LAO Contact

September 7, 2023

MOU Fiscal Analysis: Bargaining Unit 7 (Protective Services and Public Safety)

On Saturday, September 2, 2023, the administration submitted to the Legislature a tentative agreement between the state and Bargaining Unit 7 (Protective Services and Public Safety). This analysis of the proposed labor agreement fulfills our statutory requirement under Section 19829.5 of the Government Code. State Bargaining Unit 7 consist of employees whose work is related to public safety and includes responsibilities such as protecting state lands and buildings, issuing licenses or permits, and arresting individuals for violating penal or administrative laws. As of July 2, 2023, employees represented by Unit 7 work under the terms and conditions of an expired memorandum of understanding (MOU). Current members of Unit 7 are represented by the California Statewide Law Enforcement Association (CSLEA). The administration has posted on the California Department of Human Resources’ (CalHR’s) website the agreement, a summary of the agreement, and a summary of the administrations fiscal estimate for the agreement. The proposed agreement may go into effect only after it has been ratified by the Legislature and a majority of voting CSLEA members. (Our State Workforce webpages include background information on the collective bargaining process, a description of this and other bargaining units, and our analyses of agreements proposed in the past.)

Background

Vacant Positions

Vacancy Rate Growing, Similar to Statewide Average. A decade or so ago, the average state vacancy rate hovered between 10 percent and 15 percent. Over the past few years, the statewide vacancy rate has increased significantly such that the average vacancy rate is now around 20 percent. Similar to this statewide trend, Unit 7 also has more vacant positions today than it did several years ago. Specifically, while 15 percent of Unit 7 positions were vacant in 2018, 23 percent of Unit 7 positions were vacant as of July 31, 2023.

Compensation Study

The most recent Unit 7 compensation study released by CalHR evaluated four occupational groups represented by Unit 7: Detectives and Criminal Investigators, Forensic Science Technicians, Police and Sheriff’s Patrol Officers, and Public Safety Telecommunicators. Together, these four occupational groups account for 56 percent of Unit 7 members.

Study Found Two Occupational Groups Lag Market…The study found that Detectives and Criminal Investigators as well as Police and Sheriff’s Patrol Officers represented by Unit 7 earn total compensation that lags the market by 17 percent and 49 percent, respectively.

…And Two Occupational Groups Lead Market. The study found that Forensic Science Technicians and Public Safety Telecommunicators represented by Unit 7 earn total compensation that leads the market by 34 percent and 5 percent, respectively.

High Voluntary Separation Rate for Two Occupational Groups. The turnover rates for two occupational groups—Police and Sheriff’s Patrol Officers at 11 percent and Public Safety Telecommunicators at 10 percent—are higher than the statewide average of 8 percent. For both of these occupational groups, voluntary separations were the leading cause of turnover. Specifically, voluntary separations accounted for more than one-half of the turnover among Unit 7 Police and Sheriff’s Patrol Officers and more than three-fourths of the turnover among Unit 7 Public Safety Telecommunicators. This means that state employees in these two occupations are more likely to choose to leave state service without retiring and either seek employment with another employer or exit the workforce.

Major Provisions of Proposed Agreement

Term. The agreement would be in effect from July 1, 2023 through June 30, 2026. This means that the agreement would be in effect for three fiscal years: 2023‑24, 2024‑25, and 2025‑26.

Provisions Related to Pay

General Salary Increases (GSIs). The agreement would provide three GSIs over the course of the agreement, described below.

3 Percent in 2023‑24. Effective July 1, 2023, all Unit 7 members would receive a 3 percent salary increase.

2 Percent in 2024‑25. Effective July 1, 2024, all Unit 7 members would receive a 2 percent salary increase.

2 Percent in 2025‑26. Effective July 1, 2025, all Unit 7 members would receive a 2 percent salary increase.

Special Salary Adjustments (SSAs) in 2023‑24 Ranging From 4.82 Percent to 8.44 Percent. Effective July 1, 2023, the agreement would provide specified classifications specified salary increases ranging from 4.82 percent to 8.44 percent.

Top Step Pay Increases in 2023‑24 Ranging From 2.5 Percent to 8 Percent. Effective July 1, 2023, the agreement would increase the top step of the salary range of specified classifications by a specified amount ranging from 2.5. percent to 8 percent. Employees who have been at the top step of their salary range for at least a year would receive the pay increase immediately.

Educational Incentive Pay Differential. Under the expired agreement, Unit 7 members who achieve specified education levels or certifications are eligible to receive flat dollar pay differentials ranging from $50 to $125. The proposed agreement would change this pay differential to instead be a percentage of pay ranging from 2.5 percent of base pay (or no less than $120) to 5 percent of base pay (or no more than $240).

Longevity Differential to Non-Peace Officers. Employees who are not designated under the Peace Officer and Firefighter retirement plan would be eligible to receive a longevity differential of a specified percentage of pay pursuant to a schedule established by the agreement. The schedule would phase the benefit in over the course of the agreement such that, by July 2026, employees with 17, 18, or 19 years of service would receive a pay differential of 2 percent of pay; employees with 20, 21, or 22 years of service would receive a pay differential of 3 percent of pay; employees with 23 or 24 years of service would receive a pay differential of 4 percent of pay; and employees with 25 or more years of service would receive a pay differential of 5 percent of pay. This differential would be considered compensation for purposes of calculating employees’ pension benefits.

Various Other Pay Differentials. The agreement would provide numerous pay differentials and other payments to Unit 7 members who work under specified working conditions or meet specified criteria. We do not include a summary of these provisions as, in aggregate, they account for less than 3 percent of the new annual costs under the agreement. Refer to the administration’s summary or the agreement itself for a summary of these provisions.

Health Benefits. The agreement would increase the state’s contribution to Unit 7’s health premiums in order to maintain for the term of the agreement the current proportion of the average health premium paid by the state.

LAO Assessment

Administration’s Fiscal Estimate

Agreement Would Increase Ongoing Annual Costs by More Than $130 Million. As Figure 1 shows, the administration estimates that the agreement would increase annual state costs by $133 million by 2025‑26. The administration estimates that extending provisions of the agreement to excluded employees affiliated with Unit 7 (generally, managers and supervisors) would increase annual costs an additional $24 million.

Figure 1

Administration’s Estimated Fiscal Effect of Proposed Unit 7 Agreement

(In Millions)

|

Proposal |

2023-24 |

2024-25 |

2025-26 |

|||||

|

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

|||

|

General Salary Increases |

$10.4 |

$26.9 |

$17.9 |

$46.1 |

$25.4 |

$65.6 |

||

|

Top Step Increase |

9.6 |

20.6 |

9.6 |

20.6 |

9.6 |

20.6 |

||

|

Health Benefits |

1.5 |

3.9 |

4.0 |

10.4 |

6.7 |

17.2 |

||

|

Special Salary Adjustments |

2.1 |

11.0 |

2.1 |

11.0 |

2.1 |

11.0 |

||

|

Education Incentive Pay Differential |

2.9 |

7.4 |

3.8 |

9.8 |

3.8 |

9.8 |

||

|

Longevity Pay Differential |

0.5 |

1.4 |

1.5 |

3.8 |

1.8 |

4.7 |

||

|

Other Pay Differentials |

0.5 |

2.6 |

0.6 |

3.4 |

0.6 |

3.4 |

||

|

Other Provisionsa |

0.3 |

0.6 |

0.5 |

1.1 |

0.5 |

1.1 |

||

|

Totals |

$27.8 |

$74.3 |

$40.0 |

$106.3 |

$50.5 |

$133.4 |

||

|

aThe administration assumes that a portion of these costs would not require a new appropriation from the Legislature. |

||||||||

Compensation Study

Voluntary Separation Rates Could Signal Retention Problem. The high voluntary separation rates among Police and Sheriff’s Patrol Officers and Public Safety Telecommunicators suggests that there could be a retention problem with state employees in these classifications.

Pay Increases

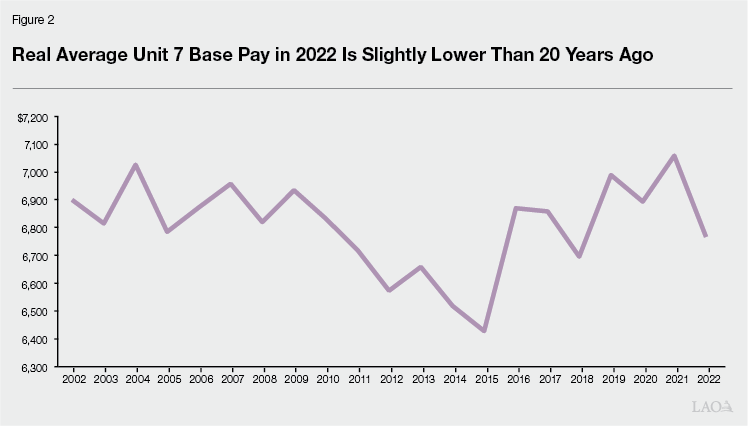

Unit 7 Average Base Pay Slightly Lower Today Than 20 Years Ago. As Figure 2 shows, after controlling for inflation, the average Unit 7 base pay has fluctuated significantly over the past two decades. Despite this variation, however, in 2022, average base pay was 1.5 percent lower than in 2002. We do not know the cause of this variation; however, the trend could reflect shifts in the workforce over time that affect the average salary rather than a reflection of past pay increases not keeping pace with inflation. For example, we note that the age distribution of Unit 7 members today reflects a younger workforce than it did earlier in the period. Younger workers tend to have lower average salaries given they have less tenure.

Proposed GSI in 2023‑24 Close to Most Recent Inflation Levels. The most recent (July) California Consumer Price Index was 3.1 percent higher compared to the prior year. Since 2020, however, prices have risen 17 percent. To the extent that the lower real average base pay in 2022 is a reflection of past GSIs not keeping pace with inflation, the tentative agreement’s GSI in 2023‑24 would maintain wages, but would not catch up to prior price increases. Moreover, if inflation remains elevated, state employees’ purchasing power likely will be further eroded by the end of the agreement as the other GSIs are lower. Alternatively, if inflation continues to fall, the GSIs could be closer to the rate of inflation.

Administration Offers No Justification for SSAs or Any Pay Increase. Unlike a GSI, which provides the same pay increase to all classifications represented by a bargaining unit, an SSA provides specified pay increases to specified classifications. While a GSI can be justified by the rate of inflation, an SSA, on the other hand, requires further justification as it singles out one classification over another to receive a pay increase within the same bargaining unit. That being said, it is not clear what methodology, if any, was used to identify which classifications should receive SSAs and at what levels. While there is evidence of possible recruitment and retention issues of some Unit 7 occupations, the administration does not provide a justification for the various SSAs, but states they are the result of the bargaining process. Moreover, whether the longevity pay would address these issues is unclear. The significant use of SSAs and other pay differentials with no justification from the administration reduces transparency and increases complexity of the agreement with only days to review. This limits the ability for both the Legislature and the public to understand why some state employee should receive higher pay increases than others.

Duration

Standing LAO Recommendation: Do Not Approve Agreements Longer Than Two Years. Since 2007, we have recommended that the Legislature not ratify labor agreements with durations longer than two years in order to maintain legislative flexibility and authority to respond to changing economic situations. An MOU establishes the state’s employee compensation policies and locks in state expenditures for the duration of the agreement. Though the Legislature has authority to modify economic provisions of ratified MOUs through its appropriation authority, in practice, it is difficult for the Legislature to exercise this authority.

Uncertainty Makes Legislative Flexibility Even More Important. By 2025‑26—the last year of this agreement—General Fund revenues could be tens of billions of dollars higher or lower than current estimates. There is significant uncertainty about economic conditions by the end of this agreement. Inflation may remain elevated, in which case the pay increases provided by this agreement might not be sufficient to preserve employees’ purchasing power. Alternatively, if inflation continues to fall, the state could end up providing pay increases above the rate of inflation under the agreement, resulting in the state potentially paying more than might be necessary. Further, labor markets could remain tight or soften. While we cannot say with certainty how these economic conditions will unfold, we have advised the Legislature to remain cautious as key economic indicators—such as the treasury bond yield curve—have signaled an economic and revenue slowdown could be forthcoming.

Three-Year Agreement Locks-in State Costs and Limits Legislative Flexibility. Although future addenda or side letters may be established to address unforeseen issues that might materialize during the term of the MOU, the addenda review process established under Item 9800 of the annual budget act defers more authority to the Governor than the MOU ratification process. A shorter term allows the Legislature greater control over the state’s compensation policies.

Legislature’s Role in Bargaining Process

Legislature Is Ultimate Authority of Any Labor Agreement. Under the Ralph C. Dills Act, while the Governor negotiates terms and conditions of employment with bargaining units, the Legislature retains the ultimate authority to approve or reject agreements. The Legislature can reject an agreement either by (1) rejecting a tentative agreement that is submitted to the Legislature for ratification or (2) not appropriating sufficient funds to pay for the terms of an MOU that the Legislature has already ratified.

Administration’s Delivery of Agreement Does Not Allow for Sufficient Time for Legislative or Public Review. The administration submitted this agreement to the Legislature after the budget committees met to discuss other proposed labor agreements submitted near the end of the legislative session. Giving the Legislature such a constrained review period to review a proposal with such significant fiscal and policy implications is not acceptable. The public—including the members of the bargaining unit—also should have a greater opportunity to review the provisions of the agreement and provide input to the Legislature.

Budget Change Proposals of Far Smaller Size Would Require Justification From Administration, Legislative Deliberation, and Public Scrutiny. If ratified and its provisions extended to excluded employees, the agreement will increase state costs by more than $160 million. When budget proposals of far lesser value are submitted to the Legislature by the Governor during the budget process, they are subject to public and legislative review for a period of weeks or months, not days.

LAO Recommendations

Require Bargaining Cycle to Consider Legislative Calendar. The parties regularly submit labor agreements to the Legislature with a legislative deadline looming only days away. This is a long-standing problem and is not unique to this administration. This time constraint is unnecessary. The legislative calendar is public and known far in advance. The legislative calendar and deadlines should be built into the administration’s planning such that the Legislature has sufficient time to consider labor agreements. As we have recommended in the past, we recommend that the Legislature adopt a standing policy to reject (1) any agreement that affects the compensation of state employees in the July pay period that is submitted to the Legislature after June 2 and (2) any agreement that is submitted to the Legislature fewer than two weeks before the end of session.