020‑21. (While there are many other, sometimes significant, adjustments, these other adjustments roughly cancel each other out.)

Budget Year

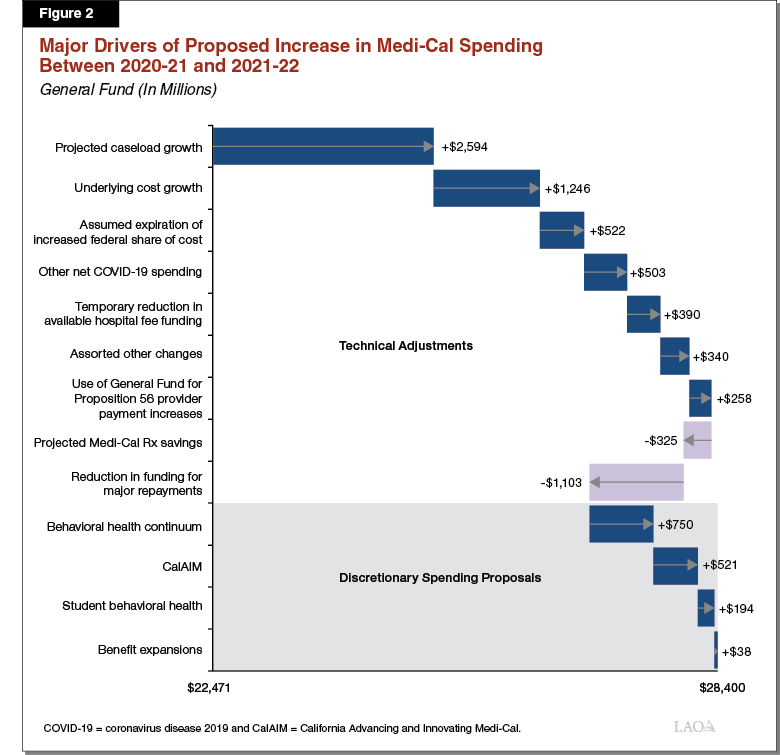

Proposed General Fund Spending to Grow by $5.9 Billion, Reaching $28.4 Billion in 2021‑22. Under the Governor’s proposed budget, General Fund spending in Medi‑Cal would grow from $22.5 billion in 2020‑21 to $28.4 billion in 2021‑22—a $5.9 billion, or 26 percent, increase in year‑over‑year spending. Year‑over‑year growth in General Fund spending in Medi‑Cal of this magnitude is unprecedented. As shown in Figure 2, $4.4 billion of the $5.9 billion in General Fund growth in 2021‑22 reflects technical adjustments to the Medi‑Cal budget. The remaining $1.5 billion reflect new policy proposals from the Governor. Total spending in Medi‑Cal is proposed to grow by $4.3 billion to nearly $122.2 billion on a year‑over‑year basis. Total spending growth is less than General Fund spending growth in part due to lower federal funding, which we explain later.

Major Technical Adjustments. Technical adjustments, or year‑over‑year changes in the funding needs of the program under existing program rules, account for around three‑quarters of the growth in proposed General Fund spending between 2020‑21 and 2021‑22. While the following bullets summarize the major General Fund cost drivers, ultimately, many additional factors contribute to this increase in proposed spending.

- Caseload. Medi‑Cal costs vary closely with the program’s caseload. The Governor’s budget projects significant (12 percent) year‑over‑year growth in the Medi‑Cal caseload going into 2021‑22. This caseload growth is responsible for $2.6 billion of the increase in General Fund costs in 2021‑22.

- Underlying Cost Growth. Underlying cost growth reflects changes in Medi‑Cal costs due to health care cost inflation and underlying service utilization trends (the disruption COVID‑19 has had on service utilization would not factor into underlying trends). We estimate that underlying cost growth accounts for about $1.2 billion of the overall increase in General Fund costs between 2020‑21 and 2021‑22. This reflects somewhat higher, but not extraordinary, underlying cost growth compared to recent years.

- Assumed Expiration of Enhanced Federal Funding. As a part of federal COVID‑19 response legislation, Congress approved a 6.2 percentage point increase in the federal government’s share of cost for Medicaid for the duration of the COVID‑19 national public health emergency. The federal government determines when the emergency is over. For each year the increase in federal funding is in effect, the state saves between $2 billion and $3 billion General Fund in Medi‑Cal. The Governor’s budget assumes the public health emergency will remain in place through December 2021. Because the increased federal funding would expire halfway through 2021‑22 under the administration’s assumption, about $500 million General Fund is needed in Medi‑Cal in 2021‑22. (Significantly higher General Fund cost increases as a result of the expiration of increased federal funding would occur in 2022‑23, reflecting a full fiscal year without the enhanced federal funding.)

- Reduction in Funding for Major Repayments. The 2020‑21 budget includes $1.1 billion General Fund to make various repayments to the federal government and managed care plans to correct prior federal fund claims and other payments that were made in error. These repayments are concentrated in 2020‑21. As a result, the net amount of General Fund needed for such repayments is projected to go down by $1.1 billion.

Discretionary Spending Proposals. Discretionary spending proposals account for about one‑quarter of the $5.9 billion General Fund proposed increase in Medi‑Cal spending in 2021‑22. This $1.5 billion in discretionary spending includes the following proposals:

- Behavioral Health Continuum Infrastructure. To expand county behavioral health treatment capacity, the Governor proposes $750 million one‑time available for three years to provide grant funds to counties to acquire and renovate behavioral health facilities. We will analyze this proposal in a separate upcoming post, The 2021‑22 Budget: Behavioral Health: Continuum Infrastructure Funding Proposal.

- California Advancing and Innovating Medi‑Cal (CalAIM). CalAIM is a far‑reaching set of reforms to expand, transform, and streamline Medi‑Cal service delivery and financing. To implement CalAIM, the Governor proposes $532 million General Fund ($1.1 billion total funds) in 2021‑22. This funding reflects the first half‑year of CalAIM funding, a portion of which would be ongoing under the CalAIM funding plan. We analyze CalAIM financing issues in a separate post, The 2021‑22 Budget: CalAIM Financing Issues.

- School‑Based Behavioral Health. To increase capacity to provide student behavioral health services, the Governor proposes $200 million General Fund ($400 million total funds) one‑time available for three years to provide incentive payments to Medi‑Cal managed care plans to establish partnerships with schools and county behavioral health departments. We will analyze this proposal in a separate upcoming post, The 2021‑22 Budget: Behavioral Health: Medi‑Cal Student Services Funding Proposal.

- Benefit Expansions. The Governor’s budget proposes net spending of $30 million General Fund ($85 million total funds) on three Medi‑Cal benefit expansions. (Because of technical reasons and the fact that one of the benefit expansions already is in effect temporarily, these benefit expansion increase General Fund spending by $38 million on a year‑over‑year basis.) These three expansions are (1) introducing a new remote patient monitoring benefit as part of a larger package of telehealth reforms; (2) adding continuous glucose monitors as a benefit for Medi‑Cal beneficiaries with Type I diabetes; and (3) permanently reinstating coverage of over‑the‑counter cough and cold products, which currently are covered as a part of the state’s temporary package of Medi‑Cal pandemic response policies.

Analysis of Caseload

Background

Prior to the pandemic, Medi‑Cal provided coverage to around 13 million Californians. Medi‑Cal serves a number of discrete populations with somewhat distinct characteristics and costs to the state and federal government. These populations include families with children, seniors aged 65 or older, persons with disabilities, and childless adults who are part of the eligibility expansion under the Patient Protection and Affordable Care Act. Seniors and persons with disabilities (SPDs) tend to have greater needs than some other Medi‑Cal populations, and therefore tend to have higher per‑enrollee costs. Childless adults and families tend to have lower per‑enrollee costs. Additionally, the federal government currently pays 90 percent of Medi‑Cal costs for individuals enrolled as part of the optional expansion.

Budget Act Assumed Sharply Rising Caseload Due to COVID‑19. The budget act assumed that the deteriorating economic conditions caused by the COVID‑19 crisis would cause a surge in the Medi‑Cal caseload. From a low of around 12.5 million beneficiaries in March 2020, the budget act projected Medi‑Cal caseload would increase to roughly 14.5 million enrollees by July 2020, increasing General Fund costs above what they otherwise would be by about $3 billion across 2019‑20 and 2020‑21. This rapid projected growth in the Medi‑Cal caseload was assumed to be due to two primary factors:

- Employment Losses. The early months of the COVID‑19 pandemic brought unprecedented declines in employment in California. The budget act assumed that individuals and families experiencing job losses or otherwise having their incomes fall under COVID‑19 would join the Medi‑Cal program in huge numbers. Most of the caseload growth assumed in the budget act was attributed to this factor.

- Eligibility Redetermination Suspensions. Federal COVID‑19‑related legislation effectively requires the state to suspend most eligibility redeterminations in Medi‑Cal for the duration of the national COVID‑19 public health emergency. As a result, enrollees who, under standard Medi‑Cal eligibility rules, would be found to have become ineligible and therefore disenrolled from the program (for example, because they no longer meet the program’s low‑income requirements), now may remain enrolled in Medi‑Cal through the emergency period. The budget act assumed Medi‑Cal caseload would increase significantly—on net—from what it otherwise would be if eligibility redeterminations were not suspended.

Caseload Growth to Date Is Significantly Below Expectations. Preliminary data show that Medi‑Cal caseload growth to date has been significantly slower than what was assumed in the budget act. Rather than growing by around 2 million enrollees between March 2020 and July 2020 (and then declining thereafter) as assumed in the budget act, caseload grew only by around 1.2 million enrollees from March to December 2020, the most recent month for which we have data. Overall, caseload growth to date appears largely due to the suspension of eligibility terminations. Relatively few new enrollees appear to have joined the program even as unemployment reached record numbers. Although why employment losses have not yet had a significant impact on Medi‑Cal caseload is unclear, there likely are several factors at play. For example, employment losses disproportionately have affected low‑wage workers who were more likely to already be enrolled in Medi‑Cal.

Governor’s Budget

Administration Projects Strong, Extended Caseload Growth Through December 2021, Followed by Declines. Governor’s budget estimates that caseload grew by 155,000 enrollees per month over the second half of 2020. The administration assumes this growth rate increases to 200,000 additional enrollees per month in January 2021, and that new enrollees will be added to the Medi‑Cal caseload at that higher rate for the duration of 2021, with caseload peaking at more than 16 million in December 2021. This increase is driven by the projected impact of the ongoing COVID‑19 pandemic. As a result, the Governor’s budget estimates the average number of enrollees in 2020‑21 to be slightly below 14 million. While this represents a gain of more than 1 million enrollees over 2019‑20, it is still nearly 300,000 enrollees fewer than what the budget act projected. We estimate that the downward revision for 2020‑21 results in $950 million in General Fund savings ($1.4 billion in total funds).

Projected Caseload Increase Results in Significant Growth in Costs in 2021‑22. As noted above, the administration anticipates caseload to continue to grow through December 2021. In response to the assumed end of the public health emergency and the ensuing resumption of eligibility redeterminations, however, the Governor’s budget then projects that caseload will decline by roughly 275,000 enrollees per month for the first half of 2022. Over the course of 2021‑22, the administration projects the average number of enrollees to be 15.5 million. The administration projects that Medi‑Cal spending will rise by $2.6 billion General Fund ($13.5 billion total funds) from 2020‑21 to 2021‑22 due to continued COVID‑19‑related caseload increases. The administration projects that General Fund costs associated with caseload increases will be $4.3 billion above what they would have been absent the COVID‑19 pandemic in 2021‑22.

Assessment

At a high level, Medi‑Cal costs are driven by two factors, caseload, or the number of people enrolled in the program, and cost per enrollee. Because different enrollee populations have different average per‑enrollee costs, assumptions around which enrollee populations will join or remain on the program in greater proportions significantly affects costs per enrollee. (These assumptions are made more important by the fact that the state is responsible for different shares of cost for different enrollee populations.) Below, we describe how our assumptions around caseload and cost per enrollee differ from the administration’s, which lead to different expectations of cost growth.

Projected Caseload Growth

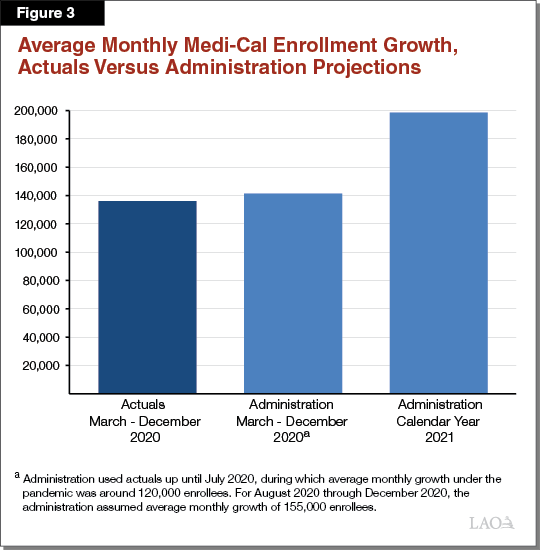

Administration’s 2021 Caseload Projections Exceed Recent Trends. The administration’s caseload estimates use actual caseload numbers through July 2020. For August 2020 through December 2020, the administration assumes monthly caseload growth of 155,000 enrollees. Based on updated actuals through December 2020, the average monthly growth has been roughly 6,000 enrollees (4 percent) lower than assumed by the administration. A difference of this magnitude shows the administration’s 2020 caseload growth estimates are quite reasonable. (Average monthly caseload growth over the entire course of the pandemic in 2020—from March 2020 through December 2020—has been somewhat lower than the administration’s assumptions, coming in at less than 140,000 enrollees per month.) To reach a caseload of 16 million in January 2022, the administration assumes that caseload will grow by nearly 200,000 enrollees per month for all of 2021—46 percent above the average since the beginning of the emergency in March 2020 and 10 percent higher than the maximum growth rate of any individual month to date. Figure 3 displays the difference between the administration’s projections and caseload actuals.

Administration’s Caseload Projections Are Likely Overstated, Particularly in 2021‑22. Caseload likely will rise significantly over the course of 2021‑22 as a result of the COVID‑19 pandemic. Given the trends we have observed so far, however, we believe caseload rising to 16 million enrollees by January 2022 is unlikely. For this to happen, average monthly caseload growth for all of 2021 would need to be 46 percent higher than it has been for the duration of the pandemic to date. Although the administration’s projections fall within the realm of possibility, they likely represent a worst‑case scenario in fiscal terms. If caseload were to grow at an average monthly rate similar to one of the fastest months of growth since the pandemic started—but not the fastest month of growth—we would expect caseload to grow 13 percent faster in 2021 than it has so far during the pandemic. This would reflect slightly more than 150,000 additional enrollees per month. With this assumption, Medi‑Cal caseload would peak at 15.7 million enrollees in January 2022—approximately 300,000 (3 percent) lower than what the administration projects. (The somewhat modest difference in our peak caseload estimates is due to (1) the preliminary November and December 2020 actuals coming in higher than estimated by the administration and (2) our assumption that caseload declines after the end of the national public health emergency begin in February rather than January 2022.)

Projected Per‑Enrollee Costs

Administration Assumes Relatively High Growth Among Costlier Caseload Groups. The administration’s assumptions around which enrollee populations will join or remain in the program in greater proportions differ from the actuals that we have observed to date during the pandemic. The administration projects 9 percent of new enrollees will be SPDs. The preliminary actuals we have reviewed indicate that 5 percent of the enrollees added since the beginning of the pandemic are SPDs. If SPDs make up a smaller share of pandemic‑related caseload growth than the administration assumes, the result likely would be significantly lower per‑enrollee costs since SPDs can be two‑to‑three times as costly per enrollee. Additionally, we find that optional expansion enrollees have comprised a larger share of caseload growth so far under the pandemic than assumed by the administration. While optional expansion enrollees are relatively high cost in total fund terms, the federal government pays 90 percent of their costs and the General Fund only covers 10 percent. In contrast, for other populations, the state generally pays 50 percent of enrollee costs.

Administration’s Assumed Costs Per Case Likely Are Overstated. We expect the additional Medi‑Cal enrollee populations will be similar over the next year to what we have observed so far during the pandemic. For example, we assume growth among SPDs would remain relatively insensitive to future labor market impacts, which suggests SPD‑enrollee, pandemic‑driven growth likely would be close to what the actuals to date indicate. As a result, we would expect SPDs to comprise about 5 percent of COVID‑19‑related caseload growth going forward, rather than the 9 percent assumed by the administration. We also would assume optional expansion enrollees continue to comprise around 45 percent of additional enrollment, rather than nearly 40 percent as assumed by the administration. Due to our different assumptions on the case mix of Medi‑Cal caseload growth, we assume per‑enrollee General Fund costs will be around 5 percent lower than the administration.

Overall Assessment

Our office modeled Medi‑Cal caseload to compare the administration’s caseload projections with what we would expect. Like the administration, we assumed a set number of enrollees will be added to the Medi‑Cal caseload each month in calendar year 2021 as a result of the COVID‑19 public health emergency, and that caseload will begin to decline in substantial numbers after the assumed end of the public health emergency in December 2021. We also used administration projections of the average monthly per‑enrollee cost for each eligibility category. However, we made two key assumptions that differed from those of the administration. First, we assumed caseload would grow at an average monthly rate similar to a month during the pandemic that showed a large, but not the largest, caseload increase. Second, we assumed the case mix of additional enrollment in Medi‑Cal would equal the shares observed so far under the pandemic.

General Fund Costs in Medi‑Cal Could Be Significantly Lower Than Assumed in the Governor’s Budget. In our assessment, General Fund costs in Medi‑Cal are likely to be around $1 billion lower across the current year and budget year than under administration assumptions. Should caseload growth be closer to the average of what the state has seen under the pandemic so far—rather than somewhat higher than average monthly growth to date, as we assume in our model—General Fund costs could be even lower than we estimate. While our projections differ significantly from those of the administration, we are not at this time recommending an adjustment to the Governor’s budget. The COVID‑19‑related public health emergency is unprecedented in the history of Medi‑Cal, and so its impact on Medi‑Cal caseload is difficult to predict. As a result, any projections of near‑term caseload growth and associated costs are highly uncertain. Accordingly, we will wait for additional information to make our final assessment and recommendations related to Medi‑Cal caseload costs at the time of the May Revision.

Analysis of Other Technical Issues

Governor’s Budget Assumption on the End of the National Public Health Emergency Is Reasonable. As discussed previously, federal COVID‑19 legislation increased the federal government’s share of cost for Medicaid by 6.2 percentage points for the duration of the national COVID‑19 public health emergency. The federal administration has discretion to determine when the emergency ends. The assumption of when the public health emergency will end has substantial impacts on the Medi‑Cal budget since every year that it remains in effect saves the state between $2.5 billion and $3.5 billion General Fund (or between $240 million and $300 million General Fund per month).

The budget act assumed the national public health emergency would end in June 2021 at the end of the state’s 2020‑21 fiscal year. The Governor’s budget assumes that the national public health emergency would remain in place for six months longer, through December 2021. Ultimately, when the public health emergency expires is uncertain and will depend on the course the pandemic takes as well as decisions by federal policymakers. Should the public health emergency remain in place for longer than is assumed by the administration, General Fund costs in Medi‑Cal could be hundreds of millions of dollars lower than currently budgeted in 2021‑22. Should the emergency be ended sooner than assumed, General Fund costs could be hundreds of millions of dollars higher than budgeted. We find the Governor’s budget assumption on the expiration of the national public health emergency reasonable, particularly in light of recent pronouncements by the new federal administration that the national public health emergency is likely to remain in effect through December 2021.

General Fund Cost Related to Proposition 56 Provider Payments Likely Is Overstated Due to Flavored Tobacco Referendum. Proposition 56 (2016) raised state taxes on tobacco products and dedicates most revenues to Medi‑Cal on an ongoing basis. Funding from Proposition 56 for Medi‑Cal is used to make increased payments to health care providers, which are intended to ensure timely access, limit geographic shortages of services, and ensure quality care. Proposition 56 revenues provided about $1.3 billion in 2019‑20 to Medi‑Cal. Because tobacco use is projected to continue to decline on an ongoing basis—partially as a result of the new taxes put in place under Proposition 56—revenues from Proposition 56 for Medi‑Cal are expected to gradually decline on a year‑over‑year basis.

The administration projects a substantial decline of about $200 million in Proposition 56 revenues between 2020‑21 and 2021‑22. Although Proposition 56 revenues are expected to gradually decline on a year‑over‑year basis, the administration’s projected revenue decrease primarily is attributed to the anticipated implementation of Chapter 34 of 2020 (SB 793, Hill et. al) which bars retailers from selling flavored tobacco products. This prohibition—slated to implement January 1, 2021—was expected to substantially reduce Proposition 56 revenues in both 2020‑21 and 2021‑22, since it would result in fewer transactions involving tobacco products for the state to tax. The Governor’s Medi‑Cal budget includes $275 million General Fund to backfill this expected revenue decline in 2021‑22 in order to sustain the provider payment increases Proposition 56 has supported. However, opponents of this legislation have collected enough signatures to place a referendum for voter approval of SB 793. Accordingly, implementation of this ban on sales of flavored tobacco products will be delayed pending the results of the referendum. As a result, we expect the administration’s Proposition 56 revenue estimates to be revised upward by around $50 million in 2020‑21 and around $200 million in 2021‑22 at May Revision. This would reduce the need for General Fund to support Proposition 56 provider payment increases by $200 million in 2021‑22.

General Fund Costs Will Need to Be Adjusted Upward Due to Recent Federal Extension of Disproportionate Share Hospital Funding. The 2021‑22 Medi‑Cal budget proposal reflects a $100 million year‑over‑year reduction in General Fund spending on payments to private disproportionate share hospitals, which serve large numbers of low‑income or uninsured populations. This reduction generally is triggered by a scheduled reduction in federal funding that the state largely directs to public disproportionate share hospitals. (The General Fund payment levels that go to private hospitals are tied to federal funding levels that go to public hospitals, so reductions in federal funding lower General Fund payments to participating private hospitals.) After the Governor’s budget largely was finalized, Congress has delayed the scheduled federal reduction (as it has done previously). Due to the Congressional delay in the scheduled federal reduction, we would expect General Fund costs to be around $100 million higher in 2021‑22 than currently budgeted.

Conclusion

Medi‑Cal spending projections are subject to enormous uncertainty given the program’s size, complexity, and the manner in which it is budgeted. Given these characteristics, the Medi‑Cal budget regularly is subject to significant adjustments each time it is estimated. We would expect the upcoming May Revision to be no different. In this post, we identify significant net General Fund savings in Medi‑Cal of over $1 billion that, given our current understanding and assumptions around caseload, we anticipate would be reflected in the May 2021 revised Medi‑Cal budget. However, our estimated downward adjustment assumes no other net changes to the Medi‑Cal budget, which is unlikely. We will carefully analyze the revised Medi‑Cal budget in May to assess its overall reasonableness, including in light of our anticipated adjustments.