LAO Contact

December 16, 2022

Issues That Could Impact Californians’

Health Care Coverage in 2023 and Beyond

Summary

This brief looks at health care coverage in California; provides background on the drivers of the significant decline in the percent of Californians without health care coverage over the last ten years; and discusses various issues that could impact the number of Californians with coverage, and how the type of coverage they have may change, in calendar year 2023.

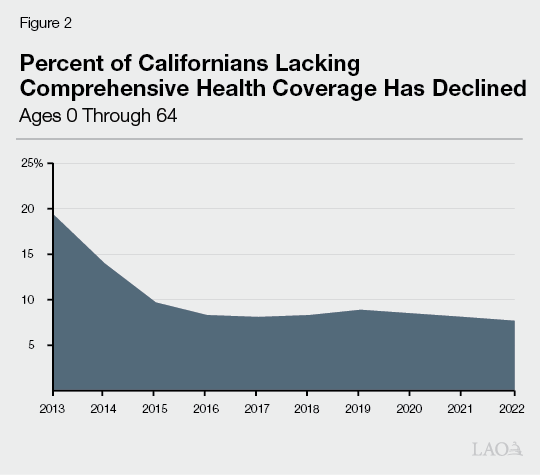

Most Californians Have Health Care Coverage. Since 2013, the percent of Californians who lack comprehensive health care coverage has declined from over 19 percent to about 8 percent. As a result, about 92 percent of Californians have health coverage.

State and Federal Policies Have Improved Health Coverage Rates. Over the last decade, various state and federal policy changes have increased the number of Californians with comprehensive health care coverage. Notable federal policy changes include the Patient Protection and Affordable Care Act (ACA), which gave states the option to expand the populations eligible for Medi‑Cal (the state’s Medicaid program) and create health benefit exchanges like Covered California that offer federally subsidized health insurance to eligible populations. More recently, temporary policies put in place during the COVID‑19 national public health emergency (PHE) have increased the number of Californians with health coverage from what the number would be absent these policies.

In 2023, Various—Potentially Offsetting—Factors Could Impact Coverage Rates. With the possible end of the PHE sometime in the earlier part of 2023, policies that temporarily increased Medi‑Cal enrollment from what it otherwise would be will expire—resulting in a decline in Medi‑Cal enrollment. In addition, state and federal policies could improve Covered California affordability—likely encouraging more people to purchase coverage. Finally, inflation and the unemployment rate could have various impacts on health coverage rates.

Background

Most Californians Have Health Care Coverage

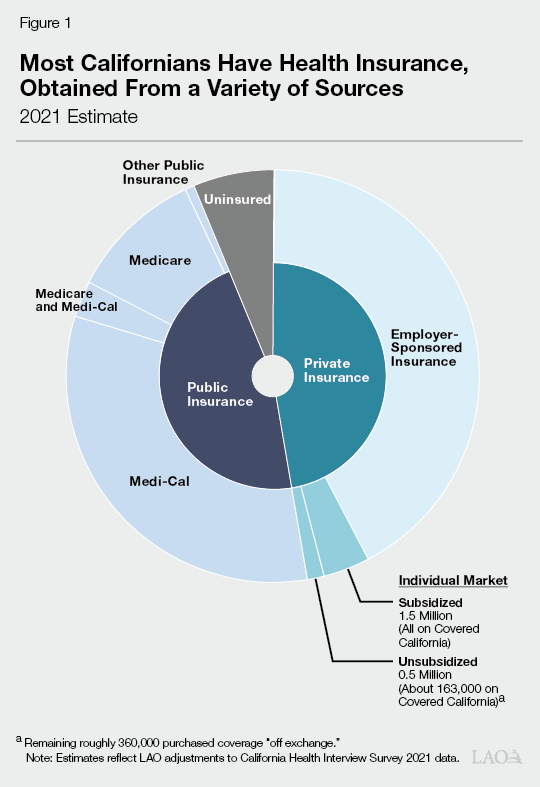

As shown in Figure 1, we estimate that most Californians—92 percent—have comprehensive health care coverage. (Compared to other states, California’s rate of health care coverage is roughly in the middle—some states have higher rates of health care coverage, while others have lower rates of health care coverage.) Employer‑sponsored insurance is the most common source of coverage. Major public health insurance programs, including Medi‑Cal, the state’s Medicaid program which provides health insurance to eligible low‑income people, and Medicare, the federal program that primarily provides health coverage to the elderly, also cover large portions of the state’s residents.

Percent of Californians Lacking Health Care Coverage Has Declined

Over the last decade, various state and federal policy changes have increased the number of Californians with comprehensive health care coverage. As shown in Figure 2, the percent of Californians lacking comprehensive health coverage declined from over 19 percent in 2013 to roughly 8 percent in 2022. The most significant declines are associated with the Federal Patient Protection And Affordable Care Act (ACA)—most of the provisions of which became effective in 2014. In the paragraphs below, we discuss the ACA and other key policies that impacted access to comprehensive health care during this period.

Impacts of the ACA

As noted earlier, the ACA brought about significant changes to the provision of health care coverage in California. Notably, the ACA gave states the option to expand Medicaid eligibility and establish health benefit exchanges.

Expanded Eligibility for Medi‑Cal. Prior to the ACA, childless adults generally were not eligible for Medi‑Cal regardless of income. By opting in to an optional provision of the ACA, California was able to expand Medi‑Cal eligibility to most adults with incomes under 138 percent of the federal poverty level (FPL) regardless of whether they have children. Currently, over 4.5 million childless adults, known as the ACA expansion population, are enrolled in Medi‑Cal.

Establishment of Covered California. The ACA also provided for the establishment of state‑run individual health insurance marketplaces, such as Covered California, that allow consumers to purchase health care coverage. Most consumers who purchase plans through Covered California receive subsidies that reduce or eliminate their premiums. About 1.7 million Californians have health coverage purchased through Covered California.

Individual Mandate for Health Coverage. As originally enacted, the ACA imposed a requirement, referred to as the individual mandate, that most individuals obtain specified minimum health insurance coverage or pay a penalty. The individual mandate was intended to discourage people from going without health insurance coverage, particularly younger and healthier individuals who have lower risk of incurring health care costs and who otherwise would be less likely to enroll in coverage. Increased coverage of younger, healthier populations leads to a more balanced insurance risk pool and allows the costs of covering higher‑risk populations to be spread more broadly. This in turn reduces the average cost of coverage.

As part of the federal Tax Cuts and Jobs Act of 2017, Congress effectively eliminated the federal individual mandate by setting the penalty for violating the coverage requirement to zero beginning in 2019. In response, California adopted a personal health care mandate and penalty which went into effect in 2020. The state’s mandate and penalty were modeled after the original provisions of the ACA and are intended to have similar effects on coverage rates and costs.

COVID‑19 Policies Increased Medi‑Cal and Covered California Enrollment

In response to the COVID‑19 pandemic, the federal government made a number of temporary policy changes impacting Medi‑Cal and Covered California. Many of these policy changes are tied to the COVID‑19 national public health emergency (PHE). The PHE was first declared in early 2020 and has subsequently been extended for numerous 90‑day periods. Currently, the PHE has been extended to at least January 2023. Because the federal government has committed to providing at least a 60‑day notice before ending the PHE and has not provided such notice, we expect the PHE will be extended beyond January 2023.

Continuous Coverage Requirement Increased Medi‑Cal Enrollment. Congress made a number of temporary policy and financing rule changes impacting Medi‑Cal while the PHE is in effect. Notably, federal legislation allows the state to draw down additional federal funding while the PHE is in effect. However, in order to receive the enhanced federal funding for Medi‑Cal, the state must follow certain federal requirements, including a temporary suspension on terminating the eligibility of current Medi‑Cal enrollees, except in limited circumstances, until after the PHE ends. This requirement is known as the “continuous coverage requirement.” Largely as a result of this policy, the Medi‑Cal caseload has increased by 2 million enrollees between March 2020 and July 2022 (the most recent data available). Most of this caseload growth has been among families and the ACA expansion population.

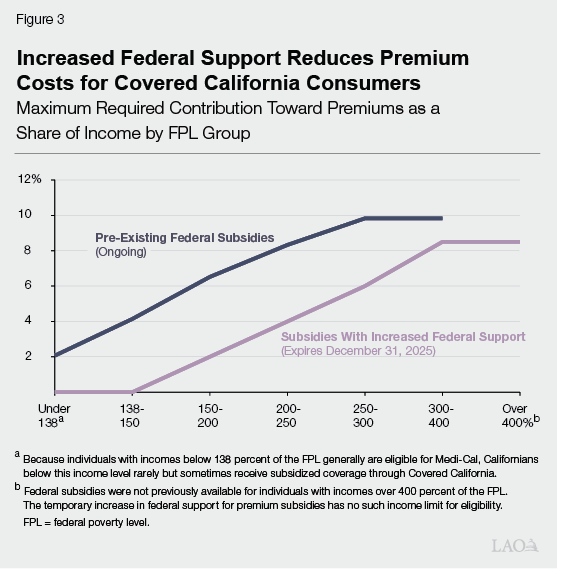

Increased Federal Support for Covered California Premium Subsidies. In 2021, Congress temporarily increased the level of federal support for premium subsidies for coverage purchased on health benefit exchanges like Covered California. While the increased federal support was set initially to expire at the end of calendar year 2022, Congress extended the increased federal support through calendar year 2025. The increased federal support reduced premium costs for Californians by about $1.6 billion per year, with premiums dropping to $0 for many enrollees. As shown in Figure 3, the increased federal support for premium subsidies substantially lowers the cost of premiums Californians need to pay for plans purchased through Covered California—including for households whose incomes made them ineligible for the preexisting premium subsidies under the ACA. Following the initial adoption of the increased federal support, the number of individuals who purchased health coverage through Covered California increased by over 150,000—the largest annual increase in the program’s history.

Medi‑Cal Eligibility for Undocumented Residents

Certain Income‑Eligible Undocumented Residents Can Enroll in Medi‑Cal. Up until recently, all undocumented residents who met the income criteria for Medi‑Cal have been eligible only for restricted‑scope Medi‑Cal coverage, which only covers emergency‑ and pregnancy‑related health care services. Between 2016 and 2020, the state implemented a number of expansions to expand comprehensive Medi‑Cal coverage to income‑eligible undocumented residents who are under the age of 26. Beginning in May 2022, the state further expanded eligibility for comprehensive Medi‑Cal coverage to income‑eligible undocumented residents over the age of 49. About 500,000 undocumented residents are enrolled in comprehensive Medi‑Cal coverage as of July 2022 (the most recent data available).

Remaining Income‑Eligible Undocumented Residents to Gain Medi‑Cal Eligibility in 2024. As part of the 2022‑23 Budget Act, the Legislature approved expanding eligibility to income‑eligible undocumented residents between the ages of 26 through 49 beginning no later than January 1, 2024. At full implementation, over 700,000 undocumented residents between the ages of 26 through 49 are expected to enroll in comprehensive Medi‑Cal.

Various Factors Could Impact Coverage in 2023

In the sections below, we discuss various factors that could impact the percent of Californians enrolled in comprehensive health care coverage in 2023, including federal and state policies, inflation, and potential increases in unemployment. Notably, federal policies will put substantial downward pressure on the Medi‑Cal caseload while increasing Covered California caseload to a lesser degree. In addition, economic factors such as inflation and the unemployment rate could impact the number of people enrolled in health coverage through Medi‑Cal, Covered California, and employer‑sponsored plans.

Medi‑Cal Eligibility Redeterminations Will Resume After PHE Ends

Once the PHE ends, the continuous coverage requirement will expire and counties will have 14 months to redetermine the eligibility of all Medi‑Cal enrollees. However, due to the administrative processes involved, we anticipate that the first individuals to lose Medi‑Cal coverage once eligibility redeterminations restart will not occur until three months after the PHE ends. Were redeterminations to begin in May 2023 (meaning the PHE ends in April 2023), we estimate caseload would peak in July at roughly 14.9 million enrollees before declining to 12.1 million enrollees by July 2024. However, there is considerable uncertainty around such estimates. In the paragraphs below, we discuss various factors that could result in individuals losing Medi‑Cal coverage once eligibility redeterminations restart and steps being taken to reduce the number of individuals who could lose health care coverage—either by taking steps to ensure individuals eligible for Medi‑Cal do not lose their coverage or by helping individuals who are no longer eligible for Medi‑Cal transition to other types of coverage.

Enrollees Who Are No Longer Income‑Eligible for Medi‑Cal. Because eligibility redeterminations have not been conducted since March 2020 and low‑wage workers have experienced wage growth over the last couple of years, many Medi‑Cal enrollees may no longer be income‑eligible for the program. Various steps have been taken to mitigate the likelihood that these enrollees lose access to health care coverage when redeterminations resume. Pursuant to Chapter 845 of 2019 (SB 260, Hurtado), the Department of Health Care Services (DHCS) and Covered California have developed a system to streamline the transition from Medi‑Cal to Covered California for individuals no longer income‑eligible for Medi‑Cal. Upon losing Medi‑Cal eligibility, individuals will be given an option to be auto‑enrolled in coverage through Covered California if eligible. In addition, DHCS and counties have adopted increased flexibilities when dealing with discrepancies between self‑reported information on income‑eligibility and income data from other sources. Due to these flexibilities, certain enrollees could keep their Medi‑Cal coverage even if data from federal data sources suggest their household income is above the threshold. We also note that at least some of the individuals who are no longer income‑eligible for Medi‑Cal could be eligible for affordable health coverage through their employer.

Individuals Who Lose Eligibility for Administrative Reasons. Typically, once a year, enrollees receive a notice that either their Medi‑Cal enrollment has been auto‑renewed based on information already on file or that additional information is needed to verify eligibility. During the PHE, many beneficiaries have had little to no contact with Medi‑Cal eligibility offices. As a result, the information currently on file for enrollees could be out of date. For example, enrollees who have moved since the start of the PHE might not have updated their addresses. In such cases, individuals who might otherwise still be eligible for Medi‑Cal could have their coverage terminated if counties cannot locate them to verify their Medi‑Cal eligibility. DHCS estimates that about 2 million enrollees could be at risk of losing Medi‑Cal eligibility for such reasons. In order to reduce the likelihood of otherwise‑eligible individuals losing their Medi‑Cal enrollment, DHCS is working with county eligibility offices, managed care plans, and the United States Postal Service to try to gain updated contact information for enrollees. In April 2022, DHCS, along with various partners, also launched an outreach campaign in order to help ensure enrollees are aware of any steps they may need to take to ensure their Medi‑Cal benefits continue once eligibility redeterminations resume.

Enrollees Who Turned 65 After March 2020 and Did Not Enroll in Medicare. Under state law, in order to continue to receive Medi‑Cal benefits, individuals who turn 65 must apply for Medicare. Typically, individuals have an opportunity to enroll in Medicare upon turning 65 during an annual open enrollment period. However, because of the continuous coverage requirement, some Medi‑Cal enrollees who turned 65 might not have enrolled in Medicare during the PHE. The federal government has approved a special enrollment period that will commence when the PHE expires to allow such individuals to enroll in Medicare. As a result, individuals who missed previous enrollment windows will have another opportunity to sign up for Medicare, allowing them to maintain their Medi‑Cal eligibility.

Undocumented Residents Who Turned 26 After March 2020. As was discussed earlier, otherwise income‑eligible undocumented residents between the ages of 26 through 49 are not yet eligible for comprehensive Medi‑Cal services. However, many undocumented young adults who have turned 26 since March 2020 have remained in Medi‑Cal due to the continuous coverage requirement. These undocumented residents, who are now 26 or older, could temporarily lose Medi‑Cal eligibility between the end of the PHE and January 1, 2024. In order to prevent a temporary lapse in health care coverage for these individuals, DHCS has directed counties to deprioritize the eligibility redeterminations for such individuals until after January 1, 2024.

Federal Policy Changes Impacting Covered California

Increased Federal Support for Premium Subsidies. The American Rescue Plan Act, which Congress passed in 2021, temporarily increased the level of federal support for premium subsidies for coverage purchased on health benefit exchanges like Covered California. The increased federal support was set to expire at the end of 2022. However, Congress recently extended the increased federal support through 2025.

Federal Rule Change to Address Family Glitch. Under the ACA, households that have access to affordable health insurance through other sources such as an employer are ineligible for federally subsidized health plans through exchanges such as Covered California. Beginning in December 2022, the federal government considers employer‑sponsored coverage of family members to be affordable if the employee’s share of cost for the family’s health care coverage is less than 9.5 percent of household income (this percentage is updated annually). Prior to this rule change, the federal government considered a family to have access to affordable health care coverage if self‑only coverage for at least one household member met the affordability threshold. The definition became known as the “family glitch” because of its potentially adverse impact on families being able to access affordable coverage through the health benefit exchanges in certain circumstances—such as if an employer provided affordable self‑only coverage to employees but contributed little to nothing for the coverage of spouses and dependents. As a result of this rule change, roughly 38,000 Californians who currently lack health care coverage are expected to enroll in plans purchased through Covered California. The rule change also is expected to improve affordability for many Californians who currently have health care coverage but previously were not eligible for premium subsidies through Covered California. Notably, about 100,000 Californians who currently have employer‑sponsored insurance with a share of cost above 9.5 percent of household income are expected to switch to plans purchased through Covered California due to lower monthly costs after the premium subsidies compared to what they would pay if they kept their employer‑sponsored insurance.

Additional Funding Available to Improve Covered California Affordability

Ongoing Funding of $304 Million for Covered California. The 2022‑23 Budget Act included $304 million from the Health Care Affordability Reserve Fund in 2022‑23 for improving the affordability of health care coverage purchased through Covered California, with annual funding of a like amount coming from the General Fund in future years. At the time the funding was appropriated, it was intended to be used to provide a state premium subsidy program beginning in 2023 if the increased federal support for premium subsidies expired at the end of 2022. Since this time, the increased federal support for premium subsidies have been extended through 2025. As a result, the $304 million in state funding can be used to provide additional financial assistance to California residents with household incomes at or below 600 percent of the FPL. Additional financial assistance further could improve affordability and, as a result, encourage some Californians who currently lack health coverage to purchase plans through Covered California. However, the state has not developed a program to use the funding to provide additional financial assistance. Notably, the Governor recently vetoed a bill that would have used the funding to provide further financial assistance in 2023 and 2024 to reduce out‑of‑pocket costs for consumers including reducing copayments and eliminating deductibles. In the veto message, the administration has indicated that it intends to reserve the funding to ensure that state‑only premium subsidies can be provided in the future if the increased federal support for premium subsidies expires in 2025 as currently scheduled.

Impacts of Inflation and the Unemployment Rate on Health Coverage

Our office currently projects a modest increase in the unemployment rate through calendar year 2023. We also project that inflation will be above the historical average in 2023 (although not as high as in 2022). While difficult to quantify, we discuss below the potential impacts these trends could have on the number of people enrolled in comprehensive health insurance—particularly coverage through employer‑sponsored plans, Medi‑Cal, and Covered California.

Higher Unemployment Could Reduce Enrollment in Employer‑Sponsored Health Coverage. The most common form of health coverage in California is employer‑sponsored health coverage—either through an individual’s own job or the job of someone in their household. As a result, some Californians who currently have employer‑sponsored coverage could lose their current health coverage due to job losses. Individuals and families who lose employer‑sponsored coverage may be eligible for other sources of coverage such as Medi‑Cal, plans purchased through Covered California (either with or without premium subsidies), or by enrolling in employer‑sponsored coverage through a new job or another household member’s employer‑sponsored coverage.

Inflation Impacts on Employer‑Sponsored Health Coverage. In addition, insurance companies could raise premiums to cover increased costs due to inflation. If this happens, employers would face higher costs to provide employer‑sponsored insurance and might make changes to the benefits they provide. For example, in response to higher premiums, employers could increase the share of costs employees pay for either self‑only coverage or coverage for their dependents—impacting the affordability of such coverage for employees. However, because premiums generally have been set for 2023 already, the potential impacts of inflation on employer‑sponsored health insurance likely will not occur until 2024. Moreover, whether such changes would impact overall coverage rates is unclear. Depending on how employers change benefits, impacted individuals potentially could shift to subsidized coverage through Covered California.

Medi‑Cal Enrollment Generally Increases With Unemployment Rate. Historically, when the unemployment rate increases, more Californians become eligible for Medi‑Cal. As such, higher unemployment rates in 2023 would result in more people qualifying for Medi‑Cal than if the unemployment rate was lower. However, as previously discussed, we anticipate overall enrollment in Medi‑Cal will still decline over the course of calendar year 2023 due to the resumption of eligibility redeterminations.

Impact of Inflation on Medi‑Cal Enrollment Difficult to Quantify. The effect of inflation on Medi‑Cal enrollment is unclear. The income thresholds for Medi‑Cal, which are based on the FPL, typically are adjusted annually to account for inflation. New FPL guidelines typically are released in January. When the FPL increases, the income threshold for Medi‑Cal also increases. As such, if inflation increases at a faster rate than household income, more households are likely to qualify for Medi‑Cal. Historically, during periods of high inflation, increases in household income have not kept up with inflation. As such, an increase in the level of the FPL in 2023 likely will outpace household income—which will result in an increase in the number of households eligible for Medi‑Cal. On the other hand, because of wage growth for low‑wage workers over the last couple years and the suspension of eligibility redeterminations since March 2020, more Medi‑Cal enrollees could be at risk of losing income eligibility for Medi‑Cal than in a typical year.

Higher Premiums in Covered California. Health plans purchased through Covered California are subject to annual premium adjustments, most typically increases. During periods of higher inflation, premium increases tend to be higher. For the 2023 plan year, premiums are expected to increase on average by 6 percent. In comparison, premiums increased by less than 2 percent on average in 2022. However, due to the structure of federal premium subsidies and the extension of the increased federal support for these subsidies through 2025, most households who purchase plans through Covered California will not see an increase in the monthly premiums that they are required to pay. Consequently, we do not anticipate premium adjustments to affect enrollment.