Carolyn Chu

February 24, 2025

The 2025-26 Budget

Undertaking Fiscal Oversight

As outlined in our November Outlook, we advise the Legislature to use the 2025-26 budget process to conduct robust fiscal oversight of state programs. In particular, we advise the Legislature to put particular focus on programs and activities supported by the General Fund to help prepare for actions that might be needed to address significant expected deficits in the coming years. These deficits will have to be addressed through some combination of spending reductions, revenue increases, and/or other solutions. The guidance in this post aims to assist the Legislature in its efforts to undertake oversight of its current spending activities and revenue structure. Moreover, the guidance in this post can help the Legislature prepare for proposals from the administration to balance the multiyear budget. In presenting the Governor’s budget, the administration indicated such proposals would be forthcoming in May.

What Is Fiscal Oversight?

Fiscal Oversight Provides Insight Into the Benefits and Costs of State Programs. As the state’s primary policymaking body and stewards of public resources, the Legislature regularly undertakes oversight of the state’s programs. While this oversight can take a few forms, the Legislature’s oversight function is often exercised through policy and budget committee hearings. Fiscal oversight is distinct from other important types of legislative oversight—such as authorizing audits that determine the degree to which the administration is implementing programs in accordance with law, or investigating potential instances of waste, fraud, or abuse. Instead, fiscal oversight aims to identify whether public resources are being used in a way that achieves the intended goals and at a reasonable cost. In the budget context, fiscal oversight hearings often are organized around the administration’s proposals. However, these hearings also present the opportunity for the Legislature to step back and evaluate whether programs are functioning as intended. Specifically, the Legislature can assess whether programs are providing adequate benefits given the costs. This fiscal oversight requires assessing (1) what the key program goals and expected outcomes are, (2) the extent to which programs are delivering those expected outcomes, (3) whether programs’ costs align with expectations, and (4) whether the benefits justify the costs. This evaluation applies to both traditional spending programs and tax expenditures.

Why Is It Particularly Important Now?

State Faces Notable Deficits After 2025-26, Meaning Difficult Choices Are Ahead. Under the Governor’s January proposals and estimates, the 2025-26 budget is expected to be balanced. In large part, this is because the Legislature took significant action last year to solve the budget problem anticipated for 2025-26. As a result, absent substantial changes to these estimates, the Legislature does not need to take any major additional actions this year to balance the budget. However, both our office and the administration anticipate sizeable deficits starting in 2026-27. While the state has projected out-year deficits many times in the past, the underlying dynamics of revenue and cost growth make these deficits more likely to materialize than in the past. Specifically, our November forecasted spending growth is about 6 percent over the multiyear period (2026-27 thought 2028-29)—a growth rate that is high by historical outlook standards and slightly above what we consider to be long-term revenue growth. Meanwhile, revenue growth over the outlook window is just above 4 percent—this is lower than its historical average largely due to policy choices, namely the limitations on deductions and credits that end during the forecast window. As such, we anticipate the Legislature will need to adopt ongoing budget solutions—through a combination of spending reductions, revenue increases, and others—to balance the budget. Although the Legislature solved sizeable deficits over the past few years, totaling over $80 billion, those solutions largely only impacted one-time and temporary programs supported by the one-time, post-pandemic revenue surge. To prepare for next year’s budget, the Legislature will need to weigh its suite of ongoing, or core, program commitments and determine their relative priority.

Evaluating Program Success Challenging. Identifying the effect of state programs on key outcomes of interest is often challenging because it usually requires in-depth research to determine whether state funding—or some other external factor—is driving the observed trends. In many cases, this type of research does not exist. As a result, rarely is information available to determine whether a state program was the cause of a particular change or outcome. In some cases, however, basic data tracking of high-level outcomes and/or metrics of program delivery are available. For example, programs typically have information about the rate of expenditure, number of people served, and services provided. While these metrics provide important insights into programs, they often only provide indirect evidence of programs’ success.

Gathering Program Information Takes Time. While a few programs, like the Homeless Housing, Assistance and Prevention Grant Program, have dashboards providing program metrics, often this information is not centrally collected. As such, the Legislature typically must rely on the administration to collect and provide data on program delivery and other initiatives. Often, gathering this information from program participants, departments, and other sources takes time. For example, the administration proposed achieving efficiencies across state departments as part of last year’s budget solutions. Undertaking this effort has required focused effort by the Department of Finance and state departments over the last six months, but little information is yet available as to how those efficiencies will be achieved.

How Do You Focus Your Efforts?

The Legislature cannot reasonably undertake in-depth oversight of all state programs in one budget season. As such, the Legislature must determine how to focus its efforts so as to provide information that would be most helpful in making future budget decisions. This section offers some questions to determine how to focus those efforts.

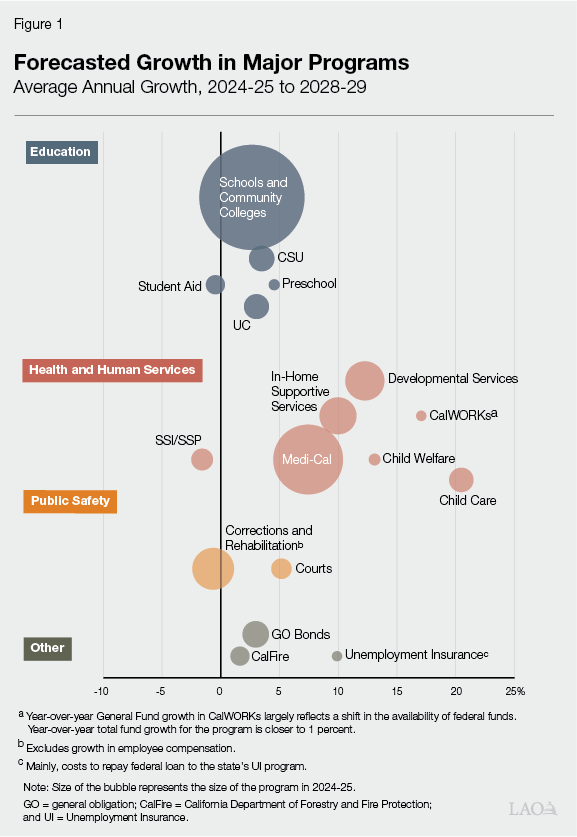

What Is the Distribution of General Fund Commitments? Figure 1 shows the relative size and expected growth rates of major General Fund programs. Larger bubbles reflect higher levels of spending and bubbles farther to the right reflect higher rates of expected growth. Notably, this figure excludes special funds, which support a variety of other programs (some of which are of interest to the Legislature, like unemployment insurance and high-speed rail).

We focus on General Fund here because it is the state’s main operating account and faces significant fiscal pressure in coming years. Moreover, the Legislature has more flexibility in allocating General Fund resource across a variety of different program areas. As such, Figure 1 provides an understanding of how the state currently commits those resources. Special funds, by contrast, are dedicated to specific purposes. Special funds can be funded by fees paid by users for services, like entrance to state parks, or taxes levied on specific products, like tobacco or gasoline. Oversight of special funds and the associated activities also is an important area for legislative oversight, but it usually does not involve the same trade-offs as assessing the suite of General Fund programs.

What Is the Extent of the Legislature’s Fiscal Flexibility Over Spending and Program Design? Before undertaking fiscal oversight, the Legislature first will want to understand its ability to change the level of funding for a particular program or policy. The Legislature has varying degrees of fiscal flexibility, depending on the program. Typically, restrictions on the Legislature’s flexibility are imposed by the voters, courts, or the federal government. For example, the minimum funding level for schools and community colleges is set by the constitutional requirements of Proposition 98 (1988). While the Legislature can change how funds within Proposition 98 are distributed, funding less than the constitutional minimum in any particular year requires a two-thirds vote and creates a future obligation for more school funding in subsequent budgets. Similarly, state-federal partnerships, like Medi-Cal, the state’s Medicaid program, require the state provide a minimum level of funding for large portions of the program. Where the state has implemented expansions of state-federal partnerships, however, there typically is greater fiscal flexibility.

Can the Entire Program Be Evaluated, or Should Oversight Focus on Specific Components? Some programs can be assessed comprehensively more easily than others. Often, programs that are more targeted or only provide a single type of service can be good candidates for comprehensive review. In contrast, oversight of larger programs with multiple facets and program components can be more successful if the programs are broken down into key pieces. For example, oversight of homeless encampment resolution grants likely could be done comprehensively. In contrast, oversight of Medi-Cal likely requires discrete examinations of factors like eligibility, caseload, services, and utilization to understand the program benefits. For instance, California Advancing and Innovating Medi-Cal, a recent initiative to test new ways of delivering services, could be a focus of Medi-Cal oversight. Focusing on key elements of larger programs can provide the Legislature more detailed and practicable insight into program dynamics.

Which Areas Have Been Underemphasized Recently? Another way to target legislative oversight is to identify issues within policy areas or departments that have not been focused on recently. The Legislature could do this by identifying issues, policies, and programs that have been key areas of attention in recent years. The affected departments likely have had less capacity for other responsibilities during that time. The Legislature could direct its oversight of those departments to those less-focused-on program and policy elements. In addition, the Legislature could identify departments that have not been focused on in recent years and focus oversight on their activities.

Which Programs Could Be Susceptible to Unanticipated Impacts? Certain programs are more susceptible to external factors like federal policy changes, demographic shifts, or economic trends. In some cases, programs are designed intentionally to respond to these factors. For instance, safety net programs have higher enrollment during economic downturns. Similarly, state firefighting costs rise significantly in years with larger wildfires. However, sometimes external changes can alter a program’s scope or the population served in ways that are unanticipated. These changes can make programs costlier or more difficult to administer. Focusing oversight to understand which programs are susceptible to these unanticipated changes is important as they can have significant fiscal implications for the state.

What Information Helps to Assess Costs and Benefits?

This section describes the type of information the Legislature can gather to try to assess the costs and benefits of state programs. Once program costs and metrics are understood, the Legislature can weigh the benefits relative to the costs. Ultimately, the Legislature must assess which program outcomes it prioritizes and whether the benefits conferred are sufficient to warrant the costs of the program (or if the benefits could be achieved at a lower cost). In most cases, this assessment will not be straightforward because—as discussed above—the information regarding whether program goals are being achieved will be limited. However, proactive efforts to help improve the amount of information that is available could help the Legislature gain sufficient insight so as to determine which programs to prioritize over others.

Are Programs Providing Expected Benefits? Understanding the extent to which programs are achieving the desired outcomes requires identifying what the key program goals are, assessing whether programs are well scoped to achieve those goals, and whether the key program objectives are being met.

Are Programs Designed to Address Well-Defined Problems? The Legislature can first assess whether the problem addressed by the program is well defined. For example, is the program aimed at a well-understood gap or market failure? Does the problem still exist in the way it did when the program was created? The Legislature can then assess whether the program is designed to address that problem. To the extent that the problem is not well defined or the program is not well targeted, the program is less likely to provide expected benefits.

Is There Reliable Evidence the Objectives Are Being Met? The extent to which state programs are meeting their objectives can be difficult to assess. Often, the Legislature will need to use a combination of other metrics and information about program delivery to assess outcomes. Examples of these metrics are described in Figure 2.

Figure 2

Example Program Oversight Metrics

|

Metric |

Description |

Example |

|

Participation Rates |

What share of the eligible population enrolls or participates in the program? |

In some programs, like CalFresh, enrollment can be as high as about 80 percent. |

|

Access Measures |

Can program participants access the benefits provided by the program? |

What is the ratio of service providers to participants in the program? |

|

Benefit Benchmarks |

To what extent do program benefits enable participants to reach some threshold? |

What share of costs do student aid grants cover? |

|

Timely Delivery |

Are services provided when needed? |

How long do applicants need to wait to have state permits processed? |

|

Expenditure Rate |

What share of program funds have been allocated? |

How successful has the department been at executing contracts to deliver services? |

|

Program Completion |

What share of participants complete the program? |

What are high school graduation rates? |

|

Production Rates |

How many or how much of a product was made? |

How many affordable housing units were built? |

|

Qualitative Information |

What do program participants, community members, and service providers think about the program? |

Has the department surveyed providers or recipients of the services it provides? What are the findings? |

Are Costs Higher, Lower, or as Expected? Understanding the extent to which programs’ costs align with expectations lays the foundation for assessing the ultimate cost of program benefits. In some cases, total program costs are fixed. In these cases, the Legislature can examine how far services can stretch within a fixed appropriation. That is, the Legislature can assess whether the expected amount of services can be provided given the level of funding. For example, the Legislature can assess the extent to which its broadband infrastructure investments are sufficient to build the expected network connections. In other cases, programs are created or changed with certain expectations of the cost, but the ultimate costs can vary depending on demand, level of service, and other factors. Assessing whether the costs, once implemented, are higher or lower than initially expected when the program (or change) was implemented is important. For example, if a program costs less than what was anticipated, it could be that demand is less than estimated. Alternatively, there could be issues with program access. In cases where program costs are higher than original estimates, the Legislature will want to assess whether the benefits of the program still justify the new, updated cost or whether similar benefits could be delivered at a lower cost.

How Can the Legislature Gather This Information? Budget subcommittee hearings are a key way the Legislature can start to collect information about program benefits and costs. Almost all departments will come before the Legislature through this process to discuss their operations, budget proposals, and policy updates. We recommend the Legislature ask departments about the issues highlighted in this piece as part of these hearings—including for programs which may not have new budget requests for 2025-26. Asking these questions can help the Legislature understand which programs it may wish to focus on in greater depth in the spring. These questions also will help identify areas where the administration will need to report back to the Legislature with the requested information. This reporting could be provided through required reports to the Joint Legislative Budget Committee (required through budget bill or trailer bill language), Supplemental Reporting Language, or other means. As noted earlier, it can take considerable time to obtain program metrics.

What About Revenues?

In the past, budget problems have been solved with a combination of spending reductions, revenue increases, and other solutions (like cost shifts). In addition to assessing the state’s spending, the Legislature can take time now to assess the state’s revenue structure.

Does the Existing Tax System Strike the Right Balance? California’s tax system has various goals including economic growth, stability of revenue, administrative ease, and fairness. The Legislature could examine the distribution of its tax structure to assess the extent to which the current system achieves these goals. It also could assess how the tax system is applied across individuals and entities. (As part of this assessment, we encourage the Legislature to consider whether it wishes to renew—or change—the provisions of Proposition 55 [2016], which will expire in 2030. While the expiration is still five years away, the Legislature’s preference has implications for the structure of the state budget.)

Are Existing Tax Expenditures Providing Expected Benefits? Tax expenditures, like tax credits, should be subject to the same scrutiny as any other spending. The Legislature could assess existing tax expenditures by asking questions similar to those asked of other state programs. For example, does the Legislature still agree with the original objective of the tax expenditure? Is there quality evidence the objective is being met? Could alternative spending or policy changes meet the same objective more efficiently or transparently?

Fiscal Oversight Checklist

Figure 3 summarizes the steps to take and questions to ask as the Legislature focuses its fiscal oversight activities.

Figure 3

Fiscal Oversight Checklist

|

Identifying Areas for Oversight |

|

|

|

|

|

|

Assessing Costs and Benefits |

|

|

|

|

|

|

Assessing Revenues |

|

|

|

|

|

|