November 20, 2024

The 2025‑26 Budget

Medi-Cal Fiscal Outlook

Summary. This post describes our fiscal outlook for General Fund spending in Medi-Cal. Under our outlook, General Fund support grows from the 2024‑25 enacted level of $35 billion to $48.8 billion in 2028‑29—an average annual rate of growth of 8.6 percent. However, there is heightened uncertainty around projecting the Medi-Cal budget that stems from the managed care organization (MCO) tax, caseload trends, and the recently implemented health care minimum wage. As a result, annual Medi-Cal General Fund spending could be as much as several billion dollars higher or lower than what is reflected in our outlook. Below, we summarize our outlook results and describe these key areas of uncertainty.

Outlook Overview

Background

Medi-Cal Is a Sizable Portion of the State Budget. Medi-Cal, the state’s Medicaid program, provides health care coverage for low-income Californians. The enacted 2024‑25 budget provides $161 billion for Medi-Cal, roughly half of which is funded by the federal government and the remaining covered by state and local sources. Of this amount, $35 billion comes from the General Fund—roughly 17 percent of total General Fund spending. The enacted 2024‑25 budget also assumes Medi-Cal enrolls an average of 14.5 million people each month, or more than one-third of Californians.

Overall Multiyear Projections

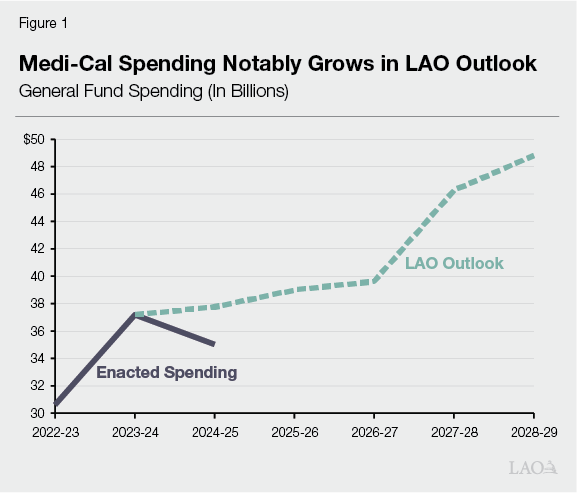

Project Increase in Medi-Cal Spending Through the Outlook Period. Our outlook projects $48.8 billion General Fund support for Medi-Cal in 2028‑29, a $13.8 billion (39 percent) increase over the enacted 2024‑25 level. This amount represents an average annual rate of growth of 8.6 percent. As Figure 1 shows, this growth reflects both higher estimated spending in the short term and a substantial ramp up over the longer term.

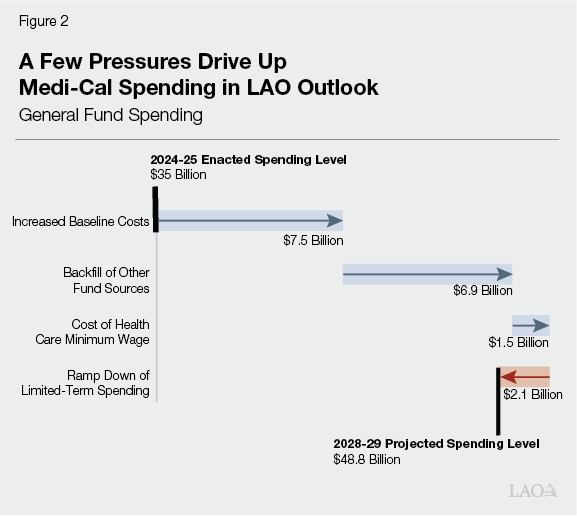

Two Key Drivers Increase Medi-Cal Spending in Outlook. In Figure 2 we break down the drivers of Medi-Cal spending over the outlook period, but the majority of the increase in Medi-Cal spending comes from two key drivers. The largest driver pertains to increases in “baseline costs”—related to increases in the utilization of services and provider rates (which grow between 3 percent and 5 percent a year) that are partially offset by declines in overall caseload. The next largest driver is a General Fund backfill of declining other fund sources, particularly the MCO tax.

Below, we briefly discuss our estimate for Medi-Cal General Fund spending in the current year (2024‑25) and our spending projection for the budget year (2025‑26).

Estimate Spending Increases From Enacted General Fund Level in Current Year. Our outlook estimates $37.8 billion General Fund support for Medi-Cal in 2024‑25—a net increase of $2.7 billion relative to the enacted level. This increase is driven primarily by a rapidly growing senior caseload (even while overall caseload is declining) and the passage of Proposition 35, both of which we describe further below.

Project Overall Spending Increase in Budget Year. We project Medi-Cal General Fund spending to be $39 billion in 2025‑26—a $1.2 billion net increase from our 2024‑25 estimate. The key drivers include increasing service utilization and provider rates (around 5 percent), continued elevated growth in the senior caseload, and the impacts of Proposition 35. These are partially offset by continuing declines in overall caseload and the ramp down of limited-term spending.

Key Issues Impacting Medi-Cal Spending

Medi-Cal Budget Is in Period of Heightened Uncertainty. When adopting the annual budget for Medi-Cal, the Legislature typically faces substantial uncertainty around caseload, program costs, and other areas. Even relative to this typical situation, however, uncertainty in Medi-Cal’s budget is particularly heightened this year. This heightened uncertainty stems from a number of factors, including pending details of the MCO tax implementation, developing trends in the senior caseload, and a new state health care minimum wage policy. As a result, Medi-Cal General Fund spending could be as much as several billion dollars higher or lower than what is reflected in our outlook. Below, we highlight three key issue areas in our Medi-Cal outlook as the Legislature prepares for, and considers, the upcoming Governor’s budget.

MCO Tax

Federal Approval of Recent MCO Tax Increases Is Pending. To go into effect, the MCO tax must receive federal approval, conditioned on meeting certain rules. The federal government approved the current version of the MCO tax in December 2023. As of the release of this post, however, federal approval is pending on additional tax increases enacted as part of the 2024‑25 budget. The administration indicates that it expects approval in December of this year. Because these increases appear to meet existing federal rules, our outlook assumes they are in effect through the term of the current version of the MCO tax (through 2026). Were the federal government to delay or deny approval of these increases, however, there could be additional General Fund costs to backfill the lost funding.

Proposition 35 Raises Two Key Issues. In November 2024, California voters approved Proposition 35. The measure makes the MCO tax permanent under state law and changes how the funds are to be used. The Legislature faces two key issues as a result of these changes, described below.

Higher General Fund Costs. Proposition 35 likely will result in more General Fund costs in the budget window (through 2025‑26). This is because the measure requires the state to use more MCO tax money to increase Medi-Cal services, rather than to offset General Fund spending. The exact fiscal impact depends on how the state implements the measure’s complex rules. Our outlook includes a cost of between $2 billion to $3 billion in the budget window.

Implementation of New Augmentations. Under current law, previously planned MCO tax-supported augmentations cannot go into effect if voters pass Proposition 35. Instead, Proposition 35 will determine which services and areas receive increased funding. Given that these augmentations will be new, the Legislature likely will want to track how they are structured and implemented. Moreover, the Legislature could consider which, if any, of its previously enacted augmentations it would like to support from the General Fund. (As noted in the Fiscal Outlook, however, given the budget lacks capacity for additional commitments, solutions in other areas of the budget would be required to continue these earlier augmentations.)

Potential Federal Rule Changes Could Affect MCO Tax in Future. In recent years, federal officials have indicated plans to change the rules around structuring health care-related taxes, including the MCO tax. Were these rule changes to happen, there could be many possible effects on the size and structure of future versions of the MCO tax. In line with this risk, our outlook assumes future rule changes result in a much smaller MCO tax in 2027 (around the size of the version that existed from 2020 through 2022). That said, other effects also are possible. For example, the next tax could be even smaller than what we assume. This is because Proposition 35 includes certain limits on how the state structures the MCO tax. Alternatively, were federal officials to rescind these plans, the MCO tax might continue at its existing size. Also, while not reflected in our outlook, federal rule changes could affect the size and structure of other state taxes and fees, such as fees on hospitals and skilled nursing facilities, that help support Medi-Cal services.

Caseload

Caseload has been a major issue in Medi-Cal in recent years. Caseload surged during the pandemic when the state had temporarily suspended redetermining eligibility for enrollees and has begun to decline as counties have resumed conducting eligibility redeterminations. While we project overall caseload to continue to decline, the senior caseload has been increasing for reasons we discuss below.

Recent Surge in Senior Caseload Driving Increase in Costs. From January 2024 through July 2024, we have observed a sharp increase in Medi-Cal enrollment among the senior population. Specifically, monthly growth averaged about 14,500 people, notably higher than the previous six months (averaging 1,600) or even during the continuous coverage period (averaging 6,200), when the state temporarily paused redeterminations of enrollee eligibility. We assume that the key driver of this caseload surge is the recent (January 1, 2024) full elimination of the asset limit test. (In addition to specific income limits, prior to July 2022, seniors and persons with disabilities faced strict asset limits for eligibility. Specifically, nonexempt assets could not exceed $2,000 for individuals and $3,000 for couples. The 2021 budget package raised the asset limit to $130,000 for individuals and $195,000 for couples effective July 2022, and fully eliminated the asset test as of January 1, 2024.) The surge also aligns with the implementation of additional federal flexibilities meant to limit the impacts of eligibility redeterminations being conducted by counties for the first time since the beginning of the pandemic. We assume that the elevated senior caseload continues for a three-year period, roughly in line with the phase in of past eligibility expansions. However, given only several months of data under the full elimination of the asset test, projecting the exact trend is subject to uncertainty. To the extent that events play out differently, costs could differ significantly from those reflected in our outlook, particularly in 2025‑26. The Legislature likely will want to assess any updated estimates from the administration around the senior caseload and the asset test elimination as part of next year’s budget process.

Recent Continuous Coverage Flexibilities Assumed to Expire, Resulting in Steeper Caseload Declines. In June 2023, counties resumed determining eligibility for Medi-Cal enrollees for the first time since the onset of the pandemic. These redeterminations have resulted in caseload declines, but the effect has been less substantial than originally assumed. Specifically, as of the end of the first full year of redeterminations, total Medi-Cal caseload stood at nearly 15 million—more than two million enrollees greater than was projected by the administration in May 2023 and our office in November 2023. This likely is because of temporary eligibility flexibilities implemented by the administration. Federal approval of these flexibilities extends through June 2025. Just as these flexibilities appear to have been successful in minimizing the impacts of redeterminations on Medi-Cal enrollees, the extent to which caseload will return to more normal historical levels if they are allowed to expire will be a key issue to watch. We assume that the federal government does not extend the flexibilities, resulting in steeper caseload declines beginning in the budget year. However, this effect is uncertain and could differ from our outlook. Given this uncertainty, the Legislature likely will want to assess the administration’s assumptions when they are released in January.

Health Care Minimum Wage

Health Care Minimum Wage Recently Went Into Effect. In October 2023, the state enacted Chapter 890 (SB 525, Durazo), which increases the minimum wage for many health care workers. The law is complex, establishing five separate minimum wage schedules depending on workers’ type of employer. The timing of the start of the wage increases had been uncertain, as they depended on certain trigger conditions adopted in trailer bill legislation as part of the 2024‑25 budget. The Department of Finance recently determined that one of the conditions had been met, triggering a start date of October 2024. Accordingly, our outlook includes costs associated with the wage increases, described below.

Costs From Wage Increases Are Uncertain. While the new minimum wage increases will impact the Medi-Cal budget, the state budget to date has not reflected these effects. Owing to the legislation’s complexity, the magnitude and timing of the impact is uncertain. The Department of Finance has publicly stated that the General Fund cost will be in the low billions of dollars annually, largely attributable to Medi-Cal. At the time of this analysis, the administration has not released detailed information on this estimate. Other researchers, by contrast, estimate that the cost to the state could be in the low hundreds of millions of dollars annually. For planning purposes, our outlook assumes an initial cost that falls in between these estimates (around $1 billion) and ramps it up over time. Given the significant uncertainty, however, the Legislature likely will want to carefully assess the administration’s estimates—including its back-up information—when released with the Governor’s budget in January.