LAO Contact

September 1, 2023

MOU Fiscal Analysis: Bargaining Unit 12 (Craft and Maintenance)

This analysis of the proposed memorandum of understanding (MOU) between the state and Bargaining Unit 12 (Craft and Maintenance) fulfills our statutory requirement under Section 19829.5 of the Government Code. Unit 12 consists of roughly 12,500 full-time equivalent (FTE) state employees who operate and maintain state equipment, facilities, buildings, grounds, and roads. Unit 12’s current members are represented by the International Union of Operating Engineers Locals 3, 39, and 501. The administration posted on its website the agreement, a summary of the agreement, and a summary of the administration’s estimate of the agreement’s fiscal effects. The union also posted a summary of the agreement on its website. (Our State Workforce webpages include background information on the collective bargaining process, a description of this and other bargaining units, and our analyses of agreements proposed in the past.) The union reported on August 21, 2023 that the tentative agreement was approved by the union’s membership. Under state law, a tentative agreement does not go into effect as the MOU for a bargaining unit unless it is ratified by both the Legislature and union membership.

Major Provisions of Proposed Agreement

Term. The agreement would be in effect from July 1, 2023 through June 30, 2026. This means that the agreement would be in effect for three fiscal years (2023‑24, 2024‑25, and 2025‑26).

Provisions Related to Pay

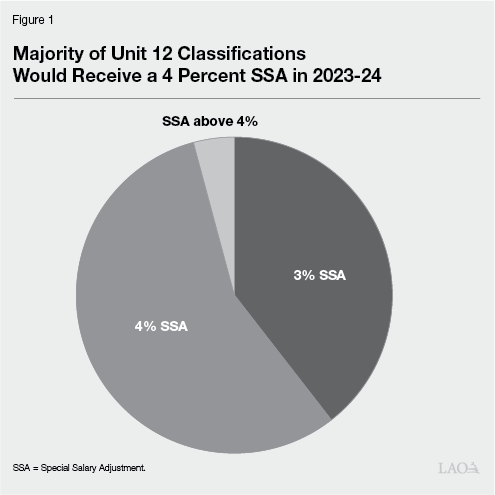

2023‑24 Special Salary Adjustments (SSAs). The proposed agreement would provide all Unit 12 members specified SSAs effective July 1, 2023. Unlike a General Salary Increase (GSI), which applies a uniform pay increase to the salary ranges of all classifications represented by a bargaining unit, an SSA increases the pay ranges of specified classifications. As Figure 1 shows, most Unit 12 members would receive either a 3 percent or 4 percent SSA. As we describe below, a small portion of the bargaining unit would receive an SSA greater than 4 percent. On average, Unit 12 members would receive an SSA of 3.9 percent in 2023‑24 under the agreement.

6.7 Percent SSA for Park Landscape Maintenance Technicians. The agreement would provide the four FTE Park Landscape Maintenance Technicians a 6.7 percent pay increase.

5 Percent SSA to Foundation Drillers and Maintenance Aide (Seasonal) Classifications. The agreement would provide the 246 FTE employees in one of three Foundation Driller classifications and the Seasonal Maintenance Aide classification a 5 percent pay increase.

4.8 Percent SSA to Park Maintenance Worker IIs. The agreement would provide the 35 FTE employees who work as a Park Maintenance Worker II a 4.8 percent pay increase.

4.41 to Lead Automotive and Motorcycle Mechanics. The agreement would provide the two FTE employees in either the Lead Automotive Mechanic or the Lead Motorcycle Mechanic classifications a 4.41 percent pay increase.

4.19 Percent SSA to Telecommunications Facilities Technician IIs (California Highway Patrol). The agreement would provide the five FTE employees who work at the California Highway Patrol as a Telecommunications Facilities Technician II a 4.19 percent pay increase.

4 Percent SSA to 74 Specified Classifications. The administration’s summary of the agreement lists the 74 classifications for which the agreement would provide a 4 percent pay increase. There are 7,053 FTE employees in these classifications.

3 Percent SSA to Remaining Unit 12 Classifications. The remaining classifications, affecting 4,944 FTE employees, would receive a 3 percent pay increase.

Additional SSA for Senior Maintenance Aide (Seasonal). The agreement specifies that, following the 3 percent SSA mentioned above, the Senior Maintenance Aide (Seasonal) classification’s pay range would be adjusted (1) to ensure that the minimum step of the classification is 5 percent above the maximum step of the Maintenance Aide (Seasonal) classification and (2) such that there are 5 percent differentials between each step of the salary range. The administration estimates that this provision would increase Senior Maintenance Aide (Seasonal) pay by 21.5 percent. This would affect 35 FTE employees.

2024‑25 Pay Increases. The agreement would provide the below pay increases to eligible Unit 12 members effective July 1, 2024. These provisions would result in 49 percent of Unit 12 members receiving no salary adjustment in 2024‑25.

5 Percent SSA to Foundation Drillers. The 16 FTE employees in one of three Foundation Driller classifications would receive a 5 percent pay increase.

4 Percent Top Step Increase to All Other Unit 12 Classifications. The top step of the salary ranges for all Unit 12 classifications, other than Foundation Drillers, would increase by 4 percent. Employees at the top step of their salary range for more than 12 qualifying pay periods would receive the pay increase July 1, 2024. The administration indicates that this provision would provide pay increases to about 6,400 FTE employees.

2025‑26: 4 Percent Top Step Increase for All Classifications. Effective July 1, 2025, the agreement would increase the top step of all Unit 12 classifications’ salary ranges by 4 percent. Employees at the top step of their salary range for more than 12 qualifying pay periods would receive the pay increase July 1, 2025. Slightly more than one-half of the bargaining unit is at the top step of their salary range. This means that nearly one-half of the bargaining unit would receive no SSA in 2025‑26.

Employees Who Work Through August 2026 Eligible to Receive Payments Totaling Up to $3,600. The agreement would provide six payments, each up to $600, over the course of the term of the agreement. The payments would be made in January 2024, August 2024, January 2025, August 2025, January 2026, and August 2026. Over the course of the agreement, employees could receive up to $3,600 from these payments. To be eligible for the full payment, employees would need to work for the six months preceding each payment date and be employed by the state at the time of payment. For the average Unit 12 member, $1,200 per year is equivalent to 1.9 percent of base pay.

One-Time Payment of $1,500 for Specified Past Work. In 2023‑24, the agreement would provide a one-time payment of $1,500 to eligible Unit 12 members. To be eligible for this payment, employees would need to have been (1) employed by the state on January 1, 2022 and remained in employment through the first day of the pay period following ratification and (2) worked more than 50 percent of the time in a correctional facility, correctional health care facility, Veteran’s Home, state hospital, developmental services, or formally deployed and reassigned to work on emergency wildfire response efforts.

Recruitment and Retention Differentials and Other Provisions Related to Pay. The agreement would provide various “recruitment and retention” payments to Unit 12 members who perform specific jobs and would provide various other provisions related to pay. We do not summarize these provisions here as they are numerous and constitute less than 3 percent of the ongoing annual increased costs resulting from the agreement. For a detailed discussion of these pay increases and their individual costs, refer to the administration’s summary of the agreement and its fiscal effect.

Other Major Provisions

Increased State Contribution to Health Benefits. The state contributes a flat dollar amount to Unit 12 members’ health benefits. The proposed agreement would adjust the amount of money the state pays towards these benefits to maintain a state contribution equivalent to the 80/80 formula, whereby the state pays an amount equal to 80 percent of the weighted average of the basic health plan premiums for the employee and any eligible dependents. The state’s contribution would be adjusted to reflect changes in premiums in January of 2024, 2025, and 2026.

Reduced Employee Pension Contributions to Align With PEPRA Standard. The Public Employees’ Pension Reform Act (PEPRA) established a standard, but not a requirement, that employees and the state each contribute one-half of the normal cost to fund employee pension benefits. The actual rates paid by state employees varies and has been established through the collective bargaining process. As this table from recent California Public Employees’ Retirement System Board meeting materials indicates, Unit 12 members pay among the highest state employee contribution rates. For example, Unit 12 miscellaneous members pay 10 percent of pay to fund the benefit when most other state employees in that pension tier pay 8 percent or 8.5 percent of pay. The proposed agreement would reduce Unit 12 members’ employee contribution rates towards their pension benefits by 0.5 percent of pay effective July 1, 2024 and again July 1, 2025. Effective July 1, 2026, similar to what has been adopted for other bargaining units, the employee contribution rate would be reevaluated each year to maintain the standard that employees pay one-half of normal cost. Specifically, if the actuarially determined blended total normal cost increases or decreases by more than 1 percent of pay, the employee contribution will increase or decrease to one-half of the actuarially determined blended total normal cost, rounded to the nearest quarter of 1 percent of pay. For reference, the total blended normal cost for State Miscellaneous is 17.6 percent of pay.

Classification Consolidation. Under the agreement, the parties agree to meet for the purposes of “considering and discussing potential consolidation of Bargaining Unit 12 classifications necessary and appropriate.” The agreement does not define what constitutes necessary or appropriate. Presumably, the parties would define this standard during their deliberations. The agreement specifies when certain classifications would be considered: (1) within six months of ratification, the California Prison Industry Authority would initiate a feasibility study to determine if the Industrial Supervisor, Prison Industries series can be consolidated; (2) within 12 months of ratification, the California Department of Human Resources (CalHR) would initiate a workgroup of departments that employ Truck Driver classifications; and (3) within 12 months of ratification, CalHR would initiate another workgroup consisting of departments that employ department-specific Equipment Operator classifications and Tractor Operator classifications.

LAO Assessment

Administration’s Fiscal Estimate

Figure 2

Administration’s Fiscal Estimate of Proposed Unit 12 Agreement

(In Millions)

|

Provision |

2023-24 |

2024-25 |

2025-26 |

2026-27 |

|||||||

|

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

||||

|

Special Salary Adjustment |

$17.3 |

$46.6 |

$17.3 |

$46.7 |

$17.3 |

$46.7 |

$17.3 |

$46.7 |

|||

|

Top Step Increases |

— |

— |

11.5 |

27.4 |

23.2 |

55.5 |

23.2 |

55.5 |

|||

|

Up to $1,200 Annual Payment |

2.8 |

7.4 |

5.7 |

14.8 |

5.7 |

14.8 |

2.8 |

7.4 |

|||

|

Health Benefits |

2.2 |

5.6 |

5.8 |

15.1 |

9.6 |

25.0 |

11.2 |

29.2 |

|||

|

$1,500 Payment for Past Work |

4.4 |

4.4 |

— |

— |

— |

— |

— |

— |

|||

|

Recruitment and Retention Differentials and Other Pay Provisionsa |

0.7 |

4.7 |

0.9 |

5.1 |

0.9 |

5.1 |

0.9 |

5.1 |

|||

|

Reduced Employee Pension Contributionsa |

— |

— |

0.9 |

2.4 |

1.8 |

4.8 |

1.8 |

4.8 |

|||

|

Totals |

$27.4 |

$68.7 |

$42.0 |

$111.5 |

$58.4 |

$151.9 |

$57.2 |

$148.7 |

|||

|

aAt least a portion of these costs are considered “non-add” by the administration as they will not affect departmental appropriations. |

|||||||||||

Agreement Would Increase Ongoing Annual Costs by More Than $140 Million. Due to one-time costs associated with provisions of the agreement, 2025‑26 would be the highest cost year resulting from the agreement, increasing costs in that year by $152 million ($58 million from the General Fund). After the one-time provisions have ended, the agreement would increase annual state costs by more than $140 million (more than $50 million General Fund) beginning in 2027‑28.

2023‑24 Provisions Related to Pay Increases Represent 5 Percent of Current Unit 12 Payroll Costs. The state’s salary and salary-driven benefit costs for Unit 12 members is about $1.2 billion. Excluding health benefits, the agreement would increase Unit 12 compensation costs in 2023‑24 by $63 million, about 5 percent of current Unit 12 payroll costs. By the end of the three-year term of the agreement, ongoing annual costs (excluding health benefits) would increase by the equivalent of about 10 percent of current Unit 12 payroll costs.

Cost to Extend Provisions to Excluded Employees. The administration estimates that extending the economic provisions of the agreement to employees excluded from the collective bargaining process but associated with Unit 12 (primarily Unit 12 managers and supervisors) would increase state costs in 2023‑24 by $18.4 million ($7.5 million General Fund).

Compensation Study

2020 Compensation Study Evaluated Seven Occupations Representing 59 Percent of Bargaining Unit 12 Jobs. The most recent compensation study of Unit 12 was published in 2022 and relied on data from 2020. That compensation study looked at seven occupations represented by Unit 12 classifications: highway maintenance workers; maintenance and repair workers (general); stockers and order fillers; mobile heavy equipment mechanics (except engines); electricians; painters, construction, and maintenance workers; and landscaping and groundskeeping workers. The study compared the compensation provided to employees in these occupations by the state with that provided by private sector, federal government, and local government employers. The study looked at both wages and total compensation (meaning wages and benefits).

Study Found Two Occupations Compensated Below Market… When looking at wages alone, the compensation study found that the state’s salaries for highway maintenance workers (representing about 30 percent of the bargaining unit), mobile heavy equipment mechanics (representing 5 percent of the bargaining unit), and electricians (representing 4 percent of the bargaining unit) lagged the median wage provided by other employers. When considering total compensation, however, the study found that the state did not lag the total compensation provided to electricians but did lag in the case of the other two occupations. Specifically, the study found that the state lagged the total compensation provided to mobile heavy equipment mechanics by 5 percent and highway maintenance workers by 10 percent.

…But Other Occupations Compensated Above Market. When looking at total compensation, the study found that the state leads the market in the other five occupations—representing roughly one-fourth of Unit 12 classifications. The identified leads ranged from 6 percent (in the case of electricians) and 42 percent (in the case of stockers and order fillers). As we discuss in greater detail below, the proposed agreement would provide classifications in two of the occupations identified as being compensated above market larger SSAs in 2023‑24 than other classifications. Further, all of the classifications in the five occupations where the state’s compensation leads the market would receive the top step increases provided by the agreement in 2024‑25 and 2025‑26.

Duration

Agreement Would Be in Effect Longer than We Recommend. Since 2007, we have recommended that the Legislature not ratify labor agreements with durations longer than two years in order to maintain legislative flexibility and authority to respond to changing economic situations. An MOU establishes the state’s employee compensation policies and locks in state expenditures for the duration of the agreement. Though the Legislature has authority to modify economic provisions of ratified MOUs through its appropriation authority, in practice, it is difficult for the Legislature to exercise this authority.

By 2025‑26—the last year of this agreement—General Fund revenues could be tens of billions of dollars higher or lower than current estimates. There is significant uncertainty about economic conditions by the end of this agreement. Inflation may remain elevated, in which case the pay increases provided by this agreement might not be sufficient to preserve employees’ purchasing power. Alternatively, if inflation continues to fall, the state could end up providing pay increases above the rate of inflation under the agreement, resulting in the state potentially paying more than might be necessary. Further, labor markets could remain tight or soften. While we cannot say with certainty how these economic conditions will unfold, we have advised the Legislature to remain cautious as key economic indicators—such as the treasury bond yield curve—have signaled an economic and revenue slowdown could be forthcoming.

Although future addenda or side letters may be established to address unforeseen issues that might materialize during the term of the MOU, the addenda review process established under Item 9800 of the annual budget act defers more authority to the Governor than the MOU ratification process. A shorter term allows the Legislature greater control over the state’s compensation policies.

Pay Increases

Some Higher SSAs Supported by Compensation Study Findings. Classifications in two occupation groups—highway maintenance workers and mobile heavy equipment mechanics—that were identified to be lagging in the compensation study would receive SSAs above 3 percent under the agreement. Specifically, the state’s total compensation for highway maintenance workers and mobile heavy equipment mechanics was identified to lag the market by 9.6 percent and 4.8 percent, respectively. Classifications from these occupations represent about two-thirds of the FTE employees who would receive 2023‑24 SSAs above 3 percent under the agreement. Based on these findings, the compensation study seems to support these classifications receiving higher SSAs.

Justification for Some of the Other Pay Increases Unclear. Roughly one-fourth of the FTE employees who would receive SSAs above 3 percent in 2023‑24 work in classifications that were not included in the most recent compensation study. For these classifications, we have limited data to assess the justification of a higher pay increase.

Some Occupations Found to Be Compensated Above Market Would Receive SSAs Above 3 Percent, Potentially Reflecting Other Workforce Issues. As we discuss below, the compensation study paints a complicated picture that does not necessarily support higher SSAs in 2023‑24 for maintenance and repair workers or landscaping and groundskeeping workers, both of which were included in the compensation study. Together, classifications from these two occupations represent 8 percent of FTE employees who would receive 2023‑24 SSAs above 3 percent.

Maintenance and Repair Workers Paid Above Market, but Have High Rates of Voluntary Separations and Vacancies. In the case of state maintenance and repair workers, the compensation study found that the state’s compensation package leads the market by 16 percent. However, despite the above market compensation, the study suggests that the occupation group might have a turnover problem. The overall turnover rate is 12 percent, which is higher than the Unit 12 average of 10 percent and significantly higher than the statewide average of 7.2 percent. This high turnover rate appears driven primarily by high rates of voluntary separations, which were reported to be more than 2.5 times the statewide voluntary separation rate. Possibly in part due to this turnover, the study indicates that more than 22 percent of state maintenance and repair worker positions are vacant.

Landscaping and Groundskeeping Workers Paid Above Market, but Have High Rates of Involuntary Separations, Retirements, and Vacancies. The compensation study found that state landscaping and groundskeeping workers are compensated 16 percent above market. Despite being compensated above market, state landscaping and groundskeeping classifications have higher turnover rates and vacancy rates than the rest of Unit 12 and the state workforce. The high turnover appears to be driven mostly by retirements, which account for 54 percent of the turnover. However, involuntary separations—accounting for 18 percent of the turnover for the occupation group—are nearly twice the involuntary separation rate of other Unit 12 classifications and four times the statewide involuntary separation rate.

SSAs in 2023‑24 Suggest Targeted Precision to Address Classification-Specific Issues Without Clear Justification for Approach. Typically, the state provides a GSI to all workers in a bargaining unit to account for inflation, whereas SSAs are provided to ensure wages are competitive with other employers. Instead of a GSI, the proposed agreement provides specified SSAs above 3 percent in 2023‑24 to 85 different Unit 12 classifications and 3 percent to the remaining classifications. The higher SSAs range from 4 percent to 6.7 percent. The compensation study, however, only provided information on occupation groups that include 24 of these classifications. As a result, there is limited information to support the SSAs for the other classifications. Moreover, there is little evidence to justify why a higher SSA should be provided to some classifications but not to others. In the end, we think the approach implemented by the proposed agreement to provide pay increases to employees in 2023‑24 is unnecessarily convoluted and creates a lack of transparency for the Legislature and the public to understand why some state employees should receive higher pay increases than others.

Most Provisions Geared Towards Benefitting Seniority Rather Than Recruiting New Employees. The overall structure of the agreement seems intended to benefit employees with the highest levels of seniority. The largest economic provisions give pay increases to the top step of classification pay ranges, pay employees for work done in the past, and reward employees who stay employed by the state for the duration of the agreement. There is evidence of retention difficulties with Unit 12—for example, the rate of voluntary separations in Unit 12 is more than 60 percent higher than the statewide rate and the Unit 12 voluntary separation rate grew since the 2018 compensation study while the statewide rate decreased. Moreover, there is also evidence that the state is having challenges filling positions vacated by the turnover. For example, the vacancy rate increased from 16.6 percent in the 2018 study to 19.6 percent in the most recent study. In calendar year 2022, on average, 25 percent of Unit 12 authorized positions were vacant compared with 19 percent of authorized positions being vacant statewide. Despite the recruitment challenges of Unit 12, few of the provisions of the proposed agreement seem geared towards making Unit 12 classifications broadly more competitive in the labor market to recruit new hires.

LAO Recommendations

Require Administration to Justify Compensation Increases. With the exception of the costs to maintain Unit 12 health benefits, the agreement targets specific classifications or steps within classification ranges to receive specified compensation increases. This means that the agreement proposes targeted compensation increases that increase state annual costs by more than $100 million by 2026‑27. When budget proposals of far lesser value are submitted to the Legislature by the Governor during the budget process, the administration is expected to explain why a cost increase is necessary. Much of the budget conversations circle around identifying the problem intended to be addressed by a budget proposal and evaluating whether the proposal would address the identified problem satisfactorily. When it comes to bargaining agreements, however, the administration has not provided justification for why it and a bargaining unit think that a specific change in compensation is needed for one classification but not another. The compensation studies that the administration submits to the Legislature pursuant to state law do not always support the compensation increases that the administration and bargaining units propose. This leaves the Legislature with limited tools (and often with limited time) to assess whether proposed changes in compensation are warranted. Going forward, we recommend that the Legislature direct the administration to submit to the Legislature a justification for each economic provision of a proposed labor agreement that (1) identifies the problem being addressed by the provision and (2) explains how the provision addresses the problem.