LAO Contact

Drew Soderborg

September 10, 2024

The 2024-25 California Spending Plan

Judiciary and Criminal Justice

The 2024-25 budget provides $17.8 billion from the General Fund for judicial and criminal justice programs, including support for program operations and capital outlay projects, as shown in Figure 1. This is a decrease of $1.5 billion, or 8 percent, below the revised 2023-24 level. This decline is largely due to reductions in General Fund spending in 2024-25, such as those made to address the state’s budget problem, as well as the expiration of limited-term funding provided in previous years. (The budget totals reported here and below do not reflect the plan to reduce General Fund state operations spending by up to 7.95 percent on an ongoing basis statewide beginning in 2024-25. For more on this planned reduction, please see the “State Operations and Employee Compensation” write-up in our Other Provisions post.)

Figure 1

Judicial and Criminal Justice Budget Summary

General Fund (Dollars in Millions)

|

2022‑23 |

2023‑24 |

2024‑25 |

Change From 2023‑24 |

||

|

Amount |

Percent |

||||

|

Department of Corrections and Rehabilitation |

$14,318 |

$14,582 |

$13,914 |

‑$688 |

‑5% |

|

Judicial Branch |

3,233 |

3,176 |

2,978 |

‑198 |

‑6 |

|

Department of Justice |

457 |

518 |

504 |

‑14 |

‑3 |

|

Board of State and Community Corrections |

724 |

795 |

229 |

‑565 |

‑71 |

|

Other Departmentsa |

162 |

220 |

199 |

‑21 |

‑10 |

|

Totals, All Departments |

$18,893 |

$19,290 |

$17,824 |

‑$1,467 |

‑8% |

|

aIncludes Office of the Inspector General, Commission on Judicial Performance, Victim Compensation Board, Commission on Peace Officer Standards and Training, State Public Defender, funds provided for trial court security, and debt service on general obligation bonds. |

|||||

|

Note: Detail may not total due to rounding. |

|||||

California Department of Corrections and Rehabilitation

The budget provides $14.3 billion (mostly from the General Fund) for the California Department of Corrections and Rehabilitation. This is a net decrease of $559 million (4 percent) from the revised 2023-24 level. This decrease reflects various reductions, such as those associated with prison capacity deactivations and the expiration of limited-term funding provided in prior years. (The net decrease in spending does not reflect growth in employee compensation costs in 2024-25 because such costs are accounted for elsewhere in the budget.) We identify some of the major actions taken in the 2024-25 budget process below.

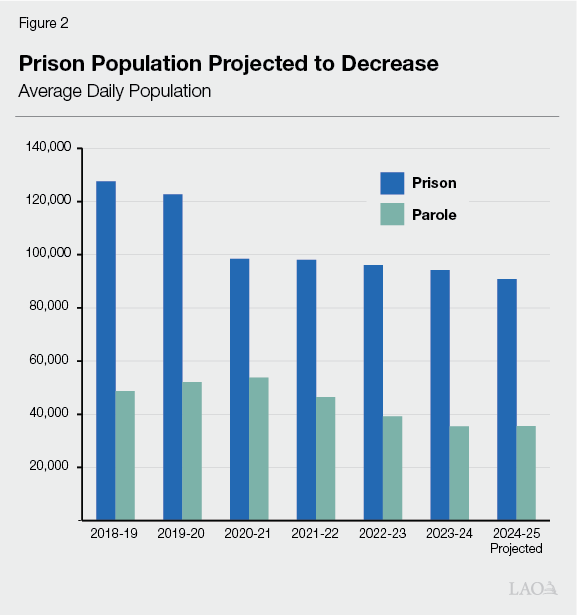

Adult Correctional Population. Figure 2 shows the recent and projected changes in the prison and parole populations. As shown in the figure, the prison population is projected to decrease by about 3,400 (4 percent) from 94,200 in 2023-24 to 90,900 in 2024-25. The parole population is projected to remain roughly the same at around 35,600.

Prison Capacity Deactivations. The budget reflects ongoing General Fund reductions of $169 million beginning in 2024-25 (growing to $225 million beginning in 2025-26) associated with prison capacity deactivations. This consists of (1) $77 million (growing to $132 million in 2025-26) from the previously planned deactivation of Chuckawalla Valley State Prison in Blythe, (2) $82 million from the deactivation of 42 housing units across 11 state prisons, and (3) $10 million (growing to $11 million in 2025-26) related to reduced administrative costs resulting from these and previous deactivations.

Health Care. The budget includes various adjustments related to correctional health care beginning in 2024-25. Some of the major adjustments include:

$26.4 million ongoing net increase for contract medical services including funding based on medical acuity levels, medical parole, and administrative claims. This net increase results from a $38.5 million General Fund increase offset by a $12.1 million decrease in reimbursement authority.

$24.3 million one-time General Fund reappropriation of funds provided in 2023-24 for COVID-19 response and mitigation activities, such as testing and staff overtime. These funds will support the department’s COVID-19-related costs during 2024-25.

$20 million one-time General Fund to cover projected overspending in the prison medical care budget.

$16.5 million one-time increase in reimbursement authority for the continued development of an information technology system for Medi-Cal billing to support the implementation of the California Advancing and Innovating Medi-Cal justice-involved initiative.

In addition, the budget package includes language that would allow the Department of Finance to make payments from the General Fund for any fines related to staffing vacancies in the Coleman v. Newsom court case related to the provision of prison mental health care.

The budget also reflects various General Fund reductions to correctional health care programs beginning in 2024-25. These include:

$30.9 million annually for three years to reflect reduced pharmaceutical expenses related to a new pharmaceutical rebate contract.

$10.5 million ongoing for toxicology tests provided to patients receiving medication assisted treatment through the Integrated Substance Use Disorder Treatment Program. This reflects a lower cost per test and a decrease in tests per patient from 14 tests per year to 12 per year.

Price Increases. The budget provides General Fund augmentations beginning in 2024-25 due to price increases, including:

$26 million annually for four years to cover the cost resulting from a new contract for parole Sex Offender Management Program rehabilitation services.

$23.1 million (increasing to $46.2 million annually beginning in 2025-26) to pay for increased utility costs.

Other General Fund Solutions. The budget reflects various General Fund solutions to address the state’s budget problem, including:

$27 million reduced from 2023-24 to reflect the delayed installation of video surveillance technology at five prisons. These costs will be shifted to 2025-26 ($16 million) and 2026-27 ($11 million).

$15 million reduced beginning in 2024-25 and ongoing associated with various administrative positions and contract funding that are no longer needed.

$8.5 million reduced from 2023-24 (growing to $22.6 million annually in 2025-26) to reflect a reduction in annual training for correctional officers from 48 hours to 40 hours and discontinuing the use of the California Reality Based Training Center.

$8.5 million reduced from 2022-23 and $15.3 million from 2023-24 related to a partial cancelation of the previously planned installation of cellphone interdiction technology at various prisons.

Facilities. The 2023-24 budget included funding for capital outlay at San Quentin Rehabilitation Center (SQ) intended to support an effort to develop the California Model, which is broadly focused on promoting a more rehabilitative and health-focused environment in California prisons. Specifically, it included: (1) $360.6 million in new lease revenue bond authority to demolish an existing building and construct a new educational and vocational center and (2) $20 million General Fund for unspecified improvement projects. The 2024-25 budget reduced lease revenue bond authority for the educational and vocational center project by $121.6 million to reflect a revised project cost of $239 million. In addition, $8 million of the $20 million General Fund provided in 2023-24 was repurposed to support the continuation of the Hope and Redemption Team Program with $4 million being provided each year in 2024-25 and 2025-26. (The program provides opportunities for formerly incarcerated individuals to serve as life coaches and mentors for the incarcerated population.) The remaining $12 million will be used to construct spaces for outdoor recreation and programming at SQ.

Judicial Branch

The budget provides $5.2 billion for the judicial branch in 2024-25—a net decrease of $85 million (2 percent) from the revised 2023-24 level. This includes $3 billion from the General Fund and $499 million from the counties, with most of the remaining balance from fine, penalty, and court fee revenues. The General Fund amount is a net decrease of $198 million (6 percent) from the revised 2023-24 amount. This net decrease is largely due to a one-time reduction in General Fund support for the branch offset by increased support from the Trial Court Trust Fund (TCTF) and an ongoing reduction to baseline trial court operations to help address the state’s budget problem. Funding for trial court operations is the single largest component of the judicial branch budget, accounting for about 75 percent of total spending. In addition to the amounts above, the budget also includes $101 million in new lease revenue bond authority. We identify some of the major actions taken in the 2024-25 budget process below.

Baseline Support for Trial Court Operations. The budget includes a $97 million ongoing General Fund reduction in baseline support for trial court operations. (This reduction is consistent with—though separate from—the plan to reduce General Fund state operations spending by up to 7.95 percent on an ongoing basis statewide.) It also includes a $36.6 million ongoing General Fund augmentation for increased trial court health and retirement benefits. Additionally, the budget package sets aside funding to support any increases for these benefits that occur during 2024-25.

Fine and Fee Related Backfills Supporting Trial Court Operations. The budget package generally retains General Fund backfills provided in last year’s budget to address various declines in fine and fee revenue supporting trial court operations, but adjusts one backfill. Specifically, the budget provides $37.3 million one time to backfill an ongoing decline in a subset of various fine and fee revenues collected to support trial court operations. (This backfill maintains funding provided by these fines and fees at the 2013-14 revenue collection level.) This is a $23.4 million decrease from the revised 2023-24 backfill level.

Community Assistance, Recovery, and Empowerment (CARE) Program. The budget includes General Fund reductions to the amounts provided in prior budgets to support court and legal representation costs associated with implementing the CARE program created by Chapter 319 of 2022 (SB 1338, Umberg). Specifically, the budget reverts $17.5 million in unspent funds from 2023-24. It also includes a $59.5 million reduction in 2024-25 (growing to $78.6 million annually beginning in 2025-26) to reflect updated workload cost estimates. As shown in Figure 3, this results in total judicial branch-related CARE program funding of $47.4 million in 2024-25 increasing to $54.3 million annually beginning in 2025-26.

Figure 3

Summary of Total CARE Program Funding

General Fund (In Millions)

|

Entity |

Purpose |

2022‑23 |

2023‑24 |

2024‑25 |

2025‑26 |

2026‑27 |

|

Judicial Branch |

||||||

|

Judicial Branch |

Court Operations |

$5.9 |

$15.2 |

$28.6 |

$35.0 |

$35.0 |

|

Judicial Branch |

Legal Representation |

0.3 |

22.9 |

18.8 |

19.3 |

19.3 |

|

Totals, Judicial Branch |

$6.1 |

$38.1 |

$47.4 |

$54.3 |

$54.3 |

|

|

Health Entities |

||||||

|

CalHHS |

Training |

$5.0 |

— |

— |

— |

— |

|

DHCS |

Training, Data Collection, and Other Activities |

20.2 |

$6.1 |

$6.1 |

$6.1 |

$6.3 |

|

DHCS |

County Grants |

57.0 |

27.2 |

37.8 |

46.5 |

47.0 |

|

Totals, Health Entites |

$82.2 |

$33.3 |

$43.9 |

$52.6 |

$53.3 |

|

|

Total CARE Program Funding |

$88.3 |

$71.3 |

$91.3 |

$106.9 |

$107.6 |

|

|

CARE = Community Assistance, Recovery, and Empowerment; CalHHS = California Health and Human Services Agency; and DHCS = Department of Health Care Services. |

||||||

Excess Property Tax Offset. The budget includes a $247.6 million one-time reduction in General Fund support for trial court operations in 2024-25 in order to reflect the availability of property tax revenue in accordance with Control Section 15.45 and Section 2578 of the Education Code. Such funds are allocated by the state to support trial court operations in counties that collect more property tax than state law allows them to spend on education. This reduction is the same as the revised 2023-24 level.

Other General Fund Solutions. The budget reflects various adjustments to help address the state’s budget problem. Most notably, the budget includes a $105 million one-time reduction in General Fund support for the judicial branch in 2024-25. This reduction is completely offset by increased funding from the unrestricted fund balance of the TCTF. (The unrestricted fund balance of the TCTF is the portion of the fund balance that is not set aside for particular purposes, such as emergency reserves.) The offset from the fund balance includes $5 million that became unrestricted as the budget package reduced the statutorily required trial court emergency reserve from $10 million to $5 million.

The budget also reverts up to $50.7 million one-time General Fund provided in prior budgets—$30.1 million from 2022-23 and $20.6 million from 2023-24—for various purposes to help address the state’s budget problem. This includes:

$20.4 million from 2022-23 related to savings in the Court Interpreter Employee Incentive Grant Program, which provided grants to trial courts to establish new court interpreter positions.

$16.1 million ($9.7 million from 2022-23 and $6.4 million from 2023-24) in unspent monies provided to increase the number of official court reporters in family and civil cases.

$9.2 million from 2023-24 related to the Firearm Relinquishment Grant Program, which supported court-based programs to remove firearms from people prohibited from owning them.

$5 million from 2023-24 related to Judicial Council operational savings.

Other Notable Changes. The budget package also includes the following notable changes:

$19.1 million General Fund annually for three years beginning in 2024-25 to continue funding for self-help services that was due to expire at the end of 2023-24. This maintains total direct state funding for self-help centers at $30 million—the level it has been at since 2018-19.

$5.1 million one-time General Fund reappropriation of monies provided as part of the 2022-23 budget package to implement and maintain remote access to court proceedings as required by Chapter 526 of 2021 (AB 716, Bennett). These funds were originally allocated to upgrade courtroom audio and video capabilities.

Legislation extending the sunset date for remote proceedings in certain criminal and civil proceedings to January 2027.

Facilities. The budget includes a $40 million reduction in 2024-25 (decreasing to $30 million annually beginning in 2025-26) to the General Fund backfill of the State Court Facilities Construction Fund. This backfill provides the fund with sufficient revenues to support its existing debt service, facility modification, and other facility-related expenditures. The reduction results in a net General Fund backfill of $40 million in 2024-25 and $89 million annually beginning in 2025-26.

The budget provides $101 million in new lease revenue bond authority for the construction phase of two projects—$89.5 million for the Sixth District Court of Appeal project and an additional $11.5 million for the Sonoma Santa Rosa Criminal Courthouse project.

Department of Justice

The budget provides $1.3 billion for the Department of Justice (DOJ) in 2024-25—a decrease of $10 million (1 percent) from the revised 2023-24 level. This amount includes $504 million from the General Fund—a net decrease of $14 million (3 percent) from the revised 2023-24 amount. (The net decrease does not reflect changes in employee compensation costs in 2024-25 because such costs are accounted for elsewhere in the budget.) We identify some of the major actions taken in the 2024-25 budget process below.

Legal Resources. The budget includes a net $15.2 million augmentation in 2024-25 (decreasing to $6.3 million annually beginning in 2027-28) from the General Fund and various special funds for additional legal resources. This includes $21.2 million in augmentations in 2024-25 (decreasing to $12.3 million annually beginning in 2027-28) for increased workload and the implementation of recently enacted legislation. Major components of this increase include:

$7.8 million ongoing ($1.9 million from the False Claims Act Fund and $5.9 million in federal funds) for Division of Medi-Cal Fraud and Elder Abuse (DMFEA) workload.

$4.7 million Unfair Competition Law (UCL) Fund in 2024-25 (increasing to $4.8 million in 2025-26 and 2026-27) to support civil climate change litigation.

$4 million General Fund annually for three years beginning in 2024-25 to supplement baseline funding supporting increased legal services for small clients.

These augmentations are offset by $8 million in ongoing General Fund reductions beginning in 2024-25 consisting of:

$5 million from general legal operations.

$2 million from DMFEA, fully offset by an equivalent augmentation from the False Claims Act Fund (separate from the augmentation noted above).

$1 million from legal workload related to state responses to actions taken by the federal government, leaving $2.5 million in ongoing funding for this workload.

Firearms. The budget provides $11.6 million General Fund in 2024-25 (generally decreasing to $6.9 million General Fund and $3.2 million Fingerprint Fees Account annually beginning in 2028-29) to implement five pieces of recently enacted firearm legislation. This amount includes $8 million General Fund in 2024-25—generally increasing to $8.2 million ($5 million General Fund and $3.2 million Fingerprint Fees Account) annually beginning in 2028-29—for the implementation of Chapter 249 of 2023 (SB 2, Portantino) related to carry concealed weapon licenses.

Technology Projects. The budget provides $7.7 million in 2024-25 (decreasing to $1.8 million annually beginning in 2025-26) from the General Fund and various special funds for the continuation of two technology projects. The amount includes $4.6 million General Fund in 2024-25 (decreasing to $1.8 million annually beginning in 2025-26) for a project to modernize the state’s firearms systems. It also includes $1.6 million one time each from the Special Distribution Fund and Gambling Control Fund (for a total of just under $3.2 million) for a project to manage gambling licensing workload.

UCL Fund. The budget includes an up to $130 million one-time, no-interest loan from the UCL Fund to the General Fund in 2024-25 to help address the state’s budget problem. (UCL revenues generally consist of the state’s share of litigation proceeds from cases related to unlawful, unfair, or fraudulent business practices, as well as false or misleading advertising.) Repayment of this loan is required under certain circumstances, most notably if UCL funds are needed to support DOJ legal workload.

Other Notable Changes. The budget package also includes the following notable changes:

$5 million one-time General Fund for use over five years (1) to coordinate and assist local and tribal law enforcement agencies in the identification and investigation of missing and murdered indigenous individuals and (2) for DOJ to act as a liaison between tribal governments, families, and other law enforcement agencies.

Authorization for DOJ to increase its billable hourly rates for legal services to generate $8.7 million in additional revenue. The package increases the rates to $228 (from $220) for attorney services, $213 (from $205) for paralegal services, and $202 (from $195) for auditor and research analyst services.

Legislation increasing the Controlled Substance Utilization Review and Evaluation System fee from $9 to $15 per licensee per year, beginning in April 2025, to cover DOJ’s costs to operate and maintain the system. This fee increase is estimated to raise an additional $1.9 million annually.

Board of State and Community Corrections

The budget provides $494 million for the Board of State and Community Corrections (BSCC) in 2024-25—a decrease of $528 million (52 percent) from the revised 2023-24 level. This amount includes $229 million from the General Fund—a net decrease of $565 million (71 percent) from the revised 2023-24 amount. This decrease is primarily due to the expiration of limited-term funding provided in 2023-24 for various grant programs as well as actions taken in the 2024-25 budget process. We describe some of the major actions below.

Grant Funding. The budget package includes adjustments related to various grants administered by BSCC. These include:

$210 million shift of General Fund and $13 million shift in federal funds to implement the previously authorized transfer of juvenile justice grant programs from BSCC to the Office of Youth and Community Restoration. (For more details, please see our health spending plan post.)

$175 million loan in 2024-25 from the Cannabis Tax Fund to the General Fund that is expected to be repaid from the General Fund in 2025-26 ($75 million), 2026-27 ($50 million), and 2027-28 ($50 million). These funds are being loaned from unspent monies that support the board’s Proposition 64 Public Health and Safety Grant Program.

$75 million augmentation in 2024-25 and ongoing from the newly created Gun Violence Prevention and School Safety fund, which receives revenues from a new firearm and ammunition tax. This will support the California Violence Intervention and Prevention (CalVIP) grant program, pursuant to Chapter 231 of 2023 (AB 28, Gabriel). The budget also reflects a $9 million reduction in 2024-25 and ongoing to eliminate General Fund support for CalVIP.

$13.3 million one-time General Fund augmentation in 2024-25 to provide competitive grants to federally recognized Indian tribes in California to support efforts to identify, investigate, and solve cases involving missing and murdered indigenous people.

$10.5 million General Fund reversion of funds appropriated in 2023-24 for a competitive grant program to provide counties with funding to support medication assisted substance use disorder treatment.

$8 million General Fund reduction in 2024-25 and ongoing to reflect the elimination of grants to counties that submit Community Corrections Partnerships plans to BSCC providing information about their implementation of the 2011 public safety realignment.

New In-Custody Death Review Division. The budget provides $3.3 million General Fund in 2024-25 (increasing to $7.7 million in 2025-26 and ongoing) for BSCC to establish a new division that will review investigations of deaths that occur in local correctional facilities and make recommendations to such facilities as required by Chapter 306 of 2023 (SB 519, Atkins).

Other Criminal Justice Programs

Victim Compensation Board. The budget includes a one-time reduction of $25 million in 2024-25 and $10 million in 2025-26 to the General Fund backfill of the Restitution Fund, which primarily supports the Victim Compensation Board. This backfill is provided to offset declines in the fine and fee revenue supporting the fund. The backfill will return to $39.5 million annually beginning in 2026-27.

Commission on Peace Officer Standards and Training (POST). The budget includes two reductions in General Fund support for POST to help address the state’s budget problem. This includes the reversion of $8 million in unspent funds from 2023-24 for the implementation of the peace officer certification program created by Chapter 409 of 2021 (SB 2, Bradford and Atkins). It also includes an ongoing reduction of $2.8 million beginning in 2024-25 of local assistance funding that POST reports had not been allocated in recent years.