Helen Kerstein

February 12, 2025

The 2025-26 Budget

Cap–and–Trade Expenditure Plan

Summary

The Governor proposes roughly $1.8 billion in discretionary cap‑and‑trade expenditures in 2025‑26. The Governor’s plan funds a number of programs and activities that were initially to be supported with the General Fund, but then were shifted to the Greenhouse Gas Reduction Fund (GGRF) through the 2024‑25 budget process in order to address the multiyear budget problem. Additionally, the Governor proposes two new fund shifts in the budget year to help reduce pressure on the Motor Vehicle Account (MVA), which faces insolvency in 2025‑26 absent corrective action.

We find that while the proposed fund shifts present trade‑offs, the Governor’s GGRF proposal for 2025‑26 largely adheres to the expenditure plan the Legislature agreed to as part of the 2024‑25 budget package. However, GGRF revenues are subject to substantial uncertainty and are trending lower than forecasted as of the middle of the 2024‑25 fiscal year. To the extent these somewhat lower revenue patterns persist, the Legislature may need to make modifications to the GGRF expenditure plan for 2025‑26. Should they further weaken, modifications to 2024‑25 GGRF spending may also be necessary. Moreover, to the extent that the General Fund condition worsens, the Legislature could be faced with making ongoing reductions to base programs. If that were to occur, the Legislature might want to consider using this fund source as a tool to help preserve its highest‑priority activities—which may differ from those in the current plan. Accordingly, we recommend that the Legislature closely monitor GGRF and General Fund revenues and be prepared to adjust expenditure plans as necessary.

Background

Expenditures for Most Cap‑and‑Trade Auction Revenues Are Directed by Statute. The California Air Resources Board (CARB) holds quarterly cap‑and‑trade auctions. The revenues from these auctions are deposited into GGRF and generally are allocated to climate‑related programs. Over the past three years, individual quarterly auctions have generated an average of $1.1 billion in revenue, with annual amounts averaging $4.4 billion. Under current law, most GGRF is allocated to specific programs, as shown in Figure 1. The remaining revenue is available for appropriation by the Legislature for discretionary spending programs, as well as to cover state administrative costs, through the annual budget process.

Figure 1

Continuous Appropriations and Other Statutorily Required GGRF Appropriations

|

Program |

Department |

Appropriation Amount |

|

High‑speed rail project |

HSRA |

25 percent of annual revenues |

|

Affordable Housing and Sustainable Communities Program |

SGC |

20 percent of annual revenues |

|

TIRCP |

CalSTA |

10 percent of annual revenues |

|

Low Carbon Transit Operations Program |

Caltrans |

5 percent of annual revenues |

|

Healthy and resilient forest activities |

CalFire |

$200 million |

|

Safe and Affordable Drinking Water Program |

SWRCB |

5 percent of annual revenues (up to $130 million) |

|

Manufacturing tax credit |

N/A |

Roughly $100‑$140 million |

|

State Responsibility Area fee backfill |

CalFire |

Roughly $70‑$90 million |

|

GGRF = Greenhouse Gas Reduction Fund; HSRA = High‑Speed Rail Authority; SGC = Strategic Growth Council; TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; CalFire = California Department of Forestry and Fire Prevention; SWRCB = State Water Resources and Control Board; and N/A = not applicable. |

||

Past Two Budget Agreements Included Plans for Spending Out‑Year Discretionary GGRF. The past two budget agreements—2023‑24 and 2024‑25—not only appropriated GGRF to discretionary programs for those respective budget years, but also included plans to dedicate a large share of out‑year discretionary GGRF revenues for specific purposes. This contrasts with the historical practice of allocating funding on a year‑by‑year basis. As shown in Figure 2, the bulk of the agreed‑upon planned GGRF spending would backfill reductions to expenditures that were previously planned to be made from the General Fund for a wide variety of activities. These actions were taken with the intent of sustaining previous multiyear spending commitments while achieving General Fund savings in response to the deficit and worsening budget condition.

Figure 2

Discretionary Greenhouse Gas Reduction Fund Expenditure Plan as of 2024‑25 Budget Act

(In Millions)

|

Program |

Department |

2024‑25 |

2025‑26 |

2026‑27 |

2027‑28 |

2028‑29 |

|

Fund Shifts From General Fund |

$2,434 |

$1,504 |

$1,314 |

$1,089 |

$650 |

|

|

Climate Packages |

$1,371 |

$1,051 |

$952 |

$989 |

— |

|

|

Drinking water/wastewater projects (Water) |

SWRCB |

$225 |

$30 |

— |

— |

— |

|

Drayage trucks & infrastructure (ZEV) |

CEC |

157a |

— |

— |

— |

— |

|

Flood projects (Water) |

DWR |

126 |

— |

— |

— |

— |

|

ZEV fueling infrastructure grants (ZEV) |

CEC |

120a |

— |

— |

$99 |

— |

|

Habitat restoration projects (NBA) |

DWR |

103 |

— |

— |

— |

— |

|

Streamflow Enhancement Program (Water) |

WCB |

101 |

— |

— |

— |

— |

|

Demand side grid support (Energy) |

CEC |

75 |

75 |

— |

— |

— |

|

Clean trucks/buses/off‑road equipment (ZEV) |

CEC |

71a |

— |

— |

— |

— |

|

Protecting wildlife (NBA) |

WCB |

70 |

— |

— |

— |

— |

|

Emerging opportunities (ZEV) |

CARB |

53 |

— |

— |

— |

— |

|

Fire prevention grants (Wildfire) |

CalFire |

40 |

— |

— |

42 |

— |

|

Transit buses & infrastructure (ZEV) |

CEC |

29a |

— |

— |

— |

— |

|

Ocean protection activities (Coastal) |

OPC |

28 |

— |

37 |

— |

— |

|

Extreme heat/community resilience (Extreme heat) |

OPR |

25 |

— |

— |

— |

— |

|

Equitable Building Decarbonization (Energy) |

CEC |

25 |

— |

— |

93 |

— |

|

Long duration storage (Energy) |

CEC |

23a |

26 |

— |

— |

— |

|

Carbon removal innovation (Energy) |

CEC |

20a |

— |

— |

— |

— |

|

Prescribed fire pilot; monitoring & research (Wildfire) |

CalFire |

26 |

— |

— |

— |

— |

|

Wetlands restoration (NBA) |

CDFW |

17 |

— |

— |

— |

|

|

Livestock methane reduction (Agriculture) |

CDFA |

17 |

7 |

— |

— |

— |

|

Climate Action Corps (Community Resilience) |

OPR |

9 |

9 |

9 |

9 |

— |

|

Salton Sea activities (Water) |

DWR |

7 |

— |

— |

— |

— |

|

ZEV programs (ZEV) |

CEC |

— |

385 |

299 |

387 |

— |

|

ZEV programs (ZEV) |

CARB |

— |

215 |

301 |

213 |

— |

|

Distributed Electricity Backup Assets (Energy) |

CEC |

— |

200 |

180 |

— |

— |

|

Hydrogen grants (Energy) |

CEC |

5 |

34 |

— |

— |

— |

|

Oroville pump storage (Energy) |

DWR |

— |

30 |

100 |

100 |

— |

|

Watershed climate resilience (Water) |

WCB |

— |

15 |

— |

— |

— |

|

Water recycling/groundwater cleanup (Water) |

SWRCB |

— |

15 |

— |

— |

— |

|

Tribal engagement (Wildfire) |

CalFire |

— |

10 |

— |

— |

— |

|

SWEEP (Water) |

CDFA |

— |

— |

21 |

— |

— |

|

Environmental justice grants (Community Resilience) |

CalEPA |

— |

— |

5 |

— |

— |

|

Unit fire prevention projects (Wildfire) |

CalFire |

— |

— |

— |

26 |

— |

|

Regional Forest and Fire Capacity (Wildfire) |

DOC |

— |

— |

— |

20 |

— |

|

Transportation and Other Environmental Programs |

$1,063 |

$453 |

$363 |

$100 |

$650 |

|

|

Competitive and formula‑based TIRCP |

CalSTA |

$958a |

$368 |

$20 |

— |

— |

|

Vulnerable community toxic cleanup |

DTSC |

65 |

— |

43 |

— |

— |

|

Diablo Canyon land conservation |

Various |

40 |

10 |

50 |

$50 |

— |

|

CERIP |

CEC |

— |

50 |

150 |

50 |

$650 |

|

Highways to Boulevards |

Caltrans |

— |

25 |

50 |

— |

— |

|

Oil well plug/abandonment |

DOC |

— |

— |

50 |

— |

— |

|

Non‑Fund Shifts |

$315 |

$278 |

$480 |

$710 |

$275 |

|

|

AB 617—Community Air Protection |

CARB |

$250 |

$250 |

$250 |

$250 |

$250 |

|

Zero Emission Transit Capital Program |

CalSTA |

— |

— |

230 |

460 |

— |

|

Salton Sea activities |

Various |

65 |

3 |

— |

— |

— |

|

Community renewable energy |

CPUC |

— |

25 |

— |

— |

25 |

|

Totals |

$2,750 |

$1,783 |

$1,794 |

$1,799 |

$925 |

|

|

aIncludes funding scored in 2023‑24. |

||||||

|

SWRCB = State Water Resources Control Board; ZEV = zero‑emission vehicles; CEC = California Energy Commission; DWR = Department of Water Resources; NBA = nature‑based activities; WCB = Wildlife Conservation Board; SWEEP = State Water Efficiency and Enhancement Program; CARB = California Air Resources Board; CalFire = California Department of Forestry and Fire Protection; OPC = Ocean Protection Council; OPR = Governor’s Office of Planning and Research; CDFW = California Department of Fish and Wildlife; CDFA = California Department of Food and Agriculture; CalEPA = California Environmental Protection Agency; DOC = Department of Conservation; TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; DTSC = Department of Toxic Substances Control; CERIP = Clean Energy Reliability Investment Plan; Caltrans = California Department of Transportation; and CPUC = California Public Utilities Commission. |

||||||

Governor’s Proposal

Governor Proposes $1.8 Billion Discretionary Spending in 2025‑26. As shown in Figure 3, the Governor proposes spending $4.8 billion from GGRF in 2025‑26. Of this amount, the proposal provides $2.6 billion for continuous appropriations, $346 million for other existing statutory commitments, and $1.8 billion for discretionary spending. Almost all of the proposed 2025‑26 discretionary spending would be used to implement agreements that were part of the 2024‑25 budget package, as detailed in Figure 2. Based on the administration’s revenue assumptions and proposed expenditures, it estimates GGRF would maintain a balance (also known as a reserve) of roughly $160 million at the end of 2025‑26.

Figure 3

Governor’s Proposed 2025‑26 Cap‑and‑Trade Expenditure Plan

(In Millions)

|

Department |

Proposed in |

|

|

Continuous Appropriationsa |

$2,576 |

|

|

High‑speed rail project |

HSRA |

$936 |

|

Affordable Housing and Sustainable Communities Program |

SGC |

749 |

|

TIRCP |

CalSTA |

374 |

|

Healthy and resilient forests activities |

CalFire |

200 |

|

Low Carbon Transit Operations Program |

CalTrans |

187 |

|

Safe and Affordable Drinking Water Program |

SWRCB |

130 |

|

Other Existing Statutory Commitments |

$346 |

|

|

Manufacturing tax credit |

N/A |

$141 |

|

Baseline operations |

Various |

117 |

|

State Responsibility Area fee backfill |

CalFire |

88 |

|

Discretionary Appropriations |

$1,832 |

|

|

2024‑25 Budget Agreement |

$1,783 |

|

|

Fund shifts from General Fund (climate packages) |

Various |

$1,504 |

|

Non‑fund shifts |

Various |

278 |

|

New Proposals |

$49 |

|

|

Motor Vehicle Account offset |

CARB |

$81 |

|

CERIP |

CEC |

‑32b |

|

Total |

$4,754 |

|

|

aBased on Governor’s revenue assumption of $4.2 billion in 2025‑26. bGovernor proposes shifting $32 million of planned spending on CERIP from GGRF to Proposition 4. |

||

|

HSRA = High Speed Rail Authority; SGC = Strategic Growth Council; TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; CalFire = California Department of Forestry and Fire Prevention; SWRCB = State Water Resources and Control Board; N/A = not applicable; CARB = California Air Resources Board; CERIP = Clean Energy Reliability Investment Plan; and CEC = California Energy Commission. |

||

Adds Two Proposed Fund Shifts Aimed at Supporting MVA. The Governor proposes two modifications to the cap‑and‑trade expenditure plan agreed to as part of the 2024‑25 budget. Both are GGRF‑related fund shifts with the goal of supporting CARB activities typically funded by MVA. (As we discuss in our February 2025 publication, The 2025‑26 Budget: Transportation Proposals, MVA continues to be structurally imbalanced and faces insolvency in the budget year absent corrective action.) The two proposals include:

- Clean Energy Reliability Investment Plan (CERIP) Fund Shift ($32 Million Shift From GGRF to Proposition 4). The Governor proposes shifting $32 million of planned spending to implement CERIP from GGRF to Proposition 4. (The Legislature established CERIP in 2022 to support various activities aimed at helping the state reach its clean energy goals.) Along with this proposed fund shift, the Governor would designate the funding specifically for the Demand Side Grid Support Program. (Previous budget agreements included intent to provide GGRF for CERIP‑related activities in 2025‑26 but deferred decisions on which specific activities would be funded to future budget deliberations.) This proposal would reduce pressure on GGRF by $32 million in 2025‑26. (Please see our February 2025 report, The 2025‑26 Budget: Proposition 4 Spending Plan, for further discussion of these shifts.)

- MVA Offset ($81 Million Shift From GGRF to MVA). The Governor proposes to transfer a total of $81 million from GGRF to MVA in 2025‑26. This consists of the $32 million that would be “freed up” by the CERIP fund shift discussed above, along with $49 million from projected additional unallocated discretionary GGRF revenues. These transfers would pay for the costs of CARB’s Mobile Source Program, which is intended to reduce emissions from on‑ and off‑road mobile sources. (Separately, the Governor also proposes to transfer $85 million from CARB’s Air Pollution Control Fund to further address MVA shortfalls.)

Assessment

Governor’s Proposal Maintains Agreed‑Upon Expenditure Plan. We find the Governor’s GGRF proposal to be largely consistent with the expenditure plan agreed to in 2024‑25. (The one relatively small modification is related to the proposed fund shift for CERIP.) Assuming GGRF revenues are adequate and the Legislature’s priorities remain unchanged, maintaining these previous spending plans is both reasonable and appropriate. However, should the budget condition or prioritization of potential activities change, the Legislature may want to revisit these intentions.

Using GGRF to Backfill MVA Comes With Trade‑Offs. The proposed fund shifts come with notable trade‑offs, as we discuss in further detail in The 2025‑26 Budget: Transportation Proposals. For example, a key advantage is that they allow the state to continue to keep MVA balanced in 2025‑26 without raising vehicle fees or reducing service levels. However, some key disadvantages include that (1) the amount shifted to Proposition 4 results in the bond funds being used to sustain existing commitments rather than to enhance the state’s climate efforts, (2) using unallocated projected discretionary GGRF revenues for this purpose means they are not available for other purposes, and (3) sustaining the proposed level of expenditures from GGRF in 2025‑26 may be difficult if revenues fail to strengthen, as discussed below.

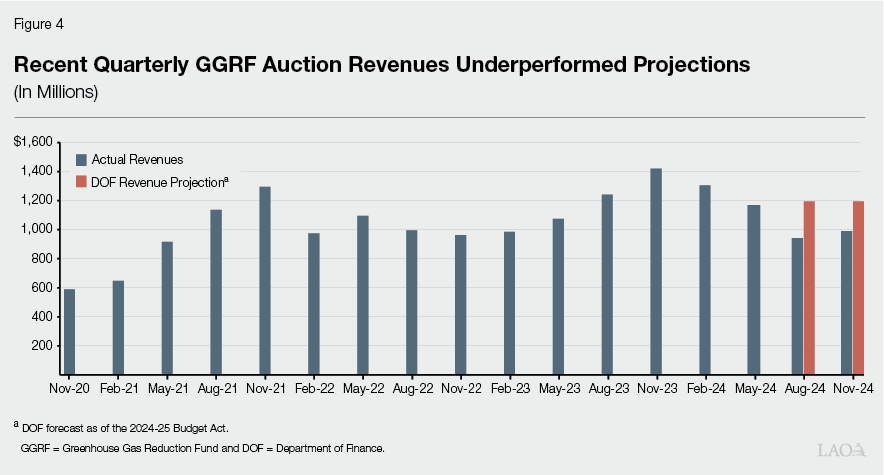

2024‑25 GGRF Revenues Are Coming in Below Projections. The Department of Finance (DOF) estimates future GGRF revenues based on an average of actual allowance prices from auctions that occurred in the previous calendar year. In general, we find this methodology to be a reasonable approach. However, the past two auctions have reflected some weakening in allowance prices compared to the auctions that took place during the prior year. Specifically, DOF projected 2024‑25 auction prices of about $38 per allowance, but actual prices at the first two quarterly auctions of the fiscal year were roughly $31. Accordingly, as shown in Figure 4, GGRF revenues in 2024‑25 have been somewhat lower than the administration’s projections last spring that formed the basis of the 2024‑25 Budget Act’s GGRF spending package.

If Revenue Trends Continue at Modest Decline, Planned Current‑Year Expenditures Likely Still Feasible… Two auctions remain in the 2024‑25 fiscal year—February and May. We estimate that even if allowance prices continue to trail the 2024‑25 Budget Act’s assumptions, if they remain at comparable levels to the past two auctions (roughly $31), GGRF likely will be able to continue to support the expenditures that currently are planned for 2024‑25. This is in part because many of the continuous appropriations are calculated as a percentage of GGRF revenues and thus automatically adjust downward when revenues decline. However, should allowance prices decline more steeply than occurred in the August and November 2024 auctions, modifications to planned expenditures for 2024‑25 could potentially be necessary. DOF could address such a circumstance through Control Section 15.14 of the annual budget act, which provides a mechanism for DOF to make midyear reductions if auction revenues are insufficient to support discretionary GGRF spending at the budgeted levels.

…But Revisiting GGRF Spending Plan for 2025‑26 Could Be Necessary Depending on February and May Auction Results. If the somewhat lower allowance prices that the state has experienced over the past two auctions persist into 2025‑26, we estimate that revenues may not be sufficient to fund existing statutory commitments and the budget‑year spending plan agreed to in the 2024‑25 budget package. Specifically, we estimate that if the allowance prices seen at the past two auctions persist throughout 2025‑26, in adopting the final budget plan the Legislature and Governor would need to reduce the Governor’s proposed 2025‑26 expenditures by nearly $200 million to prevent a negative fund balance for GGRF at the end of the fiscal year. Since GGRF revenues are subject to substantial uncertainty, as we discuss in greater detail below, revenues could be notably higher or lower than recent trends. Further declines in revenues compared to what has been the case thus far would necessitate additional reductions to planned expenditures, whereas increases in revenues could potentially result in additional monies becoming available for discretionary purposes.

Substantial and Increasing Degree of Uncertainty Around GGRF Revenues. Predicting how the cap‑and‑trade market will behave and forecasting corresponding GGRF revenues are always subject to some uncertainty. However, a couple of factors may contribute to more uncertainty than usual for this exercise over the next several years. The Legislature may want to keep these uncertainties in mind as it makes its GGRF budgeting decisions. In particular:

- CARB Considering Cap‑and‑Trade Program Changes. CARB has indicated that it intends to begin a rulemaking process for potential amendments to the cap‑and‑trade program that would influence allowance prices. These include potential changes to the number of allowances the state makes available and the allocation of those allowances.

- 2030 Expiration of Statutory Authorization. Before the Legislature last extended the statutory authorization for the cap‑and‑trade program in 2017, revenues from GGRF began to decline due to investor uncertainty about the status of the program. Should considerable uncertainty about the fate of the program exist as its next statutory end‑date approaches (2030), a similar downward pressure on revenues could emerge.

- Linkage With Washington State. CARB has indicated that it is discussing linking California’s cap‑and‑trade program with the program in Washington state. Such action could affect allowance prices in both states as they come into alignment.

Revisiting Spending Plan Also Could Make Sense if Budget Condition Worsens. As of January 2025, both our office and DOF projected that the state’s General Fund will be roughly balanced in 2025‑26 under the Governor’s budget proposal. However, various factors could change over the coming months that could affect the condition of the state’s General Fund. For example, if the costs of responding to and recovering from the January 2025 wildfires that affected the Los Angeles region are higher than anticipated or state revenues come in lower than projected, the state’s budget condition could worsen. Additionally, our office and DOF project out‑year deficits of over $10 billion annually over the next few years. To the extent the state’s budget condition weakens in the coming months, the Legislature could consider modifying its GGRF spending plan. For example, if revenue declines result in the state facing a large budget problem that necessitates cuts to ongoing programs, the Legislature could consider forestalling those reductions by redirecting GGRF to help sustain higher‑priority activities.

Recommendations

Monitor Auctions and General Fund Condition Over Coming Months. Given the growing uncertainty around cap‑and‑trade revenues, we recommend the Legislature continue to closely monitor quarterly auctions to assess how revenues are materializing. To the extent that revenues from the February and May 2025 auctions deviate from projections, the 2025‑26 GGRF spending levels may not be able to support the plans included in the 2024‑25 budget agreement.

Additionally, we recommend that the Legislature consider updated information on the condition of the General Fund as it becomes available over the coming months before it finalizes its GGRF spending plan. In the event that the General Fund condition deteriorates notably, the Legislature could consider redirecting GGRF as a tool to help sustain its highest‑priority activities.

Adopt GGRF Spending Plan Consistent With Legislative Priorities. Ultimately, once the picture is clearer regarding GGRF revenues as well as the General Fund condition, we recommend the Legislature adopt a GGRF expenditure plan that is consistent with its intent and priorities. This will include assessing strategies for supporting the MVA and the programs that account historically has supported, and the degree to which the Legislature is comfortable with the trade‑offs associated with the Governor’s proposed fund shifts.

Figure 3

Governor’s Proposed 2025‑26 Cap‑and‑Trade Expenditure Plan

(In Millions)

|

Department |

Proposed in |

|

|

Continuous Appropriationsa |

$2,576 |

|

|

High‑speed rail project |

HSRA |

$936 |

|

Affordable Housing and Sustainable Communities Program |

SGC |

749 |

|

TIRCP |

CalSTA |

374 |

|

Healthy and resilient forests activities |

CalFire |

200 |

|

Low Carbon Transit Operations Program |

CalTrans |

187 |

|

Safe and Affordable Drinking Water Program |

SWRCB |

130 |

|

Other Existing Statutory Commitments |

$346 |

|

|

Manufacturing tax credit |

N/A |

$141 |

|

Baseline operations |

Various |

117 |

|

State Responsibility Area fee backfill |

CalFire |

88 |

|

Discretionary Appropriations |

$1,832 |

|

|

2024‑25 Budget Agreement |

$1,783 |

|

|

Fund shifts from General Fund (climate packages) |

Various |

$1,504 |

|

Non‑fund shifts |

Various |

278 |

|

New Proposals |

$49 |

|

|

Motor Vehicle Account offset |

CARB |

$81 |

|

CERIP |

CEC |

‑32b |

|

Total |

$4,754 |

|

|

aBased on Governor’s revenue assumption of $4.2 billion in 2025‑26. bGovernor proposes shifting $32 million of planned spending on CERIP from GGRF to Proposition 4. |

||

|

HSRA = High Speed Rail Authority; SGC = Strategic Growth Council; TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; CalFire = California Department of Forestry and Fire Prevention; SWRCB = State Water Resources and Control Board; N/A = not applicable; CARB = California Air Resources Board; CERIP = Clean Energy Reliability Investment Plan; and CEC = California Energy Commission. |

||