LAO Contact

February 2, 2022

The 2022‑23 Budget

Supplemental Security Income/State Supplementary Payment (SSI/SSP) Program

Summary. This post summarizes the Governor’s budget assumptions and proposals related to the SSI/SSP program, including the Governor’s intent to increase SSP grants in 2023‑24. The post also summarizes other SSI/SSP goals the Legislature could pursue relative to the intended 2023‑24 SSP grant increase.

Background

The SSI/SSP program provides cash grants to low‑income aged, blind, and disabled individuals. Grant levels for SSI/SSP are determined by both the federal government and the state. Specifically, the federal government pays for the SSI portion of the grant while the state pays the SSP portion of the grant. For 2022‑23, the Governor’s budget proposes $3.1 billion from the General Fund for the state’s share of SSI/SSP—an increase of $226 million (8 percent) over estimated 2021‑22 expenditures. This increase would bring total program funding to $10.3 billion ($3.1 billion from the General Fund and $7.2 billion federal funds) in 2022‑23. The primary driver of this increase is the full‑year cost impact of the 23.95 percent SSP grant increase that took effect on January 1, 2022.

Governor’s Budget Caseload Assumptions

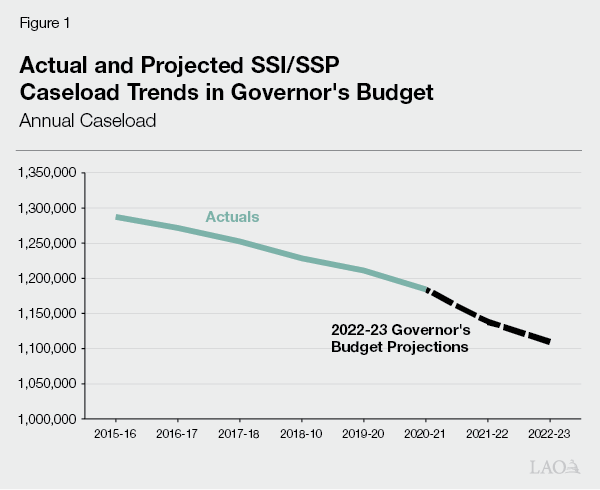

Governor’s January Budget Assumes SSI/SSP Caseload Continues to Decline. The SSI/SSP caseload grew at a rate of less than 1 percent each year between 2011‑12 and 2014‑15. Beginning in 2015‑16, however, SSI/SSP caseload began to slowly decline at an average rate of 1.5 percent each year. As shown in Figure 1, the Governor’s budget projects that caseload will decrease by 3.8 percent in 2021‑22 and 2.5 percent in 2022‑23, which is a slightly higher rate of decline relative to past caseload trends. We are working with the Department of Social Services to better understand the reasons behind the continued decline in SSI/SSP caseload and will provide further comments at the time of the May Revision if necessary.

Governor’s 2022‑23 and 2023‑24 SSI/SSP Grant Assumptions

Federal Government Required to Provide Annual COLA to SSI Grants, While State Has Option to Provide Annual COLA to SSP Grants. The federal government is required to provide an annual cost‑of‑living‑adjustment (COLA) each January to the SSI portion of the grant. The federal COLA increase is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI‑W). In years that the CPI‑W is negative (as was the case in 2010, 2011, and 2016), the federal government does not decrease SSI grants, but instead holds them flat.

The state has full discretion over whether and how to provide increases to the SSP portion of the grant. Until 2011, the state had a statutory annual COLA. (Despite the state statutory COLA, there were many years prior to 2011 when the COLA was not provided due to budget constraints.) Prior to the Great Recession, the state annual COLAs generally reflected whole‑grant COLAs. Whole grant COLAs worked by applying the California Necessity Index (CNI) to the total SSI/SSP grant. If the federal SSI COLA was not enough to increase total SSI/SSP grants to CNI‑adjusted levels, then the SSP portion of the grant was increased by the remaining amount. Alternatively, SSP grants occasionally were increased by applying the CNI only to the SSP portion of the grant (in 2016‑17 and 2021‑22). Additionally, the 2018‑19 budget included legislation to provide annual state COLAs beginning in 2022‑23, to the extent that funding is provided in future budget years. (We understand that the Governor’s multiyear grant projections do not include an annual state SSP COLA in 2022‑23 and onwards.)

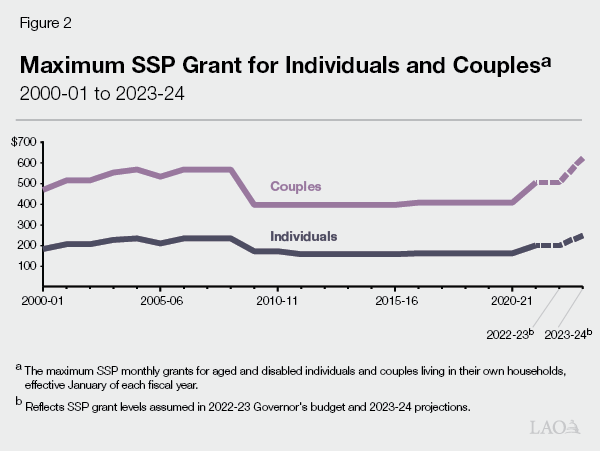

During Constrained Budget Environment, SSP Grants for Individuals and Couples Were Reduced to Federally Required Minimum... The state is required to maintain SSP monthly grant levels at or above the nominal levels in place in March 1983 ($156.40 for SSP individual grants and $396.20 for SSP couple grants) in order to receive federal Medicaid funding. As shown in Figure 2, during the Great Recession, the state incrementally decreased SSP grants for individuals and couples until they reached these minimum levels in June 2011 and November 2009, respectively.

…However, SSP Grants Were Increased in 2016‑17 and 2021‑22. Since the past SSP grant reductions, grants for individuals and couples were increased twice—in 2016‑17 (by 2.76 percent) and 2021‑22 (by 23.95 percent). The 2016‑17 SSP grant increase was based on applying the CNI only to the SSP portion of the grant (increasing grants by $4 for individuals and $11 for couples). The 2021‑22 SSP grant increase is based on a statutorily required calculation that required the Department of Finance to estimate what grant increase could be supported in 2021‑22 for a total cost of $291 million. Based on this calculation, SSP grants increased by 23.95 percent on January 1, 2022 (increasing grants by $39 for individuals and $98 for couples).

Governor’s January Budget Includes Federal SSI COLA Estimates and a 2023‑24 SSP Grant Increase. Figure 3 demonstrates how actual maximum SSI/SSP grant levels in 2021‑22 compare to the administration’s estimates of maximum SSI/SSP grant levels in 2022‑23 and 2023‑24. The projected changes in maximum SSI/SSP grant levels in 2022‑23 and 2023‑24 are due to the following factors:

- Increase in 2022‑23 Driven by Estimated Federal COLA. The Governor’s budget estimates that the federal COLA for the SSI portion of the grant will be 2.3 percent in 2022‑23, increasing maximum SSI grants by $19 for individuals and $29 for couples on January 1, 2023. (We estimate that the federal SSI COLA in 2022‑23 will be 3.8 percent, increasing grants by an additional $13 for individuals and $19 for couples above the administration’s estimates. Overall, the actual federal SSI COLA will not be known until fall 2022.) Total maximum SSI/SSP grant levels only would increase by the federal COLA since maximum SSP grant levels would remain flat between 2021‑22 and 2022‑23 under the Governor’s budget.

- Increase in 2023‑24 Driven by Anticipated SSP Grant Increase and Estimated Federal COLA. The Governor’s budget estimates that the federal COLA for the SSI portion of the grant will be 1.9 percent in 2023‑24, increasing maximum SSI grants by $16 for individuals and $24 for couples on January 1, 2024. (We estimate that the federal SSI COLA in 2022‑23 will be 2.3 percent, increasing grants by an additional $4 for individuals and $6 for couples above the administration’s estimates. Overall, the actual federal SSI COLA will not be known until fall 2023.) Additionally, the Governor’s budget assumes that maximum SSP grants would increase on January 1, 2024. Specifically, the 2021‑22 budget included legislation to provide an SSP grant increase on January 1, 2024, subject to future appropriation in the Budget Act of 2023. In response to this requirement, the Governor’s outyear budget assumptions include $296 million General Fund in 2023‑24 (increasing to $593 million General Fund in 2024‑25) to increase all SSP grants by 23.95 percent on January 1, 2024. This would increase maximum monthly SSP grants by $48 for individuals and $121 for couples. Overall, total maximum SSI/SSP grants would increase by $64 for individuals (6 percent) and $145 for couples (8 percent) in 2023‑24.

Figure 3

SSI/SSP Monthly Maximum Grant Levelsa Governor’s Proposal

|

2021‑22 |

2022‑23b |

2023‑24b |

|

|

Maximum Grant—Individuals |

|||

|

SSI |

$841.00 |

$860.00 |

$876.00 |

|

SSP |

199.21 |

199.21 |

246.92 |

|

Totals |

$1,040.21 |

$1,059.21 |

$1,122.92 |

|

Percent of Federal Poverty Levelc |

92% |

89% |

92% |

|

Maximum Grant—Couples |

|||

|

SSI |

$1,261.00 |

$1,290.00 |

$1,314.00 |

|

SSP |

504.64 |

504.64 |

625.51 |

|

Totals |

$1,765.64 |

$1,794.64 |

$1,939.51 |

|

Percent of Federal Poverty Levelc |

116% |

112% |

118% |

|

aThe maximum monthly grants displayed refer to those for aged and disabled individuals and couples living in their own households in January of fiscal year. bReflects administration’s estimate of the January 2023 and January 2024 federal cost‑of‑living adjustment for the SSI portion of the grant. Also reflects intended SSP grant increase in January 2024. cCompares grant level to federal poverty guidelines from the U.S. Department of Health and Human Services up to 2021‑22. Estimates of federal poverty guidelines for 2022‑23 and 2023‑24 are based on Consumer Price Index for All Urban Consumers projections. The 2022‑23 and 2023‑24 federal poverty guidelines will not be finalized until fall 2022 and fall 2023, respectively. |

|||

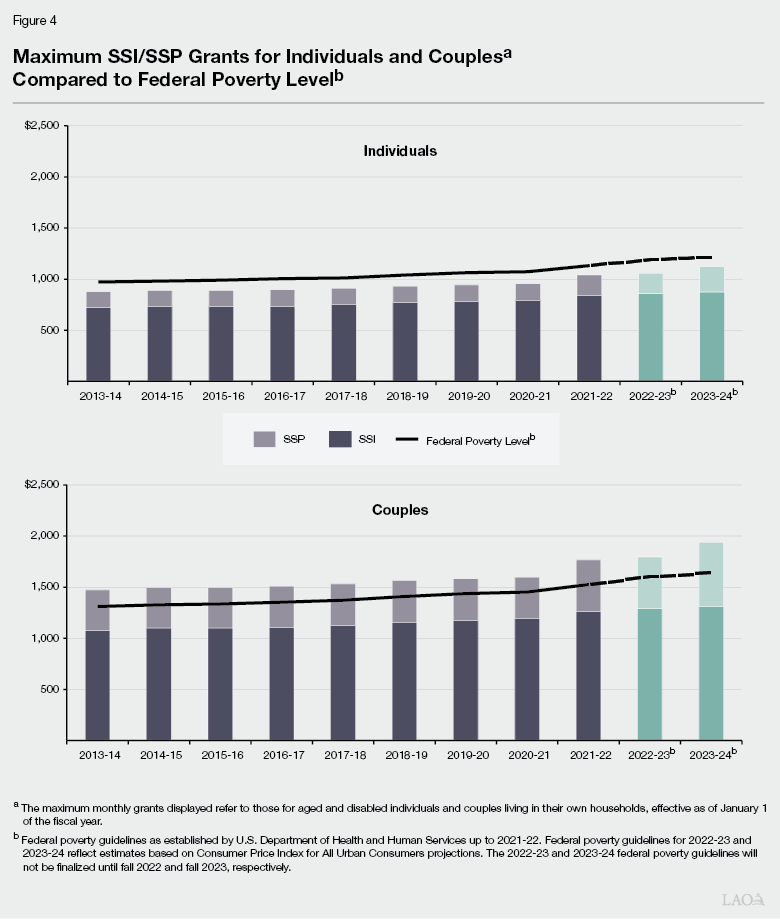

Despite Recent and Future SSI and SSP Grant Increases, Grant Levels Remain Below FPL for Individuals. As shown in Figure 4, the maximum combined SSI/SSP monthly grant amount for individuals (the bulk of the SSI/SSP caseload) and couples has been increasing on average by 1.2 percent annually since January 2014—predominantly due to the provision of federal SSI COLAs. In 2022, maximum SSI/SSP grant levels for individuals and couples experienced a more significant increase (an overall increase of 9 percent and 10 percent, respectively) due to the highest one‑time SSP grant increase (23.95 percent) and federal SSI COLA (5.9 percent) in history taking effect on January 1, 2022. Despite these 2022 grant increases, current maximum SSI/SSP grant levels for individuals remain below the federal poverty level (FPL), while grant levels for couples remain above the FPL. Moreover, despite the intended 23.95 percent SSP grant increase on January 1, 2024, maximum SSI/SSP grant levels for individuals are projected to remain below the FPL in 2023‑24.

Grant Increases Should Reflect the Legislature’s Goals

for SSI/SSP Grant Levels

The administration’s planned SSP grant increase in 2023‑24 is intended to restore SSP grant levels for individuals and couples to “pre‑recession” levels, which we understand to mean the SSP grant levels in place in January 2009 (prior to the start of multiple SSP grant reductions). Additionally, the Governor’s stated intent to provide an SSP grant increase in 2023‑24 complies with the legislation included as part of the 2021‑22 budget agreement. However, we understand that the administration does not include ongoing SSP COLAs beginning 2022‑23 (providing COLAs would align with the intent language adopted in the 2018‑19 budget). While the Governor’s goal of restoring grants to their pre‑recession levels is one way of setting a goal for SSI/SSP grants, the Legislature may wish to set its own goals for where it would like SSI/SSP grant levels to be, and over what time period it would expect to take to get there. In doing so, considering the rising costs of inflation, the Legislature could also consider how to maintain the purchasing power of its ultimate SSI/SSP grant goal over time. Below, we provide examples of different ways the Legislature could approach possible SSP grant increases—depending on its specific goal.

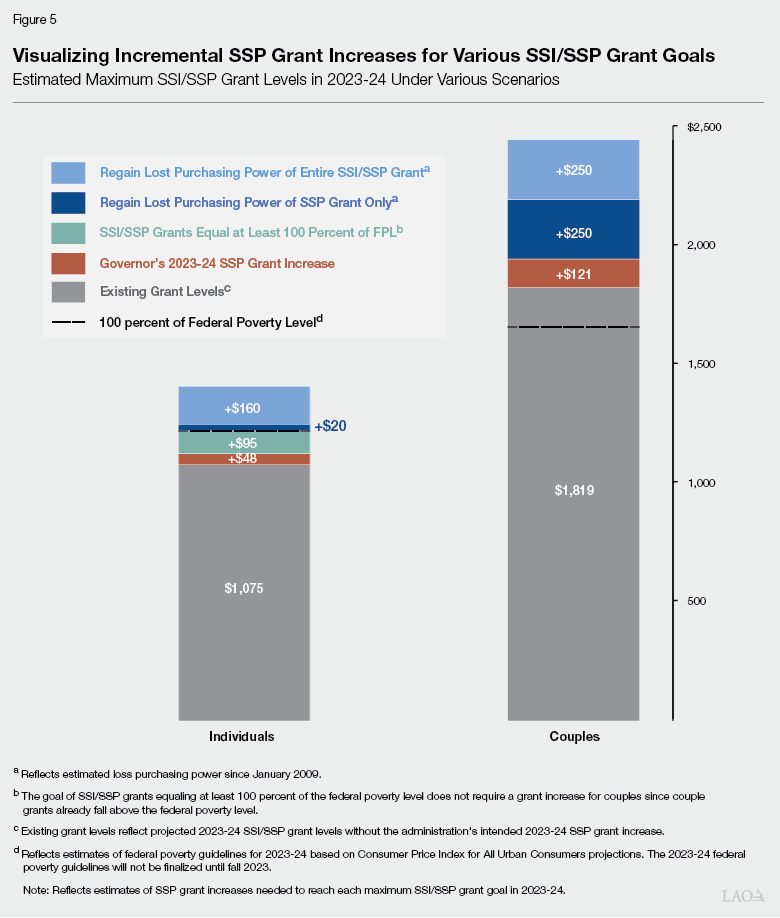

Examples of Possible Goals for SSI/SSP Grant Levels. The Governor’s planned 2023‑24 SSP grant increase (from $199 to $247 for individuals and from $504 to $625 for couples) more than achieves our understanding of the administration’s intended goal increasing SSP grants to reach at least January 2009 levels ($233 for individuals and $568 for couples). However, as shown in Figure 5, the Governor’s planned 2023‑24 SSP grant increase would not be enough to achieve alternative definitions of “pre‑recession” levels and SSI/SSP goals, which we describe below.

- Increase Grants to Regain Purchasing Power Lost Since 2008‑09. During the Great Recession, the state stopped providing annual COLAs. As a result, the value, or purchasing power, of the maximum SSI/SSP grants eroded over time. Specifically, if the state provided consistent annual COLAs beginning in 2008‑09, we estimate that maximum SSI/SSP grants would be roughly $115 to $275 higher for individuals and roughly $250 to $500 higher for couples relative to projected 2023‑24 grant levels. (The actual loss in purchasing power depends on whether the annual state COLA would have been provided only to the SSP portion of the grant [similar to the 2016‑17 and 2021‑22 SSP grant increases] or the whole SSI/SSP grant [similar to state COLAs provided prior to Great Recession].) Overall, to fully make‑up for the loss in purchasing power in 2023‑24—depending upon which type of COLA is used—we estimate that an additional roughly $700 million to $1.6 billion General Fund (annualizing to roughly a $1.4 billion to $3.3 billion General Fund increase in 2024‑25 and ongoing) would be needed above what is already included in the Governor’s multiyear budget projections.

- Increase Grants to 100 Percent of FPL for All Recipients. Another possible SSI/SSP goal could be to bring the maximum SSI/SSP grants for all recipients to at least 100 percent of the FPL (similar to how maximum SSI/SSP grants for individuals compared to the FPL in January 2009). This would, in part, address the current disparity of maximum SSI/SSP grants for couples continuing to fall above the FPL while maximum SSI/SSP grants for individuals are projected to remain below the FPL in 2023‑24 despite the Governor’s intended SSP grant increase. We estimate that maximum SSP grants for individuals would have to increase by about 70 percent to reach at least 100 percent of the FPL in 2023‑24. This means that SSP grants for individuals would need to increase by about $95—beyond the increase the Governor has included for 2023‑24—to reach at least 100 percent of the FPL. One way the Legislature could structure such a grant increase would be to fully redirect the funding for the 2023‑24 SSP grant increase to only increase grants for individuals, meaning SSI/SSP grants for couples would remain the same. If the Legislature took this approach, we estimate that it still would need to provide roughly $600 million additional General Fund (roughly $1.2 billion in 2024‑25 and ongoing) to increase maximum SSI/SSP individual grants to 100 percent of the FPL.

Ways the Legislature Could Structure SSP Grant Increases to Further Its Goals. As we have discussed above, there are various goals the Legislature may wish to establish when considering SSI/SSP grant increases, all at various costs. Once the Legislature sets its goals for the program, it can ensure that whatever funding level provided for SSI/SSP grant increases—be it the $296 million in 2023‑24 ($593 million in 2024‑25 and ongoing) proposed by the Governor or some other amount—furthers those goals. Below we discuss additional approaches the Legislature could consider in structuring an SSP grant increase to further its own goals.

- Develop Phase in for Grant Increases Over Multiple Years. We understand that the proposed timing of the SSP grant increase—January 1, 2024—reflects intent language adopted in the 2021‑22 budget. Depending on the Legislature’s ultimate goal for SSI/SSP grants, it could consider an alternative start date for the proposed SSP grant increase (such as January 1, 2023). Additionally, if the Legislature were interested in ultimately increasing SSP grants above the proposed 2023‑24 SSP grant increase, it could phase‑in the remaining grant increases over multiple years.

- Target Available Resources to Most Effectively Achieve Legislature’s Goals. The Legislature may have other SSI/SSP goals that could suggest targeting the grant increases among recipients. For example, if the Legislature established a goal to ultimately bring the maximum SSI/SSP grant for all recipients to at least 100 percent of the FPL, providing the same grant increase to all SSI/SSP individuals and couples (as proposed by the Governor) would maintain the disparity between individual and couple beneficiaries relative to the FPL. Instead, the available funding included in the Governor’s budget could be prioritized for individuals’ grants. The Legislature could also target available resources to increase grants for certain grant categories or recipient groups (such as SSI/SSP recipients residing in residential care facilities).

- Provide Annual State COLAs to Maintain Value of Grant Levels. Once SSI/SSP grants are at desired levels, the Legislature also may want to consider providing ongoing COLAs to maintain the purchasing power of those grants. This approach would align with existing intent language to provide annual state COLAs. The Legislature could consider what start date aligns with its SSI/SSP grant goal (such as beginning in 2022‑23 per existing intent language or a later date). Additionally, the Legislature could structure the COLAs as whole‑grant COLA (similar to how state annual COLAs were provided prior to the Great Recession). This approach maintains overall SSI/SSP grant levels consistent with changes in California prices. Alternatively, the Legislature could provide annual COLAs only to the SSP portion of the grant (similar to how the SSP grant increases were applied in 2016‑17 and 2021‑22). This approach maintains the state‑funded SSP portion of the grant based on changes in California prices, while federal COLAs would continue to adjust the SSI portion of the grant based on national prices. To the extent the Legislature does provide ongoing COLAs, it would want to consider how these long‑term costs would be sustained in future years.

Legislature May Wish to Revisit Existing 2023‑24 SSP Grant Increase Language in Light of Its Goals. After determining its SSI/SSP grant goals, the Legislature may wish to revisit the 2023‑24 SSP grant increase language in light of those goals. Importantly, the language indicates that an SSP grant increase will be provided in 2023‑24 (subject to Budget Act of 2023 appropriation), but is not specific about the amount of that grant increase. Additionally, the language assumes that the grant will be provided in a similar way to the grant increase that was provided in the 2021‑22 budget. To the extent the Legislature’s goal may require the SSP grant increase to be provided utilizing a different methodology, some changes will be needed. The Legislature also could consider providing annual state COLAs following the SSP grant increase as a way to maintain the purchasing power of the grant given future inflation. Overall, whatever grant goal the Legislature selects and chooses to reflect in language, it will want to consider balancing the long‑term costs associated with SSP grant increases and annual COLAs with the ability to sustain these costs in future years.