Anita Lee

February 12, 2025

The 2025-26 Budget

Judicial Branch

Summary

In this brief, we provide an overview of the proposed funding for the judicial branch in 2025‑26. We also analyze the Governor’s budget proposals to increase discretionary funding to the trial courts and start a capital outlay project to construct the new Tracy Courthouse in San Joaquin County.

Consider Trial Court Augmentations in Context of Broader Budget Challenges. The Governor’s budget proposes an $82 million ongoing General Fund augmentation to discretionary trial court operations funding—$42 million for a partial restoration of an ongoing 2024‑25 reduction and $40 million for increased costs. On the one hand, the increased trial court funding would likely help improve court service levels—a notable benefit. On the other hand, the multiyear deficits facing the state leave no capacity for new ongoing commitments, meaning any additional funding provided would likely require reduced spending for other existing state programs. As such, the Legislature should weigh this augmentation against its other budget priorities. It should also consider whether it would like to specify priorities for how any provided funding is used.

Modify Proposed Budget Bill Language Authorizing Transfer of Unrestricted Trial Court Trust Fund (TCTF) Monies to General Fund. We recommend the Legislature modify the proposed budget bill language authorizing the transfer of unrestricted TCTF fund balance monies to the General Fund to increase legislative oversight and potentially improve the state’s General Fund budget condition. First, we recommend specifying what monies should be considered for transfer or how the transfer should be calculated. Second, we recommend requiring advanced legislative notification of transfers that include information on how the transfer amount was determined.

Consider Redirecting Funding for New Tracy Courthouse to Other Trial Court Projects. The Governor’s budget proposes $2.9 million one‑time General Fund to start a capital outlay project to construct a new courthouse in Tracy. While this project would benefit residents in San Joaquin County, it would also expand service beyond the court’s existing facilities. Given the extensive unmet judicial branch facility needs at existing locations, the Legislature could consider redirecting the funding to projects that address needs at facilities that are currently in use or pressing deferred maintenance needs. This would focus resources on facilities with the most pressing unsafe conditions for current staff and court users.

Overview

Background

Roles and Responsibilities. The judicial branch is responsible for the interpretation of law, the protection of people’s rights, the orderly settlement of all disputes, and the adjudication of accusations of legal violations. The branch consists of statewide courts (the Supreme Court and the Courts of Appeal), trial courts in each of the state’s 58 counties, and state entities of the judicial branch (Judicial Council, Judicial Council Facility Program, and the Habeas Corpus Resource Center). The branch receives support from several funding sources including the state General Fund, civil filing fees, criminal penalties and fines, county maintenance‑of‑effort payments, and federal grants.

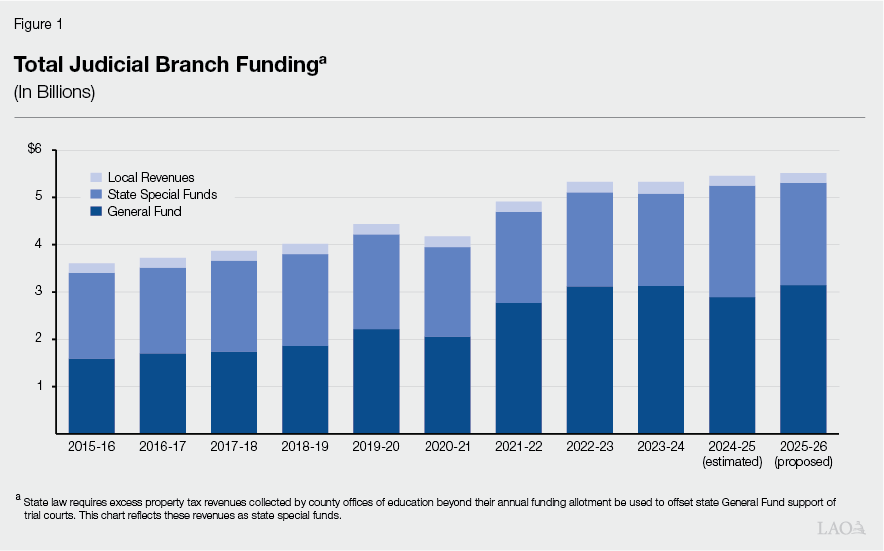

Majority of Support From General Fund. As shown in Figure 1, total operational funding for the judicial branch has steadily increased from 2015‑16 through 2024‑25. The percent of total operational funding from the General Fund has also steadily increased during this period—from 44 percent in 2015‑16 to a high of 59 percent 2023‑24, before decreasing slightly to 53 percent in 2024‑25. Since 2019‑20, the majority of the judicial branch budget has been supported by the General Fund. This growth is due to various reasons, including increased operational costs as well as General Fund resources to backfill decreases in fine and fee revenue. (These figures do not reflect a Governor’s 2025‑26 proposal to increase funding for the trial courts by $42 million annually beginning in 2024‑25, which is discussed in greater detail below.)

Trial Courts Report $478 Million in Reserves at End of 2023‑24. Trial courts have a limited ability to keep and carry over any unspent funds (also known as “reserves”) from one fiscal year to the next. Specifically, trial courts are only allowed to carry over funds equal to 3 percent of their operating budget from the prior fiscal year under current law. However, certain funds held in the reserve—such as those that are encumbered, designated for statutory purposes, or funds held on a court’s behalf by Judicial Council for specific projects—are not subject to this cap, meaning they also can generally be carried over. At the end of 2023‑24, trial courts reported having $478 million in reserves. Of this amount, $389 million (81 percent) is not subject the cap. This amount consists of funds that are encumbered ($204 million), statutorily excluded ($118 million), designated for prepayments or other purposes ($43 million), or held by Judicial Council on behalf of the trial courts for specific projects ($24 million). This leaves $88 million (19 percent) in reserves subject to the cap. This is less than the $105.9 million the trial courts could have retained under the current 3 percent cap.

Governor’s Proposal

Governor Proposes $5.3 Billion in State Funds for Judicial Branch. For 2025‑26, the Governor’s budget includes $5.5 billion from all fund sources to support the judicial branch. This amount includes $5.3 billion from all state funds (General Fund and special funds), an increase of $62 million (1 percent) above the revised amount for 2024‑25, as shown in Figure 2. (These totals do not include expenditures from local revenues or trial court reserves.) Of this amount, about $3.1 billion (59 percent) is from the General Fund. This is a net increase of $254 million (9 percent) from the revised 2024‑25 General Fund amount. This net increase reflects various changes—including the expiration of a one‑time reduction in General Fund support included in the 2024‑25 budget to help address the state’s budget problem.

Figure 2

Judicial Branch Budget Summary—All State Funds

(Dollars in Millions)

|

2023‑24 |

2024‑25 |

2025‑26 |

Change From 2024‑25 |

||

|

Amount |

Percent |

||||

|

State Trial Courts |

$3,840 |

$3,957 |

$3,985 |

$28 |

0.7% |

|

Supreme Court |

50 |

59 |

57 |

‑2 |

‑3.4 |

|

Courts of Appeal |

284 |

291 |

297 |

6 |

2.1 |

|

Judicial Council |

310 |

328 |

292 |

‑36 |

‑11.0 |

|

Judicial Branch Facility Program |

576 |

596 |

662 |

66 |

11.0 |

|

Habeas Corpus Resource Center |

19 |

20 |

20 |

— |

‑0.1 |

|

Totals |

$5,078 |

$5,251 |

$5,313 |

$62 |

1.2% |

LAO Comment

Administration Likely Overestimates Excess Property Tax Available for General Fund Offset. Each of California’s 58 counties has a County Office of Education (COE). A primary source of funding for COEs is the Local Control Funding Formula (LCFF). This formula provides an allotment based on (1) the number and size of the school districts in the county and (2) the number of students attending COE alternative schools. A COE’s annual LCFF allotment is supported first with local property tax revenue (which can fluctuate from year to year), with the remainder covered by state Proposition 98 General Fund. Some COEs collect more in property tax revenue than their LCFF allotment. This amount collected above the LCFF allotment is known as excess property tax. State law requires any excess property tax be used to offset state General Fund support of trial courts in the year after the taxes were collected. For example, excess property taxes collected in 2023‑24 offset the state’s General Fund support of trial courts in 2024‑25. The Governor’s budget estimates that $247.6 million in excess property tax will be available to offset state General Fund support of trial courts in 2024‑25 and in 2025‑26. Our preliminary analysis of property tax revenues projects less excess property tax revenues being available than assumed in the Governor’s budget. Specifically, we estimate that roughly $100 million less—about $70 million in 2024‑25 and at least $30 million in 2025‑26—will be available to offset General Fund support of trial court operations. Under our estimates, the Legislature would have higher General Fund costs than assumed in the Governor’s budget. Our office will review updated property tax data that will become available in the spring and provide updated estimates at the time of the May Revision.

Trial Court Discretionary Funding

Background

Augmentations to Trial Court Operations Funding Provided in Different Ways. The state’s annual budget typically designates the bulk of funding available to fund trial court operations. In recent years, funding adjustments have generally been provided by the state through the approval of (1) discretionary (or unallocated) funding increases, (2) funding to support specific cost increases to maintain existing service levels (such as funding for increased trial court health benefit and retirement costs), and (3) budget requests for specific priorities (such as increased funding to implement enacted legislation).

Trial Courts Generally Have Discretion in How to Use Their Operations Funding. While a portion of trial court operations funding is provided for specific programs or purposes (such as court interpreters), a significant portion of the funding is provided on a discretionary basis with little to no restrictions on its use. Upon receiving its allocation, each trial court has significant flexibility in determining how its share of discretionary funding from the state is used. This can result in significant difference in the programs or services offered and the level of service provided across trial courts. For example, some trial courts may choose to use a greater proportion of their funding to increase employee compensation, while others might allocate more funding to provide additional services, such as self‑help services.

Judicial Council Generally Determines How to Allocate Operations Funding to Trial Courts. Absent state direction on the allocation of funding, Judicial Council—the policymaking and governing body of the judicial branch—is responsible for allocating funding to individual trial courts. Judicial Council has developed various methodologies to allocate such funding. One common formula—known as the “workload formula”—is typically used for the allocation of discretionary funding changes. This workload formula calculates how much funding Judicial Council believes each trial court should receive. This estimated need is based on each court’s workload as measured by various factors, including the number and type of filings the court receives. This amount is known as a court’s workload formula identified need. The formula then calculates the level of funding each trial court actually received as a percentage of its workload formula identified need. This amount is known as the court’s funding ratio. Each court’s funding ratio is then compared to the statewide funding average. Different rules related to the workload formula adopted by Judicial Council are then used to determine the specific allocations of discretionary funding to trial courts. For example, trial courts whose funding ratio is above the statewide funding average—meaning they are comparatively better funded than their fellow courts—may receive a smaller proportion of funding increases or a greater proportion of funding reductions than those below the statewide funding average.

TCTF Is the Primary Special Fund Supporting Trial Court Operations. The TCTF is the major special fund supporting trial court operations. It receives revenues from various sources—including the state General Fund, civil filing fees, criminal penalties and fines, as well as county maintenance‑of‑effort payments—for various purposes. For example, one specific allocation is a General Fund backfill to address declines in fine and fee revenue deposited into the fund in order to maintain trial court funding levels. This backfill has been provided annually since 2014‑15. The specific backfill amount varies annually, but is typically calculated by comparing each year’s revenue against the amount collected in 2013‑14. Another example is General Fund provided to support the cost of trial court judge salaries.

Some Unspent TCTF Funds Are Restricted to Certain Uses. In some cases, when TCTF funds go unspent, they do not remain in the TCTF fund balance. For example, the budget bill includes specific language directing unspent funds associated with $30 million General Fund provided to increase the number of court reporters in family and civil law cases revert to the General Fund. In other cases, certain unspent TCTF funds—such as unspent court interpreter funds—remain in the fund balance, but are restricted to the purpose for which the funds were originally provided.

Unrestricted TCTF Fund Balance Monies Can Be Used in Various Ways. All other unspent funds that remain in the TCTF balance are unrestricted. Examples of such funds include salary savings associated with trial court judges and excess General Fund backfill dollars that are unneeded when fine and fee revenues deposited into the TCTF are higher than originally estimated. Statute generally requires that these funds remain in the TCTF fund balance unless used for the benefit of the trial courts. For example, the budget bill authorizes the Department of Finance (DOF) to use these funds to augment the amount available for trial court operations funding, if additional resources are available in the fund, subject to 30‑day notification to the Joint Legislative Budget Committee (JLBC). Additionally, the state can use unrestricted TCTF fund balance monies to benefit the General Fund to a certain extent. For example, the 2024‑25 budget package decreased General Fund support for trial court operations by $100 million on a one‑time basis and used unrestricted TCTF fund balance monies to fully offset this reduction.

2024‑25 Enacted Budget Included Reductions to Trial Court Operations Funding. To help address the state’s budget problem, the 2024‑25 budget package assumed that ongoing General Fund state operations expenditures for many state agencies would be reduced by up to 7.95 percent beginning in 2024‑25. How such reductions were to be achieved—and the actual amount achieved—were generally left to departments and DOF through a process laid out in Control Section 4.05. Support for trial court operations is considered local assistance rather than state operations. Accordingly, it was not covered by Control Section 4.05. However, to be consistent with the statewide reduction, the budget package included a $97 million (or 7.95 percent) ongoing General Fund reduction to trial court operations to be implemented at the judicial branch’s discretion. However, unlike the Control Section 4.05 reductions, there was no discretion to adjust the size of the reduction. Additionally, the 2024‑25 budget did not include a discretionary funding increase to help address growth in operational costs. (However, as in past years, the state provided separate General Fund support specifically to cover increased trial court health and retirement benefit costs.) While the trial courts are not entitled to a discretionary funding increase to address increased operational costs, the state has provided such funding in 2021‑22 (a 3.7 percent increase), 2022‑23 (a 3.8 percent increase), and 2023‑24 (a 3 percent increase).

Governor’s Proposal

Provides $82 Million Discretionary Funding Increase. The Governor’s 2025‑26 budget includes two proposals that increase trial court discretionary funding. The two proposals are as follows:

- $42 Million Ongoing Funding Restoration. As noted above, the 2024‑25 budget included an ongoing $97 million reduction in General Fund support for trial court operations. The Governor’s 2025‑26 budget proposes to provide a $42 million ongoing funding restoration—beginning in 2024‑25—effectively making the ongoing reduction $55 million. The administration proposes to use unrestricted TCTF fund balance monies to pay for the restoration in 2024‑25. The General Fund would then pay for the restoration in 2025‑26 and ongoing. These higher costs are not currently reflected in the budget materials submitted to the Legislature—such as the budget bill or the detailed judicial branch budget display. Our understanding is that it will be incorporated during the May Revision.

- $40 Million Ongoing General Fund Discretionary Funding for Increased Costs. The Governor’s budget proposes a $40 million ongoing increase in discretionary funding from the General Fund to help pay for increased trial court operation costs beginning in 2025‑26. (This augmentation is reflected in the budget materials submitted by the administration.) Unlike prior years in which such funding was provided, a specified percentage increase (such as a 3.8 percent increase in 2022‑23) was not used to determine the amount of this augmentation.

Proposes Budget Bill Language for Transfer of Unrestricted TCTF Monies to General Fund. The Governor’s proposed 2025‑26 budget includes budget bill language to authorize DOF to transfer any unrestricted TCTF fund balance monies to the General Fund in consultation with Judicial Council.

Assessment

Restoration Likely to Improve Court Service Levels… The ongoing $97 million reduction has been operationalized by trial courts in various ways. These include hiring freezes, furloughs, and reduced phone and public service counter hours, as well as delayed infrastructure and information technology (IT) expenditures. For example, the judicial branch reports that 27 courts are holding an estimated 580 positions vacant and 13 courts have implemented furloughs. While the actions taken by individual trial courts vary broadly, these actions generally reduce service to court users—such as by causing longer wait times, inability to access self‑help or other services, and backlogs. As such, a partial restoration of the ongoing reduction would likely improve court service levels. For example, the Riverside Superior Court announced that it plans to cancel limited service or furlough days between February and June 2025—in part due to the proposed partial restoration of funding.

…But Some Impacts Likely to Remain. Despite the proposed restoration, court service levels are still likely to be impacted. This is because the trial courts will still need to operationalize an ongoing $55 million General Fund reduction. While trial courts could use the proposed $40 million ongoing General Fund augmentation for increased operational costs to further offset this reduction, it would still leave a net reduction of $15 million. Furthermore, as shown in Figure 3, the trial courts did not receive a discretionary funding increase to address growth in costs in 2024‑25 and the amount proposed for 2025‑26 is about half of what was provided in prior years. This means that trial courts will need to manage their budgets to address any increased employee compensation, contractual, or other costs. This could constrain the extent to which service levels may be restored. For example, increased employee compensation costs for existing employees could limit a court’s ability to fully restore staffing levels. Such increased costs could also constrain the ability of courts to pay for infrastructure, IT, or other fixed costs that could improve the delivery of court services.

Figure 3

Ongoing Discretionary Changes to Trial Court Funding

by Budget Year Provided

(In Millions)

|

Fiscal Year |

Unallocated |

Changes for |

|

2013‑14 |

$60 |

— |

|

2014‑15 |

86 |

— |

|

2015‑16 |

91 |

— |

|

2016‑17 |

20 |

— |

|

2017‑18 |

— |

— |

|

2018‑19 |

123 |

— |

|

2019‑20 |

— |

— |

|

2020‑21 |

‑177 |

— |

|

2021‑22 |

177 |

$72 |

|

2022‑23 |

100 |

84 |

|

2023‑24 |

— |

74 |

|

2024‑25 |

‑97 |

— |

|

2025‑26 (proposed) |

42 |

40 |

|

aFunding in certain years may have been provided for a specific purpose. For example, some funding was designated for promoting fiscal equity among the trial courts. However, the provided funding was unallocated and subject to Judicial Council’s discretion. bDoes not include funding provided specifically for increased trial court health and retirement benefits as the state covers such costs in full. |

||

Administration and Judicial Branch Already Implementing 2024‑25 Funding Restoration...The administration and judicial branch are already in the process of implementing the restoration of $42 million in trial court operations funding in 2024‑25. The restoration initially moved forward as the judicial branch believed that the provisions of Control Section 4.05—namely the ability for state entities to work with DOF to determine the final reduction amount—applied to the trial court reduction. Additionally, the judicial branch wanted to mitigate the impacts of the reductions on court users by distributing the funding as quickly as possible and had sufficient excess TCTF expenditure authority to do so. Its internal committees acted in January to recommend Judicial Council restore the funding by revising the $97 million reduction downward to a $55 million reduction. This revised reduction was recommended to be allocated to the trial courts using the workload formula and methodology that was used for the $97 million reduction. Specifically, trial courts within 4 percent of the statewide funding average would generally be required to take a reduction proportional to their share of overall trial court funding. Trial courts (excluding the state’s smallest trial courts) more than 4 percent above the statewide funding average would take additional reductions; while those more than 4 percent below the statewide funding average would take lesser reductions.

...Despite Not Receiving Direction From the Legislature. The 2024‑25 budget package did not include budget bill or other language directly providing the administration flexibility to adjust the $97 million reduction. As such, in our view, any restoration—which would be a change from the enacted 2024‑25 budget package—should require legislative review. Ultimately, the judicial branch and DOF recently submitted a JLBC letter requesting to implement the 2024‑25 restoration by increasing the amount available for trial court operations funding using unrestricted TCTF fund balance monies. As discussed above, this is allowed under the different budget bill language permitting DOF to augment the amount available for trial court operations funding by $42 million with unrestricted TCTF fund balance monies. However, the administration and the judicial branch undertook the process of seeking legislative approval after beginning to implement the change.

Requires Trade‑Off With Other Budget Priorities. In total, the Governor’s budget proposes an $82 million augmentation to ongoing General Fund spending compared to what was agreed upon in the 2024‑25 budget agreement. As discussed above, these additional funds would likely help improve court service levels. However, this approach comes with significant trade‑offs for other parts of the state budget. Given the state’s current fiscal position—with a budget that is roughly balanced in 2025‑26 and notable deficits projected in the out‑years—the state does not have capacity for new ongoing commitments. As a result, in future years, this proposed ongoing spending will likely require trade‑offs with other areas of spending and potentially require even further budget solutions, such as reduced spending for other existing state programs.

Provides Judicial Council With Full Allocation Discretion. Both components of the Governor’s proposed augmentation provide Judicial Council with complete discretion over (1) what the funds are used for and (2) how the funds are allocated to the trial courts. As noted above, it appears that the workload formula will be used to allocate the $42 million ongoing funding restoration. However, it is unclear at this time how the $40 million for increased costs will be allocated. Providing Judicial Council with full discretion on the allocation of such funds limits the Legislature’s ability to ensure that the funding is in line with legislative priorities. For example, the Legislature could prioritize using the funding to specifically restore phone or counter hours over filling all vacant positions.

Proposed Budget Bill Language Is Vague, Limiting Legislative Oversight. The proposed budget bill language authorizing the transfer of unrestricted TCTF fund balance monies to the General Fund is a reasonable proposal as such monies would be available for other budget priorities. However, the language is vague as the exact amount would be determined by DOF in consultation with Judicial Council. First, it does not specify what monies are being considered for transfer. For example, it is unclear whether only excess General Fund backfill monies accumulated from prior years would be considered for transfer, or if General Fund savings from judicial salaries or other areas will be considered. This makes it difficult for the Legislature to determine whether it agrees with what monies are being considered for transfer back to the General Fund. Second, the proposed language does not include any requirements for legislative notification. As a result, if a transfer is made (even with more detailed guidance from the Legislature on what should be considered as part of the calculation), the Legislature lacks the opportunity to review how the specific amount was calculated and whether the calculation met its desired parameters. This makes it difficult for the Legislature to ensure that the maximum amount it desires is being transferred back to the General Fund to be used for its budget priorities. The need for such oversight is even more critical given the multiyear deficits facing the state.

Recommendations

Direct Judicial Branch To Report on Process for Seeking Midyear Adjustments. While the judicial branch eventually sought legislative input before moving ahead with implementing the restoration of the $42 million reduction in 2024‑25, it is concerning that it had first moved to act without legislative oversight. Accordingly, we recommend the Legislature direct the judicial branch to report at budget hearings on its process for making midyear budget adjustments and how it will ensure the Legislature has had the opportunity to weigh in on them.

Consider Trial Court Augmentations in Context of Broader Budget Challenges. The proposed $82 million augmentation comes with significant trade‑offs that the Legislature will need to weigh. On the one hand, the increased trial court funding would likely help improve court service levels, which is a notable benefit. On the other hand, the multiyear deficits facing the state in the coming years leave no capacity for new ongoing commitments. This means that any approved ongoing funding would likely require the Legislature to reduce spending on other existing state programs or activities. As such, the Legislature should carefully consider the degree to which it prioritizes this funding over its other budget priorities. For any additional funding that is ultimately provided, the Legislature should also consider whether it has certain priorities for how such funding is used. This is particularly important if any ongoing reduction must still be operationalized. For example, the Legislature could determine that the increased General Fund support should be prioritized for the restoration of phone and counter hours or self‑help services. Such priorities could be documented in budget bill language and would ensure that the funding is used consistent with legislative priorities.

Modify Proposed Budget Bill Language Authorizing Transfer of Unrestricted TCTF Monies to General Fund. We recommend the Legislature modify the proposed budget bill language authorizing the transfer of unrestricted TCTF fund balance monies to the General Fund in two key ways to increase legislative oversight. First, we recommend the Legislature modify the language to provide guidance on which specific unrestricted TCTF fund balance monies it believes should be considered for transfer or how the calculation should be determined. For example, the language could specify that any excess General Fund backfill monies be returned to the General Fund. This would be reasonable as the funding was provided specifically to maintain trial court operation levels if insufficient fine and fee revenue was deposited into the TCTF. Accordingly, if sufficient fine and fee revenue is available, the excess General Fund monies should be immediately available for other legislative priorities. This same rationale could also apply to savings from General Fund provided for specific purposes (such as trial court judge salaries). Second, we recommend the Legislature modify the language to require that notification be provided to JLBC 30‑days before a transfer is made and that such notification include information on how the final transfer amount was determined. These changes would enhance legislative oversight and potentially benefit the General Fund, which will be particularly important given the multiyear deficits facing the state.

San Joaquin County New Tracy Courthouse

Background

Judicial Branch Has Extensive Facility Needs. The judicial branch currently manages around 435 facilities across all 58 counties. Its facility program is responsible for various activities including maintaining these facilities, managing leases, and constructing new courthouses to replace outdated facilities. In a November 2019 assessment of its facilities, the judicial branch identified a need for a total of 80 construction projects—56 new buildings and 24 renovations—totaling $13.2 billion. These projects were categorized into five groups—and ranked within each group—in the following descending priority order: 18 immediate need projects ($2.3 billion), 29 critical need projects ($7.9 billion), 15 high need projects ($1.3 billion), 9 medium need projects ($1.6 billion), and 9 low need projects ($100 million). Additionally, in August 2024, the judicial branch identified 22,673 deferred maintenance projects totaling around $5.2 billion. Of this estimated cost, the state would be responsible for around $3.8 billion (74 percent). (The remaining amount would generally be the responsibility of counties that share space in court facilities.)

Existing Construction Account Insolvent. State law authorizes Judicial Council to construct trial court facilities and established a state special fund—the State Court Facilities Construction Fund (SCFCF) to support construction and other facility‑related expenses. (A second construction account was consolidated into the SCFCF in 2021‑22.) The SCFCF is used to support both the construction and maintenance of court facilities and is mainly supported by criminal and civil fines and fees. The amount of revenue deposited into the fund steadily declined over the past years, resulting in expenditures routinely exceeding revenues. The state contributed to this structural fund imbalance by redirecting over $1.5 billion from the fund to the General Fund or to support trial court operations. This led to the fund becoming insolvent and required various actions be taken—most notably the cancelation and suspension of projects supported by the construction account. Currently, the fund remains insolvent and is estimated to require a General Fund backfill in the tens of millions of dollars annually for at least a decade to maintain existing facility related activities and to pay the debt service for completed construction projects.

New Construction Supported by the General Fund. Absent any state action, the SCFCF’s insolvency halted the judicial branch’s construction program. This led the state to shift support for the construction program to the state General Fund. The 2018‑19 budget included $1.3 billion in lease revenue bond authority backed by the General Fund—rather than the SCFCF—to finance ten previously planned projects. This commitment effectively backfilled the $1.4 billion transferred from the SCFCF to the General Fund to help address the state’s budget condition between 2009‑10 and 2017‑18. The 2021‑22 budget formally shifted support for the construction of any future courthouses to the General Fund. When proposing new projects, the administration generally follows the ranked project priority list identified in the judicial branch’s 2019 assessment of facility needs. Since 2021‑22, the construction or renovation of about a dozen of the highest ranked immediate need projects have commenced.

Governor’s Proposal

Fund Performance Criteria Stage of San Joaquin County New Tracy Courthouse Project. The Governor’s 2025‑26 budget proposes to provide $2.9 million one‑time General Fund to support the Performance Criteria phase of the San Joaquin County New Tracy Courthouse. The proposed funding would start this capital outlay project to construct a new two‑courtroom courthouse. This new courthouse would replace four existing, vacant court facilities and is estimated to cost $65 million.

Assessment

Proposed Project Generally Reasonable… The selection of the new Tracy courthouse is generally reasonable as it is the next project in line to be funded when following the judicial branch’s 2019 ranked list of facility project needs. This project is an immediate need project (highest‑priority category) that would replace four vacant, outdated, and unsafe facilities. Additionally, the identified scope and cost of the project seem reasonable.

…But Would Expand Service Back to Tracy… During the Great Recession, trial courts—along with other state entities—received budget reductions. Trial courts took various actions to operationalize the budget reductions, including closing courtrooms or courthouses as well as reimagining how to deliver services (such as centralizing certain services). The judicial branch indicates that all Tracy branch facilities have been closed since 2011 due to budget constraints from the recession and the poor condition of the existing facilities. Because services are not currently being provided in Tracy, approval of this new construction project would effectively be expanding service back to Tracy. The San Joaquin Superior Court indicates that it estimates $1.2 million would be needed annually to operate the new courthouse and believes it has the budget capacity to do so. The new courthouse would provide a benefit to people in San Joaquin County by improving court access for those living in Tracy and shifting workload from other courthouses back to Tracy, which could reduce wait times for services in other parts of the county.

…Rather Than Addressing Needs at Currently In‑Use Facilities. As noted above, the judicial branch has extensive need for new or renovated trial court facilities as well as for deferred maintenance projects. Despite the benefits of a new Tracy courthouse, there are no facilities in the immediate needs category that are currently being actively used in San Joaquin County. In contrast, there are still other facilities elsewhere in the state—such as in Kern and Placer Counties—that are being used despite their condition being so poor that they have projects in the immediate needs category. It would be reasonable to consider redirecting this funding to such projects or pressing deferred maintenance needs to address unsafe conditions faced by current staff and court users in such facilities. A new Tracy courthouse could be funded instead at a later date.

Recommendations

Consider Redirecting Funding to Other Trial Court Projects. The proposed new Tracy courthouse is next in line to be funded according to the judicial branch’s ranked priority list of facility need and would be provide benefits to those in San Joaquin County. However, service is not currently being provided in the area. Given the extensive unmet facility needs elsewhere, the Legislature could consider whether the proposed funding should be redirected to projects that are next in line to be funded and that address needs at facilities that are currently in use—rather than expanding service back to Tracy—or to address pressing deferred maintenance needs. This would focus resources on facilities with the most pressing unsafe conditions for current staff and court users.