LAO Contact

Kenneth Kapphahn

Update (2/21/25): This brief has been updated to reflect our office’s estimate of the K-12 COLA (2.26 percent).

February 13, 2025

The 2025‑26 Budget

Proposition 98 Guarantee and K‑12 Spending Plan

Summary

Each year, the state calculates a “minimum guarantee” for school and community college funding based upon the formulas established by Proposition 98 (1988). Compared with the 2024‑25 enacted budget level, the Governor’s budget estimates the guarantee is up $3.9 billion in 2024‑25 and $3.6 billion in 2025‑26. These estimates build upon revenue assumptions that seem reasonable in light of recent tax collection trends but could reverse quickly if the stock market were to decline. Moreover, the recent extension of tax deadlines in Los Angeles County will complicate revenue projections over the coming months. For 2024‑25, the guarantee is exceptionally sensitive to revenue changes and would increase or decrease nearly dollar for dollar with higher or lower revenue. The Governor proposes to mitigate the downside risks by delaying a $1.6 billion “settle‑up” payment to schools until the state finalizes the guarantee. We think this proposal addresses a reasonable concern about volatility, but an alternative involving a discretionary reserve deposit is more compelling because it avoids delaying costs into the future. The state also faces the possibility of significant revenue swings in 2025‑26, but the guarantee is less sensitive to changes that year.

Accounting for increases in the guarantee, the delayed settle‑up payment, and baseline cost savings, $7.8 billion is available for new K‑12 spending. The Governor proposes to dedicate $4.4 billion to ongoing increases—primarily a 2.43 percent cost‑of‑living adjustment (COLA) and the expansion of transitional kindergarten (TK). The remaining $3.4 billion would fund one‑time activities, including a discretionary block grant, literacy and math coaches, an increase for the Learning Recovery Emergency Block Grant (LREBG), and several teacher training initiatives. The plan has several positive elements, including (1) a balance of one‑time and ongoing spending; (2) a cushion that would help protect ongoing programs; and (3) a mix of flexible funding and targeted proposals, including funds school districts could use to address learning loss and various cost pressures. We recommend building a budget that retains these features. Regarding the specific proposals, we recommend approving the discretionary block grant with modifications to ensure districts can direct funds to their most urgent one‑time costs. We also recommend approving the LREBG funding with a modification to extend the expenditure deadline. Finally, we recommend approving a proposal to eliminate the payment deferral adopted last year. (For brevity, we refer to school districts, charter schools, and county offices of education collectively as “districts.”)

Introduction

This brief analyzes the Governor’s plan for school spending. The first section examines the funding requirement established by Proposition 98 and explains how changes in revenue estimates could affect this requirement. The second section analyzes the Governor’s plan for spending the available funding. This brief focuses on proposals affecting schools—we analyze the community college proposals in our forthcoming publication The 2025‑26 Budget: California Community Colleges. On the “EdBudget” portion of our website, we post numerous tables with additional information about the budget. Over the next several weeks, we plan to release additional briefs analyzing many of the proposals in detail.

Minimum Guarantee

Proposition 98 established a minimum funding requirement for schools and community colleges commonly known as the minimum guarantee. In this section, we (1) provide background on the guarantee, (2) describe the administration’s estimates of the guarantee, and (3) explain how the guarantee could change in the coming months as the state revises its revenue estimates.

Background

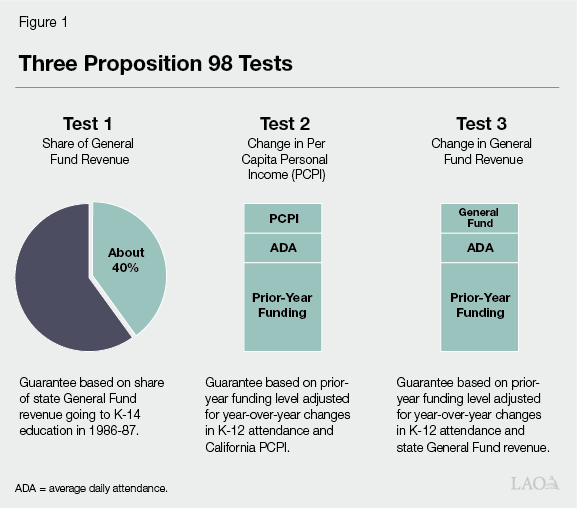

Minimum Guarantee Depends Upon Various Inputs and Formulas. The California Constitution sets forth three main tests for calculating the Proposition 98 guarantee. Each test takes into account specific inputs, including General Fund revenue, per capita personal income, and student attendance (Figure 1). Whereas Test 2 and Test 3 build upon the funding provided the previous year, Test 1 links school funding to a minimum share of General Fund revenue. The Constitution sets forth rules for comparing the tests, with one of the tests becoming operative and used for calculating the guarantee that year. Although the state can provide more funding than required, it usually funds at or near the guarantee. With a two‑thirds vote of each house of the Legislature, the state can suspend the guarantee and provide less funding than the formulas require that year. The state funds the guarantee through General Fund and local property tax revenue.

“Maintenance Factor” Accelerates Growth in the Guarantee. In addition to the three main tests, the Constitution requires the state to track an obligation known as maintenance factor. The state creates maintenance factor when Test 3 is operative or the Legislature suspends the guarantee. The maintenance factor obligation equals the difference between the actual level of funding provided and the higher Test 1 or Test 2 level. Moving forward, the state adjusts the obligation annually for changes in student attendance and per capita personal income. In future years, the Constitution requires the state to make maintenance factor payments when General Fund revenue is growing faster than per capita personal income. The size of these payments increases in tandem with faster revenue growth.

“Spike Protection” Slows Growth in the Guarantee. Whereas maintenance factor payments accelerate growth in the guarantee, a separate formula known as spike protection prevents the guarantee from growing at an unsustainable rate. This formula applies when the guarantee increases much faster than per capita personal income and student attendance. The formula works by excluding some Proposition 98 funding from the guarantee calculation in the subsequent year. Technically, it reduces the Test 2 and Test 3 funding levels from what they otherwise would be in the year following the increase. These lower levels are then compared with Test 1 (which is unaffected). The purpose of spike protection is to protect the state budget from needing to sustain increases in the guarantee resulting from temporary revenue spikes.

At Key Points, the State Recalculates the Guarantee. The state makes an initial estimate of the guarantee when it enacts the annual budget, but this estimate typically changes as the state updates the relevant Proposition 98 inputs. The state recalculates the guarantee at the end of the year based upon revised estimates of these inputs, then makes a second recalculation at the end of the following year. This schedule means that for any given budget, the state has new estimates of the guarantee for the prior year, current year, and upcoming year. The state finalizes its calculation for the prior year through “certification.” Certification is a six‑month process involving the publication of the underlying Proposition 98 inputs and a period for public comment and review. The most recently certified year is 2022‑23. The certification process for 2023‑24 will begin in May of 2025.

When the Guarantee Rises, the State Must Make Settle‑Up Payments. When the guarantee rises after the enactment of the budget, the state makes a one‑time payment to settle up to the higher guarantee. These payments can be allocated for any school or community college purpose. The timing of these payments is not addressed explicitly in the Constitution. Since 2019‑20, the state has made settle‑up payments as soon as it recognized the increase in the guarantee. Before 2019‑20, the state sometimes recognized a higher guarantee but did not make the settle‑up payment for several years. Current law specifies that if the state has an unpaid settle‑up obligation when it finishes certification, the Director of the Department of Finance must develop a schedule for making the required payments.

When the Guarantee Drops, the State Decides Whether to Reduce Spending. If the guarantee drops relative to a previous estimate, the state can reduce school spending by a commensurate amount. As part of the 2019‑20 budget, the state adopted a statutory policy addressing drops in the prior year (the fiscal year that ended before the current fiscal year). This policy commits the state to avoiding reductions in school and community college spending after the year is over while still requiring the state to make settle‑up payments if the guarantee rises. The policy does not address drops affecting the guarantee in the current year, and the state has tended to reduce school spending in response to these drops.

Proposition 98 Reserve Deposits and Withdrawals Required Under Certain Conditions. Proposition 2 (2014) created a state reserve specifically for schools and community colleges—the Public School System Stabilization Account (Proposition 98 Reserve). The Constitution requires the state to deposit Proposition 98 funding into this reserve when the state receives high levels of capital gains revenue and the minimum guarantee is growing quickly relative to inflation. It also requires the state to withdraw funding when the guarantee is growing slowly relative to inflation. When the state’s overall fiscal condition is relatively weak, the Legislature can suspend or reduce required deposits or make discretionary withdrawals. Unlike other state reserves, the Proposition 98 Reserve is earmarked exclusively for school and community college programs.

Administration’s Estimates

Guarantee Revised Up in 2024‑25. Compared with the June 2024 budget estimates, the administration’s estimate of the minimum guarantee is up $3.9 billion (3.4 percent) in 2024‑25 (Figure 2). This increase primarily reflects higher General Fund revenue estimates. Test 1 is operative, meaning the guarantee increases by nearly 40 cents for each dollar of additional General Fund revenue. The increase in the guarantee also includes a $1.6 billion increase in the required maintenance factor payment. Under the administration’s estimates, the state would make a $5.6 billion total maintenance factor payment, leaving $2.7 billion outstanding. Regarding property tax revenue, the administration’s estimate is down $101 million relative to the June 2024 budget estimate. When Test 1 is operative, this reduction has a dollar‑for‑dollar effect on the guarantee. (The budget contains no changes to overall funding in 2023‑24 because the state suspended the guarantee that year.)

Figure 2

Proposition 98 Guarantee Revised Up in 2024‑25, Unchanged in 2023‑24

(In Millions)

|

2023‑24a |

2024‑25 |

||||||

|

June 2024 |

January 2025 |

Change |

June 2024 |

January 2025 |

Change |

||

|

Minimum Guarantee |

$98,484 |

$98,484 |

$0 |

$115,283 |

$119,188 |

$3,905 |

|

|

General Fund |

$67,095 |

$67,093 |

‑$2 |

$82,612 |

$86,619 |

$4,006 |

|

|

Local property tax |

31,389 |

31,392 |

2 |

32,670 |

32,569 |

‑101 |

|

|

General Fund tax revenue |

$185,490 |

$188,918 |

$3,428 |

$200,107 |

$206,495 |

$6,388 |

|

|

aThe June 2024 budget suspended the Proposition 98 guarantee in 2023‑24 and set forth $98.5 billion as the intended funding level. |

|||||||

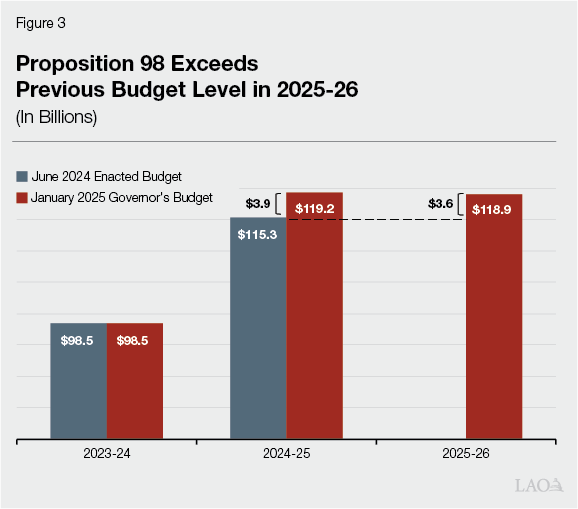

Guarantee Grows in 2025‑26 Relative to Previously Enacted Budget Level… The administration estimates the guarantee is $118.9 billion in 2025‑26, an increase of $3.6 billion (3.2 percent) relative to the 2024‑25 enacted budget level (Figure 3). Test 1 is operative in 2025‑26, with increases in General Fund and local property tax revenue contributing to the higher guarantee. The state does not make maintenance factor payments because General Fund revenues are not growing as quickly as per capita personal income. The increase in the guarantee also includes an upward adjustment of nearly $900 million for the expansion of TK. (The Legislature and Governor previously agreed to increase the guarantee for the students who are newly eligible under this expansion.)

…But Decreases Slightly Relative to Revised Estimate of 2024‑25. Whereas the guarantee exceeds the previously enacted budget level by $3.6 billion in 2025‑26, it is $264 million (0.2 percent) below the revised estimate for 2024‑25 (Figure 4). This year‑over‑year decrease results from the spike protection formula, which excludes a portion of the guarantee in 2024‑25 from the calculation of the guarantee in 2025‑26. Absent this constitutional adjustment, a different Proposition 98 test (Test 3) would have been operative in 2025‑26, and the guarantee would have been $5.7 billion higher than the estimate in the Governor’s budget.

Figure 4

Proposition 98 Key Inputs and Outcomes Under Governor’s Budget

(Dollars in Millions)

|

2023‑24 |

2024‑25 |

2025‑26 |

|

|

Minimum Guarantee |

|||

|

General Fund |

$67,093 |

$86,619 |

$84,603 |

|

Local property tax |

31,392 |

32,569 |

34,321 |

|

Totals |

$98,484a |

$119,188 |

$118,923 |

|

Change From Prior Year |

|||

|

General Fund |

‑$6,853 |

$19,526 |

‑$2,016 |

|

Percent change |

‑9.3% |

29.1% |

‑2.3% |

|

Local property tax |

$1,618 |

$1,177 |

$1,752 |

|

Percent change |

5.4% |

3.8% |

5.4% |

|

Total guarantee |

‑$5,235 |

$20,703 |

‑$264 |

|

Percent change |

‑5.0% |

21.0% |

‑0.2% |

|

General Fund Tax Revenueb |

$188,918 |

$206,495 |

$213,621 |

|

Growth Rates |

|||

|

K‑12 average daily attendance |

0.8% |

1.0% |

0.7% |

|

Per capita personal income (Test 2) |

4.4 |

3.6 |

6.4 |

|

Per capita General Fund (Test 3)c |

7.3 |

9.6 |

3.8 |

|

Maintenance Factor |

|||

|

Amount created (+) or paid (‑) |

$7,960 |

‑$5,637 |

— |

|

Total outstandingd |

7,960 |

2,695 |

$2,887 |

|

Proposition 98 Reserve |

|||

|

Deposit (+) or withdrawal (‑) |

‑$8,413 |

$1,157 |

$376 |

|

Cumulative balance |

— |

1,157 |

1,533 |

|

Operative Test |

Suspended |

1 |

1 |

|

aThe June 2024 budget suspended the guarantee and set forth this amount as the intended funding level. bExcludes nontax revenues and transfers, which do not affect the calculation of the guarantee. cAs set forth in the State Constitution, reflects change in per capita General Fund plus 0.5 percent. dIncludes adjustments for growth in per capita personal income and K‑12 attendance as required by the State Constitution. |

|||

Required Reserve Deposits Anticipated in 2024‑25 and 2025‑26. The administration estimates the state must make Proposition 98 Reserve deposits of $1.2 billion in 2024‑25 and $376 million in 2025‑26. These deposits would bring the balance in the reserve to $1.5 billion. (The state previously withdrew the entire balance to address drops in school funding that occurred in 2023‑24.) The mandatory deposit in 2024‑25 replaces a $1.1 billion discretionary deposit the state made as part of the June 2024 budget.

LAO Comments

General Fund Revenue Estimates Are Reasonable but Depend on Volatile Stock Market. Since the adoption of the June 2024 budget, state tax collections from personal income tax withholding and the corporation tax have been running ahead of projections. Based on these trends, the higher revenue estimates in the Governor’s budget seem reasonable. On the other hand, the recent revenue gains build primarily upon a booming stock market—which could reverse rapidly and without warning. The overall state economy remains lackluster, with elevated unemployment, a stagnant job market (outside the government and healthcare sectors), and sluggish consumer spending. Given these concerns, we advise the Legislature to approach the recent revenue improvements cautiously.

Tax Payment Extensions Add Uncertainty to Revenue Estimates. The state ordinarily receives payments from the personal income tax and corporation tax on a consistent schedule and adjusts its projections based on trends in these collections. In response to destructive wildfires in Los Angeles County, the state extended the deadline for several tax payments ordinarily due between January and September until October 15, 2025. This extension applies to all individuals and businesses located in the county. These taxpayers account for a significant share of state revenue, including more than 20 percent of the personal income tax. The extension means the state will have to develop its May revenue estimates with incomplete data. (The state faced a similar problem when it adopted the 2023‑24 budget after a tax extension affecting nearly all counties. That extension masked a severe revenue shortfall that did not become evident until the fall of 2023.)

Guarantee Is Highly Sensitive to Revenue Changes in 2024‑25. To the extent General Fund revenue differs from the estimates in the Governor’s budget for 2024‑25, the guarantee would increase or decrease nearly 95 cents for each dollar of higher or lower revenue. This high level of sensitivity exists because Test 1 is operative and the state is paying maintenance factor. Specifically, for each dollar of higher or lower revenue, the Test 1 requirement would change by nearly 40 cents, and the maintenance factor payment would change by almost 55 cents. One consequence of this sensitivity is that the guarantee could vary much more than usual from the estimates in the Governor’s budget. Moreover, higher or lower revenue estimates in 2024‑25 would have relatively little effect on programs funded outside of Proposition 98 because nearly all of the increase or decrease would be absorbed by changes in the guarantee. Since the adoption of Proposition 98 in 1988, this level of sensitivity has occurred only twice before (in 2012‑13 and 2014‑15).

Guarantee Is Moderately Sensitive to Revenue Changes in 2025‑26. Similar to 2024‑25, Test 1 is likely to remain operative in 2025‑26 even if General Fund revenue or other inputs vary from the estimates in the Governor’s budget. In contrast to 2024‑25, the state is unlikely to pay any maintenance factor because state revenues are unlikely to outpace the growth in per capita personal income. (The administration estimates a 3.3 percent increase in per capita General Fund revenues and a 6.4 percent increase in per capita personal income. Our November outlook estimate for per capita personal income was even higher at 8.4 percent. The state will compute the final per‑capita income factor for 2025‑26 based on growth from the last quarter of 2023 to the last quarter of 2024.) In Test 1 years without maintenance factor payments, the guarantee is moderately sensitive to changes in General Fund revenue—increasing or decreasing about 40 cents for each dollar of higher or lower revenue.

Proposition 98 Reserve Deposit Highly Sensitive to Capital Gains Estimates in 2024‑25. Whereas the guarantee is highly sensitive to changes in General Fund revenue in 2024‑25, the required Proposition 98 Reserve deposit is highly sensitive to changes in revenue from capital gains. Specifically, the required deposit would increase or decrease by nearly 95 cents for each dollar of higher or lower capital gains revenue. This requirement means that an increase or decrease in the guarantee might not translate into more or less funding for school and community college programs. If the guarantee were to increase based on higher revenues, but these higher revenues came mainly from capital gains, the state would need to deposit most of the increase into the reserve.

Proposition 98 Reserve Deposit Likely Not Required in 2025‑26. The Proposition 98 Reserve formulas require the state to meet several conditions before a deposit becomes mandatory. One condition is that the calculation of the guarantee under Test 1 must exceed the calculation under Test 2. Under our estimates, Test 2 is a few billion dollars higher than Test 1 in 2025‑26, meaning no reserve deposit would be required that year. The state will receive updated data in March clarifying whether this condition is met. If the revised data show that a deposit is not required, the state could still make a discretionary deposit equal to the amount proposed by the Governor (or any other amount).

Los Angeles Fires Likely to Have Modest Negative Effect on Statewide Property Tax Estimates. The Los Angeles fires burned more than 37,000 acres and destroyed thousands of homes and other structures. Affected property owners must continue paying property taxes but are eligible for a reduction in their bills to reflect the lower market value of their properties. Our preliminary assessment is that the fires will reduce property tax revenue by $100 million to $200 million in 2025‑26. (A partial‑year reduction in 2024‑25 also is likely.) This reduction will fade over time as debris is removed and homes are rebuilt. Schools receive about 30 percent of the property tax revenue collected in Los Angeles County, meaning the school share of this reduction in 2025‑26 will likely range from $30 million to $60 million. For individual districts, state law generally provides an automatic increase in General Fund to offset the reduction. At a statewide level, however, lower property tax revenue would reduce the overall funding available for schools under Proposition 98. This reduction is relatively modest compared with the $34.3 billion in property tax revenue schools would receive under the Governor’s budget estimates for 2025‑26.

K‑12 Spending Plan

In this section, we analyze the Governor’s plan for allocating the available Proposition 98 funding to schools. First, we describe the Governor’s overall approach and explain the most notable spending proposals. Next, we assess the merits of this approach and analyze the most significant proposals. Finally, we provide our recommendations for the Legislature.

Governor’s Budget

Spending Overview

Contains $7.8 Billion in Proposition 98 Spending Proposals for Schools. Of the $7.8 billion in new spending, the Governor proposes $4.4 billion for ongoing augmentations and $3.4 billion for one‑time activities (Figure 5). From an accounting perspective, $5.8 billion is attributable to 2025‑26 and $2 billion is attributable to 2024‑25. The spending in 2024‑25 mainly reflects increases in the Proposition 98 guarantee. The spending in 2025‑26 reflects growth in the guarantee and savings from the end of previous one‑time expenditures. (The June 2024 budget allocated almost $3 billion in ongoing funds for one‑time spending. In 2025‑26, these funds are freed up for new activities.)

Figure 5

Governor’s Budget Has $7.8 Billion in Proposition 98

Spending Proposals for Schools

(In Millions)

|

Ongoing |

|

|

LCFF COLA (2.43 percent) |

$1,858 |

|

Transitional kindergarten expansiona |

1,065 |

|

Transitional kindergarten lower student‑to‑adult ratios |

746 |

|

Expanded Learning Opportunities Program |

435 |

|

COLA for select categorical programs (2.43 percent)b |

206 |

|

Universal school meals |

84 |

|

Statewide System of Support: literacy |

5 |

|

K‑12 High Speed Network |

4 |

|

California College Guidance Initiative |

3 |

|

Homeless education technical assistance centers |

2 |

|

FCMAT salary adjustment |

1 |

|

Subtotal |

($4,408) |

|

One Time |

|

|

Discretionary block grant |

$1,776c |

|

Literacy and math coaches |

500 |

|

Learning Recovery Emergency Block Grant |

379 |

|

Pay down LCFF deferral |

247 |

|

Teacher recruitment incentive grant |

150 |

|

Kitchen infrastructure and training |

150 |

|

National Board Certified Teacher Certification Incentive Program |

100 |

|

Training for literacy screenings |

40 |

|

Transitional kindergarten English language proficiency screeners |

10 |

|

Statewide System of Support: literacy |

5 |

|

IEP template digitization and translation |

2 |

|

Evaluation of standards and materials adoption process |

1 |

|

Subtotal |

($3,359) |

|

Total |

$7,768 |

|

aReflects additional LCFF costs associated with serving more students in transitional kindergarten, including costs of existing 12:1 staffing ratios. bApplies to the Foster Youth Services Coordinating Program, American Indian Early Childhood Education, Special Education, Child and Adult Care Food Program, Charter School Facility Grant Program, American Indian Education Centers, Equity Multiplier, and K‑12 mandates block grant. cIncludes $2.8 million in reappropriated Proposition 98 funds. |

|

|

LCFF = Local Control Funding Formula; COLA = cost‑of‑living adjustment; FCMAT = Fiscal Crisis and Management Assistance Team; and IEP = Individualized Education Program. |

|

Allocates New Spending for a Mix of Flexible Funding and Targeted Proposals. The budget provides $4 billion for three proposals that would provide flexible funding for districts—a COLA for the Local Control Funding Formula (LCFF), a new discretionary block grant, and an increase for the LREBG. The budget provides $3.5 billion for various targeted proposals that restrict funding to specific uses or require districts to meet particular conditions (such as serving additional students). Most of these proposals revolve around four programmatic areas: (1) TK, (2) literacy and math initiatives, (3) teacher training and recruitment, and (4) expanded learning (after school programs and summer programs). In addition to the flexible and targeted proposals, the budget provides $247 million to eliminate a payment deferral.

Delays $1.6 Billion Settle‑Up Payment in 2024‑25 Pending Final Calculation. Under the Governor’s budget, total spending on schools and community colleges in 2024‑25 would be $1.6 billion less than the revised estimate of the Proposition 98 guarantee. The difference between these two amounts creates a $1.6 billion settle‑up obligation the state would need to pay in the future if revenues remain unchanged. The administration indicates the state would address the payment in the June 2026 budget plan—after the state makes its final revenue estimate for 2024‑25, recalculates the guarantee, and determines the amount owed to schools. According to the administration, the delay is intended to mitigate the risk that the guarantee drops. The proposal does not involve any changes to certification—the statutory mechanism for ensuring the final spending level meets or exceeds the guarantee. For the state, delaying the payment would reduce costs in this year’s budget but increase costs in the June 2026 budget if the guarantee does not drop. (The proposal only affects 2024‑25. For 2025‑26, the proposed spending level equals the estimate of the guarantee.)

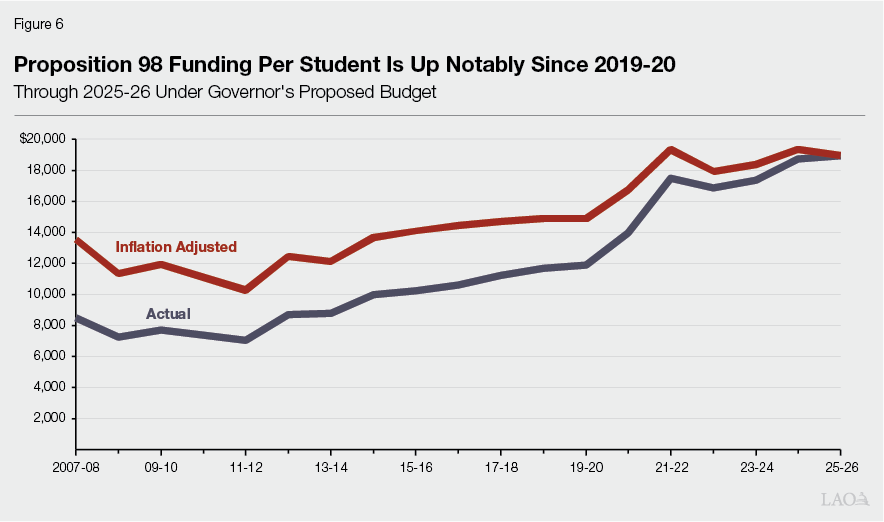

Maintains Funding Near Previous Peak. Under the Governor’s budget, total Proposition 98 funding for schools would be $18,935 per student in 2025‑26, an increase of $203 (1.1 percent) over the revised 2024‑25 level. As Figure 6 shows, school funding peaked following rapid increases in 2020‑21 and 2021‑22. Since that time, funding has been roughly flat after adjusting for inflation.

Major Ongoing Proposals

$2.1 Billion for COLA. The state calculates the COLA rate using a price index published by the federal government. This index accounts for changes in the cost of goods and services purchased by state and local governments across the country during the preceding year. For 2025‑26, the administration estimates the statutory rate is 2.43 percent. The Governor’s budget provides $2.1 billion to cover the associated increase for existing school programs. Of this amount, $1.9 billion is for the LCFF and $206 million is for categorical programs (primarily special education).

$1.1 Billion for Expansion of TK. In 2022‑23, the state began implementing a plan to make all four‑year‑old children eligible for TK. The Governor’s budget provides $1.1 billion to fund the final year of this expansion in 2025‑26. Of this amount, $860 million is for the LCFF funding generated by the newly eligible students and $206 million is for an add‑on that funds additional staff. The law currently requires districts to have at least 1 adult for every 12 TK students to receive this add‑on. These cost estimates assume that statewide attendance for TK students is 229,200 in 2025‑26, an increase of 61,300 compared with the attendance in 2024‑25.

$746 Million for Additional Staff in TK Classrooms. In addition to covering costs for additional TK students, the Governor proposes to increase the TK add‑on funding rate. Whereas the add‑on currently provides about $3,150 for each student, the budget would increase it to about $6,400 per student. This increase is to cover the cost of having at least one adult for every ten students beginning in 2025‑26. The budget provides $746 million to cover the higher add‑on.

$435 Million for the Expanded Learning Opportunities Program (ELOP). ELOP funds after school programs and other enrichment activities outside regular school hours. The program has a two‑tier rate structure. If at least 75 percent of the students in a district are English learners or from low‑income families (EL/LI), the district receives a higher funding rate and must offer the program to all students in grade 6 or below. All other districts receive a lower funding rate and are only required to offer the program to EL/LI students in grade 6 or below. The state currently provides $4 billion per year for the program. The Governor’s budget proposes an increase of $435 million to lower the threshold for the first tier from 75 percent to 55 percent.

Major One‑Time Proposals

$1.8 Billion for Discretionary Block Grant. The Governor proposes $1.8 billion to create the Student Support and Professional Development Discretionary Block Grant. Districts would receive funding based on their average daily attendance in 2024‑25—$323 per student based on current attendance estimates. Trailer legislation would direct districts to use the grant to “address rising costs” and fund specified state priorities, including (1) teacher professional development, (2) teacher recruitment and retention activities, (3) career pathways, and (4) dual enrollment programs. According to the administration, the funding is intended to be entirely discretionary. Districts would be able to spend the grant through 2028‑29.

$500 Million for Math and Literacy Coaches. Of the total, $250 million is for math coaches that will support teachers with implementing math instruction and interventions. Districts are eligible to receive funding for schools where at least 90 percent of students are EL/LI (rural schools qualify if at least 75 percent of students are EL/LI). In addition, the Governor proposes $235 million to support literacy programs, coaches, and interventions at schools where at least 94 percent of students are EL/LI. (The state has provided almost $500 million for this purpose in recent years. Schools that received previous grants would be ineligible for additional funds.) The budget also includes $15 million for one or more county offices of education to provide training to develop literacy coaches and reading specialists.

$379 Million for LREBG. The state provided $7.9 billion for the LREBG in the 2022‑23 budget to mitigate the learning loss and social disruption students experienced during the pandemic (see box below). The accompanying legislation allowed districts to spend these funds through 2027‑28. The state reduced the grant by $1.1 billion in the 2023‑24 budget but adopted intent language to restore the original amount over three years, beginning in 2025‑26. The Governor’s budget provides $379 million to cover the first year of the restoration. The proposal leaves the original 2027‑28 spending deadline in place.

Update on Learning Recovery Emergency Block Grant

Learning Recovery Emergency Block Grant (LREBG) Established in 2022‑23. The June 2022 budget created the LREBG to support learning recovery efforts in schools and the social and emotional well‑being of students and staff. Examples of allowable expenditures include lengthening the school day or year, tutoring and small‑group instruction, counseling and mental health services, training for teachers and staff, literacy programs for younger students, and credit recovery programs for high school students. The state initially provided $7.9 billion for the program. Districts received funding based primarily on their count of English learners and low‑income students. Trailer legislation made this funding available for learning recovery initiatives through 2027‑28. It also required districts to submit an interim spending report by December 1, 2024 and a final report by December 1, 2029.

State Reduced LREBG in 2023‑24 to Address Budget Shortfall. The state faced a revenue shortfall in 2023‑24, accompanied by a drop in Proposition 98 funding for schools. To help address the shortfall, the June 2023 budget implemented a $1.1 billion (14.3 percent) reduction to the LREBG. This reduction lowered the funding for the program to $6.8 billion (equivalent to about $1,800 for each English learner and low‑income student). The budget also contained intent language to restore this funding. Specifically, the language indicated the state would provide $379 million annually in 2025‑26, 2026‑27, and 2027‑28.

New Requirements Added in 2024‑25 Following a Legal Settlement. In late 2020, the families of several students living in Oakland and Los Angeles filed a lawsuit alleging the state had failed to ensure that schools provided adequate instruction during the pandemic (Cayla J. et al. v. State of California). In early 2024, the state agencies involved in the suit announced a settlement agreement with the plaintiffs. The agreement called for the Governor to propose new requirements for the LREBG. The requirements consisted of actions districts would need to take before spending the rest of their grants, including (1) conducting a needs assessment to identify the students in greatest need of support, (2) documenting the rationale for their proposed use of the grant, (3) explaining how research or other evidence supported their plans, (4) soliciting and responding to community feedback through their local planning process, and (5) tracking relevant measures of student engagement and academic performance. The agreement recognized that districts had already spent some of their LREBG funds but presumed at least $2 billion in unspent funds would be subject to the new requirements. The Legislature approved the changes as part of the 2024‑25 budget.

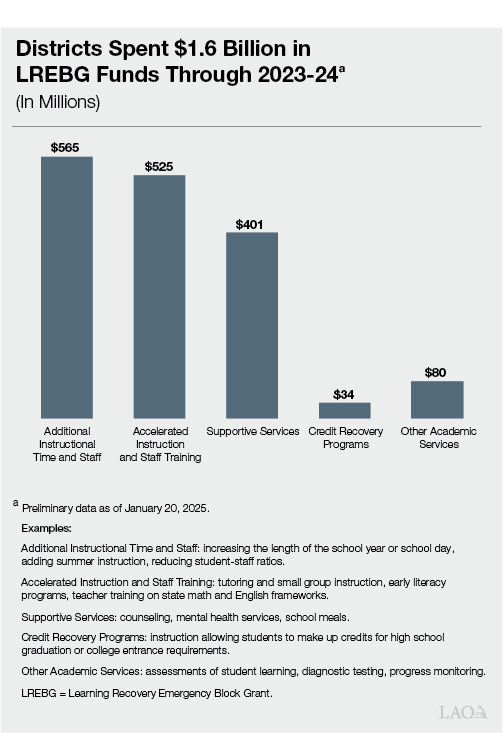

Districts Spent $1.6 Billion Through 2023‑24 and Report Faster Spending in 2024‑25. The December 2024 interim reports show that districts spent $1.6 billion through the first two years of the program (2022‑23 and 2023‑24). Most of this spending supported academic activities, including additional instructional time, additional staff, accelerated instruction (such as tutoring), and teacher training (refer to the figure below). Although statewide data for subsequent years are not yet available, many districts indicate they accelerated spending significantly in 2024‑25. Based on this information, we anticipate that more than half of the initial $6.8 billion allocation will be spent by the end of the year. Many districts also indicate they have specific plans for the remainder of their allocations.

$247 Million for Eliminating Payment Deferral. The June 2024 budget deferred $247 million in payments from 2024‑25 to 2025‑26. It implemented this deferral by moving a portion of the payment schools typically receive at the end of June 2025 to the beginning of July 2025. The Governor’s budget leaves this deferral in place but proposes to eliminate the deferral and restore the regular payment schedule beginning in 2025‑26.

LAO Assessment

Overarching Comments

Plan Contains a Reasonable Mix of One‑Time and Ongoing Spending. Ongoing spending increases can help districts address longer‑term challenges and state priorities, sustain new programs, and cover their ongoing cost pressures. Conversely, one‑time funds can help districts cover one‑time expenses and pay for starting up programs. One‑time spending also allows the state to avoid committing to ongoing increases it might be unable to sustain during tighter fiscal times. The Governor’s plan addresses these trade‑offs by proposing a balance of new ongoing and one‑time spending. This approach seems like a reasonable starting point for building the budget.

Plan Builds a Budget Cushion That Would Help Protect Ongoing Programs. Of the one‑time school spending, $1.4 billion is attributable to 2025‑26. Other one‑time allocations attributable to 2025‑26 include the $376 million deposit into the Proposition 98 Reserve and $331 million in one‑time community college spending. Accounting for all these allocations, the budget has $2.1 billion in ongoing Proposition 98 funds dedicated to one‑time activities. This budgeting approach creates a cushion that helps protect ongoing programs. For example, if the guarantee were to drop by as much as $2.1 billion in 2026‑27, the state could accommodate the drop without reducing programs or deferring payments. The state most recently took a similar approach when it adopted the 2022‑23 budget. When the guarantee declined the following year, the cushion helped the state avoid reductions to ongoing programs.

Plan Contains a Reasonable Mix of Flexible Funding and Targeted Proposals. Flexible funding allows districts to implement programs based on their unique circumstances and local priorities. It also helps districts cover their cost increases and create cohesive local programs. Conversely, targeted proposals help ensure districts use their funding for activities the Legislature considers its highest priorities. The Governor’s plan has significant proposals in both categories but places more emphasis on flexible funding. This budgeting approach could allow districts to address their cost pressures and a few core state priorities without being overwhelmed by new requirements.

Most of the Targeted Proposals Expand Upon Existing Programs. In contrast to some previous budgets, the Governor does not propose any significant new programs. Instead, the targeted proposals generally expand existing programs or support one‑time activities the state funded in previous years. This budgeting approach would encourage districts to prioritize activities that are already underway. For the upcoming hearings, the Legislature could focus its review of the proposed expansions on a few core issues: (1) whether the underlying problem remains unaddressed, (2) whether the existing program is meeting its objectives, and (3) whether additional funding would allow districts to address the problem more effectively.

Settle Up Proposal Addresses a Reasonable Concern About Volatility… The state generally makes settle‑up payments as soon as it recognizes a higher estimate of the guarantee. Although the Governor’s proposal to delay $1.6 billion departs from this practice, it would mitigate some of the volatility in the 2024‑25 guarantee. If the guarantee drops below current estimates, the state could reduce or eliminate this payment more easily than if it had already appropriated that amount to schools. This reduction would reduce the risk of the state committing to a spending level that would be unaffordable with lower revenues. This buffer seems especially important if the state intends to avoid downward adjustments to school appropriations after the year ends. The Governor’s proposal also recognizes that the guarantee is unusually volatile in 2024‑25 due to (1) the state’s reliance on unpredictable stock market growth for its higher revenue estimates and (2) the high sensitivity of the guarantee to changes in revenue estimates. This volatility means the guarantee could easily drop billions of dollars below current estimates.

…But a Compelling Alternative Is Available… The Legislature could consider several alternatives that would mitigate volatility in the guarantee without creating a settle‑up obligation (Figure 7). One compelling alternative is to make a $1.6 billion discretionary deposit into the Proposition 98 Reserve. This deposit would count toward the guarantee in 2024‑25 and supplement the $1.2 billion required deposit. The state could rescind the deposit if revenues fall short—lowering state costs without affecting previous school payments. (If revenues meet expectations, the deposit would remain to help protect school programs from future downturns.) This alternative would increase state costs by $1.6 billion this year relative to the Governor’s budget. The higher cost would mean adopting a budget with lower general‑purpose reserves or additional solutions like spending reductions. The main advantage is that the state would avoid the settle‑up payment—making the budget easier to balance in 2026‑27. As we explain in The 2025‑26 Budget: Overview of the Governor’s Budget, the state has a roughly balanced budget this year but will likely face a significant deficit in 2026‑27.

Figure 7

Comparing the Governor’s Settle‑Up Proposal With Three Alternatives

|

Option |

Helps Balance the |

Increases Future |

When Would State Decide How to |

|

Governor’s settle‑up proposal |

Yes |

Yes |

June 2026 budget |

|

Discretionary reserve deposit |

No |

No |

Future year(s) whenever funds are withdrawn |

|

Appropriation with delayed disbursement |

No |

No |

June 2025 budget |

|

Suspending the guarantee |

Yes |

Yes |

Future year(s) based on maintenance factor formulas |

|

aAssuming revenue estimates for 2024‑25 meet the projections in the Governor’s budget. |

|||

…As Well as Two Other Alternatives. A second alternative is to appropriate a $1.6 billion payment this year but delay disbursing the funds to schools until June 2026. By then, the state will have its final revenue estimate for 2024‑25. The state could release the payment if revenues meet projections or rescind the payment if revenues fall short. This alternative is conceptually similar to the discretionary reserve deposit because it increases state costs this year while lowering costs in the future. The main difference is that the state would commit to a specific use of the funding instead of saving it in reserve. A third alternative is to suspend the guarantee. Assuming the state sets funding at the level proposed by the Governor, it would create a $1.6 billion maintenance factor obligation—adding to the existing obligation of $2.7 billion—but eliminate the settle‑up payment. The state would pay the maintenance factor in future years when revenue is growing relatively quickly. This alternative is conceptually similar to the Governor’s proposal because it would reduce state costs this year while increasing costs in the future.

Specific Proposals

COLA Rate Likely to Be Slightly Below the Budget Estimate. On January 30, the federal government released updated data for the price index that determines the COLA rate. With this release, seven of the eight quarters of data that affect calculation are now available. Based on this update and our projections for the final quarter, we estimate the final rate to be about 2.26 percent—slightly below the estimate in the Governor’s budget. This lower COLA rate would reduce the cost of the COLA for LCFF and categorical programs by about $145 million compared with the estimate in the Governor’s budget. The state will be able to finalize the COLA rate after the federal government publishes the last quarter of data on April 30.

Proposed Funding Increase for TK Staffing Seems High. The Governor’s proposal to increase the TK add‑on rate would provide more funding than necessary for districts to implement the additional staffing requirements in 2025‑26. In our brief The 2025‑26 Budget: Transitional Kindergarten, we analyze the proposal and provide the Legislature with alternatives that are better aligned with staffing costs.

Districts Could Use Discretionary Grant to Support Local Programs and Address Certain Costs… During the pandemic, the federal government provided more than $20 billion in flexible one‑time grants for districts. Districts used these funds—which expired in September 2024—to hire staff, expand programs, cover one‑time costs, and build reserves. The proposed discretionary grant could allow districts to sustain some of these local programs for another few years. For example, we spoke with several districts that indicated they would use the grants to continue the additional counseling and coaching they have provided since the pandemic. Other districts indicated they would fund programs focused on academic intervention and literacy for younger students. Districts also could use the grant to pay for certain costs. For example, several districts indicated they intend to replace or update the technology they purchased when the pandemic began. Some districts are planning facility updates, such as replacing ventilation systems and refurbishing classrooms for TK students. Many districts also could use funds to cover one‑time and ongoing cost increases they have experienced for property and general liability insurance.

…But Language on the Allowable Uses Is Somewhat Unclear. The language regarding the allowable uses of the grant could be interpreted in multiple ways. Regarding the cost language, some districts might interpret it to mean the grant may cover any costs, whereas others might read it as limiting the grant to costs that grow over time. Regarding the state priority areas, the state historically has provided discretionary block grants with two components: (1) intent language encouraging districts to consider specific activities and (2) local control language allowing each district to make the final decision about its funding. The Governor’s proposal does not have the local control language, which could leave districts uncertain about spending on activities outside the state priorities.

Additional Funding for LREBG Is Reasonable… The original impetus for the program—helping students recover from learning loss—remains a significant issue. Test scores and other measures of academic performance show that student achievement remains notably below pre‑pandemic levels. Districts also report students coming to school with much higher levels of socio‑emotional challenges than they experienced before the pandemic. Interim spending data suggest that districts have spent their LREBG funds on various initiatives that could address learning loss, including additional instructional time, additional staff, accelerated instruction (such as tutoring), and teacher training. Additional LREBG funding could help districts sustain the most promising activities for another few years. The proposal also is consistent with the intent to restore the grant to its original funding level.

…But Original Expenditure Deadline Now Seems Less Feasible. The state adopted the 2027‑28 spending deadline for the LREBG as part of its original plan to fund the entire grant in 2022‑23. Under the changes adopted in 2023‑24, however, districts would not receive their final installment of funding until 2027‑28. Moreover, districts must undertake a much longer planning and consultation process than the state required initially. If the deadline remains unchanged, districts would have three years to adopt plans and spend the LREBG funds they receive in 2025‑26, two years for the funds they receive in 2026‑27, and one year for the funds they receive in 2027‑28. This deadline could be difficult to meet—especially over the final two years—and might encourage districts to spend their remaining funds quickly rather than purposefully.

Eliminating the Deferral Is Prudent. The Governor’s proposal to eliminate the deferral would make the budget more resilient by aligning the ongoing cost of school programs with the ongoing funding necessary to support those programs. It also would improve local cash flow and simplify state and school accounting.

Recommendations

Maintain One‑Time Budget Cushion. A one‑time cushion helps mitigate future drops in the Proposition 98 guarantee and protect ongoing programs. Regardless of the specific proposals the Legislature decides to fund, we recommend maintaining a cushion at least as large as the one proposed by the Governor ($2.1 billion across all school and community college programs). This approach means the final budget would have a mix of one‑time and ongoing spending, which the Legislature could use to address its short‑term and long‑term spending priorities.

Maintain Focus on Flexible Funding With Some Targeted Spending. The Governor’s plan to dedicate most new spending to flexible funding while reserving a smaller portion for targeted proposals is a reasonable way to build the budget. This approach would allow districts to address their local priorities while making progress on a few core state priorities. Whether the Legislature decides to fund proposals in the programmatic areas proposed by the Governor or in different areas, we recommend adopting a similar mix of flexible and targeted spending proposals.

Address Volatility in 2024‑25 Guarantee Proactively. The Proposition 98 guarantee in 2024‑25 is unusually volatile and uncertain. We recommend adopting a plan that addresses the downside risk proactively. Although the Governor’s settle‑up proposal is a viable option, we think the most compelling approach is to make a discretionary reserve deposit that could be rescinded if revenues fall short. This approach increases state costs this year but reduces costs in the future when the state is likely to face a large deficit. In selecting among the Governor’s proposal, the discretionary deposit, or the other alternatives, the Legislature will need to consider its plan for balancing the state budget now and in the future.

Adopt Discretionary Block Grant With Some Refinements. A discretionary block grant would help districts support local programs and address various costs. We recommend adopting a version of the Governor’s proposal with some refinements. Regarding the amount, the $1.8 billion proposed by the Governor is reasonable, but the Legislature could consider higher or lower amounts to conform with its overall plan for school funding. For example, the Legislature could reduce the amount if the guarantee decreases by May or increase the amount if it rejects some of the Governor’s other proposals. Regardless of the final amount, we recommend modifying the accompanying language in three ways:

- Clarify Grant Is Discretionary. We recommend modifying the language to clarify that the funding is entirely discretionary. This modification would align the language with the intent of the proposal and allow districts to focus on the local programs and costs that represent their highest priorities.

- Refine Intent Language on Costs. Districts indicate that intent language sometimes influences how they use a grant, even if the funding is discretionary. We recommend modifying the language related to “rising costs” so that the grant explicitly references fiscal liabilities and temporary costs. Examples could include technology updates, facility improvements, and one‑time insurance increases. This change would encourage districts to consider the costs that one‑time funds are best suited to address.

- Adopt Standard Mandate Offset Language. A few districts have claims for unreimbursed state mandates, generally pre‑dating the creation of the mandates block grant in 2012‑13. The state routinely adopts language specifying that any one‑time discretionary funds these districts receive count toward their outstanding claims. We recommend adding this language to help pay down the mandates backlog.

Adopt Funding for LREBG but Delay Expenditure Deadline. The additional funding for the LREBG could help districts mitigate learning loss. We recommend adopting the proposal but delaying the expenditure deadline for at least a year (through 2028‑29). Delaying the deadline would allow districts to complete the detailed planning process and spend their funding more evenly over the next several years. Accounting for the additional LREBG funding and the discretionary block grant, all districts would receive an allotment of flexible funding for each student and targeted funding to support learning recovery based on their EL/LI students. This funding structure parallels the LCFF.

Adopt Proposal to Eliminate the Deferral. The Governor’s proposal to eliminate the deferral is prudent budgeting, and we recommend adopting it. Whereas the Governor proposes to eliminate the deferral beginning in 2025‑26, the Legislature could consider early action to eliminate the deferral in 2024‑25. This accelerated approach would eliminate the state and local workload associated with calculating each district’s share of the June 2025 deferral and processing requests for exemptions. If the Legislature were interested in this approach, it would need to act by early April.