LAO Contact

March 5, 2024

The 2024‑25 Budget

Sustainable Funding for the

Department of Pesticide Regulation

Summary

The Governor proposes to increase the mill assessment—a tax levied on pesticides when first sold into or within the state—to address the structural deficit within the Department of Pesticide Regulation’s (DPR’s) special fund and to support various programmatic expansions for the department. Additionally, the proposal would (1) require DPR to adjust certain fees to support a portion of the programmatic expansions; (2) provide funding from the Greenhouse Gas Reduction Fund (GGRF) to support community air pollution monitoring and outreach; and (3) make several policy changes related to what entity pays the mill assessment, pesticide enforcement, and emergency pesticide use authorizations. Overall, we find the increases to the mill assessment and the programmatic expansions to be reasonable, but recommend the Legislature ensure that its spending priorities are reflected in the scope of work and associated level of funding provided. We also recommend the Legislature approve the proposed policy changes and support DPR’s community air pollution monitoring activities with the department’s special fund instead of GGRF.

Background

DPR Is Responsible for Regulating Pesticides. DPR is charged with protecting public health and the environment by regulating pesticides. The department is responsible for evaluating and registering pesticide products at the state level. This includes the continuous review of pesticides and, if needed, the formal reevaluation of products to identify actions needed to reduce or eliminate adverse impacts. DPR also is responsible for licensing individuals and businesses that sell, consult on, or apply pesticides. Additionally, the department tests pesticide residues on fresh produce and oversees local enforcement of pesticide use laws and regulations by County Agricultural Commissioners (CACs). DPR and CACs have the authority to discipline those who violate state pesticide laws and regulations, such as through levying administrative penalties. Finally, the department offers grants and conducts outreach activities to encourage the adoption of alternative pest management practices. Historically, about 90 percent of DPR’s budget has been supported by the DPR Fund—discussed next—with the remaining amount coming from other special funds and federal funds.

DPR Fund Is Used to Support the Regulation of Pesticides. The DPR Fund is a repository of taxes and fees paid by pesticide retailers, wholesalers, and businesses. The state uses the fund to support state and local activities related to regulating pesticides. The majority of the fund’s resources are provided to DPR to support its core functions and responsibilities. Roughly one‑quarter of the DPR Fund’s revenues are provided to CACs as partial reimbursement for their pesticide enforcement activities. Expenditures from the DPR Fund are expected to total roughly $138 million in 2023‑24.

DPR Fund Is Made Up of Revenues From Tax on Pesticide Sales And Several Fees. The DPR Fund is primarily supported by three main funding sources: the mill assessment, registration fees, and licensing fees:

- Mill Assessment. The largest revenue source for the DPR Fund—about 80 percent—is the mill assessment, a tax levied on pesticides when first sold into or within the state. In 2023‑24, the mill assessment is estimated to raise about $100 million. The mill assessment is currently set at the statutory maximum level of 21 mills, or 2.1 cents per dollar of sales. Revenues derived from 7.6 mills are statutorily directed to CACs. The remaining amount is used primarily to support several DPR activities, such as pesticide enforcement, monitoring and surveillance, reevaluations of potential pesticide impacts, and alternative pest management grants and outreach.

- Registration Fees. Registration fees account for about 16 percent of the fund’s total revenues. All pesticides must be registered with DPR before they can be sold or used in the state. Registration fees are collected both at the time of initial product registration and through annual renewals. In 2023‑24, registration fees are estimated to raise about $25 million. DPR uses these revenues to directly support its workload in registering pesticides. Statute authorizes DPR to adjust fees through the regulatory process to ensure that revenues fully support the department’s Registration Program.

- Licensing Fees. Licensing fees—which are paid biennially by pesticide professionals and businesses—account for about 4 percent of the fund’s total revenues. In 2023‑24, licensing fees are estimated to raise about $2 million. DPR uses these revenues to directly support its workload in licensing and certifying pesticide professionals and businesses. Statute authorizes DPR to adjust fees through the regulatory process to ensure that revenues fully support the department’s Licensing and Certification Program.

Additional Mill Assessment Levied on Agricultural Use Pesticides. The state also levies an additional .75 mills on agricultural use pesticides. In 2023‑24, this additional assessment is estimated to raise about $2 million. These revenues go to the Department of Food and Agriculture Fund—not the DPR Fund. This funding supports the California Department of Food and Agriculture (CDFA) in providing consultation services to DPR on certain regulatory actions.

Legislature Has Taken Some Short‑Term Actions in Response to DPR Fund’s Structural Deficit. In recent years, the growth in expenditures from the DPR Fund has outpaced growth in revenues, creating a structural deficit within the fund. This is primarily due to revenues from the capped mill assessment being unable to keep pace with costs associated with expanded DPR programmatic responsibilities that have been enacted through legislation. The Governor’s 2021‑22 budget included a proposal to increase and tier the mill assessment. Under that proposal, more acutely toxic pesticides would have been charged a higher rate (or tier). The additional funding generated would have been used to address the fund’s structural deficit and support various programmatic expansions across DPR, CDFA, and CACs. The Legislature rejected the proposal and instead provided General Fund resources of $10.3 million in 2021‑22 and $8.8 million in 2022‑23 to DPR. The funding provided relief to the DPR Fund and supported alternative pest management grants and outreach, environmental monitoring, and pesticide takeback events hosted by CACs. Budget bill language also directed DPR to use a portion of the funding to hire a consultant to study tiering the mill assessment.

DPR Developed a Sustainable Pest Management (SPM) Roadmap. In January 2023, the department released its SPM Roadmap, which includes strategies to transition the state to safer, more sustainable pest management. Actions in the plan include expediting the registration of new pesticide products, supporting research of and outreach for alternatives to high‑risk pesticides, and expanding monitoring and data collection. A key goal of the roadmap is to eliminate the use of “priority pesticides” by 2050. The plan defines priority pesticides as those that warrant attention and planning to expedite their replacement and elimination, but does not list any specific pesticides as falling into this category. The criteria for priority pesticides include factors such as risk level and the availability of effective alternatives. The plan states that DPR will take future steps to identify which pesticides should receive this categorization under the advisement of a multi‑stakeholder committee.

Independent Contractor Examined Funding Needs for DPR and Appropriate Structure for Mill Assessment. In August 2023, the independent contractor that DPR hired to conduct the statutorily directed study released its final findings and recommendations. These included:

- Set Mill Assessment at a Flat Rate in the Near Term. The report recommended that the mill assessment initially be set at a flat rate—such that all pesticides are assessed the same tax rate—increasing from 21 mills to 33.9 mills over a three‑ to five‑year period. It also recommended allowing the mill assessment to be adjusted up to a cap to be set in statute.

- Generate Additional Funding to Expand DPR’s Activities. The study recommended that the mill assessment be set at a level sufficient to generate revenues above what is needed to cover the structural deficit to enable DPR and CACs to address identified programmatic needs at an expanded level, and to provide an additional amount to CDFA to support its pesticide consultation services.

- Consider Tiered Mill Assessment Structure in the Future. The report recommended that DPR revisit the possibility of adopting a tiered mill assessment once it has made progress in identifying priority pesticides pursuant to its SPM Roadmap. Under a tiered model, the state would levy a higher mill assessment on products that the department categorizes as priority pesticides. The report noted that such an approach likely would not incentivize the purchase of safer alternatives, but rather would (1) signal a need for alternatives and (2) generate additional revenues that could be used to support the research of and outreach for alternatives.

- DPR Has Additional Needs. The report found that DPR’s registration and licensing programs—which are not supported by the mill assessment—also have unfunded programmatic needs.

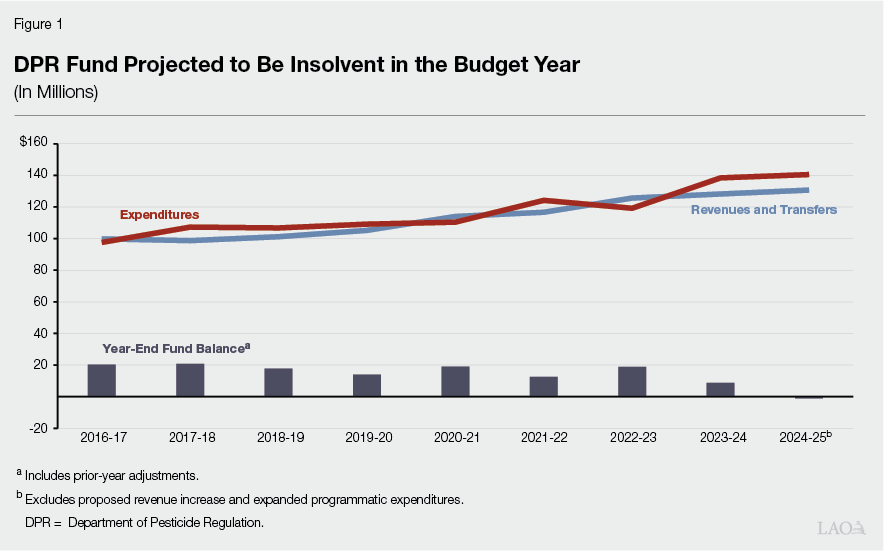

DPR Fund Projected to Be Insolvent in 2024‑25. Because the steps the Legislature took to provide relief to the DPR Fund relied on temporary General Fund support, the fund’s structural deficit remains. As shown in Figure 1, the administration projects that the DPR Fund will be insolvent in the budget year—meaning it will not have sufficient revenues to cover projected expenditures. Specifically, projected expenditures of $140.5 million will exceed the anticipated available resources of $139.3 million from revenues and reserves (from the prior‑year end fund balance), resulting in a $1.2 million gap. The ongoing structural gap is even larger without the fund’s reserves to help cover expenditures. (These totals reflect projections of what would occur in 2024‑25 absent the Governor’s proposed new revenues and expenditures, which we discuss below.) As shown, the revenues that support the fund have grown steadily in recent years, including a notable increase around 2019‑20 resulting from pandemic‑related pesticide sales (such as household disinfectants). At the same time, expenditures have continued to increase at an even faster rate due to augmented activities related to pesticide enforcement and additional staff approved to support the registration and reevaluation of pesticides.

Governor’s Proposal

The Governor proposes several changes to increase revenues into the DPR Fund which would generate a total of $30.4 million of new revenues in 2024‑25 (growing to $43.9 million in future years). Of this amount, $9.8 million would address the structural deficit and $17.8 million would be used to expand programs and activities (growing to $32.5 million). The increased revenues would be generated by: (1) increasing the mill assessment ($22.1 million in 2024‑25, growing to $33.8 million), (2) increasing registration fees through regulations ($6.3 million in 2024‑25, growing to $7.2 million), and (3) increasing licensing fees through regulations ($2 million in 2024‑25, growing to $2.9 million). The proposal also would provide $717,000 from GGRF on an ongoing basis to support additional programmatic expansions for the department. We describe these proposals in more detail below.

Increases Mill Assessment Over a Three‑Year Period, Authorizes DPR to Increase Further in Future, Sets New Statutory Caps. The Governor proposes budget trailer legislation that would increase the mill assessment over a three‑year period from the current level of 21 mills to (1) 26 mills in 2024‑25, (2) 27.5 mills in 2025‑26, and (3) 28.6 mills in 2026‑27. Beginning in 2027‑28, the proposal would authorize DPR to further adjust the mill assessment as needed to align revenues with expenditures approved by the Legislature in the annual budget act, not to exceed a new statutory cap of 33.9 mills. The proposal would maintain the structure of the assessment as a flat rate and would not authorize the department to charge differential rates, such as tiering based on the acute toxicity of pesticides (as had been proposed previously) or for priority pesticides. The administration estimates that its proposed increases would generate an additional $22.1 million in 2024‑25, growing to $33.8 million in 2026‑27 when the rate is set at 28.6 mills.

The Governor’s proposal also would increase the statutory cap for the additional mill assessment levied on agricultural use pesticides. Specifically, the current cap of .75 mills would be raised to 1.04 mills. As under current law, CDFA would have the authority to increase this additional mill assessment in coordination with DPR to ensure that it is properly resourced to provide pesticide consultation services to DPR—as long as it does not exceed the cap. The administration indicates that CDFA does not anticipate raising this additional mill assessment in 2024‑25 even if it is granted authority to do so.

Utilizes Additional Revenues to Address Structural Deficit and Support Additional Program Spending. In addition to addressing the structural deficit within the DPR Fund, the proposal would generate additional revenues to support various programmatic expansions for DPR. The proposal also would provide a small amount of ongoing GGRF to support additional programmatic expansions for the department, which we discuss in greater detail below. As shown in Figure 2, the proposal would provide DPR with an additional $18.5 million in 2024‑25 beyond what is needed to address existing workload. This would cover 65 new positions in 2024‑25, increasing to $33.2 million and 117 positions in 2026‑27 and ongoing. (In addition to the ongoing amounts displayed in the figure, the proposal includes about $100,000 from the DPR Fund on a one‑time basis in 2026‑27 for travel support related to inspections.)

Figure 2

Governor’s Proposed Spending Increases for DPR

(Dollars in Millions)

|

Activity |

2024‑25 |

2025‑26 |

2026‑27 and Ongoing |

|||||

|

Funding |

Positions |

Funding |

Positions |

Funding |

Positions |

|||

|

Process Improvements and Safer Alternatives |

$9.5 |

35 |

$15.7 |

58 |

$17.9 |

64 |

||

|

Alternative pest management grants and support |

$4.3 |

7 |

$6.7 |

11 |

$7.7 |

11 |

||

|

Administrative support |

3.1 |

14 |

4.7 |

22 |

4.7 |

22 |

||

|

Pesticide registrations and reevaluations |

1.1 |

7 |

1.7 |

10 |

2.2 |

12 |

||

|

Pesticide environmental evaluations |

0.9 |

6 |

2.2 |

13 |

2.9 |

17 |

||

|

Pesticide human health evaluations |

0.2 |

1 |

0.4 |

2 |

0.4 |

2 |

||

|

Statewide Service Improvements |

$5.5 |

18 |

$7.1 |

22 |

$9.1 |

33 |

||

|

Pesticide monitoring and data evaluation |

$3.2 |

7 |

$3.2 |

7 |

$3.9 |

11 |

||

|

Pesticide takeback events |

0.6 |

1 |

1.1 |

1 |

1.1 |

1 |

||

|

Product compliance and mill auditing |

0.6 |

5 |

0.6 |

5 |

1.0a |

7 |

||

|

State pesticide enforcement actions |

0.3 |

1 |

0.3 |

1 |

1.2 |

6 |

||

|

Fumigation tarp testing |

0.3 |

— |

0.3 |

— |

0.3 |

— |

||

|

Worker Health and Safety Program |

0.3 |

2 |

0.4 |

3 |

0.4 |

3 |

||

|

Regulation development |

0.3 |

2 |

0.3 |

2 |

0.3 |

2 |

||

|

Licensing and Certification Program |

0.1 |

— |

1.0 |

3 |

1.0 |

3 |

||

|

Support for CACs and Outreach |

$3.5 |

12 |

$5.6 |

19 |

$6.3 |

20 |

||

|

Training and compliance support for CACs |

$2.0 |

5 |

$2.5 |

5 |

$3.2 |

6 |

||

|

Local engagement and outreach |

1.5 |

7 |

3.0 |

14 |

3.1 |

14 |

||

|

Totals |

$18.5 |

65 |

$28.3 |

99 |

$33.2 |

117 |

||

|

aIn addition to the ongoing amount, the proposal includes about $100,000 from the DPR Fund on a one‑time basis for travel support related to inspections. |

||||||||

|

Note: Totals may not add due to rounding. All additional spending and positions are supported by the DPR Fund, except $717,000 from GGRF to support four positions and air monitoring activities. |

||||||||

|

DPR = Department of Pesticide Regulation; CACs = County Agricultural Commissioners; and GGRF = Greenhouse Gas Reduction Fund. |

||||||||

As shown in the figure, a significant portion of this funding would go towards alternative pest management grants and support activities. Other major new spending includes support for (1) enforcement activities, such as investigating pesticide use violations and tracking pesticide residue levels on fresh produce; (2) pesticide registrations, such as reducing the time needed to complete registrations and expediting the approval of safer alternatives; and (3) pesticide evaluations and monitoring, such as identifying and reevaluating pesticides for which actions might be needed to reduce or eliminate adverse impacts.

Most of the programmatic expansions from the DPR Fund would be supported by the additional revenues generated from increasing the mill assessment, while a smaller amount would come from new revenues associated with DPR increasing registration and licensing fees and from GGRF (discussed below). In cases where projected revenues exceed proposed expenditures, DPR would use the remaining funding to address the structural deficit and build sufficient reserves within the DPR Fund.

DPR Would Increase Registration and Licensing Fees to Align With Additional Expenditure Authority. In several cases, the proposal would provide additional expenditure authority from the DPR Fund to augment the department’s Registration Program and Licensing and Certification Program. As mentioned earlier, both programs are directly supported by their respective regulatory fees. The proposal would continue with this practice by having these augmentations be supported by fees instead of the mill assessment. However, in order to fully support these proposed expansions, DPR would need to use its existing authority to increase both registration and licensing fees through the regulation process. The department indicates the exact fee increases it would implement still are uncertain and that it would plan to hold public workshops in 2024 to discuss potential changes. Despite this uncertainty, the administration estimates that the forthcoming increases would generate an additional $8.3 million in 2024‑25 ($6.3 million from registration fees and $2 million from licensing fees), growing to $10.1 million by 2026‑27 and thereafter ($7.2 million from registration fees and $2.9 million from licensing fees).

Provides Some New Funding From GGRF for Air Quality Monitoring and Outreach Activities. The proposal also would provide $717,000 from GGRF and four positions in 2024‑25 and ongoing to support pesticide air monitoring and data evaluations and stakeholder engagement. The department indicates that this work is related to the community air pollution monitoring and reduction program established by Chapter 136 of 2017 (AB 617, C. Garcia).

Includes Several Policy Changes. The Governor proposes budget trailer legislation that would make several changes, including the following:

- Changes Mill Assessment Payer Responsibility. The proposal would require the mill assessment to be paid by the entity that first sells a pesticide into the state. This contrasts with current law, under which it is paid by the entity who has registered the pesticide. DPR indicates that this change would address payment responsibility issues related to online retail and align the mill assessment with how the state collects other fees and taxes.

- Extends Statute of Limitations for Mill Assessment Payment Violations Found in Audits. The proposal would extend the current statute of limitations for DPR to take enforcement actions when audits reveal mill assessment payment violations. Currently, the department must bring enforcement actions within four years of the occurrence of the violation. The proposal would allow DPR to bring enforcement actions on violations that have occurred within four years of the audit’s commencement, but no later than two years after the audit’s completion. DPR indicates that this extended time line would better reflect the period it needs to complete audits and take corresponding enforcement actions.

- Extends Statute of Limitations for Pesticide Use Violations. Currently, enforcement actions on pesticide use violations must be brought by DPR or CACs within two years of the occurrence of the violation. The proposal would extend this time line to three years. The department indicates that this change would better reflect the time needed to investigate and bring enforcement actions for pesticide use violations.

- Authorizes DPR to Enforce California’s Laws on Out‑of‑State Pesticide Dealers. The proposal would authorize DPR to levy administrative penalties of up to $15,000 on violations related to pesticide dealers, such as when entities act in this role without a license. Currently, the authority to levy administrative penalties related to pesticide dealers resides solely with CACs. DPR indicates taking enforcement actions on out‑of‑state pesticide dealers would be a more appropriate role to assign to the state, since the primary role of CACs is to be the main enforcement authorities within their jurisdictions.

- Exempts Emergency Pesticide Use Authorizations From California Environmental Quality Act (CEQA) Review. CEQA requires state and local agencies to consider the potential environmental impacts associated with potential public or private projects or activities. Federal law authorizes the U.S. Environmental Protection Agency to allow federal and state agencies (such as DPR) to permit the unregistered use of a pesticide to address emergency conditions. For example, this might occur when no other registered pesticides are available to control a serious pest problem that would result in significant economic losses or cause adverse environmental impacts. These emergency authorizations are only permitted for a limited time within a defined geographical area and usually involve pesticides that have been registered for other uses (such as for different crops). The proposal would exempt such emergency pesticide use authorizations from requiring a CEQA review.

Assessment

Increasing Mill Assessment Is Justified. Overall, we find two key justifications for the state to increase the mill assessment. First, it has not been increased since 2004. Given the considerable amount of time since its last adjustment, an increase is warranted to ensure that it both aligns with current department expenditures and is able to support new state priorities related to pesticides going forward. Second, increasing the mill assessment to support these activities aligns with the “polluter pays” principle, whereby those who produce or otherwise contribute to pollution (such as environmental impacts from pesticides) should bear the associated regulatory costs of managing and preventing damage to public health and the environment.

Flat Increase to the Mill Assessment Represents Reasonable Approach. We find that a flat increase to the mill assessment, as the Governor has proposed, is a reasonable approach. This structure has several benefits. For instance, a single tax rate is easier for the state to administer and offers a more predictable revenue stream. It also is simpler and more predictable for the entities that pay the tax. A flat increase also aligns with the recommendations in the independent contractor’s report. The report analyzed various ways in which the state could tier the mill assessment, but ultimately found that a flat increase was the most appropriate structure until the department has begun identifying priority pesticides. Given the department still is in the beginning stages of identifying priority pesticides—with much of this work dependent on the expanded staffing the Governor proposes—adopting plans to implement a tiered mill assessment structure now would be premature.

Proposal Would Solve Structural Deficit Within the DPR Fund and Allow for Future Growth in DPR and CDFA Activities. The Governor’s proposal would address the structural imbalance within the DPR Fund on an ongoing basis. Specifically, the proposed increases to the mill assessment would provide sufficient new revenues for the DPR Fund to address its current structural deficit and cover DPR’s existing workload on an ongoing basis. Furthermore, raising the statutory cap and providing DPR with authority to make future increases to the mill assessment also would add to the ongoing stability of the fund by establishing a way for revenues to keep pace with the expenditure levels the Legislature sets through the annual budget act. Authorizing this “room” for revenues to grow also can provide the Legislature with greater confidence that it will be able to assign necessary responsibilities to the department in the future without placing excessive pressure on the DPR Fund. Similarly, the proposed increase in the statutory cap for the mill assessment on agricultural use pesticides would create a mechanism to ensure CDFA remains sufficiently resourced to provide consultant services to DPR. The inclusion of the statutory caps also aligns with the recommendations in the independent contractor’s report. We find the specific new caps the Governor proposes for the two mill assessments—33.9 mills for all pesticides and the additional 1.04 mills specifically for agricultural use pesticides—to be reasonable. However, moderately lower or higher statutory caps also could be justifiable.

Increasing Mill Assessment to Support Programmatic Expansions Would Help DPR Pursue State Goals. As noted, the Governor proposes increasing the mill assessment beyond what is needed to address the DPR Fund’s existing operating imbalance and generating additional funding to expand DPR’s activities. Overall, we find the proposed programmatic augmentations supported by the mill assessment increases to be reasonable given that they are targeted at (1) enhancing the enforcement of pesticide laws and regulations, (2) increasing the number of pesticide reevaluations the department can administer, and (3) encouraging the use and development of safer alternatives and practices. None of the proposed activities seem beyond the scope of the department’s responsibilities or extraneous to meeting its core mission. Furthermore, the proposed augmentations largely align with the funding needs identified in the independent contractor’s report.

Supporting Certain Programmatic Expansions With Fee Increases Also Is Appropriate. The Governor’s proposal would augment the department’s registration and licensing activities by having DPR use its existing regulatory authority to increase the fees that directly support these programs. Overall, we find the proposed programmatic expansions to be reasonable given that they would be used to (1) improve the department’s registration process, which has experienced an increase in average processing times in recent years and (2) provide the department with additional resources to certify and educate individuals and businesses applying for pesticide licenses. We also find that the proposed augmentations largely align with the funding needs identified in the independent contractor’s report. Furthermore, supporting these activities with fee increases is an appropriate approach given that it tasks those who are regulated by these programs with paying the costs for the provided services.

However, Legislative Priorities Should Also Be Incorporated. While we find the administration’s proposed programmatic augmentations to be reasonable, they do not represent the only options for expanding DPR’s activities. The Legislature has an important opportunity now to determine (1) the scope of activities it wants DPR to conduct, (2) the associated level of resources required, and (3) the corresponding level at which the mill assessment should be set. This could involve removing or refining activities proposed by the Governor or adding activities that are legislative priorities. Ensuring that legislative priorities are reflected is particularly important given the opportunity that adjusting taxes and fees provides in setting the state’s overall goals for pesticide regulation and ensuring they are well supported. Depending on the actions taken, modifying planned programmatic augmentations could result in higher or lower increases to the mill assessment and registration and licensing fees than proposed by the Governor. Potential categories of modifications the Legislature could consider include:

- Funding for SPM Roadmap Activities. The Governor’s proposal would use funding to support activities outlined in the department’s SPM Roadmap—such as identifying priority pesticides and expediting the registration of reduced‑risk pesticides. While these activities could provide some benefits, we note that the SPM Roadmap is an administration‑led initiative. The Legislature may wish to consider whether it agrees that these are worthwhile activities for DPR to undertake and whether any statutory guidance might be needed to further align the proposed actions with its own priorities.

- Funding for CACs. A central component of the proposal is to ensure that sufficient state resources are provided to uphold pesticide laws and regulations. While the Governor’s proposal includes additional enforcement funding for DPR, it does not augment funding for CACs’ enforcement activities. This diverges from the recommendation made in the independent contractor’s report, which identified a $10.2 million funding need for CACs. We also note that the last time the state raised the mill assessment, the portion provided to CACs was also increased. While current allotments could be sufficient, this is an important opportunity for the Legislature to ensure that CACs are properly resourced to effectively complete their statutorily required enforcement activities.

- Recently Chaptered Legislation. The proposal does not provide resources to implement recently chaptered legislation—such as for Chapter 662 of 2023 (AB 652, Lee), which requires DPR to convene an environmental justice committee. This omission is consistent with the administration’s overall approach in the Governor’s budget, which mostly excludes augmentations related to implementing recently chaptered legislation. (The administration indicates it will consider including such resources as part of the May Revision depending on the overall budget condition.) However, given the important opportunity the Legislature has right now to set DPR’s scope of work and corresponding funding needs, it is a key juncture for considering whether all of its desired activities are included—particularly those already enacted into law by the Legislature and Governor.

If Community Air Pollution Workload Is a Core Department Activity, Funding It From the DPR Fund—Rather Than GGRF—Is Appropriate. One of the primary purposes of reconsidering the mill assessment is to provide sufficient resources for DPR’s core programs so the department is better equipped to meet its mission and statutory authorities. Historically, the department’s core functions and programs have been supported by the DPR Fund. The Governor’s proposal continues this approach with one notable exception—the proposal to instead fund the ongoing activities related to AB 617 with GGRF. The ongoing nature of these augmentations suggests that the administration views this workload as a core department function. Moreover, DPR indicates that these activities—working with local communities on air pollution impacts caused by pesticides—are needed even in areas that do not currently participate in the AB 617 program. Accordingly, we find the DPR Fund to be a more appropriate ongoing fund source than GGRF to support these activities.

Policy Changes Appear to Be Reasonable. Overall, we find that the Governor’s proposed statutory changes align with the overall intent of the budget proposal and would support the department in further meeting its mission and statutory responsibilities. As noted above, these include changing the mill assessment payer responsibility, extending the statute of limitations for pesticide use and mill assessment payment violations, authorizing DPR to enforce state laws and regulations on out‑of‑state pesticide dealers, and exempting emergency pesticide use authorizations from CEQA. We find that these changes could (1) improve the collection of the mill assessment, (2) strengthen the enforcement of pesticide laws and regulations, and (3) facilitate the authorized use of pesticides in emergency situations.

Incorporating Accountability Measures Could Help Legislature Assess Effectiveness of Proposed Changes. The amount of funding DPR would receive under this proposal would represent a significant augmentation for the department. The proposal (including the proposed GGRF spending) would increase the department’s ongoing base spending levels by about 25 percent. While we find the proposed augmentations to be reasonable, the Legislature would benefit from conducting oversight of how the funding is being used and the degree to which it is helping DPR meet its core objectives. Monitoring the department’s progress in meeting state objectives—such as improving the registration and reevaluation of pesticides—would inform the Legislature on DPR’s successes and challenges in implementing the funding augmentations and, in turn, help inform whether future programmatic modifications might be needed.

Recommendations

Approve Some Level of Flat Mill Assessment Increase With Statutory Caps… We recommend the Legislature approve a flat increase to the mill assessment to address the structural deficit within the DPR Fund and to support high‑priority programmatic expansions. The mill assessment has not been adjusted in 20 years and an increase would ensure that the DPR Fund can accommodate current department expenditures and is able to support new state priorities for pesticides going forward. Furthermore, structuring the change as a flat increase—rather than tiered—is a reasonable approach given that it is easier to administer, offers a more predictable charge and revenue stream, and DPR has not yet identified a list of priority pesticides that could be used to form tiers for differential charges. We also recommend the Legislature incorporate statutory caps for both the mill assessment applied to all pesticides and the additional mill assessment levied on agricultural use pesticides—either at the levels proposed by the Governor or something close. This would allow revenues within the DPR Fund to keep pace with expenditure levels set by the Legislature and provide confidence that the department can be tasked with future responsibilities without placing excessive cost pressures on the fund.

…But Consider Modifications to Ensure DPR Has Sufficient Resources to Accomplish Legislative Priorities. Given the opportunity that revising the mill assessment provides in setting the state’s overall goals related to pesticides, we recommend the Legislature ensure that its spending priorities are reflected in the scope of work and associated level of funding that the final budget deal provides. This could include modifying or adding to the Governor’s proposed programmatic augmentations. Depending on the actions taken, this may require the Legislature to implement higher or lower increases to the mill assessment and registration and licensing fees than proposed by the Governor.

Support DPR’s Community Air Pollution Workload With DPR Fund. We recommend the Legislature reject the Governor’s proposal to fund DPR’s community air pollution workload with GGRF and instead support these activities with the DPR Fund. The ongoing nature of this augmentation suggests that this workload is a core department function, and the department indicates the needs for this community engagement exist beyond just AB 617 program participants. Accordingly, we find it reasonable to support these activities with the department’s primary funding source. This would mean ensuring the mill assessment is set at a level to generate revenues that can cover the associated costs ($717,000 to support four positions and air monitoring activities), along with whatever other modifications the Legislature makes to the Governor’s proposal. This would also align with our overall recommendation that the Legislature minimize out‑year GGRF commitments in order to maintain legislative flexibility over the use of these funds in upcoming years, particularly given the forecasted deficits. (Please see our recent report, The 2024‑25 Budget: Cap‑and‑Trade Expenditure Plan, for more detail on our GGRF‑related recommendations.)

Approve Various Policy Changes. We recommend the Legislature approve the Governor’s proposed policy changes. These include changing the mill assessment payer responsibility, extending the statute of limitations for pesticide use and mill assessment payment violations, authorizing DPR to enforce state laws and regulations on out‑of‑state pesticide dealers, and exempting emergency pesticide use authorizations from CEQA. These changes align with the overall intent of the budget proposal and would support the department in further meeting its mission and statutory responsibilities. We find that these changes could (1) improve the collection of the mill assessment, (2) strengthen the enforcement of pesticide laws and regulations, and (3) facilitate the authorized use of pesticides in emergency situations.

Consider Adding Accountability Measures. We recommend the Legislature consider adding accountability measures as a way to conduct oversight of programmatic expansions and to ensure that funding is helping DPR meet its core objectives. Monitoring the degree to which the department is meeting these objectives—such as improving the registration and reevaluation of pesticides—also would inform the Legislature on the successes and challenges of implementing the augmentations and, in turn, guide potential future programmatic modifications. Specifically, the Legislature could require DPR to complete a report that discusses how the funding augmentations are being utilized and what outcomes are being achieved. The Legislature could require the report to include specific metrics that it believes are important to track, such as average processing times for pesticide registrations, the number of pesticide reevaluations being undertaken each year, and updates on the department’s progress in identifying priority pesticides.