Jason Constantouros

February 20, 2025

The 2025-26 Budget

Health Care Access and Information

Summary

The Governor proposes providing the Department of Health Care Access and Information (HCAI) $207 million General Fund ($581 million total funds) in 2025‑26, a majority of which is one time. This amount includes funds for a proposed new initiative to provide free diapers to Californians. We find several weaknesses with this proposal, including that it is not well targeted and that key details remain conceptual. If expanding access to diapers remains a high priority for the Legislature, we recommend it build upon existing programs that are better targeted and pose fewer implementation challenges. For example, the Legislature could increase the California Work Opportunity and Responsibility to Kids (CalWORKs) diaper assistance subsidy or further support the state’s existing diaper banks. We also provide an implementation update to HCAI’s CalRx program, identifying initial successes but also raising three key issues to keep apprised of in the coming years.

Overview

In this section, we provide background on HCAI and summarize the Governor’s proposed budget for the department.

Background

Department Has Several Key Responsibilities. One of several health departments overseen by the California Health and Human Services Agency, HCAI has a number of responsibilities. These include: (1) promoting health care access and affordability, (2) overseeing state health workforce issues, (3) regulating the design and construction of certain health care facilities, (4) insuring loans for nonprofit health care facilities, and (5) collecting healthcare data. In 2024‑25, the department has 757 authorized positions to manage operations and administer programs.

State Recently Reorganized Department. For many decades, the department was known as the Office of Statewide Health Planning and Development. Chapter 143 of 2021 (AB 133, Committee on Budget) changed the department’s name to HCAI and expanded its mission and operations in several ways. For example, the legislation expanded the department’s scope to include health care affordability issues. It also reorganized and expanded the department’s pre‑existing activities around health care workforce planning and development.

Department Is Supported by Many Fund Sources. Reflecting its varied mission and activities, HCAI’s budget is supported by several sources of funding. For example, HCAI assesses fees on health care facilities, which are collected in special funds. These funds support HCAI’s regulation of facilities, data collection activities, and other programs. Most General Fund support for HCAI has focused on health care workforce and affordability programs. In 2024‑25, the department is receiving $684 million, of which $484 million (71 percent) comes from General Fund support. (As we note later, this proportion is distorted by a substantial amount of unspent carryover funds from previous years. Excluding these carryover funds, General Fund support is 27 percent of spending in 2024‑25.)

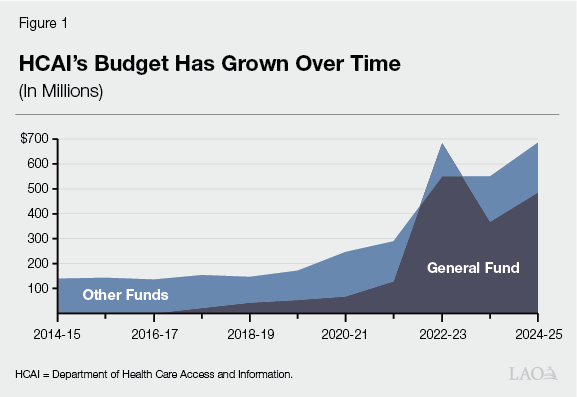

General Fund Support Has Expanded in Recent Years. Prior to 2017‑18, the department (then known as the Office of Statewide Health Planning and Development) did not receive General Fund support. Instead, special funds supported its various activities. Since 2017‑18, the state has provided General Fund support for certain limited‑term initiatives. Many of these funds are being spent over multiple years, resulting in a large amount of carryover funds. Following its reorganization into HCAI, the department’s budget also has expanded somewhat to support new health care affordability activities. As Figure 1 shows, this General Fund support has notably increased HCAI’s budget.

Governor’s Budget

Proposes Spending Increases, Excluding Carryover Funds. The Governor’s budget includes $207 million General Fund ($581 million total funds) for HCAI in 2025‑26. As Figure 2 shows, while this amount technically reflects a reduction over the revised 2024‑25 level, HCAI’s substantial carryover funds skew this trend. When excluding technical carryover, HCAI spending increases across most fund sources, including General Fund support.

Figure 2

Excluding Carryover Funds, Spending Increases

Across Several Fund Sources

HCAI Budget (In Millions)

|

2024‑25 |

2025‑26 |

Change From 2024‑25 |

||

|

Amount |

Percent |

|||

|

Funding |

||||

|

General Fund |

||||

|

Ongoing/one time |

$73 |

$207 |

$134 |

183.5% |

|

Carryovera |

411 |

— |

‑411 |

‑100.0 |

|

Totals |

$484 |

$207 |

‑$277 |

‑134.1% |

|

Other Funds |

||||

|

Reimbursements |

$18 |

$189 |

$171 |

952.0% |

|

Hospital Building Fund |

77 |

79 |

3 |

3.4 |

|

California Health Data and Planning Fund |

53 |

49 |

‑4 |

‑8.2 |

|

Behavioral Health Services Fund |

8 |

31 |

23 |

284.7 |

|

Opioid Settlements Fund |

24 |

— |

‑24 |

‑100.0 |

|

All other funds |

19 |

26 |

7 |

34.5 |

|

Totals |

$200 |

$374 |

$174 |

46.6% |

|

Grand Totals |

$684 |

$581 |

‑$103 |

‑17.7% |

|

aReflects carryover of unspent one‑time appropriations from previous years. |

||||

|

HCAI = Department of Health Care Access and Information. |

||||

Handful of One‑Time Items Increase General Fund Spending. Most of the increase in General Fund spending in 2025‑26 (excluding carryover funds) is driven by a handful of one‑time items. As Figure 3 shows, the largest of these items is related to a new behavioral health workforce initiative. (This funding—connected to a new package of behavioral health‑focused initiatives—is offset by federal funds budgeted in the Medi‑Cal program. The funds appear as a General Fund increase in HCAI’s budget, but is a net zero across the state’s entire General Fund budget.) A handful of new proposals also impact spending, including a proposed new diaper access initiative. The much smaller ongoing increase primarily supports higher rental costs associated with HCAI’s relocation to a new building.

Figure 3

One‑Time Initiatives Drive Up

General Fund Spending

HCAI General Fund Changes (In Millions)

|

One Time |

|

|

Local Assistance |

|

|

Behavioral health workforcea |

$66.6 |

|

New CalRx manufacturing facilityb |

50.0 |

|

California Medicine Scholars Programc |

2.8 |

|

State Operations |

|

|

Health Care Payments Databased |

$9.0 |

|

Diaper access initiative |

7.4 |

|

Other |

0.8 |

|

Total |

$136.6 |

|

Ongoing |

|

|

State Operations |

|

|

Relocation rent adjustment |

$0.8 |

|

Other operations |

0.1 |

|

Total |

$0.9 |

|

aPart of federally funded Behavioral Health Community‑Based Organized Networks of Equitable Care and Treatment (BH‑CONNECT) initiative. According to administration, General Fund amount is offset by federal funds in Medi‑Cal’s budget. bOriginally appropriated in 2022‑23 budget. Deferred to 2025‑26 as part of 2024‑25 budget. cThird year of five‑year spending plan. dReappropriation. |

|

|

HCAI = Department of Health Care Access and Information. |

|

Behavioral Health Workforce Initiative Drives Non‑General Fund Spending Increase. The new behavioral health workforce initiative also is the main driver of increased non‑General Fund spending at HCAI. In December 2024, the state received approval for a new Medi‑Cal waiver called the Behavioral Health Community‑Based Organized Networks of Equitable Care and Treatment (BH‑CONNECT). This waiver includes $1.9 billion over four years for behavioral health workforce initiatives at HCAI. The initiative primarily is supported by federal Medicaid funds, with a much smaller amount of support coming from the Behavioral Health Services Fund.

Adds Many New Positions, Mostly Related to Health Care Payments Database. Under the Governor’s budget, HCAI’s staffing consists of 825 positions, an increase of 68 positions (8.9 percent) over the revised 2024‑25 level. A majority (47) of these positions are related to the full implementation of the Health Care Payments Database, which collects encounter and claim data from health care payors. These positions previously were limited term; the budget proposes making them permanent, as envisioned when the Legislature established the database in the 2018‑19 budget. Most of the remaining new positions implement previously enacted legislation.

Diaper Access Initiative

In this section, we analyze the Governor’s proposed diaper access initiative. We first provide background on diaper‑related issues. Next, we describe the Governor’s proposal. We then assess the proposal and provide associated recommendations.

Background

Paying for Diapers Can Be Challenging for Low‑Income Households. Households face many cost pressures related to their infants. One such cost is diapers, particularly for newborn babies. We understand from limited information that the cost of diapers can be as much as $100 each month (or more than $1,000 each year) for an infant. These costs can be particularly challenging for low‑income families. In a 2023 national survey, nearly half of families with infants reported struggling to cover the cost of diapers. A majority of families reporting hardship were low income, with a smaller share of higher‑income families reporting difficulty.

Some State Programs Help Low‑Income Families With Diaper Costs. There are many ways California supports low‑income families with infants, including by providing cash assistance (such as CalWORKs), food and nutrition assistance (such as CalFresh), health coverage (such as Medi‑Cal), and child care. Most of these programs, however, do not target assistance specifically for the cost of diapers. As an exception, the state recently has targeted support for diapers using two programs:

- Cash Assistance for Low‑Income Families. CalWORKs provides cash assistance (around $1,000 each month, depending on family size and income) and supportive services to low‑income households (over 350,000 households in 2024‑25). In 2017, the Legislature added to this cash assistance a $30 monthly allowance to help pay for the cost of diapers (Chapter 690 of 2017 [AB 480, Gonzales Fletcher]). The additional assistance is available to each child under the age of three years old. The benefit, which has not been adjusted for inflation since its inception, supports around 50,000 children, at a cost of $18 million in 2024‑25.

- Food Banks. California has a number of private, nonprofit diaper banks, consisting of food banks and other providers that offer free diapers to low‑income families. These banks are supported by several sources, including private donations. The state also periodically has provided one‑time General Fund support for these banks—most recently, $9 million in 2024‑25.

State Also Has Explored Adding Diaper Coverage as Medi‑Cal Benefit. Like most state Medicaid programs, Medi‑Cal (which covers health care for low‑income people) generally does not cover the cost of diapers for infants. State policymakers have been interested in expanding coverage, given Medi‑Cal’s broad coverage of children in California (around 40 percent of births), the potential health benefits to infants from ensuring access to diapers, and the potential to offset a portion of costs using federal Medicaid funds. As part of the Supplemental Report of the 2023‑24 Budget Act, the Legislature directed the Department of Health Care Services (DHCS) (which administers Medi‑Cal) to develop options to get Medi‑Cal coverage of diapers for infants three years old and younger. The department’s analysis (which was presented to staff but not published, as directed by the Legislature) provided a wide range of estimated costs, depending on how the benefit would be implemented. While no action was subsequently taken, since then, two other state Medicaid programs (in Tennessee and Delaware) have obtained federally approved waivers for limited coverage of diapers for infants.

Proposal

Creates New Diaper Initiative, With Two Phases. The Governor proposes to create a new initiative to assist all families in California with the cost of diapers. According to the administration, the new initiative would aim to make diapers more affordable, improve access to diapers, and mitigate infant health risks associated with limited diaper access. The initiative contains two key phases:

- Phase 1: Three‑Month Supply of Diapers for All Newborns. In the first phase, the state would work with a private partner to purchase a three‑month supply of diapers (400 diapers) for each newborn baby in California. The diapers would be available to families for free. The department envisions distributing diapers to households through hospitals that voluntarily participate in the initiative. However, the department also emphasizes that it plans to work out key implementation details, including distribution, with the private partner. As part of this effort, the department has already initiated a nonbinding request for information from potential partners.

- Phase 2: Market Intervention to Lower Costs. In the second phase, the state would explore a new commercial distribution model to lower costs for the remaining months of diapers. According to the administration, it envisions a mechanism that will enable the state to leverage its purchasing power and directly negotiate for the price of diapers. The state would begin exploring how this mechanism works through a request for information in fall 2025, with implementation potentially beginning in 2026‑27.

Establishes Two‑Year Pilot… From discussions with the administration, we understand that this new program is intended to be ongoing, with both phases working in tandem. In the proposal before the Legislature, however, the administration provides just two years of funding. As Figure 4 shows, this plan includes costs mostly for the first phase, ramping up to covering half of all births in California by 2026‑27. The department indicates that it is exploring using equity‑based metrics to prioritize distribution, such as by partnering first with safety‑net hospitals. The requested funds also include one‑time support for the start of the second phase. With only two years of funding included, the administration has characterized this proposal as a pilot, enabling the state to evaluate outcomes before further ramping up funds.

Figure 4

Proposed Spending Plan Only Covers

Two Years of Costs

Proposed Plan for Diaper Access Initiative

|

2025‑26 |

2026‑27 |

|

|

Key Inputs for Phase 1 |

||

|

Births |

||

|

Number covered |

100,000 |

200,000 |

|

Approximate percent of births in state |

25% |

50% |

|

Diapers |

||

|

Number provided |

40 million |

80 million |

|

Number per birth |

400 |

400 |

|

Hospitals |

||

|

Number participating |

100 |

200 |

|

Spending (In Millions) |

||

|

Phase 1 |

||

|

Manufacturing cost |

$3.8 |

$7.6 |

|

Other related costs |

2.4 |

3.8 |

|

Other |

||

|

State operations |

$0.7 |

$1.1 |

|

Phase 2 request for information |

0.5 |

— |

|

Totals |

$7.4 |

$12.5 |

|

Phase 1 = plan to provide three months of diapers to all California families with newborn babies. Phase 2 = plan to pursue new market distribution model to lower price of diapers. |

||

…With Long‑Term Funding Plan to Be Determined. To sustain this initiative long term, additional funds beyond 2026‑27 would be needed. This includes funding to ramp up coverage of three months of free diapers to 100 percent of households (phase 1), as well as administrative costs to begin the new commercial distribution model (phase 2). The administration has not provided a comprehensive estimate of these long‑term costs. However, using the administration’s cost assumptions, we estimate that universal access to three months of free diapers (Phase 1) could cost between $20 million and $30 million General Fund annually.

Assessment

Initiative Is Not Well‑Targeted, Likely Limiting Impact. In aiming to cover diaper costs for all Californians, the administration proposes to provide a small benefit to a large population. Such an approach differs markedly from many other state financial assistance programs, which aim to provide greater benefits to smaller groups of financially needy households. For example, while small on a monthly basis, CalWORKs’ diaper subsidy provides eligible low‑income families with support up until the child is three years old. This approach better maximizes impacts, because more support is targeted to those who struggle the most financially. Moreover, while the administration says it plans to prioritize equity during the initial ramp‑up years, it is uncertain whether such an approach would adequately target California’s lowest‑income households. Without better mechanisms in place to target resources to the neediest households, the Governor’s proposal likely would have relatively limited impact on diaper access and affordability.

Proposal Poses Challenges Around Distribution… At the time of our analysis, we understand key aspects of this proposal to still be somewhat conceptual. This conceptual plan poses challenges and uncertainties. Most importantly, the administration’s plan to distribute diapers through hospitals raises many questions. For example, it is uncertain whether nearly all hospitals with maternity wards would voluntarily store large inventories of diapers to distribute, as the administration’s plan appears to assume. For births occurring at hospitals that do not participate, it is unclear how the state would connect families to their three‑month diaper allotment. Similarly, it is uncertain how the state would reach families where the birth occurs in a nonhospital setting, such as a birthing center.

…and Cost. It also is uncertain whether the proposal’s anticipated low costs are realistic. On paper, the proposed initiative purchases hundreds of millions of diapers for Californians at relatively low cost. The administration plans to accomplish this plan through bulk purchasing, thereby achieving lower costs (less than $0.20 per diaper) than current market prices. The department indicates it projected costs after initial discussions with manufacturers. With limited public information available on manufacturing costs, however, we are not able to independently validate these anticipated costs. Moreover, because the department has not finalized plans for distribution, there is risk that program costs could be higher than assumed.

Proposal Lacks Plan for Legislative Oversight. Though conceptually a two‑year pilot program, the proposal does not include any plans to report outcomes to the Legislature. Without such a plan, the Legislature would risk having inadequate information to assess whether to further ramp up the initiative in the future.

Recommendations

Weigh Expanding Diaper Access Against Priorities in Light of Fiscal Constraints. As we have noted in recent publications, the General Fund has little capacity to pursue new initiatives, particularly ongoing ones. This is because the state faces future deficits down the road that will require actions to address, such as increasing taxes or reducing spending. As such, the Legislature likely will want to be cautious in adopting new proposals, funding those that are at the top of its policy agenda. We therefore recommend the Legislature carefully weigh expanding access to diapers against its many other fiscal priorities.

If a Priority, Pursue Alternatives to Administration’s Proposal. To the extent the Legislature wishes to expand access to diapers in this year’s budget, we recommend it pursue approaches that build upon the state’s existing programs. Taking such actions would better target limited resources to low‑income households and provide more certainty around implementation and cost. Below, we offer two key options that could be taken separately or in tandem:

- Increase CalWORKs Subsidy. The Legislature could increase the CalWORKs diaper subsidy, which already is targeted to low‑income families. We estimate every $1 increase in the monthly subsidy would cost around $600,000 annually.

- Provide More One‑Time Support to Diaper Banks. The Legislature could allocate more funding for diaper banks to acquire and distribute diapers. Much like the first option, this approach likely better targets diaper access to low‑income households. This option also would leverage an existing distribution model, providing greater likelihood that the initiative would be successful. Moreover, diaper banks also engage in bulk purchasing, potentially providing much of the same price‑reducing effects envisioned by the administration.

Consider Pursuing Other Long‑Term Options. To the extent the Legislature would like to pursue longer‑term ways to improve diaper access and affordability, we recommend it take actions in this year’s budget. For example, the Legislature could adopt supplemental reporting language directing HCAI to report back on potential market interventions, following HCAI’s exploratory work in fall 2025. The Legislature could then make better informed decisions, to the extent HCAI’s exploratory work yields promising options. In addition, the Legislature could resume its work with DHCS to pursue federal waiver authority for Medi‑Cal coverage of diapers for infants. In pursuing Medi‑Cal coverage, the Legislature would want to ensure it understands the potential benefit, cost, and likelihood of obtaining federal approval.

CalRx

In this section, we provide: (1) background on prescription drug costs and the CalRx program, and (2) an implementation update on CalRx.

Background

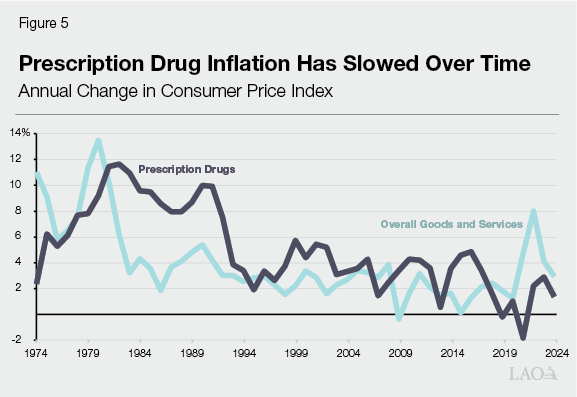

Prescription Drugs Have Been a Key Driver of Health Care Costs. Prescription drugs comprise more than 10 percent of personal health care spending in the U.S. and California. Historically, prescription drug prices have tended to grow faster than prices for overall consumer goods and services. As Figure 5 shows, however, as measured by the consumer price index, prescription drug cost inflation has slowed over the past 50 years. While drug inflation has tended to exceed overall inflation, this trend reversed in the last few years. Many factors likely helped control drug inflation over time, such as growing use of generic drugs (described more in the next paragraph). While inflation has slowed, drug prices vary considerably, with some drugs orders of magnitude more expensive than others.

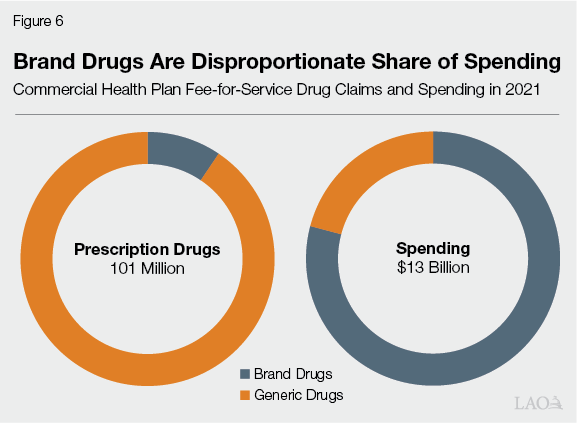

Brand Name Drugs Tend to Cost Much More Than Generic Drugs… Companies that develop and patent new drugs have exclusive rights to sell their product for a limited period of time. Once this time expires, other drug makers can produce and sell their own generic versions of the drugs. Patent‑protected, brand name drugs tend to be significantly more expensive than generic versions. This is because (1) generic drugs often do not require the same level of research and development to go to market and (2) entry of generic drugs creates market competition that drives down prices. As Figure 6 shows, while brand drugs represented a small share of commercial health plan fee‑for‑service claims in 2021, they comprised a majority of spending. Costs also are higher for consumers, with average out‑of‑pocket costs more than four times the cost for brand drugs than generics. A substantial share of spending on brand drugs was concentrated among a handful of relatively expensive drugs.

…Though Data Limitations Complicate Comparisons. The prescription drug market involves a complex and opaque system of payments and players, complicating assessments of drug prices. One key issue is rebates—negotiated discounts that drug makers pay to health plans after drugs are purchased. Rebates help health plans mitigate the high cost of drugs, and brand drugs likely come with higher rebates than generic drugs. However, limited information is available on rebates, as these arrangements often are confidential. As a result, analyses on drug costs often exclude the impact of rebates (including the prescription drug claims and spending data described in the previous paragraph). Moreover, because of many players involved in the prescription drug market, consumers may not always benefit from the savings generated by rebates.

In 2020, State Created CalRx to Expand Access to Generic Drugs. Over the years, the state has taken a number of steps to help reduce the cost of prescription drugs in state programs and to consumers. One key step was the creation of the CalRx program at HCAI. Established by legislation in 2020 (Chapter 207 of 2020 [SB 852, Pan]), the program aims to reduce the cost of drugs by expanding the availability of low‑cost generics in the market. The program accomplishes this objective by entering into partnerships with private entities to distribute or manufacture generic drugs. Before entering into these partnerships, HCAI must ensure they result in savings, address market failures, improve patient access, and are viable.

Since Inception, Two Key Initiatives Comprise CalRx. Since creating CalRx in 2020, the Legislature has adopted two key initiatives, described further below.

- Insulin. The 2022‑23 budget provided $100 million one‑time General Fund for a partnership to manufacture a biosimilar insulin product. (Diabetics take insulin to help regulate their blood sugar. Insulin is among the costliest drugs for health insurance plans and consumers.) Of this amount, one‑half was for the contract with the partner and the other half was to help support the construction of a new manufacturing facility in California. The 2024‑25 budget later deferred the facility construction funds to 2025‑26.

- Naloxone. The 2023‑24 budget provided $30 million one‑time Opioid Settlements Fund for a partnership to produce a generic, over the counter naloxone nasal spray product. (Naloxone is used to alleviate the effects of an opioid overdose.) The 2024‑25 budget later reduced this amount to $25 million, reflecting updated available Opioid Settlements Fund resources.

Implementation Update

Insulin Initiative Has Private Partner. In February 2023, HCAI executed a contract with a nonprofit drug maker (Civica Rx) to produce a biosimilar insulin product. Adopting a public‑private partnership, HCAI is committed to pay the partner up to $50 million for meeting specified project milestones. The contract also grants other specific oversight mechanisms, such as giving HCAI representation on the partner’s governing board. The agreement extends for a ten‑year period after the first commercial sale of the new product. According to HCAI, the partnership will produce three generic insulin products, with insulin glargine (also known by the brand name Lantus) most likely to be launched first.

HCAI Anticipates Substantial Commercial Savings From Generic Product. As part of the agreement, the partner has set a target price for the new product of $30 for each vial or $55 for a pack of five prefilled insulin pens. According to HCAI, these prices are close to the cost of production. As a result, HCAI anticipates these products could result in significant savings when they reach the market. For example, in a 2023 report to the Legislature, HCAI projected commercial health plans could save 43 percent on per‑enrollee spending on insulin glargine as a result of the new product, even after factoring rebates. (Estimated savings were even higher for other insulin products.) For uninsured or underinsured patients that pay the full price out of pocket, HCAI estimated potential savings to be over 90 percent.

Key Time Lines for Insulin Production Remain Unknown. Because key aspects of the partnership are confidential, it is unknown when the new product will enter the market. HCAI recently reported to our office that manufacturing has started, though the partner has not received final federal approval of the new product. HCAI also indicates that it has reviewed data from the partner on initial tests and studies. Moreover, the partner and HCAI are engaging with wholesalers and patients to determine distribution. As of our analysis, however, HCAI indicated that it could not provide an estimated time line to receive federal approval to sell the product.

Naloxone Initiative Appears to Be Moving at Faster Pace. In February 2024, HCAI entered into a contract with a private company (Amneal Pharmaceuticals) for the naloxone initiative. Under the contract, which extends through the end of 2026, the contractor is to sell the new over‑the‑counter naloxone nasal spray product at $24 for each twin pack. The product entered the market in May 2024. One key reason why this initiative was able to move relatively quickly is that it used an existing program to distribute the product. The Naloxone Distribution Project, which is administered by DHCS, provides free naloxone products by request to hospitals, schools, law enforcement, and other public and community‑based organizations. In May 2024, the new CalRx naloxone product became the primary supplier to this state program, reflecting a 40 percent lower rate than the previous supplier. As a result, HCAI estimates the new product has saved the state millions of dollars annually. HCAI indicates it plans to launch a direct‑to‑consumer approach with the contractor in spring 2025.

With Some Initial Successes Under Its Belt, Three Key Questions Remain on CalRx. To date, the state has successfully entered into two partnerships to reduce the cost of two key drugs. One of these drugs has received federal approval and resulted in savings to the state, while the other has the potential to reduce costs in the private market. Despite these initial successes, three key questions remain about CalRx:

- When Will the Products Become Available to Consumers? As of this analysis, neither CalRx product is available directly to consumers. Far less is known around the timing of the insulin initiative, as key components remain confidential. Selling to consumers is not a simple task, and key risks remain. For example, generic drugs can struggle to compete with brand drugs, despite being substantially lower cost. This is because brand drugs can come with large rebates that, on net, benefit health plans and their contracted pharmacy benefit managers. As CalRx initiatives move further along, the Legislature likely will want to keep apprised of their availability and utilization among consumers.

- Will the New Products Lower Costs to Consumers? In concept, CalRx aims to offer lower‑cost drugs to the market, offering less costly alternatives to consumers and creating more competition. According to HCAI, several months after the Naloxone Distribution Project began using CalRx as the primary supplier, the program’s previous supplier notably reduced its prices. HCAI attributes this reduction to the competition created by the new CalRx naloxone product. Whether or not CalRx has broader impacts to consumers, however, will depend on how available these new drugs are to consumers, as well as utilization.

- How Will the Products Compare to Other Competitors? Since the start of the insulin and naloxone initiatives, a handful of other generic competitors have received federal approval and entered the market. Moreover, as part of recent federal legislation, Medicare out‑of‑pocket costs for insulin are capped at $35, just slightly higher than the $30 cost per vial intended for the CalRx product. These developments could limit the potential savings effect of CalRx. However, these issues remain very uncertain. According to HCAI, many generic competitors have pursued more traditional high price, high rebate models, limiting their affordability to consumers. Also, HCAI states that it has heard of patients experiencing difficulty accessing price‑capped insulin products. The Legislature likely will want to track these market and policy developments over time as it assesses the impact of CalRx.

Need for Manufacturing Funds Are Uncertain. As adopted in last year’s budget, the Governor’s budget includes $50 million one‑time General Fund to HCAI to help support construction of a new manufacturing facility. The funds originally were appropriated in 2022‑23, but were later deferred to 2025‑26 as a budget solution. At the time, HCAI indicated that it could defer these funds because construction of the new insulin product will instead occur at an existing site in Virginia. According to HCAI, a forthcoming report to the Legislature will further examine the feasibility of the state engaging more directly in drug manufacturing. With key implementation details of the insulin initiative still uncertain, the Legislature likely will want to work with HCAI to better understand the continued need for these funds. If stronger justification is not forthcoming, the Legislature could redirect these funds for other one‑time budget priorities or further defer them as needed.