LAO Contact

February 7, 2023

The 2023-24 Budget

Proposition 98 Overview and

K‑12 Spending Plan

Summary

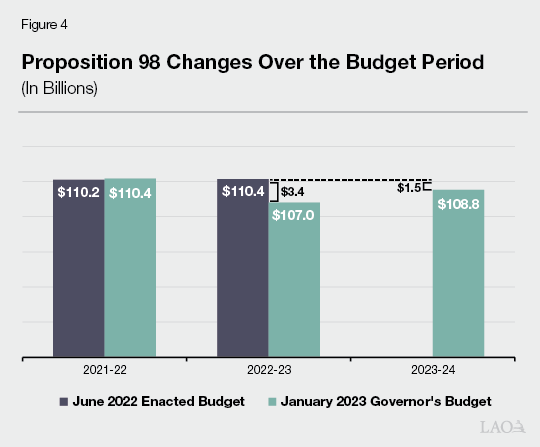

Each year, the state calculates a “minimum guarantee” for school and community college funding based upon a set of formulas established by Proposition 98 (1988). Compared with the level in the 2022‑23 enacted budget, the Governor’s budget estimates the guarantee is down $3.4 billion in 2022‑23 and $1.5 billion in 2023‑24. We think the guarantee is likely to decline further—under our best estimates of General Fund revenue, the guarantee would be roughly $2 billion below the Governor’s budget level in each year. Higher local property tax revenue, however, could offset some of this drop.

Despite the lower estimates of the guarantee, the Governor’s budget has about $5.2 billion available for new K‑12 spending. This funding is due to lower baseline costs for the Local Control Funding Formula (LCFF) and the expiration of various one‑time grants funded in the June 2022 budget. The largest K‑12 proposal in the budget is an 8.13 percent statutory cost‑of‑living adjustment (COLA), but the Governor also proposes several smaller initiatives. Since these proposals together would exceed the available funding, the Governor proposes to (1) use $1.4 billion in one‑time funds to pay for ongoing LCFF costs and (2) reduce one of the discretionary block grants the state approved last year by $1.2 billion. We recommend the Legislature commit to less ongoing spending so that the K‑12 budget does not rely upon one‑time funds. Our brief outlines several options to consider, including (1) funding a lower COLA, (2) avoiding new ongoing proposals, and (3) reducing certain existing programs. Modifying the budget in this way would better position the state to address a lower guarantee emerging in May or future years.

Introduction

In this brief, we analyze the Governor’s Proposition 98 budget package. The first section analyzes the administration’s estimate of the minimum funding requirement established by Proposition 98 and explains how this requirement could change in the coming months. The second section describes the Governor’s plan for allocating the available funding and provides our assessment of the plan. This brief focuses on the Proposition 98 proposals affecting K‑12 schools—we analyze the proposals affecting community colleges in our forthcoming brief The 2023‑24 Budget: California Community Colleges. On the “EdBudget” portion of our website, we post numerous tables with additional information about the Governor’s budget. Over the next few weeks, we plan to release additional briefs analyzing specific proposals in detail.

Minimum Guarantee

Proposition 98 (1988) established a minimum funding requirement for schools and community colleges commonly known as the minimum guarantee. In this section, we (1) provide background on the guarantee, (2) analyze the administration’s estimates of the guarantee, and (3) explain how the guarantee could change in the coming months.

Background on the Guarantee

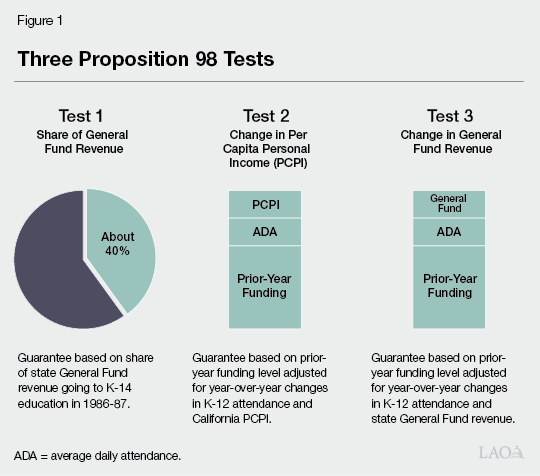

Minimum Guarantee Depends on Various Inputs and Formulas. The California Constitution sets forth three main tests for calculating the Proposition 98 minimum guarantee. Each test takes into account certain inputs, including General Fund revenue, per capita personal income, and student attendance (Figure 1). Test 1 links school funding to a minimum share of General Fund revenue, whereas Test 2 and Test 3 build upon the amount of funding provided the previous year. The Constitution sets forth rules for comparing the tests, with one of the tests becoming operative and used for calculating the minimum guarantee that year. Although the state can provide more funding than required, it usually funds at or near the guarantee. With a two‑thirds vote of each house of the Legislature, the state can suspend the guarantee and provide less funding than the formulas require that year. The guarantee consists of state General Fund and local property tax revenue.

“Spike Protection” Slows Growth in the Guarantee Following Revenue Surges. In addition to the three tests, the Constitution contains a provision to prevent the minimum guarantee from growing too quickly when General Fund revenue is especially strong. Specifically, when the minimum guarantee is growing much more quickly than per capita personal income and student attendance, this provision excludes some Proposition 98 funding from the calculation of the guarantee in the subsequent year. This provision is sometimes known as spike protection because it is intended to protect the state budget from needing to sustain increases in the guarantee that are the result of temporary spikes in revenue. Technically, spike protection works by reducing the Test 2 and Test 3 funding levels from what they otherwise would be in the year following the spike. These lower levels are then used in the comparison with Test 1 (which is unaffected). In practice, the spike protection adjustment allows the guarantee to remain elevated, but only to the extent the revenue spike is sustained the following year.

At Key Points, the State Recalculates the Minimum Guarantee. The guarantee typically changes from the level initially assumed in the enacted budget as the state updates the relevant Proposition 98 inputs. The state continues to update Proposition 98 inputs until the following May after the close of each fiscal year. If these updates show that the revised minimum guarantee exceeds the initial estimate, the state must make a one‑time payment to “settle up” for the difference. If the guarantee drops, the state can reduce spending to the lower guarantee. After making these revisions, the state finalizes its calculation of the guarantee through an annual process called “certification.” Certification involves the publication of the underlying Proposition 98 inputs and a period of public review. The most recently certified year is 2020‑21.

Proposition 98 Reserve Has Rules for Deposits and Withdrawals. Proposition 2 (2014) created a state reserve specifically for schools and community colleges—the Public School System Stabilization Account (Proposition 98 Reserve). The Constitution generally requires the state to deposit Proposition 98 funding into this reserve when the state receives high levels of capital gains revenue and the minimum guarantee is growing relatively quickly (see box). The Constitution also requires the state to withdraw funding from the reserve under certain conditions—generally when the guarantee is growing slowly relative to inflation and student attendance. If the Governor declares a budget emergency, the Legislature can make discretionary withdrawals. Unlike other state reserve accounts, the Proposition 98 Reserve is available only to supplement the funding schools and community colleges receive under Proposition 98.

Overview of Proposition 98 Reserve

Deposits Predicated on Two Minimum Conditions. To determine whether a deposit is required, the state estimates the amount of revenue it will receive from taxes on capital gains (a relatively volatile source of General Fund revenue). Deposits are required only when the state projects capital gains revenue will exceed 8 percent of total General Fund revenue. The state also identifies which of the three tests will determine the minimum guarantee. Deposits are required only when Test 1 is operative. (Test 1 years often are associated with relatively strong growth in the guarantee.)

Required Deposit Amount Depends on Formulas. After the state determines it meets the basic conditions, it performs additional calculations to determine the size of the deposit. Specifically, the deposit equals the lowest of the following four amounts:

- Portion of the Guarantee Attributable to Above‑Average Capital Gains. The state calculates what the Proposition 98 guarantee would have been if the state had not received any revenue from “excess” capital gains (the portion exceeding 8 percent of General Fund revenue). Deposits are capped at the difference between the actual guarantee and the hypothetical guarantee without the excess capital gains.

- Growth Relative to Prior‑Year Base Level. The state calculates how much funding schools and community colleges would receive if it adjusted the prior‑year funding level for changes in student attendance and inflation. The prior‑year level consists of the guarantee that year, adjusted for any reserve deposits or withdrawals, spike protection, and any funds provided on top of the guarantee. The inflation factor is the higher of the statutory cost‑of‑living adjustment or growth in per capita personal income. Deposits are capped at the difference between the Test 1 funding level and the prior‑year adjusted level.

- Difference Between the Test 1 and Test 2 Levels. Deposits are capped at the difference between the higher Test 1 and lower Test 2 funding levels. (The inflation factor for Test 2 is based upon per capita personal income only, so in practice, this calculation rarely limits the deposit amount more than the previous calculation.)

- Room Under 10 Percent Cap. The Proposition 98 Reserve has a cap on required deposits equal to 10 percent of the funding allocated to schools and community colleges. Deposits are required only when the balance is below this level.

Withdrawals Required Under Certain Conditions. The Constitution requires the state to withdraw funds from the reserve if the guarantee is below the prior‑year funding level, as adjusted for student attendance and inflation. (The prior‑year funding level and inflation adjustments in this calculation are the same as in the calculation for deposits.) The amount withdrawn equals the difference between the prior‑year adjusted level and the actual guarantee, up to the full balance in the reserve. The Legislature can allocate withdrawals for any school or community college purpose.

Discretionary Withdrawals Possible if State Experiences a Budget Emergency. If the Governor declares a budget emergency (based upon a natural or manmade disaster or weakness in state revenues), the Legislature may withdraw any amount from the reserve or suspend required deposits. In contrast to the Budget Stabilization Account (the state’s main rainy day fund), the Constitution does not limit discretionary withdrawals from the Proposition 98 Reserve to half the balance or the amount of the emergency.

Proposition 98 Reserve Linked With Cap on School Districts’ Local Reserves. A state law enacted in 2014 and modified in 2017 caps school district reserves after the Proposition 98 Reserve reaches a certain threshold. Specifically, the cap applies if the funds in the Proposition 98 Reserve in the previous year exceeded 3 percent of the Proposition 98 funding allocated to schools that year. When the cap is operative, medium and large districts (those with more than 2,500 students) must limit their reserves to 10 percent of their annual expenditures. Smaller districts are exempt. The law also exempts reserves that are legally restricted to specific activities and reserves designated for specific purposes by a district’s governing board. In addition, a district can receive an exemption from its county office of education for up to two consecutive years. The cap became operative for the first time in 2022‑23.

Administration’s Estimates

Minimum Guarantee Revised Up in 2021‑22 but Down in 2022‑23. Compared with the estimate included in the June 2022 budget plan, the administration revises its estimate of the minimum guarantee up $178 million in 2021‑22 (Figure 2). This increase primarily reflects updated data showing local property tax revenue exceeded previous estimates. For 2022‑23, the administration revises its estimate of the guarantee down $3.4 billion. This decrease primarily reflects lower General Fund revenue estimates. In addition, the administration estimates local property tax revenue will grow more slowly than it anticipated in June. Test 1 remains operative in both years. In Test 1 years, the change in the General Fund portion of the guarantee is about 40 cents for each $1 of higher or lower General Fund revenue. Changes in local property tax revenue, by comparison, have dollar‑for‑dollar effects on the guarantee in these years. (The state also records large spike protection adjustments in both years, which reduce the Test 2 and Test 3 levels in 2022‑23 and 2023‑24. Without the spike protection adjustment, Test 3 would have been operative in 2022‑23 and the guarantee would have been about $1 billion above the level in the Governor’s budget.)

Figure 2

Tracking Changes in the Prior‑ and Current‑Year Guarantee

(In Millions)

|

2021‑22 |

2022‑23 |

||||||

|

June 2022 |

January 2023 |

Change |

June 2022 |

January 2023 |

Change |

||

|

Minimum Guarantee |

|||||||

|

General Fund |

$83,677 |

$83,630 |

‑$47 |

$82,312 |

$79,103 |

‑$3,210 |

|

|

Local property tax |

26,560 |

26,785 |

225 |

28,042 |

27,889 |

‑153 |

|

|

Totals |

$110,237 |

$110,415 |

$178 |

$110,354 |

$106,991 |

‑$3,363 |

|

|

General Fund Tax Revenue |

$220,109 |

$219,986 |

‑$123 |

$214,887 |

$206,469 |

‑$8,418 |

|

Guarantee Grows Slowly in 2023‑24 but Remains Below Previously Enacted Budget Level. The administration estimates the minimum guarantee is $108.8 billion in 2023‑24 (Figure 3). This funding level is $1.8 billion (1.7 percent) above the revised 2022‑23 level but remains $1.5 billion (1.4 percent) below the 2022‑23 level enacted last June (Figure 4). Test 1 is operative in 2023‑24, and nearly all of the increase in the guarantee is attributable to growth in local property tax revenue. (Under the Governor’s estimates of the guarantee, the spike protection provision would exclude nearly $6 billion of the guarantee in 2023‑24 from the Test 2 and Test 3 calculations in 2024‑25. Spike protection applies in 2023‑24 because the guarantee recently has grown much more quickly than per capita personal income and student attendance in recent years.)

Figure 3

Proposition 98 Key Inputs and Outcomes Under

Governor’s Budget

(Dollars in Millions)

|

2021‑22 |

2022‑23 |

2023‑24 |

|

|

Minimum Guarantee |

|||

|

General Fund |

$83,630 |

$79,103 |

$79,613a |

|

Local property tax |

26,785 |

27,889 |

29,204 |

|

Totals |

$110,415 |

$106,991 |

$108,816 |

|

Change From Prior Year |

|||

|

General Fund |

$13,426 |

‑$4,528 |

$510 |

|

Percent change |

19.1% |

‑5.4% |

0.6% |

|

Local property tax |

$916 |

$1,104 |

$1,315 |

|

Percent change |

3.5% |

4.1% |

4.7% |

|

Total guarantee |

$14,342 |

‑$3,424 |

$1,825 |

|

Percent change |

14.9% |

‑3.1% |

1.7% |

|

General Fund Tax Revenueb |

$219,986 |

$206,469 |

$205,989 |

|

Growth Rates |

|||

|

K‑12 average daily attendance |

‑8.9% |

3.1% |

‑0.8% |

|

Per capita personal income (Test 2) |

5.7 |

7.6 |

2.8 |

|

Per capita General Fund (Test 3)c |

19.7 |

‑5.1 |

0.3 |

|

Proposition 98 Reserve |

|||

|

Deposit (+) or withdrawal (‑) |

$3,710 |

$1,096 |

$365 |

|

Cumulative balance |

7,012 |

8,108 |

8,473 |

|

Operative Test |

1 |

1 |

1 |

|

aExcludes $941 million supplemental payment associated with Proposition 28 (2022). |

|||

|

bExcludes nontax revenues and transfers, which do not affect the calculation of the guarantee. |

|||

|

cAs set forth in the State Constitution, reflects change in per capita General Fund plus 0.5 percent. |

|||

|

Note: No maintenance factor is created or paid over the period. |

|||

Guarantee Adjusted for Transitional Kindergarten Expansion. The June 2021 budget established a plan to expand eligibility for transitional kindergarten over a four‑year period, beginning in 2022‑23. It also reflected an agreement between the Governor and the Legislature to “rebench” the Proposition 98 guarantee for this expansion. Consistent with this agreement, the calculation of the guarantee in 2023‑24 includes a $690 million increase to reflect costs for the second year of the expansion. The budget implements this adjustment by increasing the minimum share of General Fund revenues allocated to schools under Test 1 from 38.3 percent in 2022‑23 to 38.6 percent in 2023‑24. This adjustment is responsible for all of the increase in the General Fund portion of the guarantee in 2023‑24. (Absent this adjustment, the General Fund portion of the guarantee would have declined slightly.)

Proposition 98 Reserve Deposits Revised Down. The June 2022 budget estimated the state would be required to make Proposition 98 Reserve deposits of $4 billion in 2021‑22 and $2.2 billion in 2022‑23. Based upon lower estimates of capital gains revenue, the Governor’s budget reduces the estimated deposits to $3.7 billion and $1.1 billion in each year, respectively. For 2023‑24, the budget estimates that a deposit of $365 million is required. This deposit is required because the budget anticipates the state will receive excess capital gains and the guarantee—though growing sluggishly—is above the 2022‑23 level after accounting for spike protection and inflation. Under the Governor’s budget, the total balance in the Proposition 98 Reserve by the end of 2023‑24 would be $8.5 billion (7.8 percent of the guarantee that year). Since the balance in the reserve would remain above the 3 percent threshold through 2023‑24, the cap on local district reserves would remain operative at least through 2024‑25.

Modest Growth in the Guarantee After the Budget Year. Under the administration’s estimates, the Proposition 98 guarantee would increase by an average of 3.9 percent per year from 2023‑24 through 2026‑27. By 2026‑27, the guarantee would grow to $122.2 billion, an increase of $13.4 billion over the 2023‑24 level. Of this increase, $9.9 billion (74 percent) is attributable to growth in the General Fund portion of the guarantee and $3.5 billion (26 percent) is attributable to growth in local property tax revenue. Test 1 would remain operative each year of the period. The 3.9 percent annual increase in the guarantee is somewhat below the historical average—growth in the guarantee since the adoption of Proposition 98 in 1988 has averaged 5.5 percent per year. This lower growth rate primarily reflects the administration’s estimate that economic growth will be moderate after multiple years of rapid growth.

LAO Comments

General Fund Revenue in 2022‑23 and 2023‑24 Likely Lower Than Administration’s Estimates. Since the adoption of the June 2022 budget, several areas of the economy have shown notable weakness. For example, the housing market has cooled, consumer spending has slowed, and business startup activity has decreased. Much of this weakness reflects the Federal Reserve’s effort to fight inflation by raising interest rates. Although the Governor’s budget contains lower revenue estimates than the budget the state adopted in June, we think revenues are likely to drop even further. Among other considerations, several leading indicators of revenue performance—including retail sales and income tax withholding—have shown notable weakness over the past few months. For 2022‑23, we estimate the probability that General Fund revenues fall below the level in the Governor’s budget is nearly 80 percent. Our best estimate is that revenues would be about $5 billion lower, though the decrease easily could be several billion dollars more or less than this estimate. For 2023‑24, we think revenues are likely to remain roughly flat relative to our lower 2022‑23 estimate. Compared with the Governor’s budget estimate for 2023‑24, this level of revenues would represent a reduction of approximately $5 billion.

Reductions in General Fund Revenues Would Reduce the Guarantee. General Fund revenue tends to be the most significant input in the calculation of the Proposition 98 guarantee. For any given year, the relationship between the guarantee and General Fund revenue generally depends on which Proposition 98 test is operative and whether another test could become operative with higher or lower revenue. Our analysis indicates Test 1 is likely to remain operative for all three years of the budget period, even if General Fund revenue varies significantly from the levels in the Governor’s budget. In Test 1 years, the guarantee increases or decreases about 40 cents for each $1 of higher or lower revenue. For example, if General Fund revenues were $5 billion below Governor’s budget estimates in 2022‑23 and 2023‑24, the reduction in the guarantee would be approximately $2 billion each year. (The tendency for Test 1 to remain operative over the budget period is due in large part to spike protection, which lowers the other two tests and makes them less likely to affect the calculation of the guarantee.)

Proposition 98 Reserve Provides Some Cushion Against Revenue Declines. Changes in revenue estimates and the minimum guarantee likely would affect the amount of funding the state is required to deposit in the Proposition 98 Reserve. A relatively modest revenue reduction occurring in 2022‑23 or 2023‑24 likely would reduce or eliminate the required deposit in the year the reduction occurs. If the revenue reduction were significant—especially in 2023‑24—the state might be required to make an automatic withdrawal. These changes in the Proposition 98 Reserve would help mitigate the effects of a drop in the guarantee on school and community college programs.

Local Property Tax Estimates Could Be Somewhat Higher by May. Estimates of local property tax revenue are the other significant factor affecting the guarantee when Test 1 is operative. Compared with the Governor’s budget, our November property tax estimates were about $1 billion higher over the three‑year period, with most of the difference related to 2023‑24. Slightly more than half of this difference involves our estimates of supplemental taxes (taxes levied on properties sold midyear). Supplemental taxes account for a small share of overall property tax revenue but are particularly volatile and difficult to forecast. Most of our remaining differences relate to assumptions about (1) residual revenue allocated to schools and community colleges from the dissolution of redevelopment agencies, and (2) estimates of excess property tax revenue. (Excess tax revenue refers to the portion of local property tax revenue that some school and community college districts receive beyond their funding levels set by the state. This revenue is excluded from the calculation of the Proposition 98 guarantee.) Compared with supplemental taxes, these two property tax components typically follow more predictable patterns of growth. Based on our latest review, we think property tax revenues are likely to be at least several hundred million dollars higher than the estimates in the Governor’s budget over the three‑year period, and could be up to $1 billion higher.

K‑12 Spending Plan

In this section, we analyze the Governor’s proposals affecting the allocation of Proposition 98 funding to schools. Specifically, we (1) describe the baseline adjustments that affect available funding, (2) describe the Governor’s major spending proposals, (3) examine potential spending increases beyond the budget year, (4) assess the overall architecture of the plan, and (5) offer our recommendations to the Legislature.

Baseline Adjustments

Lower Local Control Funding Formula (LCFF) Costs Over the Period Due to Attendance‑Related Adjustments. For 2021‑22, data published by the California Department of Education last year show that costs for LCFF were $471 million lower than the state’s previous estimate. For 2022‑23, the administration estimates LCFF costs are $1.3 billion below the level it estimated last June. This lower estimate primarily reflects (1) the lower costs in the prior year carrying forward, and (2) an increase in the estimate of the savings from the phaseout of districts’ pre‑pandemic attendance levels within the three‑year rolling average calculation the state adopted last year. This phaseout will continue in 2023‑24 and 2024‑25. For 2023‑24, the administration estimates that baseline costs for LCFF will decrease by an additional $1.6 billion relative to the lower 2022‑23 level.

Significant Amount of One‑Time Costs Expire. The June 2022 budget allocated $2.8 billion in ongoing Proposition 98 funds for one‑time K‑12 activities. The largest activities consisted of grants for community schools and pandemic recovery. Moving into 2023‑24, the costs for these activities expire and the associated $2.8 billion in funding is freed‑up for other priorities. (In addition to this amount, the June 2022 budget allocated nearly $15 billion in one‑time spending from funds that were available only on a one‑time basis.)

Major Proposals

Budget Contains $5.2 Billion in New Proposition 98 Spending. After accounting for reductions in the minimum guarantee and baseline cost savings, the Governor’s budget has approximately $5.2 billion available to allocate for new K‑12 spending. The Governor’s plan for the K‑12 budget has four basic components: (1) new ongoing increases for LCFF totaling $5.3 billion, (2) other ongoing spending proposals totaling $746 million, (3) new one‑time spending proposals totaling $376 million, and (4) one proposed reduction to an existing program of $1.2 billion (Figure 5). From an accounting perspective, most of the new ongoing spending is attributable to 2023‑24 and most of the one‑time changes are attributable to 2021‑22.

Figure 5

Governor’s Budget Contains $5.2 Billion in

K‑12 Proposition 98 Spending Proposals

(In Millions)

|

Ongoing Local Control Funding Formula (LCFF) |

|

|

Statutory COLA (8.13 percent) |

$5,691 |

|

Baseline attendance changes |

‑1,575 |

|

Transitional kindergarten expansion |

690 |

|

Transitional kindergarten staffing ratios |

165 |

|

Equity multiplier |

300 |

|

Subtotal LCFF |

($5,272) |

|

Other Ongoing Spending |

|

|

COLA for select categorical programs (8.13 percent)a |

$669 |

|

State Preschool for students with disabilities |

64 |

|

Access to opioid overdose reversal medication |

4 |

|

K‑12 High Speed Network |

4 |

|

California College Guidance Initiative |

4 |

|

Preschool assessment tool |

1 |

|

Fiscal Crisis and Management Assistance Team |

1 |

|

Subtotal Other Ongoing |

($746) |

|

New One‑Time Spending |

|

|

Literacy coaches and reading specialists |

$250 |

|

Arts and cultural enrichment |

100 |

|

Charter School Facility Grant Program |

30 |

|

CCEE adjustment for unspent prior year funds |

‑4 |

|

Testing consortium membership fee |

1 |

|

Update to digital learning and standards integration guidance |

0.1 |

|

Subtotal One‑Time |

($376) |

|

Reductions to Existing Spending |

|

|

Arts, Music, and Instructional Materials Discretionary Block Grant |

‑$1,174 |

|

Total K‑12 Spending Changes |

$5,221 |

|

aApplies to Special Education, State Preschool, Child Nutrition, K‑12 mandates block grant, Charter School Facility Grant Program, Foster Youth Program, American Indian education programs, and Adults in Correctional Facilities. COLA = cost‑of‑living adjustment and CCEE = California Collaborative for Educational Excellence. |

|

Dedicates Most Ongoing Funds to Covering Statutory Cost‑of‑Living Adjustment (COLA). The state calculates the statutory COLA each year using a price index published by the federal government. This index reflects changes in the cost of goods and services purchased by state and local governments across the country during the preceding year. For 2023‑24, the administration estimates the COLA rate is 8.13 percent. The Governor’s budget includes $5.7 billion to cover the associated increase for LCFF. It also funds the same COLA for various categorical programs. The COLA rate for 2023‑24 would build upon the 13.26 percent increase the state provided in 2022‑23, which was approximately twice the statutory rate that year.

Proposes New Ongoing Component of LCFF. The other notable ongoing proposal in the budget is $300 million for a new component of the LCFF known as the “equity multiplier.” This component would be allocated for school sites with especially high shares of students who qualify for free meals under the federal nutrition program (90 percent or above for elementary and middle schools and 85 percent or above for high schools). The administration indicates these funds are intended to provide more targeted support than the existing supplemental and concentration grants allocated to districts under LCFF. The budget also proposes refinements to the statewide system of support and school accountability system to complement this funding. These refinements would occur through trailer legislation and would not involve additional state funds.

Proposes Two Notable One‑Time Grants. The larger of the two proposals consists of $250 million for districts to hire and train literacy coaches and reading specialists. This proposal would build upon the previous allocation of $250 million included in the June 2022 budget. The other proposal would provide $100 million to fund culturally enriching activities (such as visits to theaters and museums) for students in grade 12 during the 2023‑24 school year.

Reduces Funding for One Previously Authorized Program. The June 2022 budget allocated $3.6 billion in one‑time funds to create the Arts, Music, and Instructional Materials Discretionary Block Grant. Funds from this grant are allocated to districts on a per‑students basis. Districts can use these funds for a range of costs, including instructional materials, professional development, pandemic‑related expenses, and various other operational expenses. The Governor’s budget proposes to reduce this program by $1.2 billion. (Districts received the first half of their expected grant awards in November 2022 but the state has not yet apportioned the other half.)

Covers Some Ongoing Costs Using One‑Time Funds. The Governor’s budget proposes to use $1.4 billion in one‑time funds to cover LCFF costs in 2023‑24. These one‑time funds are mainly attributable to 2021‑22. Three main factors are responsible for making these funds available: (1) the proposed reduction to the Arts, Music, and Instructional Materials Discretionary Block Grant; (2) the baseline reduction in LCFF costs in 2021‑22; and (3) the increase in the 2021‑22 minimum guarantee. The proposal would not affect the timing or distribution of LCFF allotments to districts.

Sets Aside Additional Funding for Arts Instruction as Required by Proposition 28. The voters approved Proposition 28 in the November 2022 election. The measure requires the state to establish a new program supporting arts instruction in schools, beginning in 2023‑24 (see the nearby box). The Governor’s budget estimates the initial amount for the program is $941 million. For 2023‑24, the measure specifies that this funding is on top of the minimum guarantee otherwise calculated for the year. Beginning in 2024‑25, the funding is folded into the guarantee and the guarantee is adjusted upward by a corresponding amount. For consistency with the displays in the Governor’s budget, we exclude this funding from our Proposition 98 spending totals in 2023‑24.

Proposition 28 (2022)

Establishes New Program to Fund Arts Education. Proposition 28 establishes a program to provide additional funding for arts instruction and related activities in schools, beginning in 2023‑24. The annual amount for the program equals 1 percent of the Proposition 98 funding allocated to schools in the previous year.

Provides Rules for Allocating and Using Funds. The measure allocates 70 percent of its funding to school districts, charter schools, and county offices of education through a formula based on prior‑year enrollment of students in preschool, transitional kindergarten, kindergarten, and grade 1 through grade 12. The measure allocates the remaining 30 percent based upon the share of low‑income students enrolled in those entities in the prior year. School principals are responsible for developing expenditure plans describing how they will use their share of the funds, subject to two main requirements. First, the measure requires schools with at least 500 students to use their funds primarily to hire new arts staff. Second, schools must use their funds to supplement any existing funding they already provide for their arts education programs.

Adjusts the Proposition 98 Guarantee Upward. In addition to creating a new program funded within Proposition 98, the measure adjusts the minimum guarantee upward. This adjustment occurs in two steps. In 2023‑24, the state calculates the cost of the program and funds this cost on top of the minimum guarantee otherwise calculated for the year. The state then converts this amount to a percentage of General Fund revenue. Beginning in 2024‑25, the state adds this percentage to the minimum percentage of General Fund revenue allocated to schools under Test 1. This increase in the guarantee is intended to support the cost of the program moving forward.

Legislature Can Reduce Funding if It Suspends the Guarantee. The measure allows the Legislature to reduce funding for arts instruction if it suspends the minimum guarantee. In this case, the percentage reduction for arts education cannot exceed the percentage reduction in overall funding for school and community college programs.

Beyond the Budget Year

Administration Anticipates Much Lower COLAs After 2023‑24. The administration’s economic forecast anticipates inflation will moderate significantly later this year. Consistent with this assumption, the administration estimates the statutory COLA rate for 2024‑25 is 3.54 percent. For 2025‑26 and 2026‑27, the administration anticipates COLA rates of about 3.3 percent and 3.2 percent, respectively. These COLA rates are slightly above the historical average over the past 20 years (2.8 percent).

LAO Comments

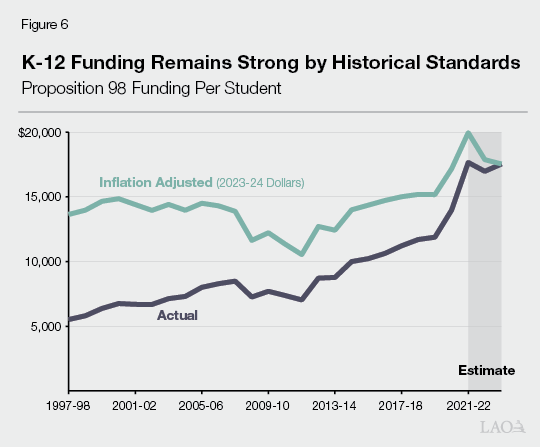

School Funding Remains Relatively Strong Despite Tighter Budget Picture. Although the Governor’s budget reflects a decrease in the guarantee relative to the previously enacted budget, Proposition 98 funding remains strong by historical standards. Between 2019‑20 and 2021‑22, the minimum guarantee grew by $31.1 billion (39.2 percent)—the fastest increase over any two‑year period since the passage of Proposition 98 in 1988. Overall funding for schools remains relatively high even though the drop in 2022‑23 erodes some of this gain. Figure 6 illustrates this point by showing how funding per student under the Governor’s budget compares with funding over the previous 25 years.

School Funding Also Fares Relatively Well Compared With the Rest of State Budget. In contrast to the relatively modest changes affecting K‑12 schools, the Governor’s budget proposes notable reductions affecting many other state programs. As we noted in a recent report, the Governor’s budget addresses a shortfall of approximately $18 billion across all programs in the state budget. The Governor’s proposed changes to programs outside of Proposition 98 include (1) delaying more than $7 billion in spending to future years, (2) eliminating more than $6 billion in previously approved augmentations (some of these reductions would be restored if revenue improves), and (3) shifting more than $4 billion in General Fund costs to various special funds. In addition, the budget provides limited or no COLA for most state programs funded outside of Proposition 98.

Statutory COLA Rate for 2023‑24 Likely to Be Slightly Higher by May. On January 26, the federal government published a new quarter of data affecting the calculation of the COLA rate. Based on the new data and our latest projections, we estimate the statutory COLA rate in 2023‑24 is 8.4 percent. Covering this higher rate would increase ongoing costs for LCFF and other K‑12 programs by approximately $220 million (relative to the Governor’s budget). The state will be able to finalize its calculation of the statutory rate on April 27 when the federal government releases the final quarter of data used to calculate the 2023‑24 COLA.

Governor’s Plan to Avoid Discretionary Reserve Withdrawal Is a Prudent Starting Point. Although the state likely meets the conditions to declare a budget emergency, the Governor does not propose any discretionary withdrawals from the Proposition 98 Reserve. We think this approach is a fiscally prudent starting point because (1) funding for school programs remains relatively strong under the Governor’s budget, and (2) saving reserves now gives the state a way to address further reductions in the guarantee that would occur if revenue deteriorates. This budgeting approach seems especially important this year given our outlook for lower General Fund revenues and the heightened risk of a recession. Saving reserves preserves a key tool the state could decide to use later to avoid program reductions or deferrals in a recession scenario. The Governor’s approach to the Proposition 98 Reserve also mirrors the approach to the Budget Stabilization Account (BSA)—the state’s main rainy day fund. One difference between these accounts is that the state might be required to make withdrawals from the Proposition 98 Reserve if revenues were to decline significantly, whereas the rules governing the BSA do not require automatic withdrawals.

Proposed Proposition 98 Budget Would Create a Deficit for Next Year. Using one‑time funds to cover ongoing costs creates a deficit in the Proposition 98 budget the following year. Under the Governor’s budget, the Proposition 98 guarantee would need to grow at least $1.4 billion in 2024‑25 to cover the portion of LCFF paid with one‑time funds in 2023‑24. If the state were in recession, this deficit would compound an already difficult budget situation and make program reductions or deferrals more likely or more severe. Even if the guarantee were growing more quickly, the deficit would reduce the funding available to cover COLA and other priorities. Recognizing these risks, the Legislature generally has avoided adopting Proposition 98 budgets that contain these deficits except during severe downturns.

Growth in Guarantee Might Not Be Enough to Support Full COLA in 2024‑25. Although the administration anticipates the Proposition 98 guarantee will grow 3.9 percent annually over the next four years, some of that increase is reserved for specific program expansions—most notably, the expansion of transitional kindergarten and new funding for arts instruction under Proposition 28. After accounting for these costs and various other adjustments, we estimate the annual growth in the guarantee available to fund COLA or other new commitments would be about 3.2 percent. Using the administration’s assumptions about the guarantee and future COLA rates, we estimate the guarantee would be about $500 million short of the amount required to cover the COLA in 2024‑25. In that scenario, the administration would have the authority under existing law to reduce the COLA to rate to fit within the available funding. For 2025‑26 and 2026‑27, we estimate the guarantee would be just above the level necessary to fund the COLA under the administration’s assumptions. All of these calculations are sensitive to small changes in assumptions about the economy.

Recommendations

Build Budget Without Creating Future Deficits. We recommend the Legislature develop a budget for the coming year that does not rely on one‑time funding for ongoing costs. Eliminating the $1.4 billion deficit in the Governor’s Proposition 98 budget would have at least two notable advantages. First, this approach would better position the state to deal with decreases in the guarantee, whether emerging in the coming months or in subsequent years. In the event of a severe downturn, the state likely would need to make larger reductions and rely upon Proposition 98 Reserve withdrawals, but starting without a deficit would make the problem more manageable. Second, the state could avoid reductions to the Arts, Music, and Instructional Materials Discretionary Block Grant. Maintaining this grant at its currently authorized level likely would be less disruptive for districts that have already developed plans to spend these funds. In the remainder of this section, we outline a few ways for the state to reduce ongoing expenditures and avoid reliance on one‑time funds.

Consider Funding Lower COLA Rate. As a starting point for developing the budget, we recommend the Legislature avoid funding a COLA above the level in the Governor’s budget—even if the statutory rate is somewhat higher by May. Holding the COLA at 8.13 percent would avoid creating additional costs that would make the Proposition 98 budget more difficult to balance. We also recommend the Legislature consider further reductions to the COLA rate, particularly if (1) the minimum guarantee is significantly lower than the Governor’s budget estimate in 2023‑24, or (2) the Legislature prefers to avoid reducing ongoing spending in other ways. For planning purposes, each 0.5 percentage point reduction in the COLA rate would reduce costs for K‑12 programs by approximately $400 million. If the Legislature were to eliminate the $1.4 billion deficit entirely through funding a lower COLA, the associated reduction in the rate would be about 1.7 percentage points (for a COLA rate of about 6.4 percent). Even in this lower COLA scenario, the rate in 2023‑24 would remain high by historical standards and would build upon the large increase the state provided in 2022‑23.

Consider Changes to LCFF Equity Multiplier Proposal That Would Ease Budget Pressure. In the coming weeks, we plan to release a brief analyzing the Governor’s LCFF equity multiplier proposal and providing our assessment. Assuming the Legislature decides to adopt the proposal, it could consider modifications that would ease budget pressure. For example, it could delay the implementation of the $300 million increase until budget conditions are more favorable. (Regardless of its decision about the proposed spending increase, the Legislature could immediately implement the other changes associated with the proposal that do not require additional ongoing spending.)

Consider Certain Reductions for Expanded Learning Opportunities Program (ELOP). The state created this program in the 2021‑22 budget to fund educational and enrichment activities for K‑12 students outside of normal school hours. The state currently allocates $4 billion for the program. These funds are in addition to funding districts receive from the two other longstanding expanded learning programs—the After School Education and Safety (ASES) program and 21st Century Community Learning Centers (21st Century). District ELOP allocations are based on total district attendance in elementary grades and the share of students who are low‑income or English learners. We understand that some districts are not on track to spend any or all of their ELOP funds in part due to slow program ramp up, difficulty hiring staff, and the continued use of temporary federal relief funds to cover expanded learning costs. Additionally, some initial district feedback indicates that, similar to current after school participation trends, not all students may express interest in participating in ELOP. The state has a few options that could reduce costs for the program. One option is to no longer assume 100 percent participation. For example, even a relatively modest change to assume 90 percent participation would reduce costs by approximately $400 million. Another option is to reduce district allocations to account for the funding districts receive through the ASES and 21st Century programs, reducing ELOP costs by at least several hundred million dollars. (Regardless of how the Legislature proceeds, we recommend the state require districts to report data on program participation. This would help the state gauge student interest and inform future funding decisions.)

Consider Certain Reductions for State Preschool. The Legislature could consider several changes that would reduce costs in State Preschool. For example, the Legislature could eliminate funding for slots going unused and ensure that total budgeted amounts are aligned with the costs of provider contracts. The savings could range from the low tens of millions of dollars to the low hundreds of millions of dollars, depending on the specific options the Legislature takes. (These savings pertain specifically to the Proposition 98 portion of State Preschool. Applying these actions to the non‑Proposition 98 portion would generate some non‑Proposition 98 General Fund savings too.) In the coming weeks, we plan to release our analysis of the Governor’s State Preschool proposals. In this brief, we will describe these options in more detail, as well as cover other aspects of the Governor’s proposals.