February 12, 2025

The 2025‑26 Budget

Transportation Proposals

- Overview

- Previous Budget Augmentations for Transportation

- Clean California Community Cleanup and Employment Pathways Grant Program

- Addressing the MVA Shortfall

Summary

In this brief, we discuss major transportation funding proposals included in the Governor’s 2025‑26 budget. Specifically, we (1) present an overview of total funding proposed for state transportation agencies and departments, (2) provide an update on recent previous augmentations provided to transportation programs, (3) evaluate a proposal to allocate $25 million from the General Fund to establish a new local litter abatement program (the Clean California Community Cleanup and Employment Pathways Grant Program), and (4) assess a proposed one‑time solution to shift a total of $166 million from two special funds—the Greenhouse Gas Reduction Fund (GGRF) and Air Pollution Control Fund (APCF)—to keep the Motor Vehicle Account (MVA) solvent in the budget year.

Our main takeaways include the following:

- Governor Does Not Propose Any Changes to Multiyear Transportation Funding Package Approved in 2024‑25. Recent budget packages planned for multiyear augmentations totaling $11.5 billion for transportation programs funded primarily by the General Fund. The Governor’s 2025‑26 budget proposal maintains these plans as agreed to in the 2024‑25 budget package, including $2 billion in the budget year for various programs.

- Recommend Rejecting Funding to Establish New Local Litter Abatement Grant Program. Given the uncertain budget context and limited General Fund available, we recommend the Legislature reject the Governor’s proposal to provide $25 million to create a new local litter abatement grant program. In our assessment, this proposal does not meet the high bar for approving new discretionary General Fund spending because (1) local litter abatement is not a core state responsibility and (2) one‑time funding is unlikely to address persistent local issues around litter.

- Address 2025‑26 MVA Shortfall in a Way That Best Aligns With Legislature’s Priorities and Develop Plan to Address Structural Issues. Any steps taken to address the MVA fund condition will come with trade‑offs. However, given the operational funding shortfall, some action is needed in 2025‑26 if the state wants to avoid significant impacts to public services. As such, we recommend the Legislature either adopt the Governor’s proposed fund shifts or some alternative for the budget year. We also recommend that the Legislature develop a plan to address the MVA’s structural deficit on an ongoing basis.

Overview

The state provides funding for eight transportation departments: the California Department of Transportation (Caltrans), the High‑Speed Rail Authority (HSRA), the California Highway Patrol (CHP), the Department of Motor Vehicles (DMV), the California State Transportation Agency, the California Transportation Commission, the Board of Pilot Commissioners, and the HSRA Office of the Inspector General. The California State Transportation Agency has jurisdiction over the various departments and is responsible for coordinating the state’s transportation policies and programs. In addition, the state provides funding to local governments for transportation purposes through “shared revenues” for local streets and roads and the State Transit Assistance program.

Figure 1 shows the Governor’s proposed spending for the state’s transportation departments and programs from all fund sources—special funds, federal funds, the General Fund, and bond funds. In total, the Governor’s budget proposes about $31 billion in expenditures for 2025‑26. This is a net decrease of $7.2 billion (19 percent) relative to estimated expenditures for the current year. The decrease is largely associated with (1) the gradual phase‑out of one‑time augmentations provided in previous budget packages and (2) the timing in which previously approved funds are needed to support the high‑speed rail project.

Figure 1

Overview of Governor’s Proposed

Transportation Budget

(In Millions)

|

2023‑24 |

2024‑25 |

2025‑26 |

|

|

Total |

$31,169 |

$38,203 |

$30,974 |

|

By Department/Program |

|||

|

Caltrans |

$14,674 |

$15,544 |

$16,050 |

|

Local streets and roads (shared revenues) |

3,526 |

3,559 |

3,625 |

|

High‑Speed Rail Authority |

3,490 |

4,339 |

975 |

|

California Highway Patrol |

3,159 |

3,313 |

3,305 |

|

Transportation Agency |

1,869 |

6,907 |

2,453 |

|

General obligation bond debt service |

1,690 |

1,777 |

2,016 |

|

Department of Motor Vehicles |

1,503 |

1,489 |

1,408 |

|

State Transit Assistance |

1,246 |

1,251 |

1,120 |

|

Transportation Commission |

8 |

11 |

10 |

|

Board of Pilot Commissioners |

3 |

9 |

9 |

|

High‑Speed Rail Authority OIG |

1 |

3 |

4 |

|

By Funding Source |

|||

|

Special funds |

$19,052 |

$27,117 |

$21,736 |

|

Federal funds |

9,455 |

6,708 |

6,915 |

|

General Fund |

2,580 |

4,275 |

2,225 |

|

Bond funds |

81 |

104 |

97 |

|

Caltrans = California Department of Transportation and OIG = Office of the Inspector General. |

|||

Previous Budget Augmentations for Transportation

Governor Does Not Propose Any Changes to Multiyear Transportation Funding Package Approved in 2024‑25. Recent budget packages planned for significant multiyear augmentations for transportation programs funded primarily by the General Fund, with a smaller portion coming from special funds. Initially, budget packages from 2021‑22 through 2023‑24 planned to provide augmentations totaling $12.3 billion over the multiyear period. To address General Fund shortfalls, the 2023‑24 and 2024‑25 budgets made a few modifications to these plans, including various reductions, delays, fund shifts, and cash flow adjustments. The 2024‑25 budget retained $11.5 billion for transportation programs across a seven‑year period (2021‑22 through 2027‑28), which represents 93 percent of the multiyear amount originally planned. The Governor’s 2025‑26 budget proposal maintains the transportation program augmentations as agreed to in the 2024‑25 budget package, which we display in Figure 2. This includes $2 billion in the budget year for various programs. Notably, $1 billion would be provided through the formula‑based Transit and Intercity Rail Capital Program (TIRCP), which allocates funding to transit agencies to support capital projects and/or operational expenditures.

Figure 2

Governor Does Not Propose Changes to Multiyear Transportation Funding Packagea

(In Millions)

|

Program |

Department |

2021‑22 to |

2024‑25 |

2025‑26 |

2026‑27 |

2027‑28 |

Totals |

|

Transportation Infrastructure Package |

|||||||

|

Formula‑based TIRCP |

CalSTA |

$2,000 |

$1,000 |

$1,000 |

— |

— |

$4,000 |

|

Competitive TIRCP |

CalSTA |

1,525 |

512 |

564 |

$438 |

$611 |

3,650 |

|

Active Transportation Program |

Caltrans |

450 |

100 |

100 |

— |

— |

650 |

|

Local climate adaptation programs |

Caltrans |

200 |

— |

— |

— |

— |

200 |

|

Clean California Local Grant Program |

Caltrans |

100 |

— |

— |

— |

— |

100 |

|

Grade separation projects |

CalSTA/Caltrans |

— |

— |

75 |

75 |

— |

150 |

|

Highways to Boulevards Pilot Program |

Caltrans |

— |

— |

25 |

50 |

— |

75 |

|

Supply Chain Package |

|||||||

|

Port and Freight Infrastructure Program |

CalSTA |

$800 |

$100 |

$200 |

$100 |

— |

$1,200 |

|

Supply chain workforce campus |

CWDB |

70 |

— |

20 |

20 |

— |

110 |

|

Port operational improvements |

GO‑Biz |

30 |

— |

— |

— |

— |

30 |

|

Increased commercial driver’s license capacity |

DMV |

9 |

— |

— |

— |

— |

9 |

|

Other |

|||||||

|

Zero‑Emission Transit Capital Program |

CalSTA |

$190 |

$220 |

— |

$230 |

$460 |

$1,100 |

|

Port of Oakland improvements |

CalSTA |

184 |

— |

— |

— |

— |

184 |

|

Totals |

$5,558 |

$1,932 |

$1,984 |

$913 |

$1,071 |

$11,458 |

|

|

General Fund |

$4,122 |

$1,350 |

$1,591 |

$538 |

$611 |

$8,212 |

|

|

Greenhouse Gas Reduction Fund |

$596 |

$582 |

$393 |

$300 |

$460 |

$2,331 |

|

|

State Highway Account |

$650 |

— |

— |

$75 |

— |

$725 |

|

|

Public Transportation Account |

$190 |

— |

— |

— |

— |

$190 |

|

|

aFigure reflects package as modified by the 2023‑24 and 2024‑25 budget agreements. |

|||||||

|

TIRCP = Transit and Intercity Rail Capital Program; CalSTA = California State Transportation Agency; Caltrans = California Department of Transportation; CWDB = California Workforce Development Board; GO‑Biz = Governor’s Office of Business and Economic Development; and DMV = Department of Motor Vehicles. |

|||||||

Large Share of Remaining Funding Has Already Been Committed for Specific Projects. Notably, even though $4 billion from the multiyear package displayed in the figure remains subject to budget appropriations in 2025‑26 and the subsequent two fiscal years, for over half of these funds the administering departments have already made grant awards and committed to specific projects. This applies to $2.3 billion of the funding displayed from 2025‑26 through 2027‑28—all programs except for formula‑based TIRCP and the Zero‑Emission Transit Capital Program (ZETCP). This somewhat unusual circumstance is the result of cash flow adjustments the state made as part of the current‑year budget agreement. Specifically, the 2024‑25 budget package reverted funds appropriated for these programs in prior years—that had already been awarded to projects—with the intent of reappropriating the dollars in a future year when they are actually needed to cover planned expenditures. This approach helped generate short‑term General Fund savings, but leaves the Legislature with little flexibility to opt not to resume these expenditures as they are now scheduled, even if the budget condition worsens—at least not without causing significant fiscal and logistical disruptions for projects and their local sponsors. Once grant awards have been made, grantees reasonably expect that funding is forthcoming and have taken steps such as entering into contracts and initiating pre‑construction activities such as planning and permitting.

While about $1.7 billion planned for formula‑based TIRCP and ZETCP in 2025‑26 and the subsequent years has not yet been committed for specific projects by the state, local transit agencies that would receive these funds likely have already begun making plans for how they will spend them—either for eligible capital projects or to help cover operational funding shortfalls. Of this total, the $1 billion for TIRCP is planned from the General Fund ($812 million) and GGRF ($188 million) and $690 million for ZETCP is planned from GGRF.

Clean California Community Cleanup and

Employment Pathways Grant Program

Background

Clean California Included Funding for Litter Abatement and Beautification Projects. The 2021‑22 budget package provided roughly $1.1 billion from the General Fund over a three‑year period for Clean California, a statewide program centered around supporting litter abatement and beautification projects. The 2022‑23 budget agreement committed an additional $100 million from the General Fund that was provided in 2023‑24 to augment funding for the Clean California Local Grant Program. The statewide program was administered by Caltrans and the combined $1.2 billion was used for the following activities:

- State Litter Abatement ($418 Million). To augment Caltrans’ ongoing litter abatement activities on the state highway system through its maintenance program.

- Clean California Local Grant Program ($400 Million). For competitive grants to local governments for beautification and cleanup projects within public spaces and local right of ways. Beautification projects included infrastructure improvements such as art installations, graffiti removal, and landscaping. Trailer bill language—Chapter 81 of 2021 (AB 149, Committee on Budget)—guided the implementation of this new program.

- State Beautification Projects ($287 Million). For Caltrans to implement beautification projects on the state highway system. Assembly Bill 149 guided the implementation of this new program.

- Program Support ($62 million). For Caltrans staff to support Clean California activities.

- Public Education ($32 Million). For Caltrans to support a public education campaign aimed at reducing litter.

Caltrans Established the Clean California Community Designation. Along with the funded activities, Caltrans established a voluntary program to recognize certain localities as “Clean California Communities.” We note that this initiative was not directed in statute, but rather was established by the department as part of its statewide outreach and engagement for Clean California. Local governments and nongovernment entities (such as neighborhood groups and community‑based organizations) can obtain this designation by applying and completing a variety of steps. These include activities such as (1) having a local leader sign a pledge, (2) establishing an informal advisory board, (3) conducting an initial litter assessment, (4) organizing community cleanups, and (5) creating a long‑term plan for keeping communities clean.

Governor’s Proposal

Proposes $25 Million One‑Time General Fund for New Local Litter Abatement Program. The Governor proposes $25 million from the General Fund on a one‑time basis in 2025‑26 to establish a new Clean California Community Cleanup and Employment Pathways Grant Program. The program would offer competitive grants to local governments and federally recognized tribal governments for litter abatement efforts. As opposed to the previous Clean California Local Grant Program, this new program would focus exclusively on local litter abatement and would not support infrastructure‑related beautification projects. The program would prioritize funding for (1) projects that create employment pathways, such as those involving partnerships with workforce development organizations, and (2) communities that are designated as Clean California Communities or are actively working toward this designation.

Assessment

High Bar for Approving New Proposals Under Current Budget Conditions. The Governor’s proposal to establish the new Clean California Community Cleanup and Employment Pathways Grant Program would commit a modest amount of discretionary General Fund in 2025‑26. However, because our office currently estimates that the budget is roughly balanced, every dollar of new spending essentially requires offsetting reductions elsewhere in the budget. The Governor “makes room” for this proposal by making modifications to funds committed to other programs. As we discuss in our January 2025 report, The 2025‑26 Budget: Overview of the Governor’s Budget, overall, the Governor proposes $2.2 billion in actions that would create capacity in the General Fund to support $570 million of discretionary proposals (including this proposal), $150 million of tax expenditures, and a larger discretionary reserve than the state typically plans. These actions include shifting nearly $300 million in previous General Fund augmentations for climate‑ and environmental‑related programs to instead be supported by the new Proposition 4 climate bond. While this would result in maintaining prior funding levels for these activities, it would preclude this amount of Proposition 4 funds from supporting expanded service levels or additional projects. Additionally, the budget faces a number of notable risks and uncertainties—including related to forecasted revenues, federal funding levels, and fire recovery costs—that could lead to the General Fund condition worsening over the coming months. Given this context, the Legislature will want to apply a higher bar to its review of new spending proposals than it might in a year in which the General Fund has more capacity to support new commitments. Overall, the Legislature will want to weigh the importance and value of the proposed new program against the activities to which it has already committed.

Local Litter Abatement Is Not a Core State Responsibility. The state is responsible for maintaining safe and clean conditions on its own property, such as on the state highway system. While addressing litter issues at the local level may be a worthwhile goal, it does not fall within the core responsibilities of the state—a distinction which is especially important in a budget environment with limited General Fund resources where the state may find it challenging to address its own areas of responsibility. Rather, addressing litter issues at the local level falls to local governments, which can raise funds, hire maintenance staff and solicit volunteers, and oversee practices within their own jurisdictions. Moreover, because it does not oversee local litter abatement, the state does not have a way to ascertain the magnitude of this problem. For the state highway system, Caltrans monitors data on the volume of litter collected and the number of service requests submitted by individuals related to litter. Caltrans does not collect similar data on an ongoing basis related to local streets and roads and public spaces more broadly. However, the department notes that based on discussions with local governments and feedback from the Clean California Local Grant Program, local governments continue to face persistent challenges related to litter.

One‑Time Funding Unlikely to Address Persistent Issues Around Litter. One‑time funding can provide short‑term benefits by enabling cleanup in specific areas within a community, but it is unlikely to lead to sustained improvements without ongoing funding. The department indicates that by targeting funding to communities that are designated as Clean California Communities or are actively working toward that designation, the program can be focused on localities that have displayed a commitment to reducing litter and therefore hope to have a more enduring impact. However, this approach relies heavily on voluntary pledges that are not accompanied by long‑term funding. The department also indicates that it would require local governments to provide a match to receive this state funding. Yet, a one‑time match similarly does not ensure lasting efforts to address litter.

Recommendation

Reject Funding to Establish Clean California Community Cleanup and Employment Pathways Grant Program. Given the limited General Fund available and uncertain budget context, we recommend the Legislature reject this proposal to create a new local litter abatement grant program. In our assessment, this proposal to create a new program does not meet the high bar for approving new discretionary General Fund spending because (1) local litter abatement is not a core state responsibility and (2) one‑time funding is unlikely to address persistent local issues around litter. If litter abatement is an issue of high legislative priority, the Legislature could consider directing this funding to support state‑level activities, such as for Caltrans’ ongoing litter abatement activities on state highways, although that too would face a number of competing priorities and likely would necessitate making modifications to other existing spending commitments.

Addressing the MVA Shortfall

Background

MVA Supports Various State Programs, Receives Revenues From Vehicle Registration Fees. MVA is the primary funding source for CHP and DMV. The account also provides some funding for the California Air Resources Board (CARB). The uses of most MVA revenues are constitutionally limited to the administration and enforcement of laws regulating the use of vehicles on public highways and roads, as well as certain other transportation activities. For 2025‑26, MVA revenues are estimated to total about $5 billion. Of this amount, over $4 billion is projected to come from vehicle registration fees. The remainder largely is generated by other DMV fees such as driver license fees. (We note that DMV also collects various other fees at the time of vehicle registration that are not deposited into MVA, such as vehicle license fees, truck weight fees, and an additional registration fee charged to owners of zero‑emission vehicles.)

Expenditures Outpacing Revenues. Since 2021‑22, annual expenditures from MVA have exceeded the account’s yearly revenues, resulting in a structural imbalance. Some of the major expenditure cost drivers have included (1) increased employee compensation costs which have been driven by both increases to staffing levels and growing salary and benefit costs at CHP, (2) workload related to the issuance of new driver licenses and ID cards that comply with federal standards (commonly referred to as “REAL IDs),” and (3) supplemental pension plan repayments that began in 2019‑20. (These payments are related to a 2017‑18 budget action that borrowed from the General Fund for a large one‑time contribution to the state employee pension fund, requiring future repayment from all relevant funds that make employer pension contributions, including MVA. Over the next 30 years, MVA is expected to receive savings that outweigh these near‑term loan repayment expenditures due to slower growth in employer pension contributions.)

State Has Undertaken Previous Efforts to Help Address Deficits and Delay Insolvency. Over the last couple of decades, MVA has experienced periodic deficits and risks of insolvency. In response, the state has taken various actions to shore up the fund. Some of these past solutions provided temporary relief, such as the state making a one‑time repayment of loans that previously were provided from MVA to the General Fund and delaying supplemental pension plan repayments to the General Fund (which temporarily reduced MVA expenditures but created additional out‑year liabilities). Other actions provided longer‑term solutions, including (1) ending a previous practice of transferring about $90 million annually from MVA to the General Fund, (2) authorizing vehicle registration fees to be adjusted annually based on the percent change in the California Consumer Price Index to account for inflation, (3) shifting certain programs from MVA to other fund sources, and (4) the state recently shifting away from using up‑front cash from MVA to pay for CHP’s and DMV’s facility needs.

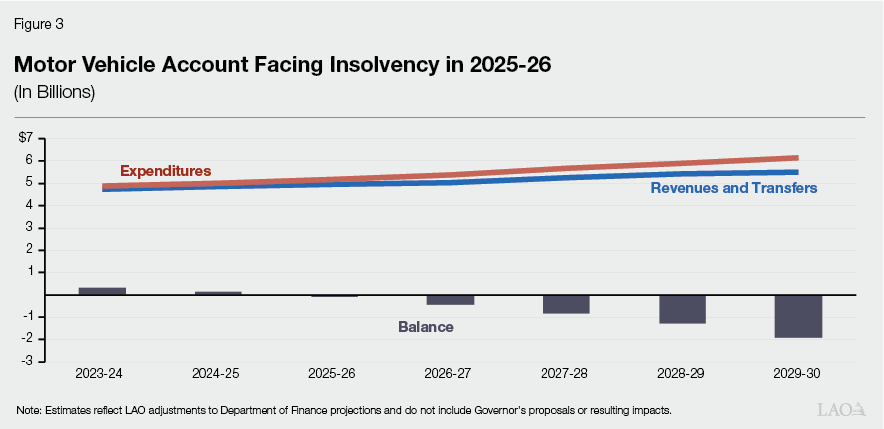

MVA Projected to Become Insolvent Beginning in 2025‑26. Without action, MVA is projected to become insolvent in 2025‑26 with deficits increasing in future years, as shown in Figure 3. Specifically, if left unaddressed, MVA is projected to have a deficit of $87 million in 2025‑26, increasing to $1.9 billion by 2029‑30.

Governor’s Proposal

Fund Shift to Prevent Insolvency, Continue Existing Support for CARB Program in 2025‑26. To maintain a positive MVA balance in 2025‑26, the Governor proposes to transfer funds into the account from two other state accounts totaling $166 million on a one‑time basis. These transfers are intended to fully offset the estimated $166 million that MVA annually provides to support CARB’s Mobile Source Program. (That program aims to reduce emissions from on‑ and off‑road mobile sources, such as vehicles and construction equipment.) The two components of these transfers consist of:

- $85 million From the Air Pollution Control Fund (APCF). The proposal would transfer $85 million from APCF to MVA. The APCF is overseen by CARB and receives revenues from fees and penalties on vehicle and non‑vehicle pollution sources. The account’s funds generally are used to carry out CARB’s duties and functions.

- $81 Million From GGRF. GGRF contains auction proceeds from the state’s cap‑and‑trade program. The proposed funds to be transferred to MVA consist of $49 million from unallocated projected discretionary GGRF revenues and $32 million that would be “freed up” by shifting some prior planned GGRF expenditures for clean energy activities to the Proposition 4 climate bond. (More information about the climate bond fund can be found in our recent publication, The 2025‑26 Budget: Proposition 4 Spending Plan.)

Reduces MVA Expenditures in Response to 2024‑25 Budget Solutions. Through Control Sections 4.05 and 4.12, the 2024‑25 budget package directed departments to identify expenditure reductions from vacancies and operational efficiencies regardless of fund source. The administration states that it has identified expenditure reductions from MVA‑supported programs across CARB, DMV, and CHP totaling $28 million in 2024‑25 and $33 million annually in 2025‑26 and ongoing. While the administration has not yet provided specific details around which positions and activities it is reducing to achieve these savings—or how service levels might be impacted—it has stated that it is not reducing public safety positions at CHP. Absent these expenditure reductions, the MVA deficit in 2025‑26 and future years would be larger.

Assessment

Several Trade‑Offs Associated With Proposal. We have a identified a number of trade‑offs raised by the Governor’s proposed MVA transfers.

- Solves Shortfall in 2025‑26 Without Impacting MVA‑Supported Activities. Based on the administration’s estimated expenditures, the proposed fund transfers would provide sufficient resources to keep MVA balanced in 2025‑26 without needing to make changes to service levels for MVA‑supported programs or increasing fees.

- Results in Less Funding Available for Other Activities. Shifting APCF and GGRF to MVA means that those funds are not available for other spending priorities across the budget which they typically help support. Additionally, one portion of the proposed GGRF transfer is dependent on shifting planned expenditures to Proposition 4, resulting in that amount of the bond being used to sustain existing commitments rather than to enhance state climate efforts.

- Does Not Address Underlying Problem. The Governor’s proposal represents a one‑year fix but would not provide an ongoing and sustainable solution to address the MVA funding shortfall. Moreover, the shortfall is projected to grow in future years. The administration indicates that APCF will not have sufficient funds available to support MVA beyond 2025‑26. MVA will remain at risk of insolvency until the state addresses the underlying imbalance between its revenues and expenditures.

- Relies on Revenue Source Subject to Uncertainty. As we discuss in further detail in our publication, The 2025‑26 Budget: Cap‑and‑Trade Expenditure Plan, GGRF revenues are subject to substantial uncertainty and are trending lower than forecasted in the current year. To the extent these declining revenue trends persist, GGRF may not have capacity to support new commitments—such as the proposed fund shift—without requiring reductions to the 2025‑26 GGRF expenditure plan that was agreed to as part of the 2024‑25 budget process.

Alternative Options Also Come With Trade‑Offs. The Legislature could consider one or more alternative actions to keep the MVA balanced in 2025‑26. However, each of these options also has associated trade‑offs.

- Use Funding From Other Sources. Similar to the Governor’s proposal, the Legislature could consider using funding from other sources to bolster MVA. For example, the Legislature could consider a transfer from the General Fund to MVA. However, any shift would result in less funding from the transferring fund left available for other activities. Moreover, the General Fund does not currently have much capacity to take on new expenditures without impacting existing commitments.

- Increase Revenues. The Legislature could take steps to increase MVA revenues, such as by increasing DMV fees. For example, based on the number of cars currently registered in California, every $1 increase in registration fees would raise about $36 million. However, this would increase costs for businesses and households that own cars.

- Reduce Expenditures. The Legislature could take steps to reduce expenditures from MVA. For example, the Legislature could temporarily suspend the supplemental pension repayments. However, this would not be sufficient on its own to address the fund condition and would lead to increased cost pressures in the near future because the principal and interest for the loan still would need to be repaid by June 30, 2030. Other expenditure reductions likely would reduce DMV and/or CHP service levels, which could affect both customer service (in the case of DMV) and safety (with regard to CHP). In addition, implementing sufficient expenditure reductions in time to keep the fund balanced in 2025‑26 could be particularly challenging.

Recommendations

Weigh Trade‑Offs and Address 2025‑26 MVA Shortfall in a Way That Best Aligns With Legislature’s Priorities. Any steps taken to address the MVA fund condition will come with trade‑offs. However, given the operational funding shortfall, some action is needed in 2025‑26 if the state wants to avoid significant impacts to public services. As such, we recommend the Legislature either adopt the Governor’s proposal or some alternative for the budget year. The Legislature likely will want to closely monitor evolving budget conditions over the next few months—including GGRF revenue trends—as it weighs its various options.

Develop Plan to Ensure Fund Remains Solvent. In order to remain solvent, MVA expenditures and revenues must be brought into balance. As such, we recommend that the Legislature develop a plan to address MVA’s structural deficit on an ongoing basis. To assist with developing such a plan, the Legislature could consider holding hearings this spring as part of the budget process to get a better understanding of the underlying causes of the MVA’s insolvency risk, the potential options for a long‑term solution to the fund condition, and the trade‑offs associated with these options.