LAO Contact

February 11, 2022

The 2022-23 Budget

Governor’s Office of Business and Economic Development Proposals

Summary. This post provides some background about the Governor’s Office of Business and Economic Development (GO‑Biz), describes the Governor’s budget proposals for GO‑Biz, and offers comments and issues for the Legislature to consider.

Background

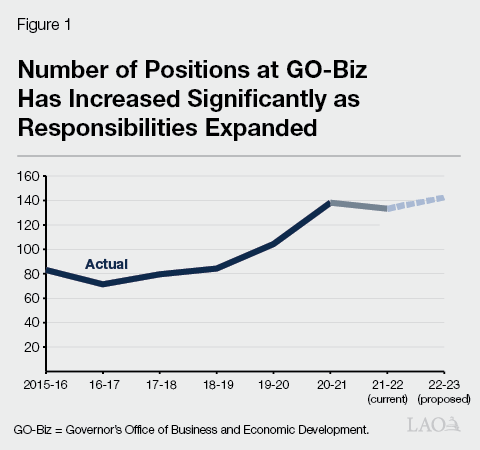

GO‑Biz Coordinates Business Assistance and Economic Development Activities. The state has had various economic development departments over time. Prior to 2003, the majority of the state’s economic development programs were housed within the Technology, Trade, and Commerce Agency. The 2003‑04 Budget Act abolished the agency and state funding for many of its programs designed to encourage economic development. GO‑Biz was established statutorily in 2011 to be the lead entity for economic strategy and the marketing of California on issues relating to business development, private sector investment, and economic growth. Since then, the responsibilities of the office have been expanded significantly. Figure 1 shows that the number of positions at GO‑Biz has increased by 66 percent over the last five years. These staff provide a wide range of advisory and coordinating roles across the administration related to economic development. Several units of GO‑Biz serve as points of contact for businesses considering relocating to or expanding in California. For example, the California Office of the Small Business Advocate (CalOSBA) provides resources for small businesses and financial assistance for small business advisory centers. Other units assist international investors, help businesses obtain information about business permits, administer the California Competes Tax Credit Program, and administer the Cannabis Local Equity Grant Program. Additionally, the California Film Commission, Travel and Tourism Commission, and the Infrastructure and Economic Development Bank have been assigned for oversight purposes to GO‑Biz.

Governor’s Proposals and LAO Comments

Local Government Budget Sustainability Fund

Community Economic Resilience Fund (CERF) Established Last Year. The 2021‑22 Budget Act included $600 million one‑time American Recovery Plan (ARP) Act fiscal relief funds to start a new grant program for regions to develop and implement regional plans to diversify their economies and develop sustainable industries, including zero‑emission vehicle infrastructure, climate resilience, transit systems, biomass projects, offshore wind, and oil well capping and remediation. As of early February 2022, the Governor’s Office of Planning and Research, the California Labor Workforce Development Agency, and GO‑Biz still are developing the CERF. Proposed budget bill language in Control Section 11.96 would change the funding source for the CERF from federal ARP fiscal relief funds to General Fund.

Governor Proposes New $450 Million Fund for Economic Diversification Grants. The Governor proposes to create the Local Government Budget Sustainability Fund to make grants to counties that have high poverty or high unemployment for economic diversification projects. This proposal would supplement the CERF, funding additional economic diversification projects. The total request is for $450 million General Fund, over three years: $100 million in 2023‑24, $100 million in 2024‑25, and $150 million in 2025‑26.

Proposal Lacks Important Details. This proposal does not provide a detailed justification for the amount of funding requested or the criteria that would be used to make the grants. The administration also is still developing its statewide economic recovery and economic diversification framework—the Just Transition Roadmap—and the CERF, so we are unable to evaluate whether this proposal would fill critical gaps in CERF funding, as the administration has claimed in its comments to the Legislature, or would be a duplicative additional source of funding for economic diversification projects.

Reject Local Government Budget Sustainability Fund. The administration has not provided a clear and compelling justification for the need for $450 million, in addition to the $600 million that already has been provided, for economic diversification projects. Given that this request is for funding beginning in 2023‑24, we recommend that the Legislature reject the Local Government Budget Sustainability Fund proposal and direct the administration to return with a more mature proposal next budget cycle.

Tourism Marketing

Visit California Promotes State as Tourism Destination. The California Travel and Tourism Commission, doing business as Visit California, is a 501(c)(6) nonprofit mutual benefit corporation that operates a massive marketing program to increase in‑state, domestic, and international tourism. Visit California receives funding from assessments on rental car companies, hotels, and other tourism operators. The assessments are collected by the GO‑Biz Office of Tourism.

COVID‑19 Significantly Impacted State Tourism and Visit California Revenue. Tourism is an important industry in the state that was impacted by the COVID‑19 pandemic to a greater extent than many other sectors of the state’s economy. While total consumer spending in California declined by 4 percent in 2020, Visit California estimates that direct travel‑related spending declined by 55 percent. The decline in tourism affects tourism business and, by extension, Visit California’s assessment revenues, which declined from $124 million in 2018‑19 to $76 million in 2020‑21.

2021‑22 Budget Act Provided $95 Million for Tourism Marketing. The 2021‑22 Budget Act included $95 million for tourism marketing in the current year. Visit California received the funding in October 2021 and has committed about $45 million for national and in‑state tourism advertising expenditures. Visit California has a marketing plan that would exhaust the remainder of the $95 million in the current year. The organization also may have additional tourism marketing expenditures above the $95 million. None of the $95 million would be used for administrative expenses.

Governor Proposes Additional $45 Million for Tourism Marketing. The Governor’s budget includes $45 million one‑time General Fund for tourism marketing by Visit California.

Visit California Net Assets Increased Significantly in 2020 and 2021. As revenue collections began to decline at the onset of the pandemic in 2020, Visit California sharply reduced its expenditures. The reduction in expenditures outpaced Visit California’s decline in revenues. Consequently, Visit California has increased its net assets from $20 million at the beginning of 2019‑20 to $58 million by the end of 2021‑22.

Additional State Funding for Marketing Appears Unnecessary. Tourism in California has begun to recover but likely will be depressed for some time because of ongoing public health concerns. While Visit California’s assessment revenue over the next several years will continue to be depressed to some extent, we do not think assessment revenues will decline below 2020‑21 levels. Given the state’s $95 million contribution, stable or increasing revenues, and the significant amount of net assets, we find that Visit California should be able to spend somewhat above their pre‑pandemic levels without additional state funds.

Port Operational and Process Improvements

This item is part of a larger Supply Chain Resilience package. Our analysis of the Governor’s full Supply Chain Resilience proposal, including a more in‑depth analysis of this specific item in the context of the other associated proposals, will be published in a separate post.

Governor Proposes $30 Million for Grants to Ports. The Governor’s budget includes $30 million General Fund, one time, for grants to make operational and process improvements at the state’s ports to help alleviate supply chain problems.

Grants Might Help Implement Common Standard for Freight Data. The Federal Maritime Commission currently is identifying data interoperability problems at ports. Their initial findings will be reported in spring 2022. One possible use for this funding would be to help implement recommendations for common data standards.

Improved Data Interoperability Might Address Supply Chain Problems… Ports, ocean carriers, marine terminal operators, truckers, and railroads apparently lack common data standards that would allow for efficiently sharing cargo records or other relevant information about port and cargo handling operations. This lack of data standards could be contributing to recent supply chain congestion. The federal Maritime Commission and GO‑Biz believe that implementing data standards would help to alleviate these problems.

…But State Role Is Unclear. In the event that GO‑Biz decides to move forward with a focus on helping to improve data interoperability, we observe that there is not a clear role for the state. Federal agencies may be better situated to play a coordinating or incentivizing role. The beneficiaries would primarily be private, for‑profit companies. We note that if adopting common data standards would significantly alleviate supply chain congestion, there would be a clear private‑sector interest in paying to implement the recommendations using their own funds.

Proposal Lacks Key Details. We are unable to fully evaluate the merits of the proposal without more information about how the funding would be allocated and used.

Is GO‑Biz Most Appropriate Agency to Administer This Program? Should the Legislature determine that state funding for these improvements is appropriate, it should then consider which agency is most suited to administer the program. GO‑Biz has a cross‑cutting coordination role for the state’s key economic issues but has limited expertise in technical goods movement issues.

Retail Theft Grants

This item is part of a larger Public Safety package. Our analysis of the Governor’s full proposal for addressing organized retail theft, including a more in‑depth analysis of this item in the context of the other associated proposals, will be published in a separate brief.

Governor Proposes $20 Million for Grants to Small Businesses Affected by Retail Theft Incidents. The Governor’s budget includes $20 million General Fund, one time, to administer grants to small businesses victimized by smash‑and‑grab robberies or that have suffered damage caused during retail theft incidents. The administration has suggested that it would define a small business as having less than $5 million in annual gross revenue.

Several Practical Considerations Must Be Addressed. GO‑Biz has not finalized key details of the proposed new grant program. This is particularly concerning because GO‑Biz has no institutional experience implementing a program like this. There are several practical considerations that would need to be addressed and it may be very difficult or costly to do so. These include:

- What Types of Damages and Losses Would Be Covered and How Much Would Be Covered by the Grant? The range of damage that could be covered by smash‑and‑grab robberies and retail theft incidents is quite broad. GO‑Biz would need to define what damages and losses would be eligible and have the administrative capacity to distinguish between eligible and ineligible damages and losses. In addition, would businesses be compensated for the entire amount of eligible damages or just a portion?

- How Would GO‑Biz Verify Applicant Eligibility? What evidence would be required to substantiate claims of damages or losses? Would a police report be required and would that be sufficient?

- How Would GO‑Biz Verify the Amount of Losses or Damages? Would businesses self‑certify their damages or would they need to provide records? How much effort would be invested to verify the claims for compensation?

- How Would GO‑Biz Verify an Amount Was Not Covered by Insurance? Presumably, damages that are covered by insurance would not be eligible for compensation. Many retailers carry business owners insurance policies that could cover many common damages and losses. However, options allow coverage to vary based on the individual needs of different businesses. Some businesses may not have insurance.

Program Could Have Unintended Consequences. It is unclear that a victim’s compensation model will translate well to small businesses. Would this program have unintended consequences, such as discouraging businesses from taking precautions to prevent theft or to carry sufficient insurance?

Is This Proposal Consistent With Legislature’s Public Safety Goals? In considering the individual components of the package to address organized retail theft, we suggest the Legislature consider whether the goal of this proposal—to provide compensation to some victims of organized retail theft—is consistent with its broader public safety goals. Depending on the Legislature’s priorities, there might be more effective alternatives to this proposal. In our forthcoming brief, we provide a framework to help the Legislature think through its goals and broadly provide various alternatives that expand on existing programs and are based on research.

Immigration Integration

Governor Proposes Package of Funding for Immigration and International Investment Programs. The Governor’s budget includes $11.6 million General Fund, one time, in 2022‑23, and $500,000 annually thereafter, to support several GO‑Biz functions related to international trade, investment, and economic development. Specifically, the proposal would:

- Create a New Grant Program. $8.7 million, encumbered over three years, for a competitive grant program. The grants would be to provide seed funding to cities or counties for programs that provide support to immigrants and immigrant‑owned businesses. GO‑Biz plans to make about 20 grants, in amounts between $200,000 to $1 million.

- Expand Business Quick Start Guides. For many years, GO‑Biz has been producing pamphlets with information to help entrepreneurs set up different kinds of businesses. The proposal would provide $600,000, one time in 2022‑23, and $200,000 ongoing to translate the existing guides into languages other than English, expand the number of guides, and to maintain the guides over time.

- Expand Export Training Network. $2 million, one time, to expand an existing program in the international affairs and trade unit of GO‑Biz that helps business owners export their products to other countries. This expansion would focus on mentoring immigrant and refugee entrepreneurs.

- Fund Trade Missions. $150,000 ongoing to expand cross‑border trade between California and Mexico.

- Establish New Immigrant Business‑Focused Position. Support one new position to administer grant programs and coordinate other immigrant‑focused activities.

How Proposal Complements Existing Programs Is Unclear. The state supports many existing programs and organizations that provide technical assistance, mentoring opportunities, and financial support to underserved businesses and entrepreneurs from underserved communities. How this proposal would help address challenges specifically faced by immigrant businesses that are not addressed by these programs is unclear.

Proposed Local Assistance Program Lacks Key Details. The single largest component of this proposal would fund grants to local governments for programs that might aid immigrants or immigrant business owners. The proposal is conceptual and lacks key details, including:

- Specific Objectives. The proposal provides a broad range of possible uses for the grant funds which does not clearly indicate whether the funds are to be used for immigrant support services generally or narrowly targeted economic development programs for entrepreneurs or existing business owners. The proposal also is unclear whether the purpose is to incentivize innovation—to develop a new pilot program—or to deploy programs or best practices developed in other places.

- Grant Administration Details. The proposal specifies that funds would be awarded competitively, but it does not specify what criteria the new program would use to evaluate the grant applications. While it may be premature to identify specific criteria, a more mature proposal would describe a process for developing the criteria and other regulations for administering the grant program. Other key administrative details would include whether specific geographic regions or immigrant communities would be targeted and how grant performance would be monitored.

- Transparency and Program Evaluation. The proposal does not include specific reporting requirements or a process for evaluating whether the program was effective and whether it could be improved should the Legislature later decide to extend or otherwise change the program.

Translation of Business Assistance Materials to Languages Other Than English Has Merit. Many of the state’s residents have a greater fluency in a language other than English. Translating state resources into languages other than English would have merit not limited to immigrants. The Legislature also could evaluate whether the Department of Consumer Affairs, the Secretary of State, and other state agencies that provide services to businesses should make more of their forms and informational materials available in languages other than English.

Need for Export Trade Network Expansion Unclear. California is a major global exporter. The proposal does not provide an analysis of the specific shortcomings in the current program and how the requested one‑time funding would address those shortcomings. The federal government also provides export and trade assistance. Additionally, many private companies offer consulting services and technical information to exporters.

Technical Assistance Expansion and Capital Infusion Programs

Technical Assistance Expansion Program (TAEP) Helps Fund Business Training and Consulting Centers. TAEP provides supplemental financial support to a wide range of federally contracted and state supported programs—such as Small Business Development Centers (SBDCs), Women’s Business Centers, Procurement Technical Assistance Centers, Minority Business Development Agency Centers, and Veteran Business Outreach Centers—that provide training and consulting to small businesses and entrepreneurs. In 2020‑21, CalOSBA disbursed about $17 million among 83 centers.

Capital Infusion Program (CIP) Provides Grants to SBDCs. The CIP is a competitive grant program for SBDCs, with a focus on expanding assistance in underserved geographic areas. The 2018‑19 Budget Act funded CIP at $3 million per year for five years.

Governor Proposes to Increase and Permanently Fund Small Business Technical Assistance Programs. The Governor’s budget proposes to increase TAEP by $6 million in 2022‑23, from $17 million to $23 million. The budget also would make the funding for TAEP and CIP permanent, a total of $26 million in 2023‑24 and ongoing.

Increase in Funding Appears to be Supported by Demand From Centers. CalOSBA has demonstrated that the existing amount of funding for technical assistance centers is oversubscribed.

Ongoing Funding Reasonable, but Reduces Accountability and Legislative Flexibility. Should the Legislature strongly support continued state funding for the small business training and consulting centers, it would be reasonable to consider funding on an ongoing basis. Ongoing funding provides GO‑Biz and the centers more certainty. While limited‑term funding might make long‑term planning by the centers more difficult, limited‑term funding allows for greater Legislative oversight and budgetary flexibility.

Inclusive Innovation Hub Program

Inclusive Innovation Hub Program Supports Underserved Start‑Up Businesses. The state created the Innovation Hub program in 2010 to develop formal partnerships between industry, startups and entrepreneurs, universities and research institutions, and government in a specific geographic area, focused on a specific sector. The Innovation Hub program lapsed in 2020 but was relaunched in 2021 as the Inclusive Innovation Hub, with a greater emphasis on outreach to businesses and entrepreneurs from underserved regions and communities. The 2021‑22 budget provided $2.5 million one‑time General Fund to establish a new network of ten Inclusive Innovation Hub partnerships. GO‑Biz has not yet announced where the hubs will be located or which organizations are participating in them.

Governor Proposes to Extend and Expand Innovation Hub Program. The budget includes $20 million General Fund to extend and expand the Inclusive Innovation Hub program and rename it to “Accelerate CA: Inclusive Innovation Hub.” Of that amount $13 million would fund an expansion of the network from 10 hubs to 13 hubs, $6.5 million would be used to create a new, one‑time grant program, and $500,000 would pay for GO‑Biz administrative costs.

Grant Program Administered by Inclusive Innovation Hubs. The proposed grant program would provide funds to the Inclusive Innovation Hubs. Each Inclusive Innovation Hub would award up to $100,000 to five new businesses that participated in its programs. Each Inclusive Innovation Hub would determine its criteria for awarding the grants.

Increasing Number of Inclusive Innovation Hubs to 13 Could Be Reasonable… The proposal would expand the number of Inclusive Innovation Hubs from 10 to 13 in order to better align the program with the CERF economic development initiative (described above in the background of the Local Government Budget Sustainability Fund proposal). In developing the CERF, the administration has proposed a map that divides the state into 13 regions. While the state still is developing key details regarding the CERF program, allowing GO‑Biz to establish one Inclusive Innovation Hub in each of the 13 CERF regions could be reasonable.

…But New Funding Would Be Premature. The Inclusive Innovation Hub program is still being established. No specific information is available about the program’s outcomes or needs because it is still being implemented. GO‑Biz previously requested and received one‑time funding of $250,000 per hub to establish the new program. The proposal does not clearly justify why a significant amount of additional funding would now be required.

Consider Evaluating Effectiveness of Inclusive Innovation Hubs. The effectiveness of the 2010‑2020 Innovation Hub initiative has not, to our knowledge, been evaluated. The administration did not study the Innovation Hub programs before providing new funding for Inclusive Innovation Hubs last year. Some Innovation Hubs continued operating without state funds, while others became inactive. Regardless of whether the legislature approves this proposal, we suggest requiring the program to collect information about the Inclusive Innovation Hub programs, such as their other sources of funding, participants, and specific activities, as well as measure specific outcomes. Such evidence would better inform future proposals to modify, expand, or to extend or end the program.

Human Resources Staffing

No Concerns With Proposal for Increased Human Resources Staffing. The Governor’s budget includes $110,000 ongoing General Fund to increases GO‑Biz human resources by one position. The number of positions at GO‑Biz has increased by 66 percent over the last five years as the Legislature has increased the responsibilities of this department. We are not raising concerns with this proposal because management and general administrative expenses typically follow increases in departmental programmatic responsibilities.