February 28, 2025

The 2025-26 Budget

California Student Aid Commission

- Introduction

- Overview

- Cal Grants

- Middle Class Scholarships

- California College of the Arts

- State Operations

Summary

Brief Covers the California Student Aid Commission (CSAC). This brief provides an update on Cal Grant and Middle Class Scholarship (MCS) cost estimates, as well as analyzes the Governor’s budget proposals for California College of the Arts (CCA) and CSAC’s state operations.

Governor’s Budget Includes Baseline Augmentation for Cal Grants. The Governor’s budget revises 2024‑25 Cal Grant spending upward by $14 million (0.6 percent) relative to the enacted level. From the revised 2024‑25 level, the Governor’s budget increases Cal Grant spending by $109 million (4.5 percent), bringing total program spending to $2.6 billion in 2025‑26. Though the administration’s cost estimates appear reasonable at this time, they likely will change between now and the May Revision due to various factors. Notably, CSAC could learn more over the coming months about how the continued rollout of the revised federal financial aid application and changes in application deadlines are affecting program costs.

MCS Funding Decreases Under 2025‑26 Budget Plan. MCS awards reflect a certain percentage of students’ remaining cost of attendance after accounting for their available resources (including any gift aid they receive). MCS awards are expected to cover 35 percent of a student’s remaining cost of attendance in 2024‑25. The 2025‑26 budget plan reduces funding for MCS by $110 million ongoing, while also removing $289 million in previous one‑time funding for the program. As a result of these actions, total MCS funding would decline from $925 million in 2024‑25 to $527 million in 2025‑26. At the reduced funding level, CSAC estimates that MCS awards will cover 18 percent of students’ remaining costs of attendance in 2025‑26.

Recommend Rejecting Proposal for $20 Million One‑Time Funding for CCA. CCA is a nonprofit, private college based in San Francisco. The proposed $20 million would be on top of $2.5 million in one‑time General Fund the state provided to CCA in 2024‑25. CCA is currently facing a $20 million budget deficit. Though we recognize CCA’s difficult financial situation, it is not the only campus in the state facing budget challenges. Certain California State University (CSU) campuses are in somewhat similar situations. Under the 2025‑26 budget plan, state support for CSU and the University of California (UC) is being reduced. Given supporting private schools is not part of the state’s core mission, we recommend rejecting this proposal. The school, however, recently announced that it had received $45 million in philanthropic donations, which will help alleviate its fiscal challenges.

Recommend Approving Chief Information Security Officer (CISO) Position but Holding Off on Operating Expenses and Equipment (OE&E) Request. The Governor’s budget has two proposals relating to CSAC’s state operations. The first proposal is $230,000 ongoing General Fund for a CISO position. Given CSAC houses a large amount of personal and sensitive information and has experienced increasing financial aid fraud attempts, we recommend approving this position. The second proposal is $1.4 million one‑time General Fund in 2025‑26 and $3 million ongoing General Fund in 2026‑27 for general operational support. CSAC indicates it will use the funds to support currently authorized but unfilled positions and cover rising operational costs due to inflation. Before taking action on this proposal, we recommend the Legislature request that CSAC provide additional clarity on what workload it is currently unable to cover and what the associated programmatic implications are of not undertaking that work.

Introduction

Brief Focuses on CSAC Budget. CSAC administers many of the state’s student financial aid programs. This brief is organized around the Governor’s 2025‑26 budget proposals for CSAC. The first section provides an overview of CSAC’s budget. The remaining sections cover proposals for (1) Cal Grants, (2) MCS, (3) CCA, and (4) state operations. The Governor also has proposals relating to Golden State Teacher Grants and College Corps (a financial aid program that California Volunteers administers), which we plan to cover in forthcoming publications.

Overview

CSAC Programs Rely Heavily on State Funding. Historically, CSAC’s student financial aid programs were supported entirely with state General Fund. Several years ago, the state began supporting some of these financial aid costs with federal Temporary Assistance for Needy Families (TANF) funds. From 2020‑21 through 2024‑25, the amount of TANF support has held steady at $400 million (approximately 10 percent to 15 percent of CSAC’s total funding). In 2024‑25, state General Fund comprised nearly 90 percent of CSAC funding. The small remainder of CSAC support comes from various other fund sources, including reimbursements from other departments.

Governor’s Budget Provides $3.2 Billion in Total Funding for CSAC in 2025‑26. As Figure 1 shows, the proposed 2025‑26 funding level for CSAC is $335 million (9.4 percent) lower than the revised 2024‑25 level. The lower funding level is due to a large decrease in one‑time funding. Ongoing funding increases by a net of only $1 million. Federal TANF funding remains flat at $400 million.

Figure 1

Ongoing General Fund Support for CSAC Is Flat

in 2025‑26

(In Millions)

|

2024‑25 |

2025‑26 |

Change From 2024‑25 |

||

|

Amount |

Percent |

|||

|

Spending |

||||

|

Local assistance |

||||

|

Cal Grants |

$2,453 |

$2,562 |

$109 |

4.5% |

|

Middle Class Scholarships |

925a |

527 |

‑398 |

‑43 |

|

Golden State Teacher Grantsb |

116 |

50 |

‑66 |

‑57 |

|

California College of the Artsb |

3 |

20 |

18 |

700 |

|

Other programs |

39 |

38 |

‑0.1 |

‑0.3 |

|

Subtotals |

($3,535) |

($3,198) |

(‑$337) |

(‑9.5%) |

|

State operations |

$23 |

$26 |

$2 |

9.3% |

|

Totals |

$3,558 |

$3,223 |

‑$335 |

‑9.4% |

|

Funding |

||||

|

General Fund |

$3,135 |

$2,802 |

‑$333 |

‑11% |

|

Ongoing |

2,729 |

2,730 |

1 |

—c |

|

One‑time |

406 |

72 |

‑334 |

‑82 |

|

Federal TANF |

$400 |

$400 |

— |

— |

|

Other funds and reimbursements |

$23 |

$21 |

‑$2 |

‑7% |

|

aIncludes $289 million in one‑time funds. bOne‑time initiatives. cBelow 0.1 percent. |

||||

|

CSAC = California Student Aid Commission and TANF = Temporary Assistance for Needy Families. |

||||

Governor’s Budget Includes Several Changes to CSAC Spending. The largest CSAC spending increase in the Governor’s budget is a $109 million ongoing General Fund augmentation to cover higher anticipated Cal Grant costs in 2025‑26. Consistent with the budget agreement the state made last year, the budget plan includes a $110 million reduction in ongoing General Fund support for the MCS program, together with the expiration of $289 million in one‑time funding provided for that program in 2024‑25. The Governor’s budget proposes $50 million one‑time General Fund to support another year of Golden State Teacher Grants (which we analyze in a forthcoming publication). It also includes $20 million one‑time General Fund to provide general fiscal support for CCA (a private, nonprofit college in San Francisco). Lastly, it contains various smaller changes to CSAC’s state operations.

Cal Grants

In this section, we first provide background on the Cal Grant program and then discuss cost estimates for this program.

Background

Cal Grant Program Is the State’s Largest Financial Aid Program. The Cal Grant program is intended to help students with financial need cover college costs. The program offers multiple types of Cal Grant awards. As Figure 2 shows, the amount of aid students receive depends on their award type and the segment of higher education they attend. Cal Grant A awards cover full systemwide tuition and fees at public universities and a fixed amount of tuition at private universities. Cal Grant B awards provide the same amount of tuition coverage as Cal Grant A awards in most cases, while also providing an “access award” for nontuition expenses such as food and housing. Cal Grant C awards, which are only available to students enrolled in career technical education (CTE) programs, provide lower amounts of tuition and nontuition coverage. Across all award types, larger amounts of nontuition coverage are available to students with dependent children as well as current and former foster youth.

Figure 2

Cal Grant Amounts Vary by Award Type,

Sector, and Student Characteristics

Maximum Annual Award Amount, 2024‑25

|

Amount |

|

|

Tuition Coverage |

|

|

Cal Grant A and Ba |

|

|

UC |

$14,436b |

|

Nonprofit institutions |

9,358 |

|

WASC‑accredited for‑profit institutions |

8,056 |

|

CSU |

6,084 |

|

Other for‑profit institutions |

4,000 |

|

Cal Grant C |

|

|

Private institutions |

$2,462 |

|

Nontuition Coveragec |

|

|

Cal Grant A |

|

|

Students with dependent children |

$6,000 |

|

Foster youth |

6,000 |

|

Cal Grant B |

|

|

Students with dependent children |

$6,000 |

|

Foster youth |

6,000 |

|

All other students |

1,648 |

|

Cal Grant C |

|

|

Students with dependent children |

$4,000 |

|

Foster youth |

4,000 |

|

Other CCC students |

1,094 |

|

Other private‑institution students |

547 |

|

aCal Grant B recipients generally do not receive tuition coverage in their first year. bReflects award amount for new UC students. Award amounts for continuing students are based on the tuition levels set in the year the student first enrolled at UC. cStudents attending private for‑profit institutions are ineligible for “students with dependent children” and “foster youth” awards. |

|

|

WASC = Western Association of Schools and Colleges. |

|

Cal Grants Have Financial and Academic Eligibility Criteria. Students apply for Cal Grant awards by submitting a Free Application for Federal Student Aid (FAFSA) or California Dream Act Application. To qualify for an award, students must meet certain income and asset criteria. These criteria vary by family size and are adjusted annually for inflation. For example, in the 2024‑25 award year, a dependent student from a family of four must have an annual household income of no more than $131,200 to qualify for a Cal Grant A or C and no more than $69,000 to qualify for Cal Grant B. In most cases, students must also meet a grade point average (GPA) requirement. The specific GPA requirement varies by award type. Most award types require a minimum high school GPA of 2.0 or 3.0 or a minimum community college GPA of 2.0 or 2.4.

Most Cal Grants Are Entitlements, but Some Are Awarded Competitively. For more than 20 years, the state has provided Cal Grants as entitlements to recent high school graduates as well as transfer students under age 28. In 2021‑22, the state also began providing Cal Grants as entitlements to community college students, regardless of their age and time out of high school. The state currently provides approximately 162,000 new entitlement awards annually. The state also provides a limited number of competitive awards (13,000 new awards annually) to students who do not qualify for an entitlement award—typically older students attending four‑year universities.

Cost Estimates

Governor’s Budget Reflects Small Prior‑Year and Current‑Year Revisions to Cal Grant Spending. From the 2024‑25 Budget Act level, the Governor’s budget revises prior‑year Cal Grant spending downward by $38 million, reflecting underlying downward adjustments to nearly all Cal Grant program components. The Governor’s budget adjusts current‑year Cal Grant spending upward by $14 million (0.6 percent). This increase brings estimated Cal Grant spending in 2024‑25 to $2.5 billion—$158 million (6.9 percent) higher than the revised 2023‑24 level.

Two Factors Explain Higher Current‑Year Spending. The upward revision to 2024‑25 spending since budget enactment is the net result of many underlying changes. Whereas the estimated costs of certain program components declined, they increased in two areas. Anticipated spending increased for (1) Cal Grant A and B entitlement awards and (2) Cal Grant C awards. CSAC believes the increase in entitlement costs are being driven by a higher share of renewal awards, which have a higher average cost than new awards (in part because some new recipients do not receive tuition coverage their first year). For Cal Grant C, CSAC attributes the increase to a change in its outreach strategies. Whereas CSAC previously used a much more targeted outreach approach (sending Cal Grant C applications only to students who marked they were enrolled in a CTE program on their FAFSA), it blanketed many more students in 2024‑25 (as the Better FAFSA stopped asking that particular question). CSAC, in turn, expects more paid Cal Grant C recipients in 2024‑25.

Governor’s Budget Reflects Further Spending Increases in 2025‑26. From the revised 2024‑25 spending level, the Governor’s budget further increases Cal Grant spending by $109 million (4.5 percent) in 2025‑26. This is a lower growth rate compared to the increase of 6.9 percent from 2023‑24 to 2024‑25. We summarize the projected changes for 2025‑26 by segment and award type in our Cal Grant Spending and Cal Grant Recipients tables. The higher spending reflects a 1.3 percent projected increase in recipients and a 3.2 percent projected increase in average Cal Grant award amounts, primarily due to UC’s and CSU’s planned tuition increases. (Under CSAC’s estimates, $48 million of the Cal Grant spending increase in 2025‑26 is attributable to covering higher tuition costs at UC and CSU.)

Cost Estimates Will Be Updated at May Revision. CSAC prepared the Cal Grant cost estimates underlying the Governor’s budget in October 2024. In the spring, CSAC plans to update its estimates based on more recent program data for 2024‑25. The administration is expected to update its Cal Grant spending levels at the May Revision accordingly. Though the administration’s cost estimates for 2024‑25 and 2025‑26 seem reasonable at this time, CSAC is still studying how certain factors are affecting program costs. In particular, CSAC is still examining how the Better FAFSA (explained in the nearby box) has impacted the number of financial aid recipients and their financial aid packages.

Financial Aid Application Changes

Better FAFSA Was Launched for the 2024‑25 Financial Aid Cycle. To apply for many types of federal, state, and institutional financial aid, students fill out a federal application. Over the years, many concerns have been expressed about the length and complexity of this form, known as the Free Application for Federal Student Aid (FAFSA). In response to these concerns, the U.S. Department of Education recently made significant changes to shorten and simplify the form. Specifically, the number of questions on the form were reduced and the transfer of certain data from tax filings was streamlined. The updated form is known as the Better FAFSA. The department released the new application form for the 2024‑25 award year on December 30, 2023 (about three months later than usual). Given the delay, the state extended California’s student financial aid priority deadline for Cal Grants to May 2 and for Middle Class Scholarships (MCS) to July 2, 2024.

Agencies Are Still Determining Impacts of Initial Better FAFSA Implementation. In addition to the delayed launch, students and their families experienced various technical difficulties as they filled out the new form. The California Student Aid Commission (CSAC) notes these challenges may have impacted high school students applying for financial aid in 2024‑25 given they were completing the form for the first time. The number of new high school entitlement awards did decrease by 7.4 percent (6,146 recipients) in 2024‑25 compared to the prior year. This decrease might be partly attributable to the FAFSA delay and technical difficulties (and partly attributable to a decline in high school graduates). In addition to first‑time filers, certain families, particularly those in which one or more parents do not have a social security number, experienced heightened issues completing the new form. CSAC and the higher education segments are still determining the extent to which aid offers and payments for these families were affected.

Pell Grant Recipients and Aid Increased Notably. Under Better FAFSA, the U.S. Department of Education revised the process for determining a student’s aid eligibility. The new formula, known as the Student Aid Index, changes how family assets, size, and number of children in college impacts a student’s financial need. These changes were projected to increase the number of students eligible for Pell Grants. CSAC reports that the number of Cal Grant‑eligible applicants who were also eligible for Pell Grants increased by 9.8 percent in 2024‑25 compared to the prior year. CSAC also reports the average Pell Grant award received by University of California (UC) and California State University (CSU) students receiving an MCS award in 2023‑24 compared to 2024‑25 increased notably. Specifically, the average Pell Grant award increased $860 (25 percent) for UC MCS recipients and $764 (22 percent) for CSU MCS recipients. These increases likely are due mainly to the FAFSA changes.

Application Deadline Extended for 2025‑26 Award Year. In January 2025, CSAC used its administrative authority to grant students attending schools within Los Angeles and Ventura Counties a one‑month application extension (to April 2, 2025) due to the wildfires in those vicinities. In February 2025, CSAC extended the April 2 extension to all students in California. The deadline was extended to all students given the delays in the 2025‑26 FAFSA rollout. The 2025‑26 FAFSA became available on December 1, 2024 rather than its traditional date of October 1.

Middle Class Scholarships

In this section, we first provide background on the MCS program. We then provide a 2024‑25 program update and end by describing the 2025‑26 budget for the program.

Background

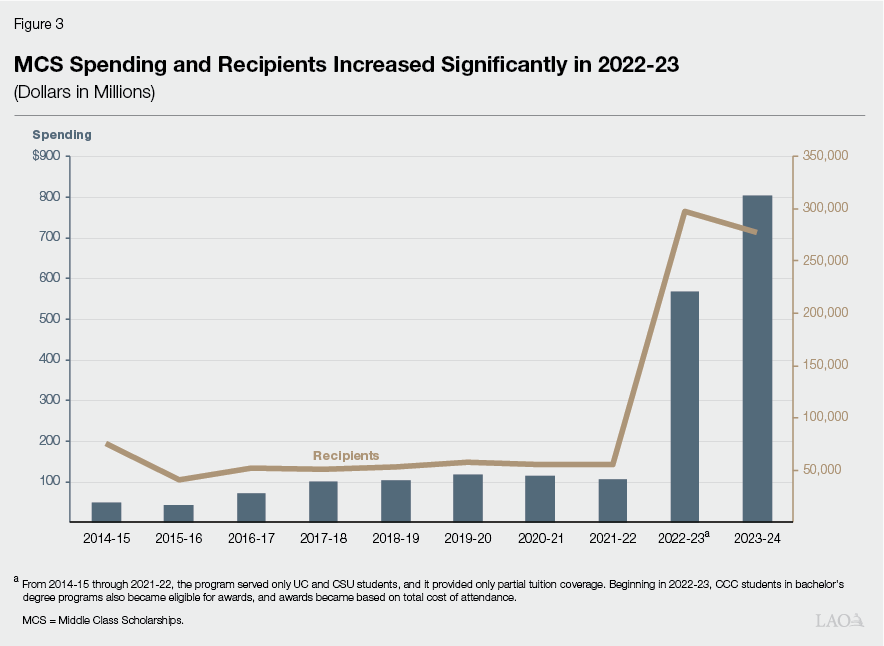

State Revamped MCS Program in 2022‑23. The state created the original MCS program in the 2013‑14 budget package to provide partial tuition coverage to certain UC and CSU students. (During the Great Recession, UC and CSU significantly raised tuition, partly in response to declines in state funding.) Originally, awards were for students who were not receiving tuition coverage through the Cal Grant program or other need‑based financial aid programs. In 2022‑23, the state implemented a new set of rules for the MCS program. The new program focuses on total cost of attendance (rather than only tuition). Under the new program, students may use their awards for nontuition expenses, such as housing and food. As Figure 3 shows, the spending for the program and number of recipients increased sharply in 2022‑23 with the launch of the new MCS program.

MCS Award Amounts Are Calculated Based on Total Cost of Attendance. As Figure 4 shows, calculating each student’s award amount involves several steps. Starting with a student’s total cost of attendance, CSAC deducts the student’s available resources, consisting of other need‑based gift aid; non‑need‑based gift aid; a student contribution from part‑time work earnings; and, in some cases, a parent contribution. The parent contribution only applies to dependent students with a household income of more than $100,000. Students who are from lower‑income households have no required parent contribution and generally are eligible for more gift aid (including federal Pell Grants and Cal Grant B awards for nontuition coverage). This calculation determines the student’s remaining costs. Next, CSAC determines what percentage of each student’s remaining costs it can cover based on the annual state appropriation for the program. Awards cover the same percentage of remaining costs for each student, except foster youth receive awards that cover 100 percent of their remaining costs.

Figure 4

Middle Class Scholarships Are Calculated

Using Multicomponent Formula

Illustrative CSU Dependent Student With $110,000 Household

Income Living Off‑Campus, 2024‑25

|

Award Calculation |

|

|

Cost of attendance |

$34,717 |

|

Federal, state, and institutional need‑based gift aida |

‑6,084 |

|

Student contribution from work earnings |

‑8,154 |

|

33 percent of parent contribution from federal SAIb |

‑4,807 |

|

Student’s Remaining Costs |

$15,672 |

|

Percentage based on annual appropriationc |

35% |

|

Award Amount |

$5,485 |

|

aThe amount also includes any private grants and scholarships, institutionally awarded merit‑based aid, as well as institutionally awarded emergency housing and other basic needs emergency grants that are in excess of the sum of the student contribution and parent contribution. bOnly applies to dependent students with a household income of more than $100,000. cState law requires CSAC to determine what percentage of each student’s remaining costs to cover each year based on the annual appropriation for the program. The program is estimated to cover about 35 percent of each student’s remaining costs in 2024‑25. |

|

|

SAI = Student Aid Index and CSAC = California Student Aid Commission. |

|

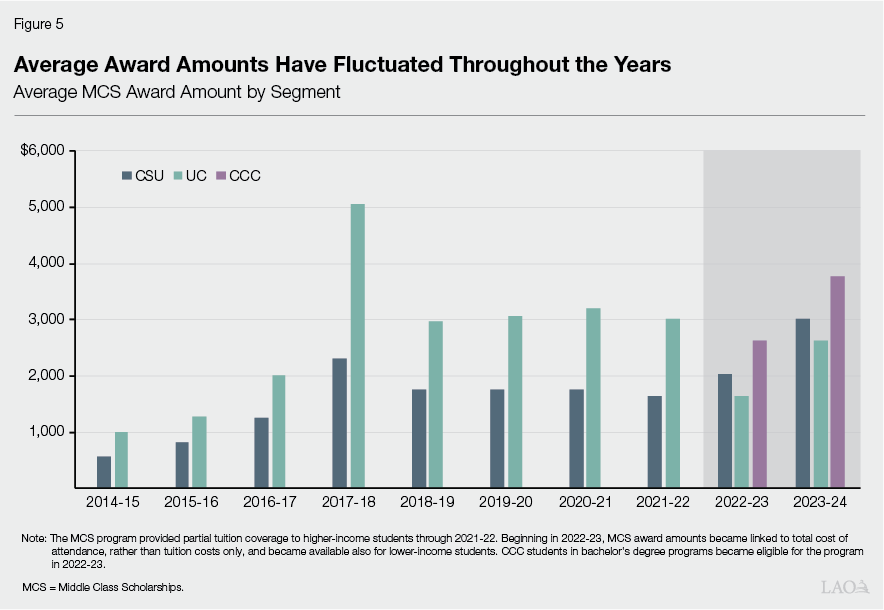

Award Amounts Have Varied Over the Years and Across the Segments. Given MCS awards cover a percentage of a student’s remaining cost of attendance, award amounts depend each year on the amount of funding and number of recipients. As Figure 5 shows, the average award amount has fluctuated over the years. The award amount also has varied across UC and CSU, and more recently at CCC. (CCC students in bachelor’s degree programs became eligible for the MCS program in 2022‑23.)

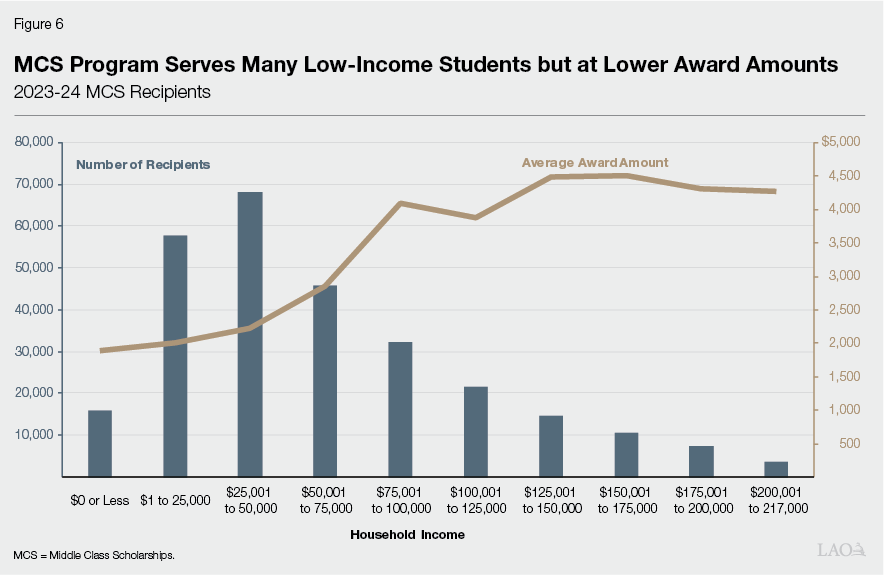

Awards Are Available to a Broader Group of Students. The revamped MCS program generally maintains the income and asset ceilings of the original program, adjusted annually for inflation. The maximum annual household income to qualify for an award is $226,000 for dependent students in 2024‑25. However, the program, in its current form, now serves considerably more low‑income students than the original program. This is because students receiving tuition coverage through Cal Grants or other need‑based financial aid programs are now eligible for MCS awards to help cover nontuition expenses. Of MCS recipients in 2024‑25, 55 percent also received Cal Grants. As Figure 6 shows, more than half of students who received MCS awards in 2023‑24 had a household income of $50,000 or less, and almost 80 percent had a household income of $100,000 or less. Students with lower household incomes, however, tended to receive smaller award amounts because they were receiving more gift aid from other programs.

Various Program Factors Impact Award Coverage. Each year, all the underlying inputs to the MCS formula change (including enrollment, total cost of attendance, and the assumed work earnings). The cost of attendance tends to increase, reflecting UC and CSU tuition increases as well as rising nontuition expenses (such as housing and food). Yet, these increases in cost of attendance are partly offset by increases in students’ available resources, including other gift aid and work earnings. Beyond these changes, the MCS income ceiling is adjusted annually based on changes to cost of living. When more students qualify for MCS awards, CSAC has to spread out funding over a larger pool of students.

Most Students Are Being Notified About Award Amount After Enrollment Decisions. Campuses typically provide students with their financial aid offers in the spring, as students are making their admission decisions. As part of these offers, some campuses indicate a student may receive an MCS award and provide an initial estimate of the award amount. Many campuses, however, have been reluctant to include such information given award amounts are unknown at that time. The data CSAC needs to estimate award amounts (enrollment rosters from each of the campuses) is not available until about August. In turn, campuses typically have been notifying students of their MCS award amount in the fall. As the academic term has begun by then, MCS awards may likely not impact students’ college admission decisions. To date, it is unclear if the awards are impacting the number of hours students work or the level of debt they incur.

2024‑25 Program Update

CSAC Reports an Unexpectedly Large Number of MCS Award Recipients for 2024‑25. The 2024‑25 Budget Act provided $926 million ($637 million ongoing, $289 million one time) for the MCS program. In October 2024, CSAC estimated that the appropriation amount was sufficient to cover 35 percent of students’ remaining costs. As of February 2025, CSAC shared it is seeing an unexpectedly large increase in MCS recipients in 2024‑25. Specifically, CSAC is anticipating 79,495 more recipients in 2024‑25 (29 percent) compared to 2023‑24. Originally, CSAC estimated a 12 percent increase. Although CSAC is continuing to examine why the number of MCS recipients increased so sharply in 2024‑25, it believes it may be partly due to last year’s application deadline extension (from its normal deadline of March 2 to July 2, 2024). Given the number of expected recipients has increased, CSAC anticipates needing an additional $103 million to keep 2024‑25 award coverage at 35 percent. CSAC, the administration, and the Legislature are currently working on solutions to address this shortfall.

2025‑26 Budget Plan

CSAC Estimates Awards Will Cover 18 Percent of Students’ Remaining Costs in 2025‑26. Consistent with last year’s budget agreement, the 2025‑26 budget plan reduces MCS funding by $110 million ongoing General Fund, bringing ongoing funding down from $637 million to $527 million. Additionally, the $289 million in one‑time funding provided in 2024‑25 expires. Based on CSAC’s preliminary estimates, the 2025‑26 funding level would be sufficient to cover 18 percent of each student’s remaining costs. This estimated award coverage, however, could change at the May Revision, as it was estimated before CSAC saw the larger‑than‑expected increase in 2024‑25 recipients.

California College of the Arts

In this section, we provide background on CCA, discuss the Governor’s proposal to provide the college with $20 million one‑time General Fund, assess the proposal, and provide a recommendation.

Background

CCA Is a Private, Nonprofit College Based in San Francisco. CCA specializes in the study of art, architecture, design, and writing. It opened in Berkeley in 1907, relocated to Oakland in 1922, and opened a second campus site in San Francisco in 1996. Serving as a two‑campus institution for more than two decades, CCA is currently transitioning down to a one‑campus institution, retaining only its San Francisco site. After a notable capital campaign, CCA added a large new facility at the San Francisco site in 2024. CCA offers 22 undergraduate and 10 graduate programs. Though data on its graduates is limited, CCA shared that many of its graduates remain in California and work at organizations such as KQED Arts & Culture; SFMOMA; Pixar; and the Institute of Contemporary Art, San Diego.

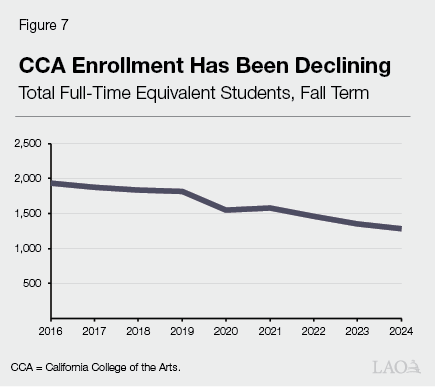

CCA Enrollment Has Been Declining. As Figure 7 shows, CCA enrollment has been declining since fall 2016. After many years of having its enrollment hover at approximately 1,800 students, CCA enrollment declined notably at the onset of the pandemic and has continued to decline. In fall 2024, CCA enrolled a total of 1,280 full‑time equivalent (FTE) students—approximately 650 FTE students (34 percent) fewer than in fall 2016. Approximately half of CCA students are California residents, with the other half coming from other states and countries.

School Is Facing an Operating Deficit. CCA has been facing a continual budget deficit since 2021. The deficit has grown from $4.9 million in 2021 to $11.4 million in 2023, with a slight decrease to $5.8 million in 2024. CCA is projecting a $20 million deficit in 2025. This is the largest deficit the school has experienced over the past decade. One factor driving this deficit is the school’s enrollment decline, which is resulting in a loss of associated tuition and fee revenue. CCA has also increased spending in areas such as institutional financial aid. As a result, operating expenditures are outpacing operating revenue, leading to sizable budget gaps in the past five years. In prior years, CCA has relied on philanthropic donations to help fill these gaps.

CCA Received State Support in 2024‑25. The state provided $2.5 million one‑time General Fund to support CCA in 2024‑25. CCA shared that it is using this funding for scholarships. Current annual undergraduate tuition is $59,376. The estimated total cost of attendance for students living off campus is $93,624. About 78 percent of students receive some type of financial aid. (CCA’s undergraduate tuition level is slightly higher than a few other private art schools in the state and notably higher than one.)

Proposal

Governor Proposes Providing $20 Million One‑Time State Funding for CCA in 2025‑26. The Governor’s budget includes $20 million one‑time General Fund to provide the school with a second year of general fiscal support. The administration indicates the state funding would help the school as it continues to address its operating deficit. The school indicates the state funding is part of its two‑year, $100 million investment strategy to stabilize the school’s financial foundation and ensure long‑term sustainability. The school’s plans include addressing its immediate budgetary needs and redesigning academic programs to attract more students. The administration indicates it has no plan to provide further state funding for the college beyond 2025‑26.

Assessment

CCA Recently Received a Large Donation to Address Budget Gap. On February 14, 2025, CCA announced it had raised nearly $45 million in new philanthropic donations. The largest single component was a $22.5 million donation from the Jen‑Hsun and Lori Huang Foundation, with the remainder coming from current and former trustees; alumni; and members of San Francisco’s arts, culture, and technology communities. The school indicates that these funds “will bridge the college into the next fiscal year, address its current deficit, and position the college both to continue its strong fundraising work and pursue its path to long‑term sustainability.”

CCA Is Not the Only Campus Facing Budget Challenges. CCA indicates the demographic decline in the college‑age population over the last decade has impacted it, similarly to how those demographic declines have impacted other small, regional higher education campuses across the state and country. In California, CSU has identified seven campuses that are more than 10 percent below their enrollment targets. Most of these campuses are looking at downsizing while simultaneously searching for new enrollment opportunities. CSU has expressed concerns more generally given its systemwide budget shortfalls in 2023‑24 and 2024‑25. Both CSU and UC currently are expressing concerns given the 2025‑26 state budget plan includes funding reductions for them. Both university systems indicate they have begun taking associated actions, including hiring freezes, eliminating positions, and cutting back on spending for student services.

State Is Positioned to Support Public Higher Education Institutions. The intent of California’s Master Plan for Higher Education is for the state to provide funding, monitor performance, and maintain mission differentiation among California’s public higher education segments (UC, CSU, and the California Community Colleges). Though the state is not legally prohibited from providing fiscal support to private higher education institutions, it is not in the state’s scope of responsibility and has been done very rarely. By doing so, the state increases the likelihood that other private institutions submit funding that could lead to uncontainable cost pressure and exposure moving forward.

Recommendation

Recommend Rejecting Proposal. Given CCA is not part of the state’s typical scope of fiscal responsibility, and the college recently attained a large amount of donor support, we recommend the Legislature reject the proposal to provide the school with state funding. Though we recognize CCA’s difficult financial situation and the efforts it is making to regain fiscal sustainability, the state is not in a fiscal position to support the school. This is especially the case given the state is in the midst of reducing funding in other higher education areas, including for public universities facing similar challenges, and it is projected to have significant operating deficits in the coming years.

State Operations

In this section, we first provide background on CSAC state operations. We then describe the Governor’s two proposals relating to CSAC state operations—an unallocated augmentation for general operational support and a targeted augmentation for a new staff position focused on cybersecurity. Next, we analyze these proposals and make associated recommendations.

Background

CSAC’s Mission Is to Administer State Financial Aid Programs. CSAC administers certain state financial aid programs and provides related technical assistance. As discussed earlier in the brief, the largest of these programs are the Cal Grant and MCS programs. CSAC also administers a few smaller financial aid programs, including the California Dream Act Service Incentive Grant and Cal‑HBCU Transfer Grant. Beyond these programs, the state approved one‑time funding in 2021‑22 for a five‑year Golden State Teacher Grant initiative. (That same year, the state approved one‑time funding for two other financial aid initiatives, but it subsequently ended those initiatives and rescinded associated unspent funding.) In administering these programs, CSAC works with financial aid administrators at colleges and universities, counselors and other staff at local educational agencies, and students across California. In 2023‑24, CSAC processed a total 2.2 million financial aid applications.

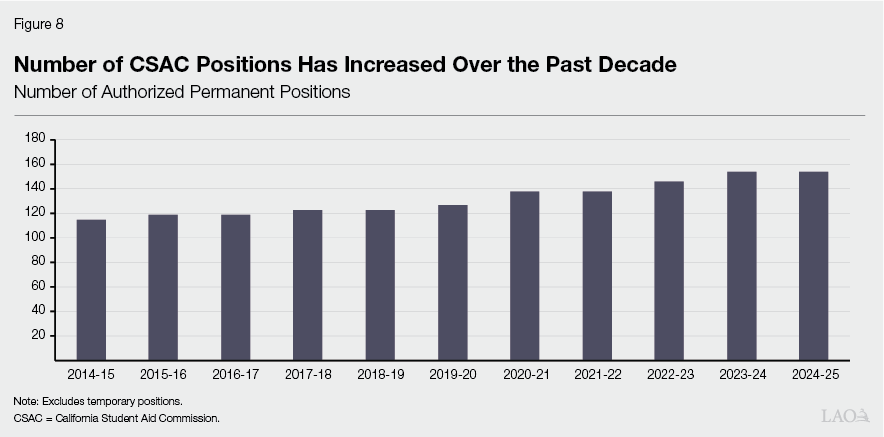

CSAC’s Staffing Has Grown Over the Past Ten Years. As Figure 8 shows, the number of authorized permanent positions at CSAC increased from 114.5 in 2014‑15 to 153.5 positions in 2024‑25. Many of CSAC’s new positions in recent years have been to support administrative workload associated with program expansions, along with additional cybersecurity, research, and policy support. Most recently, in 2023‑24, CSAC received eight new permanent positions for these kinds of purposes. When the state has added new authorized positions, it has added associated funding. For example, in 2023‑24, the state augmented CSAC’s state operations budget $1.1 million for the additional positions, along with a few hundreds of thousands of dollars for other things (new high school toolkits and additional Cash for College efforts). CSAC received $23 million in state operations funding in 2024‑25, primarily from the General Fund.

CSAC Has Vacant Positions It Cannot Fill Due to Lack of Funding. Currently, CSAC has 145 filled positions. CSAC shared it cannot fulfill its workload with this number of positions. Though CSAC has 8.5 vacant positions, it states that it does not have adequate funding to fill these positions. CSAC notes it would need additional ongoing funding to hire and retain full‑time staff for these positions.

CSAC’s Operational Costs Have Been Increasing. In addition to concerns regarding workload, the department shared that its costs for OE&E have been increasing at a rate that outpaces available funding. CSAC cites cost increases for subscription services, information technology (IT), data centers, consulting services, facilities, and staff training and travel. These cost increases are primarily driven by higher prices due to inflation.

Administration Recently Applied Small Reduction to CSAC State Operations Budget. To balance the 2024‑25 budget, the state authorized reductions in agencies’ state operations funding. Reductions of up to 7.95 percent were unallocated. Additional reductions were associated with eliminating certain vacant positions. CSAC was included in this package of state operations reductions, but the administration used its discretion to reduce CSAC significantly less than the authorized maximums. In total, CSAC received a $245,000 ongoing General Fund reduction in 2024‑25—about 1 percent of its annual operating budget. As part of this reduction, the administration swept a portion of one position (0.7 position). Initially, the administration swept five vacant positions, but it subsequently restored position authority for 4.3 positions. All five positions initially swept were IT positions, primarily on CSAC’s application development team. CSAC notes that these positions were vacant given recruitment and budget challenges.

Proposals

Governor Proposes Unallocated Augmentation for CSAC’s State Operations. The Governor’s budget includes $1.4 million one‑time General Fund in 2025‑26 for CSAC’s state operations. The administration indicates its intent to provide $3 million ongoing General Fund in 2026‑27 to further assist CSAC with its operating costs. CSAC indicates the $1.4 million in one‑time funding will be sufficient to cover costs in 2025‑26, but the larger amount of ongoing funding is needed to cover expected cost increases the following year. The administration indicates CSAC has discretion in deciding how to use the proposed funds. If the state commits to providing the ongoing funding in 2026‑27, CSAC indicates it would use the 2025‑26 and 2026‑27 funds to support existing authorized but unfilled positions, along with covering cost increases relating to consulting services, equipment, facilities, and other operating expenses.

Governor Proposes Targeted Augmentation for a Chief Information Security Officer (CISO). The Governor’s budget includes $230,000 ongoing General Fund to provide CSAC with a CISO position. The request for this position is part of CSAC’s ongoing work to protect student data and address cybersecurity risks. The responsibilities of the CISO include addressing identified cybersecurity gaps and issues of concern, ensuring CSAC is compliant with certain cybersecurity expectations, developing CSAC’s Information Security Office, and leading fraud detection and prevention programming.

Assessment

CSAC Has Yet to Provide Clear Explanation for How It Would Use Unallocated Augmentation. Despite the notable increase in its authorized permanent positions over the past ten years and the associated funding increases, CSAC believes it has inadequate funding to fulfill its current workload. However, it has not clearly identified its workload gaps to determine where staffing problems are occurring. Instead, its budget change request focused on addressing the department’s shortfall in OE&E funding, which is largely driven by inflationary pressures. Though CSAC provided documentation showing how OE&E costs have been increasing, it did not include detail on how additional funding would be allocated to cover both rising OE&E costs and staffing shortages.

Cybersecurity Is Critical to CSAC’s Mission. CSAC houses a significant amount of personally identifiable and sensitive information. It is CSAC’s responsibility to ensure this information is protected and address any threats that may compromise student data. In addition, CSAC has seen an increase in financial aid fraud attempts. Therefore, to protect students and families, as well as mitigate potential financial aid fraud, CSAC has invested in security software and consulting services, as well as instituted two full‑time cybersecurity positions in 2023‑24. CSAC’s investment in cybersecurity is also part of its mission to position itself as compliant with Cal‑Secure. Cal‑Secure is a roadmap created by the administration in 2021 to enhance and improve the state’s role in the cybersecurity space, including ensuring the state has effective cybersecurity defenses. While CSAC has a Chief Information Officer, it has never had a CISO to lead these efforts.

Recommendations

Withhold Recommendation on Unallocated Augmentation Pending More Specific Workload Justification. We recommend the Legislature withhold action on the proposed unallocated increase to OE&E funding given the lack of clarity regarding how CSAC will use the additional funding to address operating costs and staffing shortages. We recommend the Legislature request the department to answer, at a minimum, the following questions:

- What workload is CSAC currently unable to cover?

- What are the programmatic implications of not being able to perform this work?

- How much additional funding is needed to address each of the identified workload issues?

If CSAC provides clear answers to these questions by early May, the Legislature could consider approving an associated augmentation as part of its budget closeout activities. Alternatively, CSAC could take more time to examine where its workload gaps are most pronounced and submit a new budget change request for the 2026‑27 budget cycle.

Request for CISO Is Reasonable, Recommend Approving. CSAC maintains a large and growing volume of sensitive data on students and their families. In recent years, CSAC’s cybersecurity needs have increased due to the state’s new cybersecurity priorities and requirements, as well as more financial aid fraud attempts. Though CSAC has two authorized positions for cybersecurity staff, it lacks a leadership position dedicated to cybersecurity. The administration and CSAC have provided a reasonable list of job duties and associated workload justifying the proposed position. In addition, a review by the California Department of Technology concludes CSAC faces some IT risk. Therefore, we recommend approving the proposal.