LAO Contact

Edgar Cabral

September 16, 2024

The 2024-25 California Spending Plan

Proposition 98 and K-12 Education

Proposition 98

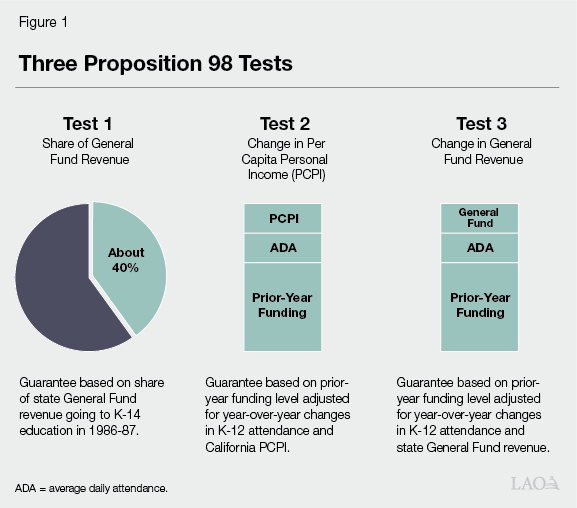

Proposition 98 Establishes Minimum Funding Level for Schools and Community Colleges. This funding requirement is commonly called the minimum guarantee. The state calculates the guarantee by comparing three main formulas or “tests” (Figure 1). Each test takes into account certain inputs, such as state General Fund revenue, per capita personal income, and K-12 student attendance. These inputs often change after the state adopts the budget, in some cases resulting in significant increases or decreases to the guarantee. The state can choose to fund at the guarantee or any level above it. It also can suspend the guarantee with a two-thirds vote of each house of the Legislature, allowing the state to provide less funding than the formulas require that year. Two of the three tests (Test 2 and Test 3) build upon the level of funding the state provided in the previous year, meaning a decision about funding in one year can change the minimum requirement for subsequent years. The state meets the guarantee through a combination of state General Fund and local property tax revenue.

Proposition 98 Budget Debate Revolved Around Unprecedented Drop in Prior-Year Guarantee. In March 2023, the state delayed the deadline for various personal income and corporation tax payments to conform with delays in federal tax deadlines. When the state finally received these payments in November 2023, they showed that revenues for 2022‑23 were far below the previous estimate. These lower revenues eventually reduced the Proposition 98 guarantee that year by $9.8 billion—an unprecedented drop for a fiscal year that was already over. This drop led to a debate about whether the state should reduce school and community college funding to the lower guarantee or maintain funding at the higher level it originally approved. A major consideration was that significant changes to 2022‑23 would have led to corresponding changes in the Proposition 98 guarantee in 2023‑24 and 2024‑25. The final budget agreement involves funding schools above the revised guarantee in 2022‑23, suspending the guarantee in 2023‑24, withdrawing funds from the Proposition 98 Reserve, and shifting payments across fiscal years. The rest of this section explains these and other actions in the adopted budget.

Proposition 98 Actions

Funds Above the Guarantee in 2022‑23 by Using New Type of Fiscal Maneuver. The adopted budget finalizes the 2022‑23 funding level for schools and community colleges at $103.7 billion—$6.2 billion above the state’s revised calculation of the guarantee that year (Figure 2). The budget also affirms the state will use this higher funding level as the base for calculating the Proposition 98 guarantee in 2023‑24 and future years. For accounting purposes, however, the state will not recognize the $6.2 billion as an expenditure in 2022‑23. Instead, it will accrue this amount to the future by recognizing the $6.2 billion in equal installments over ten years, beginning in 2026‑27. This spending, when recognized, will be attributed to the non-Proposition 98 side of the budget. Conceptually, this maneuver is similar to the state taking an internal loan from its cash reserves in order to finance a higher level of funding for schools and community colleges. The maneuver does not delay or reduce any payments to schools or community colleges, though it will reduce the funding available for other state programs for the next ten years.

Figure 2

Proposition 98 Changes in 2022‑23

(In Millions)

|

June 2023 |

June 2024 |

Change From |

|

|

Minimum Guarantee |

$107,359 |

$97,527 |

‑$9,832 |

|

Proposition 98 Funding |

|||

|

K‑12 schools |

$93,241 |

$91,261 |

‑$1,980 |

|

Community colleges |

12,331 |

12,187 |

‑144 |

|

Reserve deposit/withdrawal (+/‑)a |

1,787 |

272 |

‑1,516 |

|

Totals |

$107,359 |

$103,720 |

‑$3,639 |

|

Funding Above/Below Guarantee (+/‑) |

— |

$6,193b |

$6,193 |

|

aProposition 98 Reserve established by Proposition 2 (2014). bThis amount is attributed to 2022‑23 for the purpose of calculating the guarantee in future years but accrued to the 2026‑27 through 2035‑36 fiscal years for state budgeting purposes. |

|||

Suspends the Proposition 98 Guarantee in 2023‑24. Under the adopted budget, the Proposition 98 guarantee would have required the state to provide $106.8 billion in funding in 2023‑24. The state determined it could not afford to fund schools and community colleges at this level and suspended the guarantee that year. Trailer legislation sets the funding level for 2023‑24 at $98.5 billion (Figure 3). By suspending the guarantee, the state automatically creates an obligation—known as maintenance factor—equal to the $8.3 billion difference between the suspended funding level and the guarantee. Moving forward, the California Constitution requires the state to make maintenance factor payments when General Fund revenue is growing quickly relative to per capita personal income. These payments add to the guarantee in the future and accelerate school funding increases until the obligation is paid down.

Figure 3

Proposition 98 Changes in 2023‑24 and 2024‑25

(In Millions)

|

2023‑24 |

2024‑25 |

||||||

|

June 2023 (Enacted) |

June 2024 (Revised) |

Change From June 2023 |

June 2024 (Enacted) |

Change From 2023‑24 Revised |

Change From 2023‑24 Enacted |

||

|

Minimum Guarantee |

$108,312 |

$106,814 |

‑$1,498 |

$115,283 |

$8,469 |

$6,971 |

|

|

Proposition 98 Funding |

|||||||

|

K‑12 schools |

$94,953 |

$94,630 |

‑$323 |

$101,121 |

$6,491 |

$6,168 |

|

|

Community colleges |

12,456 |

12,267 |

‑189 |

13,108 |

841 |

652 |

|

|

Reserve deposit/withdrawal (+/‑)a |

903 |

‑8,413 |

‑9,316 |

1,054 |

9,467 |

151 |

|

|

Totals |

$108,312 |

$98,484b |

‑$9,827 |

$115,283 |

$16,798 |

$6,971 |

|

|

Funding Above/Below Guarantee (+/‑) |

— |

‑$8,329 |

‑$8,329 |

— |

$8,329 |

— |

|

|

aProposition 98 Reserve established by Proposition 2 (2014). bChapter 27 of 2024 (SB 154, Committee on Budget and Fiscal Review) suspends the Proposition 98 guarantee for 2023‑24 and sets funding at this level. |

|||||||

Withdraws Funding From the Proposition 98 Reserve. Proposition 2 (2014) established a constitutional reserve account within Proposition 98 and set forth rules requiring deposits and withdrawals under certain conditions. One rule requires withdrawals when Proposition 98 funding is below the previous year’s funding level, adjusted for changes in inflation and student attendance. For 2023‑24, funding is far below this threshold (primarily due to the suspension of the guarantee) and the state must withdraw the entire balance of $8.4 billion. The budget allocates $7.6 billion of this amount for schools and $788 million for community colleges. For both segments, these withdrawals will support costs for existing programs. In 2024‑25, the adopted budget begins to build back the reserve by making a deposit of nearly $1.1 billion. This deposit—though not mandatory under current revenue assumptions—would count toward any deposit that becomes required when the state trues-up its reserve calculation for 2024‑25.

Plans for Substantial Growth in Proposition 98 Funding in 2024‑25. The adopted budget estimates the Proposition 98 guarantee is $115.3 billion in 2024‑25, an increase of $16.8 billion (17.1 percent) over the 2023‑24 revised funding level (Figure 4). The largest factor contributing to this increase is strong year-over-year growth in General Fund revenue. Some of this revenue increase is due to trailer legislation temporarily limiting certain business tax credits and deductions, an action described more fully in the “Tax Policy Changes” section of The 2024‑25 California Spending Plan: Other Provisions. Whereas rapid revenue growth generally leads to rapid increases in the guarantee, the guarantee grows even faster in 2024‑25 because the state must make a $4.1 billion maintenance factor payment. Another contributing factor is a $1.3 billion (4.1 percent) increase in local property tax revenue. Test 1 is operative in 2024‑25, with increases in General Fund revenue and local property tax revenue contributing to growth in the guarantee. The state also makes two special adjustments that increase the Proposition 98 guarantee even further (described below).

Figure 4

Proposition 98 Inputs and Outcomes Under 2024‑25 Budget Plan

(Dollars in Millions)

|

2022‑23 |

2023‑24 |

2024‑25 |

|

|

Proposition 98 Funding |

|||

|

General Fund |

$73,946 |

$67,095 |

$82,612 |

|

Local property tax |

29,774 |

31,389 |

32,670 |

|

Totals |

$103,720 |

$98,484 |

$115,283 |

|

Change From Previous Year |

|||

|

General Fund |

‑$9,808 |

‑$6,851 |

$15,517 |

|

Percent change |

‑11.7% |

‑9.3% |

23.1% |

|

Local property tax |

$2,973 |

$1,615 |

$1,281 |

|

Percent change |

11.1% |

5.4% |

4.1% |

|

Total funding |

‑$6,835 |

‑$5,235 |

$16,798 |

|

Percent change |

‑6.2% |

‑5.0% |

17.1% |

|

General Fund Tax Revenuea |

$176,979 |

$185,490 |

$200,107 |

|

Growth Rates |

|||

|

K‑12 average daily attendance |

1.0% |

1.2% |

0.7% |

|

Per capita personal income (Test 2) |

7.6 |

4.4 |

3.6 |

|

Per capita General Fund (Test 3)b |

‑18.8 |

5.4 |

8.2 |

|

Maintenance Factor |

|||

|

Amount created (+) or paid (‑) |

— |

$8,329 |

‑$4,072 |

|

Total outstanding |

— |

8,329 |

4,623c |

|

Proposition 98 Reserve |

|||

|

Deposit (+) or withdrawal (‑) |

$272 |

‑$8,413 |

$1,054 |

|

Cumulative balance |

8,413 |

— |

1,054 |

|

Operative Test |

1 |

suspended |

1 |

|

aExcludes nontax revenues and transfers, which do not affect the calculation of the guarantee. bReflects change in per capita General Fund plus 0.5 percent. cAs required by the California Constitution, the total outstanding maintenance factor balance in 2024‑25 includes an increase of $366 million to account for growth in per capita personal income and K‑12 attendance. |

|||

Adjusts Guarantee for Expansion of Transitional Kindergarten (TK) and Arts Education Funding. The calculation of the 2024‑25 guarantee incorporates two ongoing adjustments. First, the state continues to implement a plan to make all four-year old children eligible for TK by 2025‑26. Under the plan, the state is “rebenching” (adjusting) the Proposition 98 guarantee upward to cover the costs for students who are newly eligible for TK in each year of the expansion. For 2024‑25, the calculation of the guarantee includes a $1.5 billion adjustment for three years of TK expansion, an increase of $526 million over the 2023‑24 adjustment (which accounted for two years of expansion). Second, the calculation includes a $938 million increase to cover the cost of the arts education program established by Proposition 28 (2022). Mechanically, the state implements these two adjustments by increasing the minimum share of General Fund revenue set aside for schools and community colleges under Proposition 98 from 38.6 percent in 2023‑24 to 39.2 percent in 2024‑25.

Adopts Three Notable Payment Shifts. The purpose of these payment shifts is to align school and community college funding with the levels agreed upon in the adopted budget for each fiscal year. First, the budget shifts $2.6 billion in payments originally counted in 2022‑23 to 2023‑24. This shift allows the state to cover these costs using funds withdrawn from the Proposition 98 Reserve in 2023‑24 instead of providing additional General Fund in 2022‑23. Second, the budget shifts $4 billion in payments originally counted in 2023‑24 to 2024‑25. This shift allows the state to reduce spending in 2023‑24 to match the lower suspended level of the guarantee that year. Neither action affects cash flow for schools or community colleges. Third, the budget defers $487 million in payments from June 2025 to July 2025, thereby moving the associated costs from 2024‑25 to 2025‑26. This deferral is divided about equally between schools and community colleges. Unlike the other two shifts, this deferral will affect cash flow by delaying a portion of the payment districts normally receive in June for several days. The law allows school districts to be exempt from this deferral (meaning they would receive all of their funding on time) if they can show the delay would cause fiscal insolvency.

Sets Up Payment Accrual Structure to Address Future Tax Filing Delays. Trailer legislation establishes a series of actions the state will take if tax filing delays lead to an overestimate of personal or corporate tax revenue in the future. This structure has several similarities to the approach the state adopted for 2022‑23. Specifically, the Director of the Department of Finance must (1) recalculate the Proposition 98 guarantee for the affected fiscal year when actual tax data become available and (2) determine the amount by which school and community college funding exceeds the revised calculation of the guarantee. For state budgeting and accounting purposes, this amount will be accrued to the next ten fiscal years, beginning with the third year following the year affected by the tax delay. That is, the state will treat the amount as an expenditure incurred in future years—not in the year it disbursed the funding—and use its cash reserves to cover the gap. (The accrual will not affect local district cash flow.) In contrast to the state’s approach for 2022‑23, the trailer legislation specifies that funding above the guarantee in the affected fiscal year will be excluded from the calculation of the guarantee moving forward.

K-12 Education

Overall K-12 Proposition 98 Funding Up Notably but Supports Few New Commitments. The adopted budget contains $101.1 billion in Proposition 98 funding for K-12 education in 2024‑25—$6.2 billion (6.5 percent) more than the 2023‑24 enacted budget level. Most of this increase, however, is to (1) backfill ongoing programs for the one-time savings that expire in 2024‑25 and (2) pay for expenditures the state shifted from 2023‑24 to 2024‑25. These adjustments allow the state to sustain ongoing programs but do not provide additional funding for districts. After accounting for these adjustments and various smaller changes over the 2022‑23 through 2024‑25 period, nearly $1.3 billion is available for augmentations and new commitments. The adopted budget uses this funding to cover a small cost-of-living adjustment (COLA), fund increases in the universal school meals program, and support several smaller initiatives (Figure 5). In the remainder of this section, we describe the K-12 spending actions in greater detail. (The changes related to State Preschool are covered in our publication, The 2024‑25 California Spending Plan: Child Care and Preschool.)

Figure 5

Major K‑12 Proposition 98 Spending Changes in 2024‑25 Budget Package

Proposition 98 and Reappropriated Funds (In Millions)

|

Ongoing |

|

|

LCFF COLA (1.07 Percent) |

$804 |

|

Universal school meals |

179 |

|

COLA for select categorical programsa |

89 |

|

California College Guidance Initiative |

2 |

|

State Parks access for fourth graders |

2 |

|

Inclusive College Technical Assistance Center |

2 |

|

Subtotal |

($1,079) |

|

One‑Time |

|

|

State Preschool 2024‑25 savings |

‑$302 |

|

Payment deferral |

‑244 |

|

2023‑24 universal school meals increase |

121 |

|

Training for literacy screenings |

25 |

|

Training for new mathematics framework |

20 |

|

Classified employee summer assistance |

9 |

|

Science performance tasks |

7 |

|

Holocaust and genocide educationb |

5 |

|

Research on remote and hybrid models of instruction |

4 |

|

FCMAT long‑term planning |

1 |

|

CCEE adjustment for unspent prior‑year funds |

‑6 |

|

Subtotal |

(‑$360) |

|

Total |

$719 |

|

aApplies to the Foster Youth Program, American Indian Early Childhood Education, Special Education, Child and Adult Care Food Program, Charter School Facility Grant Program, American Indian Education Centers, Equity Multiplier, and K‑12 mandates block grant. bUses reappropriated Proposition 98 funds (previously appropriated funds for other purposes that were not spent). |

|

|

LCFF = Local Control Funding Formula; COLA = cost‑of‑living adjustment; FCMAT = Fiscal Crisis Management Assistance Team; and CCEE = California Collaborative for Educational Excellence. |

|

Ongoing Spending Changes

Provides 1.07 Percent COLA for Local Control Funding Formula (LCFF) and Other Programs. The budget provides a 1.07 percent statutory COLA for the LCFF. The budget also assumes savings from a 2.29 percent decline in the attendance used to calculate funding under LCFF. The COLA and attendance adjustments combined decrease LCFF in 2024‑25 by $246 million relative to the revised 2023‑24 funding level. Separate from LCFF, the budget provides $89.2 million to cover a 1.07 percent COLA for several categorical programs (primarily special education).

Uses One-Time Funds to Cover LCFF Costs. The cost of covering the state’s core K-12 education programs exceeds the Proposition 98 funding available for schools in 2023‑24. To bridge the gap, the budget withdraws approximately $5.3 billion from the Proposition 98 Reserve to support LCFF costs in 2023‑24. Additionally, the budget uses $254 million in unspent one-time funding to cover 2024‑25 LCFF costs.

Provides Increase for TK Expansion and Staffing Requirements. Trailer legislation included in the 2021‑22 budget package gradually expanded TK eligibility beginning in 2022‑23, with all four-year old children eligible for TK by 2025‑26. From 2022‑23 through 2024‑25, TK eligibility expands by an additional two months each year. (In 2024‑25, children who have their fifth birthday by June 2 are eligible for TK.) For 2024‑25, the budget package assumes LCFF costs associated with TK will be $526 million above revised 2023‑24 levels. (This assumes an additional 38,000 children will attend TK in 2024‑25.) The budget also assumes an additional $124 million in costs in 2024‑25 associated with the requirement that school districts and charter schools maintain an average of one adult for every 12 students in TK classrooms across all school sites.

Funds Universal Meals Cost Increases. The budget package provides an increase of $179 million ongoing in 2024‑25 and $121 million one time in 2023‑24 to fully fund the cost of implementing universal school meals. These higher state costs are associated with growth in the number of meals served. Trailer legislation also makes a number of policy changes intended to maximize federal funding the state receives for the program. First, it requires certain eligible schools to participate in one of several federal provisions. These provisions allow alternative reimbursement options aimed at reducing administrative burden. Previously, all schools were required to participate if they were eligible for the Community Eligibility Provision, the most commonly used of the federal provisions. Second, trailer legislation requires districts to conduct direct certification matching on a monthly basis. (Direct certification is used to identify students automatically eligible for free meals due to their participation in CalFresh, California Work Opportunity and Responsibility to Kids, or Medi-Cal. These are state programs for low-income individuals and families that provide food assistance, cash grants and supportive services, and health care services, respectively.) Lastly, the California Department of Education (CDE) is to develop an electronic form by November 1, 2025 that can be used to determine whether a student generates supplemental and/or concentration funding under LCFF, as well as eligibility for the National School Lunch Program, the School Breakfast Program, and the federal Summer Electronic Benefit Transfer Program.

Other Ongoing Increases. The budget package includes several other ongoing Proposition 98 spending increases.

California College Guidance Initiative (CCGI). The budget provides a $2.1 million increase for CCGI, bringing total Proposition 98 funding to $20.7 million. This funding is intended to cover costs associated with providing universal accounts to all students in grades 6 to 12, expanding the number of partner school districts, enhancing the functionality of CaliforniaColleges.edu, and further supporting communications with other state agencies and offices to promote use of CaliforniaColleges.edu. CCGI also intends to use unspent prior-year funding to cover costs in 2024‑25.

State Parks Access. The budget provides $2.1 million ongoing to provide all fourth graders attending public schools with free access to California state parks. Specifically, the program waives day use fees for fourth graders and their families visiting any of the 54 participating state parks. The funding will primarily support seasonal staffing and programming for participating students, as well as cover some transportation costs. Trailer legislation allocates the funding to the Sacramento County Office of Education (COE), which, in turn, must contract with the Department of Parks and Recreation to operate the program. The Sacramento COE may use up to 5 percent of the funding for indirect costs associated with administering the program.

Inclusive College Technical Assistance Center. The budget provides $2 million ongoing for a COE to serve as the inclusive college technical assistance center. This funding is intended to increase access to post-secondary education and employment opportunities for students with disabilities by increasing the number of inclusive college programs. The technical assistance center responsibilities include assisting inclusive college programs in meeting federal requirements and facilitating collaboration between schools, regional centers, and Department of Rehabilitation field offices.

One-Time Spending Changes

The budget also includes several one-time Proposition 98 spending changes for schools.

Reduces Funding for State Preschool Offered by School Districts and COEs. The budget reduces Proposition 98 funding for State Preschool by $302 million on a one-time basis. This reflects the estimate of State Preschool funds for school districts and COEs that would otherwise go unused. The proposal is not intended to reduce rates or services. The budget also suspends the planned requirement for State Preschool providers to serve a higher share of students with disabilities. (The changes related to State Preschool are further described in our publication, The 2024‑25 California Spending Plan: Child Care and State Preschool.)

Reduces Funding for Inclusive Early Education Expansion Program. The budget reduces one-time funds for the Inclusive Early Education Expansion program by $150 million. (The state provided $250 million one-time funding for this program in recent years.) This maintains $100 million for the program that could be used for grants to early education providers.

Funds Training for Literacy Screening Requirements. Trailer legislation included in the 2023‑24 budget package requires local education agencies (LEAs)—school districts, COEs, and charter schools—to screen students in kindergarten through second grade for risk of reading difficulties beginning in 2025‑26. The budget provides $25 million one-time funding to support training for educators to administer literacy screenings to students. Funding will be allocated to LEAs based on their share of statewide enrollment in kindergarten through second grade. (The allocation formula and the requirement to administer screenings excludes TK students).

Funds Training Related to New Mathematics Framework. The budget provides $20 million one time for one or more COEs to train educators in delivering high-quality math instruction consistent with the recently adopted Mathematics Framework. Specifically, the COEs would be required to partner with the California Mathematics Project to develop a training model for math coaches and provide other resources to educators on how to deliver high-quality math instruction based on the Mathematics Framework. (The California Mathematics Project is part of the University of California Subject Matter Projects, which provide professional learning in nine K-12 subject areas.) These funds would be available to spend through June 30, 2028.

Covers Costs for Classified School Employee Summer Assistance Program. The budget provides $9 million one time for this program, bringing total funding to $99 million in 2024‑25. The program allows classified employees to deposit a portion of their income earned during the school year into a fund that is to be matched by state funds dollar for dollar and paid out in one or two installments during the summer months. The one-time funding is intended to cover higher demand for the program. (If state funding is insufficient to meet demand from participating districts, the matching funds are prorated.)

Funds Science Performance Tasks. The budget provides $7 million one time to develop performance tasks that are aligned with the state’s science standards. These tasks are to be developed by January 1, 2026 and are intended to be used statewide across all grade levels. The Los Angeles COE is to contract with one or more nonprofit organizations to develop the performance tasks.

Uses Prior-Year Funds for Holocaust and Genocide Education. The budget provides $5 million in prior-year reappropriated funds for curriculum resources and training related to Holocaust and genocide education. Specifically, funds are provided to the Marin COE, which must contract with the California Teachers Collaborative for Holocaust and Genocide Education. Funding is available for expenditure through June 30, 2029. The Marin COE may use up to 5 percent of the funding for administrative costs. (The state also provided $1.5 million one-time non-Proposition 98 General Fund for this purpose in 2023‑24.)

Funds Research on Models of Instruction. The budget includes $4 million in one-time funding to contract with a COE to research best practices for using hybrid and remote models of instruction, as well as to provide guidance, support, and resources to school districts to support their instructional continuity programs. The COE would be selected by CDE, with approval from the State Board of Education. The selected COE must report and make their research, guidance, support, and resources available to the public by June 30, 2027, as well as through widely available and free trainings and convenings for LEAs and teachers.

Non-Proposition 98 Spending

Removes Planned Facility Augmentations. The 2022‑23 budget package included intent language to provide $875 million non-Proposition 98 General Fund for the School Facility Program in 2024‑25. The 2024‑25 budget package removes this intent language and does not include funds for the planned augmentation. The budget package also removes the planned $550 million appropriation to the California Preschool, Transitional Kindergarten and Full-Day Kindergarten Facilities Grant Program. These reductions were made in anticipation of a school bond being included on the November 2024 ballot. In July 2024, the state enacted Chapter 81 of 2024 (AB 247, Muratsuchi), which places a $10 billion school and community college bond (Proposition 2) on the November 2024 ballot. Of the $10 billion, $8.5 billion would be set aside for schools. If voters approve the proposition, the state would reflect associated debt service costs through subsequent budget actions.

Includes Several Changes to Golden State Teacher Grants. The budget reflects $110 million in one-time General Fund spending for this program in 2024‑25, accounting for the remainder of the $500 million one-time General Fund appropriation provided in the 2021‑22 Budget Act. This program provides scholarships to students in teacher preparation programs who commit to working at a priority school (a school where at least 55 percent of students are low income, English learners, or foster youth). The budget also adds $1.5 million in one-time federal reimbursements from CDE (consisting of $1 million in Title II, Part A funds and $500,000 in Individuals with Disabilities Education Act funds) for the program. To stretch the available funds further, trailer legislation makes several changes to the program for 2024‑25. Most notably, it lowers the maximum award amount from $20,000 to $10,000 and correspondingly reduces the length of time recipients are required to work at a priority school from four years to two years. It also requires the California Student Aid Commission to prioritize applicants with the lowest income and asset levels when making award offers.

Supports New and Ongoing Workload at CDE. The budget provides CDE with an additional $14.6 million ($5.9 million non-Proposition 98 General Fund, $8.7 million federal funds) to accommodate new workload. Notable augmentations include $5 million to provide facility planning support to small school districts and $3.4 million to replace technology at the State Specials Schools and Diagnostic Centers. A list of all new K-12 workload for the department is on our EdBudget website.

Supports New Workload at the Commission on Teacher Credentialing. The budget provides several increases for the commission related to new workload or activities. Most notably, the budget provides $1.2 million in additional ongoing reimbursement authority to support increased legal services costs. As required by Chapter 671 of 2023 (AB 934, Muratsuchi), the budget includes $900,000 one time to develop a public awareness campaign that highlights the benefits of educational careers in California’s public schools. The budget also provides $255,000 one time for higher lease costs related to the commission’s relocation and $182,000 ongoing and two positions to support additional workload in the Division of Professional Practices.

Provides Funding for Save the Children. The budget provides $5 million one-time funding for Save the Children to operate after school programs in rural school districts. In 2023‑24, Save the Children received $3 million one-time federal funding for this purpose.

Provides One-Time Funding for Homeless Education Technical Assistance Centers (HETACs). The budget provides $2.5 million in one-time federal funds to continue supporting three HETACs originally established in 2021. Three COEs were selected through a competitive grant process and received $4.5 million for a period of three years. The HETACs are required to provide LEAs with a variety of technical support, including sharing best practices for serving homeless and unaccompanied students and their families, assisting counties and LEAs in identifying homeless and unaccompanied students, helping COEs support school districts identified for differentiated assistance for their homeless student subgroups, and fostering relationships between community partners and LEAs.

Other Actions

Creates New Attendance Recovery Program. The budget package establishes a new attendance recovery program—effective July 1, 2025—that allows LEAs to generate attendance-based funding through LCFF by providing instruction outside of the regular school day. The intent is for students who were absent to recover lost instructional time, as well as to offset funding losses associated with student absences. Attendance recovery programs may operate on weekends, before and after school, and during intersessions. Participating in these programs must be voluntary for all students. In addition, academic recovery programs must meet several requirements:

Include content that is substantially equivalent to instruction the student would have received as part of their regular school day.

Have instruction provided under the supervision of certificated staff.

Have a maximum student-to-teacher ratio of 20 to 1 for all grades except TK, which would have a maximum of 10 to 1.

Students enrolled in school districts and COEs may not generate more than five total days of attendance per school week (including regular attendance and attendance recovery combined). Students enrolled in charter schools may not generate more than one day of attendance per school day through either regular attendance or participation in attendance recovery programs. Furthermore, student attendance generated through participation in attendance recovery programs cannot exceed the number of days a student is absent throughout an academic year, up to a maximum of ten days. Beginning in 2025‑26, LEA annual audits would include a review of attendance recovery programs. Trailer legislation requires CDE to develop and maintain a webpage by June 30, 2025 that provides guidance to LEAs in creating and developing attendance recovery programs, and operating these programs in conjunction with state-funded before and after school programs.

Directs CDE to Study Student Information Systems. Trailer legislation directs CDE to research local student information systems to identify opportunities for more nuanced tracking of student absence data, with a particular focus on absences due to emergencies. CDE must provide recommendations by January 1, 2026 that would change the current absenteeism tracking system to allow for better tracking of the reasons for absences, including by student subgroup, and allow for calculating an adjusted chronic absenteeism rate that excludes absences due to emergencies.

Changes Requirements to Receive Emergency Attendance Funding. Trailer legislation modifies the requirements for LEAs to receive emergency-related attendance funding in the event of school closures or significant declines in attendance. Beginning July 1, 2025, LEAs must certify they have an instructional continuity plan that specifies how, following an emergency event, the LEA will (1) communicate with students and families within five calendar days and (2) provide access to in-person or remote instruction within ten instructional days. To meet this requirement, LEAs may also help students enroll or be temporarily assigned to another LEA within the same county or an adjacent county. Instructional continuity plans must be included as part of each school’s comprehensive school safety plan. Trailer legislation requires the Superintendent of Public Instruction to develop and post guidance on instructional continuity plans by March 1, 2025, including guidance for school engagement strategies following emergency events.

Streamlines Certain Aspects of Short-Term Independent Study. Trailer legislation makes a few modifications intended to reduce administrative burden related to short-term independent study programs. Most significantly, trailer legislation makes the following changes:

Increases the number of days students can participate in short-term independent study in a school year from 14 days to 15 days.

Eliminates the minimum number of days required for students to participate in short-term independent study. (Previously, students were only able to participate in short-term independent study if they were expected to participate for at least three consecutive school days.)

Allows students to sign independent study written agreements at any point during the school year. (Previously, students were required to sign written agreements within ten school days of starting short-term independent study.)

Allows for time spent in asynchronous instruction to count towards minimum daily minute requirements if student participation is documented by a computer program.

Suspends Summer Layoff Window. In a year when LCFF rates grow by less than 2 percent, state law allows school districts to lay off employees during the time period between five days after enactment of the state budget and August 15. Trailer legislation suspends this rule for the 2024‑25 fiscal year.

Makes Changes to Rules for Learning Recovery Emergency Block Grant. The budget makes several modifications to the requirements of the Learning Recovery Emergency Block Grant. For any block grant funds spent prior to July 1, 2024, LEAs must submit an interim expenditure report by December 15, 2024. LEAs also must conduct a needs assessment related to the expenditure of any remaining funds in the 2025‑26 through 2027‑28 fiscal years. The needs assessment must identify student subgroups most in need of learning recovery supports based on an assessment of academic performance and chronic absenteeism across student subgroups, using schoolwide and districtwide data. (LEAs may also include any local metrics as part of the needs assessment.) Trailer legislation specifies that the needs assessment and block grant expenditures must be included in Local Control and Accountability Plans from 2025‑26 through 2027‑28. Moreover, planned block grant expenditures must be connected to the needs assessment and associated with at least one metric to monitor the effect of the expense. Trailer legislation also specifies that professional development aligned to the new Mathematics Framework and the English Language Arts/English Language Development Framework are allowable uses of Learning Recovery Emergency Block Grant funds.

Changes Rules for Expanded Learning Opportunities Program (ELOP). The state has a two-tiered rate structure for ELOP. School districts and charter schools with a student body that is at least 75 percent English learners or low income (EL/LI) receive $2,750 per EL/LI student in TK through grade 6. The rate for all other districts and charter schools varies by year, depending on the amount of funding remaining. (This rate was $1,803 per student in 2023‑24.) Trailer legislation changes several rules related to ELOP funding:

Unspent ELOP funds from 2021‑22 and 2022‑23 must be used to increase 2024‑25 rates for lower-funded districts and charter schools, not to exceed $2,000 per student.

Beginning with funds provided in 2023‑24, ELOP funds must be spent by June 30 of the next fiscal year. Any unspent funds will return to the state.

Beginning in 2025‑26, school districts and charter schools must declare to the state their intent to operate a program with ELOP funding. To the extent possible, funding available from districts and charters schools not planning to operate a program can be used to increase rates for those with less than 75 percent EL/LI students.

Makes Changes to California Community Schools Partnership Program. The community schools program currently has three types of grants: two-year planning grants for new schools, five-year grants to implement the community schools model, and optional grants to extend implementation an additional two years (from five years to seven years). Trailer legislation makes a few modifications to the program:

When awarding implementation grants, CDE must prioritize schools that previously received planning grants before awarding grants to other schools.

Delays the program sunset date from 2030‑31 to 2031‑32 to give the fourth cohort of implementation grantees two years to spend their extension grants.

Shifts $60 million previously set aside for extension grants to be used for additional implementation grants.