November 17, 2021

The 2022‑23 Budget

Medi‑Cal Fiscal Outlook

This post describes our fiscal outlook for Medi‑Cal, the major factors that we expect to drive changes in General Fund spending in Medi‑Cal, and a number of our key underlying assumptions. (Specifically, this post concerns projections of Medi‑Cal local assistance spending within the Department of Health Care Services [DHCS].)

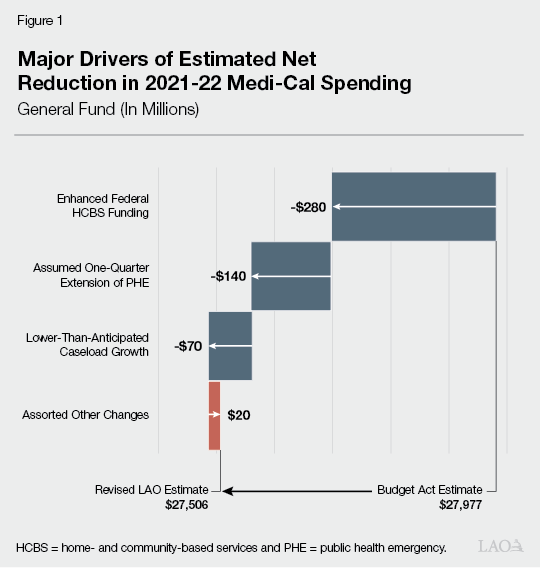

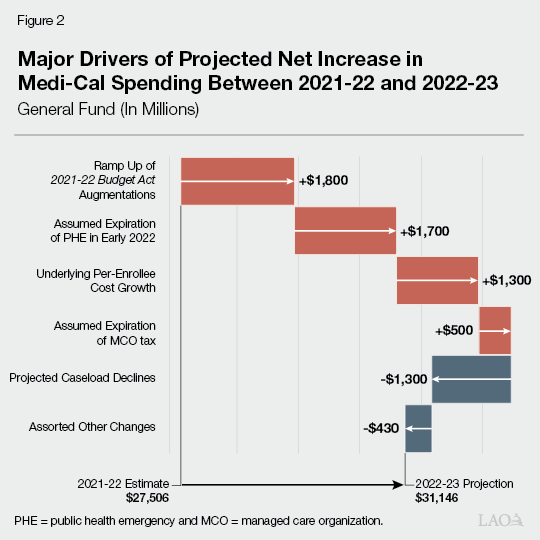

We estimate that Medi‑Cal General Fund spending will be $27.5 billion in 2021‑22, a downward adjustment of $470 million compared to the 2021‑22 Budget Act estimate. This adjustment largely is driven by our expectation of higher levels of federal funding being available (offsetting General Fund costs) than was previously anticipated. Between our revised 2021‑22 estimate and 2022‑23, we project General Fund costs in Medi‑Cal to grow by $3.6 billion to $31.1 billion. This net increase primarily is due to our expectation that enhanced (pandemic‑related) federal funding no longer will be available and a scheduled ramp up in costs for augmentations approved in the 2021‑22 Budget Act. Projected declines in caseload and its associated costs reduce the projected growth in year‑over‑year spending below what it otherwise would be.

Between 2022‑23 and 2025‑26, we project annual General Fund costs in Medi‑Cal will grow by $3.5 billion to $34.6 billion. This cost growth largely is attributable to the assumed full phase out of certain non‑General Fund sources of funding for Medi‑Cal (most notably, from the managed care organization [MCO] tax) and underlying per‑enrollee cost growth related to projected changes in utilization and service costs.

Background

Medi‑Cal, the state’s Medicaid program, provides health care coverage to around 14 million of the state’s low‑income residents. Medi‑Cal costs generally are shared between the federal and state governments. In a typical year, the General Fund covers a little more than 20 percent of total Medi‑Cal costs, with federal funds and other state and local funds respectively covering the remaining 65 percent and 15 percent of total costs.

Main Fiscal Outlook Assumes Declining Unemployment Rates. While there remains considerable uncertainty going forward, our 2022‑23 Fiscal Outlook main forecast assumes that the unemployment rate gradually will decline over the next several years. Should this decline prove slower, faster, or more volatile than assumed in our outlook, General Fund spending in Medi‑Cal could be substantially higher, lower, or more volatile than we project.

Fiscal Outlook Assumes Expiration of the National Public Health Emergency (PHE) Declaration Related to Coronavirus Disease 2019 (COVID‑19) in Early 2022. In early 2020, the federal government declared a national PHE in response to the COVID‑19 pandemic. There are a number of temporary policy and financing rule changes within the Medi‑Cal program that generally remain in place for the duration of the PHE. For example, Congress approved a 6.2 percentage point increase in the federal government’s share of cost for most Medicaid services for the duration of the PHE. In addition, the same federal legislation effectively prohibits the state (as a condition of receiving the enhanced federal share of Medicaid costs) from terminating the eligibility of current Medi‑Cal enrollees, except in limited circumstances, until after the PHE ends. This prohibition is known as the “continuous coverage requirement.” When the national PHE declaration will end is an assumption that significantly impacts our spending projections. The 2021‑22 Budget Act assumed the PHE declaration would expire by the end of December 2021. While the end date of the PHE declaration is subject to considerable uncertainty, the federal government recently announced the renewal of the PHE through at least the first half of January 2022 (with enhanced federal funding expiring at the end of March 2022). Consequently, our outlook assumes that the PHE declaration will expire at this time. We describe the fiscal implications of this assumption, as well as of the alternative scenario where the PHE is extended beyond early 2022, in further detail later in this post.

Fiscal Outlook Assumes Current State and Federal Law and Policy. Our outlook generally assumes current laws and policies remain in place throughout the outlook window (through 2025‑26). This includes federal law and policy. For example, we assume the state’s managed care organization (MCO) tax will expire halfway through 2022‑23 as scheduled in statute. (We describe the fiscal implications of our assumptions regarding the MCO tax in further detail later in this post.)

Overview of Projections

Below, we summarize our projected adjustments to the Medi‑Cal budget and describe the major drivers of these changes, both in the near and longer terms. The “near term” includes the current year (2021‑22) and budget year (2022‑23) and the “longer term” includes the final three years of the outlook window (2023‑24 through 2025‑26).

Near Term

Hundreds of Millions of Dollars in Estimated General Fund Savings in 2021‑22… We estimate that Medi‑Cal General Fund spending will be $27.5 billion in 2021‑22, a downward adjustment of $470 million compared to the 2021‑22 Budget Act (budget act) estimate. As shown in Figure 1, there are three major drivers of this downward adjustment. First, we reflect $280 million in General Fund savings due to the 6 percentage point increase in the federal share of cost for home‑ and community‑based services (HCBS) authorized by the American Rescue Plan Act for the period of April 2021 through March 2022. (These savings only reflect reduced General Fund costs in HCBS programs operated by DHCS. Per state and federal law, all associated HCBS program savings ultimately will be used to support various HCBS program augmentations, as outlined here.) Second, we estimate $140 million in net General Fund savings due to our assumption that certain program rules related to the PHE remain in place through March 2022 (the end of the quarter during which the PHE expires)—rather than through December 2021 as was assumed in the budget act. This amount is the net effect of (1) an extra three months with the enhanced federal share of cost for Medi‑Cal and (2) higher costs for certain temporary COVID‑19‑related policies which expire at or after the end of the PHE (such as certain temporary provider reimbursement rate increases). Third, we estimate slower caseload growth than was projected in the budget act, resulting in $70 million in General Fund savings.

…Followed by a Large Projected Upturn in Net General Fund Costs in 2022‑23. We project a $3.6 billion net increase in General Fund costs in Medi‑Cal between 2021‑22 and 2022‑23. This year‑over‑year increase is the result of a large number of individual adjustments. Figure 2 and the following bullets summarize the major drivers of the projected year‑over‑year net increase in General Fund costs.

- Assumed Expiration of Major Sources of Non‑General Fund Funding. We assume that three major sources of non‑General Fund funding for Medi‑Cal expire in 2022‑23, together raising year‑over‑year General Fund costs by around $2.5 billion. First, we estimate higher General Fund costs of $1.7 billion in 2022‑23 due to the assumed expiration of the PHE’s enhanced federal share of cost at the end of March 2022. Second, we assume the MCO tax expires halfway through 2022‑23 and is not reauthorized, raising General Fund costs by $500 million. Third, we back out the 2021‑22 increase in federal funding for Medi‑Cal HCBS programs, which raises General Fund costs in 2022‑23 by $280 million.

- Ramp Up of Costs for Budget Act Discretionary Augmentations. Over $1.8 billion of the projected increase in net General Fund costs between 2021‑22 and 2022‑23 is attributed to the ramp up of costs for discretionary augmentations in Medi‑Cal approved in the budget act. (This amount reflects the net of higher costs and savings from the scheduled expiration of the augmentations that were one time.) These include several major augmentations, such as:

- $1.2 billion General Fund in 2022‑23 for the Behavioral Health Continuum Infrastructure Program (an increase of $720 million from the 2021‑22 level).

- $560 million General Fund in 2022‑23 to expand comprehensive Medi‑Cal coverage for undocumented adults age 50 and up (an increase of $520 million from the 2021‑22 level).

- $450 million General Fund in 2022‑23 for school behavioral health partnerships and capacity (an increase of $350 million from the 2021‑22 level).

- $430 million one‑time General Fund in 2022‑23 to provide grants for evidence‑based behavioral health practices for children and youth.

- The elimination of the asset test for determining Medi‑Cal eligibility (which will result in General Fund costs of $200 million in 2022‑23).

- $780 million General Fund in 2022‑23 to implement the California Advancing and Innovating Medi‑Cal (CalAIM) initiative (an increase of $150 million above the 2021‑22 level).

- $180 million General Fund in 2022‑23 to extend postpartum Medi‑Cal coverage for new mothers for 12 months post‑childbirth (an increase of $140 million above the 2021‑22 level).

- Underlying Per‑Enrollee Cost Growth. Underlying per‑enrollee cost growth in Medi‑Cal is driven by changes in utilization and service costs. We project General Fund costs to grow between 2021‑22 and 2022‑23 by $1.3 billion (5 percent) due to per‑enrollee cost growth. As we describe further below, this higher than usual per‑enrollee cost growth results from (1) higher caseload and (2) our projections that as caseload declines, relatively more expensive caseload groups (such as seniors and persons with disabilities) will remain on the program in higher proportions, which raises average cost per enrollee.

- Savings From Significant Projected Reductions in Caseload. Caseloads (and their associated costs) have increased dramatically during the PHE—largely due to the continuous coverage requirement and economic conditions such as higher unemployment. We project that caseloads, and their corresponding costs, will decline substantially beginning in 2022‑23 following the expiration of the continuous coverage requirement and declines in the unemployment rate. Specifically, between 2021‑22 and 2022‑23, we project that total Medi‑Cal caseload will decline by over 1 million enrollees (7.4 percent), reducing General Fund costs by $1.3 billion.

- Assorted Other Adjustments Reduce Costs. We project $430 million in additional General Fund savings in 2022‑23 compared to 2021‑22, which reflect the net impact of a large number of individual adjustments. The largest such adjustments include additional funding from a fee on hospitals (which offset General Fund costs), savings related to the transition of Medi‑Cal pharmacy services from managed care to fee‑for‑service (a change known as Medi‑Cal Rx), and the expiration of certain temporary policies related to COVID‑19.

Longer Term

General Fund Spending in Medi‑Cal Projected to Grow by $3.5 Billion From 2022‑23 to 2025‑26. We project annual General Fund costs in Medi‑Cal will grow from $31.1 billion to $34.6 billion between 2022‑23 and 2025‑26. This reflects an average net annual General Fund cost growth of nearly $1.2 billion (3 percent). The major long‑term net cost drivers include:

- Full Phase Out of Funding From Certain Non‑General Fund Sources. As previously discussed, we assume that the enhanced federal funding under the PHE declaration expires three‑quarters of the way through 2021‑22 and that the MCO tax expires halfway through 2022‑23 The full projected phase out of these non‑General Fund sources of funding for Medi‑Cal result in $1.9 billion of the projected $3.5 billion net increase in General Fund spending in Medi‑Cal between 2022‑23 and 2025‑26.

- Underlying Per‑Enrollee Cost Growth. Between 2022‑23 and 2025‑26, we project General Fund costs to grow by around $1 billion (3 percent) annually due to per‑enrollee cost growth. This rate of growth is roughly in line with historical rates of underlying per‑enrollee cost growth in Medi‑Cal. We discuss our projections for underlying per‑enrollee cost growth, as well as for caseload, in greater detail in the next section of this post.

- Expiration of Funding for a Variety of Discretionary Augmentations. Compared to 2022‑23, we project annual General Fund costs to be about $2 billion lower in 2023‑24 and beyond due to the expiration of various limited‑term budget act discretionary augmentations in Medi‑Cal. This reduction in costs is nearly entirely driven by the expiration of billions of dollars in limited‑term funding for various behavioral health‑related augmentations.

Significant Underlying Net Cost Growth

Underlying Net Cost Growth Averaging Around $900 Million Annually Throughout the Forecast Window. Underlying net cost growth reflects the fiscal impact of changes in the Medi‑Cal caseload and per‑enrollee costs. Over the full forecast window, we project annual underlying net cost growth averaging nearly $900 million General Fund. This net cost growth stems from our projection that average per‑enrollee cost growth will more than offset the savings from projected declines in caseload. We describe these projections in detail below.

Projected Caseload Declines Beginning in Late 2021‑22

Significant Medi‑Cal Caseload Growth Under the PHE. As we noted previously, the Medi‑Cal caseload (and its associated costs) have increased dramatically during the PHE. Between March 2020 and July 2021, total Medi‑Cal caseload has grown from around 12.5 million enrollees to roughly 14 million enrollees, a 12 percent increase. This increase largely was driven by the continuous coverage requirement and economic factors such as higher unemployment. While the budget act assumed a 7.6 percent increase in caseload between 2020‑21 and 2021‑22, we estimate growth will be 6.8 percent due to actual caseload through June 2021 being lower than assumed in the budget act. (This reduction in caseload growth occurs despite our assumption that the PHE lasts one additional quarter compared to budget act assumptions.) Consequently, we expect Medi‑Cal caseload costs to be $70 million lower in 2021‑22 than was assumed in the budget act.

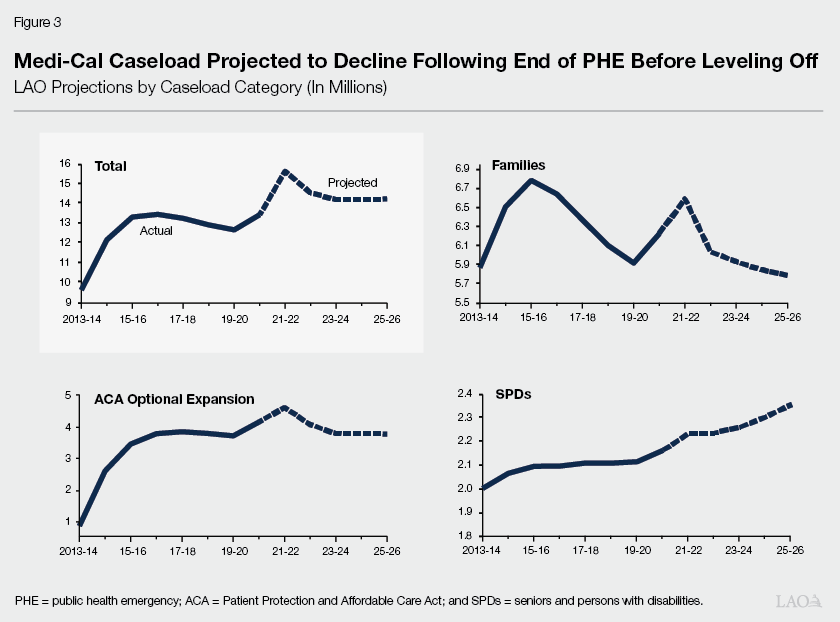

Project Large Decline in Caseload Following End of the PHE Declaration. As shown in Figure 3 on the next page, we project a large decline in the overall Medi‑Cal caseload following the end of the PHE declaration. In particular, during the 12‑month period after the continuous coverage requirement expires, we expect caseloads to drop substantially as a result of the resumption of eligibility terminations for enrollees found ineligible for the program under normal eligibility rules along with improving economic conditions. Between 2021‑22 and 2022‑23 under our projections, Medi‑Cal caseload will shrink by about 1 million enrollees (7.4 percent), which will result in reduced General Fund costs in 2022‑23 of about $1.3 billion relative to 2021‑22. We expect caseloads will continue to decline through the outlook period, largely due to reductions in the unemployment rate, but that the rate of decline will begin to level off in the final years of the outlook window. Accordingly, while we project a total caseload decline of around 3 percent between 2022‑23 and 2023‑24, we project essentially flat caseload trends in the final years of the outlook. Despite these anticipated declines, we assume caseload will remain higher than during the pre‑pandemic period due to our long‑run demographic and labor market projections. For example, while our outlook assumes that the state’s unemployment rate will continue to improve relative to its peak during the pandemic (15.2 percent), we assume that it will remain higher than the pre‑pandemic unemployment rate of about 4.3 percent.

Caseload Projections Subject to Considerable Uncertainty. Our caseload estimates are subject to significant uncertainty compared to prior years. As described earlier, the end of the PHE declaration has a significant impact on caseload. Consequently, if the PHE declaration is extended beyond the third quarter of 2021‑22, Medi‑Cal caseload would not decline as we forecast. Moreover, while there have been significant gains in the labor market over the course of 2021, there is uncertainty as to when jobs will recover, further impacting our caseload estimates.

Underlying Per Capita Cost Growth

Consistent with our expectation that new enrollees in Medi‑Cal during challenging economic times will have, on average, lower per‑enrollee costs than beneficiaries with longstanding ties to the program, we expect those who leave the program during periods of declining unemployment rates to have lower average per‑enrollee costs. This movement of less costly enrollees out of the program has the effect of significantly increasing average per‑enrollee cost growth in Medi‑Cal starting in 2022‑23. (In part, this is due to differences in the federal share of cost between such populations.) While we would expect average per‑enrollee cost growth of around 3 percent annually in periods where the caseload is stable, we project average annual per‑enrollee cost growth of almost 4 percent due to projected caseload declines between 2021‑22 through 2025‑26. In General Fund terms, our projections of per‑enrollee cost growth add around $1.1 billion annually to Medi‑Cal costs.

Fiscal Implications of Major Assumptions

This section provides further detail on the fiscal implications of two major assumptions—that the PHE declaration will expire in January 2022 and that the MCO tax will expire halfway through 2022‑23 without reauthorization. Additionally, we estimate the fiscal impacts of alternative assumptions: (1) if the PHE declaration were to remain in place beyond early 2022 and (2) if the MCO tax is reauthorized at a similar level as the current tax. Finally, we note that if Medi‑Cal price inflation exceeds the historical average, General Fund cost pressure in Medi‑Cal could be higher than we project.

Assumed Expiration of PHE in Early 2022

Below, we discuss the fiscal implications of our PHE declaration assumption in further detail and explore the fiscal implications of alternative scenarios where the PHE declaration remains in place past the first quarter of 2022.

Expiration of Enhanced Federal Funding Will Result in Higher General Fund Costs in the Low Billions of Dollars… We estimate that having three‑quarters of the enhanced federal funding in 2021‑22 will result in $2.5 billion in General Fund savings (compared to typical cost‑sharing ratios). Once the enhanced federal funding expires, the associated General Fund savings will phase out. Given cash budgeting in Medi‑Cal, we expect the phase out of General Fund savings to take two years. Between 2021‑22 and 2022‑23, we project the phase out will raise General Fund costs in Medi‑Cal by $1.7 billion. Then, in 2023‑24, the full phase out will raise General Fund costs by another $800 million.

…Which Likely Will Be Offset Partially by Other Savings Resulting From the End of the PHE Declaration. With the assumed expiration of the enhanced federal funding at the end of March 2022, the continuous coverage requirement also will end. As we described above, we expect caseload will decline significantly once the continuous coverage requirement expires. This, as well as the expiration of other policies in place during the PHE declaration (such as reimbursement increases for certain providers), should reduce General Fund costs in Medi‑Cal. We project that such reduced costs would offset over one‑third of the higher General Fund costs due to the expiration of the enhanced federal funding.

An Extension of the PHE Beyond Early 2022 Would Bring Significant Net General Fund Savings. Our assumed expiration date for the PHE is highly uncertain. When the expiration occurs ultimately will depend on public health conditions around the country, as well as other national considerations. For each additional quarter that the PHE declaration remains in effect beyond January 2022, we would expect additional General Fund savings in Medi‑Cal of around $500 million. This amount reflects the net fiscal impact of (1) savings from the longer duration of enhanced federal funding and (2) additional costs related to the continuous coverage requirement’s effect on caseload, as well as other policies in place during the PHE.

Assumed Expiration of the MCO Tax

Reauthorization of the MCO Tax Would Generate Billions of Dollars in General Fund Savings Beginning in 2023‑24. The MCO tax generates annual General Fund savings in Medi‑Cal of $1.5 billion or more for each year it is in effect. Under current state law, the MCO tax is scheduled to expire in December 2022. Our projections assume the MCO tax expires at the scheduled date and is not reauthorized, resulting in higher annual General Fund costs in Medi‑Cal that reach nearly $1.7 billion by 2024‑25. However, legislative reauthorization of a similar MCO tax for a three‑year period beginning in January 2023 could result in around $2 billion in annual General Fund savings relative to our projections in 2023‑24 and 2024‑25 and $1 billion in General Fund savings in 2025‑26. Despite a reauthorized tax potentially taking effect halfway through 2022‑23, we assume the associated General Fund savings would not materialize until the following year due to payment delays.

Inflation Expectations

Inflation in the overall state economy has been considerably higher over the last several months than average historical levels. Although the consensus of economic forecasters anticipates that inflation will subside to historical levels within a year or so, these forecasts are subject to significant uncertainty. As Medi‑Cal price inflation and broader measures of inflation in the economy are different, the Medi‑Cal Outlook does not project any substantially increased cost from inflationary pressures. Should they arise, however, General Fund cost pressure in Medi‑Cal could be higher than we project.