LAO Contact

February 29, 2024

The 2024‑25 Budget

California Student Aid Commission

Summary

Brief Covers the California Student Aid Commission (CSAC) Budget. This brief reviews the Governor’s budget proposals for the Cal Grant and Middle Class Scholarship programs—the largest two programs CSAC administers. It also revisits recent one‑time CSAC initiatives the state has funded.

Governor’s Budget Reflects Baseline Spending Increases for Cal Grants. The Governor’s budget revises 2023‑24 Cal Grant spending upward by $83 million (3.6 percent) relative to the enacted level. The increase is due primarily to higher‑than‑expected program costs for community college entitlement awards, especially as more recipients of these awards transfer to public universities. From the revised 2023‑24 level, the Governor’s budget further increases Cal Grant spending by $148 million (6.2 percent) in 2024‑25, bringing total program spending to $2.5 billion. This above‑average growth rate reflects a projected increase in recipients, combined with a projected increase in average award amounts primarily due to university tuition increases.

Middle Class Scholarship Award Amounts Would Decrease Under Governor’s Budget. As of 2022‑23, the Middle Class Scholarship is based on a student’s total cost of college attendance rather than only tuition. Students’ awards now reflect a certain percentage of their remaining cost of attendance after accounting for their available resources. Each year, CSAC determines the percentage of award coverage based on the program funding level. Under last year’s budget agreement, the state would have provided a total of $926 million General Fund (consisting of $637 million ongoing and $289 million one time) for the program in 2024‑25. Due to the state budget condition, the Governor’s budget forgoes the one‑time funds but retains the ongoing funds. We estimate the proposed funding level would cover 24 percent of students’ remaining costs in 2024‑25—down from 36 percent in 2023‑24.

Recommend Pulling Back Unspent Funds From Two Recent One‑Time Initiatives. In 2021‑22 and 2022‑23, the state provided one‑time General Fund appropriations of $500 million each for Golden State Teacher Grants and the Learning‑Aligned Employment Program. We estimate $223 million for Golden State Teacher Grants and roughly $485 million for the Learning‑Aligned Employment Program remained unspent as of January 1, 2024. Given the state budget deficit, we recommend the Legislature pull back these unspent funds. The Legislature might want to take early action to maximize savings, as less funding will remain available by the end of the fiscal year.

Introduction

Brief Focuses on CSAC Budget. CSAC administers many of the state’s student financial aid programs. This brief is organized around the Governor’s 2024‑25 budget proposals for CSAC. The first section provides an overview of CSAC’s budget. The next two sections focus on Cal Grants and Middle Class Scholarships, respectively. The last section discusses recent one‑time initiatives that could be revisited given the state’s projected budget deficits.

Overview

Governor’s Budget Provides $3.4 Billion for CSAC in 2024‑25. As Figure 1 shows, the proposed 2024‑25 funding level for CSAC is $108 million (3.1 percent) lower than the revised 2023‑24 level. The lower funding level is entirely due to changes in one‑time funding, with ongoing funding increasing from year to year. The two main fund sources for CSAC are state General Fund and federal Temporary Assistance for Needy Families (TANF). Under the Governor’s budget, state General Fund comprises 87 percent of CSAC funding and federal TANF comprises 12 percent. The remainder comes from various sources, including reimbursements from other departments.

Figure 1

Ongoing General Fund Support for CSAC Increases in 2024‑25

Spending by Program and Funding by Source (Dollars in Millions)

|

2022‑23 Actual |

2023‑24 Revised |

2024‑25 Proposed |

Change From 2023‑24 |

|||

|

Amount |

Percent |

|||||

|

Spending |

||||||

|

Local assistance |

||||||

|

Cal Grants |

$2,211 |

$2,393 |

$2,541 |

$148 |

6% |

|

|

Middle Class Scholarships |

568 |

847a |

636 |

‑211 |

‑25 |

|

|

Learning‑Aligned Employment Programb |

300 |

— |

— |

— |

— |

|

|

Golden State Teacher Grantsb |

137 |

177 |

134 |

‑43 |

‑24 |

|

|

Other programs |

56 |

38 |

39 |

1 |

2 |

|

|

Subtotals |

($3,272) |

($3,456) |

($3,351) |

(‑$105) |

(‑3%) |

|

|

State operations |

$28 |

$26 |

$24 |

‑$3 |

‑10% |

|

|

Totals |

$3,300 |

$3,482 |

$3,374 |

‑$108 |

‑3% |

|

|

Funding |

||||||

|

General Fund |

||||||

|

Ongoing |

$2,416 |

$2,655 |

$2,819 |

$164 |

6% |

|

|

One‑time |

464 |

401 |

128 |

‑272 |

‑68 |

|

|

Federal TANF |

400 |

400 |

400 |

— |

— |

|

|

Other funds and reimbursements |

19 |

27 |

28 |

1 |

2 |

|

|

aIncludes $227 million in one‑time funds. bOne‑time initiatives. |

||||||

|

CSAC = California Student Aid Commission and TANF = Temporary Assistance for Needy Families. |

||||||

Governor’s Budget Reflects a Few Changes to CSAC Spending. As Figure 2 shows, the largest change in ongoing General Fund spending for CSAC in 2024‑25 is a baseline adjustment for Cal Grants, reflecting the most recent cost estimates for the program. The only one‑time spending is for Golden State Teacher Grants, which is supported by a five‑year appropriation provided in the 2021‑22 Budget Act. In addition to the changes shown in the figure, the Governor has a proposed budget solution to forgo an originally planned $289 million one‑time General Fund allocation for the Middle Class Scholarship program in 2024‑25.

Figure 2

Largest Ongoing Spending Changes for

CSAC Are Baseline Adjustments

General Fund Changes, 2024‑25 (In Millions)

|

Ongoing Spending |

|

|

Cal Grant baseline adjustment |

$148 |

|

Middle Class Scholarship baseline adjustment |

16 |

|

Employee compensation adjustment |

—a |

|

Subtotal |

($164) |

|

One‑Time Initiatives |

|

|

Golden State Teacher Grants |

$128b |

|

Total |

$292 |

|

aLess than $500,000. bThe 2021‑22 Budget Act appropriated $500 million General Fund to be spent from 2021‑22 through 2025‑26. Amount shown reflects anticipated General Fund spending in 2024‑25. The Governor’s budget also includes $6 million in reimbursement authority for the program in 2024‑25. |

|

|

CSAC = California Student Aid Commission. |

|

Cal Grants

In this section, we first provide background on the Cal Grant program and then discuss cost estimates for this program under the Governor’s budget.

Background

Cal Grant Program Is the State’s Largest Financial Aid Program. The Cal Grant program is intended to help students with financial need cover college costs. The program offers multiple types of Cal Grant awards. As Figure 3 shows, the amount of aid students receive depends on their award type and the segment of higher education they attend. Cal Grant A awards cover full systemwide tuition and fees at public universities and a fixed amount of tuition at private universities. Cal Grant B awards provide the same amount of tuition coverage as Cal Grant A awards in most cases, while also providing an “access award” for nontuition expenses such as food and housing. Cal Grant C awards, which are only available to students enrolled in career technical education programs, provide lower amounts of tuition and nontuition coverage. Across all award types, larger amounts of nontuition coverage are available to students with dependent children as well as current and former foster youth.

Figure 3

Cal Grant Amounts Vary by

Award Type, Sector, and Student Characteristics

Maximum Annual Award Amount, 2023‑24

|

Amount |

|

|

Tuition Coverage |

|

|

Cal Grant A and Ba |

|

|

UC |

$13,752b |

|

Nonprofit institutions |

9,358 |

|

WASC‑accredited for‑profit institutions |

8,056 |

|

CSU |

5,742 |

|

Other for‑profit institutions |

4,000 |

|

Cal Grant C |

|

|

Private institutions |

$2,462 |

|

Nontuition Coverage |

|

|

Cal Grant A |

|

|

Students with dependent childrenc |

$6,000 |

|

Foster youthc |

6,000 |

|

Cal Grant B |

|

|

Students with dependent childrenc |

$6,000 |

|

Foster youthc |

6,000 |

|

All other students |

1,648 |

|

Cal Grant C |

|

|

Students with dependent childrenc |

$4,000 |

|

Foster youthc |

4,000 |

|

Other CCC students |

1,094 |

|

Other private‑institution students |

547 |

|

aCal Grant B recipients generally do not receive tuition coverage in their first year. bReflects award amount for new UC students. Award amounts for continuing students are based on the tuition levels set in the year the student first enrolled at UC. cStudents attending private for‑profit institutions are ineligible for these awards. |

|

|

WASC = Western Association of Schools and Colleges. |

|

Cal Grants Have Financial and Academic Eligibility Criteria. Students apply for Cal Grant awards by submitting a Free Application for Federal Student Aid (FAFSA) or California Dream Act Application. To qualify for an award, students must meet certain income and asset criteria. These criteria vary by family size and are adjusted annually for inflation. For example, in the 2023‑24 award year, a dependent student from a family of four must have an annual household income of under $125,600 to qualify for a Cal Grant A or C and under $66,000 to qualify for Cal Grant B. In most cases, students must also meet a grade point average (GPA) requirement. The specific GPA requirement varies by award type. Most award types require a minimum high school GPA of 2.0 or 3.0 or a minimum community college GPA of 2.0 or 2.4.

Most Cal Grants Are Entitlements, but Some Are Awarded Competitively. For more than 20 years, the state has provided Cal Grants as entitlements to recent high school graduates as well as transfer students under age 28. In 2021‑22, the state also began providing Cal Grants as entitlements to community college students, regardless of their age and time out of high school. The state currently provides approximately 162,000 new entitlement awards annually. The state also provides a limited number of competitive awards (13,000 new awards annually) to students who do not qualify for an entitlement award—typically older students attending four‑year universities. The state recently adopted plans to potentially replace this program structure in 2024‑25, as the box below describes.

Cal Grant Reform

State Has Plans to Restructure Cal Grants, Subject to Trigger Provision. In the 2022‑23 budget package, the state adopted a potential restructuring of the Cal Grant program, commonly referred to as “Cal Grant reform.” Cal Grant reform would replace the existing award types with a Cal Grant 2 award that provides nontuition coverage to community college students and a Cal Grant 4 award that provides tuition coverage at all other segments. Cal Grant reform would also make several key changes to program eligibility, including (1) removing grade point average requirements for community college recipients, (2) removing age and time out of high school requirements for recipients at all other segments, and (3) aligning income ceilings with the generally lower ceilings used in the federal Pell Grant program. Under the enacted trailer legislation, Cal Grant reform would be triggered in 2024‑25 if the state determines in spring 2024 that sufficient General Fund is available to support it over a multiyear period. Based on the California Student Aid Commission’s most recent estimates, Cal Grant reform would increase program spending by $245 million in 2024‑25. The administration indicates it intends to determine whether Cal Grant reform conditions have been met at the May Revision. Under current revenue projections, the trigger conditions would not be met.

Cost Estimates

Governor’s Budget Reflects Upward Revision to 2023‑24 Cal Grant Spending. From the 2023‑24 Budget Act level, the Governor’s budget revises current‑year Cal Grant spending upward by $83 million (3.6 percent) to align with CSAC’s most recent cost estimates. This brings estimated Cal Grant spending in 2023‑24 to $2.4 billion—a $182 million (8.2 percent) increase over the previous year. This above‑average annual growth follows three consecutive years of small decreases in Cal Grant spending (with recipients and average award amounts affected throughout the pandemic). The upward revision to 2023‑24 spending since budget enactment is primarily attributable to community college entitlement awards. With this program component now in its third year of implementation, more recipients are transferring from community colleges and bringing their awards with them to the California State University (CSU) and University of California (UC). CSAC has increased its cost estimates for these awards to reflect newly available data on the share of recipients who transfer and their average award amounts upon transferring.

Governor’s Budget Reflects Further Spending Increases in 2024‑25. From the revised 2023‑24 spending level, the Governor’s budget further increases Cal Grant spending by $148 million (6.2 percent) in 2024‑25. This is a relatively high growth rate compared to the average annual change of 3.7 percent over the past decade. We summarize the projected changes for 2024‑25 by segment and award type in our Cal Grant Spending and Cal Grant Recipient tables. The higher spending reflects a 3.4 percent projected increase in recipients, primarily for community college entitlement and high school entitlement awards. It also reflects a 2.7 percent projected increase in average award amounts, primarily due to tuition increases. Under CSAC’s estimates, $43 million of the Cal Grant spending increase in 2024‑25 is attributable to UC tuition increases and an additional $35 million is attributable to CSU tuition increases.

Cost Estimates Will Be Updated at May Revision. CSAC prepared the Cal Grant cost estimates underlying the Governor’s budget in October 2023. In the spring, CSAC plans to update its estimates based on more recent program data for 2023‑24. The administration is expected to update its Cal Grant spending levels at the May Revision accordingly. At that time, more data will likely also be available on the potential impact of recent FAFSA changes on Cal Grant application rates in 2024‑25, as we discuss in the box nearby.

Financial Aid Application Changes

Launch of New Federal Financial Aid Application Has Been Stymied by Many Delays. The U.S. Department of Education recently made significant changes to the Free Application for Federal Student Aid (FAFSA)—the form students use to apply for many types of federal, state, and institutional financial aid. The changes are intended to simplify the form by reducing the number of questions students and families need to answer and transferring data directly from their previous tax filings. After a one‑year delay in the original launch date, the revised FAFSA is now in the midst of being implemented across the nation for the first time. The department released the new application form for the 2024‑25 award year about three months later than usual (on December 30 rather than October 1, 2023). The department also is months behind schedule in sharing the resulting student records that campuses use to make financial aid offers to students. Moreover, technical difficulties have prevented many families, particularly those in which one or more parents do not have a social security number, from completing the new form.

Federal Changes and Challenges Could Impact State Aid Programs. Anticipating challenges with the new form, the state, as part of last year’s budget package, extended the application deadline for several state financial aid programs (including most Cal Grant award types and Middle Class Scholarships) from March 2, 2024 to April 2, 2024. If the U.S. Department of Education does not resolve its implementation challenges before the April 2 application deadline, the Legislature may want to consider further extending the deadline. Any continued challenges could potentially lead to fewer state financial aid recipients and lower spending in 2024‑25. Beyond these implementation challenges, students and campuses also will be affected by methodological changes in how student financial need and federal Pell Grant eligibility are determined under the new form. The federal government expects these methodological changes to increase the total amount of aid students receive under the federal Pell Grant program. The impact of these changes on state financial aid programs is not yet known.

Middle Class Scholarships

In this section, we first provide background on the Middle Class Scholarship program and then discuss cost estimates for this program under the Governor’s budget.

Background

State Revamped Middle Class Scholarship Program in 2022‑23. The state created the original Middle Class Scholarship program in the 2013‑14 budget package to provide partial tuition coverage to certain UC and CSU students. Originally, awards were for students who were not receiving tuition coverage through the Cal Grant program or other need‑based financial aid programs. In 2022‑23, the state implemented a new set of rules for the Middle Class Scholarship program. The new program focuses on total cost of attendance (rather than only tuition). Under the new program, students may use their awards for nontuition expenses, such as housing and food.

Award Amounts Are Now Calculated Based on Total Cost of Attendance. Middle Class Scholarship award amounts now vary widely among students, with each student’s award reflecting their costs and available resources. As Figure 4 shows, calculating each student’s award amount involves several steps. Starting with a student’s total cost of attendance, CSAC deducts the student’s available resources, consisting of other gift aid, a student contribution from part‑time work earnings, and in some cases a parent contribution. (The parent contribution only applies to dependent students with a household income of more than $100,000.) This calculation determines the student’s remaining costs. Next, CSAC determines what percentage of each student’s remaining costs it can cover based on the annual state appropriation for the program. Awards cover the same percentage of remaining costs for each student, except foster youth receive awards that cover 100 percent of their remaining costs.

Figure 4

Middle Class Scholarships Are

Calculated Using Multicomponent Formula

Illustrative CSU Dependent Student With $110,000 Household Income, 2023‑24

|

Award Calculation |

|

|

Cost of attendance |

$30,000 |

|

Other federal, state, and institutional gift aida |

‑5,742 |

|

Student contribution from work earnings |

‑7,898 |

|

33% of parent contribution from federal EFCb |

‑6,300 |

|

Student’s Remaining Costs |

$10,060 |

|

Percentage based on annual appropriationc |

36% |

|

Award Amount |

$3,622 |

|

aThe amount also includes any private scholarships in excess of the sum of the student contribution and parent contribution. bOnly applies to dependent students with a household income of more than $100,000. cState law requires the California Student Aid Commission to determine what percentage of each student’s remaining costs to cover each year based on the annual appropriation for the program. The program is estimated to cover 36 percent of each student’s remaining costs in 2023‑24. |

|

|

EFC = expected family contribution. |

|

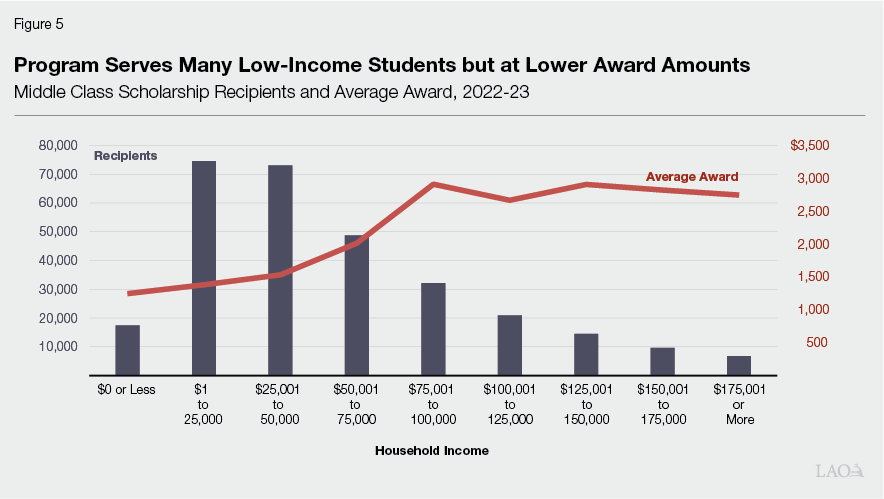

Awards Are Now Available to a Broader Group of Students. The new Middle Class Scholarship program generally maintains the income and asset ceilings of the original program, adjusted annually for inflation. The maximum annual household income to qualify for an award is $217,000 for dependent students in 2023‑24. However, the new program serves considerably more low‑income students than the original program. This is because students receiving tuition coverage through Cal Grants or other need‑based financial aid programs are now eligible for Middle Class Scholarship awards to help cover nontuition expenses. As Figure 5 shows, more than half of students who received Middle Class Scholarship awards in 2022‑23 had a household income of $50,000 or less, and more than 80 percent had a household income of $100,000 or less. Students with lower household incomes, however, tended to receive smaller award amounts because they were receiving more gift aid from other programs. In addition to serving more low‑income UC and CSU students, the program also newly serves CCC students enrolled in bachelor’s degree programs.

State Funding Level Determines Percentage of Students’ Remaining Costs Covered. Each year, the Middle Class Scholarship funding level determines what percentage of each student’s remaining costs are covered. (Statute does not specify these percentages or set forth a policy for increasing them over time.) The state currently provides $637 million ongoing for the program. In 2022‑23 (the first year of the new program), the ongoing funding level was sufficient to cover 26 percent of students’ remaining costs. In last year’s budget, the state added one‑time funds on top of the ongoing funding level to increase the percentage of each student’s remaining costs that are covered. Specifically, the budget provided $227 million one time in 2023‑24 and included intent to provide $289 million one time in 2024‑25.

Cost of Maintaining Award Coverage Tends to Increase Over Time. If the state intends to hold Middle Class Scholarship award coverage at a certain share of students’ remaining costs (such as 26 percent), more funding tends to be required each year. Annual increases in the program cost are driven by two main factors. First, the number of recipients goes up, reflecting UC and CSU enrollment growth as well as annual adjustments to the program income ceiling. Second, the cost of attendance tends to increase for each recipient, reflecting UC and CSU tuition increases as well as rising nontuition expenses (such as housing and food). These increases in cost of attendance are partly offset by increases in students’ available resources, including other gift aid and work earnings.

Cost Estimates

Awards Are Covering 36 Percent of Students’ Remaining Costs in 2023‑24. The 2023‑24 Budget Act provided a total of $864 million General Fund (consisting of $637 million ongoing and $227 million one time) for Middle Class Scholarships. The Governor’s budget revises this funding level downward by $17 million (1.9 percent) to align with CSAC’s most recent cost estimates for covering 36 percent of each student’s remaining costs. Based on CSAC’s cost estimates, this is the maximum percentage of coverage possible without going over the budget act appropriation.

Under Governor’s Budget, Awards Are Estimated to Cover 24 Percent of Students’ Remaining Costs. Under the 2023‑24 budget agreement, the state would have provided a total of $926 million General Fund (consisting of $637 million ongoing and $289 million one time) for Middle Class Scholarships in 2024‑25. Based on CSAC’s estimates, this funding level would have been sufficient to cover 35 percent of each student’s remaining costs—similar to the current coverage level. Due to the state budget condition, the Governor’s budget forgoes the one‑time funds but retains the ongoing funds in 2024‑25. We estimate the Governor’s proposed funding level is sufficient to cover 24 percent of each student’s remaining costs in 2024‑25. Figure 6 provides key information about the program, including how award amounts would change under the Governor’s proposal. Although the Governor’s proposal is reasonable given the state’s large budget deficit, it would result in students receiving smaller awards in 2024‑25 than in the current year.

Figure 6

Middle Class Scholarship Awards Are Expected to

Decrease in 2024‑25

Key Information by Segment

|

2022‑23 Actual |

2023‑24 Revised |

2024‑25 Proposed |

Change From 2023‑24 |

||

|

Amount |

Percent |

||||

|

Recipients |

|||||

|

CSU |

205,037 |

215,889 |

233,161 |

17,272 |

8% |

|

UC |

90,060 |

91,849 |

99,197 |

7,348 |

8 |

|

CCC |

37 |

40 |

43 |

3 |

8 |

|

Total |

295,134 |

307,778 |

332,401 |

24,623 |

8% |

|

Spending (in Millions) |

|||||

|

CSU |

$419 |

$617 |

$463 |

‑$154 |

‑25% |

|

UC |

150 |

230 |

173 |

‑57 |

‑25 |

|

CCC |

—a |

—a |

—a |

—a |

‑25 |

|

Total |

$568 |

$847 |

$636 |

‑$211 |

‑25% |

|

Average Award |

|||||

|

CSU |

$2,041 |

$2,858 |

$1,987 |

‑$871 |

‑30% |

|

UC |

1,663 |

2,506 |

1,742 |

‑764 |

‑30 |

|

CCC |

2,622 |

5,325 |

3,725 |

‑1,600 |

‑30 |

|

aLess than $500,000. |

|||||

|

Notes: Data for 2022‑23 and 2023‑24 reflect California Student Aid Commission (CSAC) estimates. Data for 2024‑25 reflect CSAC estimates adjusted by LAO to align with the proposed funding level in the Governor’s budget. |

|||||

One‑Time Budget Solutions

In this section, we discuss how the Legislature can achieve additional budget savings by pulling back unspent one‑time funding for two initiatives at CSAC. Although the Governor’s budget does not include these actions, they could be among the less disruptive options for addressing the state budget deficit.

State Recently Created a Few Large One‑Time Initiatives at CSAC. In 2021‑22 and 2022‑23, the state appropriated a large amount of one‑time General Fund to CSAC in response to the large budget surpluses estimated at the time. Specifically, the state provided $500 million for the Golden State Teacher Grant program, which provides scholarships of up to $20,000 to students enrolled in teacher preparation programs who commit to working for four years at a priority school or preschool program. The state also provided $500 million for the Learning‑Aligned Employment Program, which provides students from underrepresented backgrounds with work‑study opportunities related to their area of study or career interests. In addition to these two initiatives, the state provided $500 million for a third initiative offering training grants to individuals who lost employment due to the pandemic. In 2023‑24, facing both a moderate budget deficit and a strong job market, the state discontinued this third initiative and reverted approximately $480 million in unspent funds.

Some Golden State Teacher Grant Funds Remain Unspent. The $500 million appropriation for Golden State Teacher Grants was to be spent across five years, ending June 30, 2026. Of the original appropriation, we estimate CSAC has spent $277 million (consisting of $272 million for awards and $5 million for program administration) as of January 1, 2024. This leaves an estimated $223 million in unspent funding. Given that CSAC continues to issue awards for 2024‑25, the amount of unspent funding is likely to be several tens of millions of dollars lower by the end of the fiscal year.

Most Learning‑Aligned Employment Funds Remain Unspent. The $500 million appropriation for the Learning‑Aligned Employment Program was to be spent across ten years, ending June 30, 2031. This program is open to CCC, CSU, and UC campuses, and nearly all campuses across the three segments have chosen to participate. CSAC has distributed the funding to these campuses, which are in turn responsible for issuing awards to students. Participating campuses first launched the program in 2022‑23 and are expected to ramp up operations in 2023‑24. Data on program recipients and spending are only available for 2022‑23 because CSAC does not require campuses to report these data until after the end of each fiscal year. Based on the best available information, we estimate that roughly $15 million of the original appropriation was spent as of January 1, 2024. This includes spending on awards as well as program administration by CSAC and campuses. We estimate roughly $485 million remains unspent. Given that campuses continue to issue awards for 2024‑25, the amount of unspent funding is likely to be somewhat lower by the end of the fiscal year.

Given State Budget Condition, Recommend Pulling Back Unspent Funds From Both Initiatives. As we discuss in The 2024‑25 Budget: Deficit Update, recent state revenue collections indicate the state budget deficit is larger than the administration estimated in January. To address the deficit, we recommend the Legislature start by pulling back recent one‑time augmentations. Pulling back one‑time funds now would allow the state to maintain more of its reserves, which in turn could help protect ongoing programs from cuts over the next couple of years. Accordingly, we recommend the Legislature revert any remaining unspent funds from the one‑time appropriations for Golden State Teacher Grants and the Learning‑Aligned Employment Program. The Legislature might want to take early action to maximize the savings it could achieve from these initiatives, as less funding will remain available at the end of the fiscal year.