LAO Contact

October 24, 2023

California’s Cap-and-Trade Program:

Frequently Asked Questions

This post answers commonly asked questions about California’s cap-and-trade program and the revenues it generates, which are deposited and spent through the Greenhouse Gas Reduction Fund.

The Cap-and-Trade Program

What Are California’s Greenhouse Gas (GHG) Emissions Goals?

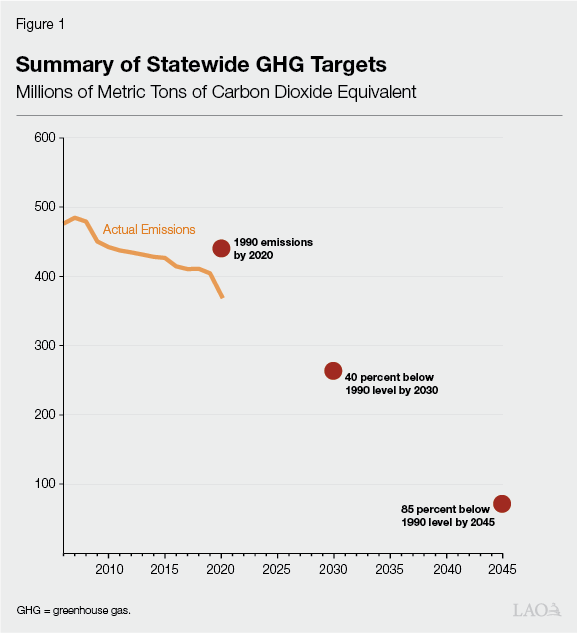

GHG emissions are the main drivers of global climate change. To try to reduce California’s contributions to climate change—and encourage innovations that influence actions in other states and countries—the Legislature has adopted various statewide GHG emissions targets. These goals are summarized in Figure 1. Specifically:

2020. Chapter 488 of 2006 (AB 32, Núñez) established the target of limiting GHG emissions statewide to the 1990 level by 2020.

2030. Chapter 249 of 2016 (SB 32, Pavley) extended the limit to at least 40 percent below the 1990 level by 2030.

2045. Chapter 337 of 2022 (AB 1279, Muratsuchi) extended the limit to at least 85 percent below the 1990 level by 2045. Assembly Bill 1279 also established a goal of attaining zero net carbon emissions by 2045, commonly known as carbon neutrality. To meet this objective, the state will need to adopt practices such as carbon capture and storage to offset remaining GHG emissions.

The state has taken a number of steps towards meeting these GHG reduction goals, such as establishing new policies, programs, and regulations—including the cap-and-trade program.

What Is the Cap-and-Trade Program?

Cap-and-trade is one of the state’s key policies intended to reduce statewide GHG emissions. Under the program, the California Air Resources Board (CARB) is tasked with setting a declining, aggregate cap on the amount of GHGs allowed to be emitted in the state each year. Entities covered under the program represent roughly 75 percent of the state’s GHG emissions and include oil refineries, electricity generators and importers, and manufacturing facilities. These covered entities can comply with program requirements in three ways: (1) reduce their GHG emissions, (2) obtain allowances (essentially a permit to emit one ton of carbon dioxide equivalent) to cover their emissions, and/or (3) purchase “offsets” (paying to support a GHG reduction project elsewhere) to cover their emissions. Figure 2 provides an illustration of these options.

CARB issues a set number of allowances each year equal to the annual cap that entities can purchase and sell on an open market—this is the “trade” component of the program. Some of these allowances are auctioned, and some are given away for free to utilities, natural gas suppliers, and industrial facilities. These free allowances are intended to protect consumers from significant rate increases and prevent emissions leakage (that is, to keep companies from moving their operations outside of California to avoid the need to comply with the program). The program does not establish individual GHG emission caps for each covered entity or facility. Rather, the total number of allowances sold and given away statewide in a given year is equal to the aggregate statewide cap on GHG emissions that CARB sets each year.

What Is the History of the Program?

The cap-and-trade program was first authorized through AB 32 in 2006, which—along with establishing the state’s first major GHG reduction goal—allowed CARB to develop a market-based mechanism to reduce GHG emissions from large emitters. Since then, CARB has adopted numerous regulations governing the program and its implementation. The Legislature also has adopted subsequent legislation governing the program’s operations. For example, Chapter 39 of 2012 (SB 1018, Committee on Budget) established criteria that must be met before CARB links California’s cap-and-trade market to other carbon markets (as described below). More recently, Chapter 135 of 2017 (AB 398, Garcia) authorized the program through 2030 and modified certain aspects of the program design, including placing new limits on the use of offsets and making some changes to the distribution of free allowances.

What Are the Program’s Key Goals and Objectives?

The cap-and-trade program’s primary goal is to reduce statewide GHG emissions at the lowest cost. Other major goals of the program include encouraging investments into cleaner, more efficient technologies that reduce emissions and establishing California as a global leader on climate issues.

How Do Auctions Work?

CARB hosts four auctions of cap-and-trade allowances each year, in February, May, August, and November. CARB sets a “floor price” (minimum price) for which an allowance can be sold, but historically allowances frequently have sold above that price due to buyer interest. For example, in the August 2023 auction, CARB set the per-allowance floor price at $22.21 but allowances ultimately sold for $35.22 each. In addition to covered entities, outside investors also are able to purchase allowances at auctions to resell to covered entities or other investors at a future date. Covered entities need not use the allowances they have purchased towards covering their emissions in that year; as discussed below, they also can “bank” them and choose to apply them towards compliance in a future year.

How Do Offsets Work?

In addition to obtaining allowances to emit GHGs, CARB allows covered entities to continue emitting GHGs by purchasing offsets. Offsets are designed to counter-balance the impacts of an entity’s emissions by reducing emissions or preventing increased emissions elsewhere. In one common example, an entity covered under cap-and-trade in California—such as an oil refinery—can purchase an offset through a private company that works directly with forest owners to preserve forest growth. (Preserving forestlands is intended to have a net positive long-term effect on GHG emissions as compared to if they were cut down because forests can sequester carbon.) Statute requires that at least half of claimed offsets—and assumed impacts on GHG emissions—provide direct environmental benefits in California, but the remainder could be for projects undertaken in other states that do not have direct environmental benefits in California. CARB maintains a number of eligibility requirements for offset projects to be used as credits for program compliance. Currently, covered entities may use offset credits to meet up to 4 percent of their compliance obligations under cap-and-trade; they must either directly reduce emissions or purchase allowances for the remainder of their compliance requirements.

What Entities Are Covered Under the Program?

Cap-and-trade program requirements generally apply to entities located within California that emit significant amounts of GHGs, such as large industrial facilities, electricity generators and importers, natural gas suppliers, and transportation fuel suppliers. However, within these sectors, CARB establishes (1) the types of emissions that are covered and (2) GHG emission threshold requirements focusing on larger facilities. As a result, not all emissions from industrial processes are covered by the cap-and-trade requirements. For example, although emissions from the energy used to power dairy product manufacturing facilities are covered by cap-and-trade, the methane emissions that come from the dairy cows that produce the milk are not covered. Moreover, smaller businesses within a covered sector—such as individual gas stations—often are exempt from meeting the requirements because their emissions are below the established threshold.

How Does Cap-And-Trade Fit in With Other State Efforts to Reduce GHGs?

As noted, the cap-and-trade program is just one of a collection of activities the state is undertaking to meet its GHG reduction goals. Other key efforts include regulations to increase adoption of zero-emissions vehicles, requirements to shift the state’s electricity to rely on renewable sources, and standards to encourage the use of lower-carbon transportation fuels. Historically, cap-and-trade has been considered as a “backstop” to ensure the state meets its targets. That is, CARB has explicitly stated that to the degree other policies collectively fall short of meeting the state’s GHG reduction goals, the cap-and-trade program is intended to reduce emissions further to make up the difference.

How Effective and Cost-Effective Is the Program?

Since the cap-and-trade program began, California’s overall GHG emissions have declined by 14 percent. However, this is not solely due to the impacts of the program. Other state programs, such as requirements and incentives to transition to greater use of renewable sources of electricity, also have contributed to these reductions. The complex interactions between cap-and-trade and other state climate change efforts—as well as the many technological and economic factors that affect emissions in California—make it difficult to quantify the level of emissions reductions attributable to the program alone. To our knowledge, no studies have produced a reliable estimate of the emission reductions achieved by the cap-and-trade program so far. While the cap-and-trade program likely also has made some progress in spurring market-based climate policies outside of California, data are similarly unavailable to quantify the extent of this influence.

While cap-and-trade is just one component of the state’s suite of climate change mitigation efforts, evidence suggests it reduces emissions more cost-effectively than most other state-funded programs. Specifically, based on auction prices, cap-and-trade has an associated cost of about $30 per ton of carbon dioxide equivalent reduced. In contrast, a large state program that subsidizes zero-emission vehicle replacements has an estimated cost per ton of $193.

However, questions have been raised about whether certain components of the current cap-and trade program—such as the option for covered entities to purchase offsets to comply while continuing to emit GHGs—are effective at meeting the state’s goals. Specifically, in recent years, academic researchers have questioned the quality of the offsets in the carbon market, with some studies finding a marginal or nonexistent climate benefit.

Is the Program Well-Positioned to Help the State Achieve Its GHG Goals?

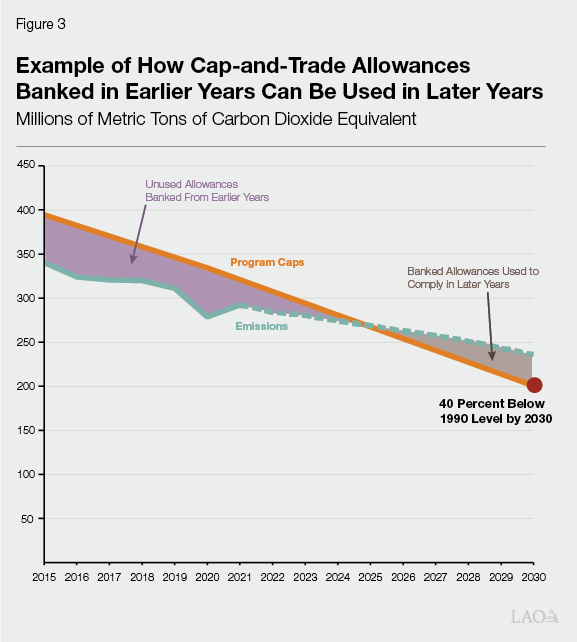

While the state depends on a wide variety of activities to meet its GHG reduction goals, cap-and-trade is a key component to make up the difference to the degree other policies and programs fall short of achieving desired reductions on their own. However, cap-and-trade currently is not stringent enough to drive the additional emissions reductions needed to meet the state’s 2030 GHG emissions reduction goal. This is because, over the past several years, covered entities and outside investors have accumulated and banked a significant number of unused allowances. That is, they have purchased—and, thus far, not yet used—excess permits that they can use to allow for additional emissions in future years. Accordingly, under the current structure of the program, covered entities likely will have more than enough banked allowances to comply with program requirements even as they continue to emit at levels exceeding the 2030 cap, as illustrated in Figure 3. This program shortcoming may keep cap-and-trade from helping the state achieve its near-term GHG goals. In the long term, CARB likely will need to adjust the cap downward to put the state on track to meet its 2045 GHG goal.

How Does California’s Program Relate to Other Cap-and-Trade Programs?

As noted above, in 2012 SB 1018 authorized CARB to join California with similar programs in other states and/or countries, creating a unified carbon market that hosts joint auctions of allowances that can be applied in all participating jurisdictions. In 2014, CARB linked the state’s program with the Canadian province of Quebec’s smaller carbon market. California’s carbon market was also linked with Ontario’s market from 2017 to 2018, before that province’s cap-and-trade program shuttered. As of this writing, CARB was considering the possibility of linking California to Washington state’s new program.

How Are Changes Made to the Program?

As noted above, in the history of the program, the state has made a number of changes to cap-and-trade through both regulations and legislation. CARB conducts a formal rulemaking process to make changes to the program. For example, the board is expected to initiate a process in 2024 which may include potential changes related to program stringency and the allocation of allowances to certain industrial entities. CARB has made numerous changes to the program in past years, including adjusting the supply of allowances and establishing the linkage with Quebec’s carbon market. The Legislature can also direct changes to the cap-and-trade program. For example, in 2017, AB 398 added the requirement that half of eligible offsets for the program be from projects that provide direct environmental benefits in California.

What Will Happen to the Program After 2030?

There is uncertainty regarding the program’s operations past 2030. When the program last neared its original expiration date of 2020, the Legislature passed legislation to authorize its extension to 2030. Whether CARB has the authority to continue the program beyond that date without legislative action or whether the Legislature must authorize a further extension currently is an area of some legal uncertainty. Should the program expire in 2030, the state likely would need to identify activities and policies to attain additional emissions reductions in order to meet its 2045 GHG goals.

How Does Cap-and-Trade Impact Local Air Pollution?

Cap-and-trade is designed to address GHG emissions, not local air pollution. However, certain entities covered under the program—such as oil refineries—emit air pollutants alongside GHGs that historically have worsened air quality and contributed to air pollution in certain parts of the state. Academic researchers have reached different conclusions about the relationship between cap-and-trade and local air pollution. A 2022 study from the University of Southern California found that the program did not improve local air quality and in some cases contributed to greater disparities in exposure to air pollution near covered facilities. Another study from University of California, Santa Barbara published in 2023 found air pollution disparities across California from facilities covered under cap-and-trade narrowed as a result of the program.

How Does the Program Affect Gas Prices?

As of this writing, CARB estimates that the cap-and-trade program adds about 27 cents to each gallon of retail gasoline sold in California. This assumes transportation fuel suppliers pass their compliance costs on to consumers in the form of higher retail gas prices, which economists have found to be the case.

What Are Some Ways in Which the Cap-and-Trade Program Impacts Lower-Income Populations?

Certain covered facilities are more likely to be located in communities with higher proportions of people of color and those earning lower incomes, fitting with the pattern of historic marginalization of these communities to areas closer to heavy industry. As noted above, cap-and trade is not designed to address these localized impacts and research is inconclusive about whether the program has resulted in better, neutral, or even worse air pollution disparities for vulnerable communities located near certain covered facilities.

As noted above, cap-and-trade increases the price of purchasing gasoline in California. Higher gas prices disproportionately impact lower-income households, which tend to pay a larger share of their income towards transportation costs. This is due in part to lower-income residents having moved further from places of employment in recent years in response to rising housing costs in California’s metropolitan centers, forcing them to spend more on gas due to longer commutes.

Additionally, as described below, the state requires that a certain portion of cap-and-trade auction revenues be spent on activities that benefit low-income and disadvantaged communities.

The Greenhouse Gas Reduction Fund

What Is the Greenhouse Gas Reduction Fund (GGRF) and How Much Revenue Does It Receive?

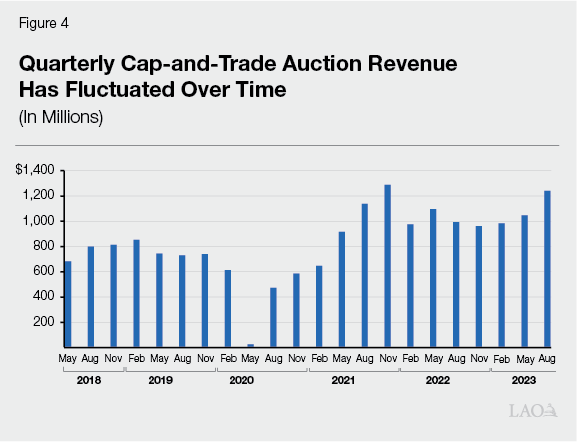

GGRF is the depository for revenues generated from the sale of cap-and-trade allowances. In recent years, cap-and-trade auctions have raised between $3 billion and $4.3 billion per year. Multiple factors influence revenues—including interest in purchasing allowances from outside investors, confidence in the longevity of the program, and the balance of supply versus demand for allowances. These dynamics make it difficult to predict with certainty how much revenue will be generated for GGRF in a given year. Figure 4 displays the fluctuations in auction revenues over the past few years. (Due to economic slowdowns related to the COVID-19 pandemic, entities purchased very few allowances in May 2020, resulting in a sharp drop in revenue from that auction.)

What Requirements Govern How GGRF Funds Can Be Spent?

The Legislature has established a number of requirements for how GGRF monies can be spent. Assembly Bill 32, the legislation that created the program in 2006, required that revenues be spent on activities that reduce GHG emissions and/or address the impacts of climate change. In addition, Chapter 830 of 2012 (SB 535, de León) required that at least 35 percent of GGRF expenditures benefit “priority populations,” which include disadvantaged and lower-income communities. (Senate Bill 535 required the California Environmental Protection Agency to develop a data tool to identify these target communities, based on the degree to which they are disproportionately affected by environmental pollution and/or have higher concentrations of people with lower incomes or greater rates of unemployment. That tool is now known as CalEnviroScreen.) Many specific spending requirements originated with the 2014-15 budget, which established a number of standard annual allocations for GGRF, as described next.

What Types of Activities Do GGRF Funds Support?

Figure 5 displays the programs and associated amounts stipulated in statute for annual GGRF allocations. These statutory requirements largely have stayed the same since the cap-and-trade program was established, though the forest health and drinking water spending amounts were added more recently (2022 and 2019, respectively). About 65 percent of annual GGRF revenues is dedicated to these statutory spending requirements. For the most part, these statutory GGRF spending commitments are continuously appropriated, meaning they are not subject to appropriation by the Legislature through the annual budget act or other legislation.

Figure 5

Statutorily Required GGRF Appropriations

|

Program |

Department |

Appropriation Amount |

|

High‑Speed Rail |

HSRA |

25 percent of annual revenues |

|

Affordable Housing and Sustainable Communities |

SGC |

20 percent of annual revenues |

|

Transit and Intercity Rail |

CalSTA |

10 percent of annual revenues |

|

Low Carbon Transit Operations |

Caltrans |

5 percent of annual revenues |

|

Healthy and Resilient Forests |

CalFire |

$200 milliona |

|

Safe and Affordable Drinking Water |

SWRCB |

$130 milliona |

|

Manufacturing Tax Credit |

Other |

Roughly $70‑$90 million |

|

SRA Backfill |

CalFire/CCC |

Roughly $70‑$90 million |

|

aAllocation may be reduced proportionally if annual revenues are not sufficient to support intended amount. |

||

|

GGRF = Greenhouse Gas Reduction Fund; HSRA = High Speed Rail Authority; SGC = Strategic Growth Council; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; CalFire = California Department of Forestry and Fire Protection; SWRCB = State Water Resources Control Board; SRA = State Responsibility Area; and CCC = California Conservation Corps. |

||

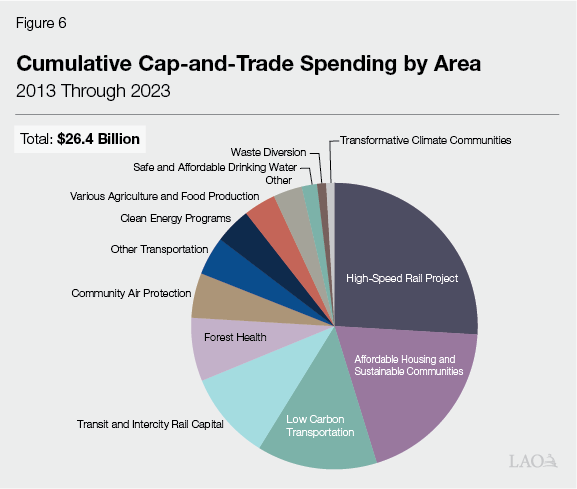

After accounting for these statutory spending commitments, the remainder of annual GGRF revenues are available for the state to spend on other activities, at its discretion (and pursuant to other statutory requirements). The Legislature typically appropriates GGRF funds as a part of the annual budget process, and spending priorities for these “discretionary” revenues can vary each year. Past expenditures have focused on low-carbon transportation programs, community-based air protection, and agriculture programs. Figure 6 provides a summary of how the state has spent GGRF revenues since the cap-and-trade program began. This link provides a summary of GGRF spending in the most recent state budget package.

How Does the State Set Its Annual GGRF Spending Level?

As part of developing the annual state budget package, the Legislature and Governor base the annual GGRF spending plan on estimates for how much revenue the cap-and-trade auctions might generate in the coming year. If revenues ultimately come in significantly lower than expected, the Legislature may need to make midyear reductions to some authorized expenditures. If revenues come in higher than expectations, the Legislature can allocate the additional funding through a subsequent budget action. The funding levels for the programs identified in Figure 5 that receive a statutorily established percentage of annual GGRF revenues adjust without the need for legislative action.