LAO Contact

February 3, 2022

The 2022-23 Budget

Judicial Branch Proposals

- Overview

- Trial Court Equity Funding

- Improvement and Modernization Fund (IMF)

- Branchwide Information Technology Modernization

- Facility Modification and Construction

Summary

In this brief, we provide an overview of the total amount of funding in the Governor’s proposed 2022‑23 budget for the judicial branch as well as assess and make recommendations on four specific budget proposals.

Trial Court Equity Funding. The Governor’s budget proposes a $100 million ongoing General Fund increase to promote fiscal equity among the trial courts. We find that it is currently unclear how the funding would be allocated, there are different ways to promote fiscal equity, and other priorities—such as funding to address COVID‑19 backlogs—could also be considered. We recommend the Legislature ensure the amount of funding provided, as well as how the funding is allocated, reflects its funding priorities for trial court operations.

Improvement and Modernization Fund (IMF). The IMF is a state special fund that has struggled to remain solvent in recent years. The Governor’s budget proposes provisional budget language authorizing the transfer of General Fund to the IMF if revenues are lower than expected. While the proposal helps prevent IMF insolvency in 2022‑23, insolvency is possible in 2023‑24. We recommend the Legislature approve the Governor’s proposal to maintain existing service levels in the budget year, but also take steps to permanently address the fund’s insolvency.

Branchwide Information Technology Modernization. The Governor’s budget proposes $34.7 million General Fund in 2022‑23 (increasing to $40.3 million annually beginning in 2025‑26) for technology modernization projects. We recommend the Legislature approve—as proposed by the Governor—$3.7 million for a new judicial branch information security office and $7.3 million for allocation to the state courts and trial courts to fund local modernization projects as these proposals seem reasonable. To the extent that providing $23.5 million in discretionary funding for branchwide modernization projects allocated at Judicial Council’s discretion is a legislative priority, we recommend modifying the proposal to increase legislative oversight.

Facility Modification and Construction. The State Court Facilities Construction Fund (SCFCF) is an insolvent special fund that supports the judicial branch’s court facility‑related projects. The Governor’s budget proposes: (1) $40 million one‑time General Fund to backfill the SCFCF and authority for additional funding if needed, (2) $15.4 million ongoing General Fund for facility modification projects, and (3) $263 million one‑time General Fund and lease revenue bond authority for eight trial court construction projects. To permanently address the SCFCF insolvency, we recommend the Legislature shift full responsibility for trial court construction to the General Fund and appropriate funding for facility‑related projects based on its General Fund priorities. If a priority, the Legislature could consider additional one‑time funding for court facility projects such as for facility modification or deferred maintenance.

Overview

The judicial branch is responsible for the interpretation of law, the protection of individuals’ rights, the orderly settlement of all legal disputes, and the adjudication of accusations of legal violations. The branch consists of statewide courts (the Supreme Court and Courts of Appeal), trial courts in each of the state’s 58 counties, and statewide entities of the branch (Judicial Council, the Judicial Council Facility Program, and the Habeas Corpus Resource Center). The branch receives support from several funding sources including the state General Fund, civil filing fees, criminal penalties and fines, county maintenance‑of‑effort payments, and federal grants.

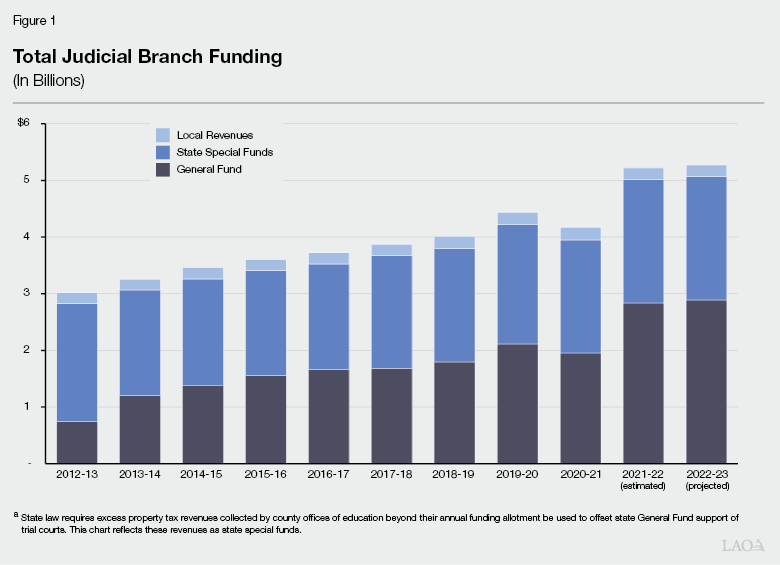

General Fund Becoming Greater Share of Judicial Branch Budget. Figure 1 shows total operational funding for the judicial branch from 2012‑13 to 2022‑23. Total funding for the judicial branch has steadily increased and the Governor proposes about $5.3 billion in support in 2022‑23. Between 2012‑13 and 2022‑23, the percent of total operational funding from the General Fund has steadily increased from 25 percent in 2012‑13 to 55 percent in 2022‑23. This growth is generally due to increased operational costs as well as decreases in fine and fee revenue.

Governor Proposes $5.1 Billion in State Funds for Judicial Branch. As shown in Figure 2, the Governor’s budget proposes about $5.1 billion from all state funds (General Fund and special funds) to support the operations of the judicial branch in 2022‑23, an increase of $52 million (1 percent) above the revised amount for 2021‑22. (These totals do not include expenditures from local reserves or trial court reserves.) Of this amount, about $3 billion (or 61 percent) is from the General Fund. This is a net increase of $65 million (or 2 percent) from the 2021‑22 amount.

Figure 2

Judicial Branch Budget Summary—All State Funds

(Dollars in Millions)

|

2020‑21 |

2021‑22 |

2022‑23 |

Change From 2021‑22 |

||

|

Amount |

Percent |

||||

|

State Trial Courts |

$2,987 |

$3,686 |

$3,797 |

$111 |

3.0% |

|

Supreme Court |

49 |

54 |

55 |

1 |

1.4 |

|

Courts of Appeal |

243 |

268 |

279 |

11 |

4.2 |

|

Judicial Council |

180 |

231 |

295 |

64 |

27.7 |

|

Judicial Branch Facility Program |

473 |

763 |

627 |

‑135 |

‑17.7 |

|

Habeas Corpus Resource Center |

16 |

19 |

19 |

— |

0.6 |

|

Totals |

$3,948 |

$5,021 |

$5,072 |

$52 |

1.0% |

Trial Court Equity Funding

Background

Funding Trial Court Operations. The state’s annual budget typically designates the total amount of funding available to fund trial court operations. While a portion of this funding is provided for specific programs or purposes (such as court interpreters), a significant portion of the funding is provided on a discretionary basis with little to no restrictions on its use. Judicial Council—the policymaking and governing body of the judicial branch—is responsible for allocating the discretionary funding to individual trial courts. Upon receiving its allocation, each individual trial court has significant flexibility in determining how its share of discretionary funding from the state is used. This can result in significant differences in the programs or services offered and the level of service provided across trial courts. For example, some trial courts may choose to use a greater proportion of their funding to provide increases in employee compensation than other courts.

In recent years, increased funding for trial court operations has generally been provided through the approval of (1) budget requests for specific priorities (such as increased funding to implement enacted legislation and funding to promote fiscal equity), (2) discretionary (or unallocated) funding increases, and (3) funding to support cost increases to maintain existing service levels (such as funding for increased trial court health benefit and retirement costs).

Workload Formula. Since 2013, the judicial branch has used a formula—known as the “workload formula”—to calculate how much funding each individual trial court should receive based on its workload as measured by various factors, including the number and type of filings each court receives. This amount is known as a court’s workload formula identified need. The formula then calculates the level of funding each trial court actually received as a percentage of its workload formula identified need. This amount is known as the court’s funding ratio. At the end of 2021‑22, individual trial court funding ratios are estimated to range from 73 percent to over 100 percent of their workload formula identified need—with the statewide average funding ratio being about 80 percent.

Judicial Council has adopted certain rules related to the workload formula to determine how to allocate discretionary funding increases provided in the annual state budget. While these rules have changed over the years, since 2018‑19, increased discretionary funding provided in the state budget is first allocated to the 15 smallest trial courts to ensure they receive 100 percent of their workload formula identified needs. Up to 50 percent of the remaining funding is then allocated to courts below the statewide average funding ratio. The remaining amount is then allocated to all trial courts generally based on workload.

State and Judicial Branch Took Various Actions to Address Pandemic‑Related Impacts. Since the start of the COVID‑19 pandemic, the state and the judicial branch have taken various actions to protect the health of court staff, stakeholders, and members of the public, as well as to address pandemic‑related impacts on trial court operations. Some of these actions included restricting physical access to court facilities, temporarily suspending court activities, and authorizing remote proceedings to allow cases to move forward.

The actions taken to respond to the pandemic have generally had three major impacts on trial court operations: (1) reduced service levels; (2) case backlogs and delays; and (3) increased one‑time and ongoing costs, such as from changing business practices to implement technology for remote proceedings. These impacts on individual trial courts differ due to various factors, including the specific actions taken during the pandemic. For example, some courts may have larger backlogs or increased costs due to a lack of space to conduct jury trials while appropriately socially distancing. The state and the judicial branch have taken various actions to address such impacts. For example, the 2021‑22 budget included $90 million one‑time General Fund to address case backlogs—with $30 million specifically for certain criminal case backlogs and $60 million for backlogs across all case types.

Governor’s Proposal

The Governor’s 2022‑23 budget proposes a $100 million ongoing General Fund increase to promote fiscal equity among the trial courts. While the funds would be used to promote fiscal equity, Judicial Council would have discretion in the allocation of the funds.

Assessment

Unclear How Judicial Council Would Allocate Funding. At the time of this analysis, it is unclear how the proposed augmentation would be allocated to the trial courts. This is because while the Governor’s proposal requires the funding be used to address fiscal equity, it would give Judicial Council discretion in allocating these funds and it is unclear how they would do so at this time. This makes it very difficult for the Legislature to assess how the funds will promote fiscal equity among the trial courts and if it is consistent with legislative priorities.

Different Ways to Promote Fiscal Equity Among Individual Trial Courts. We note that promoting fiscal equity is a goal with merit as it promotes equal access to justice across the state. To accomplish this, there are different ways to do so depending on the specific equity‑related goals the Legislature has (for example, narrowing the gap in funding between the trial courts with the highest and lowest trial court funding ratios or bringing all courts up to a minimum funding ratio) and how quickly that goal is to be reached. These decisions, in turn, dictate how much funding is needed as well as the number of courts that will receive funding and the specific amount of funding each court will receive. One example is to specify an equity goal, separate from the workload formula allocation rules discussed above. For example, the Legislature could specify that the funding be used to bring all courts up to the statewide average funding ratio (similar to how a $47.8 million ongoing General Fund augmentation was allocated in the 2018‑19 budget package). This would require funding less than the $100 million proposed by the Governor. Alternatively, the Legislature could require the funding be used to ensure that no courts have a funding ratio below a certain level. For example, the $100 million could be sufficient to bring all courts up to an estimated 84.5 percent of their workload formula identified need. Under these approaches, only a subset of trial courts would receive funding but there would be greater improvements in fiscal equity as the range of funding differences between trial courts would be narrowed more quickly.

Another example would be to allocate the funding using workload formula allocation rules. While up to half of the funding would be allocated to courts below the statewide average funding ratio, all courts would receive some portion of the funding. Under this approach, all courts would benefit from additional funding, though courts below the statewide average funding ratio would receive a greater share of the funding. Since all courts would be receiving some funding, this approach would slow improvements in fiscal equity among the trial courts.

Other Priorities Could Be Considered. The Legislature could also determine that other funding priorities are more important. In particular, to the extent the pandemic continues to impact court operations and delay court proceedings, it may want to prioritize funding to address backlogs and delays in the short term in order to minimize impacts on court users. For example, social distancing guidelines could mean that selecting and maintaining a jury for jury trials requires more in‑person space, staff, and resources, which in turn could result in fewer jury trials moving forward at any given time, resulting in backlogs. Funding could be targeted to address such impacts—such as leasing space or hiring temporary staff. Examples of other priorities outside the pandemic could include prioritizing funding for technology modernization as well as physical or remote infrastructure to help ensure that individuals have similar access—physical, remote, or electronic—across all trial courts.

Recommendation

Ensure Funding Reflects Legislative Priorities. We recommend the Legislature ensure the amount of funding provided, as well as how the funding is allocated, reflects its funding priorities for trial court operations. This can include specifying how funding must be allocated to improve fiscal equity among trial courts (as proposed by the Governor) or addressing other priorities. In particular, the Legislature could provide some, or all, of the requested funding to address pandemic‑related impacts in 2022‑23 in order to minimize impacts (such as backlogs or delays) on courts users statewide. This could help address equity in terms of public access to the courts and how quickly cases can be resolved. To provide assistance with this, the Legislature could direct the judicial branch to report in budget hearings on pandemic‑related impacts on court operations and identify where the greatest needs are. In future years, the funding could be allocated to ensure that all trial courts have at least 84.5 percent of their workload formula identified need. While this would mean that only a subset of trial courts received funding, it would narrow the fiscal inequity among trial courts more quickly.

Improvement and Modernization Fund (IMF)

Background

Originally Two Separate Judicial Branch Funds. In 1997, the state established two special funds to benefit trial courts.

- Judicial Administration Efficiency and Modernization Fund. The purpose of this fund was to promote projects designed to increase access, efficiency, and effectiveness of the trial courts. Such projects included judicial or court staff education programs, technological improvements, incentives to retain experienced judges, and improvements in legal research. The fund received monies primarily from a General Fund transfer to the judicial branch. We note that some of these funds were redirected to help offset reductions to the trial courts in 2010‑11 and 2011‑12.

- Trial Court Improvement Fund. The purpose of this fund was to support various projects approved by Judicial Council. The fund received monies from (1) criminal fine and fee revenues and (2) a transfer of 1 percent of the amount appropriate to support court operations from the Trial Court Trust Fund (TCTF). (The TCTF provides most of the funding to support trial court operations.) While Judicial Council had significant flexibility regarding the expenditures of monies in the fund, some of the monies were restricted for specified uses. For example, a portion of the fine and fee revenues had to be used for the development of automated administrative systems. State law also required that some of the monies in this fund be redirected back for allocations to trial court operations.

While the Legislature would appropriate a set amount of funding from the two funds each year in the annual budget, Judicial Council was responsible for approving and allocating monies to specific programs and systems. Accordingly, the Legislature’s role in determining how the funds were used was limited.

Two Funds Merged Into IMF. Chapter 41 of 2012 (SB 102, Committee on Budget and Fiscal Review) merged the Judicial Administration Efficiency and Modernization Fund and the Trial Court Improvement Fund into the new IMF. The IMF retained all sources of revenues as well as all transfers of monies associated with the two prior funds. While the Legislature appropriates a total amount of funding from the IMF in the annual state budget, Judicial Council generally has more discretion in how the funds are allocated to specific projects and activities than previously. Except for a couple of requirements (such as the requirement that a certain portion of fine and fee revenues be used for the development of automated administration systems), none of the statutory purposes that applied to the previous two funds currently apply to the IMF. The judicial branch is required to provide an annual report to the Legislature on the expenditures from the IMF.

IMF Struggles to Remain Solvent

Declines in Revenues. When partial payments are collected from an individual for criminal fines and fees levied by the courts, state law specifies the order in which partial payments are to be allocated to various state and local funds. In cases where full payment is not made, funds that are a lower priority pursuant to state law (such as the IMF) receive less revenue than those funds that are a higher priority (such as victim restitution or reimbursement for certain collection activities).

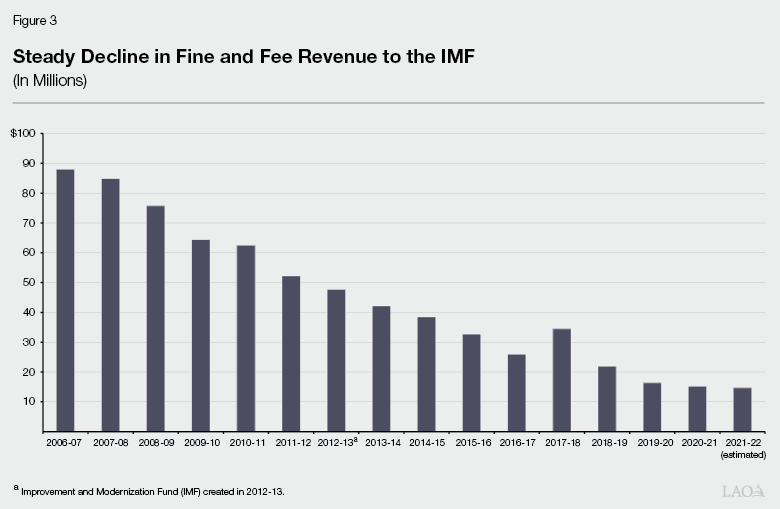

As shown in Figure 3, fine and fee revenues deposited into the IMF and its predecessors have steadily declined from nearly $88 million in 2006‑07 to an estimated $14.6 million in 2021‑22—a drop of 83 percent. The specific causes of this decline may be due to various reasons. For example, there may have been a reduction in collected criminal fine and fee revenues allocated to the IMF—such as from fewer tickets being written for traffic violations and/or more fines and fees being waived by the court which then reduces the amount available for collection. Even if the total amount of criminal fine and fee collections had remained the same, state and local funds that are a higher priority in the distribution of fine and fee payments may have been receiving an increased share of the revenue compared to the IMF.

Judicial Council Previously Authorized More Expenditures Than Available Revenues. As discussed above, state law authorizes Judicial Council to allocate funds from the IMF, as well as its predecessor funds, to specific programs and systems with very little legislative oversight. Once annual revenue into the IMF began declining, Judicial Council struggled to reduce expenditures to match the amount of available resources. Although the council took some steps to address these operational shortfalls by eliminating or reducing certain expenditures, or shifting expenditures to other fund sources, it continued to authorize funding from the IMF for programs and systems in excess of available resources in many years. However, in more recent years, Judicial Council has kept expenditures and revenues more closely aligned.

Various Actions Taken to Address Operational Shortfalls

The persistent operational shortfalls facing the IMF also led to the state taking various actions beginning in 2015‑16. The Legislature increased revenue available in the IMF in 2015‑16 by terminating an ongoing $20 million transfer from the IMF to the TCTF. Additionally, various budget proposals have been approved to help shift some or all funding for certain programs and systems from the IMF to the General Fund. In addition, the Legislature provided General Fund support to pay for the expansion of some programs and systems that otherwise would have been paid by the IMF if sufficient resources were available. For example, the 2019‑20 budget included $4.5 million General Fund to upgrade a financial and human resources system used by the trial courts and $3.2 million General Fund to replace IMF support for the system. In another example, $5.5 million in ongoing General Fund support was provided in 2015‑16 to expand the judicial branch’s Local Area Network/Wide Area Network (LAN/WAN) telecommunications network infrastructure program to include the final four courts that did not participate in the network. The IMF continues to support this program today.

Governor’s Proposal

The Governor’s budget proposes provisional budget language authorizing the Director of the Department of Finance to transfer additional General Fund support to the IMF if revenues are lower than expected. The transfer can only occur 30 days after written notification to the Legislature.

Assessment

Proposal Helps Prevent IMF Insolvency in 2022‑23. Based on current projections, the IMF fund balance will effectively be zero at the end of 2022‑23. This is generally due to the ongoing decline in criminal fine and fee revenue, which has been even greater during the pandemic for various reasons, such as the temporary suspension of the collection of criminal fines and fees by certain trial courts. As such, it is possible that actual revenues will be even lower than currently projected. Accordingly, the proposed budget language would ensure that the IMF has sufficient funds in 2022‑23 to avoid the need for Judicial Council to make midyear expenditure reductions.

But Insolvency Possible in 2023‑24. However, absent any additional actions, the IMF will likely face insolvency in future years. Specifically, if revenues and expenditures are similar to the amounts projected in 2022‑23, the IMF would become insolvent in 2023‑24. We estimate up to $18 million could be necessary to backfill the IMF unless steps are taken to reduce expenditures from the fund or revenues are greater than anticipated.

Increased Legislative Oversight Over Current IMF Programs and Systems Needed. The Legislature generally lacks oversight of IMF programs and systems as they are informed only after expenditures are made. This makes it difficult for the Legislature to ensure that its priorities are funded and how much funding is provided. For example, the Legislature may determine that certain programs are less important and should bear a larger share of any reductions to maintain IMF solvency. The Legislature could also determine that certain programs need to be maintained and should be supported from other fund sources.

Recommendations

Approve Proposed Budget Bill Language. We recommend the Legislature approve the Governor’s proposed provisional budget language as it helps ensure the IMF has sufficient funds to maintain anticipated expenditure levels.

Deposit IMF Revenues Into the General Fund and Eliminate IMF Next Year. While the Governor’s proposal would address potential IMF insolvency in 2022‑23, it does not provide a long‑term solution to address the IMF’s potential insolvency which could occur as early as 2023‑24. In order to permanently address the IMF’s solvency, as well as increase legislative oversight over the programs and systems currently funded from the IMF, we recommend the Legislature deposit IMF revenues into the General Fund and eliminate the IMF next year.

To accomplish this, we recommend that Legislature first direct the judicial branch to provide a report by December 1, 2022 on each of the programs and systems currently supported by the IMF, including information on past expenditures and the benefits achieved. Based on its review of this report, we recommend that the Legislature shift the programs and systems currently supported by the IMF that it prioritizes to the General Fund and eliminate funding for any remaining programs or systems as part of the 2023‑24 budget process. Specifically, we recommend the Legislature evaluate the need for each program and system and its cost‑effectiveness relative to all other state programs currently supported by the General Fund and determine what level of funding, if any, is appropriate to provide these programs and systems. This would greatly increase legislative oversight over these programs and systems. Our recommendation to deposit all IMF revenues into the General Fund and eliminate the IMF would offset the additional General Fund costs of the shifted programs and systems.

Taking this approach will have three major benefits. First, the amount of funding supporting IMF programs and systems prioritized by the Legislature would no longer be dependent on the amount of such revenue collected. This allows the judicial branch and administration to determine the level of support necessary for each program or system based on their operational needs rather than the amount of available IMF revenue. Second, this allows the Legislature to determine how much funding to appropriate from the General Fund to support these programs and systems based on its overall priorities. Finally, given that the IMF is likely going to struggle to maintain solvency, this approach would permanently address the issue in a comprehensive, rather than piecemeal, manner.

Branchwide Information Technology Modernization

Background

Judicial Council Uses Key Documents to Guide Selection and Oversight of Information Technology (IT) Modernization Projects. Over the past decade, Judicial Council has developed four key technology planning documents to guide its identification, approval, and oversight of IT projects that the judicial branch will pursue. These key documents include:

- Governance and Funding Model. This document provides broad guidance on the judicial branch’s vision and principles related to technology and lays out the process for the approval and oversight of projects. Specifically, this includes specifying criteria for assessing statewide versus local projects; the roles and responsibilities of all key stakeholders (such as specific Judicial Council committees, as well as individual courts); and processes by which projects are identified, justified, approved, and monitored.

- Strategic Plan. This document provides the judicial branch’s strategic goals, objectives, and metrics to measure success of technology projects over a four‑year period. The 2019‑22 Strategic Plan identifies three guiding principles: access, reliability, and innovation. Based on these principles, the plan specifies four key goals: (1) promoting the digital court, (2) innovating through the technology community, (3) advancing technology security and infrastructure, and (4) promoting rule and legislative changes that impact the use of technology. Each goal has prioritized objectives. For example, ensuring secure, reliable, and sufficient data network connectivity throughout the judicial branch is the first of six objectives to meet the goal of advancing technology security and infrastructure.

- Tactical Plan. This document provides the individual steps or areas of focus identified by the judicial branch to achieve Strategic Plan goals over a two‑year period. The 2021‑22 Tactical Plan lays out 18 specific areas of focus tied to the goals in the Strategic Plan. For example, case management system migration and deployment is one area of focus to address the goal of promoting the digital court. The Tactical Plan then lays out specific goals and objectives within each area of focus. For example, an identified goal and objective related to the case management system migration and deployment area of focus is to continue implementation of new systems for all case types across the branch.

- California Courts Connected Framework. This document provides a framework to help individual courts assess their progress in meeting the goals identified in the Strategic Plan and the Tactical Plan. This allows courts to identify their existing technology capacities as well as potential areas of need. According to the judicial branch, a July 2021 inventory assessing court needs using this framework resulted in the identification of 201 projects—totaling to $43.6 million—across 20 technology categories (such as technology infrastructure).

Using the above documents in concert with one another helps Judicial Council identify and prioritize the judicial branch’s technology needs. It also helps Judicial Council identify those specific projects where funding needs to be requested through the annual state budget process. Finally, following its approval of projects, Judicial Council generally receives regular updates to monitor the use of funding and ensure that the intended outcomes are reached.

Various Approaches Used to Fund Technology Modernization Projects. Over the years, a variety of approaches have been used to fund judicial branch technology modernization projects, with varying levels of legislative involvement in allocating funds to specific projects. The primary approaches used in recent years include:

- Ongoing IMF Funding Allocated by Judicial Council. As noted earlier in the “IMF” section of this brief, the IMF is a special fund with several dedicated revenue sources that is used to support various judicial branch activities, including technology modernization projects. Judicial Council determines the specific projects funded by the IMF and the amount of support each receives without legislative oversight. Tens of millions of dollars have been spent on technology from the IMF annually—with annual expenditures generally under $50 million in the most recent years. Examples of IMF‑supported technology projects include the LAN/WAN telecommunications network infrastructure program, data center support, and case management systems. Projects are supported from the IMF both on an ongoing and limited‑term basis.

- Funding Allocated by Legislature to Specific Projects. In more recent years, the judicial branch has regularly submitted proposals requesting limited‑term or ongoing funding—usually from the General Fund—for specific technology modernization projects through the annual state budget process. For example, several budgets in recent years have included a combined total of $63 million one‑time General Fund support to replace case management systems in 23 courts. We also note that the 2019‑20 budget included $7.8 million one‑time General Fund, to be spent over two years, to pilot and evaluate four technology projects with a plan to ultimately expand them statewide. These projects included data analytics and business intelligence using identity access management, intelligent chat, video remote hearings, and voice‑to‑text translation services.

- Limited‑Term Funding Provided by Legislature to Judicial Council For Discretionary Allocation. The 2020‑21 budget included $25 million one‑time General Fund annually in 2020‑21 and 2021‑22 for projects to modernize trial court operations that would be selected by Judicial Council. Judicial Council employed its Strategic and Tactical plans to identify and approve branchwide and court‑specific projects across 14 different categories—such as remote technology appearance and data governance—to allocate these funds. The allocations also reflected Judicial Council’s prioritization of projects—such as remote appearance technology—that would enable courts to provide services during the pandemic. Each trial court received at least $40,000 for modernization projects in 2020‑21. Judicial Council subsequently received regular status reports and made adjustments based on court needs, such as by authorizing requests to redirect funding to the immediate replacement of failing equipment used to support remote appearances.

Governor’s Proposals

The Governor’s budget proposes a total of 27 positions and $34.7 million General Fund in 2022‑23 (increasing to 50 positions and $40.3 million annually beginning in 2025‑26) for technology modernization projects.

New Judicial Branch Information Security Office ($3.7 Million). The Governor’s budget proposes $3.7 million in 2022‑23, growing to $6.2 million annually beginning in 2025‑26, to support the creation of a new Judicial Branch Information Security Office. This office would monitor judicial branch assets statewide, assists courts in addressing any incidents (such as hacking or phishing incidences), and educate staff on this topic.

Allocations for State Courts and Trial Courts to Fund Local Priorities ($7.3 Million). The Governor’s budget proposes $7.3 million in 2022‑23, decreasing to $7.2 million in 2023‑24 and ongoing, for the state courts and trial courts for technology modernization efforts. Of this amount, $3.2 million would go to support new state trial court technology staff and program costs. The remaining $4.2 million would be allocated to trial courts for technology modernization efforts to be identified by the individual courts. According to Judicial Council, annual allocations would depend on court size, with 15 courts each receiving $50,000, 35 courts each receiving $75,000, and 8 courts each receiving $100,000. The intent of this funding is to provide courts with the necessary staff and funding to conduct local technology modernization projects based on local priorities.

Judicial Branch Modernization Program to Fund Branchwide Priorities ($23.5 Million). The Governor’s budget proposes $23.5 million in 2022‑23 (growing to $26.6 million annually beginning in 2024‑25) to establish a Judicial Branch Modernization Program that would provide annual support for technology modernization projects. Of this amount, $3 million—growing to $6.1 million in 2024‑25—would go to support Judicial Council staff to manage projects funded by the program. The remaining $20.5 million would fund modernization projects selected by Judicial Council based on its priorities specified in its key technology planning documents, with $8 million of this amount dedicated to branchwide projects and $12.5 million for court‑specific projects.

Assessment

Two Proposals Appear Reasonable. Two of the Governor’s proposals appear reasonable. First, the proposal for a new Judicial Branch Information Security Office seems reasonable. Court operations are increasingly reliant on technology to operate effectively. Additionally, the courts receive, access, and process information that can be confidential or private. Accordingly, it is reasonable for the judicial branch to have an office dedicated to addressing information security issues across the state, particularly since this minimizes the need for such expertise at each individual court.

Second, the proposal requesting direct allocations to and related staffing for the state courts and trial courts seems reasonable. The requested funding would provide individual courts with a small amount of annual resources that could help address more routine and/or smaller modernization efforts. These allocations recognize that each court’s modernization needs may not be the same. Additionally, the funding provides a certain amount of flexibility to individual courts to adjust to address the most immediate needs as they arise (such as sudden equipment failure). The staffing would also provide the state courts with sufficient capacity and expertise to oversee the effective completion of modernization projects.

Judicial Branch Modernization Program Reduces Legislative Oversight, but Could Have Some Benefits as Well. The proposed Judicial Branch Modernization Program reduces legislative oversight of technology projects. This is because it lacks the same oversight mechanisms that exist when funding is allocated by the Legislature to specific projects through the annual budget process. Allocating funding through the budget process to specific projects or providing limited‑term funding for specified purposes allows the Legislature to ensure that funded projects are of high priority and reflect statewide policies and priorities for court processes and procedures. This approach also allows the Legislature to assess whether each budget request accurately identifies a problem or need and presents a cost‑effective solution, clear outcome expectations, complete and accurate costs, a comprehensive and reasonable implementation plan, and clear metrics to monitor the implementation of the solution. In addition, this approach allows the Legislature to take certain steps—such as requiring a project be piloted first, approving only partial funding, or requiring the reporting of certain information on a regular basis—to ensure it has sufficient oversight of projects. Such steps can be tailored specifically to individual projects.

As proposed by the Governor, this level of oversight would not occur over the projects that would be funded through the proposed Judicial Branch Modernization program. This is because Judicial Council would have full discretion to allocate funding to branchwide projects and court‑specific projects based on its priorities. While Judicial Council has developed a fairly robust process for identifying, approving, and conducting oversight of technology projects, those processes do not generally allow for legislative oversight or input unless the request is submitted for consideration through the budget process. We note that the level of annual funding proposed by the Governor for the new program would likely result in most of the funded projects being smaller in scope. However, because this funding is ongoing, it could enable the funding of multiyear projects—including projects whose total costs could reach into the millions of dollars.

While the specific structure of the Governor’s proposal raises concerns, we acknowledge that there are a few advantages to providing some amount of discretionary funding for branchwide modernization projects selected by Judicial Council during the course of a fiscal year. For example, such an approach would give Judicial Council the flexibility to respond quickly as needs arise across the branch. We note that the discretion provided to Judicial Council to allocate $25 million in modernization funding in 2020‑21 likely helped courts more rapidly change their business practices to operate during the pandemic. Additionally, such an approach could eliminate the need for the Legislature to consider budget requests each year for relatively small technology projects.

Recommendations

Approve Proposals for New Judicial Branch Information Security Office ($3.7 Million) and Direct Allocations to State and Trial Courts ($7.3 Million). We recommend the Legislature approve the proposals for the new Judicial Branch Information Security Office as well as the direct allocations to the state and trial courts. As discussed above, the Judicial Branch Information Security Office would address an important judicial branch information security need while the direct allocations to the state and trial courts would provide a small amount of ongoing, flexible funding for technology modernization efforts at each individual court based on their needs.

Modify Proposed Judicial Branch Modernization Program to Ensure Appropriate Legislative Oversight ($23.5 Million). To the extent that providing some discretionary funding for branchwide modernization projects to be selected by Judicial Council is a legislative priority, we recommend that the Legislature modify the proposed Judicial Branch Modernization Program to increase legislative oversight. Specifically, we recommend the Legislature specify limits on the types of projects that can be funded or set a total per‑project cost limit on projects that can be funded. This would limit the number or types of projects that could be pursued without legislative oversight through the annual state budget process. We also recommend requiring annual reporting from Judicial Council on what projects are expected to receive funding through the program each year and how program funds were actually used in the prior year. This would allow the Legislature to conduct regular oversight of the program, provide input prior to allocation of program funds, and identify areas where legislative action could be merited. Depending on the specific modifications made to the Governor’s proposal, the Legislature will want to adjust the amount of funding accordingly.

Facility Modification and Construction

Background

Judicial Branch Facility Needs. The judicial branch currently manages around 450 facilities across all 58 counties. Its facility program is responsible for various activities including maintaining these facilities, managing leases, and constructing new courthouses to replace outdated facilities. In a November 2019 assessment of its facilities, the judicial branch identified a need for a total of 80 construction projects—56 new buildings and 24 renovations—totaling $13.2 billion. These projects were categorized into five groups—and ranked within each group—in the following descending priority order: 18 immediate need projects ($2.3 billion), 29 critical need projects ($7.9 billion), 15 high need projects ($1.3 billion), 9 medium need projects ($1.6 billion), and 9 low need projects ($100 million). Additionally, in August 2021, the judicial branch identified 22,743 deferred maintenance projects totaling $5 billion.

Construction Account Insolvent. State law authorizes Judicial Council to construct trial court facilities and established a special fund, the State Court Facilities Construction Fund (SCFCF), to support the judicial branch’s court facility‑related projects. (We note a second construction account was consolidated into the SCFCF as part of the 2021‑22 budget.) Specifically, state law increased certain criminal and civil fines and fees and deposited the revenues into the SCFCF to finance trial court construction and other facility‑related expenses. The amount of revenue deposited has steadily declined over time, largely due to declining criminal fine and fee revenue. This has resulted in SCFCF expenditures—including debt service, facility modifications, and trial court operations—routinely exceeding revenues. (Currently, a total of $55.5 million is redirected annually from the SCFCF to support trial court operations. Such transfers were initially implemented to mitigate the impacts of budget reductions on trial court operations.) To support this level of spending, the judicial branch has been expending funds from the SCFCF fund balance. As a result, the SCFCF faces insolvency in 2022‑23.

New Construction Supported by General Fund. Given the insolvency of the SCFCF, the 2021‑22 budget shifted support for the construction of any future courthouses to the General Fund. The 2021‑22 budget also included funding to start the construction or renovation of six of the highest ranked immediate need projects identified in Judicial Council’s 2019 reassessment of facilities.

Governor’s Proposals

The Governor’s budget for 2022‑23 includes several proposals related to court facilities. They include the following:

- SCFCF Backfill ($40 Million). The Governor’s budget proposes a $40 million one‑time General Fund transfer to the SCFCF to help prevent its insolvency in 2022‑23. The budget also includes provisional budget language authorizing the Director of the Department of Finance to transfer additional General Fund if revenues deposited into the SCFCF are lower than expected. The transfer could only occur 30 days after written notification to the Legislature.

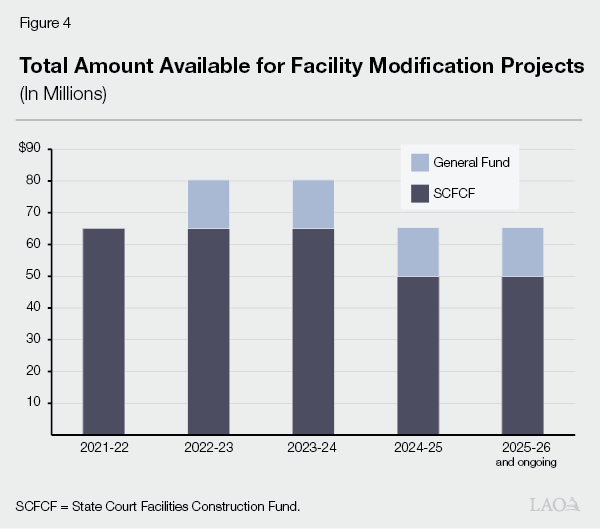

- Facility Modification ($19.4 Million). The Governor’s budget proposes $15.4 million ongoing General Fund and $4 million in ongoing SCFCF reimbursement authority (for county repayment of their share of facility costs) for trial court facility modification projects. As shown in Figure 4, this proposal would temporarily increase the total amount of funding for facility modification to $80.4 million in 2022‑23 and 2023‑24. However, due to the expiration of limited‑term funding previously authorized, total funding would decline to $65.4 million annually beginning in 2024‑25—effectively the same level of funding in the current year.

- Construction Projects ($263 Million). As shown in Figure 5, the Governor’s budget proposes a total of $132 million in General Fund support to start five new trial court construction projects. The budget also proposes an additional $3.9 million General Fund and $127.2 million in lease revenue bond authority—with debt service being repaid over time by the General Fund—for the continuation of three previously approved projects.

Figure 5

$263 Million Proposed by Governor for

Trial Court Construction Projects

(In Millions)

|

Construction Project |

General Fund |

Lease Revenue Bond Authority |

|

New Projects |

||

|

New Santa Clarita Courthouse |

$53.1 |

— |

|

New San Luis Obispo Courthouse |

29.2 |

— |

|

New Solano Hall of Justice |

21.4 |

— |

|

New Fresno Courthouse |

21.2 |

— |

|

New Quincy Courthouse |

7.1 |

— |

|

Subtotals |

($131.8) |

(—) |

|

Previously Approved Projects |

||

|

New Ukiah Courthouse |

— |

$127.2 |

|

Butte Juvenile Hall Addition and Renovation |

$3.2 |

— |

|

San Bernardino Juvenile Dependency Courthouse Addition and Renovation |

0.7 |

— |

|

Subtotals |

($3.9) |

($127.2) |

|

Totals |

$135.8 |

$127.2 |

Assessment

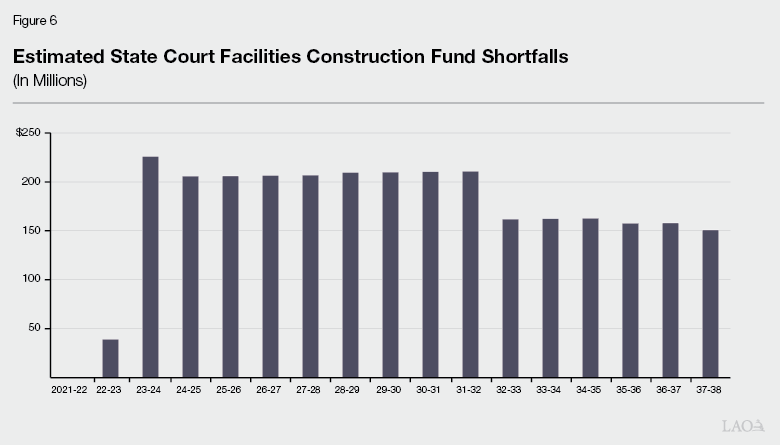

Insolvency Requires Ongoing General Fund Resources. As noted above, the SCFCF faces insolvency in 2022‑23. The Governor’s proposed one‑time SCFCF backfill would only address the insolvency in the budget year—effectively leaving the SCFCF with a zero fund balance. SCFCF revenues are estimated to be around $200 million and expenditures to be around $425 million in 2022‑23. While both amounts are estimated to decline slightly in the future, this trend continues into future years—which means that ongoing General Fund resources will be needed to backfill the difference in revenues in order for the state to meet financing payments for completed projects as well as other obligations. As shown in Figure 6, absent any changes in expenditures, this could mean that at least $200 million would be needed annually for nearly a decade. The amount would then decline as the state ends debt service payments on completed construction projects.

Proposal Provides Ongoing General Fund Support for Facility Modification for the First Time. Trial court facility modification projects are currently supported by $65 million annually from the SCFCF. While the Governor’s proposal maintains this level of annual funding in 2024‑25, almost one‑fourth of facility modification spending would be supported by the General Fund.

Recommendations

Shift Full Responsibility for Trial Court Construction to the General Fund. In order to permanently address the insolvency of the SCFCF, we recommend the Legislature shift full responsibility for trial court construction to the General Fund. This includes (1) shifting all financing obligations for completed projects to the General Fund, (2) appropriating $160 million General Fund annually (declining to $145 million in 2024‑25) to support all non‑construction‑related expenditures currently supported by the SCFCF, and (3) depositing all SCFCF revenues into the General Fund to partially offset the shifted costs. This approach would ensure that all construction‑related obligations are fully accounted for and considered when evaluating the state’s overall fiscal condition and determining General Fund priorities. It would also maintain existing levels of support for all non‑construction‑related expenditures—such as facility modification projects and trial court operations. Finally, it allows the Legislature to fund future trial court construction projects based on its priorities.

Appropriate Funding for Facility Modification and Construction Based on General Fund Priorities. Regardless of whether the Legislature adopts the recommendation to shift full responsibility for trial court construction to the General Fund, we recommend the Legislature appropriate funding for facility modification projects and construction based on its General Fund priorities. While the Governor’s proposals are generally reasonable, the judicial branch has identified significant facility needs. If a priority, the Legislature could consider additional one‑time funding—such as for facility modification projects or deferred maintenance. We note that such spending is excludable under the state appropriations limit (SAL). (The California Constitution imposes a limit on the amount of revenue the state can appropriate each year. The state can exclude certain spending—such as on capital outlay projects, as well as for certain kinds of emergency spending—from the SAL calculation.) As we discuss in our recent report, The 2022‑23 Budget: Overview of the Governor’s Budget, the SAL will continue to constrain the Legislature’s choices in the upcoming budget process.