LAO Contact

October 16, 2023

The 2023-24 California Spending Plan

Judiciary and Criminal Justice

The 2023-24 budget provides $18.6 billion from the General Fund for judicial and criminal justice programs, including support for program operations and capital outlay projects, as shown in Figure 1. This is a decrease of $1.2 billion, or 6 percent, below the revised 2022-23 spending level. A large portion of this reduction is due to the expiration of limited-term funding provided in previous years.

Figure 1

Judicial and Criminal Justice Budget Summary

General Fund (Dollars in Millions)

|

2021‑22 |

2022‑23 |

2023‑24 |

Change From 2022‑23 |

||

|

Amount |

Percent |

||||

|

Department of Corrections and Rehabilitation |

$13,487 |

$14,654 |

$14,134 |

‑$519 |

‑3.5% |

|

Judicial Branch |

2,859 |

3,435 |

3,149 |

‑287 |

‑8.3 |

|

Department of Justice |

401 |

481 |

490 |

8 |

1.7 |

|

Board of State and Community Corrections |

245 |

939 |

572 |

‑366 |

‑39.0 |

|

Other Departmentsa |

129 |

234 |

220 |

‑14 |

‑5.8 |

|

Totals, All Departments |

$17,121 |

$19,743 |

$18,566 |

‑$1,177 |

‑6.0% |

|

aIncludes Office of the Inspector General, Commission on Judicial Performance, Victim Compensation Board, Commission on Peace Officer Standards and Training, State Public Defender, funds provided for trial court security, and debt service on general obligation bonds. |

|||||

|

Note: Detail may not total due to rounding. |

|||||

Judicial Branch

The budget provides $5.3 billion for the judicial branch in 2023-24—a net decrease of $228 million (4 percent) from the revised 2022-23 level. This budgeted amount includes $3.1 billion from the General Fund and $499 million from the counties, with most of the remaining balance from fine, penalty, and court fee revenues. The General Fund amount is a net decrease of $287 million (8 percent) from the revised 2022-23 amount. This net decrease is the result of various factors, such as the expiration of limited-term funding provided in previous years. Funding for trial court operations is the single largest component of the judicial branch budget, accounting for about 75 percent of total spending. In addition to the amounts above, the budget also includes $153 million in new lease revenue bond authority.

Judicial Council. The budget package includes various augmentations for Judicial Council. Some of the notable augmentations include:

-

$19 million General Fund in 2023-24 (decreasing to $4.2 million annually beginning in 2025-26) to implement Chapter 326 of 2022 (AB 1981, Lee) related to juror reimbursement and compensation. Of this amount, $4.2 million is provided to support increased juror mileage and public transit reimbursements. The remaining amount is to support a two-year pilot program in at least six courts to study whether increased juror compensation and mileage reimbursement increase juror diversity and participation.

-

$5.9 million in reimbursement authority in 2023-24 (decreasing to $5.7 million in 2024-25 and 2025-26) to allow the judicial branch to receive federal grant funds from the Board of State and Community Corrections to support drug, mental health, and veteran collaborative courts as well as to conduct research and to provide training and technical assistance on compliance with state firearm relinquishment requirements.

-

$1 million one-time General Fund for the training of judges to implement expedited judicial California Environmental Quality Act processes for certain infrastructure projects as required by Chapter 60 of 2023 (SB 149, Caballero). (Please see our post The 2023-24 California Spending Plan: Other Provisions for a summary of the related infrastructure package adopted as part of the 2023-24 budget package.)

Baseline Support for Trial Court Operations. The budget includes a net $72.3 million ongoing General Fund augmentation in baseline support for trial court operations. This amount consists of $74.1 million to provide a 3 percent inflationary adjustment and a net $1.8 million reduction to align the amount of funding provided for trial court health and retirement benefits with actual costs. The budget package also sets aside some funding to support any cost increases for these benefits that occur during 2023-24.

Fine and Fee Related Changes. The budget package includes various changes related to fines and fees. For example, it removes the sunset date for various civil filing fees—estimated to generate $38 million annually—used to support trial court operations. In addition, the budget provides $134.3 million General Fund ($105.1 million one time) in 2023-24 to backfill various declines in fine and fee revenue. This includes:

-

$105.1 million one time to backfill an ongoing decline in various fine and fee revenues collected to support trial court operations. This is a $20 million increase from the revised backfill level in 2022-23.

-

$26.4 million in 2023-24 (increasing to $28.4 million annually in 2024-25) to backfill reduced criminal fine and fee revenue for the judicial branch due to the statewide expansion of an online adjudication tool that allows lower-income people to receive reductions in the amount they owe related to infractions based on their ability to pay. This reflects a $7.5 million increase in 2023-24 relative to the amount provided in 2022-23. We note that the 2021-22 budget package—which provided the initial backfill—assumed a total backfill of $40.7 million for 2023-24 and $55.8 million ongoing in 2024-25.

-

$1.6 million to backfill reduced civil fee revenue from changes adopted in the 2022-23 budget package allowing more lower-income people to automatically qualify for a waiver of such fees. This reflects a $16.4 million reduction in 2023-24 relative to the amount provided in 2022-23. We note that the 2022-23 budget package included an ongoing $18 million backfill.

-

$1.2 million—up to $826,000 for trial courts and up to $374,000 for counties—to backfill reduced revenue from the elimination of four post-conviction criminal administrative fees related to changing of pleas, setting aside verdicts, or record sealing.

Community Assistance, Recovery, and Empowerment (CARE) Program. The budget provides a $49.4 million General Fund augmentation in 2023-24 (increasing to $127 million annually beginning in 2025-26) relative to the amount provided in 2022-23 for increased court and legal representation costs associated with implementing the CARE program created by Chapter 319 of 2022 (SB 1338, Umberg). As shown in Figure 2, this increases total judicial branch-related CARE program funding to $55.6 million in 2023-24 (increasing to $132.9 million annually beginning in 2025-26). The funding supports the expected implementation of the program in eight counties in 2023-24, and in all remaining counties by December 2024. The budget package also requires the Department of Health Care Services—in consultation with the judicial branch—to submit a CARE program implementation report by December 2024. This report is required to include key data necessary to calculate future funding needs collected from each of the eight trial courts implementing the CARE program in 2023-24.

Figure 2

Summary of Total CARE Program Funding

General Fund (In Millions)

|

Entity |

Purpose |

2022‑23 |

2023‑24 |

2024‑25 |

2025‑26 and |

|

Judicial Branch |

|||||

|

Judicial Branch |

Court Operations |

$5.9 |

$32.7 |

$55.3 |

$68.5 |

|

Judicial Branch |

Legal Representation |

0.3 |

22.9 |

51.6 |

64.4 |

|

Totals, Judicial Branch |

$6.1 |

$55.6 |

$106.9 |

$132.9 |

|

|

Health Entities |

|||||

|

CalHHS |

Training |

$5.0 |

— |

— |

— |

|

DHCS |

Training, Data Collection, and Other Activities |

20.2 |

$6.1 |

$6.1 |

$6.1 |

|

DHCS |

County Grants |

57.0 |

67.3 |

121.0 |

151.5 |

|

Totals, Health Entities |

$82.2 |

$73.4 |

$127.1 |

$157.6 |

|

|

Total CARE Program Funding |

$88.3 |

$128.9 |

$234.0 |

$290.5 |

|

|

CARE = Community Assistance, Recovery, and Empowerment; CalHHS = California Health and Human Services Agency; and DHCS = Department of Health Care Services. |

|||||

Excess Property Tax Offset. The budget includes a $247.6 million one-time reduction in General Fund support for trial court operations in 2023-24 in order to reflect the availability of property tax revenue in accordance with Control Section 15.45 and Section 2578 of the Education Code. Such funds are allocated by the state to support trial court operations in counties that collect more property tax than state law allows them to spend on education. This reduction is $63.8 million greater than the revised 2022-23 level.

Racial Justice Act Implementation. The budget includes $2.9 million one-time General Fund for the implementation of the Racial Justice Act in death penalty cases, which prohibits convictions or sentences to be imposed based on race, ethnicity, or national origins. This amount consists of (1) $2.7 million to the Supreme Court for court-appointed private counsel ($2.2 million) and the California Appellate Project ($500,000), and (2) $250,000 for the Habeas Corpus Resource Center.

Other Budget Adjustments. The budget package includes the early reversion of up to $52.6 million one-time General Fund provided in prior budgets to support various purposes, such as court reporters in non-criminal cases and trial court employee health benefit and retirement costs. It also includes reappropriation of up to $6.8 million one-time General Fund previously provided as part of the 2021-22 budget package to support a new five-year court interpreter workforce pilot program at a minimum of four trial courts (of which one must be Los Angeles). The pilot program covers the costs of training, coursework, and up to three exam fees for court interpreters who remained employed by participating courts for at least three years after completing training.

Facilities. To address the insolvency of the State Court Facilities Construction Fund (SCFCF), the budget provides a total of $55.5 million General Fund annually to backfill SCFCF funding that was used in past years to support trial court operations. In addition, the budget transfers $120 million from the General Fund to the SCFCF annually beginning in 2024-25 to provide the fund with sufficient revenues to support its existing debt service, facility modification, and other facility-related expenditures.

The budget includes $6 million ongoing General Fund for increased facility maintenance and operations costs associated with nine trial court courthouses which have recently been constructed. The budget package also reverts $49.5 million of the $188 million one-time General Fund included in the 2021-22 budget for deferred maintenance in trial and appellate court facilities to help address the state’s budget problem. Additionally, the budget package delays from July 2024 to July 2026 the requirement for court users to be provided with lactation rooms in any courthouse in which a lactation room is provided for court employees.

The budget includes $19.2 million one-time General Fund to support three projects—$10.9 million for pre-construction activities for the Sixth District Court of Appeal and Nevada City projects and $8.3 million for construction activities for the San Bernardino Juvenile Dependency project. Due to lower than expected acquisition costs, the budget package also reflects the early reversion of $25 million of the $35.6 million one-time General Fund provided in 2020-21 for the Monterey Fort Ord project. In addition, the budget includes $153 million in new lease revenue bond authority for construction of the Monterey Fort Ord project.

California Department of Corrections and Rehabilitation

The budget provides $14.5 billion (mostly from the General Fund) for the California Department of Corrections and Rehabilitation (CDCR). This is a net decrease of $723 million (5 percent) from the revised 2022-23 level. This decrease reflects various reduced costs, such as those associated with deactivation of several correctional facilities and the expiration of limited-term funding provided in prior years. (The net decrease in spending does not reflect growth in employee compensation costs in 2023-24 because such costs are accounted for elsewhere in the budget.) In addition to the amounts above, the budget also includes a total of $360.6 million in new lease revenue bond authority to demolish an existing building and construct a new educational and vocational center at San Quentin State Prison (SQ).

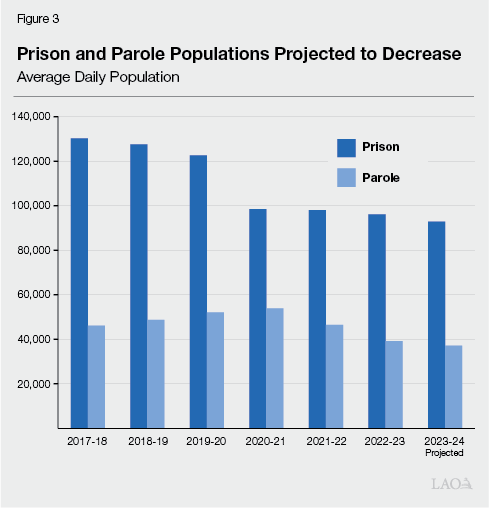

Adult Correctional Population. Figure 3 shows the recent and projected changes in the prison and parole populations. As shown in the figure, the prison population is projected to decrease by about 3,200 (3 percent) from 96,100 in 2022-23 to 92,900 in 2023-24. The parole population is projected to decrease by about 2,000 (5 percent) from 39,200 in 2022-23 to 37,200 in 2023-24.

Facility Deactivations. The budget reflects spending reductions (primarily General Fund) resulting from the deactivation of facilities due to the ongoing decline in the prison population. Specifically, the budget reflects the following reductions:

-

$153 million (increasing to $173 million annually beginning in 2027-28) to reflect the deactivation of six individual yards at various prisons in 2023.

-

$133 million annually to reflect the deactivation of the California Correctional Center in Susanville effective June 30, 2023.

-

$25 million (increasing to $127 million annually in 2024-25) to reflect the planned deactivation of the California City Correctional Facility by March 2024.

Despite these facility deactivations, prison population projections indicate the state could deactivate additional prisons in the future. To inform such potential future deactivation decisions, budget trailer legislation requires CDCR to report on various factors that impact its prison capacity needs, such as the amount of space needed to operate rehabilitation programs, by November 15, 2023.

In addition, the budget reflects a $92 million reduction (primarily General Fund) in 2023-24—generally increasing to $96 million annually beginning in 2025-26—due to the closure of the Division of Juvenile Justice (DJJ) and resulting deactivation of three of its facilities. This closure is the result of legislation included in the 2021-22 and 2022-23 budget packages, which realigned responsibility for DJJ youths from the state to the counties.

Health Care. The budget provides various augmentations related to correctional health care. Some of the major adjustments include the following:

-

$96.9 million one-time General Fund for COVID-19 response and mitigation-related activities, such as testing and overtime for staff.

-

$27.7 million one-time net increase for contract medical expenses, such as for specialty medical care provided outside of prison, private ambulance transportation, and nursing and pharmacy registries. This net increase results from a $39.8 million General Fund increase offset by a $12.1 million reduction in federal reimbursement authority.

-

$16.2 million ongoing General Fund to increase the number of toxicology tests per patient receiving medication assisted treatment through the Integrated Substance Use Disorder Treatment Program from ten tests per year to 14 per year.

-

$15 million ongoing General Fund to maintain the Employee Health Program. In addition to its focus on COVID-19, the program will begin focusing on mitigating diseases among employees such as tuberculosis, Hepatitis B, and influenza.

-

$14.9 million General Fund in 2023-24 (generally increasing to $20.7 million annually beginning in 2025-26) to expand CDCR’s tele-mental health services and to increase the number of regional staff that provide oversight for mental health services.

-

$8.4 million net decrease in 2023-24 (generally growing to $11.7 million annually beginning in 2027-28) related to the California Advancing and Innovating Medi-Cal (CalAIM) Justice-Involved Initiative, which seeks to provide targeted Medi-Cal services to eligible people 90 days prior to release from prison. This net decrease results from a $21.8 million decrease in reimbursement authority in 2023-24 (increasing to $40.5 million by 2027-28 and ongoing) offset by a $13.4 million General Fund augmentation in 2023-24 (increasing to $28.8 million annually by 2027-28 and ongoing). These changes reflect a delay in the implementation of CalAIM within CDCR as well as additional funds for a billing system that would allow the department to receive federal reimbursements related to CalAIM. (For more information about CalAIM and recent changes, please see our Health spending plan post.)

Funding to Address Staff Misconduct. The budget includes $87.7 million General Fund (generally decreasing to $14.7 million annually beginning in 2026-27) to (1) install and operate audio-video surveillance systems (AVSS) at the ten remaining prisons not currently planned for deactivation where AVSS has not been authorized and (2) fund ongoing licensing, software, and equipment replacement costs for all AVSS and body-worn camera systems beginning in 2026-27. The department expects that these cameras will help provide objective evidence related to allegations of staff misconduct in addition to other operational benefits. The budget also includes $9.6 million General Fund in 2023-24 (decreasing to $2.9 million annually beginning in 2025-26) for CDCR to continue revising its process for handling allegations of staff misconduct made by people in prison or on parole, as well as members of the public.

Other Budget Adjustments. Other major adjustments include:

$28.8 million ongoing General Fund to provide people in prison with free voice calling as required by Chapter 827 of 2022 (SB 1008, Becker).

$26.8 million ongoing increase in Inmate Welfare Fund authority to allow CDCR to receive a projected increase in revenues from prison canteens (stores where people in prison can purchase various items). These funds are used to restock and staff canteens as well as for programs that benefit people in prison.

$21 million one-time General Fund for the Rehabilitative Investment Grants for Healing and Transformation Grant 2.0 to support community-based, nonprofit organizations in delivering trauma-informed, rehabilitative, and/or restorative justice programming at various prisons.

$10.4 million General Fund in 2023-24 (decreasing to $7.2 million annually in 2024-25) to store and manage electronic records that CDCR may be required to release under various circumstances, such as pursuant to the California Public Records Act or due to litigation.

$8.2 million General Fund in 2023-24, $9.3 million in 2024-25, and $7.8 million in 2025-26 to migrate an existing system of databases to an updated software platform.

Facilities. The budget package includes two notable adjustments related to facility maintenance. Specifically, the budget (1) provides $1.5 million General Fund in 2023-24 and $62 million in 2024-25 to replace roofs at the Richard J. Donovan Correctional Facility in San Diego and (2) reverts $30 million of the $100 million included in the 2021-22 budget for deferred maintenance projects.

The budget also includes $102 million General Fund to support various capital outlay projects. This includes:

-

$35 million for the construction of a fire suppression system at Pelican Bay State Prison.

-

$34.2 million for the construction of an arsenic and manganese removal water treatment plant at Valley State Prison in Chowchilla.

-

$20 million for various projects at SQ. (We discuss these projects in greater detail below.)

-

$10 million to complete the construction of Health Care Facility Improvement Program projects at ten prisons.

In addition, the budget includes $360.6 million in new lease revenue bond authority to demolish an existing building and construct a new educational and vocational center at SQ. This project—along with the above SQ capital outlay projects—are intended to support an effort to develop the California Model, which is broadly focused on promoting a more rehabilitative and health-focused environment in California prisons. An advisory panel appointed by the Governor on May 5, 2023 will issue recommendations guiding both the development of the model and the capital outlay projects intended to support it. In addition, budget trailer legislation (1) makes various changes to help complete these projects by 2025, such as by exempting them from historic building preservation requirements and (2) changes the name of the prison to the San Quentin Rehabilitation Center.

Department of Justice

The budget provides $1.3 billion for the Department of Justice (DOJ) in 2023-24—an increase of $32 million (3 percent) from the revised 2022-23 level. This amount includes $490 million from the General Fund—a net increase of $8 million (2 percent). (The net increase does not reflect changes in employee compensation costs in 2023-24 because such costs are accounted for elsewhere in the budget.)

Bureau of Forensic Services (BFS). The budget includes $54.9 million General Fund in 2023-24 (decreasing to $47.6 million in 2024-25 and 2025-26) to maintain BFS service levels. This amount consists of (1) $46.1 million annually for three years to backfill a decline in criminal fine and fee revenue deposited into the DNA Identification Fund used to support BFS, (2) $7.3 million one time for equipment purchase and replacement, and (3) $1.5 million annually for three years to maintain Missing Persons DNA Program service levels (rather than increasing the existing death certificate fee used to support such workload). The budget authorizes the Director of the Department of Finance, 30 days after notifying the Joint Legislative Budget Committee, to augment the $46.1 million backfill if additional monies are needed to maintain BFS operations.

In addition, the budget includes a $10 million increase in DNA Identification Fund expenditure authority annually for three years to restore historical expenditure levels from the fund. (This was reduced in prior years when the budget partially addressed the fund’s insolvency by temporarily redirecting General Fund support from another DOJ program to support BFS instead.)

Legal Resources. The budget includes a net $28.8 million augmentation in 2023-24 (decreasing to $20.6 million annually beginning in 2027-28) from the General Fund and various special funds for additional legal resources. Of this amount, $11 million General Fund in 2023-24 (declining to $10.4 million annually beginning in 2027-28) is to implement recently enacted legislation. This includes $2.2 million General Fund in 2023-24, $2.1 million in 2024-25, and $848,000 annually in 2025-26 and 2026-27 to address an anticipated increase in workload of appellate cases due to implementation of the Racial Justice Act. The remaining amount reflects adjustments to baseline funding for DOJ legal workload, including the following:

-

About $8 million ongoing special funds for increased investigations and prosecutions of antitrust violations in technology, gasoline and oil, and agriculture sectors.

-

About $4.4 million ongoing General Fund and special funds for increased enforcement of tenant protection rights and increased housing-related litigation workload pursued by the Housing Strike Force.

-

$3 million ongoing General Fund reduction of support for legal workload related to state responses to actions taken by the federal government. This reduces the amount for this workload (originally provided as part of the 2017-18 budget package) to $3.5 million.

The budget also reflects the internal redirection of $13.8 million ongoing General Fund—$6.2 million from the Civil Law subdivision and $7.6 million from the California Justice Information Services Division (CJIS)—to support a new Office of General Counsel. The CJIS transfer would include shifting the entire Cybersecurity Unit as well as the entire Research Center under this new office. Additionally, DOJ’s Chief Information Security Officer will now report to the new General Counsel.

Litigation Deposit Fund (LDF). The budget includes an up to $400 million no-interest loan from the LDF to the General Fund to help address the state’s budget problem. The LDF is a state special fund that receives certain payments, known as litigation proceeds, required by settlement agreements or court judgments to resolve legal cases. Individual agreements or judgements may require that litigation proceeds be used for particular purposes. Because of this, the budget requires DOJ to provide a list of all cases whose litigation proceeds will be loaned to the General Fund and report certain information until the entire loan has been repaid. This is to ensure that the repaid monies will be used to comply with the underlying settlement agreements and court judgements of these cases. Additionally, the budget package includes various changes related to the LDF. For example, it requires that most litigation proceeds deposited into the LDF be transferred to a state fund subject to legislative oversight (1) within three months after case resolution for deposits made after July 2023 or (2) by January 2024 for deposits made before July 2023. It also requires additional reporting for litigation proceeds deposited into or transferred from the LDF.

Firearms. The budget provides $19.3 million in 2023-24 (decreasing to $6 million annually beginning in 2026-27)—mostly from the Dealers Record of Sale (DROS) Special Account—for the maintenance of firearm technology systems, implementation of firearm-related legislation, and existing baseline workload. This amount includes $7.5 million DROS in 2023-24 (decreasing to $2.6 million annually beginning in 2024-25) for the continuation of a technology project to modernize the state’s firearms systems. It also includes $5 million in 2023-24 ($2.9 million DROS and $2 million Fingerprint Fees Account) and $3.2 million in 2024-25 to begin addressing an anticipated increase in carry concealed weapon license workload due to a June 2022 United States Supreme Court Ruling.

In addition to the above amount, the budget package includes an $8.6 million General Fund loan—$4.3 million in 2023-24 and 2024-25—to the Ammunition Authorization Program in order to maintain workload service levels pending a future fee increase to support the program. The budget package also authorizes DOJ to adjust the ammunition purchase transaction fee to generate sufficient revenue to cover the program’s reasonable regulatory and enforcement costs.

Special Operations Unit. The budget provides $7.2 million ongoing General Fund—and reduces DOJ’s reimbursement authority by $5.8 million ongoing—to shift support for Special Operation Unit law enforcement teams from a special fund administered by the California Highway Patrol to the General Fund. Budget provisional language specifies that the teams are to focus on violent career criminals and organized crime—with a particular focus on illegal fentanyl, narcotics, firearms, and ammunition.

Board of State and Community Corrections

The budget provides $778 million for the Board of State and Community Corrections (BSCC) in 2023-24—a decrease of $397 million (34 percent) from the revised 2022-23 level. This amount includes $572 million from the General Fund—a net decrease of $366 million (39 percent). This decrease is primarily due to the expiration of limited-term funding provided in 2022-23 for various grant programs.

Grant Funding. The budget package includes General Fund adjustments for various grants administered by BSCC. These include:

-

$12 million one-time augmentation to provide competitive grants to federally recognized Indian tribes in California to support efforts to identify, investigate, and solve cases involving missing and murdered indigenous people.

-

$9.3 million one-time augmentation to assist counties with the temporary increase in the population served by county probation departments due to expedited prison releases resulting from Proposition 57 (2016).

-

$10 million reduction (from $50 million to $40 million) to the final year of a program—originally authorized in 2021-22—for grants to supplement local funding for indigent criminal defense.

-

$25 million reversion of funding authorized in 2022-23 to support competitive grants for gun buyback programs. (The budget provides the Governor’s Office of Emergency Services with $21 million one-time General Fund to support a gun buyback program and $4 million one-time General Fund to support public education and outreach related to gun violence and domestic violence restraining orders.)

In addition, the budget reflects an increase in federal spending authority of $29.2 million annually for five years to allow BSCC to receive federal grant monies made available to the state for certain crime and violence reduction activities. As discussed above, $5.9 million of these funds will be allocated from BSCC to the judicial branch for collaborative courts as well as research, training, and technical assistance on compliance with state firearm relinquishment requirements. The majority of the remaining funds will be allocated by BSCC to local governments to fund similar activities. The budget package also requires BSCC to oversee $7.6 million in grant funds allocated through Control Section 19.563 to local governments for various purposes generally related to public safety. (For more information on Control Section 19.563, please see the “Targeted Legislative Augmentations” section of our Other Provisions spending plan post.)

Other Criminal Justice Programs

Office of the State Public Defender. The budget package includes $5.1 million one-time General Fund for implementation of the Racial Justice Act. This amount consists of $3.1 million for death penalty cases and $2 million to provide representation in non-death penalty cases.

Commission on Peace Officer Standards and Training (POST). The budget provides $10.6 million General Fund (decreasing to $3.9 million annually beginning in 2026-27) for POST’s continued implementation of Chapter 409 of 2021 (SB 2, Bradford and Atkins), which created a process by which peace officer certification can be suspended or revoked in instances of misconduct. The final step of the process requires cases to be referred to the Office of Administrative Hearings (OAH) within the Department of General Services for a final decision made by OAH administrative law judges. The above funding includes (1) $4.5 million in 2023-24 (decreasing to $3.9 million annually in 2024-25) for costs billed by OAH to adjudicate such cases and (2) $6.1 million General Fund in 2023-24—and $5.3 million in 2024-25 and 2025-26—for costs billed by DOJ to represent POST in cases before OAH.