LAO Contacts

- Jennifer Pacella

- Deputy, Higher Education

- Paul Steenhausen

- California Community Colleges

- Regional K-16 Education Collaboratives

- Adult Education Program

- Cradle-to-Career Education Data System

- Lisa Qing

- California State University

- Student Financial Aid

- Student Mental Health

- Jason Constantouros

- University of California

- State Library

- Student Housing and Campus Expansion

- Service Opportunities for College Students

- Dual Admission

Correction (6/10/22): Totals for on-going and one-time UC core funding have been corrected.

October 11, 2021

The 2021-22 California Spending Plan

Higher Education

- California Community Colleges

- California State University

- University of California

- Student Financial Aid

- California State Library

- Crosscutting Initiatives

This budget post summarizes the state’s 2021‑22 spending package for higher education. It is part of our Spending Plan series. In this post, we cover spending for the California Community Colleges (CCC), California State University (CSU), University of California (UC), student financial aid, California State Library, and certain initiatives that crosscut the education segments. We begin with a short overview of higher education funding, then summarize major budget actions for each segment. The EdBudget part of our website contains many tables providing more detail about the 2021‑22 education budget package.

Overview

Budget Provides Substantial Increase in State Funding for Higher Education. The budget package includes $4.7 billion in new non-Proposition 98 General Fund spending for higher education across 2020‑21 and 2021‑22. Roughly one-third of this amount is for ongoing purposes, with the remainder for one-time purposes. In addition, the budget package includes $3.4 billion in Proposition 98 General Fund increases for the community colleges across the 2019‑20 through 2021‑22 period. Roughly one-fifth of this amount is for ongoing purposes, with the remainder for one-time purposes. Ongoing increases are primarily to support core campus operations and expanded eligibility for certain financial aid programs, whereas one-time initiatives span a wide range of areas, including facility projects, targeted research, and additional student and faculty support. (Beyond higher education, the budget includes a $607 million non-Proposition 98 General Fund increase for various public library programs and $15 million non-Proposition 98 General Fund for the Cradle-to-Career education data system.)

Higher Education Also Receives Substantial Federal Relief Funding. In addition to these General Fund increases, the 2021‑22 Budget Act includes a total of $2.5 billion in state-allocated federal relief funds from the American Rescue Plan Act (Coronavirus Fiscal Recovery Fund). Specifically, the state chose to allocate $1.8 billion to open college savings accounts for low-income public school children, $473 million to provide grants to help displaced workers cover the cost of education or training programs, and $250 million to provide emergency student financial aid to community college students. These funds are in addition to the relief funding that campuses received directly from the federal government. Through three rounds of funding, campuses in California received more than $10 billion in direct federal relief. More than 40 percent of direct federal relief went to emergency student financial aid, with the remainder primarily used for institutional relief (including to backfill revenue losses in campus housing programs and purchase additional technology to support remote learning).

California Community Colleges

Budget Provides $10.6 Billion in Proposition 98 Funding to CCC. Proposition 98 funding (a mix of state General Fund and local property tax revenue) is the primary source of support for the community colleges (and K-12 education). Due to higher General Fund revenues, the Proposition 98 minimum guarantee for 2020‑21was revised upward significantly. As Figure 1 shows, revised 2020‑21 Proposition 98 funding for community colleges is $1.3 billion (14 percent) higher than the 2019‑20 level. On a budgeted per-student basis, the 2020‑21 revised funding level is $1,335 (16 percent) above the 2019‑20 level. Growth in actual per-student funding is even higher (over 20 percent), as many districts benefitted notably from hold harmless provisions (which effectively insulated their budgets from drops in enrollment due to the pandemic). The 2021‑22 level of Proposition 98 support is about the same as the revised 2020‑21 level.

Figure 1

California Community Colleges Proposition 98 Funding

(Dollars in Millions)

|

2019‑20 |

2020‑21 |

Change From 2019‑20 |

2021‑22 |

Change From 2020‑21 |

|||

|

Amount |

Percent |

Amount |

Percent |

||||

|

General Fund |

$6,064 |

$7,296 |

$1,232 |

20.3% |

$7,063 |

‑$232 |

‑3.2% |

|

Local property tax |

3,226 |

3,327 |

101 |

3.1 |

3,535 |

208 |

6.3 |

|

Totals |

$9,290 |

$10,622 |

$1,332 |

14.3% |

$10,598 |

‑$24 |

‑0.2% |

Package Includes a Mix of Ongoing and One-Time Proposition 98 Spending. As Figure 2 shows, the budget provides $3.4 billion in Proposition 98 augmentations for community colleges across the three-year period. Of this total, $758 million (22 percent) is ongoing and $2.6 billion (78 percent) is one time. The new ongoing spending is predominately for core college operations, students’ basic needs and support, and workforce-related programs. The budget contains more than 30 one-time initiatives. Eliminating payment deferrals accounts for more than half of the one-time spending. The remaining one-time spending includes facilities projects, additional student and faculty support, new instructional materials, and various campus-specific projects.

Figure 2

Changes in California Community Colleges

Proposition 98 Spending

2019‑20 Through 2021‑22 (In Millions)

|

Ongoing Spending |

|

|

Core Operations |

|

|

COLA for apportionments (5.07 percent) |

$371 |

|

Full‑time faculty hiring |

100 |

|

Enrollment growth (0.5 percent) |

24 |

|

Other |

|

|

Strong Workforce Program |

$42 |

|

COLA for select categorical programsa |

31 |

|

Basic needs centers and coordinators |

30 |

|

Student mental health |

30 |

|

Student Equity and Achievement Program |

24 |

|

Extended Opportunity Programs and Servicesb |

20 |

|

California Apprenticeship Initiative |

15 |

|

Online tools |

11 |

|

Part‑Time Faculty Office Hours |

10 |

|

Rising Scholars Network |

10 |

|

CENIC cost increases |

8 |

|

MESA program |

8 |

|

Puente Project |

7 |

|

Dreamer resource liaisons |

6 |

|

Umoja program |

5 |

|

Library services platform |

4 |

|

Adult Education Program technical assistance |

1 |

|

HBCU transfer program |

1 |

|

Subtotal |

($758) |

|

One‑Time Spending |

|

|

Facilities |

|

|

Deferred maintenance projects |

$511 |

|

San Diego Continuing Education theater renovation |

35 |

|

Rio Hondo College water reservoir improvement |

7 |

|

Chaffey College welding training facility |

3 |

|

Palo Verde College child development center expansion |

3 |

|

College of the Redwoods nursing program facilities/equipment |

1 |

|

Reedley College aviation program modular building/equipment |

1 |

|

San Jose‑Evergreen Community College District vacant lot study |

1 |

|

Other |

|

|

Deferral paydown |

$1,453 |

|

Student retention and enrollment strategies |

120 |

|

Zero‑textbook‑cost degrees |

115 |

|

Student basic needs |

100 |

|

Part‑Time Faculty Office Hours |

90 |

|

Guided Pathways |

50 |

|

Equal Employment Opportunity best practices |

20 |

|

Faculty professional development |

20 |

|

High Road Training Partnerships |

20 |

|

Common course numbering work group |

10 |

|

Competency‑based education work group |

10 |

|

LGBTQ+ centers |

10 |

|

AB 1460 implementation/anti‑racism initiatives |

6 |

|

Bakersfield College health and nursing program expansions |

6 |

|

Pathways to Law School Programs |

5 |

|

MiraCosta College CERT program |

4 |

|

San Bernardino Community College District television partnership |

4 |

|

CalFresh outreach |

3 |

|

Instructional materials for dual enrollment students |

3 |

|

Riverside Community College District Military Articulation Platform |

2 |

|

Chaffey College property management job training |

1 |

|

Modernize CCC jobs registry |

1 |

|

Shasta College and College of the Siskiyous nursing programs |

1 |

|

Rio Hondo College situational simulation training center |

—c |

|

Subtotal |

($2,614) |

|

Total |

$3,373 |

|

aIncludes 5.07 percent COLA for apprenticeships; 4.05 percent COLA for the Adult Education Program; and 1.7 percent COLA for CalWORKs student services, campus child care support, Disabled Students Programs and Services, Extended Opportunity Programs and Services, and mandates block grant. bAugmentation is in addition to a $2.3 million increase resulting from the 1.7 percent COLA. cLess than $500,000. |

|

|

COLA = cost‑of‑living adjustment; CENIC = Corporation for Education Network Initiatives in California; MESA = Mathematics, Engineering, Science Achievement; HBCU = Historically Black Colleges and Universities; LGBTQ+ = lesbian, gay, bisexual, transgender, queer, and plus; AB = Assembly Bill; and CERT = Cooperative Education Reskilling and Training. |

|

Proposition 98 Support for Core Operations Grows Notably. A major priority for the Legislature was to provide a large cost-of-living adjustment (COLA) for community colleges in 2021‑22 given the absence of a COLA in 2020‑21. This priority was met, with the 2021‑22 budget including $371 million for a 5.07 percent COLA to community college apportionments. The COLA applies to both credit and noncredit instruction. Colleges have discretion in how they use their apportionment augmentation. Colleges are anticipated to use it primarily for salary and benefit increases. (The nearby box tracks increases in certain community college employer contribution rates, which are covered using apportionment funding.) The Legislature also prioritized funding for districts to increase their number of full-time faculty. The budget provides $100 million ongoing for this purpose. Additionally, the budget provides $24 million for 0.5 percent systemwide enrollment growth (equating to about 5,500 students). Each district, in turn, is eligible to increase its enrollment up to 0.5 percent over its budgeted 2020‑21 level.

Community Colleges’ Employer Contribution Rates Set to Increase

Three of the community colleges’ employer contribution rates are determined at the state level and are scheduled to increase in 2021‑22. Community colleges’ employer contribution rate for the California State Teachers’ Retirement System (CalSTRS) increases from 16.2 percent in 2020‑21 to 16.9 percent in 2021‑22. Community colleges’ contribution rate to the California Public Employees’ Retirement System (CalPERS) increases from 20.7 percent in 2020‑21 to 22.9 percent in 2021‑22. About half of participating community college employees are in CalSTRS, with the other half in CalPERS. Among the two systems, community colleges’ pension costs are expected to increase $100 million, with their total pension costs reaching $983 million in 2021‑22. Community colleges also have a higher contribution rate for the Unemployment Insurance (UI) program. Community colleges’ UI rate increases from 0.05 percent in 2020‑21 to 0.5 percent, with the higher rate in effect from July 1, 2021 through June 30, 2023. We estimate colleges’ annual UI costs will increase roughly $25 million, with their total annual UI costs reaching about $28 million in 2021 22.

Payment Deferrals Are Eliminated. In response to the projected drop in the Proposition 98 minimum guarantee at the time the 2020‑21 budget was enacted, the June 2020 budget plan included large state payment deferrals to the community colleges. (When the state defers payments from one fiscal year to the next, it can reduce spending while allowing community colleges to maintain programs by borrowing or using cash reserves.) Specifically, the June 2020 budget plan deferred $1.5 billion in payments to community colleges (plus $11 billion in payments to schools). The 2021‑22 budget pays down all of these deferrals. Beginning in 2021‑22, colleges will receive their funding according to the regular monthly state payment schedule.

Provides Ongoing and One-Time Funds for Student Basic Needs and Mental Health. After several years of providing mostly one-time Proposition 98 support for student basic needs and mental health, the state includes ongoing Proposition 98 funds for these purposes in the 2021‑22 budget. Specifically, the budget provides $30 million ongoing for each college to create a centralized basic needs center and hire a basic needs coordinator. The budget provides another $30 million ongoing for colleges to expand mental health services offered to students. In addition, the budget provides $100 million one time for colleges to address students’ heightened food and housing insecurities during the pandemic.

Increases Ongoing Funding for Various Student Support Programs. Base increases for student support programs was another high legislative priority. Whereas some of these programs receive a 1.7 percent COLA, others receive much more substantial increases. For example, ongoing funding for the Puente Project, which supports underrepresented transfer students, increases by more than $7 million—a 369 percent increase. The budget also increases ongoing support for the Student Equity and Achievement Program (CCC’s second largest categorical program) by $24 million (5 percent). Additionally, for the first time, the budget funds the Rising Scholars Network, which serves incarcerated and formerly incarcerated CCC students.

Workforce-Related Programs Are Another Budget Priority. The budget provides a mix of new ongoing and one-time funds for various workforce-related purposes. The largest is an ongoing base increase of $42 million (17 percent) for the Strong Workforce Program, which supports local career technical education programs and certain coordination activities. The budget also provides a $15 million ongoing augmentation for the California Apprenticeship Initiative, doubling base funding for this initiative. In addition, the budget provides $20 million one time for community colleges to partner with the California Workforce Development Board to increase alignment of training programs with regional workforce priorities. (The budget also provides non-Proposition 98 funds to the California Workforce Development Board for this purpose.)

Budget Authorizes Many Capital Outlay Projects, Provides Sizeable Maintenance Funding. The 2021‑22 budget includes $581 million in general obligation bond authority for the colleges, the vast majority of which is from Proposition 51 (approved by voters in 2016). This funding supports the construction phase for 32 continuing college projects ($573 million) and the preliminary plans and working drawings phases for 9 new projects ($8 million). The budget also reappropriates previously approved funding for 21 existing college projects to continue with their respective phases. In addition, the budget includes $511 million one-time Proposition 98 General Fund to address CCC’s estimated $1.1 billion deferred maintenance backlog, as well as provides a total of $50 million (also one-time Proposition 98 General Fund) for seven facilities-related projects at specified colleges.

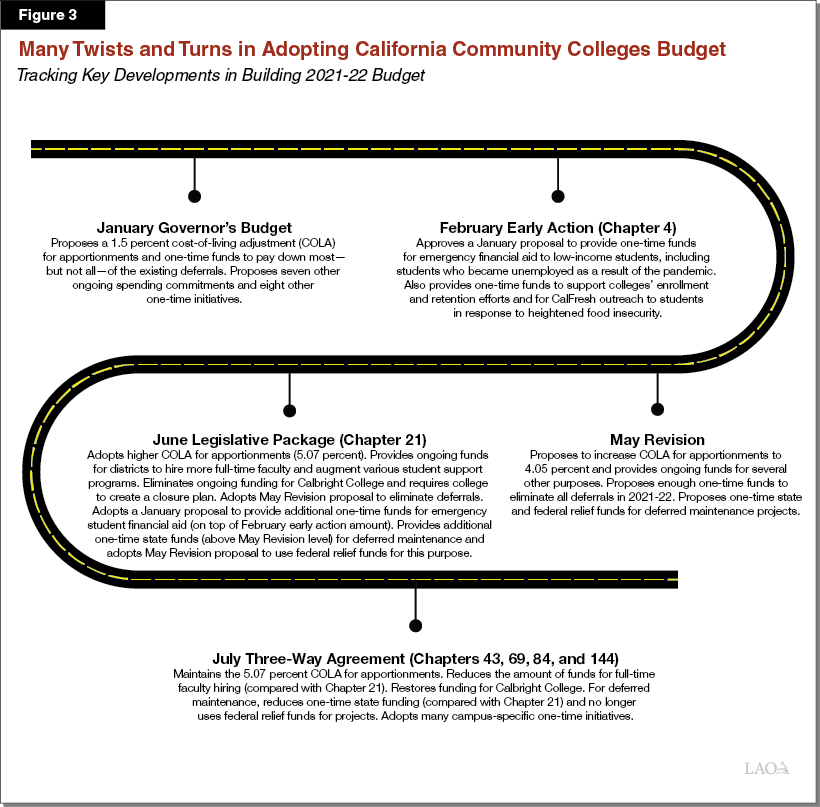

CCC Budget Takes Shape Over Many Months. Figure 3 explains how the CCC budget evolved throughout the legislative session. As with most other areas of the budget, the CCC budget package had more stages and associated legislation than in a typical year. For CCC, all key aspects of its budget package were adopted in February, June, or July. The September budget legislation included no additional spending or major programmatic changes for CCC. (The September higher education trailer legislation specifies that half of the amount already included in the budget package for student housing grants is available for the colleges. We discuss the new student housing program in the final section of this budget post.)

California State University

CSU Core Funding Is $8.9 Billion in 2021‑22. Of this amount, $5.6 billion (63 percent) comes from state General Fund, $3.2 billion (36 percent) comes from student tuition and fee revenue, and $61 million (1 percent) comes from lottery revenue. Ongoing General Fund spending increases by $594 million (15 percent) from the 2020‑21 Budget Act level. The 2021‑22 budget also includes $981 million in total one-time spending for various initiatives at CSU. Figure 4 shows the many specific spending changes for CSU in 2021‑22.

Figure 4

Changes in California State University General Fund Spending

2021‑22 (In Millions)

|

Ongoing Spending |

|

|

Core Operations |

|

|

Restoration of 2020‑21 base cut (6.9 percent) |

$299 |

|

Base augmentation (5 percent) |

186 |

|

Retiree health benefit cost increase |

53 |

|

Pension cost adjustment |

‑3 |

|

Other |

|

|

CSU Humboldt transition to polytechnic university |

$25 |

|

Student Basic Needs Initiative |

15 |

|

Student mental health |

15 |

|

Intersegmental learning management system |

2 |

|

CSU Stanislaus Stockton center enrollment increase |

1 |

|

CSU Dominguez Hills Mervyn M. Dymally Institute |

1 |

|

CENIC cost increase |

—a |

|

Subtotal |

($594) |

|

One‑Time Spending |

|

|

Facilities |

|

|

CSU Humboldt polytechnic university |

$433 |

|

Deferred maintenance and energy efficiency projectsb |

325 |

|

CSU Dominguez Hills capital outlay projects |

60 |

|

CSU Stanislaus Stockton center Acacia Building replacement |

54 |

|

CSU Northridge Center for Equity in Innovation and Technology |

25 |

|

CSU Fullerton pedestrian bridge |

1 |

|

Other |

|

|

Emergency student financial aid |

$30 |

|

Faculty professional development and equal opportunity practices |

10 |

|

CSU Monterey Bay Computing Talent Initiative |

10 |

|

CSU San Francisco Asian American studies |

10 |

|

CSU Bakersfield nursing and health professional programs |

6 |

|

California Council on Science and Technology |

5 |

|

Project Rebound student housing and other services |

5 |

|

CSU Humboldt nursing program |

3 |

|

CSU San Bernardino physician assistant program |

2 |

|

Staff salary structure evaluation |

2 |

|

CSU Fullerton arboretum |

1 |

|

Vida Mobile Clinic |

—a,c |

|

Subtotal |

($981)d |

|

Total |

$1,575e |

|

aLess than $500,000. bBudget does not list specific projects at specific campuses. cBudget passes $60,000 through CSU Northridge to this nonprofit clinic. dIn addition to the amount shown, $150 million one‑time General Fund is available for CSU through the Higher Education Student Housing Grant Program. The administration is to notify the Legislature of the specific projects proposed for funding by March 1, 2022. The state intends to provide CSU an additional $225 million in each of the subsequent two years for this purpose. eThese spending increases are offset by the removal of $20 million in prior‑year, one‑time funds. |

|

|

CENIC = Corporation for Education Network Initiatives in California. |

|

Largest CSU Ongoing Augmentations Are for Core Operations. The 2020‑21 Budget Act reduced base funding for CSU by $299 million, reflecting a 6.9 percent reduction relative to the 2019‑20 ongoing funding level. CSU took several actions in response to this funding reduction, including suspending most hiring and reducing travel and utility costs. The 2021‑22 budget fully restores CSU’s base funding, allowing CSU to reverse the budget solutions it previously adopted. On top of this restoration, the budget provides an additional $186 million base augmentation (reflecting approximately 5 percent growth) relative to the 2020‑21 Budget Act level. CSU has discretion over how to spend this augmentation. It likely will use the funds primarily to expand staffing and cover employee compensation cost increases. The budget also includes a net increase of $50 million for adjustments specifically to CSU retiree health benefit and pension costs.

Remaining Ongoing Augmentations Are for Targeted Purposes. The largest of these augmentations is $25 million for additional academic programs at the Humboldt campus to support its transition to a polytechnic university. The budget also includes two ongoing augmentations targeted toward student services. First, it provides $15 million ongoing to expand the Basic Needs Initiative, a component of CSU’s Graduation Initiative 2025 that primarily focuses on addressing student food and housing insecurity. Second, the budget provides an additional $15 million ongoing to increase student mental health resources at CSU.

Majority of One-Time CSU Funding Is for Facilities Projects. The budget provides $898 million one-time General Fund to CSU for pay-as-you-go facilities projects. Of this amount, $433 million is for the Humboldt campus to undertake various projects that would support its transition to a polytechnic university. Projects include renovating and replacing academic facilities, expanding student housing, and enhancing research infrastructure on the campus. Another $325 million is for deferred maintenance and energy efficiency projects across the system. Provisional language requires the Department of Finance to notify the Legislature of the specific projects undertaken within 30 days after releasing the funds. The remaining facilities funds are for projects at the Dominguez Hills, Stanislaus (Stockton center), Northridge, and Fullerton campuses.

Budget Also Provides One-Time Funds for Various Other Purposes. The largest of these one-time initiatives is $30 million for emergency student financial aid. (In addition to this General Fund amount, CSU received $1.3 billion in federal relief funding for this purpose.) The budget also includes $10 million for supporting equal opportunity practices and providing culturally competent professional development to CSU faculty. In addition, the budget includes $2 million for the CSU Chancellor’s Office to evaluate the existing salary structure for represented staff and consider alternative salary models. Provisional language requires the Chancellor’s Office to report its findings on the staff salary structure to the Legislature and Department of Finance by April 30, 2022. In addition to funding student and employee support, the budget includes one-time funds for specific programs spanning a broad range of fields, including the health professions, information technology, and Asian American studies.

CSU Enrollment Growth Target Is Set for 2022‑23. Beyond these 2021‑22 spending increases, the budget signals the Legislature’s intent to provide ongoing funding in 2022‑23 for CSU to increase resident undergraduate enrollment by 9,434 full-time equivalent (FTE) students (an estimated 2.6 percent) from the 2021‑22 level. (The budget sets no enrollment growth expectation in 2021‑22.) This action is estimated to cost $81 million ongoing beginning in 2022‑23. In addition to setting a systemwide enrollment growth target for 2022‑23, the budget provides $1 million ongoing to enroll an additional 115 FTE students at CSU Stanislaus’s off-campus center at Stockton beginning in 2021‑22.

Administration Authorizes Two Capital Projects Supported by CSU Bonds. Beyond the cash-funded initiatives described above, the administration preliminarily approved two capital projects financed mostly through borrowing. Specifically, one project consists of various infrastructure improvements across the system and another modifies a previously approved building renovation project at the Chico campus. CSU submitted proposals for these projects in fall 2020, and the administration provided preliminary approval for them in February 2021. As of October 1, 2021, the administration had not yet provided final approval for the projects. Together, the projects cost $299 million, of which $284 million is proposed to be financed using university bonds, with $15 million coming from campus reserves. The annual debt service associated with the university bonds is estimated to cost $16 million. CSU would use its main General Fund support appropriation to make these payments.

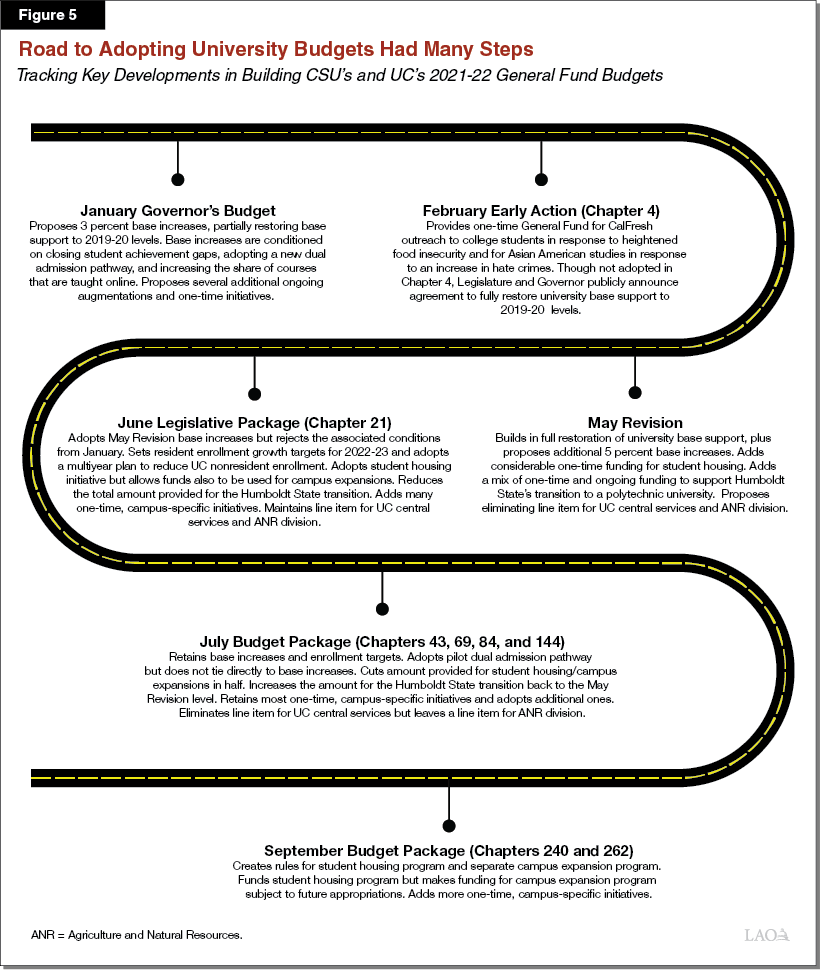

Budget for Universities Unfolds Over Many Months. Figure 5 explains how the CSU budget, as well as the UC budget, evolved throughout the legislative session. As with the CCC budget, building the budget for the universities had more stages and associated legislation than in a typical year.

University of California

UC Core Funding Is $10.3 Billion in 2021‑22. Of this amount, $4.8 billion (46 percent) comes from state General Fund, $5.1 billion (50 percent) comes from student tuition and fee revenue, and $424 million (4 percent) comes from other sources. Ongoing General Fund spending increases by $546 million (16 percent) from 2020‑21 Budget Act levels. The 2021‑22 budget also includes $743 million in total one-time spending for various initiatives at UC. Figure 6 shows the many specific spending changes for UC in 2021‑22. The graphic at the end of the CSU section explains how the universities’ budgets evolved throughout the legislative session.

Figure 6

Changes in University of California General Fund Spending

2021‑22 (In Millions)

|

Ongoing Spending |

|

|

Core Operations |

|

|

Restoration of 2020‑21 base cuta |

$302 |

|

Base augmentation (5 percent) |

173 |

|

Other |

|

|

Agriculture and Natural Resources (ANR) division staffing increase |

$32b |

|

Student mental health services |

15 |

|

Programs in Medical Education (PRIME) |

13 |

|

UC Los Angeles Latino Policy and Politics Initiative |

3 |

|

UC Davis California Veterinary Emergency Team |

3 |

|

Immigrant legal servicesc |

1 |

|

UC Davis Firearm Violence Research Centerc |

1 |

|

Intersegmental learning management platform |

1 |

|

UC Davis California Vectorborne Disease Surveillance Gateway |

1 |

|

Graduate medical education fund offset |

‑1 |

|

Subtotal |

($546) |

|

One‑Time Spending |

|

|

Facilities |

|

|

Deferred maintenance and energy efficiency projectsd |

$325 |

|

Charles R. Drew University medical education buildings |

50 |

|

UC San Diego Hillcrest Medical Center |

30 |

|

UC Riverside Center for Environmental Research and Technology |

15 |

|

UC Los Angeles Lawson Labor Center |

15 |

|

Other |

|

|

Animal Shelter Assistance Act |

$45 |

|

UC Riverside School of Medicine operations |

25 |

|

UC San Diego Scripps Reserve Vessel |

35 |

|

K‑14 Student Academic Preparation and Educational Partnerships |

23 |

|

UC Davis Institute for Regenerative Cures |

21 |

|

California Institutes for Science and Innovation |

20 |

|

UC San Diego Scripps Institute fire camera mapping system |

18 |

|

UC San Francisco Dyslexia Center |

15 |

|

Emergency financial aid for UC students |

15 |

|

UC Riverside School of Medicine Acute Care Teaching Hospital |

10 |

|

UC Riverside survey of Asian and Pacific Islander Americans |

10 |

|

UC Institute of Transportation Studies |

10 |

|

UC Merced Center on Food Resilience through Equity, Sustainability, and Health and Center of Analytic Political Engagement |

10 |

|

UC Los Angeles Climate Wildfire Institute |

7 |

|

UC Los Angeles Institute on Reproductive Health, Law, and Policy and Law School |

5 |

|

UC Los Angeles Ralphe J. Bunche Center |

5 |

|

Equal opportunity practices and professional development for UC faculty |

5 |

|

K‑12 Subject Matter Projects in learning loss mitigation |

5 |

|

UC hematologic malignancies pilot |

5 |

|

UC San Francisco Memory and Aging Center Alba Labe |

4 |

|

UC‑CSU Collaborative on Neurodiversity and Learninge |

3 |

|

UC San Diego cliff erosion research |

3 |

|

K‑12 Subject Matter Projects in ethnic studies |

2 |

|

UC ANR fire advisors |

2 |

|

UC Berkeley Labor Center |

2 |

|

UCSF public health modeling consortium |

1 |

|

UC Berkeley Alternative Meats Lab |

1 |

|

UC Berkeley Food Institute |

1 |

|

UC ANR Nutrition Policy Institute |

1 |

|

UC Berkeley Statewide Redistricting Database |

1 |

|

UC Merced Community and Labor Center |

0.4 |

|

UC Los Angeles Hollywood Advancement Project |

0.3 |

|

Subtotal |

($743) |

|

Total |

$1,288 |

|

aThe base cut was 7.7 percent for campuses and 12.7 percent for the UC Office of the President, UCPath, and ANR division. bAugmentation is on top of ANR’s restoration funds ($9.2 million) and 5 percent base increase ($3.2 million). These amounts are embedded in the restoration and base augmentation totals. cMakes one‑time General Fund support provided in previous years ongoing. dBudget does not list specific projects at specific campuses. eComponent of the California Institute on Law, Neuroscience, and Education, which is established as part of the California Bench to School Initiative. |

|

Largest UC Ongoing Augmentations Are for Core Operations. In response to a projected budget shortfall, the 2020‑21 budget enacted a $302 million base reduction to UC, reflecting a 7.7 percent reduction to campuses and a 12.7 percent reduction to the university’s line item for the Office of the President (UCOP), UCPath, and the division of Agriculture and Natural Resources (ANR). The 2021‑22 budget fully restores UC’s base funding, allowing the university to fill vacant positions and undo other budget solutions it implemented last year. In addition to the restoration funding, the budget provides a $173 million (5 percent) augmentation over the 2020‑21 enacted funding level. This augmentation will help the university cover key cost increases, including salary and benefit cost increases. (As the nearby box explains, the budget also eliminates the separate line item for UCOP and UCPath.)

Budgeting for the UC Office of the President and UCPath

Line Item Was Created in 2017‑18. In 2017‑18, the state shifted General Fund support for certain University of California (UC) services and programs out of UC’s main support appropriation and into a separate budget line item. Specifically, the separate budget line item included funds for the UC Office of the President (UCOP), UCPath (the university’s central administrative and human resource system), and the division of Agriculture and Natural Resources (ANR). The state created the line item to enhance budget transparency and oversight of UCOP and UCPath. The line item included the ANR division because that division traditionally has been funded from within UCOP’s budget.

Line Item for UCOP and UCPath Is Removed in 2021‑22. The 2021‑22 budget modifies this line item. Specifically, it transfers funds for UCOP and UCPath out of the separate budget line item and back into UC’s main appropriation. The ANR division alone remains in the separate line item. To ensure legislative oversight of UCOP continues, provisional budget language requires UCOP to annually report on its budget, beginning September 2022. (The budget also maintains an existing reporting requirement for UCPath.) Moreover, supplemental reporting language states intent that the Legislature reconsider a line item for UCOP as part of the 2022‑23 budget process.

Remaining UC Ongoing Augmentations Focused on Agricultural and Medical Programs. Of the programmatic increases, the largest is for ANR to add research and outreach staff. The budget also provides notable augmentations for UC’s on-campus student mental health services and its Programs in Medical Education (PRIME), which aim to address health disparities in medically underserved populations and regions. For PRIME specifically, the funding increase will support the establishment of two new PRIME programs (one focused on American Indian/Native Alaskan health issues and one focused on Black/African American health issues), as well as enrollment growth in the six existing PRIME programs.

Budget Allocates Notable Amount of One-Time UC Funding for Facilities. The largest initiative in this area supports deferred maintenance and energy efficiency projects across the system. As with the corresponding CSU funding, provisional budget language directs the administration to submit a list of specific projects to the Legislature within 30 days after the release of the funds. The remaining one-time capital funds support certain projects at specific campuses, with most of the projects focused on upgrading UC and UC-affiliated medical facilities.

Budget Also Funds Numerous Other One-Time Initiatives. The remaining one-time initiatives cover various research activities, outreach programs, and student services, among other areas. The largest initiative is $45 million for an animal shelter outreach program at UC Davis. Trailer legislation designates these funds for general outreach activities, a need-based grant program supporting best practices, and one-on-one consulting services for interested animal shelters. Including funds provided in the 2020‑21 budget, total one-time General Fund support for this initiative is $50 million.

Resident UC Enrollment Growth Target Is Set for 2022‑23. Beyond these 2021‑22 spending increases, the budget signals the Legislature’s intent to provide ongoing funding in 2022‑23 for UC to grow resident undergraduate enrollment by 6,230 students (3.1 percent) over the 2021‑22 level. The General Fund cost of this enrollment growth in 2022‑23 is estimated to be $68 million. (The 2020‑21 Budget Act funded UC to grow by 4,860 students, or 2.6 percent, across 2020‑21 and 2021‑22.)

Budget Establishes New UC Nonresident Enrollment Limit to Be Phased In. The budget package also sets new expectations for nonresident student enrollment at UC beginning in 2022‑23. In 2017, the UC Board of Regents adopted a policy that allowed campuses with low nonresident student shares to grow as high as 18 percent while capping each remaining campus at its specific existing higher share. Trailer legislation modifies this policy by directing the UC Board of Regents to impose an 18 percent cap on all campuses, while allowing affected campuses time to fall beneath the cap. Provisional budget language specifies that UC Berkeley, UC Los Angeles, and UC San Diego—all campuses with nonresident shares exceeding 18 percent—gradually reduce their nonresident enrollment to at or below the cap by 2026‑27. Supporting budget documentation estimates that the three affected campuses would collectively reduce nonresident enrollment by 920 students each year—replacing those students with a like amount of resident students. Recognizing that these enrollment reductions will result in lost nonresident tuition revenue, the budget package signals intent that the state appropriate ongoing funds in future years to backfill the loss. Supporting documentation estimates the General Fund cost of this multiyear plan to start at $31 million in 2022‑23, with costs rising in future years.

Administration Authorizes One Capital Project Financed by UC Bonds. Beyond the cash-funded initiatives described earlier, the administration gave preliminary approval in February 2021 for one capital project that is to be financed through borrowing. Specifically, the project is to seismically renovate Evans Hall at UC Berkeley at a cost of $117 million. UC plans to finance the cost by issuing bonds and pay the associated debt service (estimated to be $7.6 million annually) using its General Fund support. As of October 1, 2021, the administration had not yet provided final approval for the project.

UC Is Also Pursuing One Previously Approved Project. In fall 2020, UC also submitted information for a $210 million project to construct a new health science education building at UC Merced. This project is linked with 2019‑20 budget language authorizing UC to pursue a medical school project at or near the Merced campus. That budget language specified that the project is to be financed using UC bonds and the associated debt service is to be covered from UC’s General Fund support appropriation. In its fall 2020 project documentation, UC reported that it is spending $12 million on preliminary plans, with the cost covered by a mix of UC bonds and campus reserves. Its documentation did not set forth what portion of the remaining $198 million in project costs would be covered with UC bonds, campus reserves, and/or other sources.

Student Financial Aid

California Student Aid Commission (CSAC) Spending Is $4 Billion in 2021‑22. Of this amount, $3.1 billion (78 percent) is supported by state General Fund, $473 million (12 percent) is federal American Rescue Plan Act funding, $400 million (10 percent) is federal Temporary Assistance for Needy Families funding, and the remainder is from other funds and reimbursements. Across all fund sources, ongoing spending increases by $268 million (11 percent) from the revised 2020‑21 level. Almost all of the ongoing augmentation is related to the state’s Cal Grant program. The budget also includes $1.2 billion for various one-time CSAC-administered financial aid initiatives. Figure 7 shows the specific spending changes for CSAC in 2021‑22. Below, we first describe major CSAC spending changes, then we cover major student financial aid initiatives administered by other departments and segments.

Figure 7

Changes in California Student Aid Commission Spending

2021‑22 (In Millions)

|

Ongoing Spending |

|

|

Cal Grants |

|

|

CCC Expanded Entitlement Program |

$153 |

|

SWDC supplemental awards for CCC Entitlement recipients |

82 |

|

Foster youth supplemental awards |

15 |

|

Private nonprofit award increase |

5 |

|

Caseload and technical adjustments |

11a |

|

Other |

|

|

Grant Delivery System Modernization |

$1 |

|

Restoration of employee salaries |

1 |

|

Other caseload and technical adjustments |

—b |

|

Subtotal |

($268) |

|

One‑Time Spending |

|

|

Golden State Teacher Grants |

$500 |

|

Golden State Education and Training Program |

500 |

|

Learning‑Aligned Employment Program |

200c |

|

Grant Delivery System Modernization |

1 |

|

Subtotal |

($1,201) |

|

Total Changes |

$1,469 |

|

aAdjustments are relative to 2020‑21 revised spending levels. Includes $7.5 million for the Dreamer Service Incentive Grant Program, which was authorized in 2019‑20 but suspended until 2021‑22. bLess than $500,000. cThe budget agreement includes an additional $300 million one‑time General Fund for this purpose in 2022‑23. |

|

|

SWDC = students with dependent children. |

|

Largest CSAC Ongoing Augmentations in 2021‑22 Are to Expand Cal Grant Eligibility at CCC. Trailer legislation creates the CCC Expanded Entitlement Program, which guarantees a Cal Grant award to eligible community college students regardless of their age and time out of high school. Under previous state law, students were guaranteed a Cal Grant award only if they were recent high school graduates or transfer students under age 28, while older students were considered for a limited number of competitive awards. CCC students who receive an award under the new program will remain eligible for the award after transferring to CSU or UC, but not after transferring to a private institution. The budget provides $153 million ongoing General Fund to fund an estimated 133,000 additional awards in 2021‑22, bringing the total number of Cal Grant recipients at CCC to an estimated 250,000. The budget also provides $82 million ongoing General Fund for the associated supplemental awards for students with dependent children. Because the new program eliminates the need for competitive awards at CCC, trailer legislation reduces the number of new competitive awards available each year from 41,000 awards for students attending all segments to 13,000 awards for students attending segments other than CCC. The budget also includes several smaller Cal Grant changes, as the nearby box describes.

Three Smaller Cal Grant Augmentations

Cal Grant A Eligibility Is Restored for Students Who Moved Home. The budget provides $15 million ongoing General Fund starting in 2020‑21 to restore awards for certain students who lost Cal Grant A eligibility in either 2020‑21 or 2021‑22. Specifically, students who moved out of on-campus housing to live with their families or into less expensive off-campus housing in response to the shift to remote instruction saw a reduction in their total cost of attendance. As a result of the change in living arrangements, some students no longer had sufficient financial need to receive a Cal Grant award. The budget package makes an exception for these students so they can retain their Cal Grant awards.

Larger Cal Grants Are Provided for Foster Youth. The budget provides $15 million ongoing General Fund beginning in 2021‑22 to create a supplemental Cal Grant award for current and former foster youth attending the California Community Colleges, California State University, and University of California. This supplemental award increases the maximum amount of nontuition aid for eligible students from $0 to $6,000 for Cal Grant A recipients, from $1,648 to $6,000 for Cal Grant B recipients, and from $1,094 to $4,000 for Cal Grant C recipients.

Private Nonprofit Cal Grant Award Amount Is Raised. The budget provides $5 million ongoing General Fund to increase the maximum Cal Grant tuition award for students attending private nonprofit institutions from $9,084 to $9,220 in 2021‑22. Trailer legislation also postpones requirements for the private nonprofit sector to admit a specified number of students with an associate degree for transfer (ADT). Under the new requirements, the sector must admit 3,000 ADT students in 2021‑22 to maintain the maximum Cal Grant tuition award at $9,220 in 2022‑23. If the sector does not meet this target, then the maximum award amount for new Cal Grant recipients would be reduced to $8,056 in 2022‑23.

Budget Agreement Revamps Middle Class Scholarship Program. The budget agreement includes $515 million ongoing General Fund to CSAC beginning in 2022‑23 to support a significant increase in Middle Class Scholarship award amounts and recipients. Created in 2014‑15, the original Middle Class Scholarship program provides partial tuition coverage for CSU and UC students with household income and assets under a certain level ($191,000 in 2021‑22). State law caps funding for the original program at $117 million annually. The revamped program will base awards on the total cost of attendance rather than only the tuition charge. CSAC will first take into account other available gift aid, a student contribution from part-time work earnings, and a parent contribution for dependent students with a household income of over $100,000. It then will deduct these amounts from a student’s total cost of attendance to determine whether the student has remaining costs. CSAC will determine what percentage of each student’s remaining costs to cover each year based on the annual appropriation for the program. The revamped program is estimated to serve a total of about 375,000 CSU and UC students, compared to about 60,000 students under the original program. The main reason for this increase in recipients is that students receiving tuition coverage through Cal Grants (or certain other gift aid), who currently do not qualify for Middle Class Scholarship awards, will begin receiving additional nontuition coverage.

Budget Includes Additional Funding to CSAC for Golden State Teacher Grants. The budget includes $500 million one-time General Fund for this initiative, which provides scholarships of up to $20,000 to students enrolled in teacher preparation programs. Recipients must commit to teaching for four years in certain subject areas (special education; bilingual education; science, technology, engineering, and mathematics; multiple subject instruction; or transitional kindergarten) at a school where at least 55 percent of students are disadvantaged (as identified under the Local Control Funding Formula [LCFF]). These funds are in addition to $15 million one-time federal funds provided in the 2020‑21 Budget Act to support students committing to teach in special education. Trailer legislation provides CSAC until June 30, 2026, to spend both appropriations.

Budget Provides Funding to CSAC for Grants to Displaced Workers. The budget provides $472.5 million one-time federal American Rescue Plan Act funds and $27.5 million one-time General Fund to establish the Golden State Education and Training Grant Program. This program will provide grants of between $1,000 and $2,500 to individuals who have lost employment due to the pandemic and meet certain income and asset criteria. The grants are intended to help cover the cost of enrolling at a higher education institution or obtaining training from a provider on the state’s Eligible Training Provider List (maintained by the Employment Development Department).

Budget Creates New Work-Study Program Under CSAC. The budget provides $200 million one-time General Fund in 2021‑22 and $300 million one-time General Fund in 2022‑23 to establish the Learning-Aligned Employment Program. This program will provide students from underrepresented backgrounds (including first-generation college students and foster youth) with employment opportunities related to their area of study or career interests. CSAC is to allocate the funds to participating CCC, CSU, and UC campuses based on their share of Pell Grant recipients. The campuses, in turn, are to work with local employers to identify relevant opportunities in various settings (including on-campus research centers, public schools, nonprofit organizations, and for-profit enterprises). The program will cover a portion of the student’s compensation, with the employer providing the remaining amount. Campuses have until June 30, 2031 to spend the funds.

Trailer Legislation Requires School Districts to Verify Completion of Financial Aid Applications. Beginning in 2022‑23, school districts will be required to verify that each high school senior completes a Free Application for Federal Student Aid (FAFSA) or California Dream Act Application, unless the student submits an opt-out form or receives an exemption from the district. Districts will also be required to direct students to relevant support services, including programs operated by CSAC, college readiness organizations, and immigration resource centers, among others. The budget does not include any initial funding for school districts to implement the change or CSAC to account for potential Cal Grant caseload increases.

Budget Provides Funding to Scholarshare for College Savings Accounts. In addition to CSAC, other agencies are receiving funds for student financial aid. Most notably, the budget provides funding increases to the Scholarshare Investment Board (Scholarshare) for the California Kids Investment and Development Savings (CalKIDS) program—a college savings program created in 2019‑20. Trailer legislation establishes the following rules for opening college savings accounts on behalf of children in California:

-

All Newborns Get $25 Seed Deposits. The budget provides Scholarshare with $15 million ongoing General Fund beginning in 2021‑22 to open college savings accounts for all babies born after a board-determined date (no later than July 1, 2022). On behalf of each newborn, Scholarshare is to provide a seed deposit of at least $25.

-

First Graders From Low-Income Families Get $500 Supplemental Deposits. The budget provides Scholarshare with $170 million ongoing General Fund beginning in 2022‑23 to add $500 to the college savings account of each low-income first grader (as identified under LCFF). Students who are foster youth or homeless receive an additional $500 college savings account deposit (for a maximum deposit of $1,500).

-

In 2021‑22, Low-Income Students in Grades 1 Through 12 Get $500 Special Deposits. The budget provides $1.8 billion one-time federal American Rescue Plan Act funds and $92 million one-time General Fund to open college savings accounts for low-income students enrolled in grades 1 through 12 in the 2021‑22 school year. All eligible students receive a $500 deposit. Students who are foster youth or homeless receive an additional $500 deposit (for a maximum deposit of $1,500).

Segments’ Budgets Include Funding for Emergency Aid and Summer Aid. As mentioned earlier, the budget provides $250 million one-time federal American Rescue Plan Act funds to CCC, $30 million one-time General Fund to CSU, and $15 million one-time General Fund to UC for emergency student financial aid. These funds are for the segments to provide grants to low-income students who are enrolled at least half time, demonstrate an emergency need, and have earned a grade point average of at least 2.0 in a recent term. In addition, trailer legislation removes a provision in state law that would have subjected funding provided to CSU and UC for summer financial aid to potential suspension on December 31, 2021. With this statutory change, the state will continue providing $6 million ongoing General Fund to CSU and $4 million ongoing General Fund to UC for summer financial aid grants. The two segments have discretion in allocating these funds among students who are eligible for state financial aid.

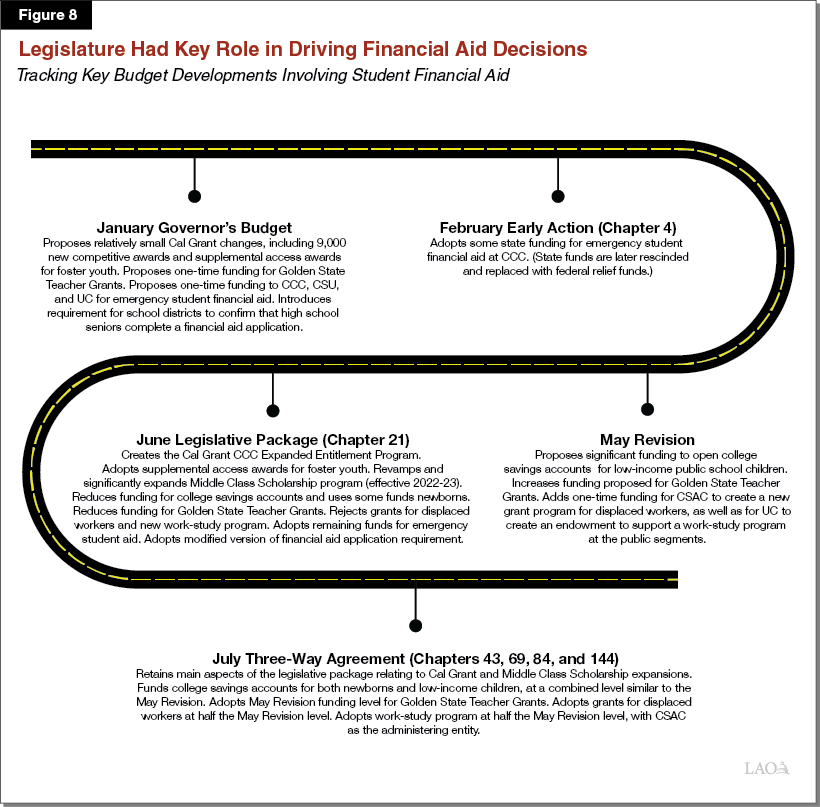

Financial Aid Package Evolves in Significant Ways Over Course of Budget Session. Figure 8 shows the key steps in building this year’s financial aid package, which contained major policy components. As with CCC, all key aspects of the financial aid components of the budget package were adopted in February, June, or July. The September budget legislation included no additional spending or major programmatic changes in this area.

California State Library

State Library Funding Is $645 Million in 2021‑22. Of this amount, $639 million (95 percent) comes from General Fund, $30 million (4.4 percent) comes from federal funds, and $2.9 million (0.4 percent) comes from various state special funds. The State Library’s budget increases $614 million over 2020‑21, a more than 11-fold increase. The vast majority of the increase comes from the General Fund ($607 million) and most of the remainder comes from an increase in federal relief funding (7.4 million). Almost all (99 percent) of the total funding increase is for one-time initiatives.

Largest One-Time Augmentation Is for Local Library Infrastructure. Of the General Fund increase, $439 million is for a one-time local library infrastructure grant program administered by the State Library. The program was initially proposed in the May Revision but was significantly expanded in the legislative package. The grants can support capital projects, maintenance, broadband upgrades, and purchases of devices, but provisional budget language specifies that life-safety and other critical maintenance and infrastructure projects are to receive first priority for funding. Provisional language further specifies that the grant program is to prioritize local library projects in high-poverty areas of the state. To qualify for the grants, local libraries are required to provide a one-to-one dollar match. Libraries with fewer resources per resident in their service areas can qualify for a smaller local match.

Budget Funds About Two Dozen Other One-Time Library Initiatives. Around half of these initiatives were proposed by the administration in the Governor’s budget and May Revision, and the other half were added in the legislative package or three-way agreement. These one-time initiatives span a broad range of areas, including broadband upgrades, English as a second language literacy programs, ethnic media grants, online tutoring, after-school programs, and mobile libraries. In addition, several initiatives fund specific local infrastructure projects, including property acquisition for a new arts and media center in San Francisco’s Chinatown neighborhood, a new youth center in San Francisco’s Richmond district, and a facility restoration project at the San Diego Public Library’s Logan Heights branch. Similar to the federal relief funding it received in 2020‑21, the State Library’s 2021‑22 one-time federal relief funding enhances the Library Services and Technology Act. These funds can be used for a variety of local library initiatives ranging from broadband upgrades and device purchases to preserving historical resources related to the pandemic.

Budget Supports Several Ongoing Library Augmentations Too. The State Library’s ongoing General Fund budget increases by $6.7 million (21 percent). Of this increase, over half ($3.6 million) is for state operations and the remainder ($3.1 million) is for local assistance programs. The budget increases the State Library’s ongoing staffing by 20 positions (14 percent) over the 2020‑21 level, with half of the new positions to help administer the various new local initiatives and the other half to implement certain state-level initiatives (such as developing a database of state grant opportunities). The largest ongoing increase for local assistance programs restores base 2020‑21 funding for regional library cooperatives, which facilitate resource sharing among participating local libraries. The budget also provides ongoing funds for the Zip Books and Lunch at the Library programs—two local library programs that had previously received one-time state funding. (Funding for the Lunch at the Library program was made ongoing beginning in 2020‑21 as part of the early action package.)

Crosscutting Initiatives

Budget Establishes Student Housing and Campus Expansion Grant Programs. Adopted in September 2021 as part of higher education trailer legislation, the first program provides grants to CCC, CSU, and UC campuses to construct additional student housing. The budget package provides a total of $2 billion one-time General Fund spread over three years ($500 million in 2021‑22, $750 million in 2022‑23, and $750 million in 2023‑24) for this program. Half of these funds are designated for CCC, 30 percent for CSU, and 20 percent for UC. Up to $25 million of CCC’s share may be used for planning grants to support colleges that are examining the feasibility of offering affordable student housing. The segments are to submit their initial student housing project proposals to the Department of Finance by October 31, 2021, with the administration submitting projects for legislative review by March 1, 2022. The second program aims to support CSU and UC in increasing resident student enrollment by constructing new academic buildings, acquiring land, or modernizing facilities. The budget package does not fund this program, making funding in future years contingent on subsequent budget action.

Budget Funds Regional K-16 Education Collaboratives. The budget provides $250 million one-time General Fund to the Department of General Services for supporting new regional collaboratives. Each collaborative is to include at least one school district, community college district, CSU campus, and UC campus. To receive grants, collaboratives must create new intersegmental academic pathways in at least two of the following occupational areas: health care, education, business management, and engineering/computing. Provisional language also requires grant recipients to adopt at least four of seven identified educational best practices, establish a steering committee that includes local employers, participate in the state’s Cradle-to-Career longitudinal data system, and participate in a statewide evaluation of the collaboratives.

New Service Opportunities Are Provided for College Students. The budget provides the Office of Planning and Research (OPR) $146.3 million ($127.5 million federal relief funds and $18.8 million one-time General Fund) for the Californians For All College Service initiative. (According to the administration, OPR will supplement these appropriations with $9.1 million from its existing federal AmeriCorps funding, bringing total programmatic spending to $155 million.) Administered as part of AmeriCorps, the initiative will provide students at public and private higher education institutions with service opportunities in areas such as education and youth development, health, and disaster response. According to the administration, $89 million will support programmatic and administrative costs, while the remaining $67 million will support stipends (up to $7,000) and scholarships (up to $3,000) for 6,250 students. The General Fund portion will support stipends and scholarships specifically for undocumented students, who generally do not qualify for federal relief funds.

Budget Funds Grants to Support Student Behavioral Health. As part of the Children and Youth Behavioral Health Initiative, the budget provides funding to the Department of Health Care Services (DHCS) for grants to expand behavioral health services in schools and school-linked settings for individuals age 25 and younger. The budget includes $30 million one-time General Fund in 2021‑22 and $120 million one-time General Fund in 2022‑23 for grants focused on CCC, CSU, and UC students. Trailer legislation authorizes DHCS to award these grants through a competitive process to higher education institutions, as well as other qualified entities (such as counties, health care service plans, community-based organizations, and behavioral health providers). At least two-thirds of the funds are to be reserved for CCC. Grant recipients are to use the funds for various purposes related to building partnerships, capacity, and infrastructure supporting behavioral health services.

Additional Funding for AEP. The Adult Education Program (AEP) is funded in CCC’s budget and jointly administered by the CCC Chancellor’s Office and California Department of Education (CDE). The budget provides a $21.8 million Proposition 98 base augmentation to fund a 4.05 percent COLA for this program, as well as a $1 million ongoing Proposition 98 increase for technical assistance to adult education providers. To address a longstanding problem of some adult education providers (mainly school districts) receiving delayed state payments due primarily to coordination issues between the CCC Chancellor’s Office and CDE, the budget also includes provisional language giving the Governor administrative authority to transfer AEP funds between these agencies to expedite payments.

Provides Funding for Cradle-to-Career Data System. After about 18 months of planning by a work group (the activities of which were funded in the 2019‑20 budget), trailer legislation authorizes a governance system and managing entity for the Cradle-to-Career data system. Regarding governance, trailer legislation creates a 21-member governing board comprised of a mix of chief executives from those state agencies tasked with contributing data to the data system, along with members of the public and legislative members. Regarding system management, the budget provides $15 million non-Proposition 98 General Fund ($11.5 million ongoing, $3.5 million one-time) to the Government Operations Agency (GovOps). A portion of the funds supports 12 staff (including an executive director) in 2021‑22 at a newly created Cradle-to-Career office within GovOps. (The budget increases authorized staff to 16 in 2022‑23 and provides an additional $500,000 ongoing funding for GovOps at that time, bringing its funding to $12 million annually beginning in 2022‑23.) The one-time funds provided in 2021‑22 will be used to cover various operating and technology acquisition costs related to the integrated data system, including funds to upgrade CDE’s K-12 database. In addition to these amounts, the budget includes $3.8 million ongoing Proposition 98 for the statewide expansion of the California College Guidance Initiative (CCGI), which is affiliated with the Cradle-to-Career data system. CCGI is a college planning and advising tool currently used by some school districts. Trailer legislation establishes an annual requirement for CCGI to report its progress in increasing usage by schools and students.

Trailer Legislation Creates New Dual Admission Programs. Trailer legislation directs CSU and UC to offer dual admission programs for freshman applicants in the 2023‑24 through 2025‑26 academic years. Under the new programs, students will receive admission guarantees to specific CSU or UC campuses conditioned on them completing an associate degree for transfer or other established transfer curriculum at a community college within two academic years. Freshmen are eligible for dual admission if they would not otherwise qualify for university admission as freshmen due to personal challenges, financial hardship, or limitations of their high school curriculum. While taking courses at community colleges, dually admitted students will have access to library, counseling, and other services at CSU or UC (depending on their admission guarantee).