February 9, 2022

The 2022-23 Budget

Analysis of the Medi-Cal Budget

- Background

- Overview of the Governor’s Budget

- Analysis of Technical Adjustments

- Analysis of Select Discretionary Proposals

Summary

Overall Medi‑Cal Budget Picture. The Governor’s budget proposes $34.9 billion for Medi‑Cal from the General Fund ($133 billion total funds) in 2022‑23, an increase of roughly $8 billion (30 percent) over the revised 2021‑22 General Fund estimate. Of this $8 billion, $6.4 billion is for technical and workload adjustments, with the balance for policy proposals.

Assumed Expiration of the Public Health Emergency (PHE) Is Reasonable, While Leaving Room for Fiscal Upside. In 2020, Congress approved an increase in the federal share of cost for Medicaid for the duration of the PHE related to COVID‑19. The Governor’s budget assumes the PHE remains in place through June 2022, which we find reasonable. However, an additional extension of the PHE is plausible, in which case we estimate that every additional quarter the PHE is in effect would result in roughly $300 million in General Fund savings in Medi‑Cal.

Governor’s Caseload Projections May Be Overstated; End Date of PHE Relevant. The administration projects continued caseload growth until the budget’s assumed end of the PHE in June 2022, after which the administration projects steep caseload declines. To assess the reasonableness of the Governor’s projections, we model two scenarios—one where the PHE expires in April 2022 and another where the PHE is extended until July 2022. In both scenarios, we project lower caseload than the administration and hundreds of millions of dollars in General Fund savings across 2021‑22 and 2022‑23 compared to the Governor’s January budget.

Recommend Legislative Consideration of Options to Renew the Managed Care Organization (MCO) Tax. The current MCO tax is scheduled to expire in December 2022. By not proposing to renew the MCO tax, the Governor’s budget would allow it to expire, raising General Fund costs in Medi‑Cal by around $1.6 billion annually beginning in 2023‑24. While we agree with the administration that the reprocurement of MCO’s Medi‑Cal contracts presents challenges for the MCO tax’s renewal, we think this barrier could be overcome. We recommend the Legislature explore the feasibility and trade‑offs of options for renewing the MCO tax as part of its budget deliberations.

Two Discretionary Policy Proposals Raise Questions for Legislative Consideration. We analyze the Governor’s proposals to: (1) make payments to providers to promote health equity and outcomes and (2) eliminate certain provider payment rate reductions. We provide several questions for the Legislature to ask the administration to assist in its assessment of these proposals and suggest that it consider alternative and/or complementary approaches to fulfilling the goals behind them.

Background

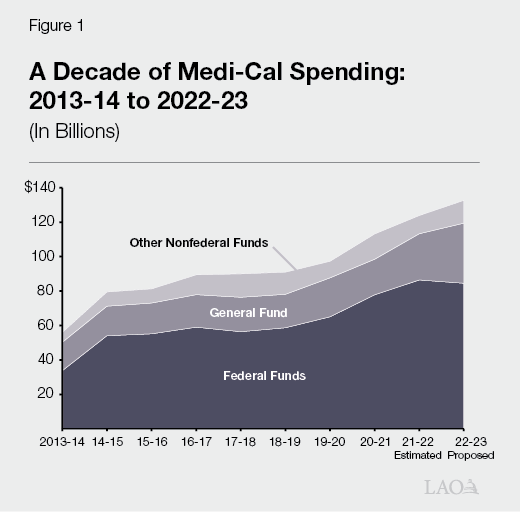

Medi‑Cal Is the State’s Medicaid Program. Medi‑Cal provides health care coverage to over 14 million Californians with low incomes. As a joint state‑federal program, costs are shared between the federal and state as well as local governments. The Department of Health Care Services (DHCS) administers the Medi‑Cal program. Figure 1 summarizes Medi‑Cal spending trends over the last decade. Federal funds currently support 69 percent of total Medi‑Cal expenditures, followed by General Fund (20 percent) and other state and local funds (11 percent).

Overview of the Governor’s Budget

Current Year

Estimated General Fund Spending Revised Downward by $1.3 Billion to Slightly Above $26.8 Billion. The Governor’s budget estimates Medi‑Cal spending to be $26.8 billion General Fund ($124 billion total funds) in 2021‑22. This reflects an approximately $1.3 billion (nearly 5 percent) downward adjustment relative to what was assumed in the 2021‑22 Budget Act. This downward adjustment is very similar in magnitude to that made last January to the prior year’s budget act at the Governor’s 2021‑22 budget. Below, we describe the major drivers of this net General Fund downward adjustment.

Extension of COVID‑19 Public Health Emergency (PHE), Generating General Fund Savings. As a part of federal COVID‑19 response legislation, Congress approved a 6.2 percentage point increase in the federal government’s share of cost for Medicaid for the duration of the COVID‑19 national PHE. To be eligible for this increased federal funding, states must comply with several requirements on top of standard Medicaid rules, the most important being a prohibition on states from terminating eligibility for existing beneficiaries except in limited circumstances. This is known as the “continuous coverage requirement.” The federal government determines when the PHE is over. While the increase in federal funding lowers General Fund costs in Medi‑Cal, the continuous coverage requirement raises General Fund (and total fund) costs by increasing Medi‑Cal caseload levels above what they otherwise would be. On net, the state receives significant savings for each period the PHE remains in effect. The 2021‑22 Budget Act assumed the increase in federal funding would expire at the end of December 2021, whereas the Governor’s budget assumes a six‑month extension of the PHE through the end of the 2021‑22. We estimate that about $900 million of the downward General Fund adjustment in 2021‑22 is due to the assumed extension of the PHE. We assess the reasonableness of the Governor’s budget assumptions on the expiration of the PHE in the “Analysis of Technical Adjustments” section of this report.

Shift in the Timing of Payments, Leading to Lower Costs. Medi‑Cal is budgeted on a “cash basis,” meaning that costs are based on when payments are made rather than when services are delivered. Changes in the timing of payments occur regularly and are difficult to predict. Additionally, implementing new Medi‑Cal programs and policy changes often occurs more slowly than the budget anticipates, which can result in shifts of funding to subsequent years. Shifts of funding between years due to these factors result in around $740 million in General Fund savings in 2021‑22. About $550 million of these General Fund savings reflect a shift of funding into 2022‑23, primarily due to new implementation time lines for various 2021‑22 behavioral health augmentations and the California Advancing and Innovating Medi‑Cal (CalAIM) reform package.

Higher Federal Repayments and Deferrals. Federal Medicaid rules require the state to repay the federal government when federal funding is claimed in error. Additionally, the federal government defers the availability of federal funds when it identifies claims that potentially were made in error. In cases where the federal government subsequently determines the claiming was not done in error, the deferred federal funds will be released and made available to the state. In both situations, General Fund generally must be used to repay the federal government or backfill deferred federal funds until they are released. The revised 2021‑22 Medi‑Cal budget estimates General Fund costs related to federal repayments and deferrals to be about $500 million higher than was assumed in the budget act, reflecting one of the largest individual upward adjustments since 2016‑17. This significant upward adjustment reflects (1) the federal government’s clarification of how much the state must repay for prior years of erroneous claims within the managed care system ($249 million), (2) a shift in the timing of a repayment related to dental services from 2020‑21 to 2021‑22 ($190 million), (3) a downward revision to the estimated amount of increased federal funding available to support the costs of certain immigrant populations for which the state had previously been under‑claiming federal funds ($102 million), and (4) updated assumptions related to the timing by which deferred federal funds would be released ($77 million).

Lower One‑Time Costs for CalAIM. CalAIM is a large set of reforms in Medi‑Cal to expand access to new and existing services and streamline how services are arranged and paid. As part of the streamlining effort, the state is changing requirements related to which beneficiary populations are mandatorily enrolled in managed care or fee‑for‑service (Medi‑Cal’s two main delivery systems). These transitions are expected to occur in 2022 and 2023. While the transitions are assumed to be cost neutral on an ongoing basis, one‑time costs are anticipated due to differences in the timing of payments between managed care and fee‑for‑service. The 2021‑22 Budget Act included $175 million General Fund to support these one‑time costs. The Governor’s budget revises these costs downward by $170 million General Fund. According to the administration, correcting a budgeting error is the primary reason for the adjustment.

Budget Year

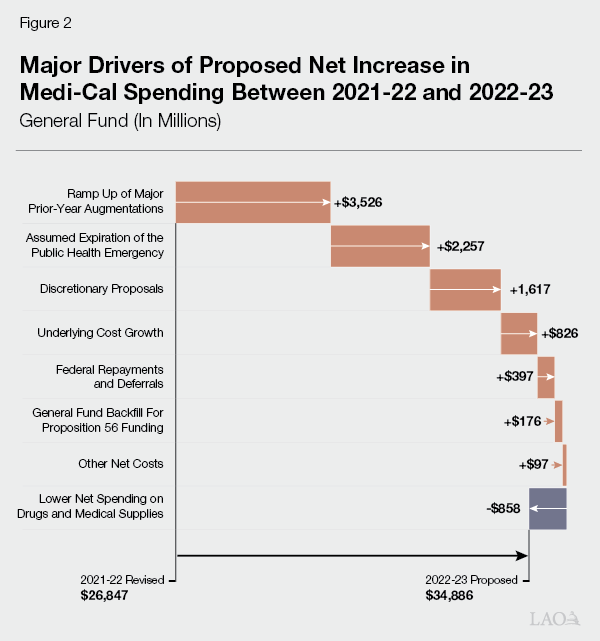

Proposed General Fund Spending Growth of $8 Billion—to $34.9 Billion—Between 2021‑22 and 2022‑23. The Governor proposes $34.9 billion in General Fund spending ($133 billion total funds) in 2022‑23, a roughly $8 billion (30 percent) increase in General Fund spending over the revised 2021‑22 estimate. This reflects the largest year‑over‑year dollar increase in General Fund spending in the last decade and is roughly equivalent to the largest percent increase in General Fund spending over the same time period, which occurred between 2020‑21 and 2021‑22. Figure 2 shows the major drivers of the proposed net increase in Medi‑Cal spending between 2021‑22 and 2022‑23.

Technical Adjustments Account for $6.4 Billion of the Net Growth in Spending

Technical adjustments, or changes in the funding needs of the program under existing program rules, account for around 80 percent of the growth in proposed General Fund spending between 2021‑22 and 2022‑23. While the following paragraphs summarize the major General Fund cost drivers, many additional factors contribute to this increase in proposed spending.

Ramp Up of 2021‑22 Augmentations. The 2021‑22 Budget Act included multiple, multiyear Medi‑Cal augmentations for which the associated spending was expected to ramp up in subsequent years. These include, for example, CalAIM and certain components of the Children and Youth Behavioral Health Initiative. Additionally, as previously noted, implementation of certain 2021‑22 augmentations have been slower than anticipated, resulting in spending originally expected to occur in 2021‑22 shifting into 2022‑23. These two factors lead to sharply rising General Fund costs to implement 2021‑22 budget act augmentations in 2022‑23 compared to 2021‑22. The ramp up of these augmentations accounts for $3.5 billion (44 percent) of the overall year‑over‑year net increase in General Fund spending in Medi‑Cal.

Assumed Expiration of the PHE, Raising General Fund Costs. As previously discussed, the Governor’s budget assumes the PHE expires at the end of June 2022, ending the increase in the federal share of cost, the continuous coverage requirement, and other temporary COVID‑19‑related policies. Because the state receives significant net savings under the PHE, its assumed expiration at the beginning of 2022‑23 has the effect of significantly raising General Fund costs in Medi‑Cal on a year‑over‑year basis. We estimate that, under the Governor’s budget assumptions, the expiration of the PHE is responsible for nearly $2.4 billion (28 percent) of the overall net growth in General Fund spending between 2021‑22 and 2022‑23.

Underlying Cost Growth. Underlying cost growth reflects changes in Medi‑Cal costs due to health care cost inflation and underlying service utilization trends. We estimate that underlying cost growth accounts for about $830 million (10 percent) of the overall net increase in General Fund spending between 2021‑22 and 2022‑23.

Higher Federal Repayments and Deferrals. About $397 million (5 percent) of the overall year‑over‑year net increase in General Fund spending is associated with repayments to the federal government for erroneously claimed federal funds and the deferral of federal funding. This increase largely is the result of a large, one‑time repayment to the federal government for erroneous claims within managed care.

Additional General Fund Needed to Backfill Projected Declines in Proposition 56 (2016) Revenues. Proposition 56 raised state taxes on tobacco products and dedicates most revenues to Medi‑Cal on an ongoing basis to increase payments to Medi‑Cal providers. The administration projects a substantial decline in Proposition 56 revenues between 2021‑22 and 2022‑23, primarily as a result of the anticipated implementation of a statewide ban on the sale of flavored tobacco products. Under the administration’s projections for 2022‑23, Proposition 56 would not provide enough revenue to Medi‑Cal to cover the costs of Proposition 56‑funded provider payment increases. To sustain these increases, the Governor proposes to use General Fund in place of Proposition 56 funds, which has the effect of raising projected General Fund spending in Medi‑Cal by $176 million.

Higher Prescription Drug and Medical Supply Savings. The state collects rebates on the prescription drugs and medical supplies used by Medi‑Cal beneficiaries. The associated revenue, the amount of which is hard to predict in advance, is used to offset state and federal spending in Medi‑Cal. In January 2021, the state began to implement Medi‑Cal Rx, which transfers Medi‑Cal’s pharmacy services benefit from managed care to fee‑for‑service. The Governor’s budget projects that Medi‑Cal Rx will result in gradually increasing savings over time. Between 2021‑22 and 2022‑23, the Governor’s budget projects that net General Fund spending on prescription drugs and medical supplies will fall by $868 million. These projected net savings are driven both by the assumed higher savings from implementing Medi‑Cal Rx and projected increases in rebate revenue not connected to Medi‑Cal Rx.

Discretionary Policy Proposals Account for Remaining $1.6 Billion in Cost Growth

The Governor proposes a number of discretionary augmentations to the Medi‑Cal budget, totaling about $1.6 billion. These augmentations collectively account for 20 percent of the net increase in General Fund spending between 2021‑22 and 2022‑23. The ongoing costs of these augmentations are expected to be over $2 billion General Fund annually. The remaining paragraphs in this section describe those proposals.

Behavioral Health Bridge Housing Funding. The Governor proposes $1.5 billion General Fund in one‑time funding (available over two years) to augment last year’s Behavioral Health Continuum Infrastructure Program to provide immediate housing support (and time‑limited treatment services) for people with behavioral health needs. While many details of this proposal remain under development, the funding is intended to go to counties. We plan to analyze this proposal in a separate behavioral health‑focused budget post.

Expansion of Medi‑Cal to All Income‑Eligible Californians. Historically, undocumented immigrants who were income‑eligible for Medi‑Cal only qualified for coverage for their emergency‑ and pregnancy‑related services. Over the last several years, and in a number of steps, the Legislature has expanded comprehensive Medi‑Cal coverage to all income‑eligible undocumented immigrants who are under the age of 26 or over the age of 49. The Governor proposes to expand comprehensive Medi‑Cal coverage to all income‑eligible undocumented immigrants aged 26 through 49 (the last remaining population not eligible for comprehensive Medi‑Cal coverage) beginning no earlier than January 1, 2024. While no funding is provided within the budget window (2021‑22 and 2022‑23) due to the proposed schedule of implementation, the administration estimates the expansion would cost $614 million General Fund ($819 million total funds) beginning in 2023‑24. On an ongoing basis, the administration projects the expansion would cost $2.2 billion General Fund ($2.7 billion total funds) annually. Of this ongoing annual spending, about $400 million General Fund is expected to fall outside of the Medi‑Cal budget and instead be captured in the In‑Home Supportive Services (Department of Social Services) budget. We will analyze this proposal in a separate publication on the Governor’s health care access and affordability proposals.

Equity and Practice Transformation Grants. The Governor proposes $200 million General Fund ($400 million total funds) in one‑time Medi‑Cal spending in 2022‑23 to promote health equity and improve outcomes in the areas of children’s preventive services, maternal health, and mental health and substance use disorder treatment. The goals of the initiative include, for example, the closing of racial and ethnic disparities in child immunizations, prenatal care, and child delivery via cesarean section. We further describe and analyze this proposal in the final section of this brief.

Reduce Medi‑Cal Premiums to $0. While Medi‑Cal coverage is free for the vast majority of program recipients, several hundred thousand beneficiaries must pay premiums to remain enrolled in the program due to their incomes being over standard Medicaid income‑eligibility levels. For the largest affected population, premiums equal $13 per beneficiary per month, with a family maximum monthly premium of $39. The Governor proposes to reduce all Medi‑Cal premiums to $0 beginning at the start of 2022‑23. The Governor’s budget projects the cost of effectively eliminating Medi‑Cal premiums to be $19 million General Fund ($53 million total funds). We will analyze this proposal in a separate budget publication on health care access and affordability.

Financing Reform for Certain Major Medi‑Cal Provider Types. The Governor’s budget expresses an intent to reform Medi‑Cal financing for three key Medi‑Cal provider types: (1) health centers (nonprofit health care clinics that deliver health care in medically underserved areas and to medically underserved populations), (2) nursing facilities, and (3) public hospitals. We understand that the intent of these reforms generally is to expand the use of value‑based payment models. The administration intends to propose statutory changes to authorize the reforms. The statutory language related to health centers is expected to be released in February 2022. The language affecting nursing facilities is expected within several weeks while that for public hospitals is expected to remain under development through the entire 2022‑23 budget process, and therefore likely will not be available for consideration until at least next year. The only fiscal impact assumed in the Governor’s budget proposal related to these financing reform proposals is for the nursing facilities, which roughly is estimated to cost $46 million General Fund ($96 million total funds).

Eliminate Certain Provider Payment Rate Reductions. To help address the state budget crisis that accompanied the Great Recession over a decade ago, the state put in place Medi‑Cal payment rate reductions of up to 10 percent for a variety of provider types. The Governor’s budget proposes to eliminate these rate reductions for several provider types at a cost of $9 million General Fund ($20 million total funds). We provide further detail and analyze this proposal in the last section of this brief.

Adds New Benefits. The Governor’s budget proposes to add three new benefits to the Medi‑Cal program in 2022‑23: (1) mobile crisis behavioral health intervention services, (2) coverage of the human papillomavirus vaccine within the Family Planning Access Care Treatment program that is operated through Medi‑Cal, and (3) laboratory‑processed crowns within the Medi‑Cal dental program for adult beneficiaries (children on Medi‑Cal already are eligible for this benefit). The Governor’s budget projects $34 million General Fund ($154 million total funds) will be needed to support these new benefits. We will analyze the mobile crisis behavioral health intervention services proposal in our budget post on behavioral health.

Discontinue the Existing Delay in End‑of‑Year Fee‑for‑Service Provider Payment Processing. As a budget solution in 2006‑07, the state implemented a delay in processing fee‑for‑service provider payments for the last two weeks of the fiscal year—a delay which remains in effect today. Because Medi‑Cal is budgeted based on when payments are made, the delayed payment processing generated one‑time savings in 2006‑07. The Governor’s budget proposes to discontinue this delay in provider payment processing in 2022‑23 in order to ease associated provider cash flow challenges. One‑time funding is needed to support the action since it would cause an additional two weeks of provider payments to occur in 2022‑23 as opposed to 2023‑24. The Governor’s budget estimates $309 million General Fund ($796 million total funds) would be needed for this purpose.

Analysis of Technical Adjustments

Budget Assumption on the Expiration of the COVID‑19 PHE

PHE Currently Set to Remain in Place Until April 16, 2022. The federal government declared a national PHE related to COVID‑19 on January 31, 2020. Federal PHEs typically last for 90 days unless renewed by the Secretary of the federal Department of Health and Human Services. On January 14, 2022, the federal government renewed the then‑latest PHE declaration, which otherwise would have expired on January 16, 2022. Unless prematurely terminated (which we do not think is likely), the PHE currently is set to remain in place until April 16, 2022. Additionally, the Biden administration has committed to providing 60‑day notice of a possible termination of the PHE. Accordingly, by mid‑February 2022, the state should know whether the PHE will be allowed to expire in April 2022.

Major Medi‑Cal Fiscal and Policy Changes Under the PHE. The federal government authorized a number of changes to Medicaid policy for the period the PHE is in effect, the two most important being a 6.2 percentage‑point increase in the federal government’s share of Medicaid costs and the continuous coverage requirement previously described. While the continuous coverage requirement expires the month after the PHE ends, the increased federal share of cost does not expire until the end of the quarter which includes days in which the PHE is in effect. Accordingly, if the PHE expires in April 2022, the increased federal funding would expire at the end of June 2022 while the continuous coverage requirement would no longer remain in place as of May 2022. The timing of the expiration of the PHE is the most significant fiscal uncertainty in the Medi‑Cal budget.

Budget’s Assumed Expiration of PHE in June 2022 Is Reasonable, While Leaving Room for Fiscal Upside. The Governor’s budget assumes the PHE remains in place through June 2022, six months later than was assumed in the 2021‑22 Budget Act. Although the budget assumption was developed prior to the most recent federal action to extend the PHE, the assumption, as it relates to the expiration of the increase in federal funding, is consistent with the latest federal action. In generally being consistent with the latest federal action and current COVID‑19 conditions, we find the Governor’s budget’s assumed expiration of the PHE to be reasonable. Nevertheless, given existing COVID‑19 conditions and uncertainties, an additional extension of the PHE is entirely plausible. An additional renewal likely would extend the PHE at least into July 2022—resulting in the increase in federal funding remaining in place through September 2022. We roughly estimate that for every additional quarter the PHE remains in effect past the second quarter of 2022, the state would save around $300 million General Fund in Medi‑Cal (this does not include an estimated nearly $300 million in additional General Fund savings per quarter in the In‑Home Supportive Services and Department of Developmental Services budgets). These estimated quarterly savings reflect the net impact of (1) lower General Fund costs due to the increase in the federal share of cost, (2) higher caseload costs due to the extension of the continuous coverage requirement, and (3) higher other costs related to other temporary policies in place during the PHE (such as increased provider payment rates). Accordingly, we project General Fund spending in Medi‑Cal would be $300 million lower—on net—than the Governor’s budget projects if the PHE is extended by the federal government for another 90‑day period.

Analysis of the Budget’s Caseload Assumptions

Background

Prior to the pandemic, Medi‑Cal provided coverage to around 12.5 million Californians. Medi‑Cal serves a number of discrete populations with somewhat distinct characteristics and costs to the state and federal government. These populations include families with children, seniors aged 65 or older, persons with disabilities, and childless adults who are part of the eligibility expansion under the Patient Protection and Affordable Care Act. Seniors and persons with disabilities tend to have greater needs than some other Medi‑Cal populations, and therefore tend to have higher per‑enrollee costs. Childless adults and families tend to have lower per‑enrollee costs. Additionally, the federal government currently pays 90 percent of Medi‑Cal costs for individuals enrolled as part of the optional expansion, as opposed to 50 percent for most other beneficiary populations.

Substantial Caseload Growth During Pandemic. Between March 2020 and October 2021 (most recent data we have available), the Medi‑Cal caseload has grown by 1.7 million (14 percent) to a total caseload of about 14.2 million. This increase is largely due to two primary factors:

- Employment Losses. The early months of the COVID‑19 pandemic brought unprecedented declines in employment in California. This resulted in an increase in individuals and families becoming eligible for Medi‑Cal due to reduced household income.

- Continuous Coverage Requirement. As previously discussed, the federal continuous coverage requirement effectively prohibits states from terminating Medi‑Cal eligibility for existing beneficiaries except in limited circumstances. This effectively requires the state to suspend most eligibility redeterminations in Medi‑Cal for the duration of the PHE. As a result, enrollees who, under standard Medi‑Cal eligibility rules, would be found to have become ineligible and therefore disenrolled from the program (for example, because they no longer meet the program’s low‑income requirements), now may remain enrolled in Medi‑Cal through the duration of the PHE. This requirement expires the month following the end of the PHE. Once that occurs, states are expected to complete all eligibility redeterminations within 12 months.

Governor’s Budget

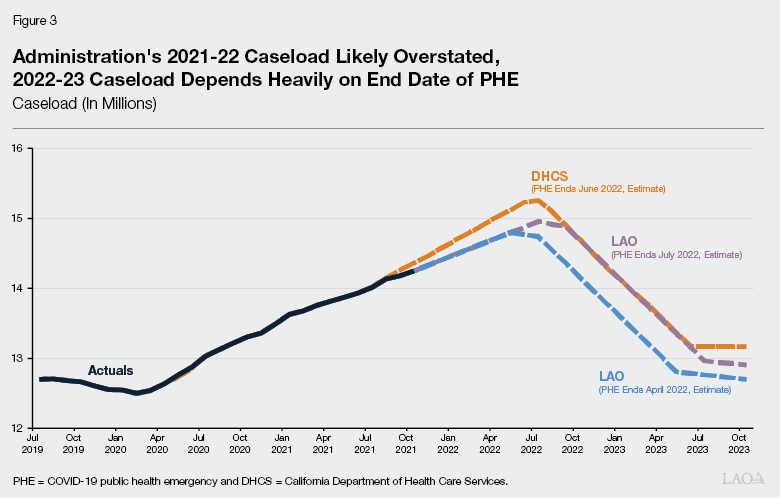

Administration Projects Caseload Will Climb Through June 2022 Before Declining. The administration projects that average Medi‑Cal caseload will continue to rise through June 2022 to a peak of about 15.1 million enrollees before beginning to decline through June 2023 due to the resumption of eligibility redeterminations. As such, the administration assumes that the average monthly caseload in 2021‑22 will be 14.7 million and 14.3 million in 2022‑23.

Assessment

The COVID‑19‑related emergency is unprecedented in the history of Medi‑Cal, and so its impact on Medi‑Cal caseload is difficult to predict. As a result, any projections of near‑term caseload growth and associated costs are highly uncertain. In particular, if the PHE remains in place beyond what is assumed, Medi‑Cal caseload and associated costs likely will be higher in 2021‑22 and 2022‑23 relative to what either the administration or we project. (However, as we discuss elsewhere, an extension of the PHE results in offsetting General Fund savings due to the enhanced federal funding that would continue.)

Administration’s 2021‑22 Caseload Estimates Likely Are Overstated. In order to reach the administration’s estimate for 2021‑22 (which was based on actual caseload data through July 2021), the Medi‑Cal caseload growth would need to increase dramatically over the next several months. As of October 2021 (the month for which the most recent actual caseload data are now available), the Medi‑Cal caseload was slightly under 14.3 million. In order to reach an average of 14.7 million enrollees for 2021‑22, the Medi‑Cal caseload would need to grow by about 126,000 enrollees per month. However, over the last 12 months of available data, average caseload growth has only been about 78,000 enrollees per month. Therefore, monthly caseload growth would have to increase by 62 percent relative to recent trends in order to reach the levels estimated by the administration. Given that monthly caseload growth appears to have slowed considerably following the first year of the continuous coverage requirement being in place, we find such an increase unlikely assuming current caseload trends.

Caseload Projections, Particularly in 2022‑23, Depend Heavily on End Date of PHE. Based on the most recent communication from the federal government, the current PHE will expire in April 2022 unless extended by the federal government. As noted earlier, the continuous coverage requirement will end the month after the PHE expires. After which point, the federal government expects eligibility redeterminations to be completed within 12 months. The administration assumes that both the PHE and the continuous coverage requirement will remain in place through June 2022, and as such, projects that the Medi‑Cal caseload will continue to grow until July 2022 before declining through June 2023 due to the resumption of eligibility redeterminations. However, if the PHE is not extended beyond April 2022, we expect that caseload likely would peak in May 2022 and that eligibility redeterminations would be largely completed by the end of April 2023. As shown in Figure 3, this would result in a lower caseload in both 2021‑22 and 2022‑23 than estimated in the Governor’s budget.

Caseload Would Continue to Grow for Additional Months if the PHE Is Extended. As discussed in more detail later in this publication, there is considerable uncertainty regarding how long the PHE will remain in place. As shown in Figure 3, if the PHE is extended beyond its currently scheduled end date in April 2022, this will significantly affect Medi‑Cal caseload levels by delaying the resumption of eligibility redeterminations. For example, if the PHE is extended for another 90 days until July 2022, eligibility redeterminations would be delayed until August 2022. We estimate this would result in an average monthly caseload of about 14.5 million in 2021‑22 and 14.2 million in 2022‑23.

Despite Overall Caseload Decline, Administration Projects Growth in High‑Cost Seniors and Persons With Disabilities. The administration projects that overall caseload will decline by about 431,000 enrollees between 2021‑22 and 2022‑23 largely due to the assumed expiration of the continuous coverage requirement. The administration projects that this decline will be concentrated among childless adults and families while other caseload groups, including higher‑cost seniors and persons with disabilities, will continue to grow. Specifically, the administration projects that between 2021‑22 and 2022‑23, the number of childless adults and families enrolled in Medi‑Cal will drop by about 480,000 (a 4 percent decline) while the number of seniors and persons with disabilities enrolled will increase by about 48,000 (a 2 percent increase).

Based on enrollment data through October 2021 along with disenrollment data from before and during the PHE, we anticipate that the number of seniors and persons with disabilities who are disenrolled from Medi‑Cal as a result of the resumption of eligibility redeterminations will largely offset any caseload growth that otherwise would occur. Accordingly, we project the seniors and persons with disabilities caseload will remain largely flat between 2021‑22 and 2022‑23, rather than growing by 48,000. Because seniors and persons with disabilities are a relative costly population, our lower projections result in significant savings relative to the administration’s caseload assumptions.

Fiscal Impact of Our Alternative Caseload Assumptions. Assuming the PHE ends in April 2022, we estimate that General Fund costs in Medi‑Cal could be over $800 million lower across the current year and budget year relative to the administration’s assumptions. We note that an extension of the PHE beyond April 2022—which is a real possibility—would delay the end of the continuous coverage requirement and result in higher overall caseloads and associated costs in both 2021‑22 and 2022‑23. However, even if the PHE is extended by 90 days to July 2022, we still project that General Fund costs related Medi‑Cal caseload would be about $300 million lower relative to the Governor’s budget across 2021‑22 and 2022‑23.

Overall Assessment. While our initial projections differ significantly from those of the administration, we recognize that any projections of near‑term caseload growth and associated costs are highly uncertain due to unprecedented nature of the COVID‑19‑related PHE. As a result, we are not at this time recommending an adjustment to the Governor’s budget. We will wait for additional information to make our final assessment and recommendations related to Medi‑Cal caseload costs at the time of the May Revision.

Budget Assumes Expiration of Managed Care Organization Tax

Managed Care Organization (MCO) Tax Expires Halfway Through 2022‑23. For over a decade and following multiple renewals, the state has imposed a tax on MCOs and used the revenues to offset General Fund costs in Medi‑Cal. The current MCO tax has been in place since January 2020 and generates an annual net General Fund benefit of over $1.5 billion. While early versions of the MCO tax taxed MCOs based on their revenues, the recent versions of the MCO tax have taxed MCOs based on their enrollment. For operational and other purposes, the MCO tax is based on a single, fixed period of recent historical MCO enrollment rather than periodically being updated to rebase the tax on the most recent annual MCO enrollment numbers. Because the MCO tax draws down federal Medicaid funds, federal approval of the current MCO tax is necessary. State authorization and federal approval of the MCO tax expire at the end of December 2022.

Governor Does Not Propose an Extension of the MCO Tax, Citing Factors Complicating Its Renewal. The Governor’s budget does not propose to extend the MCO tax, instead allowing it to lapse after December 2022. The administration has shared that the scheduled reprocurement of Medi‑Cal MCO contracts—which likely will lead to changes in which MCOs serve the Medi‑Cal program—as well as anticipated volatility in the Medi‑Cal caseload present challenges for renewing the MCO tax. We agree with the administration that the reprocurement of Medi‑Cal managed care plans temporarily complicates the renewal of the MCO tax, if the tax were renewed with its existing structure. However, once new Medi‑Cal MCO contracts are established and Medi‑Cal enrollment by MCOs can be reasonably estimated, this complication should no longer hold. On the other hand, we are less convinced that the volatility of the Medi‑Cal caseload—anticipated to significantly decline following the end of the COVID‑9 PHE—presents a major complication to the renewal of the MCO tax.

Fiscal Impact of the Budget’s Assumed Expiration of the MCO Tax. The Governor’s budget does not assume a significant General Fund impact from the expiration of the tax in 2022‑23 due to assumptions around the timing by which the associated revenues will be available to support the Medi‑Cal program. Rather, under the Governor’s budget assumptions, the fiscal impact of the expiration of the MCO tax primarily would materialize in 2023‑24, raising annual, ongoing General Fund spending by between around $1.4 billion and $1.6 billion.

Recommend Legislative Consideration of Three Options Related to the MCO Tax. Given the importance of the MCO tax as a reliable funding source for Medi‑Cal, we recommend the Legislature explore the feasibility and trade‑offs of renewing the MCO tax as part of its budget deliberations. Renewal of the MCO tax generally based on the existing model could generate a General Fund benefit of at least $1.5 billion annually for each year it is in place. Three specific options that the Legislature could consider include:

- Renew the MCO Tax Based on the Existing Model for One Year. As previously discussed, we agree with the administration that Medi‑Cal managed care reprocurement presents a challenge for a multiyear renewal of the MCO tax. However, we are not yet convinced that anticipated changes in the Medi‑Cal caseload complicate renewal. With the expiration of the existing MCO tax at the end of 2022 and the anticipated start of new Medi‑Cal managed care contracts in 2024, the MCO tax could be renewed for calendar year 2023 without being subject to the complications resulting from reprocurement. Accordingly, the Legislature could consider directing the administration to develop a plan for a one‑year renewal of the MCO tax. For 2024 and beyond, the Legislature could then reassess when it would be feasible to reimpose the MCO tax following Medi‑Cal managed care reprocurement.

- Provide Multiyear Reauthorization of a Modified MCO Tax Model That Overcomes Reprocurement Challenges. There potentially are a number of ways that the MCO tax could be modified to overcome the challenges posed by reprocurement. For example, rather than basing the tax on a fixed, prior period of MCO enrollment, the state periodically could update the tax base based on more recent MCO enrollment. By updating the tax base in this manner—as Michigan does with its similar tax—the state could ensure that MCOs’ tax liabilities properly reflect the changes in their enrollment and participation in Medi‑Cal managed care resulting from reprocurement. Importantly, some such modifications to the MCO tax model—including rebasing the tax on more up‑to‑date MCO enrollment—likely come with operational and other challenges. We recommend the Legislature consider any such challenges when deciding if and how to modify the MCO tax to allow for a multiyear reauthorization. For example, additional state operations resources may be needed by DHCS to effectively administer a significantly modified MCO tax.

- Allow MCO Tax to Lapse and Renew at a Later Date. Given the challenges in renewing the MCO tax on a multiyear basis and the existing, robust fiscal condition of the state, the Legislature could consider allowing the MCO tax to expire. In this case, we would recommend that the Legislature consider renewing the MCO tax at a later date after managed care reprocurement is completed.

Analysis of Other Technical Issues

Proposition 56 Revenues Could Be Higher Than Expected

Proposition 56 raised state taxes on tobacco products and dedicates most revenues to Medi‑Cal on an ongoing basis. Funding from Proposition 56 for Medi‑Cal is used to increase payments to health care providers, which are intended to ensure timely access, limit geographic shortages of services, and ensure quality care. Because tobacco use is projected to continue to decline on an ongoing basis—partially as a result of the new taxes put in place under Proposition 56—revenues from Proposition 56 for Medi‑Cal are expected to gradually decline on a year‑over‑year basis.

The administration projects a substantial decline of roughly $170 million in Proposition 56 revenues between 2021‑22 and 2022‑23. Although Proposition 56 revenues are expected to gradually decline on a year‑over‑year basis, the administration’s projected revenue decrease primarily is attributed to the anticipated implementation of Chapter 34 of 2020 (SB 793, Hil et. al) which bars retailers from selling flavored tobacco products. This prohibition is expected to substantially reduce Proposition 56 revenues, since it would result in fewer transactions involving tobacco products for the state to tax. However, opponents of this legislation have collected enough signatures to place a referendum for voter approval of SB 793, delaying implementation of this legislation pending the results of the referendum. Accordingly, the administration assumes that the referendum will pass (resulting in voter approval of the flavored tobacco ban) in arriving at its Proposition 56 revenue estimates. The Governor’s Medi‑Cal budget includes $176 million General Fund to backfill this expected revenue decline in 2022‑23 in order to sustain the provider payment increases Proposition 56 has supported. (Of this amount, the Governor also proposes to transition $147 million of provider payment increases on an ongoing basis from Proposition 56 revenues to the General Fund.) If the referendum fails (resulting in voter rejection of the flavored tobacco ban), Proposition 56 revenues will be higher than expected, reducing the need for General Fund to maintain the Proposition 56‑funded provider payment increases by roughly $120 million.

Uncertain Whether Certain Components of CalAIM Will Be Federally Approved

The CalAIM reform package, approved in the 2021‑22 Budget Act, requires federal approval in order to draw down federal funding. As of December 29, 2021, the federal government has approved most of CalAIM. However, discussions are continuing between the administration and federal government on whether the federal government will approve two components of the package, which allows for the availability of federal funding for these services. These components are: (1) providing services to justice‑involved people 90 days prior to release from jail or prison and (2) reimbursing costs for traditional healers and natural helpers for American Indians and Alaska Natives. The Governor’s budget assumes federal approval of these components. However, should the state not ultimately receive approval, alternative annual funding of about $123 million would be needed to support these services or they may not be able to be implemented.

Analysis of Select Discretionary Proposals

Equity and Practice Transformation Payments

Background

Medi‑Cal’s Performance on Certain Health Care Quality and Equity Measures Has Been Poor. DHCS tracks Medi‑Cal’s performance on many different health quality and equity measures across the various Medi‑Cal delivery systems, including within managed care. Examples of key quality and equity measures include whether children receive their recommended immunizations and developmental screenings, the timeliness of prenatal care for expecting mothers, effective antidepressant medication management for individuals with mental illness, and control of hemoglobin levels for individuals with diabetes. A State Auditor’s report from several years ago found that Medi‑Cal performs 40th among state Medicaid programs in providing preventive services to children. A 2020 Health Disparities Report commissioned by DHCS identified widespread health disparities across a range of preventive health measures. Finally, a recent California Health Care Foundation study found that statewide managed care performance on quality measures has declined or remained stagnant as much or more than it has improved over the last decade.

Proposal

Governor Proposes Equity and Practice Transformation Payments to Address Deficiencies in Quality and Equity. As previously noted, the Governor proposes $200 million General Fund ($400 million total funds) in one‑time Medi‑Cal spending in 2022‑23 to promote health equity and improve health outcomes. This funding would be available for expenditure for two years through 2023‑24. The goals of the initiative include (1) improving children’s preventive services utilization; (2) raising maternal and adolescent screening and referral rates for depression; (3) improving follow‑up after emergency department visits for mental health and substance use disorder; and (4) closing racial and ethnic disparities in well‑child visits, child immunizations, prenatal care, and child delivery via cesarean section. Medi‑Cal managed care plans initially would receive the funding and be expected to distribute the funding as grants to providers. The funding is intended to support clinical infrastructure improvements rather than direct health care service delivery. Examples of such clinical infrastructure improvements include developing case management and other systems designed to close care gaps, updating medical record systems, expanding telehealth and remote patient monitoring capabilities, and generally supporting population health improvements. Key aspects of the proposal, such as the selection criteria for grant applications, remain in development.

Assessment

Proposal Appropriately Targets Key Areas of Concern Related to Quality and Equity. Recently, the state has expanded its vision for how Medi‑Cal can serve to improve the health of Californians with low incomes and address longstanding health disparities. CalAIM is the most prominent example of these efforts. To a significant degree, CalAIM focuses on improving care and equity for Medi‑Cal’s most high‑risk, high‑need populations such as individuals who are homeless and/or have behavioral health disorders. CalAIM does not go as far in addressing known health care quality and equity issues for other important Medi‑Cal populations, such as children and expecting and recent mothers. This proposal, by significantly focusing on children’s preventive services and maternal health, appropriately targets addressing an existing gap in the state’s quality and equity efforts within Medi‑Cal. Moreover, following our initial review, the specific goals, such as improving childhood immunization rates and closing racial and ethnic disparities in cesarean child deliveries, target key areas of concern as indicated by existing quality and equity data measures. However, a more comprehensive review of Medi‑Cal’s current performance on quality and equity measures would be necessary to determine whether this proposal leaves unaddressed any specific, major, and comparable quality and equity deficiencies.

Condition of Existing Clinical Infrastructure Among Medi‑Cal Providers Is Difficult to Discern. This proposal rests on the assumption that deficiencies in clinical infrastructure are a major barrier to improving quality and equity within Medi‑Cal. While plausible, we currently do not have sufficient information on the state of existing clinical infrastructure to be able to determine that funding such infrastructure improvements is a key first step in improving Medi‑Cal quality and equity.

Sustained Progress on Quality and Equity Will Depend on the Strength of Future Efforts. In late December 2021, DHCS released a draft report outlining the department’s quality and equity strategy. This report establishes a roadmap incorporating current and prospective reforms for improving quality and equity within Medi‑Cal. In addition to various efforts to improve data quality, DHCS lays out an intent to reform Medi‑Cal payment methodologies to better tie payment levels to the performance of managed care plans and providers on quality and equity measures. For example, starting in 2023, DHCS intends to adjust Medi‑Cal managed care payment rates and member‑assignment methodologies based on their performance on quality and equity measures (the exact changes to these methodologies remain under development). By establishing ongoing incentives for plan and provider improvement, we believe these prospective efforts to tie payment levels to quality and equity will be essential for creating sustained improvement in Medi‑Cal.

Recommend Gathering More Information on Proposal Before Approving. We have a number of key outstanding questions related to this proposal, the answers to which would clarify whether the Governor’s approach is likely to be a successful next step toward improving health care quality and equity. These questions include:

- Are there key quality and equity goals potentially within the scope of this proposal that are left unaddressed and should be incorporated into the proposal?

- What is the condition of Medi‑Cal providers’ existing clinical infrastructure and why does funding related improvements represent a key first step to improving quality and equity within Medi‑Cal?

- How will grant applications be selected and how will the allocation and expenditure of these funds be overseen by DHCS?

- How will DHCS’s other efforts to improve data quality and tie managed care plan and provider payments to performance on quality and equity measures sustain ongoing improvement in these areas?

We recommend the Legislature gather information related to these questions before deciding whether to approve this proposal. Furthermore, we recommend the Legislature focus future oversight and provide input on how the state proceeds to more closely tie Medi‑Cal managed care plan and provider payment levels to quality and equity.

Proposed Elimination of Certain Provider Payment Rate Reductions

Background

In Response to Great Recession State Budget Crisis, State Approved a 10 Percent Reduction in Payment Rates to Many Medi‑Cal Providers. To help address the state budget crisis that accompanied the Great Recession over a decade ago, in 2011, the state put in place Medi‑Cal payment rate reductions of up to 10 percent for a variety of provider types. (Many providers challenged the legality of these payment rate reductions, which resulted in many of the reductions being implemented a few years later when the state prevailed in court proceedings.) Since then, several types of providers and services have been exempted from the payment rate reductions through either DHCS administrative decisions or enacted legislation. (For example, legislation enacted in 2015 exempted dental providers from the 10 percent payment rate reduction.) However, most of the Medi‑Cal payment rate reductions approved in 2011 remain in place.

Proposal

Governor Proposes to Eliminate Rate Cuts for Certain Providers. The Governor’s budget proposes $9 million General Fund ($20 million total funds) to eliminate these payment rate reductions for certain provider types among those still subject to the 2011 rate reductions. These proposed eliminations would apply to payment rate reductions for (1) nurses, (2) alternative birthing centers, (3) audiologists and hearing aid dispensers, (4) respiratory care providers, (5) durable medical equipment oxygen and respiratory services, (6) chronic dialysis clinics, and (7) emergency air medical transportation. (In addition, the Governor separately proposes to eliminate the payment rate reduction for nonemergency medical transportation providers by converting the current Proposition 56‑funded supplemental payment rate increase for these providers to an ongoing rate increase.)

Assessment

Why Proposal Prioritizes Certain Providers for Restored Rates Over Others Is Unclear. The Governor’s proposal to eliminate Medi‑Cal payment rate reductions does not apply to all of the provider types currently subject to these reductions. Accordingly, the Governor’s proposal prioritizes certain Medi‑Cal providers for restored payment rates over others (who would still be subject to the previously approved reductions). The administration has not provided a clear rationale for why these select Medi‑Cal provider types should be prioritized for restored payment rates. The administration broadly has stated that the proposed elimination of payment rate reductions is intended to address the impacts of COVID‑19, but has not provided information that indicates that the select group of providers targeted in the Governor’s proposal are disproportionately impacted by COVID‑19 (relative to other provider types currently subject to payment rate reductions).

Lack of Funding to Eliminate Rate Reductions Within Managed Care Raises Questions. Medi‑Cal managed care plans often—but not always—tie the payment rates they pay their contracted providers to the rates paid in the Medi‑Cal fee‑for‑service delivery system. At the same time as the fee‑for‑service provider payment rates were reduced, the state adjusted downward managed care payment rates to reflect an assumed equivalent reduction in provider payments for their contracted providers. While the administration’s proposal to restore rates likely would affect payment levels in both fee‑for‑service and managed care, the proposal’s cost estimate only reflects rate increases for fee‑for‑service providers. Fee‑for‑service providers serve only about 20 percent of Medi‑Cal enrollees, with the remaining being enrolled in managed care. The administration states the managed care costs would be small and difficult to estimate. However, if the relative impact of the proposed restorations were similar to that of all the cuts in effect, then we would expect funding the elimination of these rate reductions in managed care could cost as much as roughly twice that of fee‑for‑service. By not budgeting any funding within managed care, the Governor’s proposal appears to assume that plans would (temporarily) absorb the costs of any provider payment increases associated with the elimination of the payment reductions.

Recommend Considering Alternative Approaches and Comprehensive Cost Estimates. Why this select group of Medi‑Cal providers is targeted under this proposal is unclear. Accordingly, the Legislature could consider requesting the administration to provide a clear rationale for why these provider types were chosen. Information to request from the administration in this regard could include evidence that these provider types have experienced relatively worse impacts from COVID‑19 than other providers. In addition, the Legislature could request information justifying the assumption that managed care plans’ potential costs related to the action would be minimal. Finally, before approving the Governor’s proposal, the Legislature could consider assessing the merits (and related costs) of restoring Medi‑Cal payment rates for other or all remaining provider types that still would be subject to the 2011 rate reductions under the Governor’s proposal. Across managed care and fee‑for‑service, we estimate the annual cost of restoring all the provider payment reductions currently in place to be roughly $200 million General Fund ($550 million total funds). (These amounts include the estimated cost of the Governor’s proposed restorations.)