February 10, 2023

The 2023-24 Budget

Analysis of the Medi‑Cal Budget

Summary

Governor’s Budget Includes Major Increase to Medi‑Cal General Fund Spending. The Governor’s budget includes $38.7 billion General Fund spending on Medi‑Cal, the state’s Medicaid program, in 2023‑24. This amount reflects a $6.4 billion (20 percent) net increase over the revised 2022‑23 level. The net increase primarily is driven by current law and policy adjustments as opposed to new budget proposals. The Governor’s budget also includes several proposals that would require a change in state law, new authorization from the federal government, or both. These proposals, on net, yield a relatively small impact on Medi‑Cal General Fund spending in 2023‑24, though some have more notable impacts in later years. (We analyze the Governor’s major Medi‑Cal and non‑Medi‑Cal behavioral health proposals in a forthcoming companion report—The 2023‑24 Budget: Analysis of the Governor’s Major Behavioral Health Proposals.)

Largely Due to Recent Federal Actions, Caseload and Associated Costs Likely Overstated in Governor’s Budget. In 2020, the federal government declared the COVID‑19 national public health emergency (PHE). Congress also approved policies that significantly impacted Medi‑Cal while the PHE is in effect, including policies that impacted caseload and associated costs while providing enhanced federal funding. Recent federal actions decoupled these policies from the PHE and provided a time line for ramping down the policies over the next several months. However, due to the timing of the development of the Governor’s budget, the administration was not able to incorporate these recent federal actions into its projections of caseload and General Fund spending for Medi‑Cal. In our assessment of the administration’s projections, after taking into account the recent federal actions and more recent caseload data, we estimate a $1 billion reduction in General Fund spending in 2023‑24 relative to the Governor’s budget.

Governor’s Proposed Managed Care Organization (MCO) Tax Warrants Serious Legislative Consideration. State authorization and federal approval of the most recent MCO tax expired at the end of December 2022. The Governor proposes adopting a new version of the MCO tax from January 2024 to December 2026, which would offset around $2 billion of Medi‑Cal General Fund spending annually. (In 2023‑24, the associated offset to Medi‑Cal General Fund would be $317 million due to only receiving a partial year of revenues.) In concept, adopting a new MCO tax has merit, as past versions of the tax have been a key source of support for Medi‑Cal and a new tax would help address broader state budget shortfalls. That said, the Governor’s proposal is preliminary and the administration states that it is exploring ways to increase the level of the tax relative to the most recent version. We recommend the Legislature direct the administration to provide more robust information on the proposal during the budget process, including potential increases to the level of the MCO tax and the associated offset to the General Fund.

Introduction

This brief analyzes the Governor’s 2023‑24 budget proposals for Medi‑Cal, California’s Medicaid program. It first provides an overview of Medi‑Cal spending under the Governor’s budget. It then analyzes (1) the administration’s assumptions around caseload and COVID‑19‑related policies and (2) the Governor’s proposed MCO tax. A forthcoming companion report—The 2023‑24 Budget: Analysis of the Governor’s Major Behavioral Health Proposals—analyzes the Governor’s major Medi‑Cal and non‑Medi‑Cal behavioral health proposals.

Overview

In this section, we provide key background on the Medi‑Cal program, describe Medi‑Cal’s overall budget picture, and summarize the key changes in General Fund spending in the current year (2022‑23) and budget year (2023‑24).

Background

Medi‑Cal Provides Health Coverage for Low‑Income Californians. Medi‑Cal, the state’s Medicaid program, provides health care coverage to about 15 million of the state’s low‑income residents. As a joint state‑federal program, costs are shared among federal, state, and local governments. The share of costs paid by each level of government varies by the type of service provided and the characteristics of the enrollees being served. Overall, the federal government’s share of cost typically is 50 percent, but is higher or lower for certain populations and services.

Federal COVID‑19 Policies Notably Impacted Medi‑Cal. In early 2020, the federal government declared a national PHE in response to the emerging COVID‑19 pandemic. As part of related legislation, Congress temporarily enhanced the federal share of cost for most Medicaid services by 6.2 percentage points. The same federal legislation also prohibited the state (as a condition of receiving the enhanced federal funding) from terminating the eligibility of current Medi‑Cal enrollees, except in limited circumstances. This prohibition is known as the “continuous coverage requirement.” Up until recently, the end dates of the continuous coverage requirement and the enhanced federal funding were tied to the end date of the PHE. However, federal legislation enacted in late December 2022 decoupled the end dates of these policies from the PHE. In addition, while the end date of the PHE has been a source of considerable uncertainty in recent years, the federal administration recently announced its intent to end the PHE on May 11, 2023. We will discuss these changes and their impacts to Medi‑Cal in more detail later in this publication.

State Is Implementing Series of Major Changes Known as California Advancing and Innovating Medi‑Cal (CalAIM). Adopted in the 2021‑22 budget package, CalAIM is a large set of reforms in Medi‑Cal to expand access to new and existing services and streamline how services are arranged and paid. For example, as part of CalAIM, managed care plans are authorized to provide certain nonmedical community supports (such as housing support and transitional services) that address the social determinants of health. CalAIM also includes initiatives that help counties and other stakeholders build capacity to provide a continuum of care for individuals.

Overall Budget

Proposes Increase in Overall Spending. Under the Governor’s budget, overall Medi‑Cal spending (all fund sources) would be $139 billion in 2023‑24, a $1.2 billion (0.9 percent) increase over the revised 2022‑23 level. Of this amount, $39 billion is General Fund spending, reflecting a $6.4 billion (19.9 percent) increase over the revised 2022‑23 General Fund level in Medi‑Cal. As Figure 1 shows, this overall increase in spending primarily reflects a lower level of federal funds and a higher level of General Fund. Much of the anticipated decline in federal funds over the period is due to the administration’s assumptions around the end of enhanced federal funding related to COVID‑19, which we describe later in the report.

Figure 1

Overall Medi‑Cal Spending Grows Under Governor’s Budget

(In Billions)

|

2022‑23 |

2023‑24 |

Change From 2022‑23 Revised |

|||

|

Enacted |

Revised |

Amount |

Percent |

||

|

Total Spending |

$137.9 |

$137.7 |

$138.9 |

$1.2 |

0.9% |

|

By Fund Source |

|||||

|

Federal funds |

$88.6 |

$91.0 |

$86.1 |

‑$4.9 |

‑5.4% |

|

General Fund |

36.4 |

32.3 |

38.7 |

6.4 |

19.9 |

|

Other funds |

12.9 |

14.4 |

14.1 |

‑0.3 |

‑2.3 |

|

By Program/Delivery System |

|||||

|

Managed care |

$61.5 |

$60.2 |

$67.5 |

$7.4 |

12.2% |

|

Fee for service |

39.0 |

36.9 |

34.8 |

‑2.0 |

‑5.5 |

|

Other programs |

31.1 |

33.8 |

29.9 |

‑3.9 |

‑11.5 |

|

Local administration |

6.4 |

6.9 |

6.7 |

0.3 |

4.4 |

|

Note: Reflects local assistance spending in the Department of Health Care Services. Excludes state operations to administer Medi‑Cal, as well as state and local spending budgeted outside of the department used to claim federal Medicaid funds. |

|||||

Projected Increases Are Concentrated in Managed Care. Managed care comprises the largest share of Medi‑Cal spending. Under the administration’s estimates, managed care’s share of Medi‑Cal spending grows from 44 percent of revised 2022‑23 spending to 49 percent of proposed spending in 2023‑24. Many factors drive managed care’s relatively notable spending growth. For example, beginning in January 2023, the state is taking actions that shift certain caseload and benefits from fee for service and into managed care. The Governor’s budget also proposes increases to managed care rates.

2022‑23 General Fund Changes

Estimates Downward Revision in General Fund Spending. The Governor’s budget estimates Medi‑Cal General Fund spending to be $32.3 billion, a reduction of $4.1 billion (11.2 percent) relative to the level enacted in the 2022‑23 Budget Act. We summarize the key drivers of the reduction below.

Shifts Timing of Federal Repayments and Resolves Certain Deferrals. Federal Medicaid rules require the state to repay the federal government when federal funding is claimed in error. In addition, the federal government defers releasing funds to the state for claims potentially made in error. In cases where the federal government subsequently determines the claiming was not done in error, the deferred federal funds will be released and made available to the state. Both situations can temporarily increase General Fund spending, either to repay the federal government or backfill deferred federal funds until they are released. Normally, the annual impact of these repayments and deferrals is in the low hundreds of millions of dollars. However, the 2022‑23 Budget Act included $2.5 billion General Fund for federal payments and deferrals—largely due to a one‑time repayment to the federal government for erroneous claims within managed care. The Governor’s budget now assumes that most of these repayments will be made in 2023‑24, rather than 2022‑23. In addition, the administration anticipates receiving more federal funding in 2022‑23 due to resolving certain deferred claims. The overall impact of these adjustments in 2022‑23 is a $2.8 billion downward revision in General Fund spending. (As we will discuss later, there will be a need for increased spending in 2023‑24 due to the shift in timing for the repayments.)

Assumes Extension of Policies Related to COVID‑19. Because the administration largely concluded its development of the Medi‑Cal budget by early December 2022, the Governor’s budget does not reflect the recent federal actions impacting COVID‑19‑related policies. Instead, the proposed budget assumes that the PHE would end in April 2023, six months later than assumed in the 2022‑23 Budget Act. Consistent with federal law at the time the budget was prepared, the administration assumed the end of the PHE also would initiate the end of various COVID‑19‑related policies including the continuous coverage requirement and the enhanced federal funding. Relative to the 2022‑23 Budget Act, the administration’s assumptions result in a $774 million downward revision in General Fund spending, largely due to additional months of enhanced federal funding.

Recognizes Reduced General Fund Needed to Backfill Proposition 56 (2016) Revenues. The 2022‑23 Budget Act provided $296 million one‑time General Fund support to hold harmless Proposition 56‑funded provider payments from declines in Proposition 56 revenues (tobacco taxes). Due mostly to lower estimated net spending on Proposition 56‑funded provider payments, the Governor’s budget eliminates the $296 million General Fund backfill in 2022‑23.

Delays Funding for Three Sets of Planned Spending. As part of a package of solutions intended to address a projected state budget shortfall, the Governor proposes delaying or partially delaying current‑year spending for three sets of planned spending in 2022‑23. We describe each proposed funding delay below.

- Delay of Funding for Elimination of End‑of‑Year Provider Payment Processing Hold. As a budget solution in 2006‑07, the state implemented a hold in processing fee‑for‑service provider payments for the last two weeks of the fiscal year—a practice which remains in effect today. Because Medi‑Cal is budgeted based on when payments are made, the hold generated one‑time savings in 2006‑07 by shifting payments into the next fiscal year. The 2022‑23 Budget Act included one‑time General Fund support to eliminate the delay beginning in 2022‑23. The Governor’s budget proposes to shift the elimination of the delay in provider payment processing until 2024‑25, which frees up $378 million one‑time General Fund in 2022‑23.

- Partial Delay of Funding for Behavioral Health Continuum Infrastructure Program. The 2021‑22 budget package included $1.7 billion one‑time General Fund ($2.2 billion total funds) over 2021‑22 and 2022‑23 for grants to develop new behavioral health treatment facilities. The Governor proposes to delay the sixth and final round of grants intended for remaining needs not addressed by the prior rounds of grants, totaling $481 million and previously budgeted for 2022‑23. Half of the delayed funds would be provided in 2024‑25 with the remaining amount provided in 2025‑26.

- Partial Shift of Funding for Behavioral Health Bridge Housing Into 2023‑24. The 2022‑23 budget package included $1 billion General Fund in 2022‑23 and $500 million General Fund in 2023‑24 for grants to local entities to develop transitional housing for individuals experiencing homelessness who also have serious behavioral health conditions. The Governor’s budget shifts $50 million for grants to tribal entities previously budgeted in 2022‑23 to 2023‑24.

2023‑24 General Fund Changes

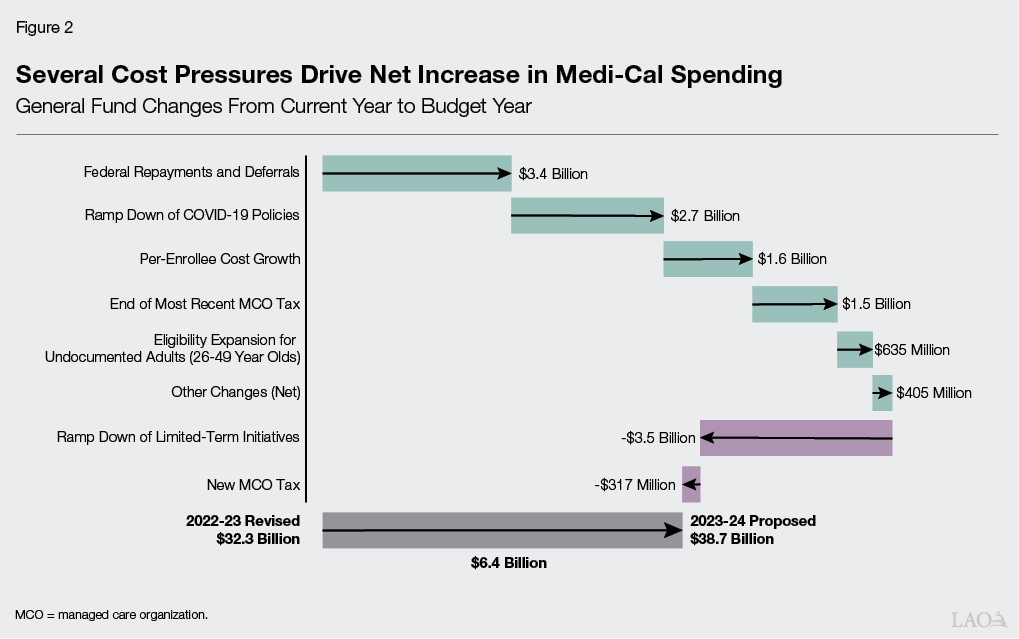

Proposes Increase in General Fund Spending. Under the Governor’s budget, Medi‑Cal General Fund spending would be $38.7 billion, a $6.4 billion (19.9 percent) increase over the revised 2022‑23 level. As Figure 2 shows, this net increase in spending is the result of several key upward and downward adjustments, most of which are intended to implement current law and policy. We describe each major adjustment below.

Provides for Shift and Increase in Federal Repayments and Deferrals. The Governor’s budget provides $3.4 billion General Fund for spending associated with federal repayments and deferrals. This amount primarily reflects the shift in the timing of repayments from 2022‑23 to 2023‑24, as well as an overall increase in estimated repayment amounts based on updated data.

Ramps Down Impacts From COVID‑19‑Related Policies. As previously noted, the administration was not able to incorporate recent federal actions impacting the end dates of COVID‑19‑related policies in its development of the Governor’s budget. Instead, the Governor’s budget assumes the PHE ends in April 2023, followed by eligibility redeterminations resuming in May 2023 and enhanced federal funding expiring in June 2023. Relative to 2022‑23, these assumptions result in a net increase of roughly $2.7 billion in General Fund costs due to increased state spending to backfill the expiration of the enhanced federal funding, which is partially offset by lower caseload costs once eligibility redeterminations resume.

Supports Per‑Enrollee Cost Growth. Under the Governor’s budget, underlying per‑enrollee costs rise due to changes in fee‑for‑service utilization, managed care rates, Medicare premiums (which Medi‑Cal pays for beneficiaries enrolled in both delivery systems), and other pressures. Based on the administration’s budget information, we estimate this cost growth to represent $1.6 billion of the overall increase in Medi‑Cal General Fund spending, reflecting a 4 percent increase over baseline spending.

Anticipates End of Most Recent MCO Tax. For over a decade and following multiple renewals, the state has imposed a tax on managed care plans (also known as MCOs). The state has used the tax to claim additional federal Medicaid funds, which the state receives on a matching basis. The additional federal funds, in turn, have helped offset General Fund costs in Medi‑Cal. Current law authorized the most recent MCO tax from January 2020 through December 2022. The administration projects the end of this version of the MCO tax, unless mitigated by the reauthorization of a new MCO tax, will increase General Fund spending by $1.5 billion in 2023‑24.

Implements Scheduled Eligibility Expansion for Undocumented Adults. Historically, undocumented immigrants who were income‑eligible for Medi‑Cal only qualified for coverage for their emergency‑ and pregnancy‑related services. Over the last several years, and in a number of steps, the Legislature has expanded comprehensive Medi‑Cal coverage to income‑eligible undocumented immigrants. Most recently, the 2022‑23 budget package expanded eligibility to all income‑eligible undocumented residents aged 26 through 49 beginning no later than January 1, 2024. The Governor’s budget includes $635 million General Fund ($844 million total funds) to cover the costs associated with implementing this expansion in 2023‑24.

Ramps Down Limited‑Term Initiatives. The Governor’s budget includes a $3.5 billion reduction in Medi‑Cal spending due to a number of limited‑term initiatives ramping down in 2023‑24. The limited‑term spending reductions are concentrated in various behavioral health initiatives including the Behavioral Health Continuum Infrastructure Program and Behavioral Health Bridge Housing. These scheduled spending reductions are separate from the administration’s proposed delays in the behavioral health area.

Includes Several New Proposals and Program Changes, Some With Mostly Out‑Year Impacts. The Governor’s budget includes several proposals that would require a change in state law, new authorization from the federal government, or both. While most of these initiatives affect Medi‑Cal spending in the budget year, some would not begin until after 2023‑24 and others notably ramp up over time. We describe each new proposal below.

- New MCO Tax Proposal. The Governor proposes implementing a new MCO tax from January 2024 through December 2026. Similar to previous versions of the tax, a portion of the resulting revenues would help offset Medi‑Cal General Fund costs. As the tax would begin half way through the budget year, and due to a fiscal lag associated with the state’s practice of budgeting for Medi‑Cal on a cash basis, the associated offset to the General Fund would be $317 million in 2023‑24. After the tax ramps up in subsequent years, the administration estimates the annual offset to the General Fund to be around $2 billion through 2026‑27. We provide a more detailed analysis of the Governor’s MCO tax proposal in a later section of this report.

- Support for CalAIM Behavioral Health Payment Reform. As part of CalAIM, beginning in 2023‑24, counties will transition away from cost‑based reimbursement to a less administratively burdensome and more timely process for receiving federal Medicaid funds for behavioral health‑related services. Under the new process, counties will transfer funds covering their nonfederal share of cost into a state account, which will be used to draw down the associated federal funds. To help implement this change, the Governor proposes $375 million in one‑time General Fund in 2023‑24. The one‑time General Fund roughly covers counties’ share of cost for the first three months of 2023‑24, mitigating potential disruptions to counties’ cash‑flow during the transition.

- Partial Delay of Funding for Behavioral Health Bridge Housing. In addition to the shift in 2022‑23 funding, the Governor proposes to delay $250 million of funding for bridge housing previously budgeted in 2023‑24 to 2024‑25.

- Federal Match for Designated State Health Programs. In late January 2023, the Department of Health Care Services received federal waiver approval allowing the state to claim federal matching funds for certain existing programs that would otherwise be funded solely with state funds. (The Governor’s budget assumed approval of this waiver.) Under the waiver, the state must use the federal matching funds to help support state costs associated with the CalAIM Providing Access and Transforming Health (PATH) program. The waiver generates total General Fund savings of $646 million over five years, including $153 million in 2023‑24.

- New Behavioral Health Community‑Based Continuum Demonstration. The Governor proposes $314 million General Fund ($6 billion total funds) over five years to Medi‑Cal and the Department of Social Services for the new Behavioral Health Community‑Based Demonstration project. In the budget year, the Governor’s budget specifically provides $311,000 General Fund ($6 million total funds) to Medi‑Cal. The demonstration would allow for federal reimbursement for eligible services provided in Institutes for Mental Disease (often referred to as IMDs) to certain individuals with high‑acuity mental health needs. To qualify for reimbursement, the state—along with counties that opt into the demonstration—must establish a robust continuum of community‑based services that reduces the need for institutional care. We provide an in‑depth analysis of this proposal, as well as of the aforementioned behavioral health‑related spending proposals and budget solutions, in our forthcoming companion report—The 2023‑24 Budget: Analysis of the Governor’s Major Behavioral Health Proposals.

- New CalAIM Transitional Rent Benefit. The Governor proposes seeking federal approval under CalAIM authorizing a new managed care community support benefit, providing up to six months of rent or temporary housing. The benefit would be available to certain individuals experiencing homelessness or at risk of homelessness and transitioning out of institutional levels of care, a correctional facility, or the foster care system. The Governor’s budget provides $6 million General Fund ($18 million total funds) in 2025‑26 to support the new benefit, with the amount eventually ramping up to $41 million ongoing General Fund ($117 million total funds) at full implementation.

- New Reproductive Health Services Demonstration. The Governor proposes to seek federal approval for a new three‑year demonstration waiver to support access and provider capacity for services related to family planning for existing enrollees and Medicaid‑eligible nonresidents beginning in 2024. To support services provided through the demonstration, the Governor proposes $15 million one‑time General Fund ($200 million total funds) in 2024‑25.

Caseload and COVID‑19‑Related Policies

In this section, we (1) provide additional background about the impact of federal COVID‑19‑related policies on the Medi‑Cal caseload and General Fund costs; (2) describe the assumptions in the Governor’s budget regarding caseload, enhanced federal funding, and General Fund costs; and (3) assess these assumptions and provide alternative estimates.

Background

Medi‑Cal Serves Distinct Populations With Varying Costs. Medi‑Cal serves a number of distinct populations, including families with children, seniors aged 65 or older, persons with disabilities, and childless adults. The last group also is known as the Patient Protection and Affordable Care Act (ACA) optional expansion population. These populations have varying characteristics and costs. Seniors and persons with disabilities tend to have greater needs than some other Medi‑Cal populations, and therefore tend to have higher per‑enrollee costs. The ACA optional expansion population and families, by contrast, tend to have lower per‑enrollee costs. In addition, the federal government currently pays 90 percent of Medi‑Cal costs for individuals enrolled as part of the ACA optional expansion, as opposed to 50 percent for most other beneficiary populations.

Federal COVID‑19 Policies Increased Caseload but Reduced General Fund Costs. As previously discussed, in 2020, Congress approved a temporary increase in federal funding for most Medicaid costs. To be eligible for this increased federal funding, states must comply with several requirements on top of standard Medicaid rules, the most important being the continuous coverage requirement, which prohibits states from terminating eligibility for existing beneficiaries except in limited circumstances. Largely as a result of these policies, caseload and associated Medi‑Cal spending across all fund sources have increased substantially since the beginning of the PHE. However, to date, the General Fund costs have been more than offset by the enhanced federal funding.

Recent Federal Actions Establish End Dates of COVID‑19‑Related Policies. In late December 2022, Congress enacted legislation that decouples the end dates of the continuous coverage requirement and enhanced federal funding from the PHE. In addition, in late January 2023, the federal administration announced an intended end date to the PHE in May. We describe these changes and their impacts on Medi‑Cal below.

- Continuous Coverage Requirement Expires in March 2023. As a result of recent federal legislation, the continuous coverage requirement will expire at the end of March 2023. Counties will resume processing eligibility redeterminations on a monthly basis beginning April 1, 2023, with the first individuals determined to be no longer eligible for Medi‑Cal expected to lose Medi‑Cal coverage on July 1, 2023. To comply with federal requirements, counties must complete all eligibility redeterminations by May 31, 2024. Thereafter, annual eligibility redeterminations will be staggered throughout the year, similar to practices before the PHE.

- Enhanced Federal Funding Ramps Down Beginning April 2023. Prior to the recent federal legislation, the enhanced federal funding would have remained at 6.2 percentage points until being fully eliminated at the end of the quarter that the PHE expires. Instead, as a result of the federal legislation, the enhanced federal funding will ramp down over the course of calendar year 2023. Beginning in April 2023, the enhanced rate for most services will drop from 6.2 percentage points to 5 percentage points, then to 2.5 percentage points by July 2023, 1.5 percentage points by October 2023, and will be fully eliminated by January 2024. After this point, the federal share of Medi‑Cal costs will return to the rates provided before the PHE.

- PHE Ends in May 2023. The federal government recently announced intent to end the PHE on May 11, 2023. While the continuous coverage requirement and enhanced federal funding no longer will be impacted by the end date of the PHE, certain COVID‑19‑related policies such as revised reimbursement rates for certain behavioral health services will be impacted by the end date of the PHE.

Governor’s Budget Assumptions

Assumes PHE Ends in April and Does Not Account for Recent Federal Actions. Due to the timing of the development of the Governor’s budget, the administration was not able to consider the impacts of the recent federal actions on caseload and General Fund spending for Medi‑Cal. Instead, the administration assumed that the PHE would end in April 2023, resulting in the eligibility redeterminations beginning in May 2023. Using these assumptions, the administration estimated average monthly caseload would be about 15.2 million in 2022‑23 before declining to an average monthly caseload of a little over 14.4 million in 2023‑24. The administration also assumed that enhanced federal funding would remain at 6.2 percentage points before expiring entirely in June 2023, offsetting $4.4 billion in General Fund costs for Medi‑Cal across 2022‑23 and 2023‑24 (not including enhanced federal Medicaid funding for In‑Home Supportive Services and the Department of Developmental Services).

Assessment of Caseload Assumptions

Overall Caseload Levels Reasonable in 2022‑23, Likely Overstated in 2023‑24. Using more recent information, such as enrollment data through September 2022, we examined the administration’s caseload projections and associated costs. We find that the administration’s assumed overall level of caseload in 2022‑23 generally to be reasonable. However, we project that the average Medi‑Cal caseload in 2023‑24 will be about 270,000 enrollees (2 percent) lower than the administration’s estimates. Our lower estimate in 2023‑24 primarily reflects the continuous coverage requirement ending one month earlier than assumed by the administration. In addition, as discussed in the following paragraphs, we differ from the administration’s projections of certain subgroups of the Medi‑Cal caseload.

Continuous Coverage Requirement Ending Will Impact Some Populations More Than Others. We expect the decline in caseload associated with the earlier end date of the continuous coverage requirement will be concentrated primarily among the ACA optional expansion and family caseloads. These caseloads experienced the largest enrollment growth during the PHE. Similarly, enrollees in these populations are most likely to have changes in circumstances—like employment—that could result in eligibility losses when the continuous coverage requirement ends. As a result, relative to the administration, we estimate 2023‑24 caseload for the ACA optional expansion population to be 80,000 enrollees (1.5 percent) lower and the family caseload to be 150,000 enrollees (2.5 percent) lower.

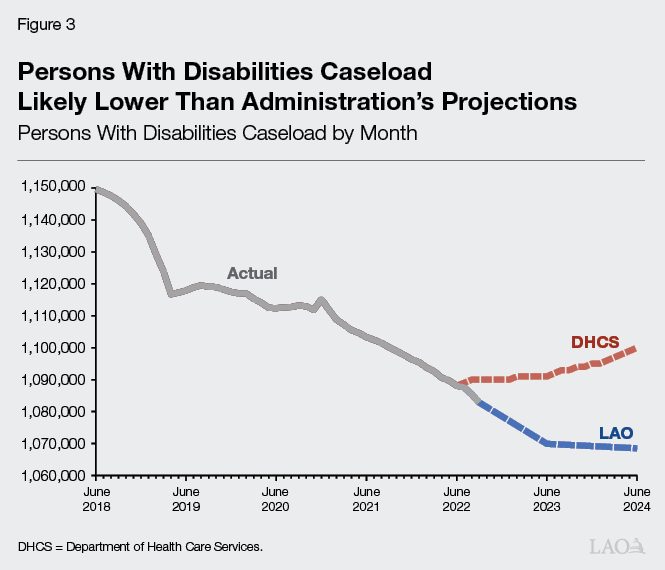

Persons With Disabilities Caseload—a Population With Relatively Higher Per‑Enrollee Costs—Likely Overstated. As Figure 3 shows, our estimate for the number of persons with disabilities enrolled in Medi‑Cal differs from the administration’s. The administration estimates that the number of persons with disabilities enrolled in Medi‑Cal will be somewhat higher than current enrollment levels in both 2022‑23 and 2023‑24. However, this caseload group has been declining consistently since 2014. Without any clear policy mechanism or external factors indicating a reversal in this trend, we expect this caseload will continue to decline. As such, we estimate the persons with disabilities caseload to be about 12,000 enrollees (1 percent) lower than the administration’s estimate in 2022‑23 and about 26,000 enrollees (2.5 percent) lower than the administration’s estimate in 2023‑24. While these differences might appear small, persons with disabilities tend to have higher per‑enrollee General Fund costs compared to other caseload groups. As a result, small differences in the persons with disabilities caseload can have disproportionate impacts on General Fund costs for Medi‑Cal.

Under LAO Projections, Lower Level of General Fund Spending on Caseload Relative to Governor’s Budget. Relative to the administration, we expect caseload‑related General Fund costs in Medi‑Cal to be more than $800 million lower across 2022‑23 and 2023‑24. For 2022‑23, we estimate the reduction in General Fund costs to be roughly $150 million lower than the administration’s estimates—largely driven by the persons with disabilities caseload. For 2023‑24, we estimate General Fund costs to be around $650 million lower than the administration—of which about $400 million is attributable to the earlier end date of the continuous coverage requirement and $250 million is attributable to the lower estimated persons with disabilities caseload.

Assessment of Enhanced Federal Funding Assumptions

Ramp Down of Enhanced Federal Funding Will Increase General Fund Costs in 2022‑23… Beginning in April 2023, the ramp down of the enhanced federal funding will result in somewhat lower federal funding in 2022‑23 than assumed by the administration. We estimate the ramp down of the enhanced federal funding will result in $150 million of higher General Fund costs than assumed by the administration.

…But Reduce General Fund Costs in 2023‑24. The ramp down schedule for the enhanced federal funding will result in six additional months of enhanced federal funding in 2023‑24 than assumed by the administration. Relative to the Governor’s budget, we estimate the additional months of enhanced federal funding will reduce General Fund costs for Medi‑Cal costs by over $400 million. (Including enhanced federal Medicaid funds in the In‑Home Supportive Services and Department of Developmental Services budgets, we estimate the ramp down of the enhanced federal funding increases General Fund spending by over $200 million in 2022‑23 and reduces General Fund spending by more than $650 million in 2023‑24 relative to the Governor’s budget, for a net offset of General Fund of about $450 million across the two years.)

Net Impact of LAO Alternative Estimates

Lower General Fund Spending in 2023‑24. Relative to the Governor’s budget, we estimate that lower caseload costs effectively will offset the General Fund impact from the ramp down of the enhanced federal funding in 2022‑23. However, relative to the Governor’s budget, we project a net reduction of about $1 billion General Fund in 2023‑24 for Medi‑Cal. Our difference with the administration is due to further reductions in caseload costs combined with additional months of enhanced federal funding, both of which will reduce General Fund spending in 2023‑24. (We note that because the federal administration has stated an intent to end the PHE one month later than assumed in the proposed budget, policies that remain tied to the PHE end date will continue for one month longer than assumed by the administration. However, any resulting budget impacts will be relatively minor.)

Recommendation

Withhold Action Until May Revision. Despite finding that General Fund costs could be around $1 billion lower in 2023‑24 than assumed in the Governor’s budget, we recommend withholding action on these adjustments until after the May Revision. By that point, the administration will have had time to update their estimates to incorporate additional months of caseload data and the recent federal actions. We will make our final assessment and recommendations based on the administration’s revised estimates at that time.

MCO Tax Proposal

In this section, we provide background on the MCO tax, describe the Governor’s proposal, and offer our preliminary assessment and recommendation.

Background

MCO Tax Has Helped Offset General Fund Medi‑Cal Spending. For over a decade and following multiple renewals, the state has imposed a tax on managed care plans (also known as MCOs). The structure of the tax has changed over time. For example, earlier versions imposed a tax on managed care plans’ revenues, whereas later versions imposed a tax on managed care plans’ enrollment. The state has used the MCO tax to claim additional federal Medicaid matching funds, which help offset the General Fund cost to provide payments to Medi‑Cal managed care plans.

Tax Requires Federal Approval. Federal approval of the MCO tax is necessary for the state to use it to draw down federal Medicaid funds. To receive approval, the state must prove to the federal government that the burden of paying the tax does not fall too disproportionately on Medicaid as opposed to non‑Medicaid services. In addition, the state may not hold managed care plans harmless by providing them direct or indirect payments that do so, as determined by the federal government. In some years, the federal government rejected the state’s proposed tax, necessitating changes to the structure and resubmission to the federal government before it could go into effect.

Recent Versions of Tax Have Imposed Relatively Small Net Cost on Health Insurance Industry. While the structure of the MCO tax has changed over time, recent versions have taxed both Medi‑Cal and non‑Medi‑Cal enrollment. The rates charged on Medi‑Cal enrollment have been substantially higher than the rates on non‑Medi‑Cal enrollment. The Medi‑Cal tax liability is cost neutral to plans, as Medi‑Cal includes the associated cost of the tax in its payments to managed care plans (as allowed under federal law). The non‑Medi‑Cal tax liability, by contrast, is not covered by the state and reflects a net cost to the health insurance industry. Analyses of recent versions of the MCO tax estimated the net cost to the health insurance industry to be in the low tens of millions of dollars annually.

Most Recent MCO Tax Has Expired. The most recent MCO tax began in January 2020 and generated annual General Fund savings of over $1.5 billion. The tax was enrollment‑based, with rates charged on tiers of each plan’s cumulative monthly enrollment in the 2018 calendar year. State authorization and federal approval of the MCO tax expired at the end of December 2022.

Proposal

Proposes New Tax. The Governor proposes a new MCO tax extending from January 2024 through December 2026. The Governor’s budget assumes the new tax will have a similar structure to the most recent version, with rates applied to tiers of cumulative monthly enrollment in the 2021 calendar year and an adjustment to account for planned Medi‑Cal managed care changes in 2024. The Governor’s Budget Summary also states intent to explore opportunities over the next few months to increase the level of the MCO tax. The administration also indicates that the proposal will include trailer legislation establishing the tax’s parameters. As of the publication of this report, the administration has not submitted associated trailer legislation to the Legislature. Because the tax would begin part way through 2023‑24, and due to a fiscal lag from the state’s practice of budgeting for Medi‑Cal on a cash basis, the Governor’s budget estimates the proposed tax would yield $317 million in General Fund savings in 2023‑24. In future years, the administration projects annual General Fund savings of around $2 billion.

Assessment

In Concept, Adopting a New MCO Tax Makes Budgetary Sense. Since its adoption, the MCO tax has been a key source of support for Medi‑Cal. Past versions of the tax have helped offset Medi‑Cal General Fund costs while imposing a relatively small net cost to the health insurance industry. Because of the tax’s longstanding role in supporting Medi‑Cal, the administration’s proposal to pursue federal approval for a new MCO tax has merit. Moreover, this is a particularly opportune time to pursue a new tax in light of the state’s current budgetary constraints. (We describe the state’s budget condition in The 2023‑24 Budget: Overview of the Governor’s Budget.)

Key Details of Proposal Remain Outstanding. We understand the proposal at this time to be preliminary. That said, as of the timing of this publication, key uncertainties remain with the proposal. Most notably, the administration has not clarified what opportunities it is exploring to increase the level of the MCO tax relative to the most recent tax. Without knowing where the administration has landed from its exploration of these opportunities, the resulting implications to the health insurance industry, the extent to which the increased tax would offset Medi‑Cal General Fund spending, and whether the increased tax meets federal rules remain unknown. Until the administration provides this information, the Legislature cannot fully weigh the merits of the proposal.

Recommendation

Authorizing New MCO Tax Warrants Serious Legislative Consideration, but More Information Needed. Given the potential benefits to the General Fund of adopting a new MCO tax and the state’s current budget situation, adopting a new tax warrants serious legislative consideration. To that end, we recommend the Legislature direct the administration during the budget process to provide more robust information about the proposal. First, the Legislature will want to know where the administration has landed in terms of increasing the level of the MCO tax and the associated offset to the General Fund. With this information, the Legislature will then want to be informed of (1) the proposed structure of the new tax, (2) year‑by‑year projections of the new tax revenues and associated offset to the General Fund, (3) the year‑by‑year net cost to the health insurance industry, and (4) an analysis demonstrating the proposed tax structure likely meets federal rules.